444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America dietary supplement market represents one of the most dynamic and rapidly evolving sectors within the broader health and wellness industry. This comprehensive market encompasses a vast array of products designed to supplement daily nutritional intake, including vitamins, minerals, herbal extracts, amino acids, probiotics, and specialized nutritional formulations. Market dynamics indicate robust growth driven by increasing health consciousness, aging demographics, and evolving consumer preferences toward preventive healthcare approaches.

Regional market leadership positions North America as a global pioneer in dietary supplement innovation and consumption patterns. The market demonstrates remarkable diversity across product categories, distribution channels, and consumer segments, with growth rates consistently outpacing traditional pharmaceutical sectors. Consumer adoption has accelerated significantly, with penetration rates reaching 77% of adults regularly consuming dietary supplements across the United States and Canada.

Technological advancement continues reshaping product development, manufacturing processes, and delivery mechanisms within the dietary supplement landscape. The integration of personalized nutrition, advanced bioavailability enhancement technologies, and sustainable sourcing practices reflects the market’s commitment to meeting evolving consumer expectations while maintaining regulatory compliance and quality standards.

The North America dietary supplement market refers to the comprehensive ecosystem of nutritional products, manufacturing processes, distribution networks, and regulatory frameworks that facilitate the development, production, and commercialization of dietary supplements across the United States, Canada, and Mexico. This market encompasses products intended to supplement the diet and provide nutrients that may be missing or insufficient in regular food consumption.

Dietary supplements within this market context include vitamins, minerals, herbs, botanicals, amino acids, enzymes, probiotics, prebiotics, and other nutritional compounds available in various forms including tablets, capsules, powders, liquids, and functional foods. The market operates under specific regulatory guidelines established by agencies such as the FDA in the United States and Health Canada, ensuring product safety and quality standards.

Market scope extends beyond traditional retail channels to encompass e-commerce platforms, direct-to-consumer models, healthcare practitioner recommendations, and specialized nutrition programs. The definition includes both branded and private-label products, covering mass market and premium segments that serve diverse consumer demographics and health objectives.

Market performance in the North American dietary supplement sector demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer health awareness and preventive care approaches. The market exhibits strong momentum across multiple product categories, with vitamin and mineral supplements maintaining dominant market positions while emerging categories like probiotics and personalized nutrition solutions gain significant traction.

Consumer behavior analysis reveals increasing sophistication in supplement selection, with 68% of consumers actively researching ingredients and health benefits before making purchase decisions. This trend supports premium product positioning and drives innovation in formulation science, delivery mechanisms, and evidence-based marketing approaches that resonate with educated consumer segments.

Distribution channel evolution continues transforming market dynamics, with e-commerce platforms capturing 35% market share and demonstrating accelerated growth rates compared to traditional retail channels. The integration of omnichannel strategies, subscription models, and personalized recommendation systems enhances consumer accessibility while supporting brand differentiation and customer loyalty development.

Regulatory landscape maintains stability while evolving to address emerging product categories and manufacturing innovations. Industry compliance with Good Manufacturing Practices (GMP), third-party testing protocols, and transparent labeling requirements supports consumer confidence and market credibility, facilitating continued expansion and investment attraction.

Primary market drivers encompass demographic trends, lifestyle factors, and healthcare cost considerations that collectively support sustained market expansion. The following insights highlight critical success factors and growth opportunities:

Health consciousness elevation represents the fundamental driver propelling North American dietary supplement market expansion. Consumer awareness of nutrition’s role in overall wellness, disease prevention, and quality of life enhancement creates sustained demand for targeted nutritional interventions. This trend accelerates as healthcare costs continue rising, motivating individuals to invest in preventive health measures through dietary supplementation.

Demographic transformation significantly influences market dynamics, with aging baby boomer populations seeking supplements for age-related health concerns including bone health, cardiovascular support, and cognitive function maintenance. Simultaneously, younger demographics embrace supplements for fitness enhancement, stress management, and lifestyle optimization, creating diverse market segments with distinct product preferences and purchasing behaviors.

Scientific advancement in nutritional research provides credible evidence supporting supplement efficacy, enabling manufacturers to develop targeted formulations with documented health benefits. Clinical studies demonstrating positive outcomes for specific nutrients and botanical compounds strengthen consumer confidence while supporting premium pricing strategies for evidence-based products.

Healthcare system evolution toward integrative and functional medicine approaches encourages healthcare practitioners to recommend dietary supplements as complementary therapies. This professional endorsement enhances market credibility while expanding distribution channels through healthcare provider networks and specialized nutrition clinics.

Digital transformation facilitates consumer education, product discovery, and convenient purchasing through online platforms and mobile applications. Social media influence, health blogger recommendations, and peer reviews create powerful marketing channels that drive product awareness and trial among target consumer segments.

Regulatory complexity presents ongoing challenges for dietary supplement manufacturers navigating varying requirements across federal, state, and provincial jurisdictions. Compliance costs, documentation requirements, and evolving regulatory interpretations create barriers to entry for smaller companies while requiring significant resources for established market participants to maintain compliance across product portfolios.

Quality control concerns persist within certain market segments, with occasional product recalls and contamination issues affecting consumer confidence in supplement safety and efficacy. These incidents highlight the importance of robust quality assurance systems while creating opportunities for companies demonstrating superior manufacturing standards and third-party verification protocols.

Market saturation in traditional supplement categories creates intense competition and price pressure, particularly for commodity vitamins and minerals. This saturation forces companies to invest heavily in differentiation strategies, innovative formulations, and brand building initiatives to maintain market share and profitability in mature product segments.

Consumer skepticism regarding supplement claims and effectiveness remains a significant challenge, particularly among healthcare professionals and evidence-based medicine advocates. Overcoming this skepticism requires substantial investment in clinical research, transparent communication, and education initiatives that demonstrate genuine health benefits rather than marketing hyperbole.

Economic sensitivity affects discretionary spending on supplements during economic downturns, as consumers may prioritize essential expenses over wellness products. This cyclical vulnerability requires companies to develop value-oriented product lines and flexible pricing strategies that maintain accessibility across diverse economic conditions.

Personalized nutrition represents the most significant emerging opportunity within the North American dietary supplement market. Advanced technologies including genetic testing, microbiome analysis, and biomarker assessment enable customized supplement recommendations tailored to individual health profiles, creating premium pricing opportunities and enhanced customer loyalty through personalized health outcomes.

Functional food integration offers substantial growth potential as consumers seek convenient ways to incorporate nutritional supplements into daily routines. Fortified beverages, enhanced snack foods, and meal replacement products provide accessible supplement delivery mechanisms while expanding market reach beyond traditional pill and powder formats.

Digital health ecosystem integration creates opportunities for supplement companies to partner with health technology platforms, wearable device manufacturers, and telehealth providers. These partnerships enable data-driven supplement recommendations, adherence monitoring, and outcome tracking that enhance product value propositions and customer engagement levels.

Sustainable product development addresses growing environmental consciousness among consumers, creating opportunities for eco-friendly packaging innovations, carbon-neutral manufacturing processes, and sustainably sourced ingredients. Companies demonstrating genuine environmental commitment can command premium pricing while attracting environmentally conscious consumer segments.

International expansion within North America, particularly into underserved Canadian and Mexican markets, offers growth opportunities for established U.S. companies. Regulatory harmonization efforts and cross-border e-commerce capabilities facilitate market entry while leveraging existing product development and manufacturing investments.

Supply chain evolution continues reshaping the North American dietary supplement market through vertical integration strategies, direct sourcing relationships, and advanced manufacturing technologies. Companies investing in supply chain control achieve better quality consistency, cost management, and product differentiation capabilities while reducing dependency on third-party suppliers and contract manufacturers.

Consumer education initiatives play increasingly important roles in market development, with successful companies investing in content marketing, educational partnerships, and healthcare professional training programs. These initiatives build brand credibility while supporting informed consumer decision-making that drives premium product adoption and customer loyalty development.

Innovation cycles accelerate as companies compete through novel ingredient discoveries, enhanced bioavailability technologies, and improved delivery mechanisms. Research and development investments focus on clinically validated formulations that demonstrate measurable health outcomes, supporting evidence-based marketing claims and premium pricing strategies.

Competitive landscape dynamics shift toward consolidation among larger players while creating opportunities for specialized niche companies serving specific consumer segments. Strategic acquisitions, licensing agreements, and partnership formations enable market participants to expand product portfolios and distribution capabilities while leveraging complementary strengths and market positions.

Technology integration transforms manufacturing processes, quality control systems, and customer relationship management through automation, artificial intelligence, and data analytics applications. These technological advances improve operational efficiency while enabling personalized customer experiences and predictive market insights that support strategic decision-making.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into North American dietary supplement market dynamics. Primary research initiatives include consumer surveys, industry expert interviews, and healthcare professional consultations that provide firsthand perspectives on market trends, consumer preferences, and industry challenges.

Secondary research integration incorporates data from regulatory filings, industry publications, academic studies, and trade association reports to validate primary research findings while providing historical context and trend analysis. This multi-source approach ensures comprehensive market coverage and reduces potential bias from individual data sources.

Quantitative analysis utilizes statistical modeling, trend analysis, and forecasting techniques to project market growth patterns and identify emerging opportunities. Data validation processes include cross-referencing multiple sources and applying sensitivity analysis to ensure projection accuracy and reliability for strategic planning purposes.

Qualitative assessment examines market dynamics through competitive analysis, regulatory impact evaluation, and consumer behavior studies that provide context for quantitative findings. This approach enables deeper understanding of market forces and strategic implications that influence business decision-making and investment priorities.

Industry collaboration with leading market participants, regulatory agencies, and research institutions ensures access to current market intelligence and emerging trend identification. These collaborative relationships enhance research quality while providing insights into future market developments and strategic opportunities.

United States market dominance continues characterizing the North American dietary supplement landscape, with 82% regional market share reflecting established consumer adoption patterns, mature distribution infrastructure, and favorable regulatory frameworks. The U.S. market demonstrates sophisticated segmentation across demographic groups, product categories, and distribution channels that support diverse business models and competitive strategies.

Canadian market growth accelerates through increasing health consciousness, aging demographics, and expanding retail availability of dietary supplements. Regulatory harmonization with U.S. standards facilitates cross-border product development while unique Canadian preferences for natural health products create opportunities for specialized formulations and marketing approaches.

Mexican market emergence represents significant growth potential driven by expanding middle-class populations, increasing healthcare awareness, and improving retail infrastructure. Economic development and urbanization trends support dietary supplement adoption while creating opportunities for international companies seeking market entry and expansion strategies.

Cross-border dynamics influence market development through trade agreements, regulatory cooperation, and supply chain integration that facilitate efficient product distribution and market access. E-commerce platforms enable seamless cross-border transactions while regulatory alignment reduces compliance complexity for multi-national operations.

Regional specialization emerges as companies develop targeted strategies for specific geographic markets, incorporating local preferences, regulatory requirements, and distribution capabilities. This localization approach enhances market penetration while supporting sustainable competitive advantages in diverse regional environments.

Market leadership within the North American dietary supplement sector reflects diverse competitive strategies ranging from broad-portfolio approaches to specialized niche positioning. Leading companies demonstrate success through innovation capabilities, distribution excellence, and brand recognition that support premium pricing and customer loyalty development.

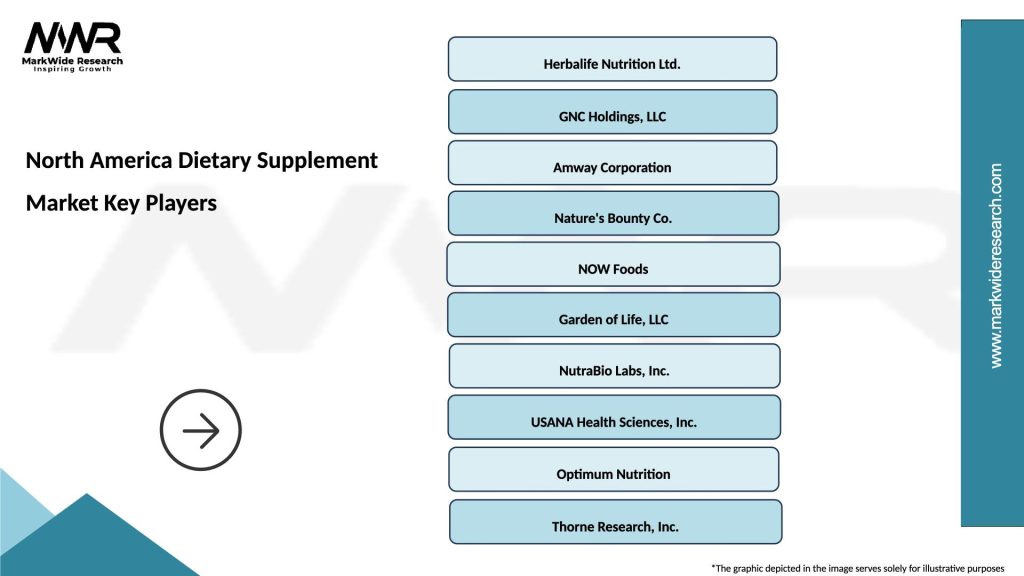

The competitive environment includes several key market participants:

Competitive differentiation strategies emphasize quality standards, scientific validation, innovative formulations, and customer service excellence that create sustainable competitive advantages. Companies investing in research and development, manufacturing capabilities, and brand building demonstrate superior market performance and growth potential.

Product category segmentation reveals diverse market opportunities across traditional and emerging supplement types. The market encompasses multiple distinct segments with unique growth characteristics and competitive dynamics:

By Product Type:

By Consumer Demographics:

By Distribution Channel:

Vitamin supplements maintain market leadership through established consumer familiarity and healthcare professional recommendations. Multivitamin formulations demonstrate consistent demand while specialized vitamin products targeting specific health concerns show accelerated growth. Innovation focuses on enhanced bioavailability, natural sourcing, and convenient delivery formats that improve consumer compliance and satisfaction.

Probiotic supplements represent the fastest-growing category with 12.4% annual growth rates driven by increasing awareness of gut health’s impact on overall wellness. Product development emphasizes strain diversity, stability improvements, and targeted formulations for specific health applications including digestive health, immune support, and mood regulation.

Sports nutrition products capture significant market share through expanding fitness culture and athletic participation across diverse demographic groups. Protein supplements, pre-workout formulations, and recovery products demonstrate strong growth while innovation focuses on clean ingredients, performance optimization, and convenience factors that support active lifestyles.

Herbal supplements benefit from growing interest in traditional medicine approaches and natural health solutions. Popular botanicals including turmeric, ashwagandha, and elderberry show strong consumer adoption while standardized extracts and clinically validated formulations support premium pricing and professional recommendations.

Specialty supplements targeting specific health conditions or demographic groups create niche market opportunities with higher margins and customer loyalty. Categories including cognitive health, joint support, and women’s health supplements demonstrate sustained growth through targeted marketing and evidence-based product development.

Manufacturers benefit from diverse revenue streams, premium pricing opportunities, and scalable business models that support sustainable growth and profitability. Investment in research and development, quality systems, and brand building creates competitive advantages while regulatory compliance ensures market access and consumer trust.

Retailers gain from high-margin product categories, repeat purchase patterns, and cross-selling opportunities that enhance overall store profitability. Dietary supplements drive customer traffic while complementing other health and wellness product categories through integrated merchandising strategies.

Consumers receive convenient access to nutritional support products that complement dietary intake and support health maintenance goals. Product variety, quality improvements, and competitive pricing provide value while educational resources enable informed decision-making and optimal product selection.

Healthcare professionals access evidence-based nutritional interventions that complement traditional medical treatments and support patient wellness goals. Professional-grade products and continuing education resources enhance treatment capabilities while patient outcomes improve through integrated healthcare approaches.

Investors find attractive growth opportunities in a market demonstrating resilience, innovation potential, and demographic tailwinds that support long-term value creation. Diverse investment options across market segments and company sizes provide portfolio diversification while regulatory stability reduces investment risks.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement transforms product development priorities as consumers increasingly demand transparent ingredient lists, natural sourcing, and minimal processing. This trend drives reformulation initiatives, supply chain transparency, and marketing communications that emphasize product purity and manufacturing integrity.

Personalization technology enables customized supplement recommendations through genetic testing, biomarker analysis, and lifestyle assessment tools. Companies investing in personalization capabilities achieve premium pricing while building stronger customer relationships through individualized health solutions and ongoing support services.

Sustainable packaging innovations address environmental concerns while differentiating products in competitive markets. Biodegradable materials, refillable containers, and carbon-neutral shipping options appeal to environmentally conscious consumers while supporting corporate sustainability initiatives and brand positioning strategies.

Functional food integration expands supplement delivery beyond traditional pills and powders through fortified beverages, enhanced snacks, and meal replacement products. This trend increases market accessibility while providing convenient consumption options that fit busy lifestyles and dietary preferences.

Digital health connectivity links supplement consumption with health monitoring devices, mobile applications, and telehealth platforms. Integration capabilities enable outcome tracking, adherence monitoring, and data-driven product recommendations that enhance customer value while supporting evidence-based health management approaches.

Professional channel expansion grows through healthcare practitioner partnerships, clinical integration programs, and professional-grade product lines. This trend enhances market credibility while creating premium distribution channels that support higher margins and evidence-based product positioning strategies.

Regulatory evolution continues shaping industry practices through updated Good Manufacturing Practice guidelines, enhanced labeling requirements, and strengthened quality control standards. Recent developments include improved adverse event reporting systems and increased FDA inspection activities that support consumer safety while raising industry compliance standards.

Technology advancement accelerates through artificial intelligence applications in product development, manufacturing optimization, and customer service enhancement. Machine learning algorithms improve formulation science while predictive analytics support inventory management and demand forecasting that enhance operational efficiency and customer satisfaction.

Strategic partnerships increase between supplement companies and healthcare organizations, technology platforms, and research institutions. These collaborations enable clinical validation studies, product development acceleration, and market access expansion while sharing development costs and regulatory expertise across partnership networks.

Manufacturing innovation focuses on continuous improvement processes, automation integration, and quality system enhancement that reduce costs while improving product consistency. Advanced manufacturing technologies enable smaller batch sizes, faster product development cycles, and customized formulation capabilities that support market differentiation strategies.

Market consolidation activities include strategic acquisitions, licensing agreements, and joint venture formations that enable portfolio expansion and market share growth. Consolidation trends create opportunities for specialized companies while challenging smaller players to develop unique value propositions and niche market positioning strategies.

Investment priorities should focus on companies demonstrating strong quality systems, innovation capabilities, and brand recognition that support sustainable competitive advantages. MarkWide Research analysis indicates that companies investing in clinical validation, manufacturing excellence, and customer education achieve superior market performance and growth sustainability.

Market entry strategies require careful consideration of regulatory requirements, competitive positioning, and distribution channel access that determine success probability. New market participants should prioritize niche segments with unmet consumer needs while building quality systems and regulatory compliance capabilities that support long-term market presence.

Product development focus should emphasize evidence-based formulations, enhanced bioavailability, and convenient delivery formats that address specific consumer needs and preferences. Innovation investments in personalization technology, sustainable packaging, and digital integration capabilities create differentiation opportunities while supporting premium pricing strategies.

Distribution optimization requires omnichannel strategies that integrate traditional retail, e-commerce platforms, and direct-to-consumer models. Companies should invest in digital marketing capabilities, customer relationship management systems, and fulfillment infrastructure that support seamless customer experiences across multiple touchpoints.

Regulatory compliance remains critical for market success, requiring ongoing investment in quality systems, documentation processes, and regulatory expertise. Companies should prioritize third-party certifications, clinical validation studies, and transparent communication strategies that build consumer trust while supporting marketing claims and professional recommendations.

Market expansion continues through demographic trends, health consciousness growth, and technological advancement that support sustained demand for dietary supplements. MWR projections indicate continued growth momentum with 6.8% compound annual growth rates expected through the next five-year period, driven by aging populations and preventive healthcare adoption.

Innovation acceleration will focus on personalized nutrition solutions, enhanced bioavailability technologies, and sustainable product development that address evolving consumer preferences. Companies investing in research and development capabilities, clinical validation studies, and technology integration will achieve competitive advantages in premium market segments.

Digital transformation will reshape customer relationships through personalized recommendations, adherence monitoring, and outcome tracking that enhance product value propositions. E-commerce growth, mobile application development, and health technology integration will create new business models while improving customer engagement and retention rates.

Regulatory evolution may include enhanced quality standards, improved labeling requirements, and strengthened safety monitoring that support consumer protection while raising industry compliance costs. Companies with robust quality systems and regulatory expertise will benefit from increased consumer confidence and competitive differentiation opportunities.

Market consolidation will continue through strategic acquisitions and partnership formations that enable portfolio expansion and operational efficiency improvements. Successful companies will balance growth investments with profitability maintenance while building sustainable competitive advantages through innovation, quality, and customer service excellence.

The North America dietary supplement market represents a dynamic and rapidly evolving sector with substantial growth potential driven by demographic trends, health consciousness, and technological advancement. Market participants benefit from diverse opportunities across product categories, distribution channels, and consumer segments while navigating regulatory requirements and competitive pressures that shape industry dynamics.

Success factors include quality excellence, innovation capabilities, regulatory compliance, and customer-centric strategies that build brand recognition and consumer trust. Companies investing in research and development, manufacturing capabilities, and digital transformation initiatives position themselves for sustained growth while contributing to overall market development and consumer health outcomes.

Future prospects remain positive as market fundamentals support continued expansion through aging demographics, preventive healthcare adoption, and personalized nutrition trends. Strategic focus on evidence-based products, sustainable practices, and technology integration will enable market participants to capitalize on emerging opportunities while building resilient business models that thrive in evolving market conditions.

What is Dietary Supplement?

Dietary supplements are products intended to supplement the diet, containing vitamins, minerals, herbs, amino acids, and other substances. They are available in various forms, including tablets, capsules, powders, and liquids.

What are the key players in the North America Dietary Supplement Market?

Key players in the North America Dietary Supplement Market include companies like Herbalife Nutrition Ltd., Amway Corporation, and GNC Holdings, among others. These companies are known for their diverse product offerings and strong market presence.

What are the main drivers of growth in the North America Dietary Supplement Market?

The main drivers of growth in the North America Dietary Supplement Market include increasing health consciousness among consumers, a rising trend towards preventive healthcare, and the growing popularity of fitness and wellness products.

What challenges does the North America Dietary Supplement Market face?

The North America Dietary Supplement Market faces challenges such as regulatory scrutiny, potential safety concerns regarding ingredient quality, and competition from unregulated products. These factors can impact consumer trust and market dynamics.

What opportunities exist in the North America Dietary Supplement Market?

Opportunities in the North America Dietary Supplement Market include the expansion of e-commerce platforms, increasing demand for plant-based supplements, and innovations in product formulations that cater to specific health needs.

What trends are shaping the North America Dietary Supplement Market?

Trends shaping the North America Dietary Supplement Market include a growing focus on personalized nutrition, the rise of clean label products, and the integration of technology in supplement delivery methods, such as smart supplements and apps.

North America Dietary Supplement Market

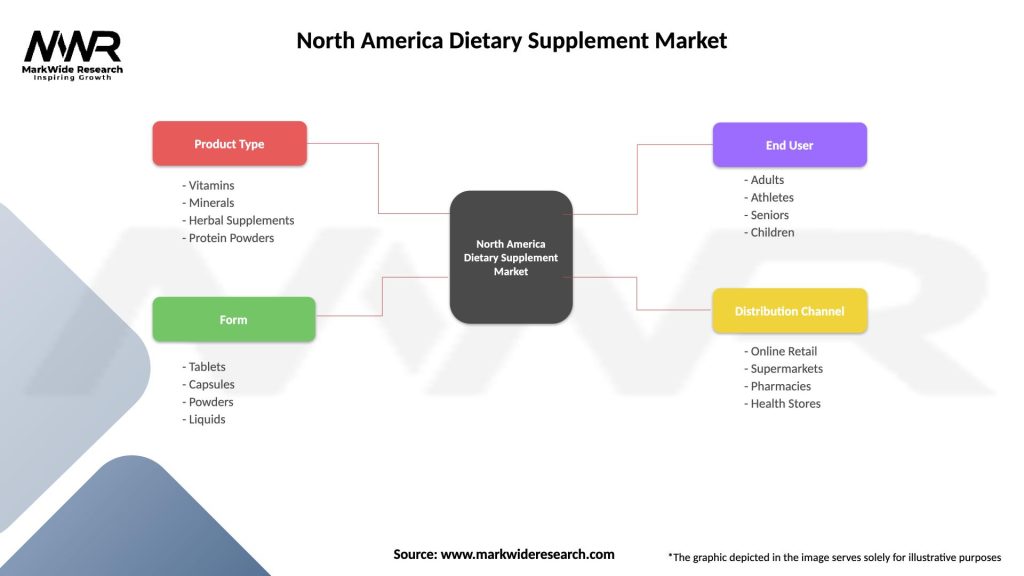

| Segmentation Details | Description |

|---|---|

| Product Type | Vitamins, Minerals, Herbal Supplements, Protein Powders |

| Form | Tablets, Capsules, Powders, Liquids |

| End User | Adults, Athletes, Seniors, Children |

| Distribution Channel | Online Retail, Supermarkets, Pharmacies, Health Stores |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Dietary Supplement Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at