444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America construction equipment rental market represents a dynamic and rapidly evolving sector that has fundamentally transformed how construction projects are executed across the United States and Canada. This market encompasses the rental of heavy machinery, tools, and specialized equipment to construction companies, contractors, and infrastructure developers who prefer flexible access to equipment rather than outright ownership. Market dynamics indicate robust growth driven by increasing construction activities, infrastructure modernization projects, and the growing preference for rental solutions over equipment purchases.

Construction equipment rental has gained significant traction as businesses recognize the financial and operational advantages of renting versus buying expensive machinery. The market includes a comprehensive range of equipment from excavators, bulldozers, and cranes to smaller tools and specialized machinery. Growth rates in this sector have consistently outpaced traditional equipment sales, with the rental model experiencing a compound annual growth rate of 4.2% over recent years, reflecting the industry’s shift toward more flexible operational models.

Regional distribution shows strong performance across major metropolitan areas and construction hubs, with particular strength in states experiencing rapid urbanization and infrastructure development. The market benefits from increasing construction spending, government infrastructure initiatives, and the growing complexity of construction projects that require specialized equipment for limited durations.

The North America construction equipment rental market refers to the comprehensive ecosystem of businesses and services that provide temporary access to construction machinery, tools, and equipment through rental agreements rather than permanent ownership. This market facilitates construction projects by offering flexible, cost-effective solutions for accessing heavy machinery, specialized tools, and technical equipment needed for various construction, infrastructure, and industrial applications.

Equipment rental services encompass a wide spectrum of machinery including earthmoving equipment, material handling devices, concrete equipment, aerial work platforms, and power generation systems. The rental model allows construction companies to access state-of-the-art equipment without the substantial capital investment, maintenance responsibilities, and storage requirements associated with ownership.

Market participants include national rental chains, regional equipment rental companies, specialty equipment providers, and manufacturer-affiliated rental operations. These entities serve diverse customer segments ranging from large general contractors and infrastructure developers to small specialty contractors and do-it-yourself consumers, creating a multi-tiered market structure that addresses varying equipment needs and project scales.

Market performance in the North America construction equipment rental sector demonstrates sustained growth momentum driven by fundamental shifts in how construction projects approach equipment acquisition and utilization. The rental model has evolved from a supplementary option to a primary strategy for many construction companies seeking operational flexibility and cost optimization.

Key growth drivers include increasing construction activity across residential, commercial, and infrastructure sectors, with rental penetration rates reaching approximately 45% of total equipment utilization in certain market segments. The trend toward equipment rental reflects broader industry preferences for asset-light business models, improved cash flow management, and access to the latest technology without long-term commitments.

Technological advancement has significantly enhanced the rental experience through digital platforms, telematics integration, and predictive maintenance capabilities. These innovations have improved equipment availability, reduced downtime, and enhanced customer service levels, contributing to increased market adoption and customer satisfaction rates exceeding 78% in recent industry surveys.

Market consolidation continues as larger rental companies expand their geographic footprint and equipment portfolios through strategic acquisitions and organic growth initiatives. This consolidation trend has improved service consistency, expanded equipment availability, and enhanced the overall customer experience across different regional markets.

Market segmentation reveals distinct patterns in equipment rental preferences across different construction sectors and project types. The following insights highlight critical market dynamics:

Construction industry growth serves as the primary catalyst driving expansion in the equipment rental market. Increased construction spending across residential, commercial, and infrastructure sectors creates sustained demand for rental equipment services. Infrastructure modernization initiatives, including transportation, utilities, and public facilities upgrades, generate substantial equipment rental requirements for specialized machinery and tools.

Financial optimization strategies adopted by construction companies increasingly favor rental solutions over equipment ownership. The rental model offers improved cash flow management, reduced capital expenditure requirements, and elimination of maintenance, storage, and depreciation costs. Asset-light business models have become particularly attractive as companies focus on core competencies while outsourcing equipment management to specialized rental providers.

Technological advancement in construction equipment has accelerated replacement cycles and increased the appeal of rental solutions. Advanced machinery featuring GPS tracking, telematics, and automated systems provides competitive advantages that justify rental costs while ensuring access to cutting-edge technology. Equipment complexity and specialized applications often make rental more practical than ownership for infrequently used machinery.

Project diversity and varying equipment requirements across different construction phases drive rental demand. Modern construction projects often require specialized equipment for specific tasks or limited durations, making rental solutions more economical than maintaining diverse equipment inventories. Regulatory compliance requirements and safety standards also favor rental arrangements that ensure access to properly maintained, certified equipment.

Equipment availability challenges during peak construction seasons can limit market growth and customer satisfaction. High demand periods often result in equipment shortages, extended lead times, and increased rental rates that may discourage some potential customers. Inventory management complexities require significant capital investment and strategic planning to maintain adequate equipment availability across diverse geographic markets.

Transportation and logistics costs associated with equipment delivery and pickup can impact rental economics, particularly for smaller projects or remote locations. Fuel costs and transportation expenses add to the total cost of rental solutions, potentially reducing their attractiveness compared to ownership for some applications.

Equipment maintenance and reliability concerns may deter some customers who prefer direct control over machinery condition and performance. Downtime risks associated with rental equipment failures can impact project schedules and costs, creating hesitation among contractors with critical timeline requirements.

Market competition from equipment sales and financing options continues to challenge rental growth in certain segments. Low interest rates and attractive financing terms for equipment purchases can make ownership more appealing, particularly for frequently used machinery or long-term projects.

Digital transformation presents significant opportunities for rental companies to enhance customer experience and operational efficiency. Mobile applications, online booking platforms, and digital inventory management systems can streamline rental processes, improve equipment tracking, and provide real-time availability information to customers.

Sustainability initiatives in construction create opportunities for rental companies to promote environmental benefits of equipment sharing and optimized utilization. Green construction trends favor rental models that reduce overall equipment manufacturing requirements and promote efficient resource utilization across multiple projects.

Emerging technologies including autonomous equipment, electric machinery, and advanced telematics systems provide opportunities for rental companies to offer cutting-edge solutions without requiring customer investment in unproven technologies. Technology partnerships with equipment manufacturers can create competitive advantages and differentiated service offerings.

Market expansion into underserved geographic regions and customer segments offers growth potential. Small contractor markets, residential construction, and specialty applications represent opportunities for targeted service development and market penetration strategies.

Supply chain integration has become increasingly sophisticated as rental companies develop comprehensive logistics networks to support efficient equipment distribution and maintenance. Regional hub strategies enable better equipment positioning, reduced transportation costs, and improved customer service levels across diverse geographic markets.

Customer relationship management has evolved beyond transactional interactions to strategic partnerships that provide value-added services including project planning, equipment optimization, and technical support. Consultative approaches help customers select appropriate equipment configurations and rental terms that optimize project outcomes and cost efficiency.

Competitive dynamics continue to drive innovation in service delivery, pricing strategies, and equipment offerings. Market differentiation increasingly focuses on service quality, equipment condition, availability guarantees, and specialized expertise rather than price competition alone.

Economic sensitivity influences rental demand patterns, with construction activity levels directly impacting equipment utilization rates and rental revenues. Market resilience has improved as rental companies diversify customer bases and equipment portfolios to reduce dependence on specific construction sectors or geographic regions.

Comprehensive market analysis employed multiple research methodologies to ensure accurate and reliable insights into the North America construction equipment rental market. Primary research included extensive interviews with industry executives, rental company operators, construction contractors, and equipment manufacturers to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research encompassed analysis of industry reports, financial statements, regulatory filings, and trade publications to validate primary findings and identify quantitative market trends. Data triangulation techniques ensured consistency and accuracy across multiple information sources and research approaches.

Market modeling incorporated economic indicators, construction spending data, and industry-specific metrics to develop comprehensive market assessments and growth projections. Statistical analysis of historical trends and current market conditions provided foundation for future outlook development and strategic recommendations.

Industry validation through expert consultations and peer review processes ensured research findings accurately reflect current market realities and emerging trends. Continuous monitoring of market developments and industry changes maintains research currency and relevance for strategic decision-making purposes.

United States market dominates the North America construction equipment rental landscape, accounting for approximately 87% of regional rental activity. Geographic distribution shows strong concentration in major metropolitan areas including New York, Los Angeles, Chicago, Houston, and Atlanta, where high construction density and urban development projects drive consistent rental demand.

Texas and California represent the largest state markets, benefiting from robust population growth, infrastructure development, and diverse construction activity across residential, commercial, and industrial sectors. Southeast region demonstrates particularly strong growth momentum driven by population migration, business relocations, and infrastructure modernization initiatives.

Canadian market contributes approximately 13% of regional rental activity, with concentration in major urban centers including Toronto, Vancouver, Calgary, and Montreal. Resource sector projects in Alberta and British Columbia generate significant demand for specialized heavy equipment rentals, while urban development in Ontario and Quebec drives general construction equipment rental growth.

Regional variations in construction activity, seasonal patterns, and equipment preferences create diverse market dynamics across different geographic areas. Climate considerations influence equipment specifications and rental patterns, with northern regions requiring specialized cold-weather equipment and seasonal demand fluctuations.

Market leadership is characterized by a mix of large national rental chains, regional specialists, and manufacturer-affiliated rental operations. The competitive environment demonstrates ongoing consolidation as larger companies acquire regional players to expand geographic coverage and equipment portfolios.

Equipment type segmentation reveals distinct market dynamics across different machinery categories, each serving specific construction applications and customer requirements:

By Equipment Category:

By Application Sector:

Earthmoving equipment maintains its position as the dominant rental category, driven by consistent demand across all construction sectors. Excavator rentals show particularly strong growth as projects increasingly require precise digging and material handling capabilities. Technology integration in earthmoving equipment, including GPS guidance and telematics systems, enhances productivity and justifies rental premiums.

Aerial work platforms demonstrate robust growth momentum as safety regulations and construction complexity drive increased demand for elevated work solutions. Electric and hybrid aerial equipment gains market share as environmental considerations and indoor applications favor cleaner power sources. Specialized platforms for unique applications command premium rental rates and strong utilization levels.

Material handling equipment benefits from increased focus on construction logistics and efficiency optimization. Telehandler rentals show strong growth as their versatility makes them valuable across multiple construction phases and applications. Automated systems and advanced controls enhance equipment productivity and safety performance.

Specialty equipment categories including concrete pumps, cranes, and power generation systems maintain strong rental penetration due to high equipment costs and specialized application requirements. Technical expertise and operator training services add value and differentiate rental providers in these specialized segments.

Construction contractors realize significant financial and operational advantages through equipment rental strategies. Cash flow optimization eliminates large capital expenditures while providing access to necessary equipment for project execution. Maintenance elimination reduces operational complexity and allows contractors to focus on core construction activities rather than equipment management.

Project flexibility enables contractors to select optimal equipment configurations for specific project requirements without long-term commitments. Technology access ensures availability of latest equipment features and capabilities without investment in rapidly evolving technology platforms.

Rental companies benefit from recurring revenue streams and asset utilization optimization across diverse customer bases. Market expansion opportunities exist through geographic growth, equipment portfolio diversification, and service enhancement initiatives. Technology investments in fleet management and customer service systems create competitive advantages and operational efficiencies.

Equipment manufacturers gain expanded market reach through rental channel partnerships while maintaining equipment sales to rental fleet operators. Product feedback from rental applications provides valuable insights for equipment development and improvement initiatives. Service revenue opportunities exist through maintenance contracts and technical support services for rental fleets.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital platform adoption continues accelerating as rental companies invest in mobile applications, online booking systems, and customer portals to enhance service accessibility and convenience. Real-time availability information and instant booking capabilities improve customer satisfaction and operational efficiency. Data analytics applications enable better demand forecasting, inventory optimization, and predictive maintenance scheduling.

Sustainability initiatives gain prominence as construction companies seek to reduce environmental impact through equipment sharing and optimized utilization. Electric equipment adoption increases, particularly in urban areas with emission restrictions and noise limitations. Fuel efficiency improvements and alternative power sources become important selection criteria for rental equipment.

Service integration trends show rental companies expanding beyond equipment provision to offer comprehensive project support services. Operator training, technical support, and project consulting services add value and strengthen customer relationships. Maintenance services and equipment optimization consulting help customers maximize productivity and minimize costs.

Consolidation activities continue as larger rental companies acquire regional operators to expand geographic coverage and achieve operational synergies. Technology investments and service standardization benefit from increased scale and market presence. Specialized acquisitions enable portfolio expansion into high-value equipment categories and niche applications.

Technology partnerships between rental companies and equipment manufacturers have intensified, creating integrated solutions that combine advanced machinery with comprehensive service support. Telematics integration enables remote monitoring, predictive maintenance, and usage optimization across rental fleets. Autonomous equipment pilot programs explore future applications of self-operating machinery in construction environments.

Market consolidation activities have accelerated with several major acquisitions expanding geographic coverage and equipment portfolios. MarkWide Research analysis indicates that consolidation trends are creating more comprehensive service networks and improved customer access to diverse equipment options. Regional expansion strategies focus on underserved markets with growth potential.

Sustainability programs have emerged as rental companies promote environmental benefits of equipment sharing and develop green equipment options. Electric equipment introductions and hybrid power systems address environmental concerns and regulatory requirements. Recycling programs for equipment components and fluids demonstrate environmental stewardship commitments.

Service innovation initiatives include development of specialized rental packages for specific project types and customer segments. Turnkey solutions combining equipment, operators, and project management services address complex customer requirements. Flexible rental terms and customized agreements accommodate diverse project needs and budget constraints.

Strategic focus on technology integration and digital service delivery will differentiate successful rental companies in an increasingly competitive market environment. Investment priorities should emphasize customer-facing technologies, fleet management systems, and data analytics capabilities that enhance operational efficiency and service quality.

Geographic expansion strategies should target underserved markets with strong construction growth potential while ensuring adequate equipment inventory and service support capabilities. Market entry approaches should consider local partnerships, acquisition opportunities, and organic growth strategies based on specific regional characteristics and competitive dynamics.

Equipment portfolio optimization requires continuous assessment of customer demand patterns, technology trends, and competitive positioning. Fleet composition decisions should balance popular general-purpose equipment with specialized machinery that commands premium rental rates and serves niche applications.

Customer relationship development through value-added services and consultative approaches will strengthen competitive positioning and improve customer retention rates. Service differentiation strategies should focus on expertise, reliability, and comprehensive project support rather than price competition alone.

Market growth prospects remain positive as construction industry expansion and increasing rental adoption rates drive sustained demand for equipment rental services. MWR projections indicate continued market expansion with growth rates potentially reaching 5.1% annually over the next five years, supported by infrastructure investment and construction technology advancement.

Technology evolution will continue transforming the rental experience through advanced digital platforms, autonomous equipment capabilities, and integrated project management solutions. Artificial intelligence applications in demand forecasting, equipment optimization, and predictive maintenance will enhance operational efficiency and customer service levels.

Sustainability trends will increasingly influence equipment selection and rental practices as environmental considerations become more prominent in construction project planning. Electric equipment adoption rates are expected to accelerate, particularly in urban markets with emission restrictions and environmental regulations.

Market consolidation is likely to continue as larger rental companies seek scale advantages and geographic expansion opportunities. Service integration trends will expand rental company roles beyond equipment provision to comprehensive project support and consulting services, creating additional revenue streams and customer value.

The North America construction equipment rental market demonstrates robust growth momentum and strong future prospects driven by fundamental industry shifts toward flexible, cost-effective equipment access solutions. Market dynamics favor rental models as construction companies increasingly prioritize capital efficiency, operational flexibility, and access to advanced technology without long-term ownership commitments.

Competitive advantages in this market increasingly depend on technology integration, service quality, and comprehensive customer support rather than price competition alone. Successful rental companies are investing in digital platforms, expanding geographic coverage, and developing value-added services that strengthen customer relationships and differentiate their market positioning.

Future success will require continued adaptation to evolving customer needs, technology advancement, and market dynamics while maintaining operational efficiency and service excellence. The North America construction equipment rental market is well-positioned for sustained growth as it continues serving the evolving needs of the dynamic construction industry across the region.

What is Construction Equipment Rental?

Construction Equipment Rental refers to the practice of renting machinery and equipment used in construction projects, such as excavators, bulldozers, and cranes, rather than purchasing them outright. This approach allows companies to manage costs and access a wider range of equipment for various projects.

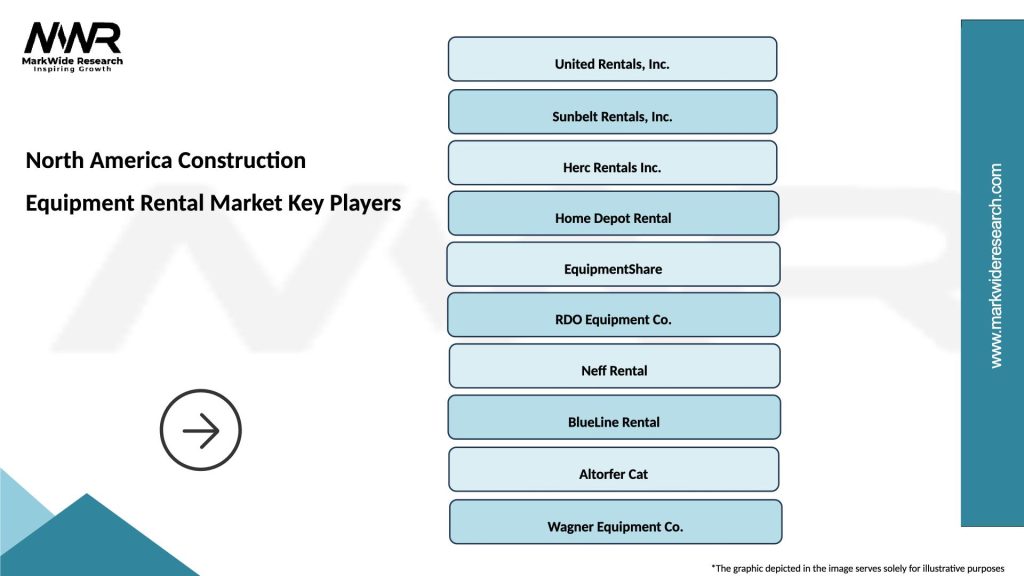

What are the key players in the North America Construction Equipment Rental Market?

Key players in the North America Construction Equipment Rental Market include United Rentals, Sunbelt Rentals, and Herc Rentals. These companies provide a variety of construction equipment and services to contractors and businesses across the region, among others.

What are the main drivers of the North America Construction Equipment Rental Market?

The main drivers of the North America Construction Equipment Rental Market include the increasing demand for construction activities, the need for cost-effective solutions, and the growing trend of outsourcing equipment needs. Additionally, urbanization and infrastructure development are significant factors contributing to market growth.

What challenges does the North America Construction Equipment Rental Market face?

The North America Construction Equipment Rental Market faces challenges such as equipment maintenance costs, fluctuating demand based on economic conditions, and competition from used equipment sales. These factors can impact rental rates and availability.

What opportunities exist in the North America Construction Equipment Rental Market?

Opportunities in the North America Construction Equipment Rental Market include the adoption of advanced technologies like telematics and automation, which can enhance equipment management and efficiency. Additionally, the growing focus on sustainable construction practices presents new avenues for rental services.

What trends are shaping the North America Construction Equipment Rental Market?

Trends shaping the North America Construction Equipment Rental Market include the increasing use of digital platforms for rental transactions, a shift towards eco-friendly equipment options, and the rise of flexible rental agreements. These trends reflect changing consumer preferences and technological advancements in the industry.

North America Construction Equipment Rental Market

| Segmentation Details | Description |

|---|---|

| Product Type | Excavators, Bulldozers, Cranes, Forklifts |

| End User | Construction, Landscaping, Mining, Infrastructure |

| Technology | Telematics, Electric, Hybrid, Autonomous |

| Service Type | Short-term Rental, Long-term Rental, Lease, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Construction Equipment Rental Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at