444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The Fraud Detection & Prevention Market in North America is a dynamic and rapidly evolving sector dedicated to combating the increasing threats posed by fraudulent activities across various industries. This comprehensive overview delves into the key dynamics, trends, and factors influencing the growth of the Fraud Detection & Prevention Market in North America.

Meaning:

Fraud detection and prevention involve the use of advanced technologies, analytics, and strategies to identify, mitigate, and deter fraudulent activities. In North America, businesses and organizations across sectors deploy fraud detection and prevention solutions to safeguard their operations, finances, and reputation from the growing threat of fraud.

Executive Summary:

The Fraud Detection & Prevention Market in North America has witnessed significant growth due to the rising sophistication of fraudulent activities, regulatory compliance requirements, and the increasing adoption of digital technologies. The executive summary provides a concise overview of market trends, key players, and the critical considerations for industry stakeholders operating in North America.

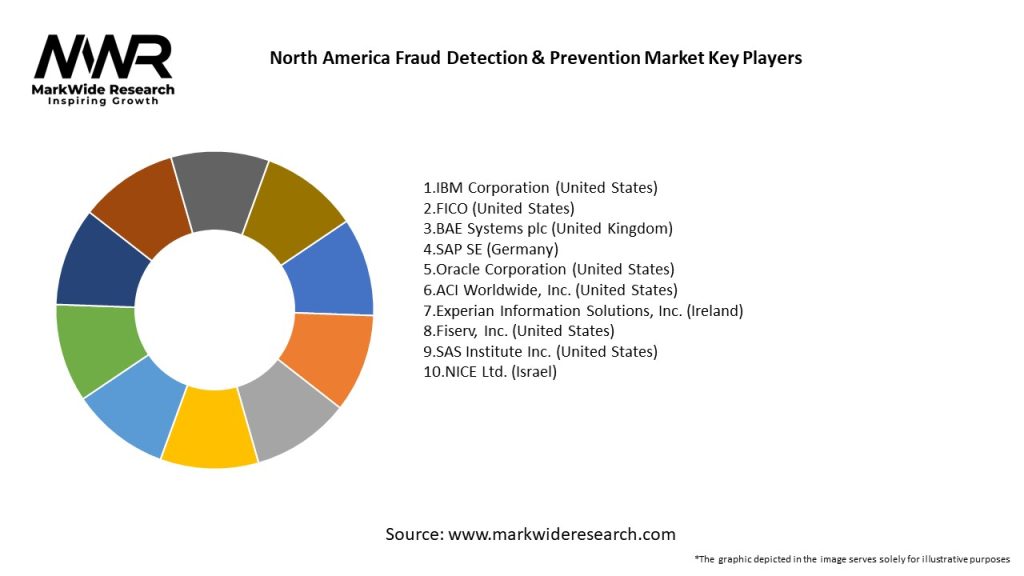

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The Fraud Detection & Prevention Market in North America operates in a dynamic environment shaped by technological advancements, regulatory changes, and evolving cyber threats. Organizations must navigate these dynamics to stay ahead in the constant battle against fraud.

Regional Analysis:

North America encompasses diverse markets with unique challenges and opportunities. A detailed regional analysis provides insights into the specific fraud landscape, regulatory frameworks, and industry trends, allowing organizations to tailor their fraud prevention strategies to individual countries and regions.

Competitive Landscape:

Leading Companies in North America Fraud Detection & Prevention Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

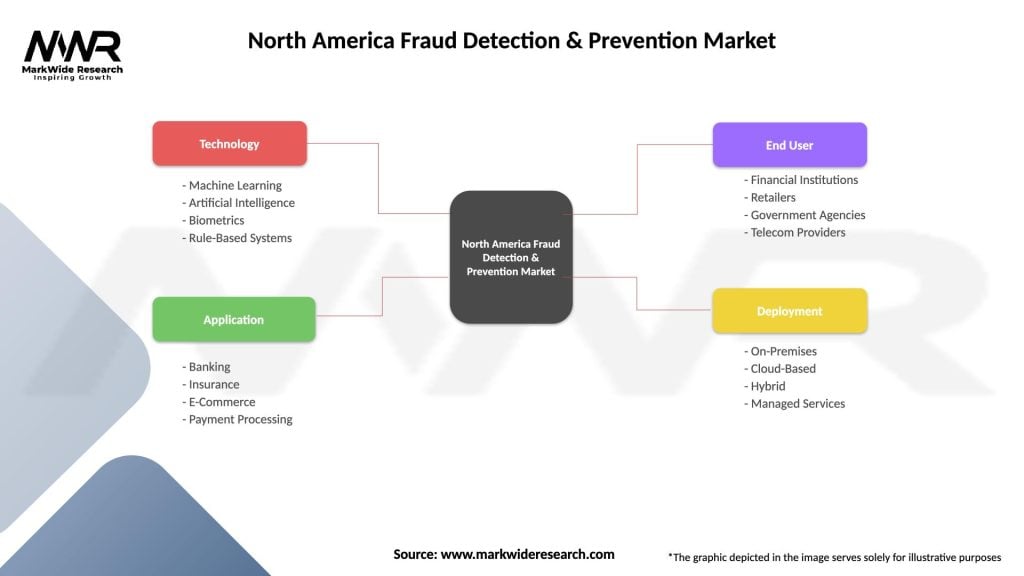

Segmentation:

The Fraud Detection & Prevention Market in North America can be segmented based on various factors, including:

Segmentation provides a more granular understanding of the specific requirements and challenges faced by organizations in different industry verticals and sizes in North America.

Category-wise Insights:

Key Benefits for Industry Participants and Stakeholders:

The adoption of fraud detection and prevention solutions in North America offers several benefits for industry participants and stakeholders:

SWOT Analysis:

A SWOT analysis provides an insightful overview of the Fraud Detection & Prevention Market in North America:

Understanding these factors through a SWOT analysis enables organizations to formulate effective strategies, address vulnerabilities, and capitalize on opportunities in the North American Fraud Detection & Prevention Market.

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has influenced the Fraud Detection & Prevention Market in North America by accelerating digital transformation initiatives, changing consumer behavior, and creating new challenges for organizations. The impact of the pandemic on fraud trends, cybersecurity priorities, and the adoption of fraud prevention solutions is discussed in this section.

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The future outlook for the Fraud Detection & Prevention Market in North America is characterized by ongoing advancements in technology, increased collaboration among industry players, and a continued focus on regulatory compliance. The market is expected to witness sustained growth as organizations prioritize cybersecurity in the face of evolving fraud challenges.

Conclusion:

The Fraud Detection & Prevention Market in North America is a critical component of cybersecurity strategies for businesses and organizations across industries. With the growing sophistication of cyber threats, the adoption of advanced fraud prevention measures becomes imperative. By staying abreast of technological innovations, collaborating with industry experts, and prioritizing user education, organizations can effectively combat fraud and secure their digital operations in the dynamic landscape of the North American Fraud Detection & Prevention Market.

What is Fraud Detection & Prevention?

Fraud Detection & Prevention refers to the processes and technologies used to identify and mitigate fraudulent activities across various sectors, including finance, e-commerce, and insurance. These systems analyze patterns and behaviors to prevent losses and protect consumers.

What are the key players in the North America Fraud Detection & Prevention Market?

Key players in the North America Fraud Detection & Prevention Market include FICO, SAS Institute, and Experian, which provide advanced analytics and machine learning solutions to combat fraud. Other notable companies include ACI Worldwide and NICE Actimize, among others.

What are the main drivers of the North America Fraud Detection & Prevention Market?

The main drivers of the North America Fraud Detection & Prevention Market include the increasing incidence of cybercrime, the growing demand for real-time fraud detection solutions, and the rising regulatory requirements for data protection. Additionally, advancements in artificial intelligence and machine learning are enhancing detection capabilities.

What challenges does the North America Fraud Detection & Prevention Market face?

Challenges in the North America Fraud Detection & Prevention Market include the evolving nature of fraud tactics, which require constant updates to detection algorithms, and the high costs associated with implementing advanced fraud prevention technologies. Additionally, there is a need for skilled professionals to manage these systems effectively.

What opportunities exist in the North America Fraud Detection & Prevention Market?

Opportunities in the North America Fraud Detection & Prevention Market include the integration of blockchain technology for enhanced security and transparency, as well as the potential for growth in sectors like online retail and digital banking. The increasing adoption of cloud-based solutions also presents significant opportunities for innovation.

What trends are shaping the North America Fraud Detection & Prevention Market?

Trends shaping the North America Fraud Detection & Prevention Market include the rise of biometric authentication methods, the use of big data analytics for predictive modeling, and the growing emphasis on customer experience in fraud prevention strategies. Additionally, there is a shift towards more collaborative approaches among financial institutions to share fraud intelligence.

North America Fraud Detection & Prevention Market

| Segmentation Details | Description |

|---|---|

| Technology | Machine Learning, Artificial Intelligence, Biometrics, Rule-Based Systems |

| Application | Banking, Insurance, E-Commerce, Payment Processing |

| End User | Financial Institutions, Retailers, Government Agencies, Telecom Providers |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Fraud Detection & Prevention Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at