444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America gutter guard market represents a rapidly expanding segment within the home improvement and construction industry, driven by increasing homeowner awareness of property maintenance and protection solutions. Gutter protection systems have evolved from simple screening solutions to sophisticated engineered products that effectively prevent debris accumulation while maintaining optimal water flow. The market encompasses various product categories including mesh guards, reverse curve systems, bottle brush inserts, and foam filters, each designed to address specific regional climate challenges and architectural requirements.

Market dynamics indicate robust growth potential across residential and commercial applications, with the residential segment commanding the largest market share at approximately 78% of total installations. The increasing frequency of severe weather events, coupled with rising labor costs for gutter cleaning services, has accelerated adoption rates among property owners seeking long-term maintenance solutions. Regional variations in product preferences reflect diverse climatic conditions, with northern regions favoring ice dam prevention systems while southern markets emphasize debris filtration capabilities.

Technological advancement continues to drive market evolution, with manufacturers developing innovative materials and installation methods that enhance durability and performance. The integration of micro-mesh technology and self-cleaning surface treatments has significantly improved product effectiveness, contributing to market expansion at a projected CAGR of 6.2% through the forecast period.

The North America gutter guard market refers to the commercial ecosystem encompassing the design, manufacturing, distribution, and installation of protective systems that prevent debris accumulation in residential and commercial gutters while maintaining proper water drainage functionality. Gutter guards serve as barrier systems installed over existing gutters to filter out leaves, twigs, pine needles, and other organic debris that can cause blockages and water damage.

Market participants include manufacturers of various guard types, specialized installation contractors, home improvement retailers, and roofing professionals who integrate gutter protection into comprehensive property maintenance solutions. The market encompasses multiple product categories ranging from basic screen systems to advanced micro-mesh technologies, each engineered to address specific environmental challenges and performance requirements across different North American climate zones.

Economic significance extends beyond product sales to include installation services, maintenance contracts, and complementary gutter system upgrades, creating a comprehensive market ecosystem that supports both DIY homeowners and professional contractors seeking reliable debris protection solutions.

Market leadership in the North America gutter guard sector is characterized by strong demand fundamentals driven by increasing property maintenance awareness and extreme weather frequency. The residential segment dominates market activity, representing the majority of installations as homeowners seek cost-effective alternatives to recurring gutter cleaning services. Product innovation has accelerated significantly, with manufacturers developing advanced materials and designs that offer superior debris filtration while maintaining aesthetic appeal.

Regional distribution shows concentrated demand in areas with heavy tree coverage and seasonal debris challenges, particularly in the northeastern and northwestern regions where deciduous forests create substantial maintenance requirements. The market benefits from favorable demographic trends, including aging homeowner populations seeking maintenance-reduction solutions and increasing new construction activity incorporating gutter protection systems as standard features.

Competitive dynamics favor companies with strong distribution networks and proven installation capabilities, as product performance and professional installation quality significantly impact customer satisfaction and market reputation. The integration of e-commerce channels has expanded market reach, enabling direct-to-consumer sales while maintaining traditional contractor distribution relationships.

Consumer behavior analysis reveals several critical market insights that shape industry development and strategic planning. Primary purchase motivations include maintenance cost reduction, property protection, and safety concerns related to ladder-based gutter cleaning activities. Decision-making factors prioritize product durability, warranty coverage, and installation complexity, with homeowners increasingly favoring professional installation over DIY approaches.

Primary growth drivers propelling the North America gutter guard market include escalating property maintenance costs and increasing awareness of water damage prevention. The rising cost of professional gutter cleaning services, which have increased by approximately 35% over the past five years, has motivated homeowners to invest in permanent protection solutions. Demographic shifts toward an aging population create additional demand as older homeowners seek to eliminate dangerous ladder-based maintenance activities.

Climate-related factors significantly influence market expansion, with increasing frequency of severe weather events highlighting the importance of effective gutter systems. Extended wildfire seasons in western regions have elevated awareness of ember protection capabilities, while ice dam formation in northern climates drives demand for specialized prevention systems. Insurance industry trends supporting preventive maintenance investments further accelerate market adoption.

Construction industry growth provides substantial market opportunities through new home construction and renovation projects. The integration of gutter guards into comprehensive roofing and exterior improvement projects has become increasingly common, with contractors recognizing the value-added benefits for customer satisfaction and project differentiation. Building code evolution in certain jurisdictions now recommends or requires gutter protection systems in high-risk areas.

Cost considerations represent the primary market restraint, as quality gutter guard systems require significant upfront investment compared to traditional cleaning services. Initial installation costs can deter price-sensitive consumers, particularly in regions with lower debris accumulation rates where the value proposition may be less compelling. Product performance variability across different manufacturers has created market skepticism, with some consumers experiencing disappointing results from inferior products.

Installation complexity poses challenges for both DIY homeowners and professional contractors, as improper installation can compromise system effectiveness and void manufacturer warranties. The requirement for specialized tools and techniques for certain product types limits market accessibility and increases overall project costs. Aesthetic concerns regarding visual impact on home appearance continue to influence purchase decisions, particularly in upscale residential markets.

Maintenance requirements for certain guard types contradict consumer expectations of maintenance-free solutions, creating dissatisfaction when periodic cleaning or adjustment becomes necessary. Seasonal limitations on installation activities in northern climates restrict market growth potential during winter months, concentrating demand into shorter timeframes that can strain installation capacity.

Technological advancement opportunities present significant potential for market expansion through development of smart gutter systems incorporating sensors and automated cleaning capabilities. The integration of IoT technology could enable remote monitoring and predictive maintenance, appealing to tech-savvy homeowners seeking comprehensive property management solutions. Material science innovations continue to offer opportunities for enhanced durability, self-cleaning properties, and improved aesthetic integration.

Market penetration opportunities exist in underserved regions and demographic segments, particularly in southern markets where awareness of gutter protection benefits remains limited. The commercial and industrial segments represent substantial untapped potential, as businesses increasingly recognize the cost-effectiveness of preventive maintenance solutions. Partnership opportunities with roofing contractors, home improvement retailers, and insurance companies could accelerate market expansion.

Sustainability trends create opportunities for eco-friendly product development using recycled materials and environmentally responsible manufacturing processes. The growing emphasis on green building practices and LEED certification requirements could drive demand for sustainable gutter protection solutions. Customization opportunities for unique architectural applications and specialty installations offer premium pricing potential in niche market segments.

Supply chain dynamics in the North America gutter guard market reflect a complex network of manufacturers, distributors, and installation professionals working to meet diverse regional demands. Manufacturing concentration primarily occurs in industrial regions with established metalworking capabilities, while distribution networks extend across urban and suburban markets through home improvement retailers and specialty contractors.

Competitive pressures drive continuous product innovation and pricing optimization, with manufacturers investing heavily in research and development to differentiate their offerings. The market demonstrates cyclical patterns aligned with construction activity and seasonal weather patterns, requiring flexible production and inventory management strategies. Quality standards have evolved significantly, with industry associations developing performance benchmarks and certification programs.

Customer relationship dynamics emphasize the importance of post-installation support and warranty service, as product performance directly impacts brand reputation and customer loyalty. The integration of digital marketing channels has transformed customer acquisition strategies, enabling direct engagement with homeowners while maintaining traditional contractor relationships. Regulatory influences continue to shape product development and installation practices, particularly regarding building codes and safety requirements.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence for the North America gutter guard sector. Primary research activities include structured interviews with industry executives, contractor surveys, and consumer behavior studies conducted across representative geographic regions. Field research encompasses installation site visits and product performance evaluations under various environmental conditions.

Secondary research components analyze industry publications, trade association reports, and government construction statistics to establish market baselines and trend identification. MarkWide Research utilizes proprietary databases and analytical frameworks to process market data and generate actionable insights for industry stakeholders. Quantitative analysis incorporates statistical modeling and forecasting techniques to project market development scenarios.

Data validation processes ensure information accuracy through cross-referencing multiple sources and expert review panels comprising industry professionals and technical specialists. Market segmentation analysis employs demographic, geographic, and psychographic variables to identify distinct consumer groups and their specific requirements. Trend analysis incorporates both historical performance data and forward-looking indicators to establish comprehensive market perspectives.

United States market dominates North American gutter guard demand, accounting for approximately 89% of regional installations due to extensive suburban housing stock and diverse climate conditions requiring debris protection. Northeast region demonstrates the highest per-capita adoption rates, driven by heavy deciduous tree coverage and ice dam prevention requirements. The region benefits from established contractor networks and high homeowner awareness of gutter maintenance challenges.

Southeast markets show rapid growth potential as hurricane frequency and intensity increase awareness of comprehensive property protection needs. The region’s year-round construction activity supports consistent installation demand, while pine needle accumulation creates specific product requirements. Western states exhibit strong demand for ember protection systems due to wildfire risks, with California leading adoption of specialized fire-resistant gutter guard technologies.

Canadian market represents approximately 11% of North American demand, concentrated in urban centers with significant tree coverage and harsh winter conditions. Ontario and British Columbia lead provincial adoption rates, supported by government incentives for home weatherization improvements. The Canadian market demonstrates preference for premium products with extended warranties due to extreme weather exposure requirements.

Market leadership in the North America gutter guard sector is distributed among several established manufacturers with strong regional presence and specialized product portfolios. Competitive positioning emphasizes product performance, warranty coverage, and installation support capabilities as key differentiation factors.

Product type segmentation reveals distinct market categories based on design principles and installation methods. Micro-mesh guards represent the fastest-growing segment due to superior debris filtration capabilities and minimal maintenance requirements. Screen-type guards maintain significant market share in price-sensitive segments, while reverse curve systems appeal to consumers prioritizing aesthetic integration.

By Material:

By Application:

Micro-mesh category demonstrates exceptional growth momentum, capturing increasing market share through superior performance characteristics and customer satisfaction rates. These systems excel in fine debris filtration while maintaining excellent water flow rates, making them particularly effective in regions with diverse vegetation types. Installation complexity requires professional expertise but results in long-term customer satisfaction and positive referral generation.

Reverse curve systems maintain strong market position in specific geographic regions where aesthetic considerations and ice dam prevention capabilities are prioritized. These products integrate seamlessly with existing gutter systems and provide effective debris shedding through aerodynamic design principles. Performance optimization continues through design refinements addressing specific regional climate challenges.

Screen and filter categories serve price-conscious market segments while providing basic debris protection functionality. These products appeal to DIY homeowners and budget-focused installations, though performance limitations may require more frequent maintenance. Market evolution in these categories focuses on improved materials and simplified installation methods to enhance value propositions.

Manufacturers benefit from expanding market demand driven by demographic trends and climate-related factors that create sustained growth opportunities. Product innovation enables premium pricing for advanced systems while building brand differentiation in competitive markets. The recurring nature of replacement and upgrade cycles provides predictable revenue streams for established market participants.

Installation contractors gain access to high-margin service opportunities that complement traditional roofing and exterior improvement projects. Gutter guard installation provides year-round revenue potential and helps contractors differentiate their service offerings in competitive markets. The technical expertise required for proper installation creates barriers to entry that protect established contractor relationships.

Homeowners realize significant long-term cost savings through reduced maintenance requirements and protection against water damage. Property value enhancement results from improved functionality and reduced maintenance concerns that appeal to potential buyers. Safety benefits eliminate dangerous ladder-based cleaning activities while ensuring optimal gutter system performance throughout seasonal weather variations.

Retailers and distributors benefit from strong product margins and growing consumer awareness that drives consistent demand. Market expansion opportunities exist through education and demonstration programs that showcase product benefits and installation processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration trends are reshaping the North America gutter guard market through development of smart systems incorporating sensors and automated maintenance capabilities. IoT connectivity enables remote monitoring of gutter performance and predictive maintenance scheduling, appealing to tech-savvy homeowners seeking comprehensive property management solutions. These advanced systems command premium pricing while providing enhanced customer value through proactive maintenance alerts.

Sustainability trends drive increasing demand for eco-friendly products manufactured from recycled materials and designed for end-of-life recyclability. Green building certification requirements create opportunities for environmentally responsible gutter protection systems that contribute to LEED points and sustainable construction goals. Manufacturers are responding with products that minimize environmental impact throughout their lifecycle.

Customization trends reflect growing consumer demand for products tailored to specific architectural styles and performance requirements. Color matching capabilities and custom sizing options enable seamless integration with existing home aesthetics while maintaining optimal functionality. The trend toward personalization extends to performance characteristics, with systems designed for specific regional climate challenges and debris types.

Installation service trends emphasize comprehensive project management and customer education, with contractors providing detailed maintenance guidance and performance monitoring. Warranty expansion trends include extended coverage periods and comprehensive performance guarantees that enhance customer confidence and market acceptance.

Product innovation developments continue to advance market capabilities through introduction of next-generation materials and design improvements. Recent developments include self-cleaning surface treatments that reduce maintenance requirements and enhanced debris shedding capabilities. Manufacturing process improvements have enabled cost reductions while maintaining quality standards, making premium products more accessible to broader market segments.

Distribution channel developments reflect the growing importance of e-commerce platforms and direct-to-consumer sales models. Digital marketing initiatives enable manufacturers to engage directly with homeowners while maintaining traditional contractor relationships through specialized programs and support services. Online product configurators and virtual consultation services enhance customer experience and streamline the purchase process.

Industry consolidation developments have resulted in strategic acquisitions and partnerships that strengthen market positions and expand geographic coverage. MarkWide Research analysis indicates that consolidation trends will continue as companies seek to achieve economies of scale and enhance competitive positioning through expanded product portfolios and distribution capabilities.

Regulatory developments include updated building codes and safety standards that impact product design and installation requirements. Industry associations have developed certification programs and performance standards that help consumers identify quality products and qualified installation professionals.

Market entry strategies should prioritize product differentiation through superior performance characteristics and comprehensive warranty coverage. New market participants should focus on underserved geographic regions or specialized applications where established competitors have limited presence. Building strong contractor relationships and providing exceptional installation support will be critical for market success.

Product development priorities should emphasize ease of installation, aesthetic integration, and maintenance-free operation to address primary customer concerns. Investment in technology development, particularly smart systems and IoT integration, will provide competitive advantages as the market evolves toward more sophisticated solutions. Sustainability initiatives should be integrated into product development to align with growing environmental consciousness.

Distribution strategy recommendations include developing multi-channel approaches that serve both DIY consumers and professional contractors effectively. E-commerce capabilities should be enhanced to capture growing online demand while maintaining strong relationships with traditional distribution partners. Customer education programs and demonstration facilities can accelerate market acceptance and reduce sales cycle times.

Partnership opportunities with roofing contractors, home improvement retailers, and insurance companies should be pursued to expand market reach and enhance value propositions. Strategic alliances can provide access to established customer bases and complement existing product offerings with comprehensive property protection solutions.

Long-term market prospects for the North America gutter guard industry remain highly favorable, supported by fundamental demographic and climate trends that drive sustained demand growth. Market maturation will likely result in increased product standardization and performance benchmarking, benefiting consumers through improved quality consistency and competitive pricing. The projected market expansion at a CAGR of 6.2% reflects strong underlying demand fundamentals and continued product innovation.

Technology evolution will transform market offerings through integration of smart systems, advanced materials, and automated maintenance capabilities. IoT connectivity and predictive maintenance features will become standard offerings in premium product segments, while basic protection systems will benefit from improved materials and simplified installation methods. The convergence of gutter protection with comprehensive home automation systems presents significant growth opportunities.

Market consolidation trends will likely continue as companies seek to achieve economies of scale and expand geographic coverage through strategic acquisitions and partnerships. MWR projections indicate that successful companies will be those that combine product innovation with strong distribution networks and exceptional customer service capabilities. The emphasis on sustainability and environmental responsibility will become increasingly important for market success.

Regional development patterns will reflect climate change impacts and evolving construction practices, with increased demand in areas experiencing more frequent severe weather events. Commercial market expansion represents significant untapped potential as businesses recognize the cost-effectiveness of preventive maintenance solutions for large-scale properties.

The North America gutter guard market represents a dynamic and expanding industry segment with strong growth fundamentals driven by demographic trends, climate factors, and increasing property maintenance awareness. Market evolution continues through technological advancement, product innovation, and expanding distribution channels that enhance accessibility and customer value. The industry demonstrates resilience through diverse product offerings that address varied regional requirements and customer preferences.

Competitive dynamics favor companies with strong product performance, comprehensive warranty coverage, and established distribution networks that can effectively serve both residential and commercial market segments. Future success will depend on continued innovation, strategic partnerships, and adaptation to evolving customer expectations regarding technology integration and environmental responsibility. The market’s projected growth trajectory reflects sustained demand for effective debris protection solutions that reduce maintenance costs and enhance property protection capabilities across North American residential and commercial properties.

What is Gutter Guard?

Gutter Guard refers to a protective system designed to prevent debris from clogging gutters, ensuring proper water flow and reducing maintenance needs. These systems are commonly used in residential and commercial buildings to enhance drainage efficiency.

What are the key players in the North America Gutter Guard Market?

Key players in the North America Gutter Guard Market include LeafFilter, Gutter Helmet, and MasterShield, among others. These companies offer a variety of gutter protection solutions and compete on factors such as product innovation and customer service.

What are the growth factors driving the North America Gutter Guard Market?

The North America Gutter Guard Market is driven by increasing awareness of home maintenance, the rising demand for durable and efficient gutter systems, and the growing trend of DIY home improvement projects. Additionally, climate change and extreme weather conditions are prompting homeowners to invest in better drainage solutions.

What challenges does the North America Gutter Guard Market face?

Challenges in the North America Gutter Guard Market include the high initial installation costs and the potential for product failure if not properly installed. Additionally, competition from traditional gutter cleaning services can hinder market growth.

What opportunities exist in the North America Gutter Guard Market?

Opportunities in the North America Gutter Guard Market include the development of innovative materials that enhance durability and effectiveness, as well as the expansion of e-commerce platforms for easier consumer access. Furthermore, increasing environmental awareness may drive demand for sustainable gutter solutions.

What trends are shaping the North America Gutter Guard Market?

Trends in the North America Gutter Guard Market include the rise of smart home technology integration, where gutter guards are equipped with sensors to monitor debris levels. Additionally, there is a growing preference for customizable gutter solutions that cater to specific architectural styles and homeowner preferences.

North America Gutter Guard Market

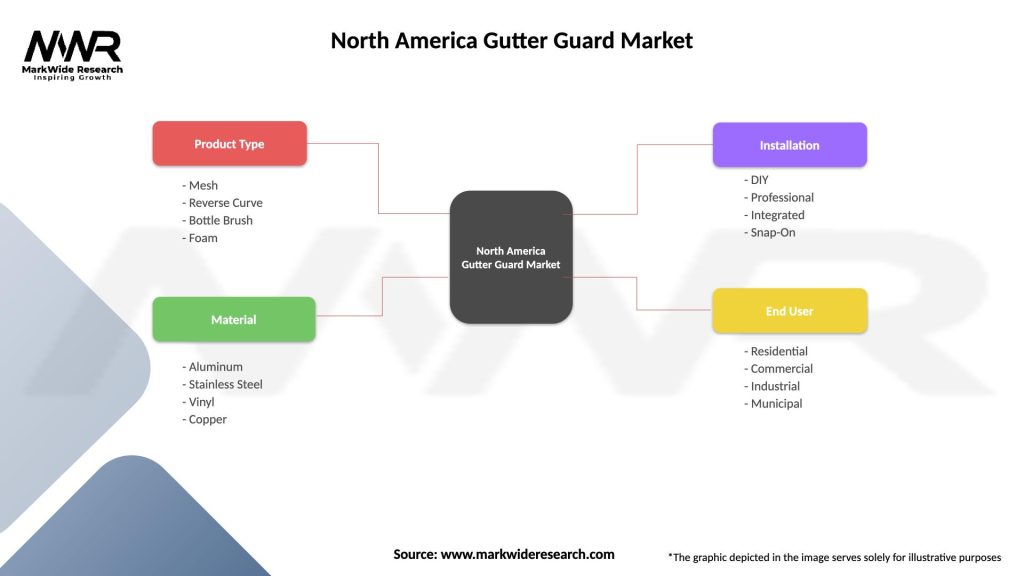

| Segmentation Details | Description |

|---|---|

| Product Type | Mesh, Reverse Curve, Bottle Brush, Foam |

| Material | Aluminum, Stainless Steel, Vinyl, Copper |

| Installation | DIY, Professional, Integrated, Snap-On |

| End User | Residential, Commercial, Industrial, Municipal |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Gutter Guard Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at