444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America dairy market represents one of the most established and dynamic food sectors in the region, encompassing a comprehensive range of products from traditional milk and cheese to innovative plant-based alternatives. Market dynamics indicate robust growth driven by evolving consumer preferences, technological advancements in dairy processing, and increasing demand for premium dairy products across the United States and Canada.

Regional consumption patterns demonstrate significant diversity, with the United States accounting for approximately 85% of regional dairy consumption while Canada maintains a strong domestic market presence. The sector benefits from advanced agricultural infrastructure, sophisticated supply chain networks, and established distribution channels that efficiently connect dairy producers with consumers across urban and rural markets.

Innovation trends are reshaping the traditional dairy landscape, with manufacturers investing heavily in sustainable production methods, enhanced nutritional profiles, and extended shelf-life technologies. The market experiences consistent growth at a CAGR of 3.2%, supported by steady population growth, rising disposable incomes, and increasing awareness of dairy products’ nutritional benefits.

Product diversification continues to expand market opportunities, with specialty cheeses, organic dairy products, and functional dairy beverages gaining significant traction among health-conscious consumers. The integration of advanced processing technologies and quality assurance systems ensures product safety and consistency while meeting stringent regulatory requirements across both countries.

The North America dairy market refers to the comprehensive ecosystem of dairy product manufacturing, processing, distribution, and consumption across the United States and Canada, encompassing traditional dairy products, value-added dairy items, and emerging dairy alternatives that serve diverse consumer segments and applications.

Market scope includes fluid milk products, cheese varieties, butter and spreads, yogurt and fermented products, ice cream and frozen desserts, dairy-based beverages, and specialty dairy ingredients used in food manufacturing. The sector operates through integrated supply chains connecting dairy farms, processing facilities, distribution networks, and retail channels.

Industry participants range from large-scale commercial dairy operations and multinational food corporations to regional processors, specialty cheese makers, and artisanal dairy producers. The market serves multiple end-use segments including direct consumer consumption, food service operations, industrial food manufacturing, and export markets.

Technological integration encompasses modern dairy farming practices, advanced processing equipment, cold chain logistics, packaging innovations, and quality control systems that ensure product safety, extend shelf life, and maintain nutritional integrity throughout the supply chain.

Market performance in the North American dairy sector demonstrates resilient growth patterns supported by stable demand fundamentals, technological innovation, and strategic market expansion initiatives. The industry benefits from favorable demographic trends, including population growth and increasing urbanization, which drive consistent consumption patterns across key product categories.

Consumer behavior analysis reveals shifting preferences toward premium dairy products, organic offerings, and functional dairy beverages that provide enhanced nutritional benefits. Approximately 42% of consumers actively seek dairy products with added health benefits, creating opportunities for product innovation and market differentiation.

Supply chain optimization remains a critical success factor, with leading companies investing in advanced logistics capabilities, sustainable packaging solutions, and direct-to-consumer distribution channels. The integration of digital technologies enhances inventory management, demand forecasting, and customer engagement across multiple touchpoints.

Competitive dynamics feature established market leaders maintaining strong positions through brand recognition, distribution networks, and product innovation, while emerging players focus on niche segments, premium positioning, and sustainable production practices to capture market share.

Strategic market insights reveal several critical trends shaping the North American dairy landscape:

Market segmentation analysis indicates that cheese products represent the largest category by volume, followed by fluid milk products and yogurt varieties. Innovation cycles typically span 18-24 months, allowing manufacturers to respond effectively to changing consumer preferences and market conditions.

Population demographics serve as fundamental market drivers, with steady population growth across North America creating consistent demand for dairy products. The region’s aging population increasingly values dairy products for their calcium content and bone health benefits, while younger demographics drive demand for convenient, portable dairy options.

Health and wellness trends significantly influence market expansion, as consumers increasingly recognize dairy products’ nutritional value, including high-quality protein, essential vitamins, and minerals. Nutritional awareness campaigns and healthcare professional recommendations support sustained consumption growth across multiple product categories.

Economic prosperity enables consumers to purchase premium dairy products, organic options, and specialty items that command higher price points. Rising disposable incomes correlate directly with increased consumption of value-added dairy products and artisanal offerings that provide enhanced taste experiences and perceived quality benefits.

Technological advancements in dairy processing, packaging, and preservation extend product shelf life, improve nutritional retention, and enable new product development. Innovation capabilities allow manufacturers to create differentiated products that meet specific consumer needs while maintaining cost-effective production processes.

Food service industry growth creates substantial demand for dairy ingredients and products used in restaurants, cafes, and institutional food service operations. The expanding food service sector drives bulk dairy product consumption and specialized ingredient applications.

Lactose intolerance prevalence affects approximately 25% of the North American population, creating natural consumption limitations for traditional dairy products. This demographic constraint requires manufacturers to develop lactose-free alternatives and educate consumers about available options that maintain dairy’s nutritional benefits.

Plant-based competition presents increasing challenges as alternative milk products, cheese substitutes, and dairy-free options gain market acceptance. Consumer experimentation with plant-based alternatives can reduce traditional dairy consumption, particularly among environmentally conscious and health-focused demographic segments.

Regulatory compliance costs impose significant operational expenses related to food safety standards, environmental regulations, and animal welfare requirements. Compliance complexity increases administrative burdens and requires ongoing investment in monitoring systems, documentation processes, and facility upgrades.

Supply chain vulnerabilities include weather-related disruptions, feed cost fluctuations, and transportation challenges that can impact product availability and pricing stability. Operational risks require sophisticated risk management strategies and contingency planning to maintain consistent market supply.

Price sensitivity among certain consumer segments limits premium product adoption and creates pressure for competitive pricing strategies. Economic downturns can shift consumer preferences toward lower-priced alternatives and reduce consumption of higher-margin specialty dairy products.

Product innovation opportunities abound in functional dairy products that combine traditional dairy benefits with additional health advantages such as probiotics, omega-3 fatty acids, and enhanced protein content. Functional food trends create substantial market potential for dairy products positioned as health and wellness solutions.

Export market expansion offers significant growth potential as North American dairy producers leverage quality reputations and production capabilities to serve international markets. Global demand for high-quality dairy products continues growing, particularly in emerging economies with expanding middle-class populations.

Sustainable production initiatives create competitive advantages and appeal to environmentally conscious consumers willing to pay premium prices for responsibly produced dairy products. Sustainability positioning can differentiate brands and build long-term customer loyalty while supporting environmental stewardship goals.

Direct-to-consumer channels enable dairy producers to capture higher margins, build direct customer relationships, and respond quickly to market feedback. Digital commerce platforms expand market reach beyond traditional geographic limitations and enable personalized customer experiences.

Specialty market segments including artisanal cheeses, grass-fed dairy products, and locally sourced options provide opportunities for premium positioning and higher profit margins. Niche market development allows smaller producers to compete effectively against larger competitors through differentiation strategies.

Supply and demand equilibrium in the North American dairy market reflects complex interactions between production capacity, consumer preferences, seasonal variations, and economic conditions. Market stability benefits from established production systems, predictable consumption patterns, and effective inventory management practices across the supply chain.

Price dynamics respond to multiple factors including feed costs, energy prices, labor availability, and regulatory changes that impact production expenses. Pricing strategies must balance profitability requirements with competitive positioning and consumer affordability considerations across diverse market segments.

Seasonal fluctuations influence both production volumes and consumption patterns, with ice cream and frozen dessert sales peaking during summer months while hot dairy beverages experience higher demand during colder seasons. Inventory management systems accommodate these predictable variations while maintaining product freshness and quality.

Competitive intensity varies across product categories, with commodity dairy products experiencing price-based competition while specialty and premium products compete on quality, brand reputation, and unique value propositions. Market positioning strategies must address specific competitive dynamics within each product segment.

Innovation cycles drive continuous product development and market evolution, with successful innovations often inspiring competitive responses and market-wide adoption of new product concepts. Technology adoption rates vary among market participants based on resources, strategic priorities, and customer demands.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, dairy producers, distributors, and retail partners to gather firsthand perspectives on market conditions, trends, and future expectations.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial disclosures to establish market baselines and validate primary research findings. Data triangulation techniques ensure consistency and accuracy across multiple information sources.

Quantitative analysis utilizes statistical modeling to identify market trends, growth patterns, and correlation relationships between various market factors. Market sizing methodologies combine top-down and bottom-up approaches to develop comprehensive market assessments and growth projections.

Qualitative research explores consumer behavior patterns, purchase decision factors, and brand perception through focus groups, consumer surveys, and observational studies. Behavioral insights inform understanding of market dynamics and future growth opportunities.

Expert validation processes involve industry specialists reviewing research findings to ensure accuracy, relevance, and practical applicability. Peer review mechanisms maintain research quality standards and enhance credibility of market analysis conclusions.

United States market dominates regional dairy consumption and production, accounting for approximately 85% of North American dairy market activity. Geographic distribution shows concentrated production in traditional dairy states including Wisconsin, California, New York, and Pennsylvania, while consumption patterns reflect population density and demographic characteristics across all states.

California leadership in dairy production stems from favorable climate conditions, advanced farming technologies, and proximity to major population centers. Production efficiency in California exceeds national averages through scale advantages, technological adoption, and integrated supply chain management.

Canadian market characteristics include strong domestic consumption, supply management systems, and quality-focused production standards. Regional preferences in Canada favor locally produced dairy products and support for domestic dairy farming communities through consumer loyalty and government policies.

Cross-border trade between the United States and Canada involves specialized dairy products, seasonal supply adjustments, and complementary production capabilities. Trade relationships benefit both countries through access to diverse product offerings and supply chain optimization opportunities.

Regional growth patterns indicate stronger expansion in southern and western United States markets driven by population migration, economic development, and changing demographic compositions. Market penetration strategies must adapt to regional preferences, distribution capabilities, and competitive landscapes.

Market leadership in the North American dairy sector features several dominant players with comprehensive product portfolios and extensive distribution networks:

Competitive strategies emphasize brand differentiation, product innovation, supply chain efficiency, and customer relationship management. Market share distribution shows fragmented competition with opportunities for both large-scale operators and specialized niche players to succeed through distinct positioning strategies.

Strategic partnerships between dairy producers, retailers, and food service companies create competitive advantages through improved market access, cost efficiencies, and collaborative innovation initiatives. Vertical integration strategies enable some companies to control multiple supply chain stages and capture additional value.

Product-based segmentation reveals distinct market categories with unique characteristics and growth patterns:

By Product Type:

By Distribution Channel:

Geographic segmentation considers regional preferences, distribution capabilities, and market development opportunities across different areas of North America. Demographic segmentation addresses varying consumption patterns among different age groups, income levels, and lifestyle preferences.

Cheese category dominance reflects strong consumer preference for variety, convenience, and culinary applications. Artisanal cheese growth demonstrates consumer willingness to pay premium prices for unique flavors, traditional production methods, and local sourcing. The category benefits from approximately 6.2% annual growth in specialty cheese segments.

Yogurt market evolution shows significant innovation in flavors, textures, and functional benefits including probiotics and protein enhancement. Greek yogurt popularity continues driving category expansion while plant-based yogurt alternatives create new competitive dynamics and consumer choice options.

Fluid milk challenges include declining per-capita consumption offset by population growth and premium product development. Organic milk growth maintains strong momentum with health-conscious consumers seeking natural and sustainably produced options despite higher price points.

Ice cream premiumization trends favor high-quality ingredients, unique flavors, and artisanal production methods. Seasonal consumption patterns require sophisticated inventory management and marketing strategies to optimize sales throughout the year while maintaining product quality and availability.

Butter market stability reflects consistent demand from both consumer and commercial applications. Specialty butter varieties including grass-fed, cultured, and flavored options create opportunities for differentiation and premium positioning in competitive markets.

Dairy producers benefit from stable demand patterns, established distribution networks, and opportunities for value-added product development. Scale advantages enable efficient production while technological innovations improve productivity, product quality, and operational sustainability.

Retailers gain from dairy products’ essential nature, frequent purchase patterns, and ability to drive store traffic. Category management strategies optimize shelf space allocation, inventory turnover, and profit margins while meeting diverse consumer preferences and seasonal demand variations.

Consumers receive nutritional benefits, product variety, convenience, and quality assurance from established dairy industry standards. Innovation benefits include enhanced flavors, improved nutritional profiles, and specialized products addressing specific dietary needs and health objectives.

Food service operators access reliable ingredient supplies, consistent quality standards, and specialized products designed for commercial applications. Menu development opportunities leverage dairy ingredients’ versatility and consumer familiarity to create appealing and profitable food offerings.

Economic stakeholders including rural communities, transportation companies, and equipment manufacturers benefit from dairy industry’s economic multiplier effects. Employment opportunities span multiple skill levels and geographic areas while supporting rural economic development and agricultural sustainability.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization trends drive consumer preference for high-quality, artisanal, and specialty dairy products that offer superior taste experiences and perceived value. Quality positioning enables manufacturers to command higher price points while building brand loyalty and market differentiation in competitive segments.

Sustainability focus influences production methods, packaging choices, and supply chain practices as consumers increasingly consider environmental impact in purchase decisions. Eco-friendly initiatives create competitive advantages and appeal to environmentally conscious consumer segments willing to support responsible business practices.

Health and wellness integration expands beyond basic nutrition to include functional benefits such as probiotics, protein enhancement, and reduced sugar content. Functional dairy products capture growing consumer interest in foods that provide specific health benefits beyond traditional nutritional value.

Convenience innovation addresses busy lifestyles through portable packaging, extended shelf life, and ready-to-consume formats that fit modern consumption patterns. On-the-go products serve active consumers seeking nutritious options that accommodate demanding schedules and mobile lifestyles.

Local sourcing preferences support regional dairy producers and create opportunities for community-based marketing strategies. Authenticity positioning resonates with consumers seeking connections to local agriculture and traditional production methods while supporting regional economic development.

Technology adoption accelerates across dairy operations with advanced automation, precision agriculture, and data analytics improving efficiency and product quality. Digital transformation enables better inventory management, predictive maintenance, and customer relationship management while reducing operational costs and improving responsiveness.

Sustainable packaging innovations address environmental concerns through recyclable materials, reduced packaging waste, and biodegradable options. Packaging evolution balances environmental responsibility with product protection requirements and consumer convenience expectations while maintaining cost effectiveness.

Product line extensions expand traditional dairy categories through flavor innovations, nutritional enhancements, and format variations. Innovation pipelines focus on meeting emerging consumer needs while leveraging existing brand equity and distribution capabilities to maximize market impact.

Strategic partnerships between dairy companies, retailers, and technology providers create synergies and competitive advantages. Collaboration initiatives enable resource sharing, risk mitigation, and accelerated innovation while expanding market reach and operational capabilities.

Regulatory adaptations respond to changing food safety standards, labeling requirements, and environmental regulations. Compliance strategies ensure continued market access while maintaining operational efficiency and cost competitiveness in evolving regulatory environments.

MarkWide Research analysis indicates that dairy companies should prioritize innovation in functional products while maintaining strong positions in traditional categories. Strategic recommendations emphasize balanced portfolio approaches that serve both mainstream and specialty market segments through differentiated product offerings and targeted marketing strategies.

Investment priorities should focus on sustainable production technologies, supply chain optimization, and digital commerce capabilities that enhance operational efficiency and customer engagement. Technology adoption rates suggest significant opportunities for companies that successfully integrate advanced systems into existing operations.

Market expansion strategies should consider both geographic diversification and product category extensions that leverage existing capabilities and brand equity. Growth opportunities exist in premium segments, export markets, and direct-to-consumer channels that offer higher margins and stronger customer relationships.

Risk management approaches must address supply chain vulnerabilities, regulatory compliance requirements, and competitive pressures from alternative products. Diversification strategies can reduce dependence on single product categories while building resilience against market fluctuations and external disruptions.

Partnership opportunities with retailers, food service operators, and technology providers can accelerate growth while sharing risks and resources. Collaborative strategies enable access to new markets, capabilities, and customer segments that might be difficult to reach independently.

Long-term growth prospects for the North American dairy market remain positive, supported by demographic trends, innovation capabilities, and expanding application opportunities. Market evolution will likely favor companies that successfully balance traditional strengths with emerging consumer preferences and technological capabilities.

Consumer behavior trends suggest continued demand for premium products, sustainable production methods, and functional benefits that address specific health and wellness objectives. Demographic shifts including aging populations and increasing health consciousness will influence product development priorities and marketing strategies.

Technology integration will accelerate across all aspects of dairy operations, from farm-level production through consumer delivery. Digital transformation opportunities include precision agriculture, automated processing, predictive analytics, and enhanced customer engagement through multiple touchpoints and channels.

Sustainability requirements will become increasingly important for market success as consumers, regulators, and stakeholders demand environmental responsibility. Green initiatives will likely transition from competitive advantages to market entry requirements, making early adoption crucial for long-term viability.

Market consolidation trends may continue as companies seek scale advantages, operational efficiencies, and expanded capabilities through mergers and acquisitions. Industry structure evolution will likely feature fewer but larger players alongside specialized niche companies serving specific market segments with unique value propositions.

North America dairy market demonstrates remarkable resilience and adaptability in responding to changing consumer preferences, technological innovations, and competitive challenges. The sector’s established infrastructure, strong brand recognition, and nutritional value proposition provide solid foundations for continued growth and market development.

Strategic success factors include innovation capabilities, supply chain efficiency, sustainability initiatives, and customer relationship management that address evolving market demands. Companies that effectively balance traditional strengths with emerging opportunities will likely achieve superior performance and market positioning.

Future market dynamics will reward organizations that invest in technology adoption, product innovation, and sustainable practices while maintaining operational excellence and customer focus. The integration of digital technologies, sustainable production methods, and premium product development creates multiple pathways for growth and differentiation.

Industry participants must navigate complex challenges including regulatory compliance, competitive pressures, and changing consumer preferences while capitalizing on opportunities in premium segments, export markets, and functional product categories. Strategic agility and continuous adaptation will be essential for long-term success in this dynamic and evolving market environment.

What is Dairy?

Dairy refers to products made from the milk of mammals, primarily cows, goats, and sheep. This includes a variety of items such as milk, cheese, yogurt, and butter, which are integral to many diets and cuisines.

What are the key players in the North America Dairy Market?

Key players in the North America Dairy Market include Dairy Farmers of America, Land O’Lakes, and Dean Foods, among others. These companies are involved in various aspects of dairy production, processing, and distribution.

What are the main drivers of growth in the North America Dairy Market?

The North America Dairy Market is driven by increasing consumer demand for dairy products, the rise in health consciousness promoting dairy’s nutritional benefits, and innovations in dairy processing technologies.

What challenges does the North America Dairy Market face?

The North America Dairy Market faces challenges such as fluctuating milk prices, stringent regulations regarding food safety, and competition from plant-based alternatives that are gaining popularity among consumers.

What opportunities exist in the North America Dairy Market?

Opportunities in the North America Dairy Market include the growing trend of organic and specialty dairy products, expansion into emerging markets, and the potential for product diversification to cater to changing consumer preferences.

What trends are shaping the North America Dairy Market?

Trends in the North America Dairy Market include the increasing popularity of lactose-free and plant-based dairy alternatives, advancements in sustainable farming practices, and a focus on health-oriented dairy products that cater to specific dietary needs.

North America Dairy Market

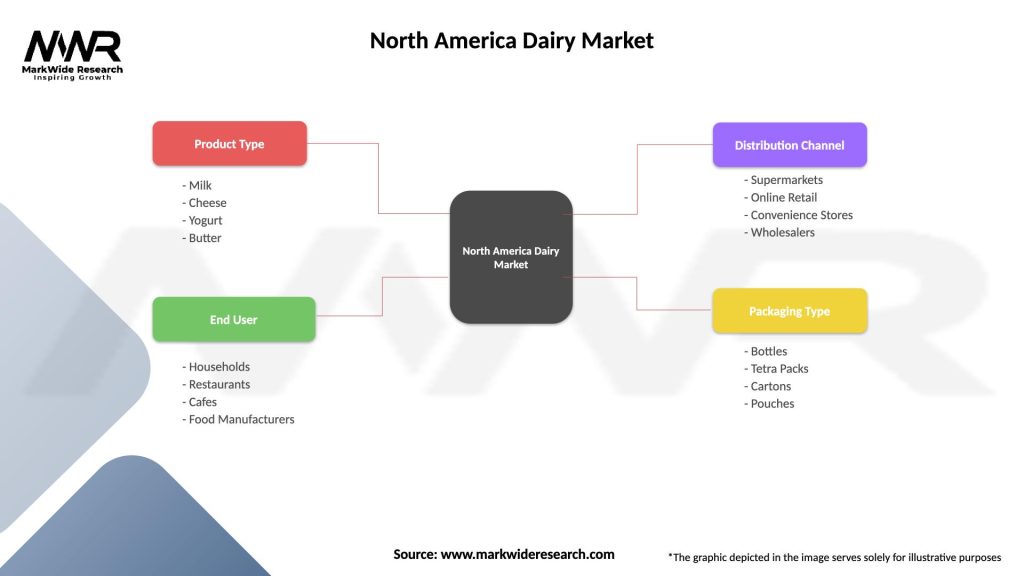

| Segmentation Details | Description |

|---|---|

| Product Type | Milk, Cheese, Yogurt, Butter |

| End User | Households, Restaurants, Cafes, Food Manufacturers |

| Distribution Channel | Supermarkets, Online Retail, Convenience Stores, Wholesalers |

| Packaging Type | Bottles, Tetra Packs, Cartons, Pouches |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Dairy Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at