444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview:

The North America Family Floater Health Insurance Market is a significant segment within the broader health insurance industry. This market caters specifically to the health coverage needs of families, offering a comprehensive insurance package that includes multiple family members under a single policy. Family floater health insurance plans provide financial protection against medical expenses for the entire family, covering hospitalization, medical treatments, and other related costs.

Meaning:

Family floater health insurance is a type of health coverage policy designed to provide financial protection to families by covering the medical expenses of all family members under a single plan. This form of health insurance offers flexibility and cost-effectiveness compared to individual health policies for each family member. It typically includes features such as cashless hospitalization, coverage for pre-existing illnesses, and additional benefits like maternity coverage.

Executive Summary:

The North America Family Floater Health Insurance Market has witnessed substantial growth due to increasing awareness of the importance of health coverage for families. The market is characterized by the presence of various insurance providers offering diverse plans with unique features. The demand for family floater health insurance is driven by factors such as rising healthcare costs, a growing focus on preventive healthcare, and the desire for comprehensive coverage for all family members.

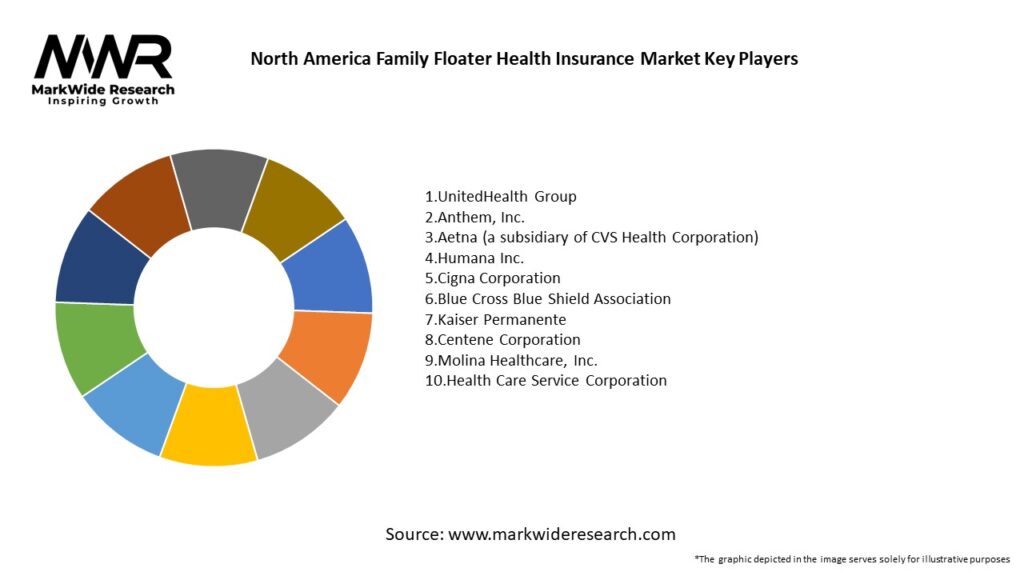

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights:

Market Drivers:

Market Restraints:

Market Opportunities:

Market Dynamics:

The North America Family Floater Health Insurance Market operates in a dynamic environment influenced by factors such as demographic trends, healthcare policies, advancements in medical technology, and consumer preferences. The market dynamics require insurance providers to stay agile in adapting their offerings to changing customer needs and market trends.

Regional Analysis:

Competitive Landscape:

Leading Companies in North America Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation:

The North America Family Floater Health Insurance Market can be segmented based on various criteria, including:

Segmentation allows insurance providers to tailor their offerings to the specific needs and preferences of different customer segments.

Category-wise Insights:

Key Benefits for Policyholders:

SWOT Analysis:

A SWOT analysis of the North America Family Floater Health Insurance Market provides insights into its internal strengths and weaknesses and external opportunities and threats:

Understanding these factors through a SWOT analysis helps insurance providers navigate market dynamics and strategize for sustainable growth.

Market Key Trends:

Covid-19 Impact:

The Covid-19 pandemic has influenced the North America Family Floater Health Insurance Market in several ways:

Key Industry Developments:

Analyst Suggestions:

Future Outlook:

The North America Family Floater Health Insurance Market is poised for continued growth, driven by factors such as increasing healthcare awareness, digital transformation, and the evolving needs of families. The market’s future will be shaped by innovations in coverage options, technology integration, and collaborative efforts between insurance providers and the broader healthcare ecosystem.

Conclusion:

The North America Family Floater Health Insurance Market plays a pivotal role in ensuring the health and financial well-being of families across the region. With a focus on comprehensive coverage, flexibility, and innovation, family floater health insurance plans continue to meet the dynamic healthcare needs of families. Success in this market requires insurance providers to adapt to changing consumer expectations, leverage technology for enhanced services, and collaborate with healthcare partners to offer holistic solutions. As families prioritize health and financial security, the family floater health insurance market is positioned for sustained growth and relevance in the North American insurance landscape.

What is Family Floater Health Insurance?

Family Floater Health Insurance is a type of health insurance policy that covers the medical expenses of an entire family under a single sum insured. It typically includes coverage for hospitalization, surgeries, and other medical treatments for all family members, making it a cost-effective option for families.

What are the key players in the North America Family Floater Health Insurance Market?

Key players in the North America Family Floater Health Insurance Market include UnitedHealth Group, Anthem, Aetna, and Cigna, among others. These companies offer a variety of plans tailored to meet the diverse needs of families seeking health coverage.

What are the growth factors driving the North America Family Floater Health Insurance Market?

The growth of the North America Family Floater Health Insurance Market is driven by increasing healthcare costs, a rising awareness of health insurance benefits, and the growing prevalence of chronic diseases. Additionally, the demand for comprehensive family coverage is propelling market expansion.

What challenges does the North America Family Floater Health Insurance Market face?

Challenges in the North America Family Floater Health Insurance Market include regulatory changes, high competition among insurers, and the complexity of policy terms that can confuse consumers. These factors can hinder market growth and consumer adoption.

What opportunities exist in the North America Family Floater Health Insurance Market?

Opportunities in the North America Family Floater Health Insurance Market include the potential for digital transformation in policy management and customer service, as well as the introduction of innovative health plans that cater to specific family needs. The increasing focus on preventive healthcare also presents growth avenues.

What trends are shaping the North America Family Floater Health Insurance Market?

Trends shaping the North America Family Floater Health Insurance Market include the rise of telemedicine services, personalized health plans, and the integration of wellness programs into insurance offerings. These trends reflect a shift towards more holistic health management solutions for families.

North America Family Floater Health Insurance Market

| Segmentation Details | Description |

|---|---|

| Product Type | Individual Plans, Group Plans, Employer-Sponsored Plans, Government Programs |

| End User | Families, Individuals, Employers, Government Agencies |

| Coverage Type | Comprehensive, Basic, Catastrophic, Supplemental |

| Payment Model | Premium-Based, Co-Payment, Deductible, Out-of-Pocket |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in North America Family Floater Health Insurance Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at