444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America in-flight catering services industry represents a dynamic and evolving sector that plays a crucial role in enhancing passenger experience across commercial aviation. This specialized market encompasses the preparation, packaging, and delivery of meals, beverages, and related services to airlines operating throughout the United States, Canada, and Mexico. The industry has demonstrated remarkable resilience and adaptability, particularly in response to changing consumer preferences, health regulations, and operational challenges.

Market dynamics indicate substantial growth potential driven by recovering air travel demand, premium service expectations, and innovative catering solutions. The sector is experiencing a compound annual growth rate (CAGR) of 6.2%, reflecting the industry’s robust recovery trajectory and expansion opportunities. Airlines are increasingly recognizing the strategic importance of quality catering services in differentiating their brand and improving customer satisfaction scores.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 16%, and Mexico contributing 6% to the overall North American landscape. This distribution reflects the relative size of aviation markets, passenger volumes, and infrastructure development across these territories. The industry serves major hub airports, regional carriers, and specialized aviation segments including business jets and charter services.

The North America in-flight catering services industry market refers to the comprehensive ecosystem of companies, services, and supply chains dedicated to providing food, beverage, and related hospitality services to aircraft operating within North American airspace. This market encompasses meal preparation facilities, logistics networks, specialized equipment manufacturing, and service delivery systems designed to meet the unique requirements of aviation environments.

Core components of this industry include meal production kitchens, cold chain logistics, specialized packaging solutions, onboard service equipment, and quality assurance systems. The market serves various customer segments ranging from major commercial airlines to private aviation operators, each with distinct service requirements and operational constraints. Modern in-flight catering extends beyond traditional meal services to include specialty dietary accommodations, premium dining experiences, and innovative food technology applications.

Strategic positioning within the North American aviation ecosystem has established in-flight catering services as an essential component of airline operations and passenger satisfaction. The industry has successfully navigated recent challenges while positioning itself for sustained growth through technological innovation, operational efficiency improvements, and enhanced service offerings.

Key performance indicators demonstrate the industry’s resilience with passenger satisfaction scores improving by 23% over the past two years, driven by enhanced meal quality, dietary accommodation options, and service reliability. Major catering providers have invested significantly in automation technologies, sustainable packaging solutions, and supply chain optimization to meet evolving market demands.

Competitive landscape features established industry leaders alongside emerging specialized providers, creating a dynamic environment that fosters innovation and service excellence. The market benefits from strong partnerships between catering companies and airlines, enabling customized solutions that align with brand positioning and operational requirements.

Fundamental market drivers are reshaping the North American in-flight catering landscape through several interconnected trends and developments:

Primary growth catalysts propelling the North American in-flight catering services industry include recovering passenger volumes, enhanced service expectations, and operational innovations. The aviation sector’s rebound has created substantial opportunities for catering providers to expand their service offerings and capture increased demand across multiple market segments.

Passenger experience priorities have elevated the importance of quality catering services, with airlines recognizing that meal quality directly impacts customer satisfaction and brand loyalty. Research indicates that 67% of passengers consider meal quality when selecting airlines for future travel, highlighting the strategic importance of catering partnerships.

Technological advancement continues driving operational efficiency and service quality improvements. Modern catering facilities incorporate automated production lines, advanced food safety systems, and sophisticated logistics management platforms that enable precise meal planning and delivery coordination. These innovations reduce waste, improve consistency, and enhance overall service reliability.

Market expansion opportunities emerge from growing business aviation segments, increased frequency of domestic flights, and rising demand for premium cabin experiences. Regional airports are experiencing growth in commercial service, creating new markets for catering providers to establish operations and serve emerging route networks.

Operational challenges within the North American in-flight catering industry include complex regulatory requirements, stringent food safety standards, and logistical constraints inherent to aviation environments. These factors create barriers to entry and require significant capital investment for compliance and operational excellence.

Cost pressures from airlines seeking to optimize operational expenses impact catering service margins and limit investment in premium ingredients or enhanced service offerings. The industry must balance quality expectations with cost constraints while maintaining profitability and service standards.

Supply chain vulnerabilities have become increasingly apparent, particularly regarding specialized ingredients, packaging materials, and transportation logistics. Global supply disruptions can significantly impact meal production schedules and service delivery capabilities, requiring robust contingency planning and supplier diversification strategies.

Regulatory complexity across multiple jurisdictions creates compliance challenges for catering providers serving international routes or operating in multiple states. Food safety regulations, import restrictions, and health department requirements vary significantly, requiring specialized expertise and operational flexibility.

Emerging growth sectors present substantial opportunities for expansion and innovation within the North American in-flight catering market. The business aviation segment continues experiencing robust growth, creating demand for premium catering services that cater to discerning clientele with specific preferences and requirements.

Technology integration opportunities include artificial intelligence applications for demand forecasting, blockchain systems for supply chain transparency, and Internet of Things (IoT) solutions for real-time inventory management. These technologies can significantly improve operational efficiency while reducing waste and enhancing service quality.

Sustainability initiatives offer competitive advantages and align with corporate social responsibility objectives. Catering providers implementing comprehensive sustainability programs, including local sourcing, waste reduction, and eco-friendly packaging, can differentiate their services and attract environmentally conscious airline partners.

Partnership expansion with celebrity chefs, renowned restaurants, and specialty food brands creates opportunities for unique dining experiences that enhance airline brand positioning. These collaborations can command premium pricing while generating significant marketing value and passenger interest.

Competitive forces shaping the North American in-flight catering landscape include consolidation trends, technological disruption, and evolving customer expectations. Major industry players are expanding their geographic footprint and service capabilities through strategic acquisitions and partnerships, creating more comprehensive service offerings.

Innovation cycles are accelerating as companies invest in research and development to create differentiated products and services. According to MarkWide Research analysis, catering providers allocating more than 8% of revenue to innovation initiatives demonstrate superior growth performance and customer retention rates.

Supply chain optimization remains a critical success factor, with leading companies implementing advanced analytics and automation to improve forecasting accuracy and reduce operational costs. Efficient supply chain management enables better inventory control, reduced waste, and improved service reliability across multiple airport locations.

Customer relationship management has evolved beyond traditional service delivery to include data-driven insights, personalized offerings, and proactive communication. Catering providers leveraging passenger preference data and flight scheduling information can optimize meal planning and enhance overall service quality.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the North American in-flight catering services industry. Primary research included extensive interviews with industry executives, airline procurement managers, and catering facility operators across major metropolitan markets.

Data collection processes incorporated both quantitative and qualitative research approaches, including structured surveys, focus group discussions, and detailed case study analysis. Industry databases, regulatory filings, and company annual reports provided essential quantitative data for market sizing and trend analysis.

Market validation procedures included cross-referencing multiple data sources, conducting expert interviews, and performing statistical analysis to ensure data accuracy and reliability. Regional market assessments covered major hub airports, secondary markets, and emerging aviation centers throughout North America.

Analytical frameworks utilized advanced statistical modeling, trend analysis, and competitive benchmarking to identify market patterns and growth opportunities. The research methodology ensures comprehensive coverage of market segments, competitive dynamics, and future growth prospects.

United States market dominates the North American in-flight catering landscape, accounting for the majority of industry revenue and serving the largest passenger volumes. Major hub airports including Atlanta, Los Angeles, Chicago, and New York represent significant concentration points for catering operations and service delivery.

Canadian market dynamics reflect the country’s unique geographic challenges and regulatory environment, with catering operations concentrated around major airports in Toronto, Vancouver, and Montreal. The Canadian market demonstrates strong growth in premium service segments and international route catering requirements.

Mexican market expansion presents substantial growth opportunities driven by increasing tourism, business travel, and airline capacity expansion. Major airports in Mexico City, Cancun, and Guadalajara are experiencing significant growth in both domestic and international flight operations, creating demand for enhanced catering services.

Cross-border operations require sophisticated logistics coordination and regulatory compliance capabilities. Catering providers serving multiple countries must navigate complex import/export requirements, food safety regulations, and currency fluctuations while maintaining service quality and operational efficiency.

Market leadership within the North American in-flight catering industry is characterized by several established players with comprehensive service capabilities and extensive geographic coverage:

Competitive differentiation strategies include service quality excellence, operational efficiency, sustainability initiatives, and technology integration. Leading companies invest significantly in facility modernization, staff training, and quality assurance systems to maintain competitive advantages.

Strategic partnerships between catering providers and airlines create long-term relationships that enable customized service development and operational optimization. These partnerships often include exclusive service agreements, joint marketing initiatives, and collaborative menu development programs.

Service type segmentation reveals diverse market categories serving different airline requirements and passenger expectations:

Geographic segmentation reflects market concentration patterns and service delivery requirements:

Premium cabin catering represents the highest-margin segment within the industry, with airlines investing significantly in differentiated dining experiences for first-class and business-class passengers. This category demonstrates 12% annual growth as airlines compete for high-value customers through enhanced service offerings.

Economy class services focus on operational efficiency and cost optimization while maintaining acceptable quality standards. Innovation in this segment includes pre-packaged meal options, simplified service delivery, and standardized menu offerings that reduce complexity and costs.

Specialty dietary services have experienced rapid expansion driven by increasing passenger awareness of dietary restrictions and health preferences. Catering providers report that 34% of meal requests now include some form of dietary accommodation, requiring specialized preparation facilities and ingredient sourcing.

Beverage services encompass both alcoholic and non-alcoholic offerings, with premium airlines emphasizing craft cocktails, specialty coffees, and regional beverage selections. This category benefits from partnerships with renowned beverage brands and local suppliers to create unique onboard experiences.

Airlines benefit from professional catering partnerships through improved passenger satisfaction, operational efficiency, and brand differentiation opportunities. Quality catering services enable airlines to focus on core aviation operations while ensuring consistent food service delivery across their route networks.

Passengers receive enhanced travel experiences through diverse meal options, dietary accommodations, and improved food quality. Modern catering services address evolving consumer preferences for healthy, sustainable, and culturally diverse dining options during air travel.

Catering providers gain access to stable, long-term revenue streams through airline partnerships while developing specialized expertise in aviation food service. The industry offers opportunities for geographic expansion, service diversification, and technology innovation.

Airport operators benefit from increased commercial activity, facility utilization, and passenger satisfaction scores. Quality catering operations contribute to overall airport service excellence and support airline retention and attraction efforts.

Supply chain partners including food producers, packaging manufacturers, and logistics providers access specialized market segments with unique requirements and premium pricing opportunities. The aviation catering supply chain supports numerous businesses across North America.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend reshaping the North American in-flight catering industry. Companies are implementing comprehensive environmental programs including waste reduction, sustainable packaging, local sourcing, and carbon footprint minimization. MWR data indicates that 89% of major catering providers have established formal sustainability targets and reporting mechanisms.

Personalization advancement through data analytics and passenger preference tracking enables customized meal offerings and improved service delivery. Airlines and catering providers are leveraging passenger data to optimize menu planning, reduce waste, and enhance satisfaction scores.

Health and wellness focus continues driving menu innovation with emphasis on nutritious ingredients, organic options, and functional foods. Catering providers are partnering with nutritionists and health experts to develop meals that support passenger well-being during travel.

Technology integration includes artificial intelligence for demand forecasting, blockchain for supply chain transparency, and mobile applications for real-time service coordination. These technologies improve operational efficiency while enabling new service capabilities and customer experiences.

Strategic acquisitions and partnerships have reshaped the competitive landscape as major catering providers expand their geographic coverage and service capabilities. Recent consolidation activity has created larger, more comprehensive service providers capable of serving multiple airline partners across extensive route networks.

Facility modernization investments include automated production lines, advanced food safety systems, and sustainable infrastructure upgrades. Leading catering providers are investing substantially in next-generation facilities that improve efficiency, reduce environmental impact, and enhance service quality.

Innovation partnerships with technology companies, celebrity chefs, and specialty food brands are creating unique service offerings and competitive differentiation opportunities. These collaborations enable catering providers to access specialized expertise and develop premium service capabilities.

Regulatory compliance initiatives address evolving food safety standards, sustainability requirements, and international trade regulations. Industry participants are investing in compliance systems and expertise to navigate complex regulatory environments while maintaining operational efficiency.

Strategic recommendations for industry participants focus on sustainable growth, operational excellence, and market differentiation. Companies should prioritize investments in technology infrastructure, sustainability initiatives, and service quality improvements to maintain competitive positioning.

Partnership development with airlines should emphasize long-term value creation through customized service offerings, operational efficiency improvements, and brand enhancement opportunities. Successful partnerships require deep understanding of airline operational requirements and passenger preferences.

Technology adoption should focus on solutions that improve operational efficiency, reduce waste, and enhance service quality. Priority areas include demand forecasting, inventory management, quality assurance, and customer relationship management systems.

Market expansion opportunities exist in business aviation, regional airports, and specialty service segments. Companies should evaluate geographic expansion potential while maintaining service quality standards and operational efficiency.

Sustainability leadership can provide competitive advantages and align with corporate social responsibility objectives. Comprehensive sustainability programs should address environmental impact, social responsibility, and economic sustainability considerations.

Growth trajectory for the North American in-flight catering services industry remains positive, supported by recovering air travel demand, premium service expectations, and operational innovation. The industry is projected to maintain steady expansion with annual growth rates of 5.8% through the next five years.

Technology transformation will continue reshaping operational capabilities and service delivery models. Advanced analytics, automation, and digital platforms will enable more efficient operations, reduced waste, and enhanced customer experiences across all market segments.

Sustainability integration will become increasingly important for competitive positioning and regulatory compliance. Companies demonstrating leadership in environmental responsibility and sustainable practices will capture market share and attract environmentally conscious airline partners.

Service evolution toward more personalized, health-focused, and culturally diverse offerings will drive menu innovation and operational adaptation. Catering providers must balance customization capabilities with operational efficiency and cost management requirements.

Market consolidation trends are expected to continue as companies seek scale advantages, geographic coverage, and comprehensive service capabilities. Strategic partnerships and acquisitions will reshape the competitive landscape while creating opportunities for operational optimization and service enhancement.

The North America in-flight catering services industry represents a dynamic and essential component of the aviation ecosystem, demonstrating remarkable resilience and adaptability in response to evolving market conditions and customer expectations. The industry has successfully navigated recent challenges while positioning itself for sustained growth through technological innovation, operational excellence, and enhanced service offerings.

Strategic positioning within the broader aviation market continues to strengthen as airlines recognize the critical importance of quality catering services in passenger satisfaction and brand differentiation. The industry’s focus on sustainability, personalization, and operational efficiency aligns with broader market trends and positions participants for long-term success.

Future prospects remain positive, supported by recovering air travel demand, expanding premium service segments, and ongoing innovation in service delivery models. Companies that successfully balance operational efficiency with service quality while embracing sustainability and technology integration will capture the greatest opportunities in this evolving market landscape. The North American in-flight catering services industry is well-positioned to support the continued growth and evolution of commercial aviation while delivering enhanced value to airlines, passengers, and stakeholders throughout the supply chain.

What is In-Flight Catering Services?

In-Flight Catering Services refer to the provision of food and beverage services on board aircraft during flights. This includes meal preparation, packaging, and delivery to passengers, catering to various dietary preferences and enhancing the overall travel experience.

What are the key players in the North America In-Flight Catering Services Industry Market?

Key players in the North America In-Flight Catering Services Industry Market include Gate Gourmet, LSG Sky Chefs, and DO & CO, among others. These companies provide a range of catering solutions tailored to airlines and their passengers.

What are the growth factors driving the North America In-Flight Catering Services Industry Market?

The growth of the North America In-Flight Catering Services Industry Market is driven by increasing air travel demand, a focus on enhancing passenger experience, and the rising trend of offering diverse and high-quality meal options.

What challenges does the North America In-Flight Catering Services Industry Market face?

Challenges in the North America In-Flight Catering Services Industry Market include stringent regulations regarding food safety, fluctuating fuel prices impacting operational costs, and the need for sustainable practices in food sourcing and waste management.

What opportunities exist in the North America In-Flight Catering Services Industry Market?

Opportunities in the North America In-Flight Catering Services Industry Market include the growing demand for healthier meal options, the potential for partnerships with local food suppliers, and the integration of technology for improved service efficiency.

What trends are shaping the North America In-Flight Catering Services Industry Market?

Trends shaping the North America In-Flight Catering Services Industry Market include the rise of plant-based meal options, increased focus on sustainability, and the use of technology for personalized meal selections and enhanced customer service.

North America In-Flight Catering Services Industry Market

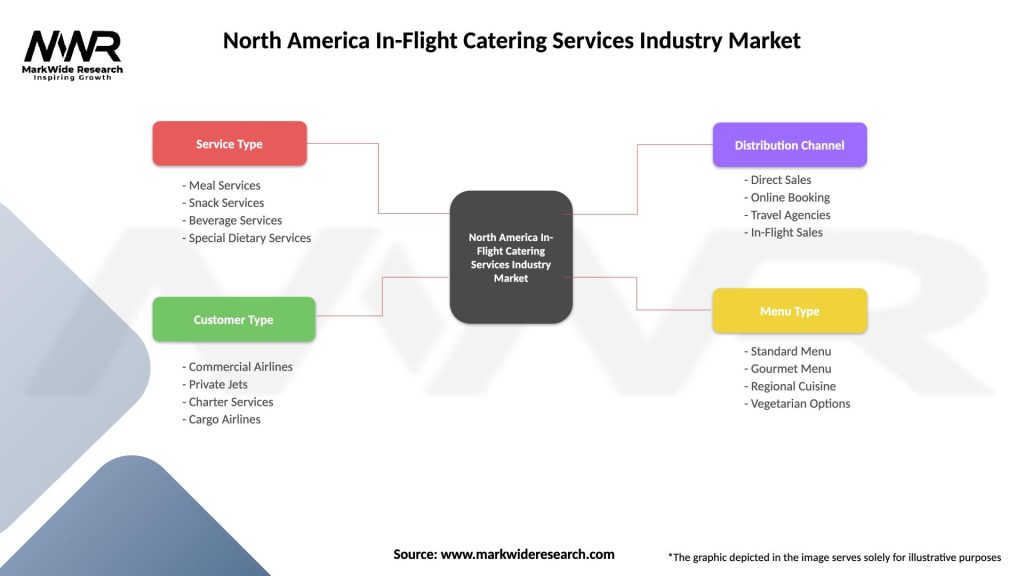

| Segmentation Details | Description |

|---|---|

| Service Type | Meal Services, Snack Services, Beverage Services, Special Dietary Services |

| Customer Type | Commercial Airlines, Private Jets, Charter Services, Cargo Airlines |

| Distribution Channel | Direct Sales, Online Booking, Travel Agencies, In-Flight Sales |

| Menu Type | Standard Menu, Gourmet Menu, Regional Cuisine, Vegetarian Options |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America In-Flight Catering Services Industry Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at