444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America Gas Insulated Switchgear (GIS) market is witnessing significant growth due to the increasing demand for reliable and efficient power transmission and distribution infrastructure. GIS is a compact, high-voltage switchgear that uses compressed sulfur hexafluoride (SF6) gas to insulate and shield electrical components. It offers numerous advantages over traditional air-insulated switchgear, including higher reliability, lower maintenance requirements, and reduced space requirements.

Meaning

Gas Insulated Switchgear (GIS) refers to a type of switchgear that uses SF6 gas as an insulation medium to provide protection and control for electrical power systems. It is widely used in high-voltage substations, power generation plants, industrial facilities, and infrastructure projects. The gas insulation allows for compact designs, efficient power distribution, and improved safety

Executive Summary

The North America Gas Insulated Switchgear market is experiencing steady growth with the increasing need for reliable power infrastructure and the growing adoption of renewable energy sources. The market is characterized by the presence of several key players offering technologically advanced GIS solutions. Factors such as urbanization, industrialization, and the expansion of smart grid networks are driving the demand for GIS in the region. However, market growth is also influenced by certain challenges and opportunities that need to be considered.

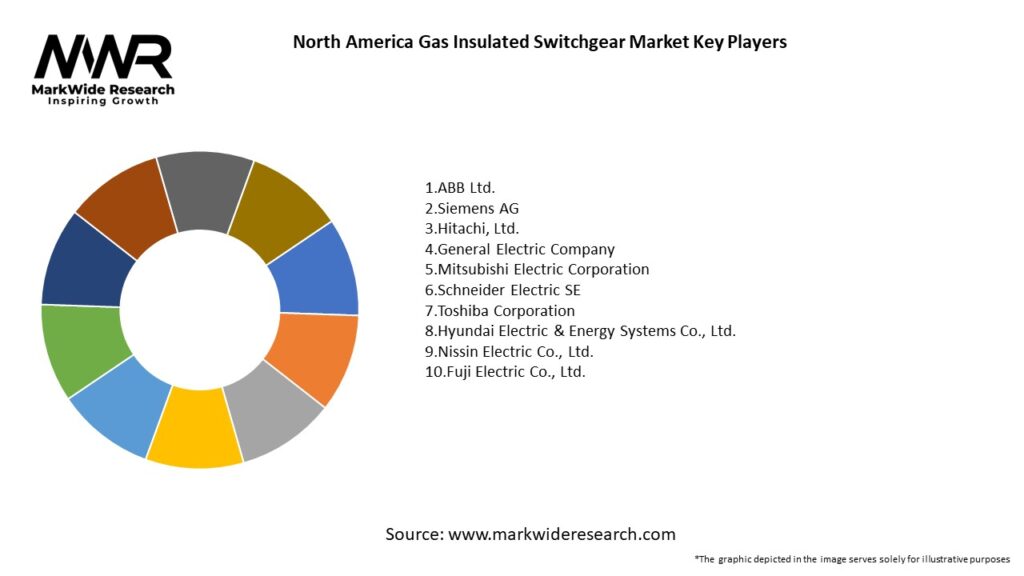

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America Gas Insulated Switchgear market is driven by various dynamics that impact its growth and development. These dynamics include market drivers, restraints, opportunities, and industry trends. The market is highly competitive, with key players focusing on product innovation, technological advancements, and strategic partnerships to gain a competitive edge. Government regulations and policies play a crucial role in shaping the market landscape, particularly concerning environmental concerns and energy efficiency. The COVID-19 pandemic has also influenced market dynamics, leading to supply chain disruptions, project delays, and shifting customer priorities.

Regional Analysis

The North America Gas Insulated Switchgear market is segmented into several key regions, including the United States, Canada, and Mexico. The United States holds a significant market share due to the presence of established GIS manufacturers, growing investments in infrastructure development, and the adoption of advanced technologies. Canada and Mexico are also witnessing steady growth in the GIS market, driven by increasing energy demand, government initiatives for renewable energy integration, and the need for reliable power transmission and distribution infrastructure.

Competitive Landscape

Leading companies in the North America Gas Insulated Switchgear (GIS) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America Gas Insulated Switchgear market can be segmented based on voltage range, insulation type, end-user, and geography. By voltage range, the market is classified into high voltage, medium voltage, and low voltage GIS. Based on insulation type, the market is divided into SF6 GIS, gas mixture GIS, and others. The end-user segment includes power transmission utilities, industrial sectors, commercial sectors, and others.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had a significant impact on the North America Gas Insulated Switchgear market. The outbreak led to supply chain disruptions, project delays, and a slowdown in construction activities. However, the pandemic also highlighted the importance of a resilient and reliable power infrastructure, driving the need for GIS solutions. As countries recover from the pandemic, the market is expected to witness a rebound, driven by government stimulus packages, investments in infrastructure development, and the increasing focus on renewable energy sources.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America Gas Insulated Switchgear market is expected to witness steady growth in the coming years. The increasing investments in renewable energy projects, grid modernization initiatives, and the expansion of smart cities will drive the demand for GIS solutions. Technological advancements, such as the development of eco-friendly gas alternatives and the integration of digital technologies, will further enhance the performance and efficiency of GIS systems. However, market players need to address challenges such as high initial costs and environmental concerns to capitalize on the market’s potential.

Conclusion

The North America Gas Insulated Switchgear market is poised for significant growth, driven by the increasing demand for reliable power infrastructure, the integration of renewable energy sources, and the expansion of smart grid networks. The market offers numerous opportunities for manufacturers to develop advanced GIS solutions that meet the evolving needs of customers. By focusing on technological innovations, strategic partnerships, and addressing environmental concerns, industry participants can position themselves for success in this dynamic and competitive market.

What is Gas Insulated Switchgear?

Gas Insulated Switchgear (GIS) refers to a compact and efficient electrical switchgear technology that uses gas as an insulating medium. It is widely used in substations and industrial applications due to its ability to operate in limited spaces and harsh environments.

What are the key players in the North America Gas Insulated Switchgear Market?

Key players in the North America Gas Insulated Switchgear Market include Siemens, Schneider Electric, and ABB, among others. These companies are known for their innovative solutions and extensive product portfolios in the electrical equipment sector.

What are the growth factors driving the North America Gas Insulated Switchgear Market?

The North America Gas Insulated Switchgear Market is driven by the increasing demand for reliable and efficient power distribution systems, the need for grid modernization, and the growing adoption of renewable energy sources. Additionally, urbanization and infrastructure development contribute to market growth.

What challenges does the North America Gas Insulated Switchgear Market face?

Challenges in the North America Gas Insulated Switchgear Market include high initial installation costs and the complexity of maintenance. Furthermore, the availability of alternative technologies may hinder market penetration.

What opportunities exist in the North America Gas Insulated Switchgear Market?

Opportunities in the North America Gas Insulated Switchgear Market include advancements in technology, such as digitalization and smart grid integration. The increasing focus on sustainable energy solutions also presents potential growth avenues for GIS applications.

What trends are shaping the North America Gas Insulated Switchgear Market?

Trends in the North America Gas Insulated Switchgear Market include the shift towards eco-friendly insulating gases, the integration of IoT for enhanced monitoring, and the development of modular GIS solutions. These trends aim to improve efficiency and reduce environmental impact.

North America Gas Insulated Switchgear Market

| Segmentation Details | Description |

|---|---|

| Product Type | Hybrid Switchgear, Modular Switchgear, Compact Switchgear, Integrated Switchgear |

| End User | Utilities, Industrial Plants, Commercial Buildings, Renewable Energy Facilities |

| Installation Type | Indoor, Outdoor, Substation, Mobile |

| Technology | SF6 Insulated, Vacuum Insulated, Air Insulated, Solid Dielectric |

Leading companies in the North America Gas Insulated Switchgear (GIS) Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at