444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America electric vehicle battery anode market represents a critical component of the rapidly expanding electric mobility ecosystem across the United States, Canada, and Mexico. Battery anodes serve as the negative electrode in lithium-ion batteries, playing a fundamental role in energy storage and discharge cycles that power electric vehicles. The market encompasses various anode materials including graphite, silicon, lithium titanate, and emerging silicon nanowire technologies.

Market dynamics in North America are driven by aggressive electric vehicle adoption targets, substantial government incentives, and increasing consumer acceptance of electric mobility solutions. The region’s automotive manufacturers are investing heavily in battery technology development, creating robust demand for advanced anode materials that can deliver improved energy density, faster charging capabilities, and enhanced cycle life.

Regional growth is particularly pronounced in the United States, where federal and state-level policies support electric vehicle infrastructure development and manufacturing. The market is experiencing significant expansion at a compound annual growth rate exceeding 18.5% CAGR through the forecast period, driven by technological innovations and scaling production capabilities.

Key market participants include established chemical companies, specialized battery material manufacturers, and emerging technology firms developing next-generation anode solutions. The competitive landscape is characterized by intensive research and development activities focused on improving anode performance while reducing manufacturing costs to support mass market electric vehicle adoption.

The North America electric vehicle battery anode market refers to the regional industry segment encompassing the production, distribution, and application of negative electrode materials used in lithium-ion batteries specifically designed for electric vehicles. Anode materials are essential components that store and release lithium ions during battery charging and discharging cycles, directly impacting vehicle range, charging speed, and overall battery performance.

Market scope includes various anode material types such as natural and synthetic graphite, silicon-based composites, lithium titanate oxide, and advanced materials like silicon nanowires and carbon nanotubes. These materials are processed and manufactured into electrode components that battery manufacturers integrate into complete battery systems for electric vehicles ranging from passenger cars to commercial trucks and buses.

Geographic coverage spans the United States, Canada, and Mexico, representing diverse market conditions, regulatory environments, and industrial capabilities. The market encompasses the entire value chain from raw material extraction and processing to finished anode production and integration into battery manufacturing facilities across North America.

Market leadership in the North America electric vehicle battery anode sector is characterized by rapid technological advancement and substantial investment in manufacturing capacity expansion. The market is transitioning from traditional graphite-dominated solutions toward advanced silicon-enhanced and next-generation anode materials that offer superior performance characteristics for electric vehicle applications.

Growth drivers include aggressive electric vehicle adoption targets set by major automotive manufacturers, with several companies committing to 100% electric vehicle production by 2030-2035. Government support through the Inflation Reduction Act in the United States and similar provincial incentives in Canada are accelerating market development by providing manufacturing tax credits and consumer purchase incentives.

Technology trends show increasing adoption of silicon-graphite composite anodes, which can improve battery energy density by 20-30% compared to traditional graphite anodes. This enhancement directly translates to extended electric vehicle range and improved consumer acceptance, driving demand for advanced anode materials across the region.

Supply chain development is a critical focus area, with companies establishing domestic production capabilities to reduce dependence on international suppliers and qualify for government incentives requiring domestic content. The market is witnessing significant investments in mining, processing, and manufacturing infrastructure to support long-term growth objectives.

Technology evolution in the North America electric vehicle battery anode market reveals several critical insights that shape industry development and investment strategies:

Government policy support represents the primary catalyst driving North America electric vehicle battery anode market expansion. The Inflation Reduction Act provides substantial tax credits for domestic battery manufacturing, while state-level zero emission vehicle mandates create guaranteed demand for electric vehicles and their components. Canadian federal and provincial governments offer similar incentives supporting electric vehicle adoption and battery manufacturing investment.

Automotive industry transformation is accelerating anode market growth as major manufacturers commit to electrification strategies. General Motors, Ford, and other leading automakers have announced plans to invest billions in electric vehicle production, creating sustained demand for advanced battery technologies. These commitments translate directly into long-term contracts for anode material suppliers.

Consumer acceptance of electric vehicles continues improving as battery technology advances address historical concerns about range, charging time, and cost. Modern anode materials enable batteries with 300+ mile range capabilities and fast charging to 80% capacity in under 30 minutes, making electric vehicles practical for mainstream consumers.

Energy security considerations are driving domestic supply chain development for critical battery materials. Recent supply chain disruptions have highlighted the importance of regional production capabilities, leading to increased investment in North American anode manufacturing facilities and raw material processing operations.

Technology advancement in anode materials is enabling breakthrough performance improvements that make electric vehicles more attractive to consumers and fleet operators. Silicon-enhanced anodes offer significant energy density improvements while maintaining acceptable cycle life, supporting longer range electric vehicles without proportional increases in battery size and weight.

High capital requirements for establishing anode manufacturing facilities represent a significant barrier to market entry and expansion. Production equipment for advanced anode materials requires substantial investment in specialized machinery, clean room facilities, and quality control systems, limiting the number of companies capable of competing effectively in the market.

Technical challenges associated with silicon-based anode materials continue to constrain widespread adoption despite their performance advantages. Volume expansion during charging cycles can cause mechanical stress and capacity degradation, requiring sophisticated engineering solutions that increase complexity and manufacturing costs.

Supply chain constraints for critical raw materials, particularly high-purity graphite and silicon, can limit production capacity and increase costs. Geopolitical tensions and trade restrictions affecting key supplier regions create uncertainty and potential supply disruptions that impact market stability and growth planning.

Regulatory complexity across different jurisdictions within North America creates compliance challenges for manufacturers operating in multiple markets. Safety standards, environmental regulations, and local content requirements vary between the United States, Canada, and Mexico, requiring companies to navigate complex regulatory frameworks.

Competition from alternative technologies including solid-state batteries and other next-generation energy storage solutions may limit long-term demand for current anode materials. Investment uncertainty regarding which technologies will dominate future electric vehicle applications can constrain capital allocation and strategic planning.

Next-generation anode development presents substantial opportunities for companies investing in advanced materials research and development. Silicon nanowire anodes and other emerging technologies offer potential for dramatic performance improvements that could revolutionize electric vehicle capabilities and market acceptance.

Recycling and circular economy initiatives create new business models and revenue streams for anode material companies. As electric vehicle batteries reach end-of-life, material recovery and reprocessing operations can provide cost-effective raw materials while addressing environmental sustainability concerns.

Commercial vehicle electrification represents a rapidly expanding market segment with unique anode material requirements. Heavy-duty trucks, delivery vehicles, and public transportation systems require high-capacity, fast-charging batteries that demand advanced anode technologies capable of supporting intensive duty cycles.

Energy storage applications beyond transportation offer additional market opportunities for anode materials. Grid-scale storage systems and residential energy storage solutions utilize similar battery technologies, creating diversified demand that can support larger scale manufacturing operations and improved cost structures.

Strategic partnerships with automotive manufacturers and battery producers can provide long-term supply agreements and collaborative development opportunities. Joint ventures and technology licensing arrangements enable smaller companies to access larger markets while providing established players with innovative technologies and capabilities.

Supply and demand balance in the North America electric vehicle battery anode market is experiencing significant shifts as production capacity expansion efforts work to meet rapidly growing demand from electric vehicle manufacturers. Capacity utilization rates across existing facilities are approaching 85-90%, indicating strong market conditions and justifying continued investment in manufacturing expansion.

Price dynamics reflect the interplay between raw material costs, manufacturing scale, and competitive pressures. Economies of scale achieved through larger production volumes are helping to offset inflationary pressures on raw materials, with some anode materials experiencing 15-20% cost reductions as production scales increase.

Technology adoption cycles show accelerating transition from traditional graphite anodes toward silicon-enhanced formulations. Market penetration of silicon-graphite composite anodes is expected to reach 35-40% of total anode demand by 2028, driven by performance advantages and improving cost competitiveness.

Competitive intensity is increasing as new entrants seek to capture market share in the rapidly growing sector. Innovation cycles are shortening as companies race to develop superior anode materials, leading to increased research and development spending and faster technology commercialization timelines.

Regulatory influence continues shaping market dynamics through policy changes affecting electric vehicle adoption, domestic content requirements, and environmental standards. Policy uncertainty regarding future regulations creates both opportunities and risks that companies must navigate in their strategic planning processes.

Primary research for analyzing the North America electric vehicle battery anode market involved comprehensive interviews with industry executives, technical specialists, and market participants across the value chain. Data collection included discussions with anode material manufacturers, battery producers, automotive companies, and research institutions to gather insights on market trends, technology developments, and competitive dynamics.

Secondary research encompassed analysis of industry reports, company financial statements, patent filings, and regulatory documents to understand market structure, competitive positioning, and technology evolution. Government databases provided information on trade flows, production statistics, and policy developments affecting the electric vehicle battery supply chain.

Market sizing methodology utilized bottom-up analysis based on electric vehicle production forecasts, battery capacity requirements, and anode material consumption rates. Cross-validation through multiple data sources ensured accuracy and reliability of market projections and growth estimates.

Technology assessment involved evaluation of patent landscapes, research publications, and company development programs to identify emerging trends and innovation trajectories. Expert interviews with materials scientists and battery engineers provided technical insights on performance characteristics and commercial viability of different anode technologies.

Competitive analysis examined company strategies, capacity expansion plans, and market positioning through public disclosures, industry presentations, and trade publication coverage. Financial analysis of key market participants provided insights on investment levels, profitability trends, and strategic priorities driving market development.

United States market dominates the North America electric vehicle battery anode sector, accounting for approximately 75-80% of regional demand driven by large-scale electric vehicle production and aggressive adoption targets. Manufacturing hubs in Michigan, Ohio, and the Southeast are attracting significant investment in battery and anode production facilities, supported by federal incentives and state-level economic development programs.

California leadership in electric vehicle adoption continues driving innovation and demand for advanced anode materials. The state’s zero emission vehicle mandate requires increasing percentages of new vehicle sales to be electric, creating guaranteed market demand that supports long-term investment planning for anode material suppliers.

Canada’s market represents approximately 15-18% of regional anode demand, with strong government support for electric vehicle adoption and battery manufacturing. Ontario and Quebec are emerging as key production centers, leveraging abundant hydroelectric power and established automotive manufacturing infrastructure to attract battery supply chain investments.

Mexico’s growing role in North American automotive production is extending to electric vehicle components, including anode materials. Manufacturing cost advantages and proximity to major automotive production centers make Mexico an attractive location for anode processing and battery component assembly operations.

Cross-border integration is increasing as companies develop regional supply chains that leverage comparative advantages across different countries. Trade agreements like USMCA facilitate this integration while domestic content requirements encourage regional sourcing and production investment.

Market leadership in the North America electric vehicle battery anode sector is distributed among established chemical companies, specialized battery material manufacturers, and emerging technology firms developing next-generation solutions:

Strategic positioning varies among competitors, with some focusing on cost-effective graphite solutions while others pursue premium silicon-enhanced technologies. Vertical integration strategies are common as companies seek to control raw material supply and ensure consistent quality for automotive applications.

Innovation focus centers on improving energy density, cycle life, and fast charging capabilities while maintaining cost competitiveness. Intellectual property portfolios are becoming increasingly important as companies seek to protect technological advantages and establish licensing revenue streams.

By Material Type:

By Application:

By End-User:

Natural Graphite Category maintains significant market share due to cost advantages and established supply chains, though growth is moderating as performance requirements increase. Chinese suppliers dominate this segment, creating supply chain security concerns that are driving investment in domestic processing capabilities.

Synthetic Graphite Category is experiencing steady growth as automotive manufacturers prioritize performance consistency and quality assurance. Manufacturing processes for synthetic graphite offer better control over material properties, making this category preferred for premium electric vehicle applications requiring reliable performance.

Silicon-Enhanced Categories represent the fastest-growing segments as technology maturity improves and costs decline. Silicon-graphite composites are achieving commercial adoption while pure silicon technologies remain in development phases, with market penetration expected to accelerate as manufacturing scales increase.

Specialty Material Categories including lithium titanate oxide serve niche applications where specific performance characteristics justify premium pricing. Fast-charging capabilities make these materials attractive for commercial vehicle applications and grid storage systems requiring rapid cycling.

Emerging Technology Categories including solid-state compatible anodes are attracting significant research investment but remain in early development stages. Commercial viability timelines for these technologies extend beyond the current forecast period, though they represent important long-term opportunities.

Automotive Manufacturers benefit from advanced anode technologies through improved electric vehicle performance, enabling longer range, faster charging, and enhanced consumer appeal. Cost reductions in anode materials contribute to overall battery cost optimization, supporting electric vehicle price competitiveness with traditional vehicles.

Battery Producers gain competitive advantages through access to superior anode materials that enable differentiated battery products. Performance improvements in energy density and cycle life allow battery manufacturers to offer more attractive solutions to automotive customers and command premium pricing.

Material Suppliers benefit from sustained demand growth driven by electric vehicle adoption and technology advancement. Long-term contracts with automotive and battery manufacturers provide revenue stability and support capacity expansion investments.

Investors gain exposure to high-growth market segments with strong fundamental drivers including government policy support and automotive industry transformation. Technology innovation creates opportunities for significant returns through successful commercialization of advanced anode materials.

Consumers benefit from improved electric vehicle performance and declining costs as anode technology advances. Enhanced capabilities including longer range and faster charging address key barriers to electric vehicle adoption, expanding consumer choice and market accessibility.

Environmental Stakeholders benefit from accelerated electric vehicle adoption enabled by advanced anode technologies. Emission reductions from transportation electrification contribute to climate change mitigation goals and improved air quality in urban areas.

Strengths:

Weaknesses:

Opportunities:

Threats:

Silicon Integration Acceleration represents the most significant trend shaping the North America electric vehicle battery anode market. Automotive manufacturers are increasingly specifying silicon-enhanced anodes to achieve energy density targets, with adoption rates reaching 25-30% in premium electric vehicle segments and expected to expand across mainstream applications.

Domestic Supply Chain Development is gaining momentum as companies invest in North American production capabilities to reduce international dependence and qualify for government incentives. Vertical integration strategies are becoming common as battery manufacturers seek to control critical material supplies and ensure consistent quality.

Sustainability Focus is driving development of recycling technologies and sustainable sourcing practices for anode materials. Circular economy initiatives are creating new business models as companies prepare for large-scale battery recycling operations when first-generation electric vehicle batteries reach end-of-life.

Performance Standardization is emerging as automotive manufacturers establish common specifications for anode materials across different suppliers. Quality assurance protocols are becoming more stringent as electric vehicle production scales and reliability requirements increase.

Technology Convergence is occurring as different anode material approaches begin incorporating similar performance enhancement strategies. Hybrid solutions combining multiple material types are gaining traction as companies seek to optimize performance while managing costs and technical risks.

Manufacturing Capacity Expansion announcements have accelerated significantly, with multiple companies committing to large-scale production facilities across North America. Investment levels in anode manufacturing infrastructure have reached unprecedented levels, supported by government incentives and long-term supply agreements with automotive manufacturers.

Strategic Partnership Formation between anode material suppliers and automotive manufacturers is reshaping competitive dynamics. Joint development programs are becoming common as companies collaborate on next-generation technologies and secure long-term supply relationships.

Technology Commercialization milestones are being achieved as silicon-based anode materials transition from laboratory development to commercial production. Pilot manufacturing facilities are scaling to full production capacity, demonstrating technical and commercial viability of advanced anode technologies.

Regulatory Compliance initiatives are advancing as companies prepare for evolving safety and environmental standards. Certification processes for automotive-grade anode materials are becoming more comprehensive, requiring extensive testing and validation procedures.

Supply Chain Localization projects are progressing as companies establish domestic raw material processing and manufacturing capabilities. Mining development projects for graphite and other critical materials are advancing to support regional supply chain independence.

Investment Prioritization should focus on companies developing silicon-enhanced anode technologies with demonstrated commercial viability and automotive partnerships. MarkWide Research analysis indicates that silicon-graphite composite manufacturers with established production capabilities represent the most attractive investment opportunities in the current market environment.

Supply Chain Risk Management requires careful evaluation of raw material sourcing strategies and domestic production capabilities. Companies with integrated supply chains or secure long-term supply agreements are better positioned to navigate potential disruptions and qualify for government incentives requiring domestic content.

Technology Assessment should emphasize performance validation and commercial scalability over laboratory-stage innovations. Market participants should prioritize technologies with proven automotive applications and clear pathways to cost-competitive production rather than pursuing unproven breakthrough technologies.

Partnership Strategy development is crucial for accessing automotive markets and securing long-term demand visibility. Strategic alliances with battery manufacturers and automotive companies provide market access and development resources that are difficult to achieve independently.

Regulatory Compliance preparation should begin early as safety and environmental standards continue evolving. Proactive engagement with regulatory agencies and industry standards organizations helps ensure product development aligns with future requirements and avoids costly redesign efforts.

Market trajectory for the North America electric vehicle battery anode market remains strongly positive, driven by accelerating electric vehicle adoption and continued technology advancement. Growth projections indicate sustained expansion at compound annual growth rates exceeding 16% through 2030, supported by automotive manufacturer electrification commitments and government policy backing.

Technology evolution will continue favoring silicon-enhanced anode materials as performance advantages become more pronounced and manufacturing costs decline. Market penetration of silicon-graphite composites is expected to reach 50-60% of total anode demand by 2030, with pure silicon technologies beginning commercial adoption in premium applications.

Supply chain maturation will result in more balanced regional production capabilities and reduced dependence on international suppliers. Domestic manufacturing capacity is projected to meet 70-80% of regional demand by 2028, supported by continued investment in production facilities and raw material processing operations.

Competitive landscape evolution will likely feature continued consolidation as companies seek scale advantages and integrated capabilities. Strategic partnerships and acquisitions will reshape market structure as participants position for long-term growth and technology leadership.

Innovation pipeline developments including solid-state compatible anodes and advanced recycling technologies will begin impacting market dynamics toward the end of the forecast period. Next-generation materials represent significant opportunities for companies investing in long-term research and development programs, according to MWR projections.

The North America electric vehicle battery anode market represents a dynamic and rapidly expanding sector positioned at the center of the region’s transportation electrification transformation. Strong fundamentals including government policy support, automotive industry commitments, and advancing technology capabilities create a favorable environment for sustained growth and investment opportunities.

Technology advancement continues driving market evolution as silicon-enhanced anode materials gain commercial adoption and demonstrate superior performance characteristics. Manufacturing scale-up and cost optimization efforts are making advanced anode technologies increasingly competitive, supporting broader market penetration across electric vehicle segments.

Supply chain development initiatives are addressing strategic vulnerabilities while positioning North America as a more self-sufficient region for critical battery materials. Investment momentum in domestic production capabilities reflects both market opportunity and policy incentives supporting regional manufacturing development.

Market participants that successfully navigate technology transitions, establish strong automotive partnerships, and build scalable manufacturing capabilities are well-positioned to capture significant value from the ongoing electric vehicle revolution. Strategic focus on performance, cost competitiveness, and supply chain security will determine long-term success in this rapidly evolving market landscape.

What is Electric Vehicle Battery Anode?

Electric Vehicle Battery Anode refers to the component in a battery that allows the flow of lithium ions during charging and discharging. It plays a crucial role in the performance and efficiency of electric vehicle batteries.

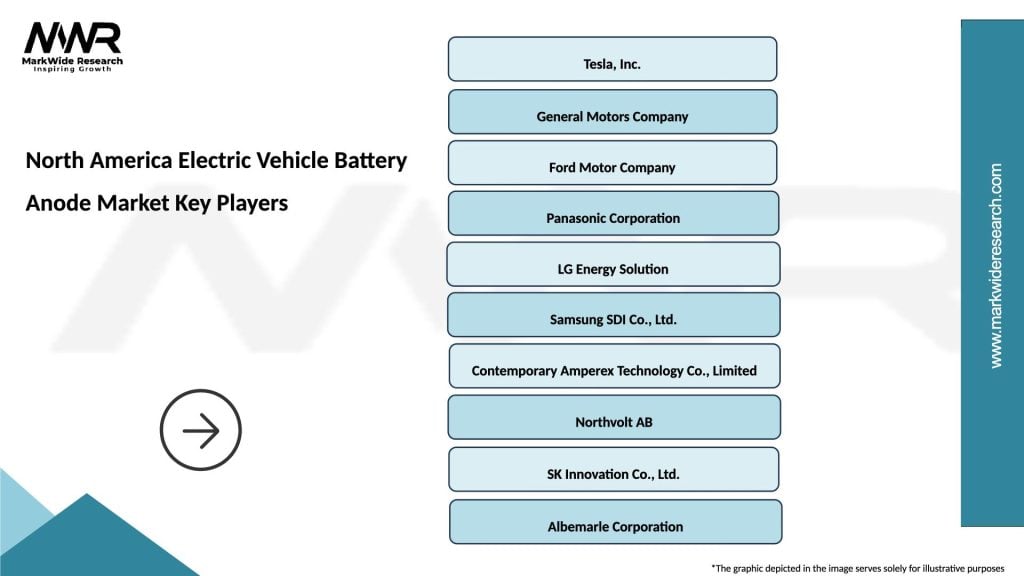

What are the key players in the North America Electric Vehicle Battery Anode Market?

Key players in the North America Electric Vehicle Battery Anode Market include companies like Tesla, Panasonic, and LG Chem, which are known for their advancements in battery technology and production capabilities, among others.

What are the growth factors driving the North America Electric Vehicle Battery Anode Market?

The growth of the North America Electric Vehicle Battery Anode Market is driven by the increasing demand for electric vehicles, advancements in battery technology, and government incentives promoting sustainable transportation.

What challenges does the North America Electric Vehicle Battery Anode Market face?

Challenges in the North America Electric Vehicle Battery Anode Market include the high cost of raw materials, supply chain disruptions, and the need for improved recycling processes for battery components.

What opportunities exist in the North America Electric Vehicle Battery Anode Market?

Opportunities in the North America Electric Vehicle Battery Anode Market include the development of new materials for anodes, increased investment in research and development, and the expansion of charging infrastructure to support electric vehicles.

What trends are shaping the North America Electric Vehicle Battery Anode Market?

Trends in the North America Electric Vehicle Battery Anode Market include the shift towards silicon-based anodes, advancements in solid-state battery technology, and a growing focus on sustainability and environmental impact in battery production.

North America Electric Vehicle Battery Anode Market

| Segmentation Details | Description |

|---|---|

| Product Type | Graphite, Silicon, Lithium Titanate, Composite |

| End User | OEMs, Tier-1 Suppliers, Aftermarket Providers, Vehicle Assemblers |

| Technology | Dry Coating, Wet Coating, Chemical Vapor Deposition, Mechanical Milling |

| Application | Passenger Vehicles, Commercial Vehicles, Two-Wheelers, Others |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Electric Vehicle Battery Anode Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at