444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America cyber security for cars market represents a rapidly evolving sector driven by the increasing digitization of automotive systems and growing concerns about vehicle cybersecurity threats. As modern vehicles become increasingly connected through advanced infotainment systems, autonomous driving capabilities, and vehicle-to-everything (V2X) communication technologies, the need for robust cybersecurity solutions has become paramount. The market encompasses a comprehensive range of security technologies, software solutions, and services designed to protect connected and autonomous vehicles from cyber attacks, data breaches, and unauthorized access attempts.

Market dynamics indicate substantial growth potential, with the sector experiencing a compound annual growth rate (CAGR) of 18.5% as automotive manufacturers and technology providers prioritize cybersecurity investments. The increasing adoption of electric vehicles, advanced driver assistance systems (ADAS), and over-the-air (OTA) update capabilities has created new attack vectors that require sophisticated security measures. North American automotive manufacturers are investing heavily in cybersecurity infrastructure to comply with emerging regulatory requirements and maintain consumer trust in connected vehicle technologies.

Regional market leadership is evident through the presence of major automotive OEMs, technology companies, and cybersecurity specialists across the United States and Canada. The market benefits from strong collaboration between traditional automotive manufacturers, technology giants, and specialized cybersecurity firms, creating a robust ecosystem for innovation and development. Government initiatives and regulatory frameworks are also driving market expansion, with federal agencies establishing cybersecurity standards and guidelines for connected vehicle deployments.

The North America cyber security for cars market refers to the comprehensive ecosystem of technologies, solutions, and services designed to protect connected and autonomous vehicles from cybersecurity threats throughout the automotive value chain. This market encompasses hardware-based security modules, software-based protection systems, cloud security platforms, and professional services that collectively safeguard vehicle systems, data, and communications from malicious attacks, unauthorized access, and privacy breaches.

Cybersecurity for cars involves multiple layers of protection including secure boot processes, encrypted communication protocols, intrusion detection systems, and continuous monitoring capabilities. The market addresses security requirements across various vehicle domains including powertrain systems, infotainment platforms, telematics units, and autonomous driving sensors. Modern automotive cybersecurity solutions must protect against diverse threat vectors including remote hacking attempts, malware infections, data theft, and physical tampering while maintaining vehicle performance and user experience standards.

Market expansion in North America’s automotive cybersecurity sector is driven by the convergence of several critical factors including increasing vehicle connectivity, regulatory compliance requirements, and growing consumer awareness of cybersecurity risks. The market has witnessed significant investment from both established automotive manufacturers and emerging technology companies, creating a competitive landscape focused on innovation and comprehensive security solutions.

Key growth drivers include the rapid adoption of connected car technologies, with 78% of new vehicles now featuring some form of internet connectivity. The proliferation of autonomous driving technologies and electric vehicle platforms has created new security challenges that require specialized solutions. Regulatory pressure from government agencies and industry standards organizations is compelling automotive manufacturers to implement robust cybersecurity frameworks throughout their product development and deployment processes.

Technology advancement continues to shape market evolution, with artificial intelligence and machine learning capabilities being integrated into cybersecurity solutions to enable real-time threat detection and response. The market is characterized by strategic partnerships between automotive OEMs, tier-1 suppliers, and cybersecurity specialists, fostering innovation and accelerating solution deployment across vehicle platforms.

Strategic market insights reveal several critical trends shaping the North American automotive cybersecurity landscape:

Market maturation is evident through the establishment of industry consortiums, standardization efforts, and collaborative research initiatives focused on addressing common cybersecurity challenges across the automotive ecosystem.

Primary market drivers propelling growth in the North American automotive cybersecurity sector include the exponential increase in vehicle connectivity and the corresponding expansion of potential cyber attack vectors. Modern vehicles contain numerous electronic control units (ECUs) and communication interfaces that create multiple entry points for malicious actors. Connected car adoption has reached critical mass, with manufacturers integrating advanced infotainment systems, telematics platforms, and cloud-based services that require comprehensive security protection.

Regulatory mandates represent another significant driver, as government agencies establish cybersecurity requirements for connected and autonomous vehicles. Federal regulations are requiring automotive manufacturers to implement security-by-design principles, conduct regular vulnerability assessments, and maintain incident response capabilities. Consumer awareness of cybersecurity risks has increased substantially, with vehicle buyers increasingly considering security features as important purchasing criteria.

Autonomous driving development is creating unprecedented security requirements, as self-driving vehicles rely on complex sensor arrays, AI processing systems, and real-time communication networks that must be protected from interference and manipulation. The integration of vehicle-to-everything (V2X) communication technologies is expanding the attack surface while simultaneously creating new opportunities for security solution providers. Electric vehicle adoption is also driving cybersecurity demand, as EV charging infrastructure and battery management systems require specialized security measures.

Significant market restraints include the high cost of implementing comprehensive cybersecurity solutions across vehicle platforms, particularly for smaller automotive manufacturers with limited resources. The complexity of modern vehicle architectures makes it challenging to implement security measures without impacting system performance or user experience. Legacy system integration presents ongoing challenges, as many existing vehicle platforms were not designed with cybersecurity as a primary consideration.

Skill shortage in automotive cybersecurity expertise represents a critical constraint, with limited availability of professionals who understand both automotive systems and advanced cybersecurity technologies. The rapid pace of technological change makes it difficult for organizations to maintain current security capabilities while adapting to emerging threats. Standardization challenges across different automotive manufacturers and technology platforms create fragmentation that can limit the effectiveness of security solutions.

Consumer resistance to additional costs associated with cybersecurity features can limit market adoption, particularly in price-sensitive vehicle segments. The perception that cybersecurity measures may compromise vehicle performance or user convenience creates additional barriers to widespread implementation. Regulatory uncertainty in some areas can slow investment decisions and delay solution deployment timelines.

Substantial market opportunities exist in the development of integrated security platforms that can address multiple vehicle domains through unified management interfaces. The growing adoption of software-defined vehicles creates opportunities for cybersecurity solutions that can adapt and evolve through over-the-air updates. Artificial intelligence integration presents significant potential for developing predictive security capabilities that can identify and mitigate threats before they impact vehicle operations.

Cloud-based security services offer scalable opportunities for providing centralized threat intelligence, incident response, and security management capabilities across large vehicle fleets. The expansion of connected vehicle ecosystems creates opportunities for comprehensive security solutions that protect not only individual vehicles but entire transportation networks. Blockchain technology applications in automotive cybersecurity present opportunities for secure identity management, transaction verification, and supply chain integrity.

International expansion opportunities exist as North American cybersecurity companies leverage their expertise to serve global automotive markets. The development of industry-specific security standards and certification programs creates opportunities for specialized service providers. Partnership opportunities between traditional automotive suppliers and cybersecurity specialists can accelerate innovation and market penetration across diverse vehicle platforms.

Market dynamics in the North American automotive cybersecurity sector are characterized by rapid technological evolution, increasing regulatory pressure, and growing collaboration between traditionally separate industries. The convergence of automotive, technology, and cybersecurity sectors is creating new competitive dynamics and business models. Innovation cycles are accelerating as companies race to develop solutions that can address emerging threats while maintaining compatibility with existing vehicle architectures.

Competitive intensity is increasing as both established cybersecurity companies and automotive technology specialists enter the market. The need for specialized automotive expertise is creating barriers to entry while simultaneously driving consolidation and partnership activities. Customer requirements are evolving rapidly, with automotive manufacturers seeking comprehensive security solutions that can scale across their entire product portfolios.

Technology integration challenges are driving demand for solutions that can seamlessly integrate with existing vehicle systems while providing robust security capabilities. The shift toward software-defined vehicles is changing traditional automotive development processes and creating new opportunities for cybersecurity integration. Supply chain dynamics are becoming increasingly important as security requirements extend throughout the automotive ecosystem from component suppliers to software developers and service providers.

Comprehensive research methodology employed in analyzing the North American automotive cybersecurity market includes primary research through extensive interviews with industry executives, technology specialists, and regulatory experts across the automotive and cybersecurity sectors. Primary data collection encompasses automotive manufacturers, tier-1 suppliers, cybersecurity solution providers, and government agencies involved in automotive security regulation and standards development.

Secondary research incorporates analysis of industry reports, regulatory documents, patent filings, and academic research related to automotive cybersecurity technologies and market trends. Market sizing and forecasting methodologies utilize multiple data sources and validation techniques to ensure accuracy and reliability. Quantitative analysis includes statistical modeling of market growth patterns, technology adoption rates, and competitive dynamics across different market segments.

Qualitative research focuses on understanding market drivers, barriers, and emerging opportunities through detailed stakeholder interviews and expert consultations. The research methodology incorporates continuous monitoring of regulatory developments, technology announcements, and market activities to maintain current market intelligence. Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market projections.

United States market dominance is evident through the presence of major automotive manufacturers, technology companies, and cybersecurity specialists concentrated in key automotive hubs including Detroit, Silicon Valley, and Austin. The U.S. market benefits from substantial government investment in connected vehicle research and development, with federal agencies providing funding for cybersecurity innovation projects. Regulatory leadership from agencies such as NHTSA and the Department of Transportation is driving cybersecurity standard development and implementation requirements.

California’s influence on automotive cybersecurity is particularly significant, with the state’s autonomous vehicle testing programs and environmental regulations driving innovation in connected and electric vehicle security solutions. The concentration of technology companies in Silicon Valley creates a robust ecosystem for automotive cybersecurity development. Market share distribution shows the United States accounting for approximately 85% of North American automotive cybersecurity investments.

Canadian market participation is growing through government initiatives supporting connected vehicle development and cybersecurity research. Canadian automotive manufacturers and technology companies are increasingly collaborating with U.S. counterparts on cybersecurity solution development. Cross-border collaboration is evident through joint research projects, shared regulatory frameworks, and integrated supply chain security initiatives that span both countries.

Market leadership is distributed among several categories of companies including established cybersecurity firms, automotive technology suppliers, and specialized automotive security providers. The competitive landscape is characterized by strategic partnerships, acquisitions, and joint ventures as companies seek to combine automotive expertise with advanced cybersecurity capabilities.

Key market participants include:

Competitive strategies focus on developing comprehensive security platforms that can address multiple vehicle domains while maintaining compatibility with existing automotive architectures. Companies are investing heavily in research and development to stay ahead of emerging threats and regulatory requirements.

Market segmentation analysis reveals distinct categories based on technology type, application area, vehicle type, and deployment model. Each segment presents unique characteristics, growth patterns, and competitive dynamics that influence overall market development.

By Technology Type:

By Application Area:

By Vehicle Type:

Hardware security modules represent the fastest-growing segment, with adoption rates increasing by 22% annually as automotive manufacturers implement hardware-based root of trust capabilities. These solutions provide tamper-resistant security processing and secure key management essential for protecting critical vehicle systems. Integration challenges remain significant as manufacturers work to incorporate hardware security modules into existing vehicle architectures without impacting performance or cost targets.

Software-based security solutions dominate current market deployment due to their flexibility and ability to address multiple security requirements through unified platforms. The segment benefits from rapid development cycles and the ability to update security capabilities through over-the-air mechanisms. Cloud integration is becoming increasingly important as software security solutions leverage centralized threat intelligence and management capabilities.

Autonomous vehicle security represents the highest-growth potential category, with specialized solutions required to protect complex sensor arrays, AI processing systems, and real-time decision-making capabilities. The segment faces unique challenges related to ensuring security without compromising the real-time performance requirements of autonomous driving systems. Regulatory focus on autonomous vehicle security is driving significant investment and innovation in this category.

Commercial vehicle applications are experiencing rapid growth as fleet operators recognize the importance of cybersecurity for protecting valuable cargo, ensuring driver safety, and maintaining operational efficiency. The segment benefits from centralized management capabilities that can provide security oversight across large vehicle fleets. Insurance integration is emerging as fleet operators seek cybersecurity solutions that can reduce insurance costs and liability exposure.

Automotive manufacturers benefit from comprehensive cybersecurity solutions that enable them to meet regulatory requirements while protecting their brand reputation and customer trust. Implementation of robust security measures helps manufacturers differentiate their products in competitive markets and reduce liability exposure related to cyber incidents. Cost optimization is achieved through integrated security platforms that can address multiple vehicle domains through unified management interfaces.

Technology suppliers gain access to new revenue opportunities through the development of specialized automotive cybersecurity solutions and services. The market provides opportunities for suppliers to establish long-term partnerships with automotive manufacturers and expand their presence in the growing connected vehicle ecosystem. Innovation acceleration results from collaboration between automotive and cybersecurity expertise.

Fleet operators benefit from enhanced operational security, reduced downtime, and improved asset protection through comprehensive cybersecurity implementations. Security solutions enable fleet operators to maintain customer confidence while protecting sensitive cargo and operational data. Insurance benefits include reduced premiums and liability exposure through demonstrated cybersecurity capabilities.

Consumers gain increased confidence in connected vehicle technologies through robust security implementations that protect personal data and ensure safe vehicle operation. Enhanced security capabilities enable consumers to take advantage of advanced connected car features without compromising privacy or safety. Long-term value is preserved through security solutions that protect vehicle functionality and data integrity throughout the ownership lifecycle.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration is transforming automotive cybersecurity through the development of predictive threat detection capabilities and automated response systems. AI-powered solutions can analyze vast amounts of vehicle data to identify anomalous behavior patterns and potential security threats in real-time. Machine learning algorithms are being trained on automotive-specific threat data to improve detection accuracy and reduce false positive rates.

Zero-trust architecture adoption is increasing as automotive manufacturers implement security models that verify every device, user, and communication before granting access to vehicle systems. This approach provides comprehensive protection against both external attacks and insider threats. Identity management capabilities are becoming increasingly sophisticated to support zero-trust implementations across complex vehicle architectures.

Quantum-resistant cryptography development is gaining momentum as the automotive industry prepares for future quantum computing threats that could compromise current encryption methods. Early adoption of quantum-resistant security measures is becoming a competitive advantage for forward-thinking automotive manufacturers. Standardization efforts are underway to ensure interoperability of quantum-resistant security solutions across different vehicle platforms.

Blockchain integration is emerging as a solution for secure vehicle identity management, supply chain verification, and transaction processing. Blockchain technology provides tamper-resistant record keeping and decentralized security capabilities that complement traditional cybersecurity measures. Smart contract applications are being developed for automated security policy enforcement and incident response procedures.

Strategic partnerships between major automotive manufacturers and cybersecurity specialists are accelerating solution development and deployment. Recent collaborations include joint research initiatives, technology licensing agreements, and integrated product development programs. Acquisition activity has increased as companies seek to combine automotive expertise with advanced cybersecurity capabilities through strategic purchases and mergers.

Regulatory milestone achievements include the establishment of federal cybersecurity standards for connected vehicles and the implementation of mandatory security testing requirements. Government agencies are working closely with industry stakeholders to develop practical and effective security frameworks. International cooperation is expanding through bilateral agreements and multilateral initiatives focused on automotive cybersecurity standardization.

Technology breakthrough announcements include the development of new hardware security architectures, advanced threat detection algorithms, and integrated security platforms. Companies are investing heavily in research and development to maintain competitive advantages in rapidly evolving markets. Patent activity has increased significantly as companies seek to protect their automotive cybersecurity innovations and technologies.

Market expansion initiatives include the launch of new cybersecurity services, the establishment of dedicated automotive security divisions, and the development of specialized training programs. Companies are building comprehensive capabilities to address the full spectrum of automotive cybersecurity requirements. MarkWide Research analysis indicates that 65% of automotive manufacturers have established dedicated cybersecurity teams within the past two years.

Strategic recommendations for automotive manufacturers include prioritizing cybersecurity integration during the early stages of vehicle development rather than treating security as an afterthought. Companies should establish comprehensive security frameworks that address the entire vehicle lifecycle from design and manufacturing through deployment and end-of-life management. Investment priorities should focus on developing internal cybersecurity expertise while maintaining strategic partnerships with specialized security providers.

Technology adoption strategies should emphasize scalable security platforms that can evolve with changing threat landscapes and regulatory requirements. Companies should prioritize solutions that provide comprehensive visibility into vehicle security status and enable rapid response to emerging threats. Standardization participation is recommended to ensure compatibility with industry-wide security frameworks and regulatory requirements.

Market positioning opportunities exist for companies that can demonstrate measurable security effectiveness while maintaining competitive cost structures. Organizations should focus on developing unique value propositions that differentiate their security offerings in increasingly crowded markets. Customer education initiatives are recommended to build market awareness and acceptance of advanced cybersecurity features.

Risk management strategies should include comprehensive threat assessment capabilities, incident response planning, and continuous security monitoring. Companies should establish clear governance frameworks for cybersecurity decision-making and resource allocation. Collaboration opportunities with industry peers, government agencies, and research institutions can accelerate innovation while sharing development costs and risks.

Market evolution projections indicate continued strong growth driven by increasing vehicle connectivity, autonomous driving development, and regulatory requirements. The market is expected to maintain a compound annual growth rate exceeding 15% through the next decade as cybersecurity becomes an integral component of automotive development processes. Technology advancement will focus on developing more sophisticated threat detection capabilities, automated response systems, and integrated security platforms.

Regulatory development is expected to accelerate with the establishment of comprehensive cybersecurity standards for connected and autonomous vehicles. Government agencies will likely implement mandatory security testing and certification requirements that will drive market demand for specialized solutions and services. International harmonization of automotive cybersecurity standards will create opportunities for North American companies to expand globally.

Innovation focus areas will include artificial intelligence integration, quantum-resistant cryptography, and blockchain-based security solutions. Companies will invest heavily in developing predictive security capabilities that can identify and mitigate threats before they impact vehicle operations. MWR analysis suggests that artificial intelligence will be integrated into 80% of automotive cybersecurity solutions within the next five years.

Market consolidation is anticipated as companies seek to build comprehensive capabilities through strategic acquisitions and partnerships. The industry will likely see the emergence of integrated security platforms that can address multiple vehicle domains through unified management interfaces. Competitive dynamics will favor companies that can demonstrate measurable security effectiveness while maintaining cost competitiveness and scalability across diverse vehicle platforms.

The North America cyber security for cars market represents a critical and rapidly expanding sector that will play an increasingly important role in the automotive industry’s digital transformation. As vehicles become more connected, autonomous, and software-defined, the importance of comprehensive cybersecurity solutions will continue to grow exponentially. The market benefits from strong regulatory support, substantial industry investment, and growing consumer awareness of cybersecurity importance in connected vehicles.

Success factors for market participants include developing deep automotive expertise, maintaining technological innovation leadership, and building scalable security platforms that can evolve with changing threat landscapes. Companies that can effectively combine automotive knowledge with advanced cybersecurity capabilities will be best positioned to capitalize on the substantial growth opportunities ahead. Strategic partnerships and collaborative approaches will remain essential for addressing the complex technical and business challenges associated with automotive cybersecurity implementation.

Future market development will be shaped by continued technological advancement, evolving regulatory requirements, and increasing integration of artificial intelligence and machine learning capabilities. The market is well-positioned for sustained growth as cybersecurity becomes an integral component of automotive development processes rather than an optional add-on feature. Long-term success will depend on the industry’s ability to stay ahead of emerging threats while maintaining the performance, cost, and user experience standards that consumers expect from modern vehicles.

What is Cyber Security for Cars?

Cyber Security for Cars refers to the protection of automotive systems, networks, and data from cyber threats. This includes safeguarding vehicle software, communication systems, and user data against hacking and unauthorized access.

What are the key players in the North America Cyber Security for Cars Market?

Key players in the North America Cyber Security for Cars Market include companies like Aptiv, Bosch, and Continental, which are actively developing solutions to enhance vehicle security. These companies focus on various aspects such as software security, intrusion detection, and secure communication protocols, among others.

What are the main drivers of the North America Cyber Security for Cars Market?

The main drivers of the North America Cyber Security for Cars Market include the increasing connectivity of vehicles, the rise in cyber threats targeting automotive systems, and the growing demand for advanced driver-assistance systems (ADAS). These factors are pushing manufacturers to invest in robust cybersecurity measures.

What challenges does the North America Cyber Security for Cars Market face?

The North America Cyber Security for Cars Market faces challenges such as the rapid evolution of cyber threats, the complexity of vehicle systems, and regulatory compliance issues. These challenges make it difficult for manufacturers to implement effective security solutions.

What opportunities exist in the North America Cyber Security for Cars Market?

Opportunities in the North America Cyber Security for Cars Market include the development of innovative security technologies, the integration of artificial intelligence for threat detection, and the increasing collaboration between automotive manufacturers and cybersecurity firms. These trends are expected to drive growth in the sector.

What trends are shaping the North America Cyber Security for Cars Market?

Trends shaping the North America Cyber Security for Cars Market include the adoption of over-the-air (OTA) updates for vehicle software, the implementation of blockchain technology for secure data sharing, and the focus on enhancing consumer awareness regarding vehicle cybersecurity. These trends are crucial for improving overall vehicle security.

North America Cyber Security for Cars Market

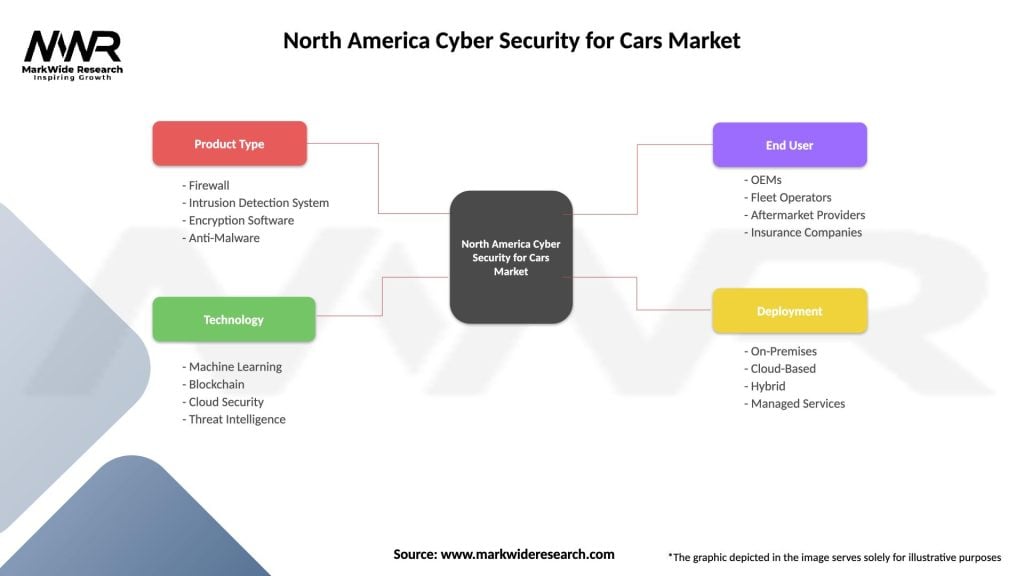

| Segmentation Details | Description |

|---|---|

| Product Type | Firewall, Intrusion Detection System, Encryption Software, Anti-Malware |

| Technology | Machine Learning, Blockchain, Cloud Security, Threat Intelligence |

| End User | OEMs, Fleet Operators, Aftermarket Providers, Insurance Companies |

| Deployment | On-Premises, Cloud-Based, Hybrid, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Cyber Security for Cars Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at