444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America food service market represents one of the most dynamic and rapidly evolving sectors within the regional economy, encompassing a vast network of restaurants, cafeterias, catering services, and institutional food providers. This comprehensive market serves millions of consumers daily across the United States, Canada, and Mexico, driving significant economic activity and employment opportunities throughout the region.

Market dynamics indicate robust growth patterns, with the sector experiencing a compound annual growth rate (CAGR) of 4.2% over recent years. The market’s resilience has been particularly evident in its ability to adapt to changing consumer preferences, technological innovations, and evolving dining habits that have emerged in the post-pandemic landscape.

Regional distribution shows the United States commanding approximately 78% of the total market share, followed by Canada at 15% and Mexico contributing 7%. This distribution reflects the varying economic conditions, population densities, and consumer spending patterns across these three major North American markets.

Technology integration has become increasingly prevalent, with digital ordering systems, mobile applications, and automated kitchen equipment transforming traditional food service operations. The adoption of these technologies has improved operational efficiency by an average of 23% across participating establishments, while simultaneously enhancing customer experience and satisfaction levels.

The North America food service market refers to the comprehensive ecosystem of businesses and organizations that prepare, serve, and deliver food and beverages to consumers outside of their homes. This market encompasses various segments including full-service restaurants, quick-service restaurants, cafeterias, catering companies, food trucks, institutional food services, and specialty food establishments.

Market participants range from large multinational restaurant chains and franchise operations to independent local establishments and specialized catering services. The sector includes both commercial food service providers that operate for profit and non-commercial operations such as school cafeterias, hospital food services, and corporate dining facilities.

Service delivery models within this market have diversified significantly, incorporating traditional dine-in experiences, takeout services, delivery options, drive-through facilities, and hybrid concepts that combine multiple service approaches. This diversification has enabled market participants to reach broader customer bases and adapt to changing consumer preferences and lifestyle patterns.

Strategic analysis of the North America food service market reveals a sector characterized by continuous innovation, intense competition, and remarkable adaptability to consumer trends. The market has demonstrated exceptional resilience, particularly in response to challenges posed by economic fluctuations, changing demographics, and evolving health consciousness among consumers.

Growth drivers include increasing urbanization, rising disposable incomes, changing work patterns, and growing demand for convenience foods. The market has also benefited from the expansion of food delivery services, which now account for 18% of total food service transactions across the region, representing a significant shift in consumer behavior patterns.

Innovation trends are reshaping the competitive landscape, with establishments increasingly adopting sustainable practices, plant-based menu options, and personalized dining experiences. These trends reflect broader societal shifts toward environmental consciousness and health-focused consumption patterns that are influencing purchasing decisions across all demographic segments.

Market consolidation continues to occur, with major chains expanding their footprints through acquisitions and franchise development, while simultaneously creating opportunities for niche players to establish specialized market positions. This dynamic creates a balanced competitive environment that benefits both operators and consumers through improved service quality and menu diversity.

Consumer behavior analysis reveals several critical insights that are shaping the future direction of the North America food service market:

Economic prosperity across North America continues to fuel growth in the food service sector, with increasing disposable incomes enabling consumers to allocate larger portions of their budgets to dining out and food delivery services. This economic foundation supports both premium dining experiences and convenient quick-service options that cater to diverse consumer preferences and spending capabilities.

Urbanization trends have created concentrated population centers where food service establishments can achieve higher customer densities and operational efficiencies. Urban environments also foster innovation in food service concepts, as diverse populations demand varied cuisine options and dining experiences that reflect their cultural backgrounds and lifestyle preferences.

Technological advancement serves as a primary catalyst for market expansion, enabling food service operators to streamline operations, reduce labor costs, and enhance customer experiences. Point-of-sale systems, inventory management software, and customer relationship management platforms have improved operational efficiency while providing valuable data insights for strategic decision-making.

Changing work patterns have significantly impacted food service demand, with remote work arrangements and flexible schedules creating new consumption patterns. These changes have led to increased demand for breakfast and lunch delivery services, as well as growth in suburban food service locations that serve work-from-home professionals.

Health and wellness trends continue to drive menu innovation and concept development, with consumers increasingly seeking nutritious, fresh, and customizable food options. This trend has created opportunities for fast-casual chains, salad bars, smoothie shops, and other health-focused concepts that align with contemporary lifestyle preferences.

Labor shortages represent one of the most significant challenges facing the North America food service market, with many establishments struggling to recruit and retain qualified staff across all operational levels. These shortages have led to increased wage pressures, reduced operating hours, and in some cases, temporary closures that impact overall market growth potential.

Rising operational costs continue to pressure profit margins across the sector, with increases in food commodity prices, energy costs, rent, and labor expenses creating challenging operating environments. These cost pressures are particularly acute for independent operators who lack the purchasing power and economies of scale available to large chain operations.

Regulatory compliance requirements have become increasingly complex, with food safety standards, labor regulations, and environmental requirements creating additional administrative burdens and operational costs. These regulations, while necessary for consumer protection, can create barriers to entry for new market participants and increase operational complexity for existing operators.

Market saturation in certain segments and geographic areas has intensified competition and made it more difficult for new entrants to establish viable market positions. This saturation is particularly evident in mature markets where consumer demand growth has slowed relative to the rate of new establishment openings.

Economic uncertainty and inflation concerns can impact consumer spending patterns, leading to reduced frequency of dining out or shifts toward lower-priced menu options. These economic pressures can particularly affect full-service restaurants and premium dining concepts that rely on discretionary consumer spending.

Technology integration presents substantial opportunities for food service operators to differentiate their offerings and improve operational efficiency. Emerging technologies such as artificial intelligence, robotics, and Internet of Things (IoT) devices offer potential for significant cost reductions and service enhancements that can drive competitive advantages.

Delivery market expansion continues to offer growth opportunities, particularly in suburban and rural markets where delivery services remain underdeveloped. The growing acceptance of delivery fees and longer delivery times has expanded the addressable market for many food service concepts beyond their traditional geographic constraints.

Plant-based menu development represents a significant growth opportunity, with increasing consumer interest in vegetarian and vegan options creating demand for innovative plant-based proteins and dairy alternatives. This trend extends beyond traditional vegetarian restaurants to mainstream establishments seeking to attract health-conscious and environmentally aware consumers.

Ghost kitchen concepts offer opportunities for market expansion with reduced capital requirements and operational complexity. These delivery-only establishments can serve multiple brands from single locations, enabling operators to test new concepts and reach customers in markets where traditional restaurant locations might not be economically viable.

Franchise expansion opportunities exist in underserved markets and emerging demographic segments, particularly as successful concepts seek to replicate their business models across broader geographic areas. Franchising enables rapid market penetration while distributing operational risks and capital requirements across multiple stakeholders.

Competitive intensity within the North America food service market continues to drive innovation and service improvements across all segments. This competition manifests through menu diversification, pricing strategies, service enhancement initiatives, and marketing campaigns designed to attract and retain customer loyalty in an increasingly crowded marketplace.

Consumer preferences are evolving rapidly, influenced by social media trends, health consciousness, environmental concerns, and cultural diversity. Food service operators must continuously adapt their offerings to meet these changing preferences while maintaining operational efficiency and profitability in competitive market conditions.

Supply chain dynamics have become increasingly important, with operators seeking reliable suppliers who can provide consistent quality ingredients at competitive prices. Supply chain disruptions have highlighted the importance of diversified sourcing strategies and local supplier relationships that can provide greater resilience and flexibility.

Digital transformation is reshaping customer interactions and operational processes throughout the food service industry. Mobile applications, online ordering platforms, and digital payment systems have become essential components of successful food service operations, requiring ongoing technology investments and staff training.

Regulatory environment continues to evolve, with new requirements related to food safety, nutritional labeling, environmental sustainability, and labor practices. These regulatory changes create both challenges and opportunities for market participants who must adapt their operations while potentially gaining competitive advantages through compliance excellence.

Data collection for this comprehensive market analysis employed multiple research methodologies to ensure accuracy and completeness of findings. Primary research included surveys of food service operators, consumer behavior studies, and interviews with industry executives and market participants across various segments and geographic regions.

Secondary research incorporated analysis of industry publications, government statistics, trade association reports, and financial data from publicly traded food service companies. This approach provided historical context and trend analysis that informed projections and market assessments included in this comprehensive evaluation.

Market segmentation analysis utilized both quantitative and qualitative research approaches to identify key market segments, assess their relative sizes and growth potential, and understand the competitive dynamics within each segment. This analysis included examination of consumer demographics, spending patterns, and preference trends across different market segments.

Geographic analysis incorporated regional economic data, population demographics, and local market conditions to assess opportunities and challenges across different North American markets. This geographic perspective enabled identification of growth opportunities and potential market expansion strategies for various food service concepts.

Competitive intelligence gathering included analysis of major market participants, their strategies, financial performance, and market positioning. This competitive analysis provided insights into industry best practices, emerging trends, and potential disruption factors that could impact future market development.

United States market dominates the North American food service landscape, accounting for the largest share of establishments, employment, and consumer spending. The U.S. market benefits from high consumer disposable incomes, diverse population demographics, and well-developed infrastructure that supports various food service concepts and delivery models.

Regional variations within the United States create distinct market opportunities and challenges, with coastal markets typically showing higher adoption rates for premium and innovative dining concepts, while interior markets often favor familiar brands and value-oriented offerings. These regional differences influence expansion strategies and menu development decisions for national chains.

Canadian market represents a significant opportunity for growth, with increasing urbanization and rising disposable incomes driving demand for diverse food service options. The Canadian market has shown particular strength in fast-casual dining and coffee shop segments, reflecting consumer preferences for quality and convenience.

Mexican market offers substantial growth potential, driven by expanding middle-class populations and increasing adoption of international food service concepts. The Mexican market has experienced rapid growth in quick-service restaurants and delivery services, particularly in major metropolitan areas where infrastructure supports these business models.

Cross-border opportunities exist for successful food service concepts to expand throughout North America, leveraging free trade agreements and cultural similarities to achieve economies of scale and market diversification. These opportunities are particularly attractive for concepts that can adapt their offerings to local tastes and preferences while maintaining operational consistency.

Market leadership in the North America food service sector is characterized by a mix of large multinational chains, regional operators, and independent establishments that serve different market segments and consumer preferences. This diverse competitive landscape creates opportunities for various business models and operational approaches to succeed.

Major market participants include:

Competitive strategies vary significantly across market segments, with quick-service restaurants focusing on speed and convenience, fast-casual concepts emphasizing quality and customization, and full-service restaurants prioritizing experience and ambiance. These different approaches create distinct competitive dynamics within each segment.

Innovation leadership has become increasingly important for maintaining competitive positions, with successful operators investing in technology, menu development, and service enhancements that differentiate their offerings and create customer loyalty in competitive markets.

By Service Type:

By Cuisine Type:

By Location Type:

Quick Service Restaurant segment continues to demonstrate strong performance, driven by consumer demand for convenience, speed, and value. This segment has successfully adapted to changing consumer preferences through menu diversification, healthier options, and enhanced digital ordering capabilities that improve customer experience and operational efficiency.

Fast Casual dining represents the fastest-growing segment within the food service market, appealing to consumers seeking higher-quality ingredients and customizable options without the time commitment of full-service dining. This segment has benefited from health consciousness trends and willingness to pay premium prices for perceived quality improvements.

Full Service Restaurant category faces ongoing challenges from changing consumer preferences and increased competition from delivery services, but continues to serve important market needs for social dining, special occasions, and experiential consumption. Successful full-service operators are adapting through enhanced takeout capabilities and unique dining experiences.

Coffee and Snack segment has shown remarkable resilience and growth, driven by coffee culture expansion and increasing demand for convenient breakfast and snack options. This segment benefits from high-frequency customer visits and strong profit margins on beverage sales.

Delivery and Takeout services have transformed from supplementary revenue streams to essential business components for many food service operators. This category has experienced accelerated growth and now represents a fundamental shift in how consumers access food service offerings.

Franchise opportunities provide pathways for entrepreneurs to enter the food service market with established business models, brand recognition, and operational support systems. Franchising enables rapid market expansion while distributing risks and capital requirements across multiple stakeholders who benefit from proven success formulas.

Employment generation represents a significant benefit of food service market growth, with the sector providing entry-level positions, management opportunities, and entrepreneurial pathways for millions of North Americans. The industry’s diverse skill requirements create opportunities for workers with various educational backgrounds and experience levels.

Economic multiplier effects extend throughout local communities as food service establishments purchase ingredients from suppliers, utilize delivery services, and attract customers who may patronize other local businesses. These economic impacts create positive feedback loops that support broader community development and economic growth.

Innovation platforms within the food service industry drive technological advancement, culinary creativity, and business model innovation that benefits consumers through improved products, services, and experiences. These innovations often spread beyond the food service sector to influence other industries and consumer markets.

Supply chain integration creates opportunities for agricultural producers, food processors, packaging companies, and logistics providers to develop specialized capabilities and achieve economies of scale through food service market participation. These supply chain relationships support rural economies and agricultural communities throughout North America.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues to reshape the food service landscape, with mobile ordering, contactless payment, and artificial intelligence-powered customer service becoming standard expectations rather than competitive differentiators. These technological advances are improving operational efficiency while creating new opportunities for customer engagement and data collection.

Sustainability focus has evolved from niche marketing appeal to mainstream consumer expectation, with food service operators implementing comprehensive environmental programs including waste reduction, sustainable packaging, renewable energy usage, and responsible sourcing practices that demonstrate corporate social responsibility.

Health consciousness trends continue to influence menu development and marketing strategies, with operators responding through transparent nutritional information, organic ingredient options, plant-based alternatives, and customizable offerings that allow consumers to make healthier choices without sacrificing taste or convenience.

Experience economy principles are being applied throughout the food service sector, with operators creating Instagram-worthy presentations, interactive dining experiences, and unique ambiance elements that encourage social media sharing and repeat visits. These experiential elements help differentiate establishments in competitive markets.

Ghost kitchen proliferation represents a fundamental shift in food service real estate and operational models, enabling operators to serve multiple brands from single locations while reducing overhead costs and expanding delivery market reach without traditional restaurant space requirements.

Personalization technology is enabling food service operators to customize menu recommendations, pricing, and marketing messages based on individual customer preferences and purchase history. These personalization capabilities improve customer satisfaction while increasing average transaction values and visit frequency.

Automation implementation has accelerated across the food service industry, with robotic kitchen equipment, automated ordering systems, and self-service kiosks becoming increasingly common in establishments seeking to address labor shortages while improving operational consistency and cost control.

Partnership strategies between food service operators and technology companies have created innovative solutions for inventory management, customer relationship management, and operational optimization. These partnerships enable food service companies to access advanced technologies without significant internal development investments.

Merger and acquisition activity continues to reshape the competitive landscape, with larger operators acquiring successful regional chains and innovative concepts to expand their market presence and diversify their brand portfolios. This consolidation trend creates opportunities for economies of scale while potentially reducing competition in some markets.

Regulatory compliance innovations have emerged as companies develop new approaches to meet evolving food safety, nutritional labeling, and environmental requirements. These innovations often become competitive advantages for early adopters while eventually becoming industry standards.

Supply chain optimization initiatives have focused on reducing costs, improving reliability, and enhancing sustainability through direct supplier relationships, local sourcing programs, and advanced logistics technologies that minimize waste and transportation costs.

MarkWide Research analysis indicates that food service operators should prioritize technology investments that improve operational efficiency and customer experience, particularly in areas such as mobile ordering, inventory management, and customer data analytics. These technology investments can provide significant returns through reduced labor costs and increased customer loyalty.

Market positioning strategies should focus on clear differentiation through either cost leadership, quality superiority, or unique customer experiences that create sustainable competitive advantages. Operators attempting to compete on multiple dimensions simultaneously often struggle to achieve market leadership in any specific area.

Geographic expansion opportunities exist in underserved suburban and rural markets where successful urban concepts can achieve strong market positions with reduced competition. However, these expansions require careful adaptation to local preferences and economic conditions that may differ significantly from urban markets.

Menu innovation should balance consumer demand for new and exciting options with operational complexity and cost considerations. Successful menu development typically involves limited-time offerings that test consumer acceptance before permanent menu additions that require significant operational changes.

Partnership development with delivery platforms, technology providers, and suppliers can provide access to capabilities and markets that would be difficult to develop independently. These partnerships should be structured to maintain brand control while accessing partner expertise and resources.

Growth projections for the North America food service market remain positive, with continued expansion expected across most segments driven by population growth, urbanization trends, and increasing consumer acceptance of food service as a regular part of their lifestyle rather than occasional convenience.

Technology integration will accelerate, with artificial intelligence, robotics, and Internet of Things devices becoming standard components of food service operations. These technologies will enable greater operational efficiency, improved food safety, and enhanced customer experiences that drive competitive advantages for early adopters.

Sustainability requirements will become increasingly important, with consumers and regulators demanding greater environmental responsibility from food service operators. Companies that proactively implement comprehensive sustainability programs will likely achieve competitive advantages and regulatory compliance benefits.

Market consolidation is expected to continue, with successful regional operators becoming acquisition targets for larger chains seeking geographic expansion and concept diversification. This consolidation will create opportunities for remaining independent operators to serve niche markets and local preferences.

Consumer preferences will continue evolving toward health-conscious, convenient, and experiential dining options that reflect broader lifestyle trends. Food service operators must maintain flexibility to adapt to these changing preferences while preserving operational efficiency and profitability.

MWR projections suggest that delivery and takeout services will stabilize at elevated levels compared to pre-pandemic patterns, representing a permanent shift in consumer behavior that requires ongoing operational adaptation and investment in delivery-optimized facilities and processes.

The North America food service market represents a dynamic and resilient sector that continues to evolve in response to changing consumer preferences, technological innovations, and economic conditions. The market’s diversity across segments, geographic regions, and operational models provides multiple pathways for success while creating a competitive environment that drives continuous improvement and innovation.

Strategic success in this market requires careful attention to consumer trends, operational efficiency, and technology adoption while maintaining focus on core competencies and market positioning. Operators who can balance innovation with operational excellence while adapting to local market conditions are most likely to achieve sustainable growth and profitability.

Future opportunities exist across all market segments, with particular potential in technology-enabled service delivery, health-conscious menu development, and sustainability-focused operations that align with evolving consumer values and regulatory requirements. The market’s continued growth trajectory provides a foundation for both established operators and new entrants to achieve success through differentiated strategies and excellent execution.

What is Food Service?

Food service refers to the industry that prepares and serves food and beverages to customers. This includes restaurants, cafes, catering services, and institutional food services such as schools and hospitals.

What are the key players in the North America Food Service Market?

Key players in the North America Food Service Market include companies like McDonald’s, Starbucks, and Yum! Brands, which operate extensive networks of restaurants and food outlets, among others.

What are the main drivers of growth in the North America Food Service Market?

The main drivers of growth in the North America Food Service Market include increasing consumer demand for convenience foods, the rise of food delivery services, and a growing trend towards dining out and experiential eating.

What challenges does the North America Food Service Market face?

Challenges in the North America Food Service Market include rising food costs, labor shortages, and increasing competition from fast-casual dining options, which can impact profitability.

What opportunities exist in the North America Food Service Market?

Opportunities in the North America Food Service Market include the expansion of plant-based menu options, the integration of technology for online ordering, and the growth of health-conscious dining trends.

What trends are shaping the North America Food Service Market?

Trends shaping the North America Food Service Market include the increasing popularity of food trucks, the emphasis on sustainability and local sourcing, and the rise of ghost kitchens that cater to delivery services.

North America Food Service Market

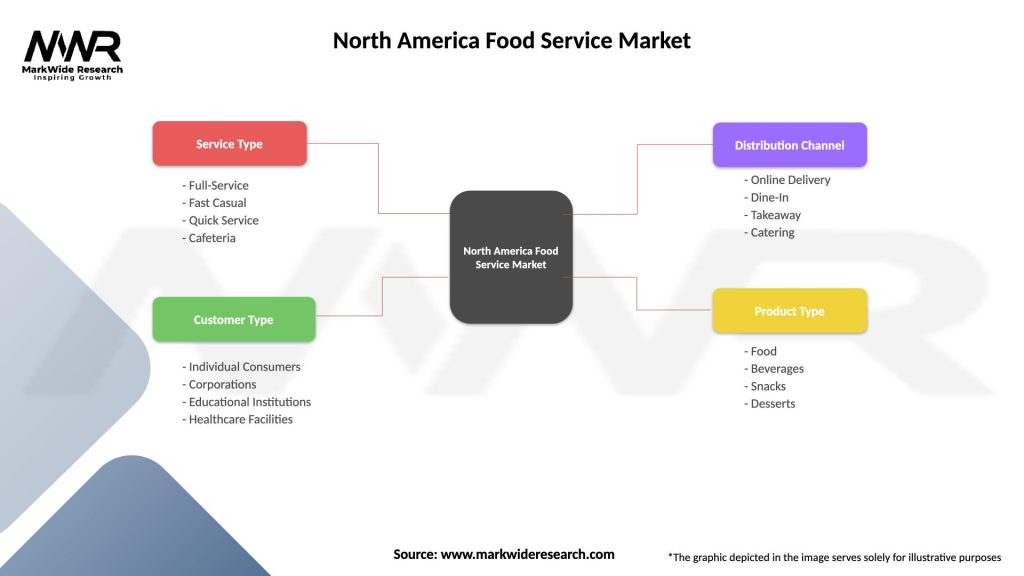

| Segmentation Details | Description |

|---|---|

| Service Type | Full-Service, Fast Casual, Quick Service, Cafeteria |

| Customer Type | Individual Consumers, Corporations, Educational Institutions, Healthcare Facilities |

| Distribution Channel | Online Delivery, Dine-In, Takeaway, Catering |

| Product Type | Food, Beverages, Snacks, Desserts |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Food Service Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at