444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America DNA sequencing market represents one of the most rapidly evolving sectors in biotechnology and healthcare, driven by unprecedented advances in genomic technologies and increasing applications across multiple industries. DNA sequencing technologies have revolutionized medical diagnostics, pharmaceutical research, agricultural development, and forensic investigations throughout the United States and Canada. The market encompasses various sequencing platforms, including next-generation sequencing (NGS), third-generation sequencing, and emerging single-cell sequencing technologies.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of approximately 12.5% over the forecast period. This expansion is primarily attributed to declining sequencing costs, improved accuracy, faster turnaround times, and expanding clinical applications. Healthcare institutions across North America are increasingly adopting DNA sequencing for personalized medicine, cancer genomics, rare disease diagnosis, and pharmacogenomics applications.

Technological innovations continue to drive market expansion, with companies developing more efficient, cost-effective, and user-friendly sequencing platforms. The integration of artificial intelligence and machine learning algorithms has enhanced data analysis capabilities, making genomic insights more accessible to healthcare providers and researchers. Academic research institutions and pharmaceutical companies represent the largest consumer segments, accounting for approximately 68% of total market demand.

The North America DNA sequencing market refers to the comprehensive ecosystem of technologies, services, and applications focused on determining the precise order of nucleotides within DNA molecules across the United States and Canada. DNA sequencing involves sophisticated laboratory techniques and computational methods that decode genetic information, enabling researchers and healthcare professionals to understand genetic variations, disease mechanisms, and therapeutic targets.

Modern DNA sequencing encompasses various methodologies, from traditional Sanger sequencing to advanced next-generation sequencing platforms that can process millions of DNA fragments simultaneously. The market includes hardware manufacturers, software developers, service providers, consumables suppliers, and end-users ranging from academic institutions to clinical laboratories and pharmaceutical companies.

Applications span multiple sectors including clinical diagnostics, drug discovery, agricultural genomics, environmental monitoring, and forensic analysis. The market’s significance extends beyond commercial considerations, as DNA sequencing technologies contribute to advancing precision medicine, understanding genetic diseases, developing targeted therapies, and improving crop yields through genomic selection.

Strategic analysis reveals that the North America DNA sequencing market is positioned for sustained growth, driven by technological advancements, expanding clinical applications, and supportive regulatory frameworks. Key market drivers include the increasing prevalence of genetic disorders, growing demand for personalized medicine, declining sequencing costs, and rising investments in genomic research initiatives.

Market segmentation demonstrates diverse opportunities across technology platforms, with next-generation sequencing commanding the largest market share at approximately 75% of total adoption. Clinical applications represent the fastest-growing segment, particularly in oncology, rare diseases, and reproductive health. Geographic distribution shows the United States maintaining market leadership, while Canada exhibits strong growth potential in academic research and clinical diagnostics.

Competitive landscape features established biotechnology companies, emerging startups, and technology giants investing heavily in genomic technologies. Innovation focuses on improving sequencing speed, accuracy, and cost-effectiveness while developing user-friendly platforms suitable for various laboratory environments. Future prospects indicate continued market expansion, with emerging applications in liquid biopsy, single-cell analysis, and long-read sequencing driving next-phase growth.

Comprehensive market analysis reveals several critical insights shaping the North America DNA sequencing landscape:

Primary growth drivers propelling the North America DNA sequencing market include technological advancements, expanding clinical applications, and favorable economic factors. Declining sequencing costs have democratized access to genomic technologies, enabling smaller laboratories and research institutions to adopt DNA sequencing capabilities previously reserved for major academic centers and pharmaceutical companies.

Healthcare transformation toward precision medicine represents a fundamental driver, with medical professionals increasingly recognizing the value of genetic information in diagnosis, treatment selection, and patient monitoring. Cancer genomics applications have shown particularly strong growth, as oncologists utilize tumor sequencing to identify targeted therapy options and monitor treatment response. The growing understanding of genetic factors in drug metabolism has also driven pharmacogenomics adoption.

Regulatory support from agencies like the FDA has accelerated market growth through streamlined approval processes for genomic diagnostic tests and companion diagnostics. Government initiatives including the All of Us Research Program and Cancer Moonshot have provided substantial funding for genomic research, creating demand for sequencing services and technologies. Additionally, increasing awareness among healthcare providers and patients about the benefits of genetic testing has expanded market acceptance and utilization.

Significant challenges continue to impact market growth despite overall positive trends. High initial capital investments required for establishing DNA sequencing capabilities remain a barrier for many potential users, particularly smaller laboratories and healthcare facilities. Advanced sequencing platforms, associated infrastructure, and skilled personnel requirements create substantial financial commitments that may limit market penetration in certain segments.

Data management complexities present ongoing challenges, as DNA sequencing generates massive datasets requiring sophisticated storage, processing, and analysis capabilities. Bioinformatics expertise shortages limit many organizations’ ability to effectively utilize sequencing data, creating bottlenecks in workflow implementation. The complexity of genomic data interpretation also requires specialized training and ongoing education for healthcare professionals.

Regulatory uncertainties in certain application areas, particularly direct-to-consumer genetic testing and emerging diagnostic applications, create market hesitation. Privacy concerns regarding genetic information storage and sharing continue to influence consumer acceptance and regulatory approaches. Additionally, reimbursement challenges for genetic testing services in some healthcare systems may limit clinical adoption rates and market expansion potential.

Emerging opportunities in the North America DNA sequencing market span multiple application areas and technological developments. Liquid biopsy applications represent a particularly promising growth area, with circulating tumor DNA analysis enabling non-invasive cancer monitoring and early detection. This application area is projected to grow at a CAGR exceeding 20% as clinical validation studies demonstrate effectiveness and regulatory approvals expand.

Single-cell sequencing technologies offer significant opportunities for understanding cellular heterogeneity in cancer, immunology, and developmental biology research. Agricultural genomics applications present substantial growth potential as food security concerns drive investment in crop improvement and livestock breeding programs utilizing genomic selection techniques.

Point-of-care sequencing represents an emerging opportunity as portable sequencing devices become more sophisticated and user-friendly. Infectious disease applications, highlighted during the COVID-19 pandemic, demonstrate the value of rapid genomic analysis for pathogen identification and outbreak monitoring. Additionally, expanding applications in forensics, paternity testing, and ancestry analysis continue creating new market segments and revenue opportunities.

Complex market dynamics shape the North America DNA sequencing landscape through interactions between technological innovation, regulatory evolution, and changing user requirements. Technology convergence is creating integrated platforms that combine sequencing, data analysis, and interpretation capabilities, simplifying workflows and reducing time-to-results for end users.

Competitive pressures continue driving innovation and cost reduction, with companies investing heavily in research and development to maintain market position. Strategic partnerships between technology providers, pharmaceutical companies, and healthcare systems are creating new business models and expanding market reach. The integration of artificial intelligence and machine learning capabilities is enhancing data analysis efficiency by approximately 60% compared to traditional methods.

Market maturation in certain segments is driving companies to explore new application areas and geographic markets. Customer requirements are evolving toward more comprehensive solutions that include not just sequencing capabilities but also data management, analysis, and clinical decision support tools. This trend is reshaping vendor strategies and creating opportunities for companies offering integrated genomic solutions.

Comprehensive research methodology employed in analyzing the North America DNA sequencing market incorporates multiple data collection and analysis approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, technology developers, clinical laboratory directors, and end users across various market segments to gather firsthand insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of published scientific literature, regulatory filings, company financial reports, and industry publications to validate primary findings and identify market patterns. Quantitative analysis utilizes statistical modeling techniques to project market growth rates, segment performance, and competitive positioning based on historical data and identified trend drivers.

Market validation processes include cross-referencing data sources, conducting expert reviews, and performing sensitivity analyses to ensure research conclusions accurately reflect market realities. MarkWide Research analysts employed triangulation methodologies to verify key findings and maintain research integrity throughout the analysis process. The methodology also incorporates real-time market monitoring to capture emerging trends and developments that may impact market projections.

United States dominance in the North America DNA sequencing market reflects the country’s advanced healthcare infrastructure, substantial research investments, and supportive regulatory environment. Market concentration in major metropolitan areas including Boston, San Francisco, San Diego, and Research Triangle Park creates innovation clusters that drive technological advancement and market growth. The U.S. accounts for approximately 88% of regional market activity, supported by major pharmaceutical companies, leading academic institutions, and well-funded biotechnology companies.

California leadership in genomic innovation stems from the presence of major technology companies, venture capital funding, and world-class research universities. Massachusetts biotechnology corridor contributes significantly to market development through established pharmaceutical companies and emerging genomic startups. Texas, North Carolina, and New York also represent important regional markets with growing genomic research capabilities and clinical applications.

Canada’s market participation demonstrates strong growth potential, particularly in academic research and clinical diagnostics applications. Government support through agencies like Genome Canada and provincial research organizations has fostered genomic research capabilities and technology adoption. Canadian market growth is projected at a CAGR of 14.2%, driven by increasing healthcare system adoption and expanding research initiatives in genomic medicine.

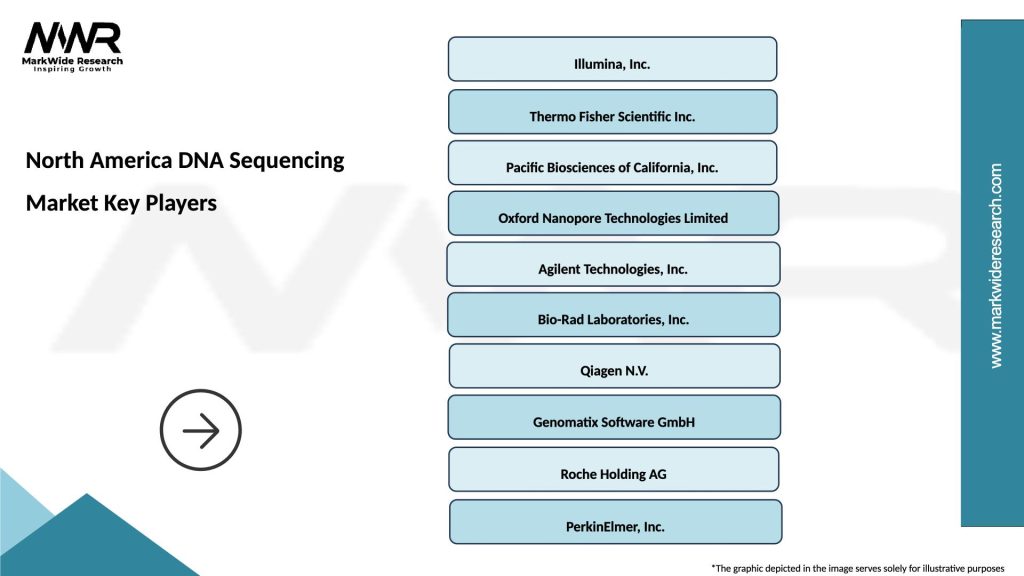

Market leadership in the North America DNA sequencing sector is characterized by intense competition among established biotechnology companies, emerging technology developers, and diversified life sciences corporations. Key market participants include:

Competitive strategies focus on technological innovation, strategic acquisitions, and expanding service offerings to create comprehensive genomic solutions. Market consolidation continues through mergers and acquisitions as companies seek to enhance capabilities and market reach.

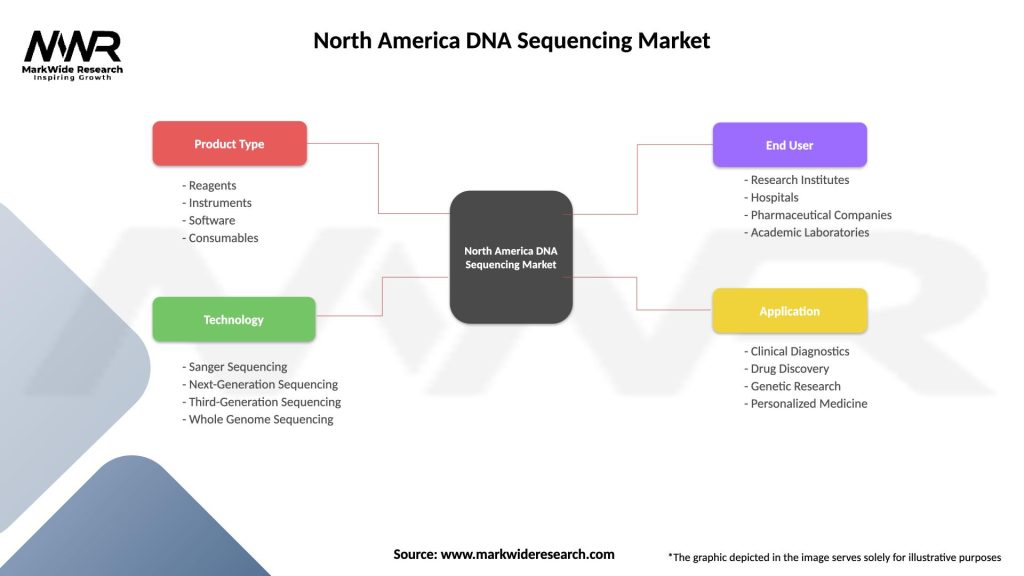

Technology-based segmentation reveals distinct market dynamics across different sequencing platforms and methodologies:

By Technology:

By Application:

By End User:

Clinical diagnostics applications demonstrate the strongest growth trajectory, with oncology genomics leading adoption rates. Cancer sequencing applications have achieved approximately 45% penetration in major cancer centers, driven by the clinical utility of tumor profiling for treatment selection. Hereditary cancer testing and rare disease diagnosis represent additional high-growth areas within clinical applications.

Pharmaceutical research applications continue expanding as drug developers recognize the value of genomic insights in target identification, patient stratification, and clinical trial design. Companion diagnostics development has become integral to drug approval processes, creating sustained demand for sequencing services and technologies. Pharmacogenomics applications are gaining traction as healthcare systems implement personalized dosing strategies.

Agricultural genomics represents an emerging high-potential category, with crop breeding programs increasingly utilizing genomic selection to improve yield, disease resistance, and nutritional content. Livestock genomics applications are expanding in dairy and beef cattle breeding, with genomic testing adoption rates reaching 78% in elite breeding programs. Environmental genomics applications, including microbiome analysis and biodiversity studies, are creating new market opportunities.

Healthcare providers benefit from DNA sequencing technologies through improved diagnostic accuracy, personalized treatment selection, and enhanced patient outcomes. Clinical decision support enabled by genomic data helps physicians identify optimal therapies, predict drug responses, and monitor treatment effectiveness. Cost savings result from more targeted treatments and reduced adverse drug reactions.

Pharmaceutical companies leverage DNA sequencing for accelerated drug discovery, improved clinical trial design, and companion diagnostics development. Target identification and validation processes benefit from genomic insights, reducing development timelines and improving success rates. Precision medicine approaches enabled by genomic data create opportunities for premium pricing and market differentiation.

Research institutions gain access to powerful tools for advancing scientific understanding across multiple disciplines. Academic researchers utilize sequencing technologies to investigate disease mechanisms, evolutionary biology, and environmental science questions. Collaborative research opportunities and grant funding availability have increased substantially due to genomic technology accessibility.

Patients and consumers benefit from more accurate diagnoses, personalized treatments, and preventive care strategies based on genetic risk assessment. Early disease detection and targeted interventions improve health outcomes while reducing healthcare costs. Access to genetic information empowers individuals to make informed healthcare and lifestyle decisions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technological convergence represents a dominant trend, with companies developing integrated platforms that combine sequencing, data analysis, and clinical interpretation capabilities. Artificial intelligence integration is enhancing data analysis efficiency and accuracy, with machine learning algorithms improving variant calling and clinical interpretation by approximately 35% compared to traditional methods.

Point-of-care sequencing is emerging as a significant trend, with portable devices enabling rapid genomic analysis in clinical settings, field research, and emergency response situations. Long-read sequencing technologies are gaining adoption for applications requiring comprehensive genomic analysis, including structural variant detection and complex region sequencing.

Liquid biopsy applications continue expanding, with circulating tumor DNA analysis becoming routine in cancer care for monitoring treatment response and detecting minimal residual disease. Single-cell sequencing is revolutionizing understanding of cellular heterogeneity and disease mechanisms, creating new research and clinical applications.

Democratization of genomics through cost reduction and workflow simplification is expanding market access to smaller laboratories and healthcare facilities. Cloud-based solutions are addressing data management challenges while enabling collaborative research and analysis capabilities across geographic boundaries.

Recent technological breakthroughs have significantly impacted the North America DNA sequencing market landscape. Next-generation sequencing platforms have achieved new performance benchmarks, with some systems capable of sequencing entire human genomes in under 24 hours. Advanced base-calling algorithms utilizing artificial intelligence have improved sequencing accuracy to over 99.9% for standard applications.

Regulatory milestones include FDA approvals for numerous genomic diagnostic tests and companion diagnostics, expanding clinical applications and market opportunities. MarkWide Research analysis indicates that regulatory approvals have accelerated by approximately 40% compared to previous years, reflecting improved understanding of genomic technologies among regulatory agencies.

Strategic partnerships and acquisitions have reshaped the competitive landscape, with major technology companies acquiring specialized genomics firms to expand capabilities and market reach. Investment activity in genomics startups has reached record levels, supporting innovation in emerging application areas including liquid biopsy, single-cell analysis, and agricultural genomics.

Clinical implementation milestones include the integration of genomic testing into routine healthcare workflows at major medical centers and the launch of population-scale genomic initiatives. International collaborations have expanded, with North American institutions leading global genomic research consortiums and data-sharing initiatives.

Strategic recommendations for market participants focus on leveraging emerging opportunities while addressing current market challenges. Technology companies should prioritize developing user-friendly platforms that reduce complexity and training requirements, making genomic technologies accessible to broader user bases. Investment in artificial intelligence and machine learning capabilities will be crucial for maintaining competitive advantage in data analysis and interpretation.

Healthcare organizations should develop comprehensive genomic strategies that include technology selection, workflow integration, and staff training programs. Partnership approaches with technology providers and service companies can help healthcare systems implement genomic capabilities without substantial capital investments. Focus on high-impact clinical applications such as oncology and rare diseases will maximize return on investment.

Pharmaceutical companies should expand genomic capabilities across drug development pipelines, from target identification through clinical trials and companion diagnostics development. Collaboration strategies with genomic technology companies and clinical laboratories can accelerate implementation and reduce costs. Investment in pharmacogenomics capabilities will become increasingly important for competitive positioning.

Investors should focus on companies developing innovative solutions for emerging applications such as liquid biopsy, single-cell analysis, and point-of-care sequencing. Market consolidation opportunities exist as the industry matures and companies seek to expand capabilities through strategic acquisitions.

Long-term market prospects for the North America DNA sequencing market remain highly positive, driven by continued technological advancement and expanding applications across multiple sectors. Technology evolution will focus on further cost reduction, improved accuracy, and enhanced user accessibility, with sequencing costs projected to decline by an additional 50% over the next five years.

Clinical integration will accelerate as healthcare systems recognize the value of genomic information in improving patient outcomes and reducing costs. Precision medicine adoption is expected to expand beyond oncology into cardiovascular disease, neurological disorders, and infectious diseases. Population health applications, including genomic screening programs, will create substantial new market opportunities.

Emerging technologies such as real-time sequencing, improved long-read platforms, and enhanced single-cell analysis capabilities will drive next-generation market growth. Artificial intelligence integration will continue advancing, with predictive analytics and automated interpretation becoming standard features of genomic platforms.

Market expansion into new application areas including environmental monitoring, food safety, and forensic analysis will diversify revenue streams and reduce dependence on traditional research and clinical markets. MWR projections indicate sustained growth momentum with the market maintaining robust expansion rates through the forecast period, supported by technological innovation and expanding clinical adoption.

The North America DNA sequencing market stands at a pivotal juncture, characterized by rapid technological advancement, expanding clinical applications, and growing recognition of genomic information’s value in healthcare and research. Market fundamentals remain strong, supported by declining costs, improving technology performance, and increasing adoption across diverse application areas.

Growth trajectory appears sustainable, driven by emerging applications in liquid biopsy, single-cell analysis, and precision medicine, while traditional research and pharmaceutical applications continue expanding. Technological innovation will remain crucial for market participants, with artificial intelligence integration, workflow automation, and user accessibility improvements defining competitive advantage.

Strategic positioning for success requires focus on emerging opportunities, investment in technology development, and building comprehensive genomic solutions that address evolving customer needs. The market’s evolution toward integrated platforms combining sequencing, analysis, and clinical interpretation capabilities will reshape competitive dynamics and create new value propositions for stakeholders across the genomic ecosystem.

What is DNA Sequencing?

DNA sequencing refers to the process of determining the precise order of nucleotides within a DNA molecule. It is a critical technology used in various fields such as genomics, personalized medicine, and biotechnology.

What are the key players in the North America DNA Sequencing Market?

Key players in the North America DNA Sequencing Market include Illumina, Thermo Fisher Scientific, and BGI Genomics, among others. These companies are known for their innovative sequencing technologies and extensive product offerings.

What are the main drivers of the North America DNA Sequencing Market?

The main drivers of the North America DNA Sequencing Market include the increasing prevalence of genetic disorders, advancements in sequencing technologies, and the growing demand for personalized medicine. These factors are contributing to the market’s expansion.

What challenges does the North America DNA Sequencing Market face?

The North America DNA Sequencing Market faces challenges such as high costs associated with sequencing technologies and ethical concerns regarding genetic data privacy. These issues can hinder market growth and adoption.

What opportunities exist in the North America DNA Sequencing Market?

Opportunities in the North America DNA Sequencing Market include the rising interest in genomics research and the potential for applications in agriculture and environmental science. These areas present avenues for growth and innovation.

What trends are shaping the North America DNA Sequencing Market?

Trends shaping the North America DNA Sequencing Market include the shift towards next-generation sequencing technologies and the integration of artificial intelligence in data analysis. These trends are enhancing the efficiency and accuracy of sequencing processes.

North America DNA Sequencing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Reagents, Instruments, Software, Consumables |

| Technology | Sanger Sequencing, Next-Generation Sequencing, Third-Generation Sequencing, Whole Genome Sequencing |

| End User | Research Institutes, Hospitals, Pharmaceutical Companies, Academic Laboratories |

| Application | Clinical Diagnostics, Drug Discovery, Genetic Research, Personalized Medicine |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America DNA Sequencing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at