444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America electric vehicle charging equipment market represents one of the most dynamic and rapidly evolving sectors within the broader clean energy ecosystem. This comprehensive market encompasses a wide range of charging solutions, from residential Level 1 chargers to high-powered DC fast charging stations that enable long-distance electric vehicle travel. Market dynamics indicate robust growth driven by increasing electric vehicle adoption, supportive government policies, and substantial infrastructure investments across the United States, Canada, and Mexico.

Regional leadership in electric vehicle charging infrastructure development has positioned North America as a critical market for charging equipment manufacturers and service providers. The market demonstrates significant expansion potential, with charging station installations experiencing accelerated deployment rates exceeding 45% annually in key metropolitan areas. Technology advancement continues to drive innovation in charging speeds, grid integration capabilities, and user experience enhancements.

Infrastructure development across North America reflects coordinated efforts between public and private sectors to establish comprehensive charging networks. Major automotive manufacturers, utility companies, and specialized charging equipment providers are collaborating to create seamless charging experiences for electric vehicle owners. Market penetration varies significantly across different regions, with coastal areas and major urban centers leading adoption rates while rural and suburban markets present substantial growth opportunities.

The North America electric vehicle charging equipment market refers to the comprehensive ecosystem of hardware, software, and services designed to provide electrical power to electric vehicles across the United States, Canada, and Mexico. This market encompasses various charging technologies, installation services, network management systems, and supporting infrastructure components that enable electric vehicle operation and adoption.

Charging equipment categories include Level 1 residential chargers operating on standard household outlets, Level 2 chargers providing faster charging through 240-volt connections, and DC fast charging systems capable of rapid battery replenishment for commercial and highway applications. Market scope extends beyond hardware to include software platforms, payment processing systems, grid integration technologies, and maintenance services that support comprehensive charging solutions.

Industry definition encompasses both public and private charging infrastructure, ranging from workplace charging stations to highway corridor fast charging networks. The market includes original equipment manufacturers, charging network operators, installation contractors, and technology providers who collectively deliver end-to-end charging solutions for diverse customer segments and use cases.

Market transformation in North America’s electric vehicle charging equipment sector reflects unprecedented growth momentum driven by accelerating electric vehicle adoption and supportive policy frameworks. Infrastructure expansion demonstrates remarkable progress, with charging station deployment rates increasing by approximately 38% year-over-year across major metropolitan areas and highway corridors.

Technology evolution continues to reshape market dynamics through innovations in charging speeds, grid integration capabilities, and user interface design. Advanced charging solutions now offer enhanced connectivity features, predictive maintenance capabilities, and seamless payment processing that improve overall user experience. Market leaders are investing heavily in research and development to maintain competitive advantages in this rapidly evolving landscape.

Regional development patterns show concentrated growth in California, Texas, Florida, and Northeast corridor states, while emerging markets in the Midwest and Southeast present significant expansion opportunities. Government initiatives including federal infrastructure investments and state-level incentive programs are accelerating market development and creating favorable conditions for sustained growth.

Competitive landscape features established players alongside innovative startups, creating dynamic market conditions that foster technological advancement and service innovation. Strategic partnerships between automotive manufacturers, utility companies, and charging infrastructure providers are becoming increasingly important for market success and comprehensive solution delivery.

Market intelligence reveals several critical insights that define the current state and future trajectory of North America’s electric vehicle charging equipment market:

Government policy support serves as the primary catalyst driving North America’s electric vehicle charging equipment market expansion. Federal infrastructure legislation allocating substantial funding for charging network development, combined with state-level incentive programs and regulatory mandates, creates favorable market conditions. Environmental regulations requiring reduced carbon emissions are compelling businesses and consumers to adopt electric vehicles, subsequently driving charging infrastructure demand.

Electric vehicle adoption acceleration represents another fundamental market driver, with major automotive manufacturers committing to comprehensive electrification strategies. Consumer acceptance of electric vehicles is increasing rapidly due to improved vehicle performance, expanded model availability, and declining battery costs. This growing electric vehicle population directly correlates with increased demand for accessible and reliable charging infrastructure.

Technological advancement in charging equipment capabilities continues to drive market growth through improved user experiences and operational efficiency. Fast charging technology development enables reduced charging times, addressing primary consumer concerns about electric vehicle convenience. Smart charging features, including grid integration and demand management capabilities, provide additional value propositions for utility companies and commercial customers.

Corporate sustainability initiatives are increasingly driving workplace and fleet charging equipment installations as organizations pursue environmental responsibility goals. Cost reduction trends in charging equipment manufacturing and installation are making charging infrastructure more accessible to diverse customer segments, expanding market reach and adoption potential.

High initial investment costs represent a significant barrier to widespread charging infrastructure deployment, particularly for small businesses and residential customers seeking Level 2 charging solutions. Installation complexity often requires electrical system upgrades, permitting processes, and professional installation services that increase total project costs and implementation timelines.

Grid infrastructure limitations in certain regions constrain charging station deployment and operation, particularly for high-powered DC fast charging installations requiring substantial electrical capacity. Utility interconnection challenges can create delays and additional costs for charging station development projects, slowing market expansion in some areas.

Technology standardization issues continue to create market fragmentation and consumer confusion, despite ongoing industry efforts to establish common charging protocols. Interoperability concerns between different charging networks and vehicle manufacturers can limit user convenience and market accessibility.

Regulatory uncertainty at federal, state, and local levels creates planning challenges for charging infrastructure investors and operators. Permitting complexities and varying local requirements can significantly extend project development timelines and increase costs, particularly for multi-state charging network deployments.

Rural market expansion presents substantial growth opportunities as charging infrastructure extends beyond urban centers to serve highway corridors and smaller communities. Government funding programs specifically targeting rural charging infrastructure development are creating favorable conditions for market expansion in previously underserved areas.

Fleet electrification trends offer significant market opportunities as commercial operators seek comprehensive charging solutions for delivery vehicles, transit systems, and corporate fleets. Depot charging installations for overnight fleet charging represent a high-value market segment with predictable usage patterns and substantial charging requirements.

Renewable energy integration creates opportunities for innovative charging solutions combining solar power generation, energy storage, and smart grid technologies. Sustainability-focused customers increasingly demand charging solutions powered by clean energy sources, driving market demand for integrated renewable charging systems.

Technology innovation opportunities include wireless charging systems, ultra-fast charging capabilities, and advanced grid integration features that provide enhanced value propositions. Software and services surrounding charging infrastructure operation, including predictive maintenance, energy management, and user experience platforms, represent growing market segments with high-margin potential.

Supply chain evolution within the North America electric vehicle charging equipment market reflects increasing localization of manufacturing and component sourcing to reduce costs and improve delivery timelines. Manufacturing capacity expansion by established players and new market entrants is creating competitive pricing pressures while improving product availability and customization options.

Partnership strategies between charging equipment manufacturers, utility companies, and automotive manufacturers are reshaping market dynamics through integrated solution offerings and shared infrastructure investments. Vertical integration trends show some companies expanding across the value chain from equipment manufacturing to network operation and maintenance services.

Market consolidation activities include strategic acquisitions and mergers as companies seek to expand geographic reach, technology capabilities, and customer bases. Investment flows from venture capital, private equity, and strategic investors continue to fuel innovation and market expansion, particularly in emerging technology segments.

Competitive intensity is increasing as traditional electrical equipment manufacturers compete with specialized charging companies and technology startups. Pricing pressures are driving efficiency improvements and innovation while making charging infrastructure more accessible to diverse customer segments across North America.

Comprehensive market analysis for the North America electric vehicle charging equipment market employs multiple research methodologies to ensure accurate and reliable insights. Primary research activities include structured interviews with industry executives, charging network operators, equipment manufacturers, and end-users to gather firsthand market intelligence and validate secondary research findings.

Secondary research sources encompass government databases, industry association reports, company financial statements, and regulatory filings to establish market baseline data and identify trends. Data triangulation methods combine multiple information sources to verify market statistics and ensure research accuracy and reliability.

Market sizing methodologies utilize bottom-up and top-down approaches, analyzing charging station installation data, equipment sales figures, and regional deployment patterns. Forecasting models incorporate multiple variables including electric vehicle adoption rates, government policy impacts, and technology advancement timelines to project future market development.

Quality assurance processes include peer review, expert validation, and cross-referencing with established industry benchmarks to maintain research integrity. Continuous monitoring of market developments ensures research findings remain current and relevant for strategic decision-making purposes.

United States market leadership dominates North America’s electric vehicle charging equipment landscape, accounting for approximately 78% of regional charging infrastructure installations. California leadership continues with the highest concentration of charging stations, followed by Texas, Florida, and Northeast corridor states. Federal infrastructure investments are accelerating charging network expansion across all states, with particular focus on highway corridor development and rural area coverage.

Canadian market development shows strong growth momentum, particularly in Ontario, Quebec, and British Columbia provinces where provincial incentive programs support charging infrastructure deployment. Cold weather considerations drive demand for specialized charging equipment designed for harsh climate conditions, creating unique market requirements and opportunities for adapted solutions.

Mexico emerging market presents significant growth potential as electric vehicle adoption accelerates in major metropolitan areas including Mexico City, Guadalajara, and Monterrey. Cross-border charging networks are developing to support electric vehicle travel between the three North American countries, creating opportunities for integrated charging solutions.

Regional market share distribution shows the United States maintaining dominant position, with Canada representing approximately 18% of regional installations and Mexico accounting for the remaining 4% but growing rapidly. Urban concentration patterns remain consistent across all three countries, with metropolitan areas leading charging infrastructure deployment while rural markets present expansion opportunities.

Market leadership in North America’s electric vehicle charging equipment sector features a diverse mix of established electrical equipment manufacturers, specialized charging companies, and innovative technology startups. Competitive positioning varies across different market segments, with some companies focusing on residential solutions while others specialize in commercial or highway charging applications.

Strategic differentiation among competitors includes charging speed capabilities, software platform features, network coverage, and customer service quality. Innovation focus areas encompass wireless charging technology, ultra-fast charging development, and advanced grid integration capabilities that provide competitive advantages in specific market segments.

Technology-based segmentation divides the North America electric vehicle charging equipment market into distinct categories based on charging capabilities and power delivery methods:

By Charging Level:

By Application:

By Connector Type:

Residential charging category represents the largest market segment by unit volume, driven by increasing electric vehicle ownership and home charging convenience preferences. Level 2 residential chargers dominate this segment, offering optimal charging speeds for overnight use while maintaining reasonable installation costs. Smart charging features including mobile app connectivity and energy management capabilities are becoming standard expectations for residential customers.

Commercial charging applications show the highest growth rates as businesses recognize employee benefits and customer attraction advantages of workplace charging stations. Workplace charging programs are expanding rapidly, with employers installing Level 2 charging stations to support employee electric vehicle adoption. Retail charging installations at shopping centers, hotels, and restaurants create additional revenue opportunities while enhancing customer experience.

Public fast charging networks represent the highest-value market segment, with DC fast charging stations commanding premium pricing due to advanced technology requirements and high-power electrical infrastructure needs. Highway corridor development focuses on ultra-fast charging capabilities exceeding 150 kW power delivery to minimize charging stop duration for long-distance travel.

Fleet charging solutions emerge as a specialized high-growth category, with commercial operators requiring customized charging infrastructure for specific vehicle types and operational schedules. Depot charging systems for overnight fleet charging offer predictable usage patterns and substantial charging requirements that justify significant infrastructure investments.

Equipment manufacturers benefit from expanding market opportunities driven by accelerating electric vehicle adoption and supportive government policies. Revenue diversification opportunities include hardware sales, software licensing, and ongoing maintenance services that create recurring income streams. Technology leadership positions enable premium pricing and market share expansion in high-growth segments.

Charging network operators gain from increasing utilization rates and expanding customer bases as electric vehicle adoption accelerates. Data monetization opportunities include energy management services, predictive analytics, and customer insights that provide additional revenue streams beyond charging fees. Strategic partnerships with automotive manufacturers and utility companies create competitive advantages and market access.

Utility companies benefit from increased electricity demand and grid modernization opportunities associated with charging infrastructure deployment. Load management capabilities through smart charging systems help optimize grid operations and integrate renewable energy sources. New service offerings including managed charging programs create additional customer relationships and revenue opportunities.

Electric vehicle owners gain from expanding charging infrastructure accessibility, reduced charging costs through competition, and improved charging experiences through technology advancement. Convenience improvements including faster charging speeds and seamless payment systems enhance overall electric vehicle ownership satisfaction and adoption rates.

Strengths:

Weaknesses:

Opportunities:

Threats:

Ultra-fast charging adoption represents the most significant technology trend, with charging stations exceeding 350 kW power delivery becoming increasingly common at highway locations. Charging speed improvements address primary consumer concerns about electric vehicle convenience and enable broader adoption across diverse user segments.

Wireless charging technology emergence creates new market opportunities for convenient charging solutions that eliminate physical connector requirements. Inductive charging systems for both stationary and dynamic applications are advancing from pilot programs to commercial deployments, particularly in fleet and public transit applications.

Grid integration sophistication continues advancing through smart charging systems that optimize electricity usage based on grid conditions, renewable energy availability, and user preferences. Vehicle-to-grid capabilities enable electric vehicles to provide grid services, creating additional value streams for charging infrastructure operators and vehicle owners.

Subscription and service models are evolving beyond traditional pay-per-use charging to include unlimited charging plans, workplace charging programs, and integrated mobility services. Customer experience enhancement through mobile applications, contactless payments, and predictive availability information improves user satisfaction and loyalty.

Major infrastructure announcements include substantial charging network expansion commitments from leading operators, with plans to increase charging station availability by over 60% within three years. Automotive manufacturer investments in charging infrastructure demonstrate vertical integration strategies and commitment to supporting electric vehicle adoption.

Technology partnerships between charging equipment manufacturers and software companies are creating integrated solutions that combine hardware reliability with advanced digital capabilities. Utility company collaborations focus on grid integration and managed charging programs that optimize electricity usage and support renewable energy integration.

Government funding allocations from federal infrastructure legislation are accelerating charging network deployment across highway corridors and underserved communities. State-level initiatives including zero-emission vehicle mandates and charging infrastructure requirements are creating additional market drivers and deployment timelines.

International expansion activities show North American companies extending operations to global markets while international players establish North American presence through acquisitions and partnerships. Cross-border charging networks between the United States, Canada, and Mexico are developing to support regional electric vehicle travel.

MarkWide Research analysis indicates that market participants should prioritize technology innovation and customer experience enhancement to maintain competitive advantages in this rapidly evolving market. Investment focus should emphasize ultra-fast charging capabilities, grid integration features, and comprehensive software platforms that provide differentiated value propositions.

Geographic expansion strategies should target underserved rural markets and emerging metropolitan areas where government funding support creates favorable development conditions. Partnership development with utility companies, automotive manufacturers, and real estate developers can provide market access and shared investment opportunities that reduce individual company risks.

Technology roadmap planning should incorporate wireless charging capabilities, renewable energy integration, and advanced grid services that position companies for future market evolution. Service model innovation including subscription programs, managed charging services, and integrated mobility solutions can create recurring revenue streams and customer loyalty.

Regulatory engagement remains critical for influencing policy development and ensuring favorable market conditions for continued growth. Workforce development initiatives addressing skilled technician shortages can support market expansion and improve service quality across the industry.

Market trajectory for North America’s electric vehicle charging equipment sector indicates sustained robust growth driven by accelerating electric vehicle adoption and comprehensive infrastructure development initiatives. Technology advancement will continue improving charging speeds, user experiences, and grid integration capabilities while reducing costs and complexity.

Infrastructure expansion is projected to reach comprehensive coverage across highway corridors and metropolitan areas within the next decade, with rural market penetration accelerating through government funding programs. Charging station density in urban areas is expected to increase by over 75% within five years to support growing electric vehicle populations.

Innovation focus areas will include wireless charging technology commercialization, ultra-fast charging standardization, and advanced energy management systems that optimize grid operations. Market consolidation may accelerate as companies seek scale advantages and comprehensive solution capabilities through strategic acquisitions and partnerships.

International integration will strengthen through cross-border charging networks and standardized payment systems that enable seamless electric vehicle travel across North America. MWR projections suggest the market will achieve mature infrastructure status in major metropolitan areas while maintaining strong growth in emerging segments and rural markets.

North America’s electric vehicle charging equipment market stands at a pivotal moment of unprecedented growth and transformation, driven by converging factors including accelerating electric vehicle adoption, substantial government infrastructure investments, and rapid technology advancement. Market fundamentals remain exceptionally strong, with supportive policy frameworks, increasing consumer acceptance, and expanding industry investment creating favorable conditions for sustained expansion.

Technology evolution continues reshaping market dynamics through ultra-fast charging capabilities, smart grid integration, and enhanced user experiences that address primary barriers to electric vehicle adoption. Regional development patterns show expanding infrastructure coverage beyond traditional urban centers to highway corridors and rural communities, creating comprehensive charging networks that support diverse travel patterns and use cases.

Competitive landscape dynamics feature increasing innovation, strategic partnerships, and market consolidation activities that drive efficiency improvements and solution integration. Future market development will likely emphasize wireless charging technology, renewable energy integration, and advanced grid services that provide additional value beyond basic charging functionality. The North America electric vehicle charging equipment market represents a cornerstone of the broader clean transportation transition, with continued growth prospects supported by fundamental shifts in mobility preferences and energy systems.

What is Electric Vehicle Charging Equipment?

Electric Vehicle Charging Equipment refers to the devices and infrastructure used to charge electric vehicles, including home chargers, public charging stations, and fast chargers. These systems are essential for supporting the growing adoption of electric vehicles in various sectors.

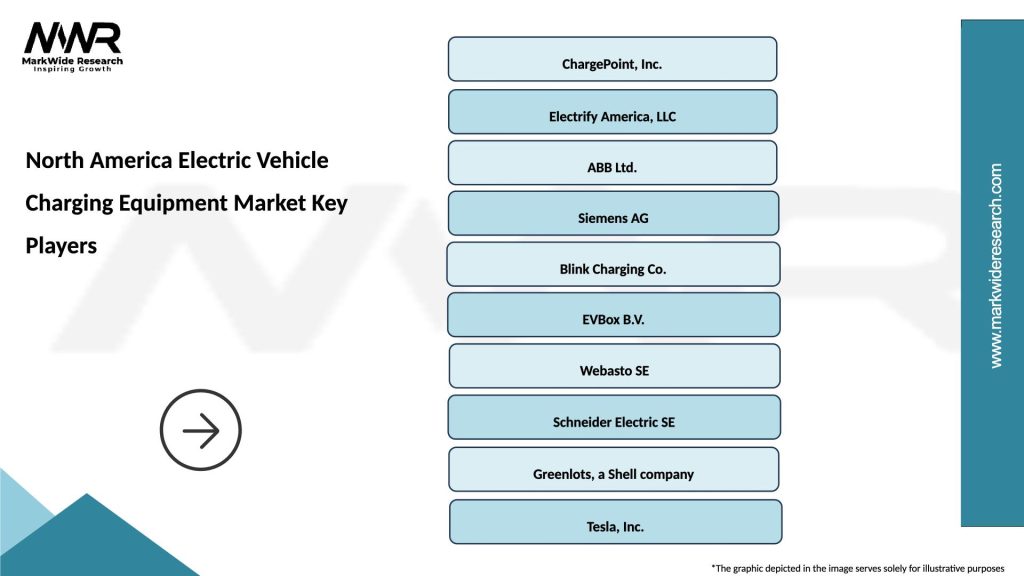

What are the key players in the North America Electric Vehicle Charging Equipment Market?

Key players in the North America Electric Vehicle Charging Equipment Market include ChargePoint, Blink Charging, and Tesla, among others. These companies are involved in the development and deployment of charging solutions to meet the increasing demand for electric vehicles.

What are the main drivers of the North America Electric Vehicle Charging Equipment Market?

The main drivers of the North America Electric Vehicle Charging Equipment Market include the increasing adoption of electric vehicles, government incentives for EV infrastructure, and advancements in charging technology. These factors contribute to a growing network of charging stations across urban and rural areas.

What challenges does the North America Electric Vehicle Charging Equipment Market face?

Challenges in the North America Electric Vehicle Charging Equipment Market include the high costs of installation, the need for standardization across different charging systems, and the limited availability of charging infrastructure in certain regions. These issues can hinder the widespread adoption of electric vehicles.

What opportunities exist in the North America Electric Vehicle Charging Equipment Market?

Opportunities in the North America Electric Vehicle Charging Equipment Market include the expansion of charging networks, the integration of renewable energy sources, and the development of smart charging solutions. These trends can enhance the efficiency and accessibility of charging infrastructure.

What trends are shaping the North America Electric Vehicle Charging Equipment Market?

Trends shaping the North America Electric Vehicle Charging Equipment Market include the rise of ultra-fast charging stations, the implementation of mobile charging solutions, and the increasing focus on sustainability in charging technologies. These innovations are expected to improve user experience and reduce charging times.

North America Electric Vehicle Charging Equipment Market

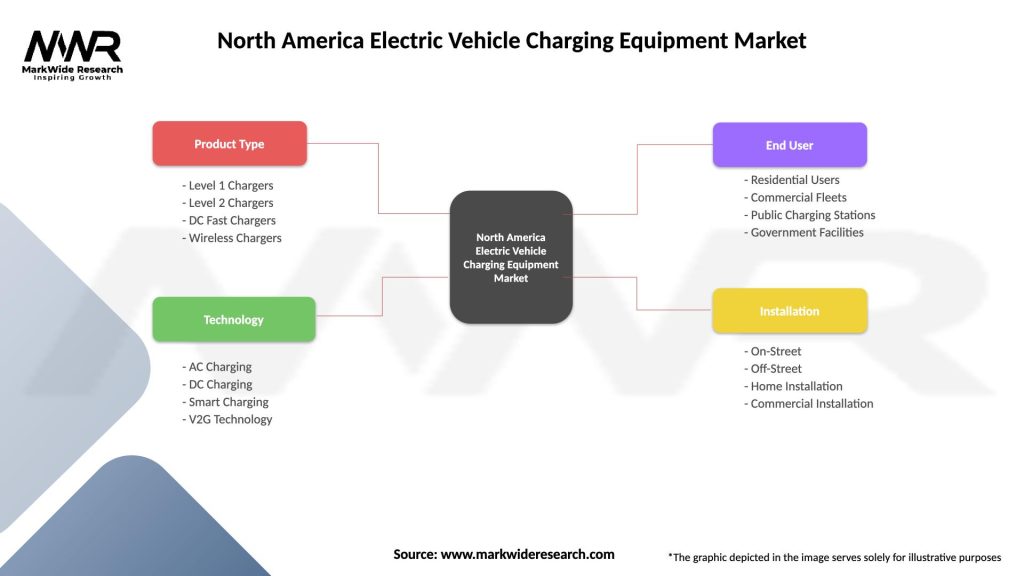

| Segmentation Details | Description |

|---|---|

| Product Type | Level 1 Chargers, Level 2 Chargers, DC Fast Chargers, Wireless Chargers |

| Technology | AC Charging, DC Charging, Smart Charging, V2G Technology |

| End User | Residential Users, Commercial Fleets, Public Charging Stations, Government Facilities |

| Installation | On-Street, Off-Street, Home Installation, Commercial Installation |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Electric Vehicle Charging Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at