444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America fruits and vegetable ingredients market represents a dynamic and rapidly evolving sector within the broader food processing industry. This market encompasses a comprehensive range of processed fruit and vegetable components used across multiple applications, from food and beverage manufacturing to nutraceuticals and cosmetics. Market dynamics indicate robust growth driven by increasing consumer demand for natural, healthy, and functional ingredients.

Regional market leadership in North America stems from advanced processing technologies, established supply chains, and strong consumer awareness regarding health and wellness. The market benefits from significant agricultural production capabilities across the United States, Canada, and Mexico, providing a stable foundation for ingredient processing operations. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period.

Consumer preferences are increasingly shifting toward clean-label products, driving demand for minimally processed fruit and vegetable ingredients. This trend has catalyzed innovation in processing technologies, preservation methods, and ingredient functionality. Market penetration across various end-use industries continues to accelerate, with food and beverage applications accounting for approximately 78% of total market consumption.

The North America fruits and vegetable ingredients market refers to the commercial sector encompassing processed, concentrated, and value-added components derived from fresh fruits and vegetables for use in various industrial applications. These ingredients include purees, concentrates, powders, extracts, oils, and dried products that serve as functional components in food manufacturing, beverage production, and other consumer goods.

Processing technologies transform raw agricultural produce into shelf-stable, functional ingredients that retain nutritional value while offering enhanced convenience, extended shelf life, and consistent quality. The market includes both conventional and organic ingredient categories, serving diverse applications from basic food formulation to specialized nutraceutical products.

Value chain integration spans from agricultural production through processing, packaging, and distribution to end-use manufacturers. This comprehensive approach ensures quality control, traceability, and consistent supply for industrial customers requiring reliable ingredient sourcing for their manufacturing operations.

Market fundamentals demonstrate strong growth momentum driven by evolving consumer preferences toward natural and healthy food products. The North American market benefits from robust agricultural infrastructure, advanced processing capabilities, and sophisticated distribution networks that support efficient ingredient supply chains.

Key growth drivers include increasing demand for clean-label products, rising health consciousness among consumers, and expanding applications across food, beverage, and nutraceutical industries. Technological advancement in processing methods has enabled the development of innovative ingredient formats that preserve nutritional integrity while enhancing functionality.

Market segmentation reveals diverse opportunities across fruit-based and vegetable-based ingredients, with citrus fruits and tomato-based products representing significant market shares. Regional distribution shows the United States commanding approximately 72% of the North American market, followed by Canada and Mexico with growing contributions to overall market expansion.

Competitive dynamics feature a mix of large multinational corporations and specialized ingredient suppliers, creating a balanced ecosystem that supports innovation and market development. Future outlook remains positive, with sustained growth expected across all major application segments and ingredient categories.

Strategic market analysis reveals several critical insights that define the current landscape and future trajectory of the North America fruits and vegetable ingredients market:

Primary market drivers propelling growth in the North America fruits and vegetable ingredients market stem from fundamental shifts in consumer behavior, technological advancement, and industry evolution. These drivers create sustained demand across multiple application segments.

Health consciousness represents the most significant driver, with consumers increasingly seeking products containing natural ingredients with proven health benefits. This trend has accelerated demand for fruit and vegetable ingredients rich in vitamins, antioxidants, fiber, and other beneficial compounds. Clean label movement further reinforces this driver, as manufacturers respond to consumer preferences for recognizable, natural ingredients.

Convenience factor drives demand from food manufacturers seeking consistent, shelf-stable ingredients that simplify production processes while maintaining product quality. Processed fruit and vegetable ingredients offer standardized nutritional profiles, extended shelf life, and reduced handling complexity compared to fresh produce.

Functional food trends create opportunities for specialized ingredients that provide specific health benefits. Market research indicates that functional food applications are growing at 8.4% annually, driving demand for ingredients with proven bioactive properties. Innovation in processing enables the development of ingredients that concentrate beneficial compounds while maintaining palatability.

Regulatory support for natural ingredients and health claims provides a favorable environment for market expansion. Government initiatives promoting healthy eating and nutrition education indirectly support demand for fruit and vegetable ingredients across various applications.

Market challenges facing the North America fruits and vegetable ingredients market include several factors that may limit growth potential or create operational difficulties for market participants. Understanding these restraints is crucial for strategic planning and risk management.

Raw material volatility represents a significant constraint, as fruit and vegetable prices fluctuate based on weather conditions, seasonal variations, and agricultural productivity. These fluctuations can impact ingredient pricing and profit margins, creating challenges for both processors and end-use manufacturers.

Processing costs associated with advanced technologies required to maintain nutritional integrity and product quality can be substantial. Capital investment requirements for state-of-the-art processing equipment may limit market entry for smaller players and constrain expansion for existing participants.

Shelf life limitations of certain fruit and vegetable ingredients, despite processing, can create logistical challenges and inventory management issues. Some ingredients require specialized storage conditions or have limited stability, increasing operational complexity and costs.

Regulatory compliance requirements, while generally supportive, can create administrative burden and compliance costs. Food safety standards, organic certification processes, and labeling requirements necessitate ongoing investment in quality systems and documentation.

Competition from alternatives including synthetic ingredients, other natural alternatives, and imported products can pressure market share and pricing. Consumer price sensitivity may limit premium positioning opportunities for certain ingredient categories.

Emerging opportunities in the North America fruits and vegetable ingredients market present significant potential for growth and innovation. These opportunities span across technological advancement, market expansion, and new application development.

Plant-based product boom creates substantial opportunities for fruit and vegetable ingredients as manufacturers develop alternatives to animal-based products. This trend encompasses plant-based meats, dairy alternatives, and protein products that rely heavily on vegetable-derived ingredients for texture, flavor, and nutritional enhancement.

Nutraceutical expansion offers high-value opportunities for specialized fruit and vegetable ingredients with proven health benefits. Market analysis suggests that nutraceutical applications are experiencing 12.3% annual growth, driven by aging populations and preventive healthcare trends.

Organic segment growth presents premium positioning opportunities, with organic fruit and vegetable ingredients commanding higher prices and margins. Consumer willingness to pay premiums for organic products creates sustainable competitive advantages for suppliers with organic capabilities.

Export opportunities to other regions experiencing similar health and wellness trends can expand market reach beyond North America. Processing expertise and quality standards developed in North America provide competitive advantages in international markets.

Technology integration including artificial intelligence, automation, and advanced analytics can improve processing efficiency, quality control, and supply chain optimization. These technologies enable better resource utilization and cost management while maintaining product quality.

Market dynamics in the North America fruits and vegetable ingredients sector reflect complex interactions between supply-side factors, demand drivers, and competitive forces. These dynamics shape market evolution and influence strategic decision-making across the value chain.

Supply chain integration has become increasingly important as processors seek to secure reliable raw material sources while maintaining quality standards. Vertical integration strategies enable better control over ingredient quality, consistency, and availability, though they require significant capital investment and operational expertise.

Demand seasonality creates both challenges and opportunities, with certain ingredients experiencing peak demand during specific periods. Inventory management and production planning must account for these variations while maintaining service levels and cost efficiency.

Innovation cycles in the market are accelerating, driven by consumer preferences for new flavors, functional benefits, and application formats. Research and development investment has increased by approximately 15% annually as companies compete to develop differentiated ingredient solutions.

Pricing dynamics reflect the balance between raw material costs, processing expenses, and market demand. Value-based pricing strategies are becoming more prevalent as ingredients demonstrate specific functional or nutritional benefits that justify premium positioning.

Regulatory evolution continues to influence market dynamics, with new standards for organic certification, health claims, and food safety creating both opportunities and compliance requirements. Proactive compliance strategies provide competitive advantages in market access and customer confidence.

Comprehensive research methodology employed in analyzing the North America fruits and vegetable ingredients market combines multiple data sources, analytical techniques, and validation processes to ensure accuracy and reliability of market insights.

Primary research involves direct engagement with industry stakeholders including ingredient processors, food manufacturers, distributors, and end-use customers. Structured interviews and surveys capture current market conditions, growth expectations, and strategic priorities across the value chain.

Secondary research encompasses analysis of industry publications, government statistics, trade association data, and company financial reports. This approach provides historical context, market trends, and competitive intelligence necessary for comprehensive market understanding.

Data triangulation methods ensure consistency and accuracy by comparing information from multiple sources and validating findings through cross-reference analysis. Statistical modeling techniques project market trends and growth scenarios based on historical patterns and identified drivers.

Expert validation processes involve consultation with industry experts, academic researchers, and market specialists to verify findings and refine analytical conclusions. Peer review mechanisms ensure objectivity and accuracy in market assessment and forecasting.

Continuous monitoring systems track market developments, regulatory changes, and competitive activities to maintain current and relevant market intelligence. Update cycles ensure that market analysis reflects the most recent industry developments and trends.

Regional market distribution across North America reveals distinct characteristics and growth patterns that reflect local agricultural capabilities, processing infrastructure, and consumer preferences. Each region contributes unique strengths to the overall market landscape.

United States market dominates the North American landscape, accounting for approximately 72% of regional consumption. California leadership in fruit and vegetable production provides abundant raw materials for processing operations, while advanced manufacturing capabilities support diverse ingredient applications. Consumer sophistication in health and wellness drives demand for premium and functional ingredients.

Canadian market represents approximately 18% of regional demand, characterized by strong organic segment growth and emphasis on sustainable processing practices. Agricultural specialization in berries, apples, and root vegetables creates opportunities for specialized ingredient development. Export orientation supports market expansion beyond domestic consumption.

Mexican contribution accounts for roughly 10% of the North American market, with rapid growth driven by expanding food processing industry and increasing health consciousness. Tropical fruit specialization provides unique ingredient opportunities, while cost advantages support competitive positioning in price-sensitive segments.

Cross-border trade facilitates market integration and specialization, with each region leveraging comparative advantages in specific fruit and vegetable categories. USMCA agreement supports continued trade facilitation and market integration across the region.

Competitive environment in the North America fruits and vegetable ingredients market features a diverse mix of large multinational corporations, regional specialists, and niche players, creating a dynamic ecosystem that supports innovation and market development.

Market consolidation trends reflect the advantages of scale in processing operations, supply chain management, and research and development capabilities. Strategic partnerships between processors and agricultural producers ensure reliable raw material supply while supporting quality and sustainability objectives.

Innovation competition drives continuous development of new processing technologies, ingredient formats, and application solutions. Patent activity in processing methods and ingredient formulations indicates robust competitive dynamics and technological advancement.

Market segmentation analysis reveals diverse opportunities across multiple dimensions, enabling targeted strategies and specialized positioning within the North America fruits and vegetable ingredients market.

By Product Type:

By Processing Method:

By Application:

Fruit ingredients category demonstrates strong growth across multiple subcategories, with citrus-based ingredients leading in volume terms due to established processing infrastructure and diverse applications. Berry ingredients command premium pricing due to high antioxidant content and perceived health benefits, while apple-based ingredients provide stable demand from traditional food applications.

Citrus ingredients benefit from year-round availability and established supply chains, supporting consistent pricing and reliable supply for industrial customers. Processing versatility enables multiple ingredient formats from single raw material sources, improving operational efficiency and cost management.

Vegetable ingredients category shows robust growth driven by plant-based food trends and functional food applications. Tomato-based ingredients represent the largest subcategory by volume, supported by extensive processing infrastructure and diverse applications across food manufacturing.

Specialty vegetables including beets, carrots, and leafy greens create opportunities for premium positioning based on unique nutritional profiles and functional properties. Color applications from vegetable sources provide natural alternatives to synthetic colorants, supporting clean-label positioning.

Organic category growth across both fruit and vegetable ingredients reflects consumer willingness to pay premiums for certified organic products. Supply chain development for organic raw materials continues to expand, supporting broader market availability and competitive pricing.

Industry participants in the North America fruits and vegetable ingredients market realize multiple benefits from market participation, ranging from operational advantages to strategic positioning opportunities.

Processors benefit from stable demand growth, diversified application opportunities, and premium positioning potential for specialized ingredients. Operational efficiency improvements through advanced processing technologies reduce costs while maintaining quality standards. Supply chain integration provides better control over raw material quality and availability.

Food manufacturers gain access to consistent, high-quality ingredients that simplify production processes while meeting consumer demands for natural products. Formulation flexibility enables product innovation and differentiation in competitive markets. Nutritional enhancement capabilities support health positioning and regulatory compliance.

Retailers and distributors benefit from growing consumer demand for products containing natural fruit and vegetable ingredients. Premium positioning opportunities support higher margins and customer loyalty. Supply reliability from established processors ensures consistent product availability.

Consumers receive enhanced nutritional value, improved taste profiles, and confidence in natural ingredient sourcing. Health benefits from bioactive compounds support wellness objectives, while convenience factors enable access to fruit and vegetable nutrition in processed food formats.

Agricultural producers benefit from value-added processing opportunities that provide premium pricing and stable demand for their crops. Contract relationships with processors offer predictable income streams and production planning certainty.

Strengths:

Weaknesses:

Opportunities:

Threats:

Transformative trends shaping the North America fruits and vegetable ingredients market reflect evolving consumer preferences, technological advancement, and industry innovation. These trends create both opportunities and challenges for market participants.

Clean label movement continues to accelerate, with consumers increasingly demanding products with recognizable, natural ingredients. This trend drives reformulation efforts across food and beverage categories, creating sustained demand for fruit and vegetable ingredients as replacements for synthetic alternatives.

Functional ingredient focus emphasizes specific health benefits beyond basic nutrition, with ingredients rich in antioxidants, fiber, vitamins, and bioactive compounds commanding premium positioning. Scientific research supporting health claims strengthens market positioning for specialized ingredients.

Sustainability emphasis influences sourcing decisions, processing methods, and packaging choices throughout the supply chain. Environmental responsibility becomes a competitive differentiator, with companies investing in sustainable practices to meet customer expectations and regulatory requirements.

Processing innovation enables better retention of nutritional compounds while improving functionality and shelf stability. Cold processing technologies, enzyme applications, and advanced extraction methods preserve heat-sensitive nutrients while enhancing ingredient performance.

Customization demand from food manufacturers drives development of specialized ingredient solutions tailored to specific applications and performance requirements. Co-development partnerships between ingredient suppliers and food manufacturers accelerate innovation and market introduction of new products.

Recent industry developments demonstrate the dynamic nature of the North America fruits and vegetable ingredients market, with significant investments in capacity expansion, technology advancement, and strategic partnerships shaping market evolution.

Capacity expansion projects across the region reflect confidence in long-term market growth, with major processors investing in new facilities and equipment upgrades. These investments focus on advanced processing technologies that improve efficiency while maintaining ingredient quality and nutritional integrity.

Acquisition activity has increased as companies seek to expand product portfolios, geographic reach, and processing capabilities. Strategic acquisitions enable rapid market entry, technology access, and supply chain integration for acquiring companies.

Technology partnerships between ingredient processors and equipment manufacturers accelerate development of innovative processing solutions. Collaborative research initiatives focus on improving extraction efficiency, preserving bioactive compounds, and developing new ingredient formats.

Sustainability initiatives include investments in renewable energy, waste reduction programs, and sustainable sourcing practices. Certification programs for environmental responsibility and social sustainability become increasingly important for market access and customer relationships.

Product innovation continues at an accelerated pace, with new ingredient formats, enhanced functionality, and specialized applications driving market differentiation. Patent filings in processing methods and ingredient formulations indicate robust innovation activity across the industry.

Strategic recommendations for market participants in the North America fruits and vegetable ingredients market focus on leveraging growth opportunities while managing operational challenges and competitive pressures.

Investment priorities should emphasize processing technology advancement, supply chain integration, and product innovation capabilities. Technology adoption in areas such as extraction efficiency, quality control, and automation can provide competitive advantages and operational improvements.

Market positioning strategies should focus on differentiation through quality, functionality, and sustainability credentials. Premium positioning opportunities exist for ingredients with proven health benefits, organic certification, or unique processing methods that preserve nutritional integrity.

Partnership development with agricultural producers, research institutions, and end-use customers can strengthen market position and accelerate innovation. Collaborative relationships enable better raw material security, technology access, and market intelligence.

Geographic expansion within North America and internationally can diversify market exposure and capture growth opportunities in emerging markets. Export development leverages North American processing expertise and quality standards in international markets.

Sustainability integration should be embedded throughout operations, from sourcing through processing and distribution. Environmental responsibility becomes increasingly important for customer relationships, regulatory compliance, and long-term market access.

Long-term prospects for the North America fruits and vegetable ingredients market remain highly positive, supported by fundamental trends in consumer behavior, technological advancement, and industry evolution. MarkWide Research analysis indicates sustained growth momentum across all major market segments.

Growth trajectory is expected to maintain strong momentum, with the market expanding at a compound annual growth rate of 6.2% through the forecast period. Demand drivers including health consciousness, clean label preferences, and functional food trends provide sustainable foundation for continued expansion.

Innovation acceleration will continue to drive market evolution, with new processing technologies, ingredient formats, and application opportunities creating competitive differentiation. Research investment in bioactive compound extraction and functional ingredient development supports premium positioning opportunities.

Market maturation in traditional segments will be offset by growth in emerging applications including plant-based foods, nutraceuticals, and specialized functional ingredients. Application diversification reduces dependence on any single market segment while expanding total addressable market.

Regulatory evolution will continue to support natural ingredient development while potentially creating new compliance requirements. Proactive compliance strategies and quality system investments position companies for regulatory success and market access.

Sustainability integration will become increasingly important for competitive positioning and customer relationships. Environmental responsibility and social sustainability practices will influence purchasing decisions and partnership opportunities throughout the value chain.

Market assessment of the North America fruits and vegetable ingredients market reveals a dynamic, growing sector with strong fundamentals and positive long-term prospects. Consumer trends toward health, wellness, and natural products provide sustainable demand drivers that support continued market expansion across multiple application segments.

Competitive advantages in the North American market stem from abundant agricultural resources, advanced processing capabilities, and sophisticated supply chain infrastructure. These strengths position the region as a global leader in fruit and vegetable ingredient production and innovation.

Growth opportunities span across product categories, applications, and geographic markets, with particular strength in functional ingredients, organic products, and plant-based applications. Technology advancement continues to create new possibilities for ingredient functionality and market differentiation.

Strategic success in this market requires focus on quality, innovation, sustainability, and customer partnership. Companies that invest in advanced processing technologies, develop strong supply chain relationships, and maintain customer-centric approaches are positioned for sustained growth and market leadership in the evolving North America fruits and vegetable ingredients market.

What is Fruits and Vegetable Ingredients?

Fruits and Vegetable Ingredients refer to the various components derived from fruits and vegetables that are used in food and beverage products, including purees, concentrates, and powders. These ingredients are essential for enhancing flavor, nutrition, and color in a wide range of applications.

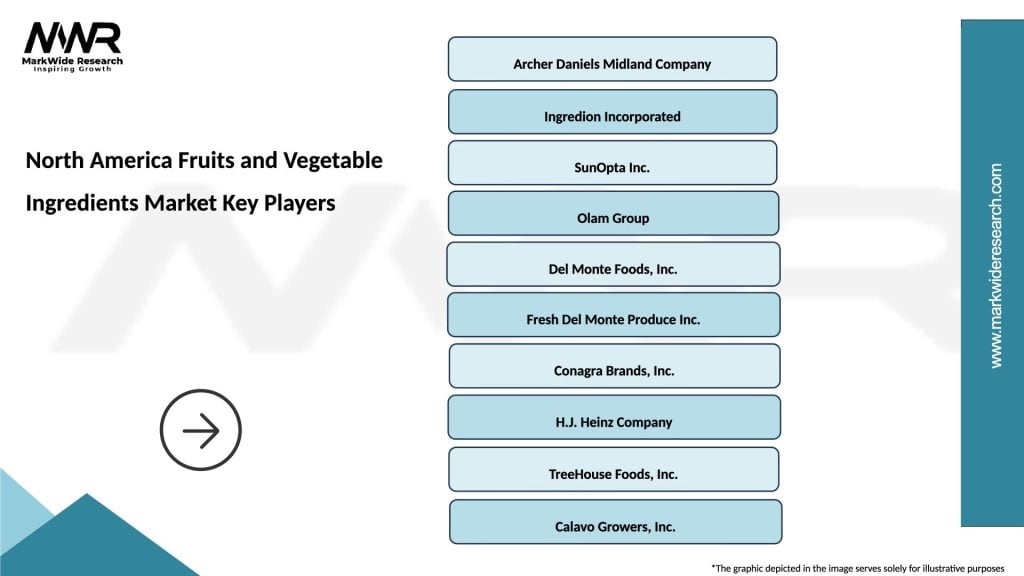

What are the key players in the North America Fruits and Vegetable Ingredients Market?

Key players in the North America Fruits and Vegetable Ingredients Market include companies like Archer Daniels Midland Company, Dole Food Company, and SunOpta, among others. These companies are involved in the production and supply of various fruit and vegetable-based ingredients for the food industry.

What are the main drivers of the North America Fruits and Vegetable Ingredients Market?

The main drivers of the North America Fruits and Vegetable Ingredients Market include the increasing consumer demand for natural and healthy food products, the rise in plant-based diets, and the growing trend of clean label products. These factors are pushing manufacturers to incorporate more fruit and vegetable ingredients into their offerings.

What challenges does the North America Fruits and Vegetable Ingredients Market face?

The North America Fruits and Vegetable Ingredients Market faces challenges such as fluctuating raw material prices, supply chain disruptions, and stringent food safety regulations. These factors can impact production costs and availability of ingredients.

What opportunities exist in the North America Fruits and Vegetable Ingredients Market?

Opportunities in the North America Fruits and Vegetable Ingredients Market include the growing trend of functional foods, innovations in processing technologies, and the expansion of e-commerce platforms for ingredient distribution. These trends can lead to new product development and market growth.

What trends are shaping the North America Fruits and Vegetable Ingredients Market?

Trends shaping the North America Fruits and Vegetable Ingredients Market include the increasing popularity of organic and non-GMO ingredients, the rise of plant-based alternatives, and advancements in food processing techniques. These trends are influencing consumer preferences and product formulations.

North America Fruits and Vegetable Ingredients Market

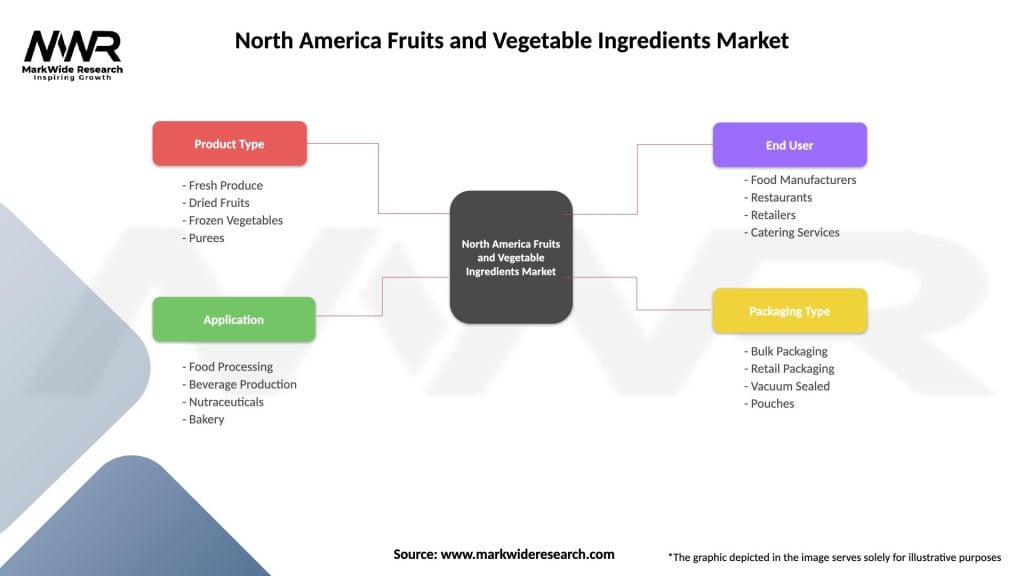

| Segmentation Details | Description |

|---|---|

| Product Type | Fresh Produce, Dried Fruits, Frozen Vegetables, Purees |

| Application | Food Processing, Beverage Production, Nutraceuticals, Bakery |

| End User | Food Manufacturers, Restaurants, Retailers, Catering Services |

| Packaging Type | Bulk Packaging, Retail Packaging, Vacuum Sealed, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Fruits and Vegetable Ingredients Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at