444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America hair conditioner market represents a dynamic and rapidly evolving segment within the broader personal care industry, characterized by continuous innovation and changing consumer preferences. This market encompasses a diverse range of conditioning products designed to improve hair texture, manageability, and overall health across various hair types and concerns. Market growth is driven by increasing consumer awareness about hair care, rising disposable incomes, and the growing influence of social media on beauty standards.

Regional dynamics show that North America maintains its position as a leading consumer of premium hair care products, with the United States accounting for approximately 78% of regional market share. The market demonstrates strong resilience and adaptability, with manufacturers continuously introducing innovative formulations that address specific hair concerns such as damage repair, color protection, and moisture retention. Consumer behavior patterns indicate a shift toward natural and organic ingredients, driving significant product development initiatives across major brands.

Technology advancement in hair care formulations has revolutionized the conditioning market, with brands investing heavily in research and development to create products that deliver superior performance. The market exhibits a compound annual growth rate of 4.2%, reflecting steady demand and continuous market expansion. Distribution channels have evolved significantly, with e-commerce platforms gaining substantial traction alongside traditional retail outlets, creating new opportunities for market penetration and consumer engagement.

The North America hair conditioner market refers to the comprehensive ecosystem of conditioning products, brands, manufacturers, distributors, and consumers operating within the United States, Canada, and Mexico. This market encompasses various product categories including rinse-out conditioners, leave-in treatments, deep conditioning masks, and specialized formulations targeting specific hair types and concerns.

Market scope extends beyond traditional conditioning products to include innovative treatments such as protein-based conditioners, sulfate-free formulations, and multi-functional products that combine conditioning benefits with styling properties. The market represents the intersection of consumer needs, technological innovation, and brand marketing strategies, creating a complex landscape where product efficacy, ingredient transparency, and brand reputation play crucial roles in determining market success.

Industry definition includes all commercial activities related to the development, manufacturing, marketing, distribution, and sale of hair conditioning products within the North American region. This encompasses both mass-market and premium segments, professional salon products, and emerging direct-to-consumer brands that leverage digital platforms for market entry and growth.

Market performance in the North American hair conditioner sector demonstrates robust growth driven by evolving consumer preferences and continuous product innovation. The market benefits from strong brand loyalty, increasing awareness of hair health, and the growing influence of beauty influencers and social media platforms on purchasing decisions. Key growth drivers include the rising demand for natural and organic ingredients, with approximately 42% of consumers actively seeking sulfate-free and paraben-free formulations.

Competitive landscape features a mix of established multinational corporations and emerging niche brands, creating a dynamic environment where innovation and marketing effectiveness determine market share. Major players continue to invest in research and development, focusing on advanced conditioning technologies and sustainable packaging solutions. Consumer trends indicate a preference for personalized hair care solutions, driving brands to develop customizable products and targeted marketing approaches.

Market segmentation reveals diverse opportunities across different product categories, price points, and distribution channels. The premium segment shows particularly strong growth, with consumers willing to invest in high-quality conditioning products that deliver visible results. Regional variations exist in product preferences, with certain formulations performing better in specific geographic areas based on climate conditions and cultural hair care practices.

Consumer behavior analysis reveals several critical insights that shape market dynamics and growth opportunities. The following key insights provide a comprehensive understanding of market trends and consumer preferences:

Primary growth drivers in the North American hair conditioner market stem from multiple interconnected factors that create sustained demand and market expansion opportunities. Consumer awareness about hair health and the importance of proper conditioning has increased significantly, driven by educational content from beauty influencers, professional hairstylists, and brand marketing initiatives.

Demographic trends play a crucial role in market growth, with millennials and Generation Z consumers demonstrating higher spending on personal care products compared to previous generations. These demographics prioritize hair health and are willing to invest in premium conditioning products that deliver visible results. Social media influence has created a culture where hair appearance directly impacts self-confidence and social perception, driving consistent product usage and experimentation.

Innovation in formulations continues to drive market growth, with manufacturers developing advanced conditioning technologies that address specific hair concerns more effectively than traditional products. The introduction of ingredients such as keratin, argan oil, and botanical extracts has expanded the market by attracting consumers seeking professional-quality results at home. Distribution channel expansion, particularly through e-commerce platforms, has improved product accessibility and convenience, contributing to increased market penetration and consumer adoption.

Market challenges in the North American hair conditioner sector include several factors that may limit growth potential and create obstacles for market participants. Price sensitivity among certain consumer segments, particularly during economic uncertainty, can impact demand for premium conditioning products and limit market expansion in specific price categories.

Ingredient concerns and regulatory scrutiny regarding certain chemical components in hair care products have created challenges for manufacturers, requiring reformulation efforts and additional compliance costs. Consumer skepticism about product claims and marketing promises has increased, demanding greater transparency and scientific validation of product benefits, which can increase development and marketing costs.

Market saturation in certain product categories and distribution channels creates intense competition, making it difficult for new brands to establish market presence and for existing brands to maintain growth rates. Supply chain disruptions and raw material cost fluctuations can impact product availability and pricing strategies, affecting overall market stability and profitability for manufacturers and retailers.

Emerging opportunities in the North American hair conditioner market present significant potential for growth and innovation across multiple dimensions. Natural and organic segments offer substantial expansion possibilities, with increasing consumer demand for clean beauty products creating space for brands that prioritize sustainable and environmentally friendly formulations.

Personalization technology represents a transformative opportunity, enabling brands to develop customized conditioning solutions based on individual hair analysis, lifestyle factors, and specific concerns. This approach can command premium pricing while building stronger consumer relationships and brand loyalty. Professional partnerships with salons and hairstylists create opportunities for product endorsement, education, and direct consumer recommendations.

Digital commerce expansion offers significant growth potential, particularly through subscription models, direct-to-consumer platforms, and social commerce initiatives. International expansion within North America, particularly in underserved markets and demographic segments, presents opportunities for market share growth and revenue diversification. Product innovation in areas such as scalp health, anti-aging benefits, and specialized treatments for chemically processed hair creates new market categories and consumer interest.

Market dynamics in the North American hair conditioner sector reflect a complex interplay of consumer behavior, competitive pressures, technological advancement, and regulatory influences. Supply and demand patterns show consistent growth in demand for premium and specialized conditioning products, while traditional mass-market segments face increased competition and price pressure.

Competitive intensity has increased significantly as new brands enter the market and established players expand their product portfolios. This competition drives continuous innovation, improved product quality, and more aggressive marketing strategies. Consumer education has become a critical factor, with brands investing heavily in content marketing and educational initiatives to differentiate their products and build consumer trust.

Seasonal fluctuations impact market dynamics, with certain products experiencing higher demand during specific times of the year based on climate conditions and hair care needs. Economic factors influence consumer spending patterns, with premium products showing resilience during economic stability and value-oriented products gaining traction during uncertain periods. Technological integration in product development and marketing has become essential for maintaining competitive advantage and meeting evolving consumer expectations.

Comprehensive research approach employed in analyzing the North American hair conditioner market combines multiple methodologies to ensure accuracy and depth of insights. Primary research includes consumer surveys, focus groups, and interviews with industry professionals, retailers, and brand representatives to gather firsthand perspectives on market trends and consumer behavior patterns.

Secondary research encompasses analysis of industry reports, company financial statements, regulatory filings, and market intelligence databases to validate findings and provide comprehensive market context. Data triangulation methods ensure reliability by cross-referencing information from multiple sources and identifying consistent patterns and trends across different data sets.

Market modeling techniques incorporate statistical analysis, trend extrapolation, and scenario planning to project future market developments and identify potential growth opportunities. Expert consultation with industry specialists, including cosmetic chemists, marketing professionals, and retail analysts, provides additional validation and insights into market dynamics and competitive strategies. Continuous monitoring of market developments ensures that research findings remain current and relevant to stakeholders making strategic decisions.

United States market dominates the North American hair conditioner landscape, representing the largest consumer base and most diverse product offerings. Market characteristics include high brand awareness, strong retail infrastructure, and sophisticated consumer preferences that drive innovation and premium product development. The US market shows approximately 15% growth in natural and organic conditioning products, reflecting changing consumer priorities and increased environmental consciousness.

Canadian market demonstrates steady growth with unique characteristics influenced by climate conditions and cultural preferences. Consumer behavior in Canada shows strong preference for products that address dry hair concerns, particularly during winter months, creating opportunities for specialized formulations. The market exhibits approximately 23% market share for premium conditioning products, indicating consumer willingness to invest in quality hair care solutions.

Mexican market represents significant growth potential with increasing urbanization, rising disposable incomes, and growing awareness of international beauty trends. Market development is characterized by expanding retail infrastructure and increasing availability of premium brands. Regional preferences vary significantly across North America, with climate, water quality, and cultural hair care practices influencing product formulation and marketing strategies. Cross-border commerce and brand expansion strategies continue to shape regional market dynamics and competitive positioning.

Market leadership in the North American hair conditioner sector is characterized by intense competition among established multinational corporations and emerging innovative brands. The competitive environment features diverse strategies ranging from mass-market accessibility to premium positioning and niche specialization.

Competitive strategies include continuous product innovation, strategic acquisitions, digital marketing expansion, and sustainability initiatives. Market positioning varies significantly, with companies targeting different consumer segments through price points, ingredient focuses, and brand messaging approaches.

Product type segmentation reveals diverse market categories that address specific consumer needs and preferences. Market distribution across different product types shows varying growth rates and consumer adoption patterns, creating opportunities for targeted marketing and product development strategies.

By Product Type:

By Hair Type:

By Distribution Channel:

Premium conditioning segment demonstrates the strongest growth trajectory, with consumers increasingly willing to invest in high-quality products that deliver visible results. This category benefits from advanced ingredient technologies, sophisticated packaging, and targeted marketing approaches that emphasize efficacy and luxury experience. Consumer research indicates that approximately 38% of premium conditioner users report higher satisfaction levels compared to mass-market alternatives.

Natural and organic category represents the fastest-growing segment, driven by increasing consumer awareness of ingredient safety and environmental impact. Market penetration in this category has accelerated significantly, with brands investing heavily in sustainable sourcing, eco-friendly packaging, and transparent ingredient communication. Price premiums in this category are generally accepted by consumers who prioritize health and environmental considerations.

Professional-grade products maintain strong market position through salon partnerships and stylist recommendations. This category benefits from credibility and expertise associated with professional use, allowing for premium pricing and strong brand loyalty. Innovation focus in professional products often leads market trends, with new technologies and ingredients typically introduced in professional lines before mass-market adoption. Distribution strategies for professional products emphasize education, training, and relationship building with salon professionals who influence consumer purchasing decisions.

Manufacturers benefit from strong market demand, continuous innovation opportunities, and diverse revenue streams across multiple product categories and price points. Brand building opportunities allow companies to develop strong consumer relationships and command premium pricing for differentiated products. Research and development investments yield competitive advantages through superior formulations and unique ingredient combinations that address specific consumer needs.

Retailers gain from high product turnover, strong consumer loyalty, and opportunities for private label development. Category management strategies enable retailers to optimize shelf space allocation and maximize revenue per square foot through strategic product placement and promotional activities. Digital integration opportunities allow retailers to enhance customer experience through online platforms and omnichannel strategies.

Consumers receive continuous product improvements, increased variety, and better value propositions as competition drives innovation and quality enhancements. Educational resources from brands and retailers help consumers make informed purchasing decisions and achieve better hair care results. Accessibility improvements through expanded distribution channels and online availability make quality conditioning products more convenient to purchase and use.

Professional stylists benefit from advanced product technologies that enhance their service offerings and client satisfaction. Training programs and educational support from manufacturers help professionals stay current with latest trends and techniques. Partnership opportunities with brands provide additional revenue streams through product sales and professional endorsements.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability revolution has emerged as a dominant trend, with consumers increasingly demanding eco-friendly packaging, sustainable ingredient sourcing, and transparent environmental practices from brands. Market response includes widespread adoption of recyclable packaging, waterless formulations, and carbon-neutral manufacturing processes. This trend shows approximately 52% consumer preference for brands demonstrating environmental responsibility.

Personalization technology is transforming the market through AI-powered hair analysis, customized formulations, and individualized product recommendations. Digital tools enable consumers to receive personalized conditioning solutions based on their specific hair type, concerns, and lifestyle factors. Brand investment in personalization technology is increasing as companies recognize the competitive advantage and premium pricing opportunities it provides.

Clean beauty movement continues to gain momentum, with consumers seeking products free from sulfates, parabens, silicones, and other controversial ingredients. Ingredient transparency has become essential, with brands providing detailed information about sourcing, processing, and safety testing. Scientific validation of natural ingredients and their efficacy is becoming increasingly important for consumer acceptance and market success.

Multi-functional products are gaining popularity as consumers seek convenience and value in their hair care routines. Product innovation focuses on combining conditioning benefits with heat protection, UV defense, styling properties, and scalp health benefits. Time-saving solutions appeal to busy consumers who want effective results with minimal effort and product usage.

Recent industry developments have significantly shaped the competitive landscape and market dynamics in the North American hair conditioner sector. Merger and acquisition activity has increased as companies seek to expand their product portfolios, enter new market segments, and achieve operational synergies. Strategic partnerships between traditional beauty companies and technology firms are driving innovation in personalization and digital commerce capabilities.

Regulatory developments have influenced product formulation and marketing practices, with increased scrutiny of ingredient safety and environmental impact. Industry response includes significant investment in research and development to create safer, more effective formulations that meet evolving regulatory standards. Sustainability initiatives have become industry-wide priorities, with major companies committing to carbon neutrality and sustainable packaging goals.

Technology integration has accelerated across the industry, with brands investing in digital platforms, artificial intelligence, and data analytics to better understand consumer behavior and preferences. Supply chain innovations include direct sourcing relationships with ingredient suppliers and investment in sustainable production facilities. Marketing evolution has shifted toward digital-first strategies, influencer partnerships, and content-driven approaches that educate consumers about hair care benefits and proper product usage.

Strategic recommendations for market participants focus on adapting to evolving consumer preferences while maintaining competitive positioning and profitability. MarkWide Research analysis suggests that companies should prioritize investment in natural and sustainable product development to capture growing demand in this segment. Innovation focus should emphasize multi-functional products that provide convenience and value to time-conscious consumers.

Digital transformation initiatives should be accelerated, with particular emphasis on e-commerce capabilities, personalization technology, and data-driven marketing approaches. Brand positioning strategies should emphasize ingredient transparency, scientific validation, and environmental responsibility to build consumer trust and loyalty. Partnership opportunities with professional stylists, beauty influencers, and technology companies can provide competitive advantages and market expansion possibilities.

Market expansion strategies should consider underserved demographic segments and geographic regions within North America. Product portfolio optimization should balance mass-market accessibility with premium positioning to maximize revenue opportunities across different consumer segments. Supply chain resilience should be strengthened through diversified sourcing strategies and strategic inventory management to mitigate potential disruptions and cost fluctuations.

Market projections for the North American hair conditioner sector indicate continued growth driven by innovation, demographic trends, and evolving consumer preferences. Long-term growth is expected to maintain a steady trajectory of approximately 4.8% annual growth over the next five years, supported by increasing consumer investment in personal care and hair health. Premium segment expansion is anticipated to outpace overall market growth as consumers become more discerning about product quality and efficacy.

Technology integration will continue to reshape the market, with personalization becoming increasingly sophisticated and accessible to mainstream consumers. Sustainability requirements will become more stringent, driving innovation in packaging, formulation, and manufacturing processes. Market consolidation may occur as smaller brands seek partnerships or acquisition opportunities to compete effectively against larger corporations with greater resources and distribution capabilities.

Consumer behavior evolution will likely emphasize convenience, efficacy, and environmental responsibility, creating opportunities for brands that successfully address these priorities. Distribution channel development will continue favoring digital platforms and direct-to-consumer models, requiring traditional retailers to adapt their strategies and value propositions. Global influence on North American market trends will increase as international beauty standards and ingredients gain popularity among diverse consumer segments.

Market assessment of the North American hair conditioner sector reveals a dynamic and resilient industry characterized by continuous innovation, strong consumer demand, and evolving competitive dynamics. Growth prospects remain positive, supported by demographic trends, increasing consumer awareness of hair health, and ongoing technological advancement in product formulations and delivery systems.

Strategic success in this market requires balancing traditional strengths such as brand recognition and distribution capabilities with emerging priorities including sustainability, personalization, and digital engagement. Consumer-centric approaches that prioritize ingredient transparency, product efficacy, and environmental responsibility will likely determine long-term market leadership and profitability.

Industry transformation continues as companies adapt to changing consumer preferences, regulatory requirements, and competitive pressures. Future opportunities exist for brands that successfully integrate innovation, sustainability, and consumer education into comprehensive market strategies. The North America hair conditioner market represents a mature yet dynamic sector with significant potential for continued growth and evolution, offering opportunities for both established players and innovative newcomers who can effectively address evolving consumer needs and preferences.

What is Hair Conditioner?

Hair conditioner is a hair care product designed to improve the texture and appearance of hair. It works by coating the hair shaft, providing moisture, reducing static, and making hair easier to manage.

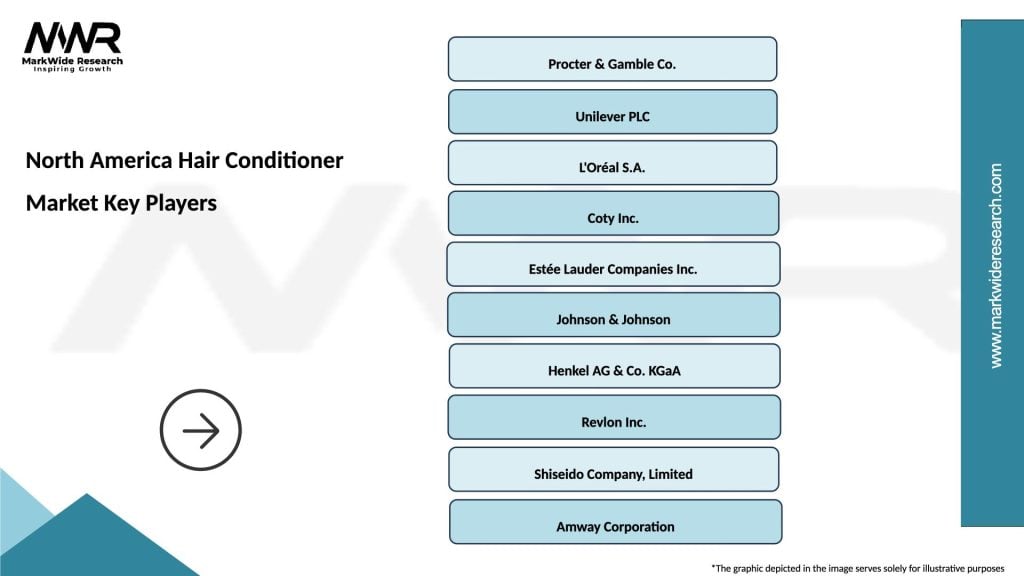

What are the key players in the North America Hair Conditioner Market?

Key players in the North America Hair Conditioner Market include Procter & Gamble, Unilever, L’Oréal, and Johnson & Johnson, among others.

What are the main drivers of growth in the North America Hair Conditioner Market?

The growth of the North America Hair Conditioner Market is driven by increasing consumer awareness of hair care, the rising demand for natural and organic products, and the influence of social media on beauty trends.

What challenges does the North America Hair Conditioner Market face?

Challenges in the North America Hair Conditioner Market include intense competition among brands, fluctuating raw material prices, and changing consumer preferences towards sustainable and eco-friendly products.

What opportunities exist in the North America Hair Conditioner Market?

Opportunities in the North America Hair Conditioner Market include the growing trend of personalized hair care solutions, the expansion of e-commerce platforms, and the increasing popularity of subscription services for beauty products.

What trends are shaping the North America Hair Conditioner Market?

Trends in the North America Hair Conditioner Market include the rise of clean beauty products, the incorporation of technology in product formulation, and the focus on scalp health as an integral part of hair care.

North America Hair Conditioner Market

| Segmentation Details | Description |

|---|---|

| Product Type | Leave-In, Rinse-Out, Deep Conditioning, Treatment |

| Formulation | Cream, Gel, Spray, Oil |

| End User | Women, Men, Children, Salons |

| Distribution Channel | Online, Supermarkets, Specialty Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Hair Conditioner Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at