444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America e-commerce watch market represents a dynamic and rapidly evolving segment within the broader digital retail landscape. This market encompasses the online sale and distribution of various timepieces, ranging from luxury Swiss watches to affordable fashion accessories, smart wearables, and vintage collectibles. Digital transformation has fundamentally reshaped how consumers discover, evaluate, and purchase watches, creating unprecedented opportunities for both established brands and emerging online retailers.

Market dynamics indicate robust growth driven by changing consumer preferences, technological advancements, and the increasing comfort level of purchasing high-value items online. The sector has experienced significant expansion, with online watch sales growing at approximately 12.5% annually across North America. This growth trajectory reflects the successful adaptation of traditional watch retailers to digital platforms and the emergence of specialized e-commerce players focusing exclusively on timepiece sales.

Consumer behavior patterns reveal a shift toward online research and purchasing, particularly among millennials and Gen Z demographics who prioritize convenience, competitive pricing, and extensive product selection. The market benefits from sophisticated digital marketing strategies, virtual try-on technologies, and comprehensive product information that helps bridge the traditional gap between physical and online watch shopping experiences.

The North America e-commerce watch market refers to the comprehensive ecosystem of online platforms, digital marketplaces, and web-based retail channels dedicated to the sale and distribution of timepieces across the United States, Canada, and Mexico. This market encompasses various watch categories including luxury timepieces, fashion watches, sports watches, smartwatches, and vintage collectibles sold through dedicated e-commerce websites, online marketplaces, and digital extensions of traditional brick-and-mortar retailers.

Market scope includes both business-to-consumer (B2C) and business-to-business (B2B) transactions, covering direct-to-consumer sales from watch manufacturers, authorized dealer networks, independent retailers, and secondary market platforms. The definition extends to encompass supporting services such as online authentication, digital warranties, virtual consultations, and e-commerce fulfillment specifically tailored to watch retail requirements.

Strategic analysis of the North America e-commerce watch market reveals a sector characterized by strong growth momentum, technological innovation, and evolving consumer preferences. The market has successfully transitioned from traditional retail models to sophisticated digital platforms that offer comprehensive shopping experiences comparable to physical stores. Key performance indicators demonstrate sustained expansion with online penetration rates reaching approximately 35% of total watch sales in the region.

Market leaders have invested heavily in digital infrastructure, creating omnichannel experiences that seamlessly integrate online and offline touchpoints. The sector benefits from advanced technologies including augmented reality try-on features, detailed product visualization, and sophisticated recommendation engines that enhance customer engagement and conversion rates.

Competitive landscape features a diverse mix of established luxury brands, fashion retailers, specialized watch e-tailers, and marketplace platforms. This diversity creates a dynamic environment where innovation, customer service excellence, and strategic partnerships drive market success. The market’s resilience has been demonstrated through various economic cycles, with online channels often outperforming traditional retail during challenging periods.

Consumer preferences in the North America e-commerce watch market reveal several critical trends that shape purchasing decisions and market dynamics:

Primary growth drivers propelling the North America e-commerce watch market include technological advancement, changing consumer behavior, and strategic industry initiatives. Digital transformation has created sophisticated online shopping environments that rival traditional retail experiences through virtual try-on capabilities, detailed product imagery, and comprehensive educational content.

Consumer convenience remains a fundamental driver, with online platforms offering 24/7 accessibility, extensive product selection, and competitive pricing that traditional retail cannot match. The ability to compare multiple brands, read customer reviews, and access detailed specifications creates informed purchasing decisions that benefit both consumers and retailers.

Generational shifts significantly impact market dynamics, as digital-native consumers increasingly prefer online shopping channels. These demographics demonstrate higher comfort levels with high-value online purchases and expect seamless digital experiences across all touchpoints. Mobile optimization has become critical, with responsive design and mobile-specific features driving engagement and conversion rates.

Brand accessibility through e-commerce platforms enables smaller and international watch brands to reach North American consumers without traditional retail infrastructure investments. This democratization of market access creates diverse product offerings and competitive pricing that benefits consumers while expanding overall market size.

Significant challenges facing the North America e-commerce watch market include consumer hesitation regarding high-value online purchases, authentication concerns, and the tactile nature of watch selection. Trust barriers remain substantial, particularly for luxury timepieces where buyers traditionally prefer physical inspection before purchase.

Counterfeit products represent a persistent threat that undermines consumer confidence and brand integrity. The proliferation of replica watches through various online channels creates market confusion and necessitates substantial investment in authentication technologies and consumer education initiatives.

Return and exchange complexities pose operational challenges, particularly for high-value items requiring specialized handling, insurance, and authentication processes. These logistical requirements increase operational costs and create potential customer service issues that can impact brand reputation.

Technical limitations in conveying watch quality, craftsmanship, and physical presence through digital channels remain challenging. Despite technological advances, the inability to physically examine timepieces continues to influence purchasing decisions, particularly for luxury and collectible segments.

Emerging opportunities within the North America e-commerce watch market center on technological innovation, market expansion, and service enhancement. Augmented reality technologies offer significant potential for creating immersive shopping experiences that bridge the gap between online and physical retail environments.

Artificial intelligence applications in personalization, recommendation engines, and customer service create opportunities for enhanced user experiences and improved conversion rates. Machine learning algorithms can analyze consumer behavior patterns to optimize product recommendations and pricing strategies.

Subscription and rental models represent untapped market potential, allowing consumers to access luxury timepieces without full ownership commitments. These models create recurring revenue streams while expanding market accessibility to broader consumer segments.

Cross-border e-commerce expansion offers opportunities to access international markets and exclusive product lines. Strategic partnerships with global brands and international shipping capabilities can significantly expand addressable market size and product diversity.

Complex interactions between supply chain factors, consumer behavior, and technological advancement shape the North America e-commerce watch market dynamics. Supply chain optimization has become critical, with successful players investing in inventory management systems, fulfillment capabilities, and logistics networks that ensure rapid, secure delivery of high-value timepieces.

Pricing dynamics reflect competitive pressures and consumer price sensitivity, with online platforms often offering more competitive pricing than traditional retail channels. This pricing advantage stems from reduced overhead costs and direct-to-consumer models that eliminate traditional retail markups.

Seasonal fluctuations significantly impact market performance, with holiday seasons, graduation periods, and special occasions driving substantial sales increases. Holiday sales can represent up to 40% of annual revenue for many e-commerce watch retailers, requiring sophisticated inventory planning and marketing strategies.

Brand relationships between manufacturers and e-commerce platforms continue evolving, with authorized dealer agreements, exclusive online releases, and direct-to-consumer strategies reshaping traditional distribution models. These relationships directly impact product availability, pricing authority, and customer service responsibilities.

Comprehensive research approach for analyzing the North America e-commerce watch market incorporates multiple data sources, analytical frameworks, and validation methodologies. Primary research includes extensive surveys of online watch purchasers, interviews with industry executives, and analysis of e-commerce platform performance metrics.

Secondary research encompasses analysis of public company financial reports, industry publications, trade association data, and government statistics related to e-commerce and luxury goods markets. This multi-source approach ensures comprehensive market understanding and validates key findings through triangulation.

Data collection methods include web scraping of e-commerce platforms for pricing and inventory analysis, social media sentiment analysis, and consumer behavior tracking through digital analytics platforms. MarkWide Research employs proprietary analytical tools to process large datasets and identify meaningful market trends and patterns.

Analytical frameworks incorporate quantitative modeling, trend analysis, and competitive benchmarking to develop actionable insights. The methodology ensures statistical significance while maintaining practical relevance for industry stakeholders and strategic decision-making processes.

United States dominates the North America e-commerce watch market, accounting for approximately 75% of regional online watch sales. The market benefits from sophisticated e-commerce infrastructure, high consumer spending power, and widespread adoption of online shopping behaviors. Major metropolitan areas including New York, Los Angeles, and Chicago drive significant market activity, with luxury watch segments showing particular strength in these regions.

Canada represents a growing market segment with increasing e-commerce adoption and cross-border shopping behaviors. Canadian consumers frequently purchase from US-based platforms, creating opportunities for retailers with international shipping capabilities. Currency fluctuations impact purchasing patterns, with favorable exchange rates driving increased cross-border transactions.

Mexico shows emerging potential with rapid e-commerce growth and increasing consumer confidence in online purchases. The market benefits from growing middle-class purchasing power and improved logistics infrastructure. Mobile commerce adoption rates in Mexico exceed regional averages, creating opportunities for mobile-optimized watch retailers.

Regional preferences vary significantly, with luxury watches showing stronger performance in affluent US markets, while fashion and sports watches demonstrate broader appeal across all three countries. These preferences influence inventory strategies and marketing approaches for successful e-commerce operations.

Market competition in the North America e-commerce watch sector features diverse players ranging from luxury brand direct-to-consumer platforms to specialized watch retailers and general marketplace platforms. Key competitive factors include product authenticity, customer service quality, pricing competitiveness, and technological innovation.

Leading market participants include:

Competitive strategies focus on differentiation through specialized services, exclusive partnerships, and superior customer experiences. Successful players invest heavily in authentication technologies, customer education, and omnichannel integration to build trust and loyalty.

Market segmentation analysis reveals distinct categories within the North America e-commerce watch market, each with unique characteristics, consumer profiles, and growth dynamics.

By Product Category:

By Price Range:

By Distribution Channel:

Luxury watch segment demonstrates strong online growth despite traditional preferences for in-person purchases. Authentication services and comprehensive warranties have increased consumer confidence, with luxury e-commerce sales growing at approximately 15% annually. This segment benefits from exclusive online releases and limited edition availability that drives urgency and premium pricing.

Fashion watch category shows the highest e-commerce penetration rates, with online sales representing over 60% of total category volume. This segment benefits from frequent style changes, competitive pricing, and strong social media marketing that resonates with younger demographics. Influencer partnerships and social commerce integration drive significant traffic and conversion rates.

Smartwatch segment leverages technology-savvy consumers comfortable with online purchases of electronic devices. This category benefits from detailed technical specifications, comparison tools, and integration with existing digital ecosystems. Subscription services and software updates create ongoing customer relationships beyond initial purchase transactions.

Vintage and collectible watches represent a specialized segment requiring extensive authentication, condition documentation, and provenance verification. This category attracts serious collectors and investors who value detailed product information and expert curation over price competition.

Manufacturers benefit from direct-to-consumer e-commerce channels that provide better margin control, customer data access, and brand experience management. Digital platforms enable global reach without traditional retail infrastructure investments while maintaining pricing authority and inventory control.

Retailers gain access to broader customer bases, reduced operational overhead, and sophisticated analytics capabilities that inform inventory and marketing decisions. E-commerce platforms provide scalability opportunities and data-driven insights that optimize business performance and customer satisfaction.

Consumers enjoy expanded product selection, competitive pricing, convenient shopping experiences, and access to detailed product information and reviews. Online platforms offer 24/7 accessibility, comparison tools, and specialized services that enhance the watch purchasing experience.

Service providers including authentication services, logistics companies, and payment processors benefit from the growing e-commerce watch market through increased transaction volumes and specialized service opportunities. Technology vendors find opportunities in developing specialized solutions for high-value e-commerce applications.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation continues reshaping the North America e-commerce watch market through innovative technologies and changing consumer expectations. Augmented reality integration allows virtual try-on experiences that address traditional online shopping limitations, with early adopters reporting improved conversion rates and reduced return volumes.

Sustainability focus increasingly influences consumer purchasing decisions, with eco-friendly packaging, carbon-neutral shipping, and sustainable manufacturing practices becoming important differentiators. Circular economy models including watch refurbishment, trade-in programs, and rental services gain traction among environmentally conscious consumers.

Personalization advancement through artificial intelligence and machine learning creates customized shopping experiences based on individual preferences, browsing history, and purchase patterns. Recommendation engines become increasingly sophisticated, driving higher engagement and conversion rates across platforms.

Social commerce integration leverages social media platforms for product discovery, peer recommendations, and seamless purchasing experiences. Influencer partnerships and user-generated content create authentic brand connections that resonate particularly well with younger demographics.

Mobile optimization remains critical as smartphone usage for e-commerce continues growing. Progressive web applications and mobile-specific features ensure optimal user experiences across devices and platforms.

Recent developments in the North America e-commerce watch market reflect ongoing evolution and adaptation to changing market conditions. Major luxury brands have significantly expanded their direct-to-consumer e-commerce capabilities, with several launching exclusive online collections and limited editions available only through digital channels.

Authentication technology advancement includes blockchain-based certification systems, AI-powered authenticity verification, and comprehensive digital documentation that creates permanent provenance records. These developments address primary consumer concerns about counterfeit products and build trust in online luxury purchases.

Marketplace consolidation has occurred through strategic acquisitions and partnerships, with larger platforms acquiring specialized watch retailers to expand their expertise and customer base. MarkWide Research analysis indicates this consolidation trend will continue as companies seek competitive advantages through scale and specialization.

Cross-border commerce expansion has accelerated, with international shipping capabilities and currency conversion services making global watch brands more accessible to North American consumers. This development increases product diversity and competitive pricing options.

Subscription service launches by several companies offer watch rental and rotation services, creating new revenue models and expanding market accessibility. These services particularly appeal to consumers interested in trying luxury timepieces without full ownership commitments.

Strategic recommendations for North America e-commerce watch market participants focus on differentiation, customer experience enhancement, and technological innovation. Investment priorities should emphasize authentication capabilities, mobile optimization, and personalization technologies that address core consumer concerns and preferences.

Brand partnerships represent critical success factors, with authorized dealer relationships providing competitive advantages through exclusive access, warranty support, and brand credibility. Companies should prioritize building strong relationships with key watch manufacturers and securing favorable distribution agreements.

Customer service excellence becomes increasingly important as market competition intensifies. Specialized services including expert consultations, comprehensive warranties, and white-glove delivery create differentiation opportunities and justify premium pricing strategies.

Data analytics investment enables better understanding of consumer behavior, inventory optimization, and personalized marketing strategies. Companies should develop sophisticated analytics capabilities to inform strategic decisions and improve operational efficiency.

International expansion opportunities should be evaluated carefully, considering regulatory requirements, logistics capabilities, and market-specific preferences. Strategic partnerships with local players can facilitate successful market entry and expansion.

Long-term prospects for the North America e-commerce watch market remain highly positive, driven by continued digital adoption, technological innovation, and evolving consumer preferences. Market growth is expected to continue at robust rates, with online penetration reaching approximately 50% of total watch sales within the next five years.

Technology integration will accelerate, with augmented reality, artificial intelligence, and blockchain authentication becoming standard features across leading platforms. These technologies will address current market limitations and create more engaging, trustworthy shopping experiences that rival traditional retail.

Generational shifts will continue favoring online channels, with digital-native consumers driving market expansion and demanding increasingly sophisticated e-commerce experiences. Mobile commerce will represent the majority of transactions, requiring continued investment in mobile-optimized platforms and features.

Market consolidation is expected to continue, with successful players expanding through acquisitions and strategic partnerships. This consolidation will create larger, more sophisticated platforms capable of offering comprehensive services and competing effectively with traditional retail channels.

Sustainability initiatives will become increasingly important, with environmentally conscious practices becoming competitive necessities rather than differentiators. Companies that successfully integrate sustainability into their operations and messaging will capture growing market segments focused on responsible consumption.

The North America e-commerce watch market represents a dynamic and rapidly evolving sector that has successfully transformed traditional timepiece retail through technological innovation and changing consumer preferences. Market fundamentals remain strong, supported by robust growth rates, increasing online adoption, and continuous platform improvements that address historical limitations of digital watch retail.

Key success factors include authentication capabilities, customer service excellence, mobile optimization, and strategic brand partnerships that create competitive advantages and build consumer trust. Companies that invest in these areas while maintaining focus on user experience and technological innovation are well-positioned for continued growth and market leadership.

Future opportunities center on emerging technologies, international expansion, and innovative service models that expand market accessibility and create new revenue streams. The market’s evolution toward greater sophistication and consumer acceptance suggests continued strong performance and expansion potential across all major segments and price categories.

What is E-Commerce Watch?

E-Commerce Watch refers to the monitoring and analysis of online retail trends, consumer behaviors, and market dynamics within the e-commerce sector. It encompasses various aspects such as sales performance, customer engagement, and technological advancements in online shopping.

What are the key players in the North America E-Commerce Watch Market?

Key players in the North America E-Commerce Watch Market include Amazon, eBay, Shopify, and Walmart, among others. These companies are significant contributors to the growth and innovation in the e-commerce landscape.

What are the growth factors driving the North America E-Commerce Watch Market?

The North America E-Commerce Watch Market is driven by factors such as the increasing adoption of mobile shopping, advancements in payment technologies, and the growing demand for personalized shopping experiences. Additionally, the rise of social commerce is also contributing to market growth.

What challenges does the North America E-Commerce Watch Market face?

Challenges in the North America E-Commerce Watch Market include intense competition among retailers, cybersecurity threats, and the complexities of supply chain management. These factors can hinder the growth and operational efficiency of e-commerce businesses.

What opportunities exist in the North America E-Commerce Watch Market?

Opportunities in the North America E-Commerce Watch Market include the expansion of omnichannel retail strategies, the integration of artificial intelligence for enhanced customer service, and the growth of subscription-based models. These trends can lead to increased customer loyalty and sales.

What trends are shaping the North America E-Commerce Watch Market?

Trends shaping the North America E-Commerce Watch Market include the rise of sustainable shopping practices, the use of augmented reality in online shopping, and the increasing importance of social media marketing. These trends are influencing consumer preferences and retailer strategies.

North America E-Commerce Watch Market

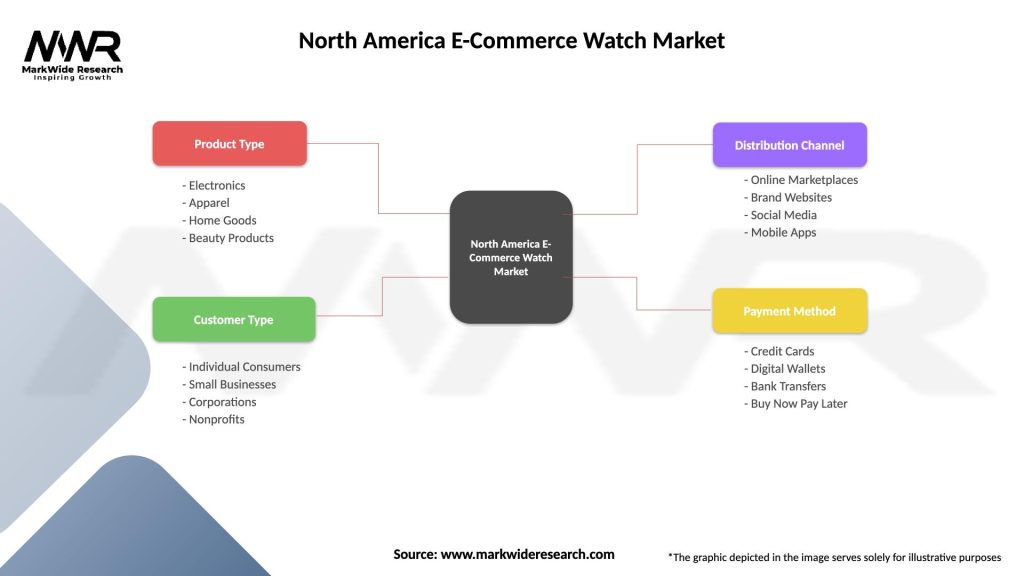

| Segmentation Details | Description |

|---|---|

| Product Type | Electronics, Apparel, Home Goods, Beauty Products |

| Customer Type | Individual Consumers, Small Businesses, Corporations, Nonprofits |

| Distribution Channel | Online Marketplaces, Brand Websites, Social Media, Mobile Apps |

| Payment Method | Credit Cards, Digital Wallets, Bank Transfers, Buy Now Pay Later |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America E-Commerce Watch Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at