444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America forklift rental market represents a dynamic and rapidly expanding segment within the broader material handling equipment industry. This market encompasses the rental and leasing services for various types of forklifts, including electric, diesel, and gas-powered units across diverse industrial applications. Market dynamics indicate robust growth driven by increasing demand for flexible material handling solutions, cost-effective equipment access, and the growing preference for operational expenditure over capital expenditure models.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with significant presence in manufacturing and logistics sectors. The market demonstrates strong performance across key industries including warehousing, manufacturing, construction, and retail distribution. Growth projections suggest the market will expand at a compound annual growth rate of 6.2% through the forecast period, driven by e-commerce expansion and supply chain modernization initiatives.

Technology adoption trends reveal increasing preference for electric forklifts, representing nearly 45% of rental fleet composition, as businesses prioritize environmental sustainability and operational efficiency. The market benefits from established rental networks, comprehensive service offerings, and flexible rental terms that cater to seasonal demand fluctuations and project-specific requirements.

The North America forklift rental market refers to the comprehensive ecosystem of businesses and services that provide temporary access to forklift equipment through rental, lease, and short-term hire arrangements across the United States and Canada. This market encompasses various stakeholder relationships between equipment manufacturers, rental companies, and end-users seeking flexible material handling solutions.

Rental models within this market include daily, weekly, monthly, and long-term lease arrangements, providing businesses with scalable access to material handling equipment without the substantial capital investment required for equipment purchase. The market serves diverse industries requiring temporary or flexible forklift access, including seasonal businesses, project-based operations, and companies experiencing fluctuating material handling demands.

Service integration extends beyond basic equipment rental to include maintenance, operator training, fleet management, and comprehensive support services. This holistic approach ensures optimal equipment performance while minimizing downtime and operational disruptions for rental customers across various industrial applications.

Market fundamentals demonstrate strong growth momentum in the North America forklift rental sector, driven by evolving business models that prioritize operational flexibility and cost optimization. The market benefits from increasing recognition of rental advantages, including reduced maintenance responsibilities, access to latest technology, and improved cash flow management for businesses across multiple industries.

Key growth drivers include the expansion of e-commerce operations requiring flexible warehouse solutions, construction industry recovery demanding temporary equipment access, and manufacturing sector modernization initiatives. According to MarkWide Research analysis, approximately 62% of businesses now prefer rental arrangements for non-core equipment needs, reflecting a fundamental shift in capital allocation strategies.

Competitive dynamics feature established national rental chains alongside regional specialists, creating a diverse market landscape that serves various customer segments. The market demonstrates resilience through economic cycles, with rental demand often increasing during periods of economic uncertainty as businesses seek to minimize capital commitments while maintaining operational capabilities.

Strategic market insights reveal several critical factors shaping the North America forklift rental landscape:

Primary market drivers propelling growth in the North America forklift rental sector stem from fundamental shifts in business operations and capital allocation strategies. The increasing adoption of lean business models has created strong demand for flexible equipment access that aligns operational costs with business activity levels.

E-commerce expansion represents a significant growth catalyst, with online retail operations requiring scalable material handling solutions to manage seasonal demand fluctuations and rapid business growth. These operations benefit from rental arrangements that provide immediate access to additional equipment during peak periods without long-term capital commitments.

Construction industry dynamics drive substantial rental demand, as project-based operations require temporary equipment access for specific durations. The cyclical nature of construction activities makes rental arrangements particularly attractive, allowing companies to optimize equipment utilization while minimizing idle asset costs.

Technology advancement in forklift design and capabilities encourages rental adoption, as businesses can access latest innovations without the depreciation risks associated with equipment ownership. This driver is particularly strong in industries where technological obsolescence poses significant financial risks.

Market constraints affecting the North America forklift rental sector include several operational and economic factors that may limit growth potential. Equipment availability during peak demand periods can create supply constraints, particularly for specialized or high-demand forklift types, potentially limiting market expansion opportunities.

Cost considerations present challenges for long-term rental arrangements, where cumulative rental costs may exceed equipment purchase prices over extended periods. This factor particularly affects businesses with stable, predictable material handling requirements that could justify equipment ownership.

Operational dependencies on rental providers for maintenance and support services can create business continuity concerns, particularly for critical operations where equipment downtime has significant operational impact. These dependencies may discourage some businesses from adopting rental models for essential equipment needs.

Geographic limitations in service coverage may restrict market penetration in remote or underserved areas, where rental companies may not maintain adequate inventory or service capabilities to meet customer requirements effectively.

Emerging opportunities in the North America forklift rental market present significant potential for expansion and innovation. The growing emphasis on sustainability and environmental responsibility creates opportunities for rental companies to promote electric and low-emission equipment options, appealing to environmentally conscious businesses.

Digital transformation initiatives across industries create opportunities for technology-enhanced rental services, including telematics integration, predictive maintenance, and fleet optimization solutions. These value-added services can differentiate rental providers and justify premium pricing structures.

Small and medium enterprise market segments represent substantial growth opportunities, as these businesses increasingly recognize the benefits of rental arrangements for accessing professional-grade equipment without significant capital investment. Tailored service packages for SME customers can drive market expansion.

Specialized applications in emerging industries such as renewable energy, advanced manufacturing, and cold storage facilities create niche opportunities for rental providers offering specialized equipment and expertise. These high-value applications often justify premium rental rates and long-term service relationships.

Market dynamics in the North America forklift rental sector reflect complex interactions between supply and demand factors, technological evolution, and changing business preferences. The market demonstrates cyclical patterns aligned with broader economic conditions, with rental demand typically increasing during economic uncertainty as businesses prioritize operational flexibility.

Supply chain considerations significantly impact market dynamics, with rental companies managing complex inventory optimization challenges to ensure equipment availability while minimizing idle asset costs. Fleet utilization rates averaging 75-80% indicate healthy market conditions and efficient asset deployment strategies.

Competitive pressures drive continuous innovation in service offerings, pricing models, and customer experience enhancements. Market leaders invest heavily in fleet modernization, service network expansion, and technology integration to maintain competitive advantages and customer loyalty.

Seasonal variations create dynamic demand patterns, with peak activity during construction seasons and holiday retail periods. Rental companies employ sophisticated demand forecasting and fleet positioning strategies to optimize equipment availability and maximize revenue opportunities during high-demand periods.

Research methodology employed for analyzing the North America forklift rental market incorporates comprehensive primary and secondary research approaches to ensure accurate market assessment and reliable insights. The methodology combines quantitative data analysis with qualitative industry expertise to provide holistic market understanding.

Primary research activities include structured interviews with industry executives, rental company operators, equipment manufacturers, and end-user customers across diverse industry segments. These interactions provide direct insights into market trends, challenges, and growth opportunities from multiple stakeholder perspectives.

Secondary research encompasses analysis of industry publications, trade association reports, government statistics, and company financial disclosures to establish market baselines and validate primary research findings. This approach ensures comprehensive coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources, statistical analysis of market trends, and expert review of findings to ensure accuracy and reliability of market assessments. The methodology emphasizes objective analysis while acknowledging inherent uncertainties in market forecasting and trend projection.

Regional market distribution across North America reveals distinct patterns reflecting economic activity, industrial concentration, and infrastructure development. The United States dominates the market landscape, accounting for the majority of rental activity across diverse geographic regions with varying industry concentrations and growth characteristics.

United States market demonstrates strong performance across major metropolitan areas, with particular strength in logistics hubs, manufacturing centers, and port cities. Regional distribution shows the Southeast and Southwest regions experiencing above-average growth rates of 7.5%, driven by population growth, industrial expansion, and infrastructure development initiatives.

Canadian market presents significant opportunities, particularly in resource-rich provinces and major urban centers. The market benefits from strong manufacturing and natural resources sectors, with market penetration rates reaching approximately 68% in major industrial regions, indicating substantial room for continued expansion.

Cross-border dynamics create opportunities for rental companies with operations in both countries, enabling efficient fleet utilization and service delivery optimization. Border proximity facilitates equipment sharing and service coordination, particularly in regions with significant cross-border trade activity.

Competitive landscape in the North America forklift rental market features a diverse mix of national chains, regional specialists, and local operators serving various customer segments and geographic markets. Market leadership positions are established through service quality, fleet size, geographic coverage, and customer relationship strength.

Major market participants include:

Competitive strategies emphasize service differentiation, technology integration, and customer relationship development to maintain market position and drive growth in an increasingly competitive environment.

Market segmentation analysis reveals distinct customer groups and application categories that drive demand patterns and service requirements in the North America forklift rental market. Segmentation enables targeted service delivery and optimized resource allocation across diverse market opportunities.

By Equipment Type:

By Rental Duration:

By End-User Industry:

Electric forklift rentals represent the fastest-growing category, driven by environmental regulations, indoor air quality requirements, and operational cost advantages. This category demonstrates annual growth rates exceeding 8.5%, reflecting strong customer preference for clean, quiet operation in warehouse and manufacturing environments.

Warehouse equipment rentals show robust growth aligned with e-commerce expansion and supply chain modernization initiatives. MWR data indicates that specialized warehouse equipment rentals have increased by 12% annually, driven by demand for order fulfillment optimization and inventory management efficiency.

Construction equipment rentals demonstrate cyclical patterns aligned with construction industry activity levels, with strong performance during infrastructure development periods and seasonal construction activities. This category benefits from project-based demand that favors rental arrangements over equipment ownership.

Long-term lease arrangements show increasing popularity as businesses seek to optimize capital allocation while maintaining access to modern equipment. These arrangements typically offer cost savings of 15-25% compared to short-term rentals while providing operational flexibility and service support.

Industry participants across the North America forklift rental market ecosystem realize significant benefits through participation in this dynamic sector. These advantages create value for rental companies, equipment manufacturers, and end-user customers while supporting overall market growth and development.

For Rental Companies:

For Equipment Manufacturers:

For End-User Customers:

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation emerges as a dominant trend reshaping the North America forklift rental market, with companies investing heavily in technology platforms that enhance customer experience and operational efficiency. These initiatives include online booking systems, mobile applications, and integrated fleet management solutions that provide real-time visibility into equipment status and availability.

Sustainability initiatives drive increasing adoption of electric and alternative fuel forklifts, reflecting growing environmental consciousness among businesses and regulatory pressures for emission reduction. This trend creates opportunities for rental companies to differentiate their offerings while supporting customer sustainability objectives.

Service integration represents a significant trend toward comprehensive solution provision, with rental companies expanding beyond basic equipment rental to include operator training, maintenance services, and fleet optimization consulting. This approach creates higher customer value and stronger competitive positioning.

Flexible rental models continue evolving to meet diverse customer requirements, including usage-based pricing, seasonal arrangements, and customized service packages. These innovations enable better alignment between customer needs and rental company capabilities while optimizing cost structures for both parties.

Recent industry developments demonstrate the dynamic nature of the North America forklift rental market, with significant investments in fleet modernization, service expansion, and technology integration initiatives. These developments reflect industry commitment to meeting evolving customer requirements and maintaining competitive positioning.

Fleet electrification initiatives have accelerated across major rental companies, with substantial investments in electric forklift inventory to meet growing customer demand for environmentally friendly equipment options. These investments support both customer sustainability objectives and operational cost optimization through reduced fuel and maintenance requirements.

Technology partnerships between rental companies and technology providers have expanded, creating integrated solutions that combine equipment rental with advanced fleet management, predictive maintenance, and operational analytics capabilities. These partnerships enhance customer value while creating competitive differentiation opportunities.

Geographic expansion activities continue among major rental companies, with strategic acquisitions and organic growth initiatives targeting underserved markets and specialized customer segments. These developments strengthen market coverage and service capabilities while creating economies of scale benefits.

Strategic recommendations for North America forklift rental market participants emphasize the importance of technology adoption, service differentiation, and customer relationship development in maintaining competitive positioning and driving sustainable growth.

Technology investment should prioritize customer-facing platforms and operational efficiency tools that enhance service delivery and reduce operational costs. Companies should focus on integrated solutions that provide comprehensive visibility into fleet performance and customer requirements while enabling proactive service delivery.

Service expansion opportunities exist in value-added offerings such as operator training, safety consulting, and fleet optimization services. These services create additional revenue streams while strengthening customer relationships and competitive positioning in an increasingly competitive market environment.

Market diversification strategies should target emerging industry segments and geographic regions with growth potential. Companies should develop specialized expertise and service capabilities to serve niche markets while maintaining core competencies in traditional customer segments.

Partnership development with equipment manufacturers, technology providers, and complementary service companies can create synergistic opportunities for market expansion and service enhancement. Strategic partnerships enable access to new capabilities and markets while sharing investment requirements and risks.

Future market prospects for the North America forklift rental sector appear highly favorable, with multiple growth drivers supporting continued expansion and market development. MarkWide Research projections indicate sustained growth momentum driven by evolving business models, technology advancement, and changing customer preferences toward flexible equipment access solutions.

Technology integration will continue transforming market dynamics, with advanced analytics, IoT connectivity, and automation capabilities creating new service opportunities and operational efficiencies. These developments will enable more sophisticated fleet management and customer service capabilities while reducing operational costs and improving equipment utilization.

Market expansion opportunities remain substantial, particularly in underserved geographic regions and emerging industry segments. The growing emphasis on supply chain resilience and operational flexibility will drive increased adoption of rental arrangements across diverse business sectors and applications.

Environmental considerations will increasingly influence equipment selection and rental decisions, creating opportunities for companies with strong electric and low-emission equipment offerings. This trend aligns with broader sustainability initiatives and regulatory developments affecting material handling operations.

Growth projections suggest the market will maintain robust expansion rates exceeding 6% annually, supported by fundamental shifts in business operations, continued e-commerce growth, and increasing recognition of rental advantages across diverse industry applications.

The North America forklift rental market represents a dynamic and rapidly evolving sector with substantial growth potential driven by fundamental changes in business operations and capital allocation strategies. The market benefits from strong underlying demand across diverse industry segments, technological advancement opportunities, and increasing customer acceptance of rental arrangements as viable alternatives to equipment ownership.

Key success factors for market participants include technology adoption, service differentiation, geographic coverage, and customer relationship development. Companies that effectively combine these elements while maintaining operational efficiency and cost competitiveness will be well-positioned to capture growth opportunities and maintain market leadership positions.

Market outlook remains highly positive, with multiple growth drivers supporting continued expansion and development. The combination of e-commerce growth, supply chain modernization, environmental considerations, and evolving business models creates a favorable environment for sustained market growth and innovation in service delivery approaches.

Strategic positioning for future success requires balanced investment in technology capabilities, fleet modernization, service expansion, and market development initiatives. Companies that successfully navigate these requirements while maintaining focus on customer value creation will realize the substantial opportunities available in this dynamic and growing market segment.

What is Forklift Rental?

Forklift rental refers to the practice of leasing forklifts for a specified period, allowing businesses to access necessary equipment without the commitment of purchasing. This service is commonly utilized in industries such as warehousing, construction, and logistics.

What are the key players in the North America Forklift Rental Market?

Key players in the North America Forklift Rental Market include companies like United Rentals, Sunbelt Rentals, and Herc Rentals. These companies provide a range of forklifts and material handling equipment to various sectors, including manufacturing and retail, among others.

What are the growth factors driving the North America Forklift Rental Market?

The North America Forklift Rental Market is driven by factors such as the increasing demand for efficient material handling solutions, the growth of e-commerce, and the need for flexible equipment solutions in industries like construction and manufacturing.

What challenges does the North America Forklift Rental Market face?

Challenges in the North America Forklift Rental Market include equipment maintenance costs, fluctuating demand based on economic conditions, and competition from used equipment sales. These factors can impact rental rates and availability.

What opportunities exist in the North America Forklift Rental Market?

Opportunities in the North America Forklift Rental Market include the expansion of e-commerce logistics, advancements in electric forklift technology, and the growing trend of sustainability in material handling practices. These trends can lead to increased rental demand.

What trends are shaping the North America Forklift Rental Market?

Trends shaping the North America Forklift Rental Market include the rise of automation in warehouses, the adoption of telematics for fleet management, and a shift towards electric and eco-friendly forklifts. These innovations are enhancing operational efficiency and reducing environmental impact.

North America Forklift Rental Market

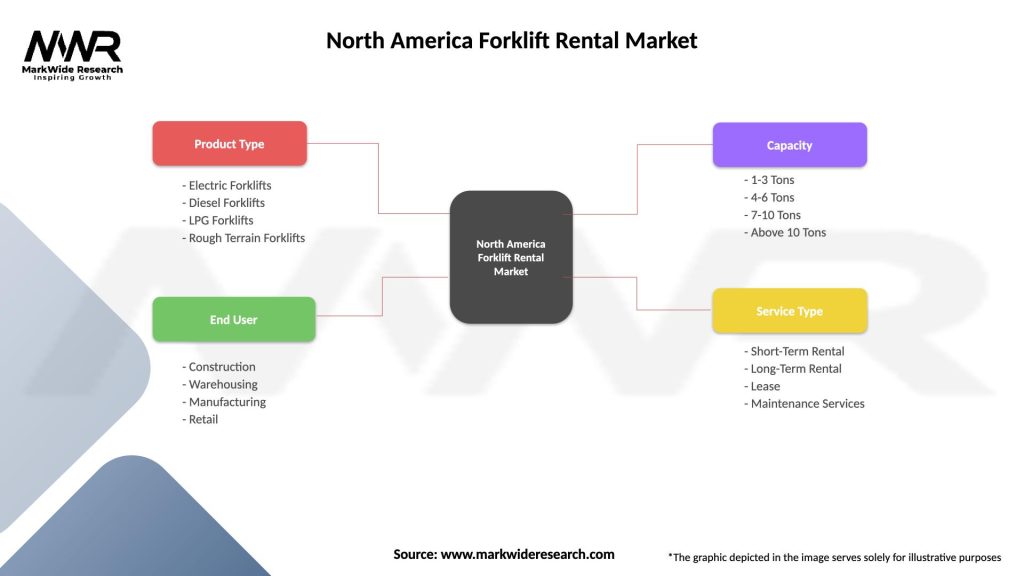

| Segmentation Details | Description |

|---|---|

| Product Type | Electric Forklifts, Diesel Forklifts, LPG Forklifts, Rough Terrain Forklifts |

| End User | Construction, Warehousing, Manufacturing, Retail |

| Capacity | 1-3 Tons, 4-6 Tons, 7-10 Tons, Above 10 Tons |

| Service Type | Short-Term Rental, Long-Term Rental, Lease, Maintenance Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Forklift Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at