444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America commercial printing market represents a dynamic and evolving industry that continues to adapt to changing consumer preferences, technological advancements, and digital transformation trends. This comprehensive market encompasses various printing services including offset printing, digital printing, flexographic printing, and specialty printing applications across diverse sectors such as packaging, advertising, publishing, and corporate communications.

Market dynamics indicate robust growth driven by increasing demand for customized printing solutions, sustainable printing practices, and innovative packaging applications. The region’s commercial printing landscape is characterized by technological modernization, with companies investing heavily in advanced printing equipment and digital integration capabilities. Growth projections suggest the market will expand at a compound annual growth rate of 4.2% through the forecast period, supported by recovering economic conditions and renewed business confidence.

Regional distribution shows the United States commanding approximately 85% market share, while Canada contributes significantly to the remaining portion. The market’s resilience stems from its ability to serve essential industries including food and beverage packaging, pharmaceutical labeling, and e-commerce fulfillment services. Digital transformation initiatives have accelerated adoption of hybrid printing solutions, combining traditional and digital technologies to meet diverse customer requirements.

The North America commercial printing market refers to the comprehensive ecosystem of businesses and services involved in producing printed materials for commercial, industrial, and consumer applications across the United States, Canada, and Mexico. This market encompasses traditional printing methods, digital printing technologies, and specialized printing services that serve various industries including packaging, advertising, publishing, retail, and manufacturing sectors.

Commercial printing distinguishes itself from personal or home printing by focusing on large-volume, professional-grade production capabilities. The market includes offset printing for high-volume runs, digital printing for customization and short runs, flexographic printing for packaging applications, and screen printing for specialty items. Service providers range from large-scale commercial printers to specialized boutique operations serving niche markets.

Market participants include printing companies, equipment manufacturers, substrate suppliers, ink and chemical providers, and finishing services. The ecosystem supports diverse applications from business cards and brochures to complex packaging solutions and large-format displays. Technology integration has expanded the definition to include hybrid services combining print with digital marketing, variable data printing, and cross-media campaign management.

Market performance in North America’s commercial printing sector demonstrates remarkable resilience and adaptation capabilities despite facing significant challenges from digital media proliferation. The industry has successfully repositioned itself by embracing technological innovation, sustainability initiatives, and value-added services that extend beyond traditional printing capabilities.

Key growth drivers include increasing demand for sustainable packaging solutions, personalized marketing materials, and e-commerce packaging applications. The market benefits from packaging segment growth of approximately 6.8% annually, driven by online retail expansion and consumer preference for branded packaging experiences. Digital printing adoption has reached 38% market penetration, enabling shorter run lengths and faster turnaround times.

Strategic positioning reveals successful companies focusing on specialization, automation, and customer service excellence. The industry’s transformation includes integration of artificial intelligence, workflow automation, and sustainable production practices. Market consolidation continues as smaller operations merge with larger entities to achieve economies of scale and technological capabilities necessary for competitive positioning.

Future prospects indicate continued evolution toward hybrid business models combining print, digital services, and logistics solutions. Companies investing in advanced technologies and sustainable practices are positioned for long-term success in this dynamic market environment.

Market intelligence reveals several critical insights shaping the North America commercial printing landscape. The industry’s transformation from traditional printing to integrated communication solutions has created new opportunities while requiring significant operational adjustments.

Primary growth drivers propelling the North America commercial printing market include diverse factors spanning technological advancement, economic recovery, and changing consumer behaviors. These drivers create sustained demand across multiple market segments and application areas.

E-commerce expansion serves as a fundamental driver, generating unprecedented demand for packaging and shipping materials. Online retail growth necessitates protective packaging, branded shipping boxes, and promotional inserts that enhance customer experience. Packaging requirements have evolved beyond basic protection to include marketing messaging, sustainability features, and unboxing experiences that build brand loyalty.

Technological advancement enables new applications and improved efficiency across printing operations. Digital printing technologies offer shorter setup times, reduced waste, and variable data capabilities that traditional methods cannot match. Automation integration reduces labor costs while improving quality consistency and production speed. Advanced color management systems ensure accurate reproduction across different substrates and printing methods.

Sustainability initiatives drive demand for environmentally responsible printing solutions. Corporate sustainability commitments require suppliers to demonstrate environmental stewardship through renewable energy usage, waste reduction, and sustainable substrate selection. Circular economy principles encourage development of recyclable and biodegradable printing materials that align with environmental objectives.

Customization trends across industries fuel demand for personalized printing solutions. Marketing campaigns increasingly rely on targeted messaging, variable data printing, and localized content that resonates with specific audience segments. Brand differentiation strategies emphasize unique packaging designs, premium finishes, and tactile experiences that distinguish products in competitive markets.

Market challenges facing the North America commercial printing industry include structural shifts, cost pressures, and competitive dynamics that require strategic adaptation. These restraints influence business models, investment decisions, and operational strategies across the sector.

Digital media competition continues to impact traditional print applications as businesses shift marketing budgets toward digital channels. Online advertising, social media marketing, and digital communications reduce demand for printed promotional materials, brochures, and direct mail campaigns. Generational preferences favor digital content consumption, particularly among younger demographics who prefer mobile and interactive media experiences.

Raw material costs present ongoing challenges as paper, ink, and chemical prices fluctuate based on global supply and demand dynamics. Supply chain disruptions experienced during recent years highlighted vulnerability to material shortages and transportation delays. Energy costs associated with printing operations add additional pressure on profit margins, particularly for energy-intensive processes.

Labor shortages affect the industry as skilled printing professionals retire without adequate replacement. Technical expertise required for modern printing equipment operation and maintenance becomes increasingly scarce. Training requirements for new technologies demand significant investment in workforce development programs that many smaller operations cannot afford.

Environmental regulations impose compliance costs and operational constraints on printing operations. Volatile organic compound emissions, waste disposal requirements, and chemical handling protocols require ongoing investment in environmental management systems. Regulatory complexity varies across jurisdictions, creating compliance challenges for companies operating in multiple states or provinces.

Emerging opportunities within the North America commercial printing market present significant potential for growth-oriented companies willing to invest in innovation and market expansion. These opportunities span technological advancement, market diversification, and service enhancement initiatives.

Sustainable printing solutions represent a major opportunity as environmental consciousness drives demand for eco-friendly alternatives. Development of biodegradable inks, recyclable substrates, and carbon-neutral production processes creates competitive advantages. Green certification programs enable premium pricing for environmentally responsible printing services while attracting sustainability-focused customers.

Industrial printing applications offer substantial growth potential beyond traditional commercial markets. Functional printing for electronics, textiles, and automotive applications requires specialized capabilities and commands higher margins. 3D printing integration expands service offerings into prototyping, small-batch manufacturing, and customized product development.

Smart packaging technologies create opportunities for value-added services including QR codes, NFC tags, and interactive elements that bridge physical and digital experiences. Anti-counterfeiting solutions using specialized inks and security features address growing concerns about product authenticity across various industries.

Nearshoring trends benefit North American printers as companies seek to reduce supply chain risks and support local economies. Reshoring initiatives create opportunities to capture business previously outsourced to overseas suppliers. Regional printing capabilities offer advantages in terms of quality control, communication, and delivery speed that distant suppliers cannot match.

Market dynamics in the North America commercial printing sector reflect complex interactions between technological evolution, customer expectations, and competitive pressures. Understanding these dynamics enables strategic decision-making and market positioning for sustained success.

Technology convergence drives fundamental changes in production capabilities and business models. Integration of digital and traditional printing methods creates hybrid solutions that optimize quality, speed, and cost-effectiveness. Workflow automation reduces manual intervention while improving consistency and reducing errors. Artificial intelligence applications enhance color matching, quality control, and predictive maintenance capabilities.

Customer relationship evolution transforms traditional vendor-client interactions into strategic partnerships focused on mutual success. Consultative selling approaches emphasize understanding customer challenges and developing customized solutions rather than simply fulfilling printing orders. Long-term contracts and service level agreements provide revenue stability while ensuring customer loyalty.

Competitive landscape shifts result from consolidation, specialization, and new market entrants with disruptive technologies. Market fragmentation creates opportunities for niche players while requiring scale advantages for broad-market competitors. Strategic alliances and partnerships enable smaller companies to access advanced technologies and expanded market reach.

Supply chain optimization becomes increasingly critical as companies seek resilience and efficiency improvements. Inventory management strategies balance cost reduction with service level maintenance. Local sourcing initiatives reduce transportation costs and delivery times while supporting regional economic development.

Research approach for analyzing the North America commercial printing market employs comprehensive methodologies combining primary research, secondary analysis, and industry expertise. This multi-faceted approach ensures accurate market assessment and reliable forecasting capabilities.

Primary research includes extensive interviews with industry executives, technology providers, and end-users across various market segments. Survey methodologies capture quantitative data regarding market trends, technology adoption, and purchasing behaviors. Focus groups provide qualitative insights into customer preferences, decision-making processes, and emerging requirements that influence market development.

Secondary research encompasses analysis of industry publications, government statistics, trade association reports, and company financial statements. Market intelligence gathering includes monitoring patent filings, technology announcements, and merger and acquisition activities that indicate market direction and competitive dynamics.

Data validation processes ensure accuracy and reliability through triangulation of multiple sources and expert review. MarkWide Research analysts apply rigorous quality control measures to verify findings and eliminate potential biases or inconsistencies in data collection and analysis processes.

Forecasting models incorporate historical trends, current market conditions, and forward-looking indicators to project future market development. Scenario analysis considers various economic and technological factors that could influence market trajectory over the forecast period.

Regional market distribution across North America reveals distinct characteristics and growth patterns influenced by economic conditions, industrial concentration, and demographic factors. Understanding regional dynamics enables targeted market strategies and resource allocation decisions.

United States market dominates the regional landscape, accounting for approximately 85% of total market activity. Major metropolitan areas including New York, Los Angeles, Chicago, and Atlanta serve as printing industry hubs with concentrated customer bases and advanced infrastructure. Manufacturing regions in the Midwest and Southeast provide strong demand for industrial printing applications and packaging solutions.

California market leads in innovation and technology adoption, driven by proximity to technology companies and entertainment industries requiring high-quality printing services. Texas market benefits from diverse industrial base and growing population that supports both commercial and packaging printing demand. Northeast corridor maintains strength in financial services and publishing applications despite overall market maturation.

Canadian market represents approximately 12% regional market share, with concentration in Ontario and Quebec provinces. Bilingual requirements create specialized opportunities for companies capable of handling French and English language printing. Resource-based industries including mining and forestry generate demand for specialized printing applications and safety materials.

Mexico market contributes the remaining 3% market share but demonstrates strong growth potential driven by manufacturing expansion and nearshoring trends. Border region dynamics create cross-border opportunities for companies serving maquiladora operations and international trade requirements.

Competitive environment in the North America commercial printing market features diverse participants ranging from large integrated companies to specialized niche providers. Market leadership requires balancing scale advantages with flexibility and customer service excellence.

Market positioning strategies emphasize differentiation through technology leadership, service quality, and specialized capabilities. Competitive advantages include geographic coverage, equipment sophistication, customer relationships, and operational efficiency. Strategic acquisitions continue reshaping the competitive landscape as companies seek scale benefits and expanded service offerings.

Market segmentation analysis reveals distinct categories based on technology, application, end-user industry, and geographic factors. Understanding segmentation dynamics enables targeted strategies and resource allocation optimization across different market opportunities.

By Technology:

By Application:

By End-User Industry:

Category analysis provides detailed understanding of performance variations across different market segments, revealing opportunities for specialization and strategic focus. Each category demonstrates unique characteristics and growth trajectories.

Packaging category emerges as the primary growth driver, benefiting from e-commerce expansion and premium packaging trends. Sustainable packaging solutions command premium pricing while addressing environmental concerns. Corrugated packaging, flexible packaging, and folding cartons represent the largest volume segments within this category. Innovation opportunities include smart packaging technologies, anti-counterfeiting features, and enhanced barrier properties.

Digital printing category demonstrates strong growth momentum driven by customization demands and shorter run requirements. Variable data printing capabilities enable personalized marketing campaigns and targeted communications. Production digital printing systems offer quality approaching offset standards while maintaining digital advantages. Market penetration continues expanding as equipment costs decrease and capabilities improve.

Commercial printing category faces challenges from digital media competition but maintains importance for business communications and marketing materials. Value-added services including design, fulfillment, and mailing services enhance profitability and customer retention. Specialty finishes, premium substrates, and unique formats create differentiation opportunities within this mature category.

Industrial printing category offers specialized opportunities requiring technical expertise and specialized equipment. Functional printing applications including electronics, textiles, and automotive components command higher margins. Regulatory compliance requirements in industries such as aerospace and medical devices create barriers to entry that protect established suppliers.

Industry participation in the North America commercial printing market offers numerous benefits for various stakeholders including manufacturers, service providers, suppliers, and customers. Understanding these benefits enables strategic decision-making and value optimization.

For Printing Companies:

For Equipment Suppliers:

For End Customers:

Strategic assessment through SWOT analysis reveals critical factors influencing the North America commercial printing market’s competitive position and future prospects. This analysis guides strategic planning and risk management initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Emerging trends shaping the North America commercial printing market reflect technological advancement, changing customer preferences, and evolving business models. Identifying and adapting to these trends enables competitive positioning and market success.

Sustainability Integration represents a fundamental trend as environmental consciousness influences purchasing decisions across all market segments. Carbon-neutral printing services, recyclable substrates, and renewable energy usage become competitive differentiators. Circular economy principles drive development of biodegradable inks and compostable packaging materials that align with corporate sustainability commitments.

Digital Transformation accelerates across the industry as companies integrate advanced technologies into traditional printing operations. Artificial intelligence applications optimize color management, quality control, and predictive maintenance. Workflow automation reduces manual intervention while improving consistency and reducing errors. Cloud-based systems enable remote monitoring and customer collaboration capabilities.

Mass Customization becomes increasingly important as customers demand personalized solutions and targeted communications. Variable data printing enables individualized marketing materials and packaging designs. Short-run capabilities support test marketing and limited edition products. On-demand printing reduces inventory requirements while enabling rapid response to market changes.

Value-Added Services expansion transforms traditional printing companies into integrated communication solution providers. Design services, fulfillment operations, and logistics management create additional revenue streams. Cross-media campaign management combines print and digital elements for comprehensive marketing solutions. Consultative approaches position printers as strategic partners rather than simple service providers.

Recent developments in the North America commercial printing industry demonstrate ongoing evolution and adaptation to market challenges and opportunities. These developments influence competitive dynamics and strategic planning across the sector.

Technology Investments continue as companies upgrade equipment and capabilities to remain competitive. Digital press installations expand production flexibility while reducing setup times and waste. Hybrid printing systems combine offset and digital technologies to optimize quality and cost-effectiveness. Advanced finishing equipment enables value-added services including embossing, foil stamping, and specialty coatings.

Consolidation Activity reshapes the competitive landscape as companies seek scale advantages and expanded capabilities. Strategic acquisitions enable geographic expansion, technology access, and customer base growth. Private equity investments provide capital for modernization and growth initiatives. Partnership agreements facilitate resource sharing and market development opportunities.

Sustainability Initiatives gain momentum as companies respond to customer demands and regulatory requirements. Renewable energy adoption reduces carbon footprints while potentially lowering operating costs. Waste reduction programs minimize environmental impact while improving operational efficiency. Sustainable substrate sourcing ensures responsible supply chain management and supports forest stewardship initiatives.

Market Diversification strategies help companies reduce dependence on traditional printing applications. Packaging expansion leverages growing e-commerce demand and premium packaging trends. Industrial printing applications including electronics and textiles offer higher margin opportunities. Service integration creates comprehensive solutions that strengthen customer relationships and increase switching costs.

Strategic recommendations for North America commercial printing market participants focus on positioning for long-term success amid ongoing industry transformation. MWR analysis indicates successful companies will emphasize innovation, sustainability, and customer-centric strategies.

Technology Investment should prioritize automation and digital integration capabilities that improve efficiency and expand service offerings. Workflow optimization through advanced software systems reduces costs while improving customer service. Equipment modernization enables competitive positioning in quality, speed, and cost-effectiveness. Research and development investments support innovation and new service development.

Market Positioning strategies should emphasize specialization and differentiation rather than competing solely on price. Niche market focus enables premium pricing and reduced competition. Value-added services create customer loyalty and higher margins. Geographic expansion through acquisition or partnership provides growth opportunities while spreading risk across multiple markets.

Sustainability Leadership becomes increasingly important as environmental concerns influence purchasing decisions. Green certification programs demonstrate environmental commitment while enabling premium pricing. Sustainable supply chain management reduces risk while supporting corporate responsibility objectives. Innovation in eco-friendly materials and processes creates competitive advantages.

Customer Relationship Management should emphasize partnership approaches and consultative selling. Long-term contracts provide revenue stability while ensuring customer loyalty. Service level agreements establish clear expectations and performance metrics. Regular communication and feedback systems maintain strong relationships and identify new opportunities.

Future prospects for the North America commercial printing market indicate continued evolution toward integrated communication solutions and sustainable practices. Market projections suggest steady growth driven by packaging demand, technology advancement, and service diversification initiatives.

Growth trajectory analysis indicates the market will expand at a compound annual growth rate of 4.2% over the next five years, with packaging applications leading growth at 6.8% annually. Digital printing adoption will continue increasing, reaching an estimated 45% market penetration by the end of the forecast period. Sustainability-focused solutions will capture an increasing share of customer spending as environmental priorities intensify.

Technology evolution will drive fundamental changes in production capabilities and business models. Artificial intelligence integration will optimize operations while reducing costs and improving quality. Advanced materials including conductive inks and smart substrates will enable new applications and market opportunities. 3D printing integration will expand service offerings into prototyping and small-batch manufacturing.

Market structure will continue evolving through consolidation and specialization trends. Large integrated companies will focus on scale advantages and comprehensive service offerings. Specialized niche players will serve specific market segments requiring technical expertise or unique capabilities. Regional partnerships and alliances will enable smaller companies to compete effectively against larger competitors.

Customer expectations will increasingly emphasize sustainability, customization, and integrated solutions. Environmental responsibility will become a standard requirement rather than a competitive differentiator. Rapid turnaround times and flexible production capabilities will be essential for maintaining customer satisfaction. Digital integration and cross-media capabilities will be necessary for comprehensive communication solutions.

The North America commercial printing market demonstrates remarkable resilience and adaptability in the face of digital transformation and changing customer requirements. While traditional applications face challenges from digital alternatives, emerging opportunities in packaging, sustainable solutions, and value-added services provide substantial growth potential for forward-thinking companies.

Market dynamics favor organizations that embrace technological innovation, sustainability leadership, and customer-centric strategies. The industry’s evolution toward integrated communication solutions creates opportunities for companies willing to expand beyond traditional printing services. Success factors include operational efficiency, service quality, and the ability to adapt quickly to changing market conditions.

Strategic positioning requires balancing scale advantages with specialization and flexibility. Companies that invest in advanced technologies, sustainable practices, and workforce development will be best positioned for long-term success. Market consolidation will continue, creating opportunities for strategic acquisitions and partnerships that enhance capabilities and market reach.

The future outlook remains positive for companies that successfully navigate industry transformation and capitalize on emerging opportunities. Packaging growth, sustainability trends, and technology advancement will drive market expansion while rewarding innovative and adaptable organizations. North America commercial printing market participants that focus on customer value creation and operational excellence will thrive in this dynamic and evolving industry landscape.

What is Commercial Printing?

Commercial printing refers to the process of producing printed materials for businesses and organizations, including brochures, flyers, and packaging. It encompasses various printing techniques such as offset, digital, and flexographic printing.

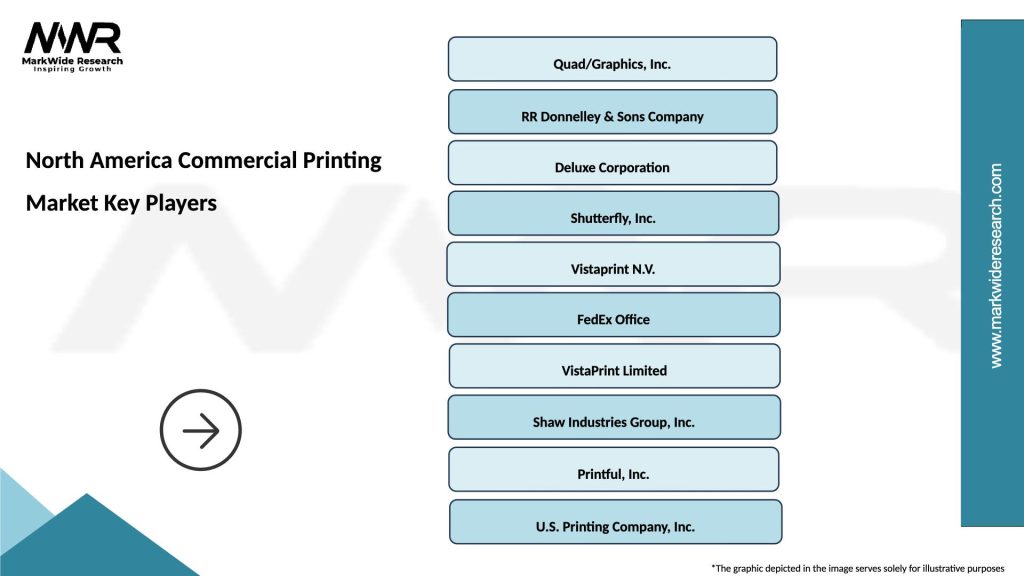

What are the key players in the North America Commercial Printing Market?

Key players in the North America Commercial Printing Market include Quad/Graphics, RR Donnelley, and Shutterfly, among others. These companies offer a range of services from traditional printing to digital solutions, catering to diverse client needs.

What are the growth factors driving the North America Commercial Printing Market?

The North America Commercial Printing Market is driven by factors such as the increasing demand for customized printing solutions, the growth of e-commerce, and advancements in printing technology. Additionally, the rise in marketing activities across various sectors contributes to market expansion.

What challenges does the North America Commercial Printing Market face?

The North America Commercial Printing Market faces challenges such as the decline in traditional print media consumption and the rising costs of raw materials. Additionally, competition from digital media and online marketing strategies poses significant hurdles for traditional printing companies.

What opportunities exist in the North America Commercial Printing Market?

Opportunities in the North America Commercial Printing Market include the growing demand for sustainable printing practices and the expansion of personalized marketing materials. Furthermore, the integration of technology in printing processes presents avenues for innovation and efficiency.

What trends are shaping the North America Commercial Printing Market?

Trends shaping the North America Commercial Printing Market include the shift towards digital printing, increased focus on eco-friendly materials, and the adoption of automation in printing processes. These trends reflect the industry’s adaptation to changing consumer preferences and technological advancements.

North America Commercial Printing Market

| Segmentation Details | Description |

|---|---|

| Product Type | Digital Printing, Offset Printing, Flexographic Printing, Gravure Printing |

| End User | Publishing, Packaging, Advertising, Commercial |

| Technology | Inkjet, Laser, 3D Printing, Screen Printing |

| Application | Labels, Brochures, Business Cards, Signage |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Commercial Printing Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at