444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America electric vehicle battery manufacturing market represents a transformative sector driving the continent’s transition toward sustainable transportation solutions. This dynamic industry encompasses the production, development, and distribution of advanced battery technologies specifically designed for electric vehicles, including lithium-ion, solid-state, and next-generation battery chemistries. The market has experienced unprecedented growth momentum, with manufacturing capacity expanding at a compound annual growth rate of 28.5% as automotive manufacturers and technology companies invest heavily in domestic battery production capabilities.

Regional dynamics indicate that North America is positioning itself as a global leader in electric vehicle battery manufacturing, driven by substantial government incentives, environmental regulations, and consumer demand for cleaner transportation alternatives. The market encompasses various battery types, including nickel manganese cobalt (NMC), lithium iron phosphate (LFP), and emerging solid-state technologies, each serving different vehicle segments and performance requirements.

Manufacturing infrastructure development has accelerated significantly, with major automotive companies and battery specialists establishing gigafactories across the United States, Canada, and Mexico. This strategic expansion addresses supply chain resilience concerns while reducing dependency on international battery imports. The market benefits from abundant lithium reserves, advanced manufacturing capabilities, and a skilled workforce, creating a competitive advantage in the global battery manufacturing landscape.

The North America electric vehicle battery manufacturing market refers to the comprehensive ecosystem of companies, technologies, and infrastructure dedicated to producing energy storage systems specifically designed for electric vehicles within the North American region. This market encompasses the entire value chain from raw material processing and cell manufacturing to battery pack assembly and recycling operations, representing a critical component of the continent’s automotive electrification strategy.

Battery manufacturing in this context involves sophisticated processes including electrode preparation, cell assembly, formation and aging, module integration, and pack assembly. The market includes various stakeholders such as automotive original equipment manufacturers (OEMs), dedicated battery manufacturers, technology suppliers, and raw material processors working collaboratively to establish a robust domestic supply chain.

Strategic importance extends beyond mere production capacity, encompassing research and development initiatives, workforce development programs, and sustainable manufacturing practices that position North America as a leader in next-generation battery technologies and circular economy principles.

Market transformation in North America’s electric vehicle battery manufacturing sector reflects a fundamental shift toward domestic production capabilities and technological innovation. The industry has witnessed remarkable expansion driven by federal and state-level incentives, automotive industry commitments, and growing consumer acceptance of electric vehicles. Manufacturing capacity utilization rates have reached 72% across established facilities, with new gigafactories coming online regularly to meet escalating demand.

Investment flows into the sector have reached unprecedented levels, with automotive manufacturers, battery specialists, and technology companies committing substantial resources to establish comprehensive manufacturing ecosystems. These investments span the entire value chain, from lithium processing facilities to advanced battery recycling operations, creating integrated supply networks that enhance competitiveness and sustainability.

Technological advancement remains a key differentiator, with North American manufacturers focusing on next-generation battery chemistries, improved energy density, faster charging capabilities, and enhanced safety features. The market benefits from strong collaboration between industry and academia, fostering innovation in battery materials, manufacturing processes, and quality control systems.

Regulatory support through initiatives such as the Inflation Reduction Act and various state-level programs has accelerated market development, providing manufacturers with clear policy frameworks and financial incentives that encourage domestic production and supply chain localization.

Manufacturing capacity expansion represents the most significant trend shaping the North American electric vehicle battery market, with production capabilities growing exponentially to meet projected demand from automotive manufacturers. The following insights highlight critical market developments:

Government incentives serve as the primary catalyst driving North America’s electric vehicle battery manufacturing expansion, with federal and state programs providing substantial financial support for domestic production initiatives. The Inflation Reduction Act and similar legislation have created favorable conditions for battery manufacturers, offering tax credits, grants, and loan guarantees that significantly reduce investment risks and improve project economics.

Automotive industry commitments to electrification have generated unprecedented demand for battery manufacturing capacity, with major automakers announcing ambitious electric vehicle production targets and corresponding battery supply requirements. These long-term commitments provide manufacturers with demand visibility necessary to justify large-scale production investments and capacity expansion plans.

Supply chain security concerns have accelerated efforts to establish domestic battery manufacturing capabilities, reducing dependency on international suppliers and enhancing resilience against geopolitical disruptions. The COVID-19 pandemic and recent supply chain challenges have highlighted the strategic importance of local production capabilities for critical automotive components.

Technological advancement in battery chemistry, manufacturing processes, and quality control systems continues to drive market growth by improving battery performance, reducing costs, and enhancing safety characteristics. Innovation in areas such as solid-state batteries, silicon anodes, and advanced cathode materials creates opportunities for manufacturers to differentiate their products and capture premium market segments.

Consumer adoption of electric vehicles has reached a tipping point, with growing awareness of environmental benefits, improving vehicle performance, and expanding charging infrastructure driving sustained demand growth that requires corresponding increases in battery manufacturing capacity.

Capital intensity of battery manufacturing operations represents a significant barrier to market entry, requiring substantial upfront investments in specialized equipment, facility construction, and workforce development. The high capital requirements limit the number of companies capable of establishing competitive manufacturing operations and create financial risks for existing manufacturers expanding capacity.

Raw material availability and pricing volatility pose ongoing challenges for battery manufacturers, with critical materials such as lithium, cobalt, and nickel subject to supply constraints and price fluctuations that impact production costs and profitability. Securing reliable, cost-effective raw material supplies remains a complex challenge requiring long-term supply agreements and strategic partnerships.

Technical complexity of battery manufacturing processes requires specialized expertise and sophisticated quality control systems to ensure product safety and performance. The learning curve associated with scaling production while maintaining quality standards can result in yield issues and increased manufacturing costs during facility ramp-up periods.

Regulatory uncertainty regarding future environmental standards, safety requirements, and trade policies creates planning challenges for manufacturers making long-term investment decisions. Evolving regulations may require costly facility modifications or process changes that impact operational efficiency and profitability.

Competition from established international manufacturers with proven track records and economies of scale presents ongoing competitive pressure for North American companies seeking to establish market position and achieve cost competitiveness in global markets.

Next-generation battery technologies present substantial opportunities for North American manufacturers to establish leadership positions in emerging market segments such as solid-state batteries, silicon anodes, and advanced cathode materials. Early investment in these technologies could provide competitive advantages and premium pricing opportunities as the market matures.

Vertical integration strategies offer manufacturers opportunities to capture additional value by expanding into upstream raw material processing or downstream recycling operations. Integrated supply chains can improve cost competitiveness, enhance supply security, and create additional revenue streams from battery lifecycle management services.

Export market development represents significant growth potential as North American manufacturers achieve scale and cost competitiveness, enabling expansion into international markets seeking high-quality battery products. Strategic partnerships with global automotive manufacturers could facilitate market entry and volume growth.

Energy storage applications beyond automotive markets, including grid-scale storage and residential systems, provide opportunities for manufacturers to diversify revenue streams and leverage existing production capabilities for multiple market segments with different performance and cost requirements.

Recycling and circular economy initiatives create new business opportunities as battery volumes increase and end-of-life management becomes critical. Companies developing comprehensive recycling capabilities can capture valuable materials while providing sustainable solutions for battery lifecycle management.

Supply and demand dynamics in the North American electric vehicle battery manufacturing market reflect rapid demand growth outpacing current production capacity, creating favorable conditions for manufacturers with established operations and near-term capacity additions. According to MarkWide Research analysis, battery demand is growing at 35% annually while manufacturing capacity expansion follows at a more measured pace, resulting in tight supply conditions and strong pricing power for established manufacturers.

Competitive dynamics are evolving rapidly as traditional automotive suppliers, dedicated battery manufacturers, and technology companies compete for market share through differentiated product offerings, strategic partnerships, and manufacturing excellence. The market rewards companies that can demonstrate consistent quality, reliable supply, and competitive pricing while maintaining technological innovation capabilities.

Technology evolution continues to reshape market dynamics as manufacturers invest in next-generation battery chemistries and manufacturing processes that promise improved performance, reduced costs, and enhanced safety characteristics. Companies successfully commercializing advanced technologies gain competitive advantages and premium pricing opportunities in high-performance market segments.

Regulatory dynamics influence market development through evolving safety standards, environmental requirements, and trade policies that impact manufacturing operations, supply chain strategies, and competitive positioning. Manufacturers must navigate complex regulatory environments while maintaining operational flexibility and cost competitiveness.

Comprehensive market analysis of the North American electric vehicle battery manufacturing sector employs multiple research methodologies to ensure accuracy and completeness of market insights. Primary research activities include extensive interviews with industry executives, manufacturing specialists, technology developers, and regulatory officials to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, company financial statements, patent filings, regulatory documents, and trade publications to validate primary research findings and identify emerging trends. This approach ensures comprehensive coverage of market dynamics and competitive landscape developments.

Quantitative analysis utilizes statistical modeling techniques to project market growth, capacity expansion, and technology adoption trends based on historical data and identified market drivers. Manufacturing capacity data, production volumes, and investment announcements provide quantitative foundations for market projections and competitive analysis.

Expert validation processes involve consultation with industry specialists, academic researchers, and technology experts to verify research findings and ensure accuracy of technical assessments. This validation approach enhances credibility and reliability of market insights and projections.

United States dominates the North American electric vehicle battery manufacturing landscape, accounting for approximately 78% of regional production capacity through major manufacturing facilities operated by leading automotive and battery companies. The country benefits from substantial federal incentives, established automotive manufacturing infrastructure, and growing electric vehicle adoption rates that support sustained market growth.

Manufacturing concentration in the United States spans multiple states, with significant facilities in Michigan, Georgia, Tennessee, Ohio, and Nevada creating regional manufacturing clusters that leverage existing automotive supply chains and skilled workforces. These geographic concentrations provide economies of scale and supply chain efficiencies that enhance competitiveness.

Canada represents an emerging market for battery manufacturing, with companies establishing operations to serve both domestic and export markets while leveraging the country’s abundant natural resources and clean energy infrastructure. Canadian facilities focus on sustainable manufacturing practices and integration with renewable energy sources.

Mexico offers cost-competitive manufacturing opportunities with proximity to major North American automotive markets, attracting battery manufacturers seeking to optimize production costs while maintaining supply chain efficiency. The country’s established automotive manufacturing ecosystem provides supporting infrastructure and skilled workforce capabilities.

Cross-border integration among North American countries creates opportunities for optimized supply chain configurations that leverage each country’s comparative advantages in raw materials, manufacturing capabilities, and market access.

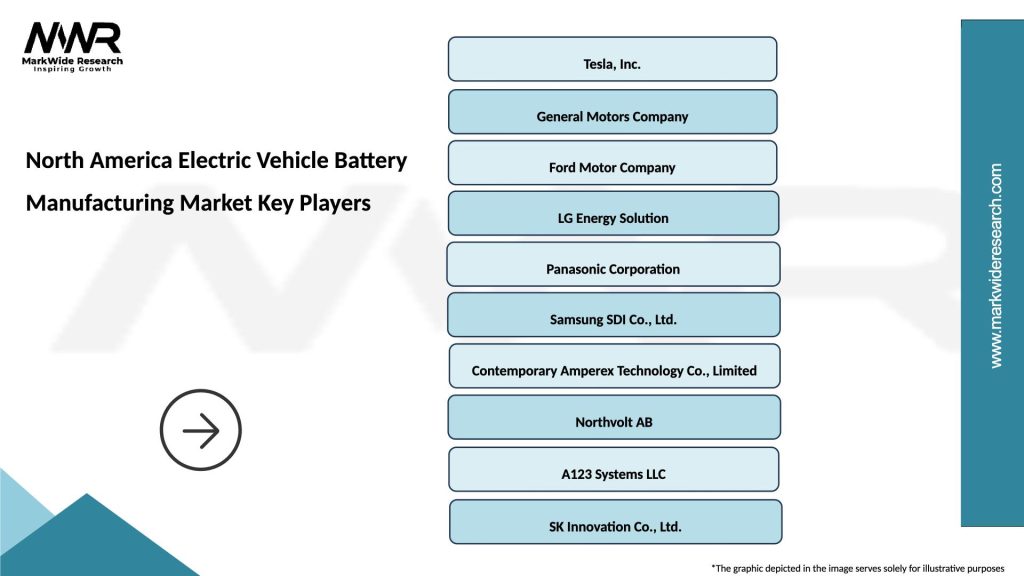

Market leadership in North American electric vehicle battery manufacturing is distributed among several categories of companies, each bringing distinct competitive advantages and strategic approaches to market development. The competitive landscape includes:

Competitive strategies vary significantly among market participants, with some companies focusing on vertical integration while others pursue specialized technology development or manufacturing excellence. Strategic partnerships between automotive manufacturers and battery specialists have become increasingly common as companies seek to balance investment requirements with supply security.

Technology segmentation of the North American electric vehicle battery manufacturing market reflects diverse approaches to energy storage solutions, with each technology category serving specific vehicle segments and performance requirements:

By Battery Chemistry:

By Vehicle Type:

By Manufacturing Scale:

Passenger vehicle batteries represent the largest and fastest-growing category within the North American manufacturing market, driven by increasing consumer adoption of electric vehicles and automotive manufacturer commitments to electrification. This segment benefits from economies of scale, standardized manufacturing processes, and continuous technology improvements that reduce costs while enhancing performance.

Commercial vehicle applications present unique opportunities for battery manufacturers, requiring specialized solutions that address diverse operational requirements including long-haul trucking, urban delivery, and construction equipment. These applications often prioritize durability, fast charging capabilities, and total cost of ownership over pure energy density metrics.

Energy storage integration creates additional market opportunities as manufacturers leverage electric vehicle battery technologies for stationary applications including grid-scale storage and residential systems. This diversification strategy helps manufacturers achieve higher capacity utilization and revenue stability across multiple market segments.

Technology categories continue evolving rapidly, with manufacturers investing in multiple battery chemistries to serve different market segments and performance requirements. The trend toward chemistry diversification reflects recognition that no single battery technology can optimally serve all applications and market segments.

Automotive manufacturers benefit significantly from domestic battery manufacturing capabilities through enhanced supply chain security, reduced logistics costs, and improved collaboration on product development and quality control. Local manufacturing enables closer integration between vehicle and battery design teams, resulting in optimized system performance and faster time-to-market for new electric vehicle models.

Battery manufacturers gain access to the rapidly growing North American electric vehicle market while benefiting from government incentives, skilled workforce availability, and proximity to major automotive customers. Domestic manufacturing operations provide competitive advantages through reduced shipping costs, faster response times, and enhanced customer relationships.

Regional economies experience substantial benefits through job creation, tax revenue generation, and industrial ecosystem development that extends beyond direct manufacturing employment to include supporting industries and services. Battery manufacturing facilities often serve as anchors for broader industrial development and technology innovation clusters.

Consumers benefit from improved electric vehicle availability, competitive pricing, and enhanced product quality resulting from domestic manufacturing capabilities and increased competition among battery suppliers. Local manufacturing also supports faster warranty service and product support capabilities.

Environmental stakeholders gain from reduced transportation emissions associated with battery imports, implementation of cleaner manufacturing processes, and development of comprehensive recycling capabilities that support circular economy principles.

Strengths:

Weaknesses:

Opportunities:

Threats:

Gigafactory proliferation represents the dominant trend shaping North American battery manufacturing, with companies establishing large-scale facilities designed to achieve economies of scale and serve multiple automotive customers. These facilities typically feature integrated operations spanning cell manufacturing, module assembly, and pack production within single locations.

Supply chain localization has accelerated significantly as manufacturers seek to reduce dependency on international suppliers and enhance supply chain resilience. This trend encompasses raw material processing, component manufacturing, and equipment sourcing, creating comprehensive domestic supply ecosystems.

Technology diversification reflects manufacturer recognition that different battery chemistries serve distinct market segments and applications. Companies are investing in multiple technology platforms to address varying performance, cost, and safety requirements across diverse vehicle categories.

Sustainability integration has become increasingly important as manufacturers implement cleaner production processes, renewable energy utilization, and comprehensive recycling programs. Environmental considerations are influencing facility design, operational practices, and supply chain strategies.

Workforce development initiatives are expanding rapidly as companies establish comprehensive training programs to develop skilled manufacturing workforces capable of operating advanced battery production equipment and maintaining quality standards.

Quality assurance advancement involves implementation of sophisticated testing and monitoring systems to ensure battery safety, performance, and longevity. Advanced quality control capabilities are becoming competitive differentiators in the market.

Manufacturing capacity announcements continue accelerating across North America, with major automotive and battery companies committing to substantial facility investments that will significantly expand regional production capabilities. Recent announcements indicate manufacturing capacity growth of 42% annually through planned facility expansions and new gigafactory developments.

Strategic partnerships between automotive manufacturers and battery specialists have intensified, creating joint venture arrangements that combine automotive market access with battery manufacturing expertise. These partnerships often involve shared investment in manufacturing facilities and technology development programs.

Technology advancement initiatives focus on next-generation battery chemistries, manufacturing process improvements, and quality control innovations that enhance product performance while reducing production costs. Companies are investing heavily in research and development capabilities to maintain competitive positions.

Regulatory developments including updated safety standards, environmental requirements, and trade policies continue influencing market dynamics and competitive positioning. Recent regulatory changes have generally supported domestic manufacturing development while establishing higher performance and safety standards.

Supply chain investments encompass upstream raw material processing facilities and downstream recycling operations, creating more integrated and sustainable battery manufacturing ecosystems that reduce external dependencies and environmental impact.

Investment prioritization should focus on manufacturing technologies and processes that provide sustainable competitive advantages rather than pursuing capacity expansion alone. MWR analysis indicates that companies achieving manufacturing efficiency improvements of 25% or greater demonstrate superior long-term profitability and market positioning compared to competitors focused primarily on scale.

Technology portfolio diversification represents a critical strategy for manufacturers seeking to serve multiple market segments and reduce technology risk. Companies should maintain capabilities across multiple battery chemistries while developing expertise in emerging technologies that may disrupt current market dynamics.

Supply chain integration offers significant opportunities for value creation and risk mitigation, particularly in raw material processing and recycling operations. Vertical integration strategies can improve cost competitiveness while enhancing supply security and environmental sustainability.

Workforce development requires sustained investment and strategic planning to ensure adequate skilled labor availability for expanding manufacturing operations. Companies should establish comprehensive training programs and partnerships with educational institutions to develop specialized manufacturing capabilities.

Quality excellence must remain a primary focus as market competition intensifies and customer expectations continue rising. Manufacturing operations should implement advanced quality control systems and continuous improvement processes to maintain competitive differentiation.

Sustainability leadership can provide competitive advantages as environmental considerations become increasingly important to customers and regulators. Companies should integrate sustainability principles throughout operations while developing comprehensive recycling capabilities.

Market expansion is projected to continue at robust rates through the next decade, driven by accelerating electric vehicle adoption, government policy support, and ongoing technology advancement. Manufacturing capacity is expected to grow at a compound annual growth rate of 31% as planned facilities come online and existing operations expand to meet increasing demand.

Technology evolution will likely favor manufacturers that successfully commercialize next-generation battery chemistries and manufacturing processes, particularly solid-state technologies and advanced cathode materials that promise significant performance improvements. Early technology leaders may capture premium market segments and establish sustainable competitive advantages.

Supply chain maturation is expected to result in more integrated and resilient domestic manufacturing ecosystems that reduce dependency on international suppliers while improving cost competitiveness. Raw material processing capabilities and recycling operations will become increasingly important components of successful battery manufacturing strategies.

Market consolidation may occur as the industry matures and competitive pressures intensify, with successful companies expanding market share while less competitive operations face challenges maintaining viability. Strategic partnerships and joint ventures are likely to continue as companies seek to optimize investment requirements and risk sharing.

Regulatory evolution will continue influencing market development through updated safety standards, environmental requirements, and trade policies that shape competitive dynamics and investment decisions. Companies must maintain operational flexibility to adapt to changing regulatory environments while pursuing long-term growth strategies.

North America’s electric vehicle battery manufacturing market represents a transformative opportunity that is reshaping the continent’s automotive and energy storage industries. The market has demonstrated remarkable growth momentum driven by government incentives, automotive industry commitments, and accelerating consumer adoption of electric vehicles. Manufacturing capacity expansion continues at unprecedented rates, with major facilities coming online regularly to serve growing demand from diverse vehicle segments and applications.

Strategic positioning of North American manufacturers has improved significantly through substantial investments in advanced manufacturing capabilities, technology development, and supply chain localization initiatives. The region benefits from abundant natural resources, established automotive infrastructure, and strong innovation ecosystems that provide competitive advantages in the global battery manufacturing landscape.

Future success will depend on manufacturers’ ability to achieve operational excellence, maintain technology leadership, and develop sustainable business models that balance growth objectives with profitability requirements. Companies that successfully navigate the complex challenges of scaling production while maintaining quality standards and cost competitiveness will capture the substantial opportunities presented by this dynamic and rapidly evolving market.

What is Electric Vehicle Battery Manufacturing?

Electric Vehicle Battery Manufacturing refers to the process of producing batteries specifically designed for electric vehicles, which includes various technologies such as lithium-ion and solid-state batteries. This sector is crucial for the automotive industry as it supports the transition to sustainable transportation.

What are the key players in the North America Electric Vehicle Battery Manufacturing Market?

Key players in the North America Electric Vehicle Battery Manufacturing Market include Tesla, LG Chem, Panasonic, and CATL, among others. These companies are leading the charge in battery technology and production capacity to meet the growing demand for electric vehicles.

What are the main drivers of the North America Electric Vehicle Battery Manufacturing Market?

The main drivers of the North America Electric Vehicle Battery Manufacturing Market include the increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting clean energy. Additionally, the push for reduced carbon emissions is fueling growth in this sector.

What challenges does the North America Electric Vehicle Battery Manufacturing Market face?

The North America Electric Vehicle Battery Manufacturing Market faces challenges such as supply chain disruptions, high raw material costs, and competition from international manufacturers. These factors can impact production efficiency and pricing strategies.

What opportunities exist in the North America Electric Vehicle Battery Manufacturing Market?

Opportunities in the North America Electric Vehicle Battery Manufacturing Market include the development of new battery technologies, expansion of production facilities, and partnerships with automotive manufacturers. The growing focus on renewable energy sources also presents avenues for innovation.

What trends are shaping the North America Electric Vehicle Battery Manufacturing Market?

Trends shaping the North America Electric Vehicle Battery Manufacturing Market include the shift towards solid-state batteries, increased recycling efforts for battery materials, and the integration of artificial intelligence in manufacturing processes. These trends aim to enhance efficiency and sustainability in battery production.

North America Electric Vehicle Battery Manufacturing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Lithium-ion, Nickel-metal Hydride, Solid-state, Lead-acid |

| Technology | Fast Charging, Wireless Charging, Battery Management Systems, Thermal Management |

| End User | OEMs, Fleet Operators, Aftermarket Providers, Charging Infrastructure |

| Application | Passenger Vehicles, Commercial Vehicles, Two-wheelers, Energy Storage Systems |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Electric Vehicle Battery Manufacturing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at