444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America fixed income assets under management market represents a cornerstone of the regional investment landscape, encompassing a diverse array of debt securities, bonds, and fixed-yield instruments managed by institutional and retail investment firms. This market has demonstrated remarkable resilience and growth, driven by increasing demand for stable income-generating investments amid economic uncertainties and demographic shifts toward retirement planning.

Market dynamics indicate that the North American region maintains its position as the world’s largest fixed income market, with the United States and Canada leading in both innovation and asset accumulation. The market encompasses government bonds, corporate debt, municipal securities, mortgage-backed securities, and emerging alternative fixed income products that cater to diverse investor risk profiles and return expectations.

Growth trajectories suggest the market is expanding at a compound annual growth rate (CAGR) of 6.2%, fueled by institutional investors’ increasing allocation to fixed income securities and the growing popularity of exchange-traded funds (ETFs) focused on bond investments. The market benefits from sophisticated infrastructure, regulatory frameworks, and technological innovations that enhance trading efficiency and portfolio management capabilities.

Regional distribution shows that approximately 85% of North American fixed income assets are concentrated in the United States, while Canada accounts for the remaining portion, with both markets exhibiting strong interconnectedness and cross-border investment flows that strengthen the overall market ecosystem.

The North America fixed income assets under management market refers to the comprehensive ecosystem of debt securities, bonds, and income-generating financial instruments that are professionally managed by investment firms, asset managers, and financial institutions across the United States and Canada. This market encompasses the total value of fixed income portfolios managed on behalf of institutional and individual investors seeking predictable returns and capital preservation.

Asset management in this context involves the professional oversight, selection, and optimization of fixed income securities to achieve specific investment objectives while managing risk exposure. The market includes various categories such as government treasuries, corporate bonds, municipal debt, mortgage-backed securities, asset-backed securities, and emerging fixed income alternatives like green bonds and inflation-protected securities.

Management structures within this market range from traditional active management approaches to passive index-based strategies, with increasing adoption of quantitative and algorithmic trading methodologies that enhance portfolio performance and risk management capabilities across diverse market conditions.

Strategic positioning of the North America fixed income assets under management market reflects its critical role in global financial markets, serving as a primary destination for capital seeking stable returns and portfolio diversification. The market has evolved significantly over the past decade, incorporating advanced technologies, regulatory enhancements, and innovative product structures that meet changing investor demands.

Key performance indicators demonstrate robust market health, with institutional adoption rates reaching 78% among pension funds and insurance companies increasingly allocating resources to professionally managed fixed income strategies. The market benefits from a mature regulatory environment, sophisticated clearing and settlement systems, and deep liquidity pools that facilitate efficient price discovery and transaction execution.

Technological integration has transformed market operations, with artificial intelligence and machine learning algorithms now managing approximately 42% of institutional fixed income portfolios, enabling more precise risk assessment, yield optimization, and automated rebalancing strategies that enhance overall portfolio performance.

Market participants include major asset management firms, investment banks, insurance companies, pension funds, sovereign wealth funds, and retail investors accessing fixed income markets through mutual funds, ETFs, and separately managed accounts that provide professional oversight and diversification benefits.

Market intelligence reveals several critical insights that shape the North America fixed income assets under management landscape:

Primary growth drivers propelling the North America fixed income assets under management market include demographic shifts, monetary policy dynamics, and evolving investor preferences that collectively create sustained demand for professionally managed fixed income strategies.

Demographic transitions represent the most significant long-term driver, as millions of baby boomers enter retirement phases requiring stable income generation and capital preservation. This demographic shift creates consistent demand for fixed income products, with retirees typically allocating 60-70% of portfolios to bonds and income-generating securities managed by professional investment firms.

Institutional demand continues expanding as pension funds, insurance companies, and endowments increase fixed income allocations to match long-term liability profiles and regulatory requirements. Insurance companies particularly drive growth through their need for duration-matched assets that align with policy obligations and regulatory capital requirements.

Monetary policy environments create cyclical opportunities for fixed income managers, with changing interest rate cycles generating alpha opportunities through duration management, credit selection, and yield curve positioning strategies that benefit from professional expertise and market timing capabilities.

Technology integration enhances market attractiveness by improving operational efficiency, reducing costs, and enabling sophisticated risk management techniques that appeal to both institutional and retail investors seeking professional oversight of their fixed income investments.

Market constraints facing the North America fixed income assets under management sector include structural challenges, competitive pressures, and regulatory complexities that may limit growth potential and profitability for market participants.

Low interest rate environments present significant challenges for fixed income managers, as compressed yields reduce absolute return potential and make it difficult to generate attractive risk-adjusted returns that justify management fees and expenses associated with professional portfolio management.

Fee compression pressures intensify as investors increasingly scrutinize costs and migrate toward lower-fee passive investment options, particularly index funds and ETFs that offer broad market exposure at significantly reduced expense ratios compared to actively managed strategies.

Regulatory compliance costs continue rising as financial institutions face increasingly complex reporting requirements, capital adequacy standards, and fiduciary responsibilities that add operational expenses and may limit profitability for smaller asset management firms.

Market volatility and credit risk concerns can reduce investor confidence in fixed income markets, particularly during economic uncertainty periods when credit spreads widen and duration risk becomes more pronounced, potentially leading to asset outflows and reduced management fees.

Technology disruption creates competitive threats as robo-advisors and automated investment platforms offer basic fixed income portfolio management at significantly lower costs, potentially displacing traditional human-managed strategies for price-sensitive investor segments.

Emerging opportunities within the North America fixed income assets under management market present significant potential for growth and innovation, driven by evolving investor needs, technological capabilities, and market structure developments.

ESG investing represents a transformative opportunity as environmental, social, and governance considerations become central to investment decision-making. The sustainable bond market is experiencing rapid growth, with green bond issuance increasing by 35% annually, creating opportunities for specialized ESG-focused fixed income strategies and expertise.

Alternative fixed income products offer differentiation opportunities as investors seek yield enhancement and diversification beyond traditional government and corporate bonds. Private credit, infrastructure debt, and real estate-backed securities provide higher yield potential while requiring specialized management expertise that commands premium fees.

Technology-enabled solutions create opportunities for operational efficiency improvements and enhanced client services through artificial intelligence, machine learning, and automated portfolio management systems that can reduce costs while improving investment outcomes and client satisfaction.

Demographic tailoring enables development of specialized products and services targeting specific age cohorts, risk profiles, and income requirements, particularly as millennial investors begin accumulating wealth and require different fixed income solutions than traditional retiree-focused products.

International expansion opportunities exist as North American asset managers leverage their expertise and technology platforms to serve global markets, particularly in emerging economies where fixed income markets are developing and require professional management capabilities.

Market dynamics within the North America fixed income assets under management sector reflect complex interactions between macroeconomic factors, regulatory changes, technological innovations, and competitive forces that shape market structure and participant strategies.

Interest rate cycles fundamentally influence market dynamics, with rising rate environments typically benefiting active managers who can capitalize on reinvestment opportunities and duration positioning, while falling rate periods may compress yields and challenge return generation capabilities across the sector.

Competitive landscape evolution shows increasing consolidation among asset management firms seeking scale advantages and operational efficiencies, while simultaneously witnessing the emergence of specialized boutique managers focusing on niche fixed income strategies and alternative credit products.

Investor behavior patterns demonstrate increasing sophistication and fee sensitivity, with institutional investors conducting more rigorous due diligence and performance evaluation processes that reward consistent alpha generation and risk-adjusted returns over pure asset gathering strategies.

Regulatory dynamics continue evolving with enhanced fiduciary standards, liquidity risk management requirements, and systemic risk monitoring that influence product development, operational procedures, and competitive positioning within the fixed income management industry.

Technology adoption rates accelerate across the sector, with approximately 68% of asset managers implementing advanced analytics and artificial intelligence systems to enhance investment processes, risk management, and client service delivery capabilities.

Research approach for analyzing the North America fixed income assets under management market employs comprehensive methodologies combining quantitative data analysis, qualitative market assessment, and primary research techniques to provide accurate market intelligence and strategic insights.

Data collection methods include extensive analysis of regulatory filings, industry reports, financial statements, and market data from leading fixed income managers, custodian banks, and trading platforms to establish baseline market metrics and trend identification across various market segments and participant categories.

Primary research activities involve structured interviews with senior executives, portfolio managers, and industry experts from major asset management firms, institutional investors, and regulatory bodies to gather insights on market trends, competitive dynamics, and future outlook perspectives.

Market segmentation analysis utilizes sophisticated statistical techniques to categorize market participants by asset size, investment strategy, client type, and geographic focus, enabling detailed understanding of market structure and competitive positioning within specific market niches.

Validation processes ensure research accuracy through cross-referencing multiple data sources, peer review by industry experts, and continuous monitoring of market developments to maintain current and reliable market intelligence for strategic decision-making purposes.

Regional market distribution across North America reveals distinct characteristics and growth patterns that reflect local economic conditions, regulatory environments, and investor preferences within the fixed income assets under management sector.

United States market dominates the regional landscape, accounting for approximately 85% of total North American fixed income assets under management. The U.S. market benefits from the world’s deepest and most liquid bond markets, sophisticated institutional investor base, and comprehensive regulatory framework that supports both domestic and international investment flows.

New York financial center serves as the primary hub for fixed income trading and asset management activities, hosting major investment banks, asset managers, and institutional investors that collectively manage the majority of North American fixed income assets through advanced trading platforms and risk management systems.

Canadian market represents a significant but smaller portion of regional assets, characterized by strong pension fund presence, conservative investment approaches, and increasing integration with U.S. markets through cross-border investment strategies and regulatory harmonization initiatives.

Regional growth patterns show the southeastern United States experiencing rapid expansion in asset management activities, with cities like Charlotte, Atlanta, and Miami attracting major financial institutions and investment firms seeking operational efficiency and talent acquisition advantages.

Cross-border integration continues strengthening as Canadian and U.S. asset managers expand operations across the border, leveraging regulatory agreements and market access arrangements that facilitate seamless investment management services for institutional and retail clients throughout North America.

Competitive environment within the North America fixed income assets under management market features a diverse ecosystem of participants ranging from global investment management giants to specialized boutique firms, each competing through differentiated strategies and service offerings.

Market leaders include established asset management firms that have built comprehensive fixed income capabilities:

Competitive differentiation occurs through various factors including investment performance, fee structures, technology platforms, client service quality, and specialized expertise in specific fixed income sectors or strategies that appeal to particular investor segments.

Market consolidation trends show larger firms acquiring specialized managers to expand capabilities and achieve scale advantages, while boutique firms focus on niche strategies and personalized service to compete effectively against larger competitors.

Market segmentation within the North America fixed income assets under management sector reveals distinct categories based on investment approach, client type, asset class focus, and management style that serve different investor needs and risk preferences.

By Investment Approach:

By Client Type:

By Asset Class:

Government securities management represents the largest and most stable category within North American fixed income assets under management, benefiting from deep liquidity, credit quality, and benchmark status that attracts both institutional and retail investors seeking capital preservation and income generation.

Corporate bond management demonstrates strong growth potential as companies increase debt issuance and investors seek yield enhancement beyond government securities. This category benefits from credit research capabilities and active management strategies that can add value through security selection and credit cycle timing.

Municipal bond management serves a specialized but important market segment, particularly attractive to high-net-worth individuals and institutions seeking tax-advantaged income. This category requires specialized expertise in credit analysis, tax considerations, and local market dynamics that create barriers to entry for generalist managers.

Mortgage-backed securities management offers diversification benefits and yield enhancement opportunities but requires sophisticated analytical capabilities to assess prepayment risk, credit quality, and structural complexity. This category appeals to institutional investors seeking duration management and yield optimization.

International fixed income management provides geographic and currency diversification benefits while requiring specialized expertise in foreign markets, currency hedging, and sovereign credit analysis. This category is growing as investors seek global diversification and yield opportunities beyond domestic markets.

Alternative fixed income management represents an emerging and rapidly growing category encompassing private credit, infrastructure debt, and other non-traditional fixed income investments that offer yield enhancement and diversification benefits for sophisticated institutional investors.

Asset managers benefit from the North America fixed income assets under management market through multiple revenue streams, including management fees, performance fees, and ancillary services that provide stable and recurring income based on assets under management and investment performance.

Institutional investors gain access to professional expertise, sophisticated risk management capabilities, and economies of scale that would be difficult to achieve through internal management. Professional fixed income management provides specialized knowledge, trading capabilities, and operational infrastructure that enhance portfolio efficiency and risk-adjusted returns.

Individual investors benefit from professional portfolio management, diversification, and access to institutional-quality fixed income strategies through mutual funds, ETFs, and managed accounts that would otherwise be unavailable to smaller investors lacking the scale and expertise for direct bond investing.

Financial advisors utilize professionally managed fixed income strategies to construct diversified client portfolios, access specialized expertise, and provide comprehensive wealth management services that meet varying client risk profiles and income requirements throughout different life stages.

Market infrastructure providers including custodian banks, trading platforms, and technology vendors benefit from increased trading volumes, asset servicing fees, and technology licensing opportunities that arise from growing fixed income assets under management and operational complexity.

Economic stakeholders benefit from efficient capital allocation, enhanced market liquidity, and improved price discovery mechanisms that result from professional fixed income management activities, contributing to overall financial market stability and economic growth.

Strengths:

Weaknesses:

Opportunities:

Threats:

ESG integration represents the most significant trend transforming the North America fixed income assets under management market, with sustainable investing principles becoming central to investment processes and product development. MarkWide Research analysis indicates that ESG-focused fixed income strategies are experiencing rapid adoption, with institutional investors increasingly incorporating environmental, social, and governance factors into their investment mandates and manager selection criteria.

Technology transformation continues reshaping market operations through artificial intelligence, machine learning, and automated trading systems that enhance investment decision-making, risk management, and operational efficiency. Approximately 55% of asset managers now utilize advanced analytics for portfolio construction and risk assessment, improving investment outcomes while reducing operational costs.

Fee compression trends persist as investors become increasingly cost-conscious and migrate toward lower-fee investment options, particularly passive strategies and ETFs that offer broad market exposure at reduced expense ratios. This trend forces active managers to demonstrate clear value proposition and alpha generation capabilities to justify higher fees.

Alternative fixed income strategies gain prominence as investors seek yield enhancement and diversification beyond traditional government and corporate bonds. Private credit, infrastructure debt, and other alternative strategies offer higher return potential while requiring specialized expertise that commands premium management fees.

Demographic shifts drive sustained demand for income-generating investments as baby boomers enter retirement phases requiring stable cash flows and capital preservation. This demographic transition creates long-term growth opportunities for fixed income managers specializing in retirement-focused investment strategies.

Regulatory evolution continues influencing market structure through enhanced fiduciary standards, liquidity risk management requirements, and systemic risk monitoring that impact product development, operational procedures, and competitive dynamics within the industry.

Strategic acquisitions and mergers continue reshaping the competitive landscape as larger asset management firms seek to expand capabilities, achieve scale advantages, and enhance technology platforms through targeted acquisitions of specialized fixed income managers and technology providers.

Product innovation accelerates with development of new fixed income instruments including green bonds, social impact bonds, and inflation-protected securities that address evolving investor preferences for sustainable investing and inflation hedging capabilities.

Technology partnerships emerge as asset managers collaborate with fintech companies and technology providers to enhance investment processes, improve client services, and develop next-generation portfolio management platforms that integrate artificial intelligence and machine learning capabilities.

Regulatory compliance initiatives focus on enhanced reporting requirements, liquidity risk management, and fiduciary responsibility standards that influence operational procedures and competitive positioning within the fixed income management industry.

International expansion activities increase as North American asset managers leverage their expertise and technology platforms to serve global markets, particularly in emerging economies where fixed income markets are developing and require professional management capabilities.

Client service enhancement programs emphasize improved transparency, reporting capabilities, and customization options that address institutional investor demands for more sophisticated portfolio management and risk monitoring services.

Strategic positioning recommendations for market participants emphasize the importance of developing differentiated capabilities that justify management fees and create sustainable competitive advantages in an increasingly competitive environment characterized by fee pressure and technological disruption.

Technology investment priorities should focus on artificial intelligence, machine learning, and automated portfolio management systems that enhance investment processes while reducing operational costs. Firms that successfully integrate advanced technologies can achieve operational efficiency gains of 25-30% while improving investment outcomes and client satisfaction.

ESG integration represents a critical strategic imperative as sustainable investing becomes mainstream. Asset managers should develop comprehensive ESG capabilities including research, product development, and reporting systems that meet growing institutional investor demands for sustainable investment options.

Alternative strategies offer differentiation opportunities through private credit, infrastructure debt, and other non-traditional fixed income investments that provide higher yield potential and justify premium management fees while serving sophisticated institutional investor needs.

Client relationship management should emphasize transparency, customization, and value-added services that strengthen client retention and support fee stability in competitive market conditions. Enhanced reporting capabilities and personalized service delivery can improve client satisfaction and reduce attrition rates.

Operational efficiency improvements through technology adoption, process automation, and scale advantages enable cost reduction while maintaining service quality, creating competitive advantages in fee-sensitive market segments and improving overall profitability.

Long-term growth prospects for the North America fixed income assets under management market remain positive, driven by demographic trends, institutional investor demand, and ongoing financial market evolution that creates sustained opportunities for professional fixed income management services.

Demographic drivers will continue supporting market growth as millions of baby boomers require income-generating investments throughout their retirement years. This demographic transition is expected to drive consistent demand for fixed income strategies, with retiree-focused products representing a significant growth opportunity over the next decade.

Technology integration will accelerate, with artificial intelligence and machine learning becoming standard components of investment processes and operational systems. MWR projections suggest that technology-enhanced investment strategies will capture an increasing share of institutional mandates, with adoption rates reaching 75% by 2028.

ESG evolution will transform product development and investment processes as sustainable investing becomes the dominant approach for institutional investors. Green bonds, social impact securities, and ESG-integrated strategies are expected to represent a growing portion of fixed income assets under management.

Market structure changes may include increased consolidation among smaller asset managers, continued growth of passive strategies, and emergence of hybrid active-passive approaches that combine low-cost exposure with selective active management for alpha generation opportunities.

Regulatory developments will likely focus on enhanced transparency, systemic risk monitoring, and investor protection measures that may influence competitive dynamics while supporting overall market stability and investor confidence in professionally managed fixed income strategies.

The North America fixed income assets under management market represents a dynamic and evolving sector that plays a crucial role in the global financial system, providing essential investment management services to institutional and individual investors seeking stable returns and portfolio diversification. The market demonstrates remarkable resilience and adaptability, successfully navigating changing interest rate environments, technological disruption, and evolving investor preferences while maintaining its position as the world’s largest and most sophisticated fixed income management ecosystem.

Market fundamentals remain strong, supported by demographic trends, institutional investor demand, and ongoing innovation in products, services, and technology platforms that enhance investment outcomes and operational efficiency. The sector benefits from deep capital markets, sophisticated regulatory frameworks, and concentration of investment expertise that creates sustainable competitive advantages in global markets.

Future success will depend on market participants’ ability to adapt to changing conditions, embrace technological innovation, and develop differentiated capabilities that justify professional management fees in an increasingly competitive environment. Organizations that successfully integrate ESG considerations, alternative strategies, and advanced technologies while maintaining focus on client service excellence are positioned to capture growth opportunities and build sustainable competitive advantages.

Strategic implications suggest that the North America fixed income assets under management market will continue evolving toward greater efficiency, transparency, and specialization, with successful participants demonstrating clear value proposition through superior investment outcomes, innovative product development, and comprehensive client service capabilities that meet diverse investor needs across changing market cycles.

What is Fixed Income Assets under Management?

Fixed Income Assets under Management refer to investment vehicles that provide returns in the form of regular income, typically through interest payments. These assets include government bonds, corporate bonds, and other debt securities managed by financial institutions.

What are the key players in the North America Fixed Income Assets under Management Market?

Key players in the North America Fixed Income Assets under Management Market include large financial institutions such as BlackRock, Vanguard, and PIMCO, which manage substantial portfolios of fixed income securities, among others.

What are the growth factors driving the North America Fixed Income Assets under Management Market?

The growth of the North America Fixed Income Assets under Management Market is driven by factors such as increasing demand for stable income sources, low-interest-rate environments prompting investors to seek fixed income options, and the diversification strategies of institutional investors.

What challenges does the North America Fixed Income Assets under Management Market face?

Challenges in the North America Fixed Income Assets under Management Market include rising interest rates that can negatively impact bond prices, regulatory changes affecting investment strategies, and competition from alternative investment vehicles.

What opportunities exist in the North America Fixed Income Assets under Management Market?

Opportunities in the North America Fixed Income Assets under Management Market include the potential for growth in sustainable fixed income products, the increasing interest in municipal bonds for funding infrastructure, and the expansion of fixed income ETFs catering to diverse investor needs.

What trends are shaping the North America Fixed Income Assets under Management Market?

Trends shaping the North America Fixed Income Assets under Management Market include the rise of ESG-focused investments, the growing popularity of passive management strategies, and advancements in technology that enhance trading and analytics capabilities.

North America Fixed Income Assets under Management Market

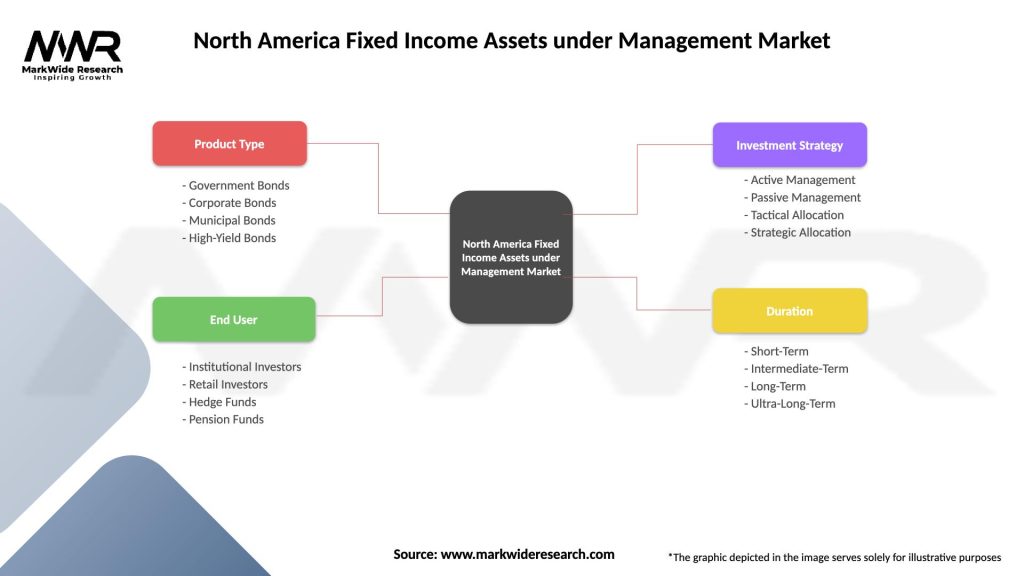

| Segmentation Details | Description |

|---|---|

| Product Type | Government Bonds, Corporate Bonds, Municipal Bonds, High-Yield Bonds |

| End User | Institutional Investors, Retail Investors, Hedge Funds, Pension Funds |

| Investment Strategy | Active Management, Passive Management, Tactical Allocation, Strategic Allocation |

| Duration | Short-Term, Intermediate-Term, Long-Term, Ultra-Long-Term |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Fixed Income Assets under Management Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at