444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America commercial HVAC market represents a dynamic and rapidly evolving sector that encompasses heating, ventilation, and air conditioning systems specifically designed for commercial applications. This comprehensive market serves diverse industries including office buildings, retail establishments, healthcare facilities, educational institutions, and industrial complexes across the United States, Canada, and Mexico. Market dynamics indicate robust growth driven by increasing construction activities, stringent energy efficiency regulations, and growing awareness of indoor air quality importance.

Commercial HVAC systems in North America are experiencing unprecedented demand as businesses prioritize employee comfort, operational efficiency, and environmental sustainability. The market demonstrates significant technological advancement with smart HVAC solutions, IoT integration, and energy-efficient systems gaining substantial traction. Growth projections suggest the market will expand at a compound annual growth rate (CAGR) of 6.2% through the forecast period, reflecting strong underlying demand fundamentals.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 16%, and Mexico contributing 6% of the total North American commercial HVAC market. This distribution reflects varying levels of commercial construction activity, regulatory frameworks, and economic development across the region.

The North America commercial HVAC market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems, equipment, components, and services specifically designed for non-residential applications across the United States, Canada, and Mexico. This market encompasses complete HVAC solutions including chillers, boilers, air handling units, rooftop units, variable refrigerant flow systems, and associated control technologies.

Commercial HVAC systems differ significantly from residential applications in terms of scale, complexity, and performance requirements. These systems must handle larger spaces, accommodate varying occupancy levels, meet stringent building codes, and deliver consistent performance across diverse operational conditions. System integration involves sophisticated controls, energy management capabilities, and advanced monitoring technologies that ensure optimal performance while minimizing operational costs.

Market scope includes equipment manufacturing, system installation, maintenance services, retrofitting solutions, and emerging technologies such as smart building integration and predictive maintenance capabilities. The commercial HVAC sector serves as a critical component of building infrastructure, directly impacting occupant comfort, productivity, and overall building operational efficiency.

North America’s commercial HVAC market demonstrates exceptional growth momentum driven by robust construction activity, increasing focus on energy efficiency, and evolving workplace requirements. The market benefits from strong regulatory support for energy-efficient systems, with building codes requiring 25% improvement in energy performance compared to previous standards. Technology adoption accelerates as businesses recognize the value proposition of smart HVAC systems in reducing operational costs and improving occupant satisfaction.

Key market drivers include the growing emphasis on indoor air quality following recent health concerns, increasing commercial construction projects, and the need for HVAC system replacements in aging building stock. Energy efficiency mandates continue to shape product development, with manufacturers investing heavily in advanced technologies such as variable speed drives, smart controls, and heat recovery systems.

Competitive landscape features established players leveraging technological innovation to maintain market position while emerging companies focus on specialized solutions and niche applications. Market consolidation trends indicate strategic partnerships and acquisitions as companies seek to expand their technological capabilities and geographic reach across the North American region.

Strategic market insights reveal several critical trends shaping the North America commercial HVAC landscape:

Market penetration of advanced HVAC technologies varies significantly across different commercial segments, with office buildings and healthcare facilities leading adoption of sophisticated systems. Regional variations reflect differences in climate conditions, building codes, and economic development levels across North American markets.

Primary market drivers propelling North America commercial HVAC market growth include increasing commercial construction activity, stringent energy efficiency regulations, and growing awareness of indoor environmental quality importance. Construction sector growth directly correlates with HVAC system demand as new commercial buildings require comprehensive climate control solutions.

Energy cost concerns drive businesses to invest in high-efficiency HVAC systems that deliver long-term operational savings. Utility incentive programs further encourage adoption of energy-efficient equipment through rebates and financing options. Building automation trends create demand for smart HVAC systems that integrate seamlessly with overall building management platforms.

Regulatory compliance requirements mandate specific performance standards for commercial HVAC systems, driving replacement of older, less efficient equipment. Environmental sustainability initiatives encourage adoption of systems with reduced carbon footprints and improved environmental performance. Workplace productivity studies demonstrate the correlation between optimal indoor climate conditions and employee performance, justifying HVAC system investments.

Technological advancements in HVAC equipment offer improved reliability, enhanced control capabilities, and reduced maintenance requirements, making system upgrades attractive to building owners. Health and safety considerations following recent global events have elevated the importance of proper ventilation and air filtration systems in commercial environments.

Significant market restraints challenge North America commercial HVAC market growth, including high initial capital investment requirements for advanced HVAC systems. Budget constraints often limit building owners’ ability to invest in premium equipment, particularly for smaller commercial establishments with limited financial resources.

Installation complexity associated with modern commercial HVAC systems requires specialized expertise and extended project timelines, potentially deterring some customers from system upgrades. Skilled labor shortages in the HVAC industry create bottlenecks in installation and maintenance services, impacting market growth potential.

Economic uncertainty can delay commercial construction projects and HVAC system replacement decisions as businesses postpone capital expenditures during challenging economic conditions. Supply chain disruptions affect equipment availability and pricing, creating challenges for both manufacturers and end-users.

Regulatory complexity across different jurisdictions within North America creates compliance challenges for manufacturers and installers, particularly for companies operating across multiple markets. Technology adoption barriers include concerns about system reliability, cybersecurity risks, and integration challenges with existing building infrastructure.

Substantial market opportunities emerge from the growing retrofit and replacement market as aging commercial building stock requires HVAC system upgrades. Building modernization projects present significant opportunities for advanced HVAC solutions that improve energy efficiency and occupant comfort simultaneously.

Smart building integration creates opportunities for HVAC manufacturers to develop connected systems that provide enhanced monitoring, control, and optimization capabilities. Data analytics applications enable predictive maintenance and performance optimization services, creating new revenue streams for service providers.

Sustainability mandates drive demand for environmentally friendly HVAC solutions, including heat pump technologies, renewable energy integration, and low-global-warming-potential refrigerants. Green building certifications create market opportunities for systems that contribute to LEED, ENERGY STAR, and other sustainability ratings.

Emerging market segments such as data centers, cold storage facilities, and specialized manufacturing environments require customized HVAC solutions with unique performance characteristics. Service market expansion offers opportunities for comprehensive maintenance contracts, energy management services, and system optimization programs that provide ongoing value to commercial customers.

Complex market dynamics shape the North America commercial HVAC landscape through interconnected factors including technological innovation, regulatory evolution, and changing customer expectations. Supply and demand balance fluctuates based on construction activity levels, economic conditions, and replacement cycles for existing HVAC equipment.

Competitive pressures drive continuous innovation as manufacturers seek to differentiate their offerings through improved efficiency, enhanced features, and superior service support. Price competition remains intense, particularly in commodity product segments, while premium technology solutions command higher margins through value-added capabilities.

Customer behavior evolution reflects increasing sophistication in HVAC system evaluation, with buyers considering total cost of ownership, energy performance, and long-term reliability rather than focusing solely on initial purchase price. Decision-making processes involve multiple stakeholders including building owners, facility managers, consulting engineers, and end-users.

Market cyclicality correlates with broader construction industry patterns, creating periods of high demand followed by slower growth phases. Seasonal variations affect demand patterns, with peak installation activity typically occurring during moderate weather periods when building disruptions are minimized.

Comprehensive research methodology employed for analyzing the North America commercial HVAC market combines primary and secondary research approaches to ensure data accuracy and market insight depth. Primary research activities include extensive interviews with industry executives, equipment manufacturers, distributors, contractors, and end-users across the commercial HVAC value chain.

Secondary research sources encompass industry publications, government databases, trade association reports, and company financial statements to validate market trends and quantify market dynamics. Data triangulation methods ensure information accuracy by cross-referencing multiple sources and identifying consistent patterns across different data points.

Market sizing methodology utilizes bottom-up and top-down approaches to estimate market dimensions and growth projections. Regional analysis incorporates country-specific factors including construction activity levels, regulatory frameworks, and economic indicators that influence HVAC market development.

Qualitative analysis techniques identify emerging trends, competitive dynamics, and strategic opportunities through expert interviews and industry observation. Quantitative modeling projects future market scenarios based on historical trends, identified drivers, and anticipated market developments across different commercial HVAC segments.

United States dominance in the North America commercial HVAC market reflects the country’s large commercial building stock, robust construction activity, and stringent energy efficiency regulations. Market concentration in major metropolitan areas drives demand for sophisticated HVAC systems in high-rise office buildings, shopping centers, and institutional facilities.

Canadian market characteristics include emphasis on cold climate HVAC solutions, energy efficiency incentives, and growing adoption of heat pump technologies for commercial applications. Regional variations within Canada reflect different climate zones and provincial building codes that influence HVAC system selection and performance requirements.

Mexican market growth benefits from increasing foreign investment, industrial development, and modernization of commercial building infrastructure. Market opportunities in Mexico include retrofit projects for existing buildings and new construction driven by economic development initiatives.

Climate considerations significantly influence HVAC system requirements across North America, with cooling-dominated markets in southern regions and heating-focused applications in northern climates. Regional preferences for specific HVAC technologies reflect local climate conditions, energy costs, and regulatory requirements that vary across different geographic areas.

Competitive landscape analysis reveals a diverse ecosystem of established multinational corporations, regional specialists, and emerging technology companies competing across different market segments. Market leaders maintain competitive advantages through comprehensive product portfolios, extensive distribution networks, and strong service capabilities.

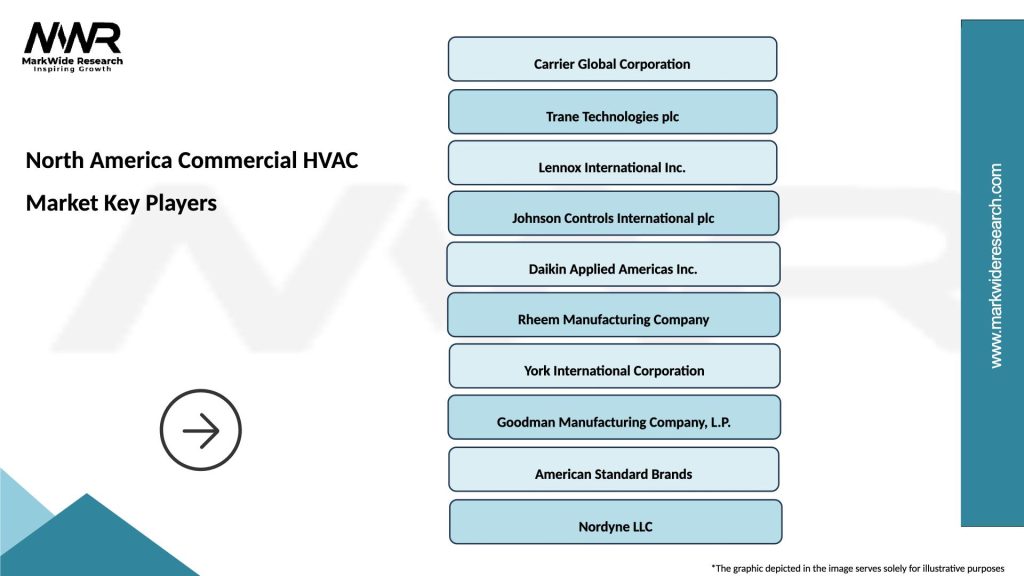

Key market participants include:

Competitive strategies emphasize technological innovation, energy efficiency improvements, and comprehensive service offerings that provide ongoing value to commercial customers. Market positioning varies from premium technology leaders to value-focused providers serving price-sensitive market segments.

Market segmentation analysis provides detailed insights into different commercial HVAC categories, applications, and end-user segments that comprise the North American market. Product segmentation encompasses various HVAC equipment types with distinct performance characteristics and application suitability.

By Product Type:

By Application:

Rooftop units category represents the largest segment of the North America commercial HVAC market, accounting for approximately 42% market share due to their versatility, cost-effectiveness, and ease of installation. Technology evolution in rooftop units includes variable speed drives, advanced controls, and improved heat exchangers that enhance energy efficiency and performance reliability.

Chiller systems category serves large commercial applications requiring centralized cooling with high efficiency and precise temperature control. Market trends include adoption of magnetic bearing chillers, heat recovery capabilities, and smart controls that optimize performance based on building load conditions.

VRF systems category demonstrates rapid growth driven by their ability to provide individual zone control, energy efficiency, and installation flexibility. Technology advantages include simultaneous heating and cooling capabilities, reduced ductwork requirements, and sophisticated control systems that adapt to varying occupancy patterns.

Air handling units category offers customizable solutions for diverse commercial applications with specific ventilation and air quality requirements. Innovation focus includes energy recovery ventilators, advanced filtration systems, and modular designs that simplify installation and maintenance procedures.

Heat pump category gains traction as businesses seek efficient heating and cooling solutions that reduce operational costs and environmental impact. Market drivers include utility incentives, environmental regulations, and improved cold-weather performance of modern heat pump technologies.

Equipment manufacturers benefit from growing demand for energy-efficient commercial HVAC systems, creating opportunities for premium product development and market expansion. Technology leadership enables manufacturers to command higher margins while building long-term customer relationships through superior performance and reliability.

Contractors and installers gain from increasing complexity of modern HVAC systems that require specialized expertise and training. Service opportunities expand as smart HVAC systems require ongoing maintenance, monitoring, and optimization services that provide recurring revenue streams.

Building owners and operators realize significant benefits through reduced energy costs, improved occupant comfort, and enhanced building value from modern HVAC system investments. Operational advantages include predictive maintenance capabilities, remote monitoring, and automated optimization that minimize system downtime and maintenance costs.

Occupants and tenants experience improved comfort, better indoor air quality, and enhanced productivity from properly designed and maintained commercial HVAC systems. Health benefits include superior air filtration, appropriate humidity control, and consistent temperature maintenance that contribute to occupant well-being.

Utility companies benefit from reduced peak demand and improved grid stability through energy-efficient HVAC systems and demand response capabilities. Environmental stakeholders gain from reduced carbon emissions and improved energy efficiency that support sustainability objectives and climate change mitigation efforts.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digitalization transformation represents the most significant trend reshaping the North America commercial HVAC market, with IoT-enabled systems providing real-time monitoring, predictive maintenance, and automated optimization capabilities. Smart building integration enables HVAC systems to communicate with other building systems for comprehensive energy management and operational efficiency.

Energy efficiency focus continues driving product development and customer purchasing decisions, with high-efficiency systems delivering substantial operational cost savings and environmental benefits. Heat pump adoption accelerates as technology improvements enable effective operation in colder climates while providing both heating and cooling capabilities.

Indoor air quality emphasis has elevated the importance of ventilation systems and advanced filtration technologies in commercial HVAC applications. Health-focused features include enhanced air purification, humidity control, and pathogen reduction capabilities that address growing occupant health and safety concerns.

Sustainability requirements drive adoption of environmentally friendly refrigerants, energy recovery systems, and renewable energy integration in commercial HVAC applications. Electrification trends promote heat pump technologies and electric heating solutions as alternatives to fossil fuel-based systems.

Customization demand increases as diverse commercial applications require tailored HVAC solutions optimized for specific operational requirements, occupancy patterns, and performance objectives. Modular system designs provide flexibility for future expansion and modification as building requirements evolve.

Recent industry developments demonstrate the dynamic nature of the North America commercial HVAC market, with manufacturers investing heavily in research and development to address evolving customer needs and regulatory requirements. Product launches focus on energy efficiency improvements, smart connectivity features, and enhanced reliability for demanding commercial applications.

Strategic partnerships between HVAC manufacturers and technology companies accelerate development of connected systems and data analytics capabilities. MarkWide Research analysis indicates that collaboration between traditional HVAC companies and software developers creates innovative solutions that provide comprehensive building management capabilities.

Acquisition activity continues as companies seek to expand their technological capabilities, geographic reach, and product portfolios through strategic transactions. Market consolidation enables companies to achieve economies of scale while investing in advanced technologies and service capabilities.

Regulatory developments include updated building codes, energy efficiency standards, and environmental regulations that influence product development and market adoption patterns. Industry initiatives promote workforce development, training programs, and certification standards that address skilled labor shortages in the commercial HVAC sector.

Technology breakthroughs in areas such as magnetic bearing compressors, advanced controls, and heat recovery systems provide new opportunities for energy efficiency improvements and performance optimization in commercial HVAC applications.

Strategic recommendations for commercial HVAC market participants emphasize the importance of embracing digitalization trends and developing connected system capabilities that provide ongoing value to customers. Investment priorities should focus on IoT integration, data analytics platforms, and predictive maintenance technologies that differentiate offerings in competitive markets.

Market positioning strategies should emphasize total cost of ownership benefits rather than focusing solely on initial equipment costs. Value proposition development requires demonstrating energy savings, operational efficiency improvements, and enhanced occupant comfort that justify premium pricing for advanced HVAC systems.

Service expansion opportunities represent significant growth potential as customers increasingly value comprehensive maintenance contracts and energy management services. Recurring revenue models provide stable income streams while building long-term customer relationships through ongoing system optimization and support.

Geographic expansion strategies should consider regional variations in climate conditions, building codes, and market preferences that influence HVAC system selection. Localization efforts may include product modifications, distribution partnerships, and service network development tailored to specific regional requirements.

Workforce development initiatives are essential for addressing skilled labor shortages that constrain market growth. Training programs should focus on modern HVAC technologies, smart system installation, and advanced troubleshooting techniques that support market expansion and customer satisfaction.

Future market prospects for the North America commercial HVAC sector remain highly positive, driven by continued construction activity, increasing focus on energy efficiency, and growing adoption of smart building technologies. Long-term growth projections indicate sustained market expansion at a CAGR of 6.2% through the next decade, reflecting strong underlying demand fundamentals and technological innovation.

Technology evolution will continue reshaping the commercial HVAC landscape with artificial intelligence, machine learning, and advanced analytics enabling autonomous system operation and optimization. Integration capabilities will expand as HVAC systems become integral components of comprehensive smart building ecosystems that manage energy, security, and occupant experience holistically.

Sustainability imperatives will drive continued adoption of heat pump technologies, renewable energy integration, and ultra-high-efficiency systems that minimize environmental impact. Regulatory evolution is expected to establish more stringent energy performance requirements and environmental standards that accelerate market transformation toward sustainable solutions.

Market opportunities will emerge from the growing retrofit and replacement market as aging commercial building stock requires HVAC system upgrades. MWR projections suggest that replacement demand will account for approximately 65% of market activity by the end of the forecast period, creating substantial opportunities for advanced system installations.

Competitive dynamics will favor companies that successfully combine technological innovation with comprehensive service capabilities and strong customer relationships. Market leadership will increasingly depend on the ability to provide integrated solutions that address multiple building performance objectives simultaneously while delivering measurable value to commercial customers.

North America commercial HVAC market represents a dynamic and growing sector characterized by technological innovation, increasing energy efficiency requirements, and evolving customer expectations for smart building solutions. Market fundamentals remain strong with robust construction activity, aging building stock requiring system replacements, and growing emphasis on indoor environmental quality driving sustained demand growth.

Key success factors for market participants include embracing digitalization trends, developing comprehensive service capabilities, and focusing on total cost of ownership value propositions that resonate with sophisticated commercial customers. Technology leadership in areas such as IoT integration, energy efficiency, and predictive maintenance will differentiate successful companies in increasingly competitive markets.

Future market evolution will be shaped by sustainability requirements, smart building integration, and continued focus on operational efficiency that creates opportunities for innovative HVAC solutions. Strategic positioning around these trends will determine long-term success as the North America commercial HVAC market continues its transformation toward more intelligent, efficient, and sustainable building climate control systems.

What is Commercial HVAC?

Commercial HVAC refers to heating, ventilation, and air conditioning systems specifically designed for commercial buildings, such as offices, retail spaces, and industrial facilities. These systems are essential for maintaining indoor air quality and comfort in large spaces.

What are the key players in the North America Commercial HVAC Market?

Key players in the North America Commercial HVAC Market include Carrier Global Corporation, Trane Technologies, Lennox International, and Rheem Manufacturing Company, among others. These companies are known for their innovative HVAC solutions and extensive product offerings.

What are the main drivers of the North America Commercial HVAC Market?

The main drivers of the North America Commercial HVAC Market include the increasing demand for energy-efficient systems, the growth of the construction industry, and the rising focus on indoor air quality. Additionally, advancements in smart HVAC technologies are also contributing to market growth.

What challenges does the North America Commercial HVAC Market face?

Challenges in the North America Commercial HVAC Market include high installation and maintenance costs, regulatory compliance issues, and the need for skilled labor. These factors can hinder the adoption of new technologies and systems in commercial settings.

What opportunities exist in the North America Commercial HVAC Market?

Opportunities in the North America Commercial HVAC Market include the growing trend towards smart building technologies, the increasing emphasis on sustainability, and the potential for retrofitting existing systems. These factors can drive innovation and expansion in the market.

What trends are shaping the North America Commercial HVAC Market?

Trends shaping the North America Commercial HVAC Market include the integration of IoT technology for better system management, the shift towards eco-friendly refrigerants, and the rise of modular HVAC systems. These trends are influencing how HVAC systems are designed and operated.

North America Commercial HVAC Market

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Heat Pumps, Rooftop Units, Split Systems |

| Technology | Variable Refrigerant Flow, Geothermal, Hydronic, Ductless |

| End User | Commercial Buildings, Retail Spaces, Educational Institutions, Healthcare Facilities |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Commercial HVAC Market

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at