444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America functional food ingredient market represents a dynamic and rapidly evolving sector that bridges the gap between traditional nutrition and pharmaceutical benefits. This market encompasses a comprehensive range of ingredients specifically designed to provide health benefits beyond basic nutritional requirements. Functional food ingredients include probiotics, prebiotics, omega-3 fatty acids, plant sterols, antioxidants, vitamins, minerals, and various bioactive compounds that contribute to enhanced wellness and disease prevention.

Market dynamics in North America are driven by increasing consumer awareness of preventive healthcare, rising healthcare costs, and a growing aging population seeking natural health solutions. The region’s sophisticated food processing infrastructure and strong regulatory framework have positioned it as a global leader in functional food ingredient innovation. Consumer preferences are shifting toward products that offer tangible health benefits, with particular emphasis on digestive health, heart health, immune support, and cognitive function enhancement.

Growth projections indicate the market is expanding at a robust 8.2% CAGR, driven by technological advancements in ingredient extraction and formulation techniques. The integration of functional ingredients into mainstream food products has accelerated, with manufacturers increasingly incorporating these components into everyday items such as dairy products, beverages, bakery goods, and snack foods. Innovation trends focus on improving bioavailability, taste masking, and ingredient stability while maintaining cost-effectiveness for mass market applications.

The North America functional food ingredient market refers to the commercial ecosystem encompassing the development, production, distribution, and application of specialized ingredients that provide health benefits beyond basic nutrition when incorporated into food and beverage products. These ingredients are scientifically formulated to support specific physiological functions, reduce disease risk, or enhance overall wellness outcomes.

Functional food ingredients distinguish themselves from conventional food additives through their proven biological activity and health-promoting properties. Unlike traditional ingredients that primarily serve nutritional or sensory purposes, functional ingredients are specifically selected and processed to deliver measurable health benefits. Regulatory frameworks in North America, particularly those established by the FDA and Health Canada, provide clear guidelines for health claims and ingredient safety standards.

Market scope encompasses both naturally derived ingredients from plant, animal, and microbial sources, as well as synthetically produced compounds that replicate natural bioactive substances. The sector includes ingredient suppliers, food manufacturers, research institutions, and regulatory bodies working collaboratively to advance functional food science and commercialization.

Strategic market positioning reveals the North America functional food ingredient market as a cornerstone of the broader nutraceutical industry, experiencing unprecedented growth driven by consumer health consciousness and scientific advancement. The market demonstrates strong resilience and adaptability, with companies successfully navigating regulatory challenges while meeting evolving consumer demands for transparency and efficacy.

Key market drivers include the rising prevalence of chronic diseases, increasing healthcare costs prompting preventive approaches, and growing consumer sophistication regarding nutrition science. Demographic trends show that 73% of consumers actively seek products with functional benefits, with millennials and Generation Z leading adoption rates. The aging baby boomer population represents a significant growth opportunity, particularly for ingredients supporting cognitive health, bone health, and cardiovascular wellness.

Technological innovations in extraction, purification, and delivery systems have enhanced ingredient effectiveness while reducing production costs. Market penetration has expanded beyond traditional health food channels into mainstream retail, with functional ingredients now appearing in 45% of new product launches across various food categories. The integration of digital health platforms and personalized nutrition approaches is creating new opportunities for targeted functional ingredient applications.

Competitive landscape features a mix of established multinational corporations and innovative specialty ingredient companies, fostering a dynamic environment for product development and market expansion. Strategic partnerships between ingredient suppliers and food manufacturers are accelerating time-to-market for new functional food products.

Consumer behavior analysis reveals fundamental shifts in purchasing decisions, with health benefits now ranking as the primary consideration for 68% of food shoppers in North America. This trend transcends traditional demographic boundaries, encompassing diverse age groups, income levels, and lifestyle preferences. Health consciousness has evolved from a niche interest to a mainstream priority, driving demand for scientifically validated functional ingredients.

Healthcare cost escalation serves as a primary catalyst for functional food ingredient adoption, as consumers and healthcare systems seek preventive solutions to reduce long-term medical expenses. The economic burden of chronic diseases, including diabetes, cardiovascular conditions, and obesity, has reached critical levels, prompting increased focus on nutritional interventions. Preventive healthcare approaches utilizing functional ingredients offer cost-effective alternatives to traditional pharmaceutical treatments.

Demographic transitions significantly influence market growth, with North America’s aging population driving demand for ingredients supporting healthy aging. The baby boomer generation, representing a substantial consumer segment, actively seeks products that maintain cognitive function, bone health, and cardiovascular wellness. Millennial consumers demonstrate strong preferences for functional foods, viewing them as essential components of active, health-conscious lifestyles.

Scientific advancement in nutrition research continues to unveil new connections between specific ingredients and health outcomes, expanding the evidence base for functional food benefits. Clinical studies demonstrating the efficacy of probiotics, omega-3 fatty acids, and antioxidants have strengthened consumer confidence and regulatory acceptance. Advanced analytical techniques enable precise measurement of bioactive compounds and their physiological effects.

Regulatory support from agencies like the FDA and Health Canada has created a favorable environment for functional ingredient innovation. Streamlined approval processes for Generally Recognized as Safe (GRAS) ingredients and qualified health claims facilitate market entry for new products. Industry collaboration with regulatory bodies ensures safety standards while promoting innovation and consumer access to beneficial ingredients.

Regulatory complexity presents significant challenges for functional ingredient manufacturers, particularly regarding health claim substantiation and safety documentation. The rigorous approval process for novel ingredients can extend development timelines and increase costs, potentially limiting innovation and market entry for smaller companies. Compliance requirements vary between the United States and Canada, creating additional complexity for companies operating across both markets.

Cost considerations remain a substantial barrier to widespread adoption, as functional ingredients typically command premium pricing compared to conventional food components. Manufacturing costs associated with specialized extraction, purification, and quality control processes contribute to higher ingredient prices. Consumer price sensitivity in certain market segments limits the penetration of functional food products, particularly during economic uncertainty.

Technical challenges in ingredient formulation and application continue to constrain market growth. Issues related to taste, texture, stability, and bioavailability require sophisticated solutions that may not be feasible for all product applications. Ingredient interactions within complex food matrices can affect functionality and require extensive testing and optimization.

Consumer skepticism regarding health claims and ingredient efficacy poses ongoing challenges for market acceptance. Despite scientific evidence, some consumers remain doubtful about functional food benefits, preferring traditional approaches to nutrition and health. Market education efforts require significant investment and time to build consumer confidence and understanding.

Personalized nutrition represents a transformative opportunity for functional ingredient applications, with advances in genetic testing and biomarker analysis enabling customized ingredient recommendations. The convergence of nutrition science and digital health platforms creates possibilities for targeted functional food solutions tailored to individual health profiles. Precision nutrition approaches could significantly expand market potential by addressing specific consumer needs and health conditions.

Plant-based ingredient innovation offers substantial growth opportunities, driven by increasing consumer interest in sustainable and natural health solutions. The development of novel plant-derived bioactive compounds and improved extraction technologies expands the functional ingredient portfolio. Botanical ingredients with traditional use histories are gaining scientific validation and regulatory acceptance, opening new market segments.

Sports nutrition expansion presents significant opportunities for functional ingredient applications beyond traditional athletic supplements. The growing fitness consciousness among general consumers creates demand for functional foods supporting exercise performance, recovery, and muscle health. Active lifestyle products incorporating functional ingredients appeal to a broader consumer base than traditional sports supplements.

Senior nutrition focus represents a rapidly expanding opportunity as the aging population seeks products supporting healthy aging. Functional ingredients targeting cognitive health, bone density, joint mobility, and cardiovascular wellness align with the specific needs of older consumers. Age-specific formulations incorporating multiple functional ingredients could capture significant market share in this demographic segment.

Supply chain evolution is reshaping the functional ingredient market through vertical integration and strategic partnerships between ingredient suppliers and food manufacturers. These collaborations enhance quality control, reduce costs, and accelerate product development timelines. Sustainability initiatives are driving changes in sourcing practices, with companies prioritizing environmentally responsible ingredient production methods.

Technology adoption continues to transform ingredient processing and application methods, with innovations in encapsulation, microencapsulation, and delivery systems improving ingredient stability and bioavailability. Nanotechnology applications are emerging as promising approaches for enhancing functional ingredient effectiveness while minimizing taste and texture impacts on food products.

Market consolidation trends show larger companies acquiring specialized ingredient manufacturers to expand their functional ingredient portfolios and capabilities. This consolidation creates opportunities for innovation while potentially reducing competition in certain ingredient categories. Strategic acquisitions enable companies to access proprietary technologies and established market positions.

Consumer education efforts by industry associations and individual companies are improving market understanding and acceptance of functional ingredients. Digital marketing strategies and social media engagement help communicate scientific evidence and health benefits to target audiences. Healthcare professional endorsement increasingly influences consumer purchasing decisions and market credibility.

Comprehensive market analysis employs multiple research methodologies to ensure accuracy and reliability of market insights and projections. Primary research involves direct engagement with industry stakeholders, including ingredient manufacturers, food processors, distributors, and end consumers. Survey methodologies capture quantitative data on market trends, consumer preferences, and purchasing behaviors across diverse demographic segments.

Secondary research incorporates analysis of industry reports, regulatory filings, patent databases, and academic publications to provide comprehensive market context. Financial analysis of publicly traded companies offers insights into market performance, investment trends, and competitive positioning. Regulatory monitoring tracks changes in approval processes, safety requirements, and health claim regulations affecting market dynamics.

Expert interviews with industry leaders, researchers, and regulatory officials provide qualitative insights into market trends, challenges, and opportunities. These discussions offer perspectives on emerging technologies, consumer behavior shifts, and regulatory developments. Focus group studies with target consumers reveal preferences, concerns, and decision-making factors influencing functional food purchases.

Data validation processes ensure research accuracy through cross-referencing multiple sources and statistical analysis techniques. Market modeling incorporates historical trends, current market conditions, and projected growth drivers to develop reliable forecasts. Continuous monitoring of market developments enables real-time updates to research findings and projections.

United States market dominates the North American functional food ingredient sector, accounting for approximately 78% of regional market share. The country’s advanced food processing infrastructure, strong research and development capabilities, and large consumer base drive market leadership. California, Texas, and New York represent the largest state markets, with high concentrations of health-conscious consumers and innovative food companies.

Canadian market demonstrates strong growth potential, with increasing consumer awareness of functional food benefits and supportive regulatory frameworks. Health Canada’s progressive approach to functional ingredient approvals has facilitated market expansion. Urban centers including Toronto, Vancouver, and Montreal show particularly strong adoption rates for functional food products.

Regional consumption patterns reveal distinct preferences across different geographic areas. West Coast consumers show higher adoption rates for plant-based and organic functional ingredients, while Midwest markets demonstrate strong demand for traditional ingredients like omega-3 fatty acids and probiotics. Southern regions exhibit growing interest in functional ingredients supporting heart health and diabetes management.

Cross-border trade between the United States and Canada facilitates ingredient sourcing and product distribution, with many companies operating integrated North American supply chains. Regulatory harmonization efforts between the two countries are reducing barriers to market entry and product standardization. Mexican market integration through USMCA trade agreements is creating additional opportunities for North American functional ingredient companies.

Market leadership is distributed among several key players, each specializing in different functional ingredient categories and market segments. The competitive environment fosters innovation while maintaining focus on quality, safety, and regulatory compliance. Strategic positioning varies from broad-portfolio suppliers to specialized niche players targeting specific health benefits or consumer segments.

Competitive strategies emphasize research and development investment, strategic acquisitions, and partnerships with food manufacturers. Companies are expanding their functional ingredient portfolios through both organic growth and targeted acquisitions of specialized ingredient companies.

By Ingredient Type: The market segmentation by ingredient type reveals distinct growth patterns and consumer preferences across different functional categories. Probiotic ingredients maintain the largest market share, driven by extensive research supporting digestive and immune health benefits. Prebiotic fibers are experiencing rapid growth as understanding of gut microbiome importance increases.

By Application: Application-based segmentation demonstrates the versatility of functional ingredients across diverse food and beverage categories. Dairy products represent the largest application segment, particularly for probiotic ingredients in yogurt and fermented milk products.

By Source: Source-based segmentation shows growing preference for plant-derived functional ingredients, driven by sustainability concerns and clean label trends. Natural sources command premium pricing and consumer preference over synthetic alternatives, with 62% of consumers preferring naturally derived functional ingredients.

Digestive Health Category dominates the functional ingredient market, with probiotics and prebiotics leading consumer adoption. Scientific evidence supporting gut health’s connection to overall wellness has strengthened this category’s market position. Recent research linking gut microbiome to immune function, mental health, and chronic disease prevention has expanded the target consumer base beyond traditional digestive health concerns.

Heart Health Category maintains strong market presence through omega-3 fatty acids, plant sterols, and soluble fiber ingredients. Cardiovascular disease prevention remains a primary consumer concern, particularly among aging populations. The category benefits from established health claims and extensive clinical research supporting ingredient efficacy.

Immune Support Category has experienced significant growth, accelerated by recent health awareness trends. Vitamin D, zinc, and elderberry ingredients have gained prominence alongside traditional immune-supporting probiotics. Consumer interest in preventive health measures has expanded this category beyond seasonal applications.

Cognitive Health Category represents an emerging growth opportunity, with ingredients like omega-3 DHA, phosphatidylserine, and botanical extracts gaining scientific validation. Brain health awareness among aging consumers and students seeking cognitive enhancement drives category expansion. The intersection of nutrition and mental wellness creates new product development opportunities.

Sports Nutrition Category continues evolving beyond traditional athletic supplements to encompass active lifestyle products for general consumers. Protein ingredients, branched-chain amino acids, and performance-supporting botanicals appeal to fitness-conscious consumers across age groups. The category benefits from growing participation in fitness activities and wellness-focused lifestyles.

Ingredient Manufacturers benefit from expanding market opportunities and premium pricing for innovative functional ingredients. The growing consumer acceptance of functional foods creates stable demand for high-quality ingredients with proven health benefits. Research and development investments in novel ingredients and delivery systems offer competitive advantages and intellectual property protection.

Food and Beverage Manufacturers gain access to differentiated product positioning and premium pricing opportunities through functional ingredient incorporation. Consumer loyalty increases when products deliver tangible health benefits, reducing price sensitivity and improving market share retention. Functional ingredients enable expansion into health-focused market segments and distribution channels.

Retailers benefit from higher margin products and increased consumer traffic driven by health-conscious shopping behaviors. Category management strategies incorporating functional foods attract health-focused consumers and increase basket size. Private label opportunities in functional foods offer retailers additional profit margins and brand differentiation.

Healthcare Professionals gain evidence-based nutritional tools for patient counseling and preventive care recommendations. Functional foods provide accessible options for patients seeking natural health solutions alongside traditional medical treatments. Professional endorsement of functional ingredients enhances credibility and consumer acceptance.

Consumers access convenient, scientifically-validated health solutions integrated into everyday food products. Preventive health approaches using functional ingredients offer cost-effective alternatives to pharmaceutical interventions. The variety of functional food options enables personalized nutrition strategies aligned with individual health goals and preferences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean Label Movement continues reshaping functional ingredient selection, with consumers demanding transparency and recognizable ingredient names. Natural and organic functional ingredients command premium positioning, while synthetic alternatives face increasing scrutiny. Manufacturers are investing in natural extraction methods and plant-based alternatives to meet clean label requirements.

Personalization Technology is transforming functional food applications through genetic testing, microbiome analysis, and biomarker assessment. Customized nutrition solutions incorporating specific functional ingredients based on individual health profiles represent the future of functional food development. Digital platforms enabling personalized recommendations are gaining consumer adoption.

Sustainability Focus influences ingredient sourcing and production methods, with companies prioritizing environmentally responsible practices. Circular economy principles are being applied to functional ingredient production, including waste reduction and byproduct utilization. Consumer preference for sustainable products is driving innovation in eco-friendly functional ingredients.

Microbiome Science advancement is expanding understanding of gut health’s impact on overall wellness, driving innovation in probiotic and prebiotic ingredients. Strain-specific research is enabling targeted probiotic solutions for specific health conditions. The connection between gut health and immune function, mental health, and chronic disease prevention continues strengthening market opportunities.

Plant-Based Innovation is accelerating development of functional ingredients from botanical sources, aligning with sustainability and clean label trends. Novel plant proteins, bioactive compounds, and traditional botanical ingredients are gaining scientific validation and consumer acceptance. The intersection of plant-based nutrition and functional health benefits creates significant market opportunities.

Regulatory Advancements include streamlined approval processes for novel functional ingredients and expanded health claim categories. The FDA’s continued support for qualified health claims and GRAS determinations facilitates market entry for innovative ingredients. International harmonization efforts are reducing regulatory barriers for companies operating across multiple markets.

Technology Breakthroughs in ingredient processing and delivery systems are improving functionality while reducing costs. Microencapsulation technologies enhance ingredient stability and bioavailability while minimizing taste impacts. Advanced extraction methods are enabling isolation of novel bioactive compounds from natural sources.

Strategic Partnerships between ingredient suppliers and food manufacturers are accelerating product development and market penetration. Collaborative research initiatives are advancing scientific understanding of functional ingredient mechanisms and applications. Vertical integration strategies are improving supply chain control and cost management.

Investment Activity in functional ingredient companies reflects strong market confidence and growth expectations. Venture capital funding for innovative ingredient startups is supporting development of novel functional solutions. Public company acquisitions of specialized ingredient manufacturers are consolidating market leadership positions.

Consumer Education Initiatives by industry associations and individual companies are improving market understanding and acceptance. Healthcare professional engagement programs are building credibility and recommendation patterns. Digital marketing strategies are effectively communicating scientific evidence and health benefits to target audiences.

Investment Priorities should focus on companies with strong research and development capabilities, diversified ingredient portfolios, and established regulatory expertise. MarkWide Research analysis indicates that companies investing in personalized nutrition technologies and sustainable ingredient sourcing will capture disproportionate market share growth. Strategic acquisitions of specialized ingredient companies offer opportunities for portfolio expansion and market consolidation.

Market Entry Strategies for new participants should emphasize differentiated ingredient solutions addressing unmet consumer needs. Niche market focus enables smaller companies to establish market presence before expanding into broader categories. Partnership strategies with established food manufacturers can accelerate market penetration and reduce development costs.

Product Development Focus should prioritize ingredients with strong scientific evidence, clean label profiles, and multiple health benefits. Combination ingredients offering synergistic effects and simplified formulation processes appeal to food manufacturers seeking efficiency. Taste-neutral and stable ingredient forms enable broader application possibilities across food categories.

Geographic Expansion opportunities exist in underserved regional markets and emerging demographic segments. Rural market penetration requires targeted education and distribution strategies. International expansion should leverage North American market success while adapting to local regulatory requirements and consumer preferences.

Technology Investment in advanced processing, delivery systems, and quality control capabilities will differentiate successful companies. Digital integration enabling traceability, personalization, and consumer engagement creates competitive advantages. Sustainability technologies addressing environmental concerns will become increasingly important for market acceptance.

Market trajectory indicates continued robust growth driven by demographic trends, health awareness, and scientific advancement. MWR projections suggest the market will maintain strong momentum through the next decade, with growth rates potentially accelerating as personalized nutrition technologies mature. The integration of functional ingredients into mainstream food products will expand market reach beyond traditional health food segments.

Innovation pipeline includes novel ingredients from emerging botanical sources, advanced probiotic strains, and bioengineered functional compounds. Precision fermentation technologies are enabling production of functional ingredients with improved sustainability profiles and cost structures. The development of multifunctional ingredients addressing multiple health benefits simultaneously will simplify product formulation and enhance consumer value propositions.

Regulatory evolution toward more flexible health claim frameworks and expedited approval processes will facilitate market growth. International harmonization efforts will reduce barriers for companies operating across multiple markets. The potential for expanded health claim categories, including mental health and longevity benefits, could significantly broaden market opportunities.

Consumer behavior trends indicate increasing sophistication and willingness to pay premiums for proven functional benefits. Generational shifts toward preventive healthcare and natural health solutions will sustain long-term market growth. The integration of digital health platforms with functional food recommendations will create new market dynamics and consumer engagement models.

Technology convergence between nutrition science, biotechnology, and digital health will transform functional ingredient applications. Artificial intelligence applications in ingredient discovery and personalized nutrition will accelerate innovation cycles. The development of smart packaging and delivery systems will enhance ingredient effectiveness and consumer experience.

The North America functional food ingredient market represents a dynamic and rapidly evolving sector positioned at the intersection of nutrition science, consumer health consciousness, and food innovation. Market fundamentals remain strong, supported by demographic trends, scientific advancement, and regulatory frameworks that facilitate innovation while ensuring safety and efficacy standards.

Growth drivers including aging populations, rising healthcare costs, and increasing consumer sophistication regarding nutrition science will continue supporting market expansion. The successful integration of functional ingredients into mainstream food products demonstrates the sector’s maturation and broad consumer acceptance. Technology advancement in ingredient processing, delivery systems, and personalization capabilities will enhance market opportunities and competitive differentiation.

Strategic opportunities exist across multiple dimensions, from novel ingredient development and application innovation to geographic expansion and demographic targeting. Companies that successfully navigate regulatory requirements, invest in research and development, and build strong partnerships with food manufacturers will capture disproportionate market share. Sustainability considerations and clean label trends will increasingly influence ingredient selection and market success.

The future outlook for the North America functional food ingredient market remains highly positive, with continued growth expected across all major ingredient categories and application segments. Innovation momentum in personalized nutrition, microbiome science, and plant-based functional ingredients will drive the next phase of market evolution, creating opportunities for both established players and new market entrants committed to advancing functional food science and consumer health outcomes.

What is Functional Food Ingredient?

Functional food ingredients are components that provide health benefits beyond basic nutrition. They include bioactive compounds, vitamins, minerals, and other substances that can enhance health and reduce the risk of diseases.

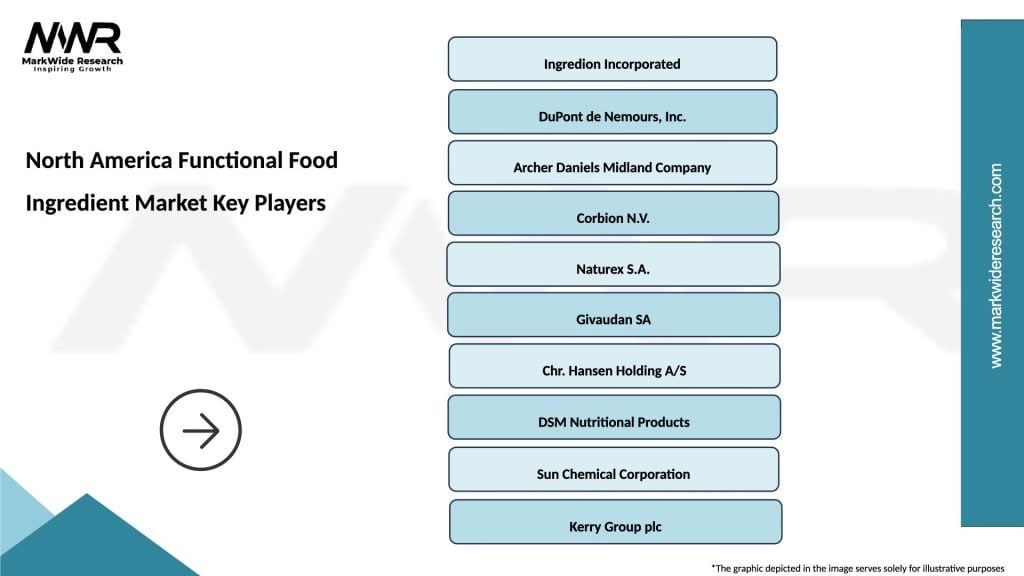

What are the key players in the North America Functional Food Ingredient Market?

Key players in the North America Functional Food Ingredient Market include DuPont, Archer Daniels Midland Company, and Ingredion Incorporated, among others.

What are the main drivers of the North America Functional Food Ingredient Market?

The main drivers of the North America Functional Food Ingredient Market include the increasing consumer awareness of health and wellness, the rising demand for natural and organic food products, and the growing prevalence of chronic diseases.

What challenges does the North America Functional Food Ingredient Market face?

Challenges in the North America Functional Food Ingredient Market include regulatory hurdles, the complexity of ingredient sourcing, and the need for extensive research and development to validate health claims.

What opportunities exist in the North America Functional Food Ingredient Market?

Opportunities in the North America Functional Food Ingredient Market include the development of innovative products targeting specific health concerns, the expansion of e-commerce channels for food ingredients, and the increasing interest in plant-based diets.

What trends are shaping the North America Functional Food Ingredient Market?

Trends shaping the North America Functional Food Ingredient Market include the rise of personalized nutrition, the incorporation of functional ingredients in everyday foods, and the growing focus on sustainability and clean label products.

North America Functional Food Ingredient Market

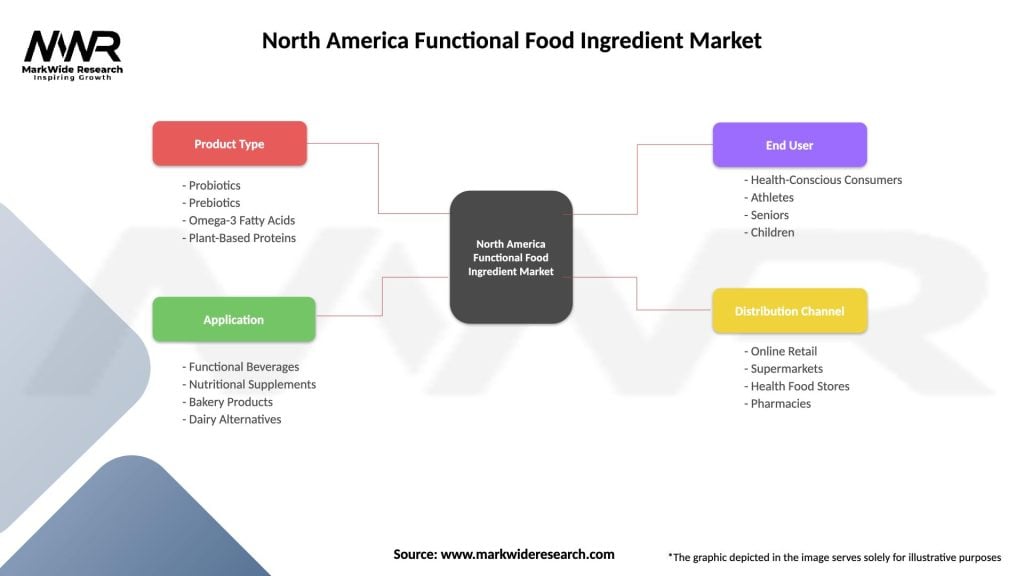

| Segmentation Details | Description |

|---|---|

| Product Type | Probiotics, Prebiotics, Omega-3 Fatty Acids, Plant-Based Proteins |

| Application | Functional Beverages, Nutritional Supplements, Bakery Products, Dairy Alternatives |

| End User | Health-Conscious Consumers, Athletes, Seniors, Children |

| Distribution Channel | Online Retail, Supermarkets, Health Food Stores, Pharmacies |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Functional Food Ingredient Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at