444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America gaming headsets market represents a dynamic and rapidly evolving segment within the broader consumer electronics industry. This market encompasses specialized audio devices designed specifically for gaming applications, featuring advanced technologies such as surround sound, noise cancellation, and wireless connectivity. Gaming enthusiasts across the United States and Canada are increasingly demanding high-quality audio experiences that enhance their competitive gaming performance and immersive entertainment experiences.

Market dynamics indicate robust growth driven by the expanding esports industry, increasing popularity of online multiplayer games, and rising consumer spending on gaming peripherals. The region’s gaming headsets market benefits from strong technological infrastructure, high disposable income levels, and a mature gaming culture that values premium audio equipment. Professional gamers and casual users alike are investing in sophisticated headset solutions that offer superior sound quality, comfort during extended gaming sessions, and seamless communication capabilities.

Regional adoption patterns show significant penetration across both console and PC gaming segments, with wireless gaming headsets experiencing particularly strong demand growth of approximately 12.5% annually. The market landscape features established audio equipment manufacturers alongside specialized gaming peripheral companies, creating a competitive environment that drives continuous innovation in audio technology, ergonomic design, and connectivity features.

The North America gaming headsets market refers to the commercial ecosystem encompassing the design, manufacturing, distribution, and retail of specialized audio devices optimized for gaming applications across the United States and Canada. These devices integrate advanced audio technologies, ergonomic design principles, and gaming-specific features to deliver enhanced audio experiences for both competitive and recreational gaming activities.

Gaming headsets differ from conventional audio headphones through their incorporation of high-quality microphones, low-latency audio processing, surround sound capabilities, and extended comfort features designed for prolonged gaming sessions. The market includes various product categories ranging from entry-level wired headsets to premium wireless models featuring active noise cancellation, customizable RGB lighting, and professional-grade audio drivers.

Market participants include hardware manufacturers, technology developers, distribution channels, and end-users spanning casual gamers, professional esports athletes, content creators, and gaming enthusiasts. The ecosystem supports diverse gaming platforms including PC, PlayStation, Xbox, Nintendo Switch, and mobile gaming devices, requiring headsets with versatile compatibility and platform-specific optimization features.

Strategic analysis reveals the North America gaming headsets market experiencing substantial expansion driven by multiple converging factors including esports growth, streaming culture proliferation, and technological advancement in audio processing. The market demonstrates strong consumer preference shifts toward wireless connectivity, with approximately 68% of new purchases featuring wireless or hybrid connectivity options during recent periods.

Key market segments show differentiated growth patterns, with premium gaming headsets commanding increasing market share as consumers prioritize audio quality and advanced features. The professional gaming segment represents a particularly lucrative niche, with esports organizations and competitive gamers driving demand for high-performance audio equipment that provides competitive advantages through superior spatial audio and communication clarity.

Technological innovation continues reshaping market dynamics through developments in spatial audio processing, adaptive noise cancellation, and low-latency wireless transmission. Major manufacturers are investing heavily in research and development to create differentiated products that address evolving consumer preferences for immersive audio experiences, extended battery life, and seamless multi-platform compatibility.

Market consolidation trends indicate increasing competition between traditional audio equipment manufacturers and specialized gaming peripheral companies, resulting in accelerated product development cycles and aggressive pricing strategies that benefit consumers while challenging profit margins across the industry.

Consumer behavior analysis reveals several critical insights shaping the North America gaming headsets market landscape:

Esports industry expansion serves as a primary catalyst driving North America gaming headsets market growth. The professional competitive gaming sector continues experiencing remarkable growth, with organized tournaments, league structures, and substantial prize pools attracting millions of participants and spectators. This ecosystem creates substantial demand for high-performance gaming peripherals, particularly headsets that provide competitive advantages through superior audio positioning and communication clarity.

Streaming culture proliferation represents another significant market driver, as content creators across platforms like Twitch, YouTube Gaming, and Facebook Gaming require professional-quality audio equipment for both gameplay and audience interaction. The creator economy’s expansion has established new consumer segments prioritizing headsets with broadcast-quality microphones, noise cancellation capabilities, and streaming-optimized features.

Technological advancement in audio processing continues driving market evolution through innovations in spatial audio, adaptive noise cancellation, and low-latency wireless transmission. These developments enable manufacturers to create differentiated products that deliver measurably superior gaming experiences, justifying premium pricing and encouraging upgrade cycles among existing users.

Gaming platform diversification creates expanding market opportunities as consumers engage with gaming across multiple devices including traditional consoles, gaming PCs, mobile devices, and emerging platforms like cloud gaming services. This trend drives demand for versatile headsets offering seamless connectivity and optimized performance across diverse gaming environments.

Price sensitivity among certain consumer segments represents a significant market restraint, particularly as premium gaming headsets command substantial price premiums over conventional audio equipment. Economic uncertainties and discretionary spending constraints can impact consumer willingness to invest in high-end gaming peripherals, potentially limiting market expansion in price-conscious demographics.

Technology fragmentation across gaming platforms creates compatibility challenges that can restrict market growth. Different gaming systems often require specific connectivity standards, audio processing protocols, or proprietary features, forcing consumers to choose between platform-specific optimization and universal compatibility, potentially limiting addressable market size for individual products.

Market saturation in certain segments poses growth challenges as many gaming enthusiasts already own functional headsets and may not perceive sufficient value in upgrading to newer models. Extended product lifecycles and durable construction quality can reduce replacement frequency, impacting overall market velocity and requiring manufacturers to focus on attracting new users rather than driving existing customer upgrades.

Competitive intensity from both established audio equipment manufacturers and emerging gaming peripheral companies creates pricing pressures that can compress profit margins and limit investment in research and development activities essential for continued innovation and market differentiation.

Emerging gaming platforms present substantial growth opportunities as cloud gaming services, virtual reality systems, and mobile gaming continue expanding their market presence. These platforms often require specialized audio solutions optimized for their unique technical requirements and user experience characteristics, creating new product categories and market segments for innovative manufacturers.

Professional esports expansion offers lucrative opportunities for premium product development as competitive gaming organizations seek every possible advantage through superior equipment. The growing recognition of esports as legitimate professional sports creates demand for tournament-grade audio equipment that meets professional standards and regulatory requirements.

Content creator economy growth provides expanding market opportunities as streaming, podcasting, and video content creation become increasingly mainstream activities. This trend creates demand for headsets optimized for content creation workflows, featuring professional microphones, streaming integration capabilities, and creator-focused design elements.

Technological integration opportunities exist in developing headsets that seamlessly integrate with smart home ecosystems, voice assistants, and productivity applications, expanding their utility beyond gaming into broader lifestyle and professional applications that justify higher price points and increase usage frequency.

Supply chain dynamics significantly influence the North America gaming headsets market through component availability, manufacturing capacity, and distribution efficiency. Global semiconductor shortages and electronic component constraints have periodically impacted production schedules and pricing strategies, requiring manufacturers to develop resilient supply chain strategies and alternative sourcing arrangements.

Consumer preference evolution continues reshaping market dynamics as gaming habits, platform preferences, and feature priorities change over time. The shift toward wireless connectivity, demand for extended battery life, and preference for customizable features reflect broader technology adoption patterns that manufacturers must anticipate and address through product development strategies.

Competitive landscape dynamics feature increasing convergence between traditional audio equipment manufacturers and specialized gaming peripheral companies, creating hybrid market segments where audio expertise meets gaming-specific innovation. This convergence drives accelerated product development cycles and feature integration that benefits consumers while intensifying competitive pressures.

Regulatory and standards dynamics influence market development through safety requirements, wireless communication standards, and environmental regulations that manufacturers must navigate while developing new products. Compliance with evolving standards can create both challenges and opportunities for market differentiation through superior regulatory compliance and safety features.

Comprehensive market analysis for the North America gaming headsets market employed multiple research methodologies to ensure accuracy, reliability, and depth of insights. Primary research activities included extensive surveys of gaming enthusiasts, interviews with industry executives, and focus groups with professional esports athletes to understand consumer preferences, usage patterns, and feature priorities.

Secondary research encompassed analysis of industry reports, manufacturer financial statements, retail sales data, and technology trend assessments from authoritative sources. This approach provided quantitative market sizing, competitive landscape mapping, and historical trend analysis essential for understanding market evolution and future projections.

Data validation processes included cross-referencing multiple information sources, conducting expert interviews with industry professionals, and employing statistical analysis techniques to ensure research findings accuracy and reliability. MarkWide Research analysts utilized proprietary databases and analytical frameworks to synthesize complex market information into actionable insights.

Market modeling techniques incorporated econometric analysis, trend extrapolation, and scenario planning to develop robust market forecasts and identify potential growth trajectories under various market conditions and external factors that could influence future market development.

United States market dominates the North America gaming headsets landscape, accounting for approximately 78% of regional market share due to its large gaming population, high disposable income levels, and mature esports infrastructure. Major metropolitan areas including Los Angeles, New York, Chicago, and Seattle serve as key consumption centers with concentrated gaming communities and professional esports organizations driving premium product demand.

California and Texas represent the largest state-level markets, benefiting from significant technology industry presence, large gaming communities, and substantial esports investment. These states host major gaming tournaments, technology companies, and content creator communities that drive demand for high-performance gaming peripherals and create market trends that influence national adoption patterns.

Canadian market demonstrates strong growth potential despite representing a smaller absolute market size, with gaming headset adoption rates of approximately 45% among active gamers. Major cities including Toronto, Vancouver, and Montreal feature vibrant gaming communities and increasing esports participation that drives demand for quality gaming audio equipment.

Regional distribution patterns show urban areas commanding disproportionate market share due to higher gaming participation rates, better retail infrastructure, and greater exposure to gaming culture and esports activities. Rural and suburban markets present growth opportunities as internet infrastructure improvements enable broader gaming participation and online retail access.

Market leadership in the North America gaming headsets market features a diverse competitive landscape combining established audio equipment manufacturers with specialized gaming peripheral companies. The competitive environment drives continuous innovation in audio technology, design aesthetics, and feature integration.

Competitive strategies include strategic partnerships with esports organizations, influencer marketing campaigns, continuous product innovation, and aggressive pricing strategies designed to capture market share across different consumer segments and gaming platforms.

By Connectivity Type:

By Price Range:

By Gaming Platform:

By User Type:

Wireless gaming headsets represent the fastest-growing category, experiencing adoption rates of approximately 15.2% annually as consumers prioritize freedom of movement and reduced cable management complexity. Advanced wireless technologies including low-latency 2.4GHz transmission and Bluetooth 5.0+ connectivity are enabling wireless headsets to achieve performance parity with wired alternatives while offering superior convenience and versatility.

Premium segment headsets demonstrate strong growth momentum as consumers increasingly recognize audio quality’s impact on gaming performance and overall experience. Features such as planar magnetic drivers, active noise cancellation, and spatial audio processing justify higher price points while delivering measurable performance improvements that appeal to serious gaming enthusiasts.

Multi-platform compatibility has become a critical category differentiator as gamers increasingly engage with multiple gaming systems and devices. Headsets offering seamless connectivity across PC, console, and mobile platforms command premium pricing while addressing consumer desire for versatile equipment that maximizes utility and investment value.

Content creator-focused headsets represent an emerging high-growth category driven by the expanding creator economy and streaming culture. These specialized products integrate professional-grade microphones, streaming software compatibility, and creator-specific features that support both gaming performance and content production workflows.

Manufacturers benefit from expanding market opportunities driven by gaming industry growth, technological innovation possibilities, and premium pricing potential for differentiated products. The gaming headsets market offers higher profit margins compared to commodity audio products while enabling brand building through gaming community engagement and esports partnerships.

Retailers and distributors gain from strong consumer demand, regular product refresh cycles, and opportunities for value-added services including product customization, extended warranties, and gaming ecosystem integration. Gaming headsets generate consistent revenue streams while attracting customers who often purchase complementary gaming accessories and equipment.

Technology suppliers benefit from increasing demand for advanced components including high-performance audio drivers, wireless communication chips, noise cancellation processors, and battery technologies. The gaming market’s willingness to pay premiums for performance improvements creates opportunities for component manufacturers to develop and commercialize cutting-edge technologies.

Gaming communities benefit from continuous product innovation that enhances gaming experiences, improves competitive performance, and enables better communication and collaboration. Advanced gaming headsets contribute to more immersive gaming environments and support the growth of esports and content creation activities that strengthen gaming culture.

Strengths:

Weaknesses:

Opportunities:

Threats:

Wireless technology advancement continues driving market evolution as manufacturers develop increasingly sophisticated wireless transmission systems that eliminate latency concerns while providing extended battery life. Advanced codecs, adaptive frequency management, and low-power consumption technologies are enabling wireless headsets to achieve performance levels previously exclusive to wired alternatives.

Spatial audio integration represents a transformative trend as gaming headsets incorporate advanced 3D audio processing capabilities that provide competitive advantages through superior positional awareness. Technologies such as Dolby Atmos, DTS:X, and proprietary spatial audio solutions are becoming standard features in premium gaming headsets, enhancing immersion and gameplay effectiveness.

Customization and personalization trends are driving demand for headsets offering extensive customization options including interchangeable components, custom audio profiles, RGB lighting systems, and modular design elements. Consumers increasingly expect products that reflect their personal style and gaming preferences while providing tailored performance characteristics.

Sustainability focus is emerging as manufacturers respond to environmental consciousness among consumers, with approximately 28% of gamers considering environmental impact in purchasing decisions. This trend drives development of eco-friendly materials, recycling programs, and sustainable manufacturing processes that appeal to environmentally conscious consumers.

AI integration is beginning to influence gaming headset development through features such as adaptive noise cancellation, intelligent audio processing, and voice command recognition that enhance user experience while providing competitive advantages through automated optimization and personalization capabilities.

Strategic partnerships between gaming headset manufacturers and esports organizations continue expanding as companies seek to establish credibility and visibility within competitive gaming communities. These partnerships often involve product development collaboration, tournament sponsorships, and professional player endorsements that drive brand recognition and market adoption.

Technology licensing agreements are becoming increasingly common as audio technology companies partner with gaming peripheral manufacturers to integrate advanced audio processing capabilities, noise cancellation technologies, and wireless communication systems that differentiate products in competitive markets.

Acquisition activities within the gaming peripheral industry reflect market consolidation trends as larger technology companies acquire specialized gaming brands to expand their gaming market presence and integrate gaming expertise with broader technology capabilities and distribution networks.

Platform integration initiatives are driving closer collaboration between headset manufacturers and gaming platform providers to optimize compatibility, develop platform-specific features, and create seamless user experiences that enhance gaming performance while supporting platform ecosystem development.

Retail channel expansion includes increasing focus on direct-to-consumer sales channels, online marketplace optimization, and gaming-focused retail partnerships that provide better customer engagement opportunities and improved profit margins compared to traditional retail distribution models.

MarkWide Research analysts recommend that gaming headset manufacturers prioritize wireless technology development and spatial audio integration as key differentiators in increasingly competitive markets. Companies should invest in advanced wireless transmission technologies that eliminate latency concerns while providing extended battery life and reliable connectivity across multiple gaming platforms.

Market positioning strategies should focus on specific user segments rather than attempting to serve all gaming markets simultaneously. Specialized products targeting professional esports, content creators, or premium gaming enthusiasts can command higher profit margins while building stronger brand loyalty and market recognition within focused communities.

Distribution channel optimization should emphasize direct-to-consumer sales capabilities, online marketplace presence, and gaming community engagement rather than relying solely on traditional retail channels. Digital marketing strategies targeting gaming communities through social media, streaming platforms, and esports events can provide more effective customer acquisition than conventional advertising approaches.

Product development priorities should balance advanced technology integration with practical usability considerations including comfort, durability, and ease of use. While cutting-edge features attract attention, long-term market success depends on delivering reliable, comfortable products that enhance rather than complicate the gaming experience.

Partnership strategies should include collaboration with game developers, streaming platforms, and esports organizations to create integrated experiences that showcase headset capabilities while building credibility within gaming communities. These partnerships can provide valuable product feedback while creating marketing opportunities that reach target audiences effectively.

Market trajectory for the North America gaming headsets market indicates continued robust growth driven by expanding gaming participation, technological advancement, and increasing consumer investment in gaming peripherals. MWR projections suggest sustained growth momentum with wireless headsets capturing an increasing share of total market volume, potentially reaching 85% market penetration within the next five years.

Technology evolution will likely focus on advanced spatial audio processing, artificial intelligence integration, and seamless multi-platform connectivity that addresses consumer demands for versatile, high-performance gaming equipment. Emerging technologies including haptic feedback, biometric monitoring, and augmented reality integration may create new product categories and market opportunities.

Market consolidation trends suggest continued acquisition activity as larger technology companies seek to establish gaming market presence while specialized gaming companies pursue scale advantages and expanded distribution capabilities. This consolidation may result in fewer but stronger market participants with enhanced research and development capabilities.

Consumer behavior evolution will likely emphasize sustainability, customization, and multi-functional products that serve gaming, professional, and lifestyle applications. The growing creator economy and remote work trends may drive demand for headsets optimized for both gaming and professional communication applications.

Competitive landscape development will probably feature increasing differentiation through software integration, ecosystem compatibility, and specialized features targeting specific gaming communities and use cases rather than competing solely on hardware specifications and pricing strategies.

The North America gaming headsets market represents a dynamic and rapidly evolving industry segment characterized by strong growth momentum, technological innovation, and increasing consumer sophistication. Market drivers including esports expansion, streaming culture growth, and advancing audio technologies create favorable conditions for continued market development and premium product adoption.

Key success factors for market participants include wireless technology mastery, spatial audio integration, targeted market positioning, and strong gaming community engagement. Companies that effectively balance advanced technology development with practical usability considerations while building authentic relationships within gaming communities are positioned for sustained market success.

Future market development will likely emphasize specialization, sustainability, and multi-functional product capabilities that address evolving consumer preferences and expanding gaming applications. The convergence of gaming, content creation, and professional communication creates opportunities for innovative products that serve multiple use cases while commanding premium pricing.

The North America gaming headsets market outlook remains positive, supported by fundamental growth drivers and continuous technological advancement that enables new product categories and enhanced user experiences. Market participants who prioritize innovation, community engagement, and strategic positioning are well-positioned to capitalize on expanding opportunities within this vibrant and growing market segment.

What is Gaming Headsets?

Gaming headsets are specialized audio devices designed for immersive gaming experiences, featuring high-quality sound, a built-in microphone for communication, and often additional features like surround sound and noise cancellation.

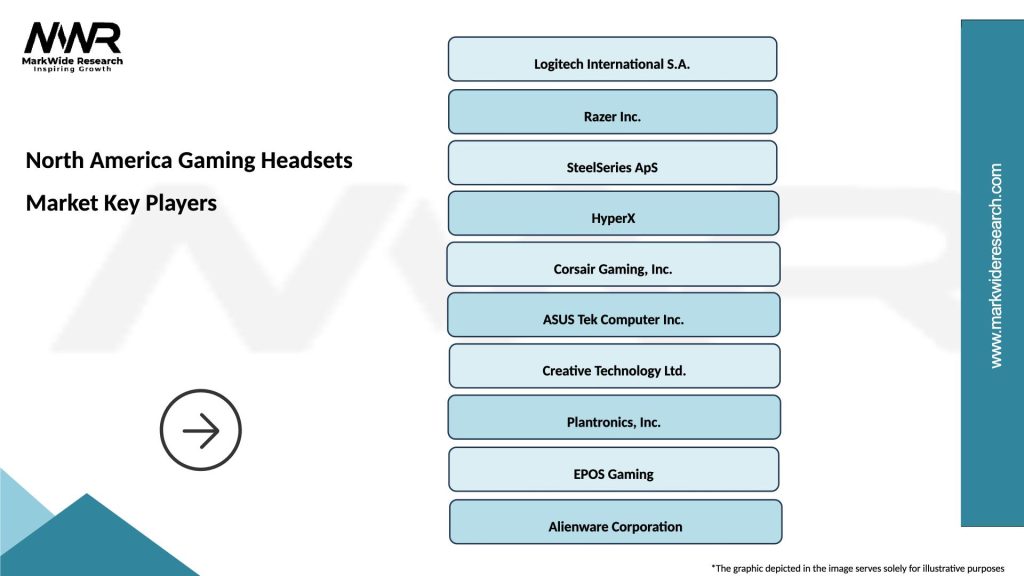

What are the key players in the North America Gaming Headsets Market?

Key players in the North America Gaming Headsets Market include Logitech, Razer, SteelSeries, and Corsair, among others.

What are the main drivers of growth in the North America Gaming Headsets Market?

The growth of the North America Gaming Headsets Market is driven by the increasing popularity of online gaming, the rise of esports, and advancements in audio technology that enhance user experience.

What challenges does the North America Gaming Headsets Market face?

Challenges in the North America Gaming Headsets Market include intense competition among manufacturers, rapid technological changes, and the need for continuous innovation to meet consumer demands.

What opportunities exist in the North America Gaming Headsets Market?

Opportunities in the North America Gaming Headsets Market include the growing demand for wireless headsets, the expansion of virtual reality gaming, and the potential for partnerships with gaming platforms and influencers.

What trends are shaping the North America Gaming Headsets Market?

Trends in the North America Gaming Headsets Market include the increasing integration of artificial intelligence for personalized audio experiences, the rise of customizable headsets, and a focus on sustainability in product materials.

North America Gaming Headsets Market

| Segmentation Details | Description |

|---|---|

| Product Type | Wired, Wireless, Over-Ear, In-Ear |

| Technology | Bluetooth, USB-C, 3.5mm Jack, Noise Cancellation |

| End User | Casual Gamers, Professional Gamers, Streamers, Esports Teams |

| Price Tier | Budget, Mid-Range, Premium, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Gaming Headsets Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at