444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America immunity health supplements market represents one of the fastest-growing segments within the broader nutraceuticals industry, driven by increasing consumer awareness about preventive healthcare and immune system support. This dynamic market encompasses a comprehensive range of products including vitamins, minerals, herbal extracts, probiotics, and specialized immune-boosting formulations designed to enhance the body’s natural defense mechanisms.

Market dynamics indicate robust growth momentum, with the sector experiencing a compound annual growth rate (CAGR) of 8.2% over the recent forecast period. The market’s expansion is particularly pronounced in the United States and Canada, where health-conscious consumers are increasingly prioritizing immune system wellness through dietary supplementation.

Consumer behavior patterns reveal a significant shift toward proactive health management, with 73% of North American consumers now incorporating immunity supplements into their daily wellness routines. This trend has been accelerated by heightened awareness of immune health importance, driving demand for scientifically-backed formulations that support overall immune function.

The market landscape is characterized by diverse product offerings ranging from traditional vitamin C and zinc supplements to advanced multi-ingredient formulations featuring adaptogens, mushroom extracts, and cutting-edge immune support compounds. Innovation in delivery formats has also contributed to market growth, with gummies, powders, and liquid formulations gaining substantial traction alongside traditional capsules and tablets.

The North America immunity health supplements market refers to the commercial ecosystem encompassing the development, manufacturing, distribution, and retail of nutritional products specifically formulated to support and enhance immune system function across the United States, Canada, and Mexico. These supplements are designed to provide essential nutrients, bioactive compounds, and specialized ingredients that help maintain optimal immune response and overall health resilience.

Immunity health supplements include a broad spectrum of products containing vitamins such as C, D, and E, essential minerals like zinc and selenium, herbal extracts including echinacea and elderberry, probiotics for gut health support, and innovative compounds like beta-glucans and colostrum. The market encompasses both single-ingredient supplements and complex multi-nutrient formulations targeting comprehensive immune system support.

This market segment operates within the larger framework of dietary supplements regulation, adhering to specific quality standards and labeling requirements while serving consumers seeking to proactively support their immune health through nutritional supplementation. Product categories range from basic immune support vitamins to sophisticated targeted formulations addressing specific immune system needs and age-related immune function concerns.

Market performance in the North America immunity health supplements sector demonstrates exceptional resilience and growth potential, establishing itself as a cornerstone of the regional nutraceuticals industry. The market has experienced unprecedented expansion driven by fundamental shifts in consumer health priorities and increased recognition of immune system importance in overall wellness strategies.

Key growth drivers include rising healthcare costs prompting preventive health approaches, aging population demographics requiring enhanced immune support, and growing scientific evidence supporting the efficacy of immune-boosting nutrients. Consumer spending on immunity supplements has increased by 42% over the past three years, reflecting the sector’s strong market position and future growth prospects.

Product innovation continues to drive market differentiation, with manufacturers developing advanced formulations incorporating clinically-studied ingredients, personalized nutrition approaches, and convenient delivery systems. The integration of traditional immune-supporting herbs with modern nutritional science has created compelling product offerings that resonate with diverse consumer segments.

Distribution channels have evolved significantly, with e-commerce platforms capturing 38% of total market share while traditional retail channels maintain strong presence through specialized health stores, pharmacies, and mass retailers. This multi-channel approach ensures broad market accessibility and supports continued growth across various consumer demographics and purchasing preferences.

Consumer demographics reveal that immunity supplement usage spans all age groups, with particularly strong adoption among adults aged 35-65 who prioritize preventive health measures. MarkWide Research analysis indicates that educated consumers with higher disposable incomes represent the primary market segment, though accessibility improvements are expanding reach across diverse socioeconomic groups.

Product preferences demonstrate clear trends toward natural and organic formulations, with consumers increasingly seeking supplements derived from whole food sources and featuring minimal artificial additives. The following key insights characterize current market dynamics:

Preventive healthcare trends constitute the primary driver of immunity supplement market growth, as consumers increasingly recognize the cost-effectiveness and health benefits of proactive immune system support. Rising healthcare costs and insurance limitations have motivated individuals to invest in preventive measures, with immunity supplements representing an accessible and affordable approach to health maintenance.

Demographic shifts significantly influence market expansion, particularly the aging baby boomer population requiring enhanced immune support to maintain health and vitality. This demographic segment demonstrates strong purchasing power and commitment to health maintenance, driving demand for high-quality, scientifically-formulated immunity products.

Scientific advancement in nutritional immunology has provided compelling evidence supporting the efficacy of specific nutrients and compounds in immune function enhancement. Research validating the benefits of vitamin D, zinc, probiotics, and botanical extracts has increased consumer confidence in immunity supplements and healthcare provider recommendations.

Lifestyle factors including increased stress levels, poor dietary habits, and environmental toxin exposure have heightened awareness of immune system vulnerability. Consumers recognize that modern lifestyles may compromise natural immune function, creating demand for supplemental support to maintain optimal immune response.

Digital health awareness facilitated by social media, health apps, and online education platforms has dramatically increased consumer knowledge about immune system function and nutritional support options. This enhanced awareness translates directly into increased supplement adoption and more informed purchasing decisions.

Regulatory complexities present ongoing challenges for immunity supplement manufacturers, as evolving FDA guidelines and state-level regulations create compliance burdens that can limit product development and marketing flexibility. The distinction between dietary supplements and medical claims requires careful navigation to avoid regulatory violations while effectively communicating product benefits.

Market saturation in certain product categories has intensified competition and price pressure, particularly for basic vitamin and mineral supplements. The proliferation of similar products makes differentiation challenging and can lead to consumer confusion about product selection and efficacy differences.

Quality concerns regarding supplement manufacturing and ingredient sourcing have created consumer skepticism about product reliability and safety. Incidents involving contaminated or mislabeled products have heightened regulatory scrutiny and consumer wariness, requiring increased investment in quality assurance and transparency initiatives.

Economic sensitivity affects consumer spending on non-essential health products during economic downturns, as immunity supplements are often viewed as discretionary purchases rather than necessities. Economic uncertainty can lead to reduced consumer spending on premium supplement products and increased price sensitivity.

Scientific skepticism from portions of the medical community regarding supplement efficacy creates challenges in building mainstream acceptance and healthcare provider recommendations. The lack of standardized dosing protocols and varying research quality can limit professional endorsement and consumer confidence.

Personalized nutrition represents a significant growth opportunity as advances in genetic testing and biomarker analysis enable customized immunity supplement recommendations based on individual health profiles and genetic predispositions. This approach can command premium pricing while delivering enhanced consumer value through targeted nutritional support.

Functional food integration offers expansion opportunities beyond traditional supplement formats, with immunity-supporting ingredients increasingly incorporated into everyday food and beverage products. This trend creates new market segments and distribution channels while making immune support more accessible to mainstream consumers.

Digital health platforms provide opportunities for direct-to-consumer marketing and subscription-based delivery models that enhance customer retention and lifetime value. Integration with health tracking apps and telemedicine platforms can create comprehensive immune health management solutions.

International expansion within North America, particularly in underserved rural markets and emerging demographic segments, presents growth opportunities for companies with appropriate distribution strategies and culturally relevant product formulations.

Clinical research partnerships with academic institutions and healthcare organizations can generate compelling efficacy data that supports premium positioning and healthcare provider recommendations, creating competitive advantages and market differentiation opportunities.

Supply chain evolution has transformed the immunity supplements market through improved ingredient sourcing, manufacturing efficiency, and quality control systems. Vertical integration strategies adopted by leading manufacturers have enhanced cost control and quality assurance while reducing dependency on external suppliers for critical ingredients.

Consumer education initiatives by industry associations and leading brands have elevated market sophistication, with consumers becoming more knowledgeable about ingredient efficacy, dosing protocols, and product quality indicators. This education has driven demand for higher-quality products and increased willingness to pay premium prices for scientifically-backed formulations.

Retail channel dynamics continue evolving with the rise of specialized health retailers, online marketplaces, and direct-to-consumer brands challenging traditional pharmacy and mass retailer dominance. E-commerce growth has enabled smaller brands to compete effectively while providing consumers with broader product selection and competitive pricing.

Innovation cycles in the immunity supplements market have accelerated, with new ingredient discoveries, delivery system improvements, and formulation advances creating regular opportunities for product differentiation and market expansion. The integration of traditional medicine wisdom with modern nutritional science continues generating novel product concepts.

Seasonal fluctuations create predictable demand patterns that influence inventory management, marketing strategies, and production planning across the industry. Companies have developed sophisticated forecasting models to optimize operations around these cyclical patterns while building year-round consumer engagement.

Primary research methodologies employed in analyzing the North America immunity health supplements market include comprehensive consumer surveys, in-depth interviews with industry stakeholders, and focus group discussions with target demographic segments. These approaches provide qualitative insights into consumer behavior, purchasing motivations, and product preferences that quantitative data alone cannot capture.

Secondary research encompasses analysis of industry reports, regulatory filings, company financial statements, and academic research publications to establish market baselines and identify emerging trends. This research foundation supports accurate market sizing and growth projections while validating primary research findings.

Market modeling techniques utilize statistical analysis and forecasting algorithms to project future market trends based on historical data, demographic shifts, and economic indicators. These models account for seasonal variations, economic cycles, and regulatory changes that influence market dynamics.

Industry expert consultations with leading manufacturers, retailers, healthcare professionals, and regulatory specialists provide insider perspectives on market challenges, opportunities, and future developments. These insights help validate research findings and identify factors that may not be apparent from public data sources.

Data validation processes ensure research accuracy through cross-referencing multiple sources, statistical verification, and peer review by industry experts. This rigorous approach maintains research credibility and supports reliable market analysis for strategic decision-making.

United States market dominates the North American immunity health supplements sector, accounting for approximately 78% of regional market share due to its large population, high disposable income levels, and strong health consciousness culture. The U.S. market demonstrates sophisticated consumer preferences for premium products and innovative formulations, driving industry innovation and setting trends for the broader region.

California and Texas represent the largest state markets within the United States, benefiting from diverse populations, health-conscious demographics, and extensive retail distribution networks. These states also serve as innovation hubs where new products and trends often emerge before spreading to other regions.

Canadian market exhibits strong growth potential with 16% of regional market share, characterized by increasing health awareness and government initiatives promoting preventive healthcare. Canadian consumers demonstrate preference for natural and organic products, creating opportunities for premium immunity supplement brands.

Mexico represents an emerging market opportunity with 6% current market share but significant growth potential driven by expanding middle class, increasing health awareness, and improving retail infrastructure. The Mexican market shows particular interest in traditional herbal immunity supplements combined with modern nutritional science.

Regional distribution patterns reveal concentration in urban areas with higher education levels and disposable income, though rural market penetration is improving through e-commerce channels and expanded retail presence. Climate variations across the region influence seasonal demand patterns and product preferences.

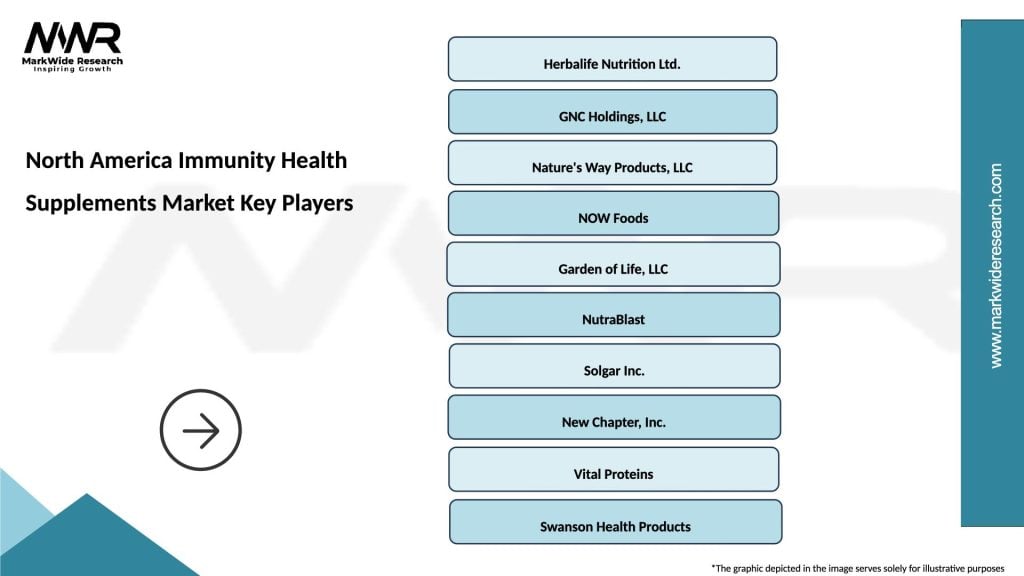

Market leadership in the North America immunity health supplements sector is characterized by a mix of established pharmaceutical companies, specialized nutrition brands, and emerging direct-to-consumer companies. The competitive environment rewards innovation, quality, and effective marketing while punishing companies that fail to adapt to evolving consumer preferences.

Leading market participants include:

Competitive strategies focus on product differentiation through unique ingredient combinations, clinical research validation, and targeted marketing to specific demographic segments. Companies invest heavily in brand building, scientific research, and distribution expansion to maintain competitive advantages.

Emerging competitors include direct-to-consumer brands leveraging digital marketing and subscription models to build customer relationships and compete with established players. These companies often focus on specific niches or innovative delivery formats to differentiate from mainstream offerings.

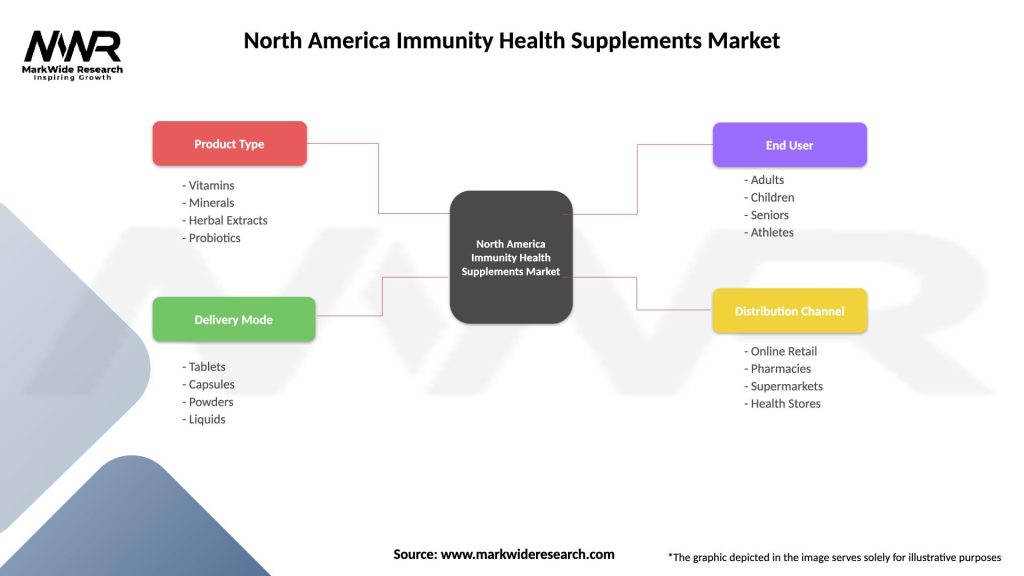

By Product Type:

By Form:

By Distribution Channel:

Vitamin C supplements maintain the largest market share within the immunity category, benefiting from widespread consumer recognition and extensive scientific research supporting immune function benefits. Innovation in this category focuses on enhanced bioavailability formulations and combination products that include complementary nutrients.

Vitamin D products have experienced exceptional growth as research has highlighted the critical role of vitamin D in immune system regulation. Consumer awareness of vitamin D deficiency prevalence has driven demand for both standalone and combination products featuring this essential nutrient.

Zinc supplements represent a rapidly growing category, particularly in lozenge and chewable formats that provide targeted support during immune challenges. The category benefits from strong scientific evidence and healthcare provider recommendations for immune system support.

Probiotic immunity products have emerged as a significant growth category as understanding of the gut-immune connection has increased. These products often command premium pricing due to specialized manufacturing requirements and clinical research supporting their efficacy.

Herbal immunity supplements appeal to consumers seeking natural alternatives, with elderberry, echinacea, and mushroom extracts leading category growth. These products often feature traditional use claims combined with modern scientific validation to appeal to diverse consumer preferences.

Combination immunity formulas represent the fastest-growing category segment, offering comprehensive immune support through scientifically-designed nutrient combinations. These products typically command higher prices while providing convenience and perceived enhanced efficacy compared to single-ingredient supplements.

Manufacturers benefit from strong market growth, premium pricing opportunities for innovative products, and expanding consumer base committed to immune health maintenance. The market’s resilience during economic uncertainty provides stability while innovation opportunities enable competitive differentiation and margin expansion.

Retailers gain from high-margin product categories, consistent consumer demand, and opportunities to build customer loyalty through health-focused product offerings. The immunity supplements category drives traffic and enables cross-selling opportunities with related health and wellness products.

Consumers receive accessible and affordable options for supporting immune system health, with increasing product variety enabling personalized approaches to immune wellness. Scientific advancement continues improving product efficacy while competitive markets ensure reasonable pricing and quality improvements.

Healthcare providers can recommend evidence-based nutritional support options that complement traditional medical care, potentially reducing patient illness frequency and healthcare costs. Professional-grade supplement lines provide additional revenue opportunities while supporting patient wellness goals.

Investors find attractive growth opportunities in a market driven by fundamental demographic and lifestyle trends that support long-term expansion. The sector’s defensive characteristics during economic downturns combined with innovation potential create compelling investment propositions.

Research institutions benefit from industry funding for clinical studies and ingredient research, advancing scientific understanding of nutritional immunology while creating opportunities for technology transfer and commercialization partnerships.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement continues reshaping product formulations as consumers demand transparency in ingredient sourcing, manufacturing processes, and product labeling. This trend drives innovation toward natural, organic, and minimally processed ingredients while eliminating artificial additives and controversial compounds.

Personalization technology is transforming how consumers select and use immunity supplements, with genetic testing, microbiome analysis, and health tracking apps enabling customized recommendations. This trend supports premium pricing while improving consumer satisfaction and product efficacy.

Sustainable packaging has become a significant factor in consumer purchasing decisions, with brands investing in eco-friendly packaging materials and reduced environmental impact throughout the supply chain. This trend particularly resonates with younger consumers who prioritize environmental responsibility.

Functional beverage integration represents a growing trend as immunity-supporting ingredients are incorporated into drinks, smoothies, and other liquid formats that appeal to consumers seeking convenient and enjoyable supplementation methods.

Subscription commerce models are gaining traction as consumers appreciate the convenience of automatic delivery while brands benefit from predictable revenue and enhanced customer lifetime value. These models often include personalization features and educational content to increase engagement.

Clinical research emphasis has intensified as brands invest in human studies to validate product efficacy and support marketing claims. MWR analysis indicates that products with clinical backing achieve 23% higher consumer trust scores and command premium pricing in competitive markets.

Regulatory evolution has included updated FDA guidance on supplement labeling, structure-function claims, and good manufacturing practices that affect how companies develop, manufacture, and market immunity products. These changes require ongoing compliance investments but ultimately benefit consumers through improved product quality and safety.

Ingredient innovation has accelerated with the introduction of novel immune-supporting compounds including specialized mushroom extracts, fermented nutrients, and bioavailable mineral forms. These innovations enable product differentiation and support premium positioning in competitive markets.

Manufacturing advancement includes improved extraction technologies, enhanced quality control systems, and sustainable production methods that reduce costs while improving product consistency and environmental impact. These developments support industry growth while addressing consumer concerns about sustainability.

Distribution expansion has included new retail partnerships, enhanced e-commerce capabilities, and direct-to-consumer platform development that improve market access and customer engagement. These developments particularly benefit smaller brands seeking to compete with established players.

Research partnerships between supplement companies and academic institutions have increased, generating clinical evidence supporting product efficacy while advancing scientific understanding of nutritional immunology. These collaborations enhance industry credibility and support evidence-based marketing approaches.

International ingredient sourcing has evolved to emphasize quality, sustainability, and traceability as companies seek to differentiate products through superior ingredient provenance and ethical sourcing practices.

Investment priorities should focus on companies demonstrating strong research and development capabilities, robust quality control systems, and effective digital marketing strategies that resonate with target consumer segments. Companies with diversified product portfolios and multiple distribution channels offer reduced risk profiles while maintaining growth potential.

Market entry strategies for new participants should emphasize niche positioning, unique ingredient combinations, or innovative delivery formats that differentiate from established competitors. Direct-to-consumer models can provide competitive advantages for brands with strong digital marketing capabilities and customer engagement strategies.

Product development should prioritize clinically-validated ingredients, clean label formulations, and convenient delivery formats that address specific consumer pain points. Combination products offering comprehensive immune support typically outperform single-ingredient supplements in terms of consumer acceptance and pricing power.

Distribution strategy should include multi-channel approaches that balance traditional retail presence with growing e-commerce opportunities. Subscription models and direct-to-consumer platforms can enhance customer relationships while improving profit margins compared to traditional retail channels.

Marketing approaches should emphasize scientific credibility, ingredient transparency, and educational content that helps consumers make informed decisions. Social media and digital platforms provide cost-effective ways to reach target demographics while building brand awareness and customer loyalty.

Quality assurance investments are essential for long-term success, as consumer trust depends on consistent product quality and safety. Third-party testing, certification programs, and transparent manufacturing practices can differentiate brands in competitive markets while reducing regulatory risks.

Market growth trajectory indicates continued expansion driven by demographic trends, increasing health consciousness, and ongoing scientific validation of immune-supporting nutrients. The market is expected to maintain robust growth rates as preventive healthcare approaches gain mainstream acceptance and consumer spending on health products continues increasing.

Innovation acceleration will likely focus on personalized nutrition solutions, novel ingredient combinations, and enhanced bioavailability formulations that improve product efficacy and consumer satisfaction. Advances in nutritional science and manufacturing technology will enable more sophisticated products that command premium pricing.

Digital transformation will reshape how consumers discover, purchase, and use immunity supplements, with technology platforms providing personalized recommendations, health tracking integration, and enhanced customer engagement. Companies investing in digital capabilities will likely gain competitive advantages in customer acquisition and retention.

Regulatory evolution may include stricter quality standards, enhanced labeling requirements, and more rigorous efficacy validation that ultimately benefit consumers and reputable manufacturers while challenging companies with inferior products or practices. Proactive compliance strategies will become increasingly important for market success.

Market consolidation trends may accelerate as larger companies acquire innovative brands and specialized manufacturers to expand product portfolios and market reach. This consolidation could improve overall industry quality standards while creating opportunities for remaining independent companies to serve niche markets.

Global integration within North America will likely increase as trade relationships strengthen and regulatory harmonization progresses, creating opportunities for companies to expand across national borders while achieving economies of scale in manufacturing and distribution.

The North America immunity health supplements market represents a dynamic and rapidly evolving sector characterized by strong consumer demand, continuous innovation, and significant growth potential. Market fundamentals remain robust, supported by demographic trends, increasing health consciousness, and growing scientific validation of immune-supporting nutrients.

Key success factors for market participants include maintaining high product quality standards, investing in scientific research and clinical validation, developing effective digital marketing strategies, and building strong distribution networks that serve diverse consumer preferences. Companies that prioritize innovation, transparency, and customer education are best positioned to capitalize on market opportunities while navigating competitive challenges.

Future market development will likely be shaped by technological advancement, regulatory evolution, and changing consumer expectations for personalized, sustainable, and scientifically-backed health solutions. The integration of digital health platforms, personalized nutrition approaches, and enhanced product formulations will create new opportunities for growth and differentiation in this expanding market.

The North America immunity health supplements market continues demonstrating resilience and adaptability, positioning itself as an essential component of the broader health and wellness industry while serving the evolving needs of health-conscious consumers across the region.

What is Immunity Health Supplements?

Immunity health supplements are products designed to enhance the immune system’s function, often containing vitamins, minerals, herbs, and other natural ingredients that support overall health and wellness.

What are the key players in the North America Immunity Health Supplements Market?

Key players in the North America Immunity Health Supplements Market include Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, and Nature’s Way, among others.

What are the main drivers of growth in the North America Immunity Health Supplements Market?

The growth of the North America Immunity Health Supplements Market is driven by increasing consumer awareness of health and wellness, a rising prevalence of chronic diseases, and a growing trend towards preventive healthcare.

What challenges does the North America Immunity Health Supplements Market face?

Challenges in the North America Immunity Health Supplements Market include regulatory hurdles, the presence of counterfeit products, and varying consumer perceptions regarding the efficacy of supplements.

What opportunities exist in the North America Immunity Health Supplements Market?

Opportunities in the North America Immunity Health Supplements Market include the development of innovative formulations, the rise of e-commerce for supplement sales, and increasing demand for plant-based and organic products.

What trends are shaping the North America Immunity Health Supplements Market?

Trends in the North America Immunity Health Supplements Market include a growing focus on personalized nutrition, the integration of technology in product development, and an increasing preference for natural and clean-label ingredients.

North America Immunity Health Supplements Market

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Extracts, Probiotics |

| Delivery Mode | Tablets, Capsules, Powders, Liquids |

| End User | Adults, Children, Seniors, Athletes |

| Distribution Channel | Online Retail, Pharmacies, Supermarkets, Health Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Immunity Health Supplements Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at