444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America FLNG (Floating Liquefied Natural Gas) market has witnessed significant growth in recent years, driven by the increasing demand for natural gas, advancements in offshore exploration and production technologies, and the need for cost-effective and efficient solutions for gas monetization. FLNG refers to the liquefaction of natural gas on offshore facilities, enabling its storage, transportation, and export. The North America FLNG market offers various opportunities for investors, technology providers, and stakeholders in the energy industry.

Meaning

Floating Liquefied Natural Gas (FLNG) refers to the process of liquefying natural gas at offshore facilities, allowing for its storage, transportation, and export. FLNG facilities are floating structures that house liquefaction units, storage tanks, and offloading capabilities. This technology provides a flexible and cost-effective solution for gas monetization, particularly in offshore gas fields where onshore infrastructure is not feasible or economically viable. FLNG offers advantages such as reduced capital costs, shorter project lead times, and the ability to access remote gas reserves.

Executive Summary

The North America FLNG market has experienced substantial growth, driven by the rising demand for natural gas, advancements in offshore technologies, and the need for efficient gas monetization solutions. FLNG offers flexibility, cost-effectiveness, and the ability to access remote gas reserves. The market presents opportunities for investors, technology providers, and stakeholders in the energy industry. However, challenges related to project economics, regulatory frameworks, and environmental considerations need to be addressed to maximize the potential of the FLNG market.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America FLNG market is dynamic, driven by the evolving energy landscape, technological advancements, and market forces. Key players in the industry focus on technological innovation, cost optimization, and environmental sustainability to maintain a competitive edge. The market is influenced by factors such as natural gas demand, LNG prices, regulatory frameworks, and geopolitical dynamics.

Regional Analysis

The North America FLNG market can be segmented into key regions, including the United States, Canada, and Mexico. The United States holds the largest share in the market, driven by its extensive natural gas reserves, favorable regulatory environment, and infrastructure capabilities. Canada and Mexico also contribute significantly to the market, with their own offshore gas potential and proximity to international LNG markets.

Competitive Landscape

Leading Companies in the North America FLNG Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America FLNG market can be segmented based on various factors, including project size, liquefaction capacity, and geographical location. Large-scale FLNG projects cater to high-volume gas reserves, while small-scale projects focus on monetizing smaller gas fields or serving niche markets. Geographically, FLNG facilities are located in offshore regions with gas reserves, such as the Gulf of Mexico and the Canadian Arctic.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a mixed impact on the North America FLNG market. The decline in global energy demand and the disruption of supply chains have affected project timelines and investment decisions. However, the long-term fundamentals of natural gas, the increasing focus on clean energy, and the expected recovery in global energy demand are likely to drive the FLNG market’s growth in the post-pandemic period.

Key Industry Developments

Analyst Suggestions

Future Outlook

The North America FLNG market is expected to witness significant growth in the coming years. The increasing demand for natural gas, the need for cost-effective gas monetization solutions, and advancements in FLNG technologies will drive the market’s expansion. Ongoing investments in research and development, collaboration among industry participants, and favorable regulatory frameworks will shape the future of the FLNG market in North America.

Conclusion

The North America FLNG market has emerged as a promising solution for the efficient and cost-effective monetization of natural gas reserves. FLNG offers flexibility, mobility, and reduced environmental impact compared to traditional onshore liquefaction plants. The market is driven by the increasing demand for natural gas, advancements in offshore technologies, and the need for innovative gas monetization solutions. The FLNG market presents opportunities for investors, technology providers, and stakeholders in the energy industry. However, challenges related to project economics, regulatory frameworks, and technological complexities need to be addressed. With the right strategies, collaboration, and sustainable practices, the North America FLNG market is well-positioned for future growth and success.

What is FLNG?

FLNG stands for Floating Liquefied Natural Gas, which refers to the technology used to produce, liquefy, store, and transfer natural gas at sea. This innovative approach allows for the extraction of natural gas from offshore reserves and its transportation in a more efficient manner.

What are the key players in the North America FLNG Market?

Key players in the North America FLNG Market include companies such as Shell, ExxonMobil, and Cheniere Energy, which are involved in various aspects of FLNG operations, from production to transportation and infrastructure development, among others.

What are the main drivers of growth in the North America FLNG Market?

The main drivers of growth in the North America FLNG Market include the increasing demand for natural gas, advancements in FLNG technology, and the need for energy security. Additionally, the ability to access remote gas reserves is also a significant factor.

What challenges does the North America FLNG Market face?

The North America FLNG Market faces challenges such as high capital costs, regulatory hurdles, and environmental concerns. These factors can impact project feasibility and investment decisions in the sector.

What opportunities exist in the North America FLNG Market?

Opportunities in the North America FLNG Market include the potential for new projects in untapped offshore reserves and the growing interest in cleaner energy sources. Additionally, partnerships and collaborations can enhance technological advancements and market reach.

What trends are shaping the North America FLNG Market?

Trends shaping the North America FLNG Market include the increasing focus on sustainability, the integration of digital technologies for operational efficiency, and the shift towards renewable energy sources. These trends are influencing how companies approach FLNG projects and investments.

North America FLNG Market

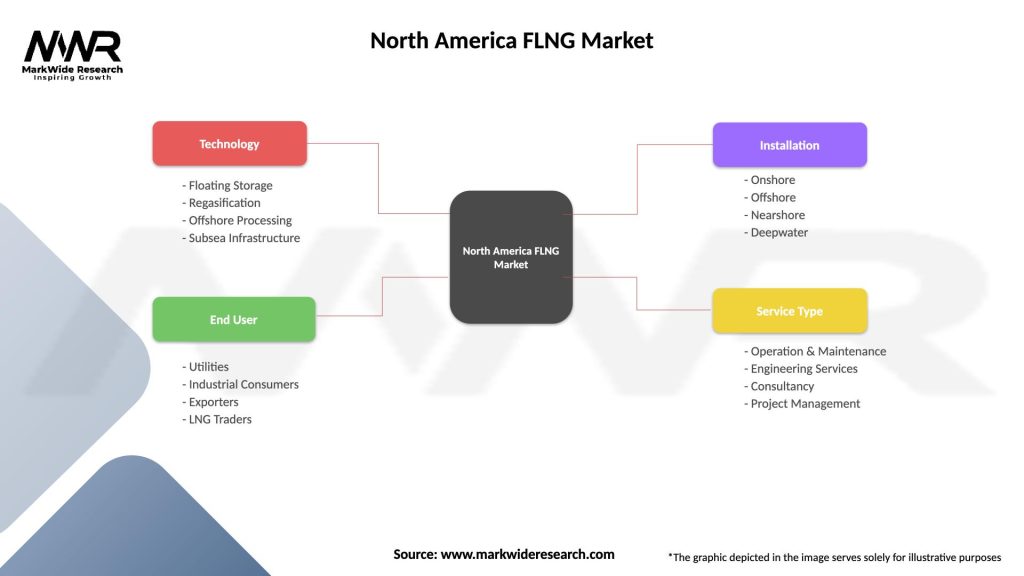

| Segmentation Details | Description |

|---|---|

| Technology | Floating Storage, Regasification, Offshore Processing, Subsea Infrastructure |

| End User | Utilities, Industrial Consumers, Exporters, LNG Traders |

| Installation | Onshore, Offshore, Nearshore, Deepwater |

| Service Type | Operation & Maintenance, Engineering Services, Consultancy, Project Management |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America FLNG Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at