444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America deodorant market represents one of the most dynamic and competitive segments within the personal care industry, characterized by continuous innovation and evolving consumer preferences. This market encompasses a diverse range of products including antiperspirants, deodorants, and combination formulations designed to address odor control and sweat protection needs across various demographics. Market dynamics indicate robust growth driven by increasing health consciousness, rising disposable incomes, and growing awareness of personal hygiene standards throughout the United States, Canada, and Mexico.

Consumer behavior patterns reveal significant shifts toward premium and natural formulations, with organic and aluminum-free products experiencing accelerated adoption rates of approximately 12.5% annually. The market demonstrates strong segmentation across gender lines, age groups, and lifestyle preferences, with millennials and Gen Z consumers driving demand for sustainable packaging and clean-label ingredients. Distribution channels have evolved substantially, with e-commerce platforms capturing increasing market share alongside traditional retail outlets including supermarkets, drugstores, and specialty beauty retailers.

Innovation trends continue to reshape the competitive landscape, with manufacturers investing heavily in advanced formulation technologies, extended-wear capabilities, and skin-friendly ingredients. The market benefits from strong brand loyalty while simultaneously experiencing disruption from emerging direct-to-consumer brands and private label alternatives. Regional variations across North America reflect diverse climate conditions, cultural preferences, and regulatory environments that influence product development and marketing strategies.

The North America deodorant market refers to the comprehensive ecosystem of personal care products specifically designed to prevent or mask body odor while providing varying degrees of antiperspirant protection across the United States, Canada, and Mexico. This market encompasses traditional stick deodorants, roll-on applications, spray formulations, and innovative delivery systems including gels, creams, and crystal-based alternatives.

Product categories within this market include antiperspirants containing aluminum-based active ingredients that temporarily block sweat ducts, pure deodorants that neutralize odor-causing bacteria without preventing perspiration, and combination products offering dual functionality. The market also includes specialized segments such as clinical-strength formulations, natural and organic alternatives, and gender-specific products tailored to distinct consumer needs and preferences.

Market scope extends beyond basic odor control to encompass skin care benefits, fragrance experiences, and lifestyle alignment with consumer values including sustainability, health consciousness, and ethical sourcing. Modern deodorant products increasingly incorporate moisturizing agents, skin-soothing compounds, and probiotic ingredients that support natural skin microbiome balance while delivering effective protection throughout daily activities.

Market performance across North America demonstrates consistent expansion driven by demographic shifts, lifestyle changes, and continuous product innovation within the personal care sector. The deodorant market benefits from essential product positioning, creating stable demand patterns while accommodating premium positioning opportunities for brands offering enhanced benefits and superior user experiences.

Key growth drivers include increasing urbanization rates, rising temperatures due to climate change, growing fitness and wellness trends, and expanding working populations requiring reliable all-day protection. Consumer preferences increasingly favor products offering 24-hour protection with approximately 78% of users prioritizing long-lasting effectiveness over price considerations. The market also responds positively to clean beauty trends, with natural and organic formulations representing the fastest-growing segment.

Competitive dynamics feature established multinational corporations competing alongside innovative startup brands, creating a diverse marketplace that serves varied consumer segments from budget-conscious shoppers to premium beauty enthusiasts. Distribution evolution continues expanding through digital channels, subscription services, and direct-to-consumer models that complement traditional retail partnerships and enhance brand accessibility across geographic regions.

Future prospects remain optimistic with projected growth supported by population increases, rising disposable incomes, and continuous innovation in formulation technologies and packaging solutions. The market demonstrates resilience against economic fluctuations due to essential product classification while maintaining capacity for premium growth through value-added offerings and enhanced consumer experiences.

Consumer research reveals fundamental shifts in purchasing behavior and product expectations that significantly impact market dynamics across North America. Modern consumers demonstrate increased sophistication in ingredient awareness, seeking products that align with personal health philosophies and environmental values while maintaining superior performance standards.

Demographic trends serve as primary catalysts for sustained market growth, with expanding urban populations, increasing workforce participation, and rising health consciousness creating favorable conditions for deodorant market expansion. The growing emphasis on personal grooming and professional appearance standards drives consistent product demand across diverse consumer segments.

Climate considerations significantly influence market dynamics, with rising average temperatures and increased humidity levels across North American regions creating greater need for effective antiperspirant and deodorant protection. Fitness culture expansion contributes substantially to market growth, with approximately 42% of adults engaging in regular exercise activities requiring specialized odor and sweat protection solutions.

Innovation acceleration continues driving market expansion through advanced formulation technologies, improved delivery systems, and enhanced user experiences that justify premium pricing and encourage brand loyalty. E-commerce growth facilitates market access and enables direct consumer relationships that support brand building and customer retention strategies.

Health awareness trends create opportunities for products positioned as safer alternatives to traditional formulations, with natural and organic segments experiencing accelerated growth rates. Social media influence amplifies brand awareness and product discovery, particularly among younger demographics who rely on digital platforms for personal care recommendations and reviews.

Regulatory challenges present ongoing obstacles for market participants, with evolving safety standards and ingredient restrictions requiring continuous reformulation efforts and compliance investments. The FDA oversight of antiperspirant active ingredients creates uncertainty around future formulation options and may limit innovation possibilities for certain product categories.

Health concerns surrounding aluminum-based antiperspirants continue generating consumer skepticism despite scientific evidence supporting product safety, creating market headwinds for traditional formulations while benefiting natural alternatives. Skin sensitivity issues affect significant consumer populations, limiting market penetration for certain formulation types and requiring specialized product development approaches.

Economic pressures influence consumer spending patterns during challenging economic periods, with deodorant purchases potentially shifting toward lower-priced alternatives or reduced purchase frequencies. Private label competition intensifies price pressure on branded products, particularly in mass market retail channels where cost-conscious consumers seek value alternatives.

Supply chain disruptions impact raw material availability and manufacturing costs, affecting product pricing and profit margins across the industry. Environmental regulations regarding packaging materials and aerosol propellants create compliance costs and may require significant reformulation investments for affected product categories.

Emerging demographics present substantial growth opportunities, with Gen Z consumers entering peak earning years and demonstrating willingness to invest in premium personal care products that align with their values and lifestyle preferences. This demographic shows strong preference for brands demonstrating social responsibility and environmental consciousness.

Natural formulation expansion offers significant market potential, with consumers increasingly seeking aluminum-free, paraben-free, and organic alternatives that deliver comparable performance to traditional products. Probiotic integration represents an innovative frontier, with formulations supporting healthy skin microbiome gaining consumer interest and scientific validation.

Personalization trends create opportunities for customized formulations based on individual skin types, activity levels, and fragrance preferences. Subscription model adoption enables recurring revenue streams and enhanced customer lifetime value through convenient delivery services and personalized product recommendations.

International expansion within North America, particularly in underserved rural markets and growing Hispanic populations, offers geographic growth opportunities. Technology integration including smart packaging, app connectivity, and IoT capabilities could differentiate premium product offerings and enhance user engagement.

Competitive intensity continues escalating as established brands face challenges from innovative startups and direct-to-consumer companies that leverage digital marketing and unique value propositions to capture market share. This dynamic environment encourages continuous innovation and forces traditional players to adapt their strategies and product offerings.

Consumer empowerment through digital platforms and social media creates more informed purchasing decisions and higher expectations for product performance, ingredient transparency, and brand authenticity. MarkWide Research analysis indicates that consumer reviews and social proof significantly influence purchase decisions, with approximately 73% of buyers consulting online reviews before trying new deodorant products.

Supply chain evolution toward more sustainable and efficient operations reflects both cost optimization needs and environmental responsibility commitments. Retail transformation continues reshaping distribution strategies, with omnichannel approaches becoming essential for reaching diverse consumer segments across multiple touchpoints.

Innovation cycles accelerate as brands compete to introduce breakthrough formulations, packaging innovations, and enhanced user experiences that justify premium positioning and drive brand differentiation. Regulatory adaptation requires ongoing investment in compliance and safety testing while creating opportunities for companies that successfully navigate changing requirements.

Comprehensive analysis of the North America deodorant market employs multiple research methodologies to ensure accurate and actionable insights for industry stakeholders. The research framework combines quantitative data collection with qualitative analysis to provide holistic market understanding and strategic recommendations.

Primary research involves extensive consumer surveys, focus groups, and in-depth interviews with key industry participants including manufacturers, retailers, and distribution partners. Consumer behavior analysis examines purchasing patterns, brand preferences, and decision-making factors across diverse demographic segments and geographic regions.

Secondary research incorporates industry reports, regulatory filings, company financial statements, and trade publication analysis to validate primary findings and provide comprehensive market context. Market modeling utilizes statistical analysis and forecasting techniques to project future trends and identify emerging opportunities.

Competitive intelligence gathering includes product analysis, pricing studies, marketing strategy evaluation, and innovation tracking across major market participants. Distribution channel analysis examines retail trends, e-commerce growth patterns, and emerging sales channels that influence market dynamics and consumer accessibility.

United States market dominates North American deodorant consumption, representing approximately 85% of regional demand driven by large population base, high disposable incomes, and sophisticated consumer preferences. The U.S. market demonstrates strong segmentation across premium and mass market categories, with coastal regions showing higher adoption rates for natural and organic formulations.

Canadian market dynamics reflect similar trends to the United States but with greater emphasis on cold-weather formulations and bilingual packaging requirements. Climate variations across Canadian provinces influence seasonal demand patterns and product positioning strategies, with winter formulations requiring different performance characteristics than summer products.

Mexican market growth accelerates driven by expanding middle class, increasing urbanization, and growing awareness of personal hygiene standards. Cultural preferences in Mexico favor stronger fragrances and longer-lasting protection, creating opportunities for specialized product formulations and marketing approaches.

Regional distribution patterns vary significantly, with the United States showing strong e-commerce adoption while Mexico maintains higher reliance on traditional retail channels. Cross-border trade influences pricing strategies and product availability, particularly in border regions where consumers have access to products from multiple countries.

Market leadership remains concentrated among several multinational corporations that leverage extensive distribution networks, substantial marketing budgets, and established brand recognition to maintain competitive advantages. These industry leaders continue investing in innovation and acquisition strategies to defend market positions and expand product portfolios.

Emerging competitors include numerous startup brands focusing on specific market niches such as aluminum-free formulations, sustainable packaging, or specialized performance characteristics. These companies often leverage digital marketing and direct-to-consumer sales models to compete effectively against established players.

Product type segmentation reveals distinct market dynamics across different formulation categories, with each segment serving specific consumer needs and preferences. Antiperspirants containing aluminum-based active ingredients continue dominating market share due to superior sweat protection capabilities, while deodorant-only products gain traction among health-conscious consumers seeking aluminum-free alternatives.

By Application Method:

By Gender Targeting:

By Distribution Channel:

Antiperspirant category maintains market dominance through superior sweat protection capabilities, with clinical-strength formulations representing the highest-value segment. Consumer loyalty in this category remains strong due to performance requirements and the inconvenience of product switching for individuals with specific protection needs.

Natural deodorant segment experiences the fastest growth rates, driven by health consciousness and ingredient transparency demands. MWR data indicates this segment grows at approximately 15.2% annually, significantly outpacing traditional formulations despite higher price points and initial adjustment periods required for consumer adaptation.

Men’s deodorant category shows robust performance driven by expanding product variety, sophisticated fragrance options, and sports-performance positioning. Premium men’s products demonstrate particular strength as male consumers increasingly invest in personal care and grooming products.

Women’s deodorant innovations focus on skin care integration, with products incorporating moisturizing agents, brightening compounds, and anti-aging ingredients. Feminine hygiene integration creates cross-category opportunities for brands seeking to expand their personal care portfolios.

Teen and young adult segments drive demand for trendy packaging, social media-friendly brands, and products that align with environmental and social values. This demographic shows willingness to pay premium prices for brands that demonstrate authenticity and social responsibility.

Manufacturers benefit from stable demand patterns and opportunities for premium positioning through innovation and brand building. The essential nature of deodorant products provides recession-resistant characteristics while allowing for value-added formulations that command higher margins and strengthen consumer loyalty.

Retailers gain from high-frequency purchase patterns and strong category performance that drives store traffic and basket building opportunities. Cross-merchandising potential with related personal care products creates additional revenue streams and enhances customer shopping experiences.

Consumers receive expanding product choices that address diverse needs, preferences, and lifestyle requirements. Innovation benefits include improved formulations, enhanced performance characteristics, and products that align with personal values regarding health, sustainability, and social responsibility.

Investors find attractive opportunities in a market characterized by consistent demand, innovation potential, and demographic tailwinds supporting long-term growth. Private equity interest in emerging natural brands demonstrates the sector’s investment appeal and consolidation potential.

Supply chain partners benefit from stable volume requirements and opportunities to support innovation through specialized ingredients, packaging solutions, and distribution services. Sustainability initiatives create new business opportunities for suppliers offering eco-friendly alternatives and circular economy solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean beauty movement continues reshaping consumer expectations and product development priorities, with brands increasingly focusing on ingredient transparency, natural formulations, and sustainable sourcing practices. This trend drives innovation in aluminum-free antiperspirants and plant-based active ingredients that deliver comparable performance to traditional formulations.

Personalization trends gain momentum as consumers seek products tailored to their specific needs, skin types, and lifestyle requirements. Customization services offered by emerging brands allow consumers to select fragrance profiles, strength levels, and ingredient preferences, creating enhanced user experiences and brand loyalty.

Sustainability focus influences packaging design, ingredient sourcing, and manufacturing processes as environmentally conscious consumers prioritize brands demonstrating genuine environmental commitment. Refillable packaging systems and biodegradable formulations represent growing market segments with strong consumer appeal.

Gender-neutral products reflect changing social attitudes and lifestyle preferences, particularly among younger demographics who prefer unisex formulations and packaging. This trend creates opportunities for brands to simplify product lines while appealing to broader consumer bases.

Technology integration emerges through smart packaging, app connectivity, and IoT capabilities that enhance user engagement and provide valuable consumer insights. Digital health tracking integration allows products to connect with fitness and wellness ecosystems, creating additional value propositions.

Acquisition activity intensifies as established companies seek to expand their portfolios with innovative brands and natural product offerings. Recent acquisitions include major corporations purchasing successful direct-to-consumer brands to access new consumer segments and distribution capabilities.

Formulation breakthroughs in aluminum-free antiperspirants address the primary weakness of natural deodorants by providing enhanced sweat protection without traditional active ingredients. Probiotic integration represents another significant development, with formulations supporting healthy skin microbiome gaining scientific validation and consumer acceptance.

Packaging innovations focus on sustainability and user convenience, with brands introducing refillable systems, biodegradable materials, and travel-friendly formats. Smart packaging technologies enable consumer engagement through QR codes, NFC chips, and augmented reality experiences that enhance brand interaction.

Regulatory developments include ongoing FDA review of antiperspirant active ingredients and potential changes to safety requirements. International harmonization efforts may influence North American regulations and create opportunities for global product standardization.

Distribution evolution continues with e-commerce platforms gaining market share and subscription services becoming mainstream options for consumer convenience. Direct-to-consumer models enable brands to build closer customer relationships and gather valuable consumer insights for product development.

Innovation investment should prioritize natural formulation development and aluminum-free antiperspirant technologies that address consumer health concerns while maintaining performance standards. Companies investing in these areas position themselves advantageously for long-term market growth and consumer preference shifts.

Digital transformation initiatives require immediate attention as e-commerce and direct-to-consumer channels continue gaining importance. Omnichannel strategies that seamlessly integrate online and offline experiences become essential for reaching diverse consumer segments and maintaining competitive relevance.

Sustainability integration should extend beyond marketing claims to encompass genuine environmental improvements in packaging, sourcing, and manufacturing processes. Circular economy principles offer opportunities for differentiation and appeal to environmentally conscious consumers willing to pay premium prices for responsible products.

Consumer education programs can address misconceptions about product safety and ingredients while building brand trust and loyalty. Transparency initiatives that clearly communicate ingredient benefits and safety profiles help consumers make informed decisions and reduce skepticism.

Partnership strategies with complementary brands, retailers, and technology companies can accelerate market access and innovation development. Strategic alliances enable resource sharing and risk mitigation while expanding market reach and capabilities.

Market prospects remain highly favorable with projected growth supported by demographic trends, lifestyle changes, and continuous innovation opportunities. The essential nature of deodorant products provides stability while premium positioning potential offers margin expansion possibilities for companies successfully executing differentiation strategies.

Natural product adoption will continue accelerating, with MarkWide Research projecting aluminum-free formulations to capture approximately 35% market share within the next five years. This shift requires significant investment in research and development but offers substantial rewards for companies achieving breakthrough formulations that match traditional antiperspirant performance.

Digital commerce integration becomes increasingly critical as younger consumers mature and e-commerce platforms enhance their personal care offerings. Subscription model adoption is expected to grow at 22% annually, creating recurring revenue opportunities and enhanced customer lifetime value for participating brands.

Personalization trends will drive demand for customizable products and services, with technology enabling mass customization at reasonable cost points. AI-powered recommendations and consumer data analytics will enhance product development and marketing effectiveness while improving customer satisfaction.

Sustainability requirements will intensify as regulatory pressure and consumer expectations continue evolving. Companies investing early in sustainable practices and circular economy solutions will benefit from first-mover advantages and enhanced brand reputation among environmentally conscious consumers.

North America deodorant market demonstrates robust fundamentals and promising growth prospects driven by essential product positioning, demographic tailwinds, and continuous innovation opportunities. The market successfully balances stability through consistent demand patterns with growth potential through premium positioning and emerging consumer trends.

Strategic success in this market requires balancing traditional performance expectations with evolving consumer preferences for natural ingredients, sustainable practices, and personalized experiences. Companies that effectively navigate these dynamics while maintaining product efficacy and competitive pricing will capture disproportionate market share and profitability.

Innovation leadership becomes increasingly important as competition intensifies and consumer expectations continue rising. Investment in natural formulation technologies, sustainable packaging solutions, and digital commerce capabilities represents essential strategic priorities for long-term market success and competitive differentiation.

Future market leaders will emerge from companies that successfully combine product excellence with brand authenticity, consumer engagement, and operational efficiency. The convergence of health consciousness, environmental awareness, and digital transformation creates unprecedented opportunities for brands that align their strategies with these fundamental market forces driving the North America deodorant market forward.

What is Deodorant?

Deodorant refers to a substance applied to the body to mask or eliminate body odor caused by bacterial growth. It is commonly used in personal care routines and comes in various forms such as sprays, sticks, and gels.

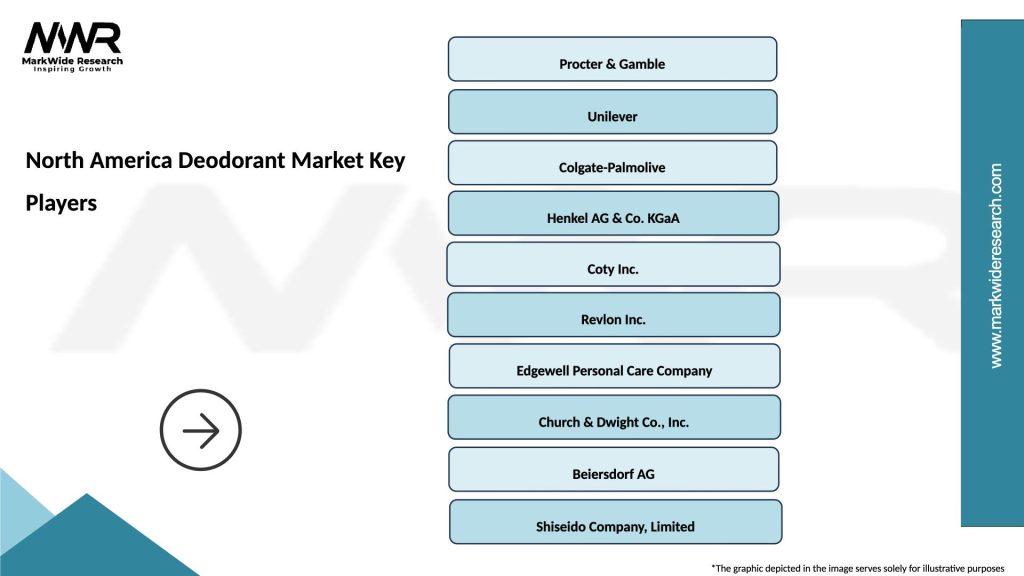

What are the key players in the North America Deodorant Market?

Key players in the North America Deodorant Market include Procter & Gamble, Unilever, Colgate-Palmolive, and Henkel, among others. These companies are known for their diverse product offerings and strong brand presence in the deodorant segment.

What are the growth factors driving the North America Deodorant Market?

The North America Deodorant Market is driven by increasing consumer awareness of personal hygiene, the rising demand for natural and organic products, and innovative product launches. Additionally, changing lifestyle trends and the influence of social media on grooming habits contribute to market growth.

What challenges does the North America Deodorant Market face?

The North America Deodorant Market faces challenges such as intense competition among brands, regulatory compliance regarding ingredient safety, and shifting consumer preferences towards sustainable products. These factors can impact market dynamics and brand loyalty.

What opportunities exist in the North America Deodorant Market?

Opportunities in the North America Deodorant Market include the growing trend of eco-friendly packaging, the expansion of men’s grooming products, and the increasing popularity of personalized deodorant solutions. Brands that innovate in these areas may capture a larger market share.

What trends are shaping the North America Deodorant Market?

Trends shaping the North America Deodorant Market include the rise of natural and organic formulations, the introduction of multifunctional products, and the use of technology in product development. Consumers are increasingly seeking products that align with their health and environmental values.

North America Deodorant Market

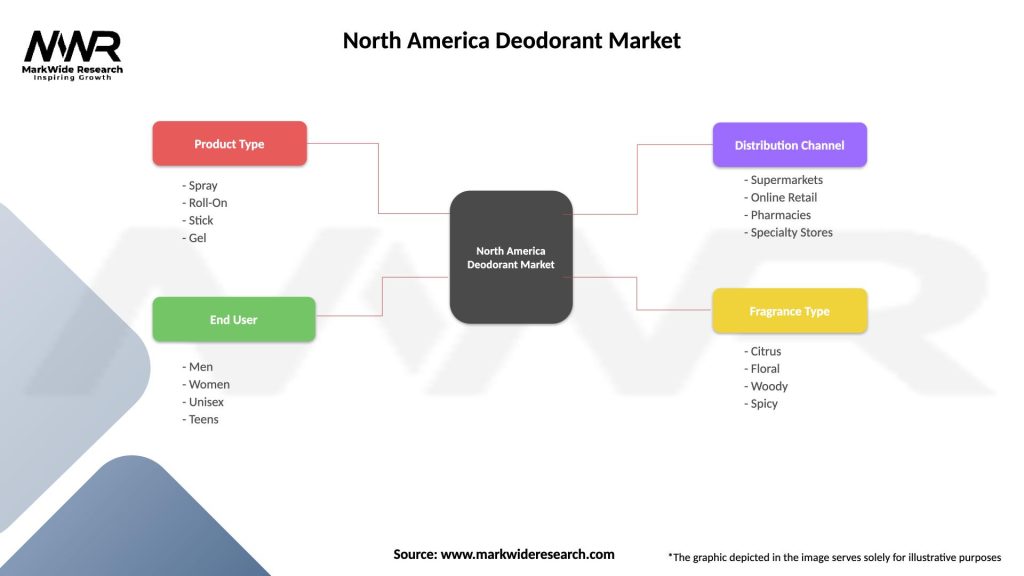

| Segmentation Details | Description |

|---|---|

| Product Type | Spray, Roll-On, Stick, Gel |

| End User | Men, Women, Unisex, Teens |

| Distribution Channel | Supermarkets, Online Retail, Pharmacies, Specialty Stores |

| Fragrance Type | Citrus, Floral, Woody, Spicy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Deodorant Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at