444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America commercial HVAC equipment market represents a dynamic and rapidly evolving sector that encompasses heating, ventilation, and air conditioning systems designed specifically for commercial applications. This comprehensive market includes office buildings, retail spaces, healthcare facilities, educational institutions, hospitality venues, and industrial complexes across the United States, Canada, and Mexico. Market dynamics indicate robust growth driven by increasing construction activities, stringent energy efficiency regulations, and growing awareness of indoor air quality standards.

Commercial HVAC systems in North America are experiencing unprecedented demand due to modernization initiatives and the replacement of aging infrastructure. The market demonstrates significant expansion with technological advancements in smart HVAC solutions, IoT integration, and energy-efficient systems driving adoption rates. Regional variations across North America show distinct preferences, with the United States leading in market adoption at approximately 78% market share, followed by Canada and Mexico contributing to the remaining segments.

Industry transformation is evident through the integration of advanced technologies including variable refrigerant flow systems, heat pumps, and intelligent building management systems. The market exhibits strong growth momentum with increasing focus on sustainability and environmental compliance driving innovation in commercial HVAC equipment design and functionality.

The North America commercial HVAC equipment market refers to the comprehensive ecosystem of heating, ventilation, and air conditioning systems specifically designed, manufactured, and deployed for commercial and industrial applications across the North American region. This market encompasses a wide range of equipment including chillers, boilers, air handling units, rooftop units, heat pumps, ventilation systems, and associated control technologies that maintain optimal indoor environmental conditions in non-residential buildings.

Commercial HVAC equipment differs significantly from residential systems in terms of capacity, complexity, and operational requirements. These systems are engineered to handle larger spaces, accommodate higher occupancy levels, and provide precise climate control for diverse commercial applications. Market scope includes both new installations and replacement systems, along with maintenance and service components that ensure optimal system performance throughout the equipment lifecycle.

Technology integration within this market encompasses traditional mechanical systems as well as advanced digital solutions including building automation systems, energy management platforms, and predictive maintenance technologies that enhance operational efficiency and reduce environmental impact.

Market leadership in the North America commercial HVAC equipment sector is characterized by intense competition among established manufacturers and emerging technology providers. The market demonstrates consistent growth patterns driven by commercial construction activities, energy efficiency mandates, and increasing demand for indoor air quality solutions. Key market drivers include regulatory compliance requirements, technological innovation, and growing awareness of environmental sustainability.

Strategic market positioning reveals that energy-efficient systems account for approximately 65% of new installations, reflecting the industry’s commitment to sustainability and operational cost reduction. Commercial segments show varying adoption rates, with office buildings and healthcare facilities leading in advanced HVAC system implementations. The market benefits from strong replacement demand as aging infrastructure requires modernization to meet current efficiency standards.

Competitive landscape features both multinational corporations and specialized regional players, creating a diverse ecosystem that fosters innovation and competitive pricing. Market consolidation trends indicate strategic partnerships and acquisitions aimed at expanding technological capabilities and market reach across the North American region.

Market intelligence reveals several critical insights that shape the North America commercial HVAC equipment landscape:

Primary market drivers propelling the North America commercial HVAC equipment market include comprehensive factors that influence both demand generation and technology adoption. Construction industry growth serves as a fundamental driver, with new commercial developments requiring advanced HVAC systems that meet current building codes and energy efficiency standards.

Energy efficiency regulations represent a critical driver, as government mandates and building certification programs require commercial facilities to implement high-performance HVAC systems. Operational cost reduction motivates building owners to invest in energy-efficient equipment that provides long-term savings through reduced utility expenses and improved system reliability.

Indoor air quality awareness has emerged as a significant driver, particularly following increased health consciousness in commercial environments. Technology advancement in smart HVAC systems offers enhanced control, monitoring, and optimization capabilities that appeal to facility managers seeking improved operational efficiency. Replacement market demand continues to drive growth as aging commercial HVAC infrastructure requires modernization to maintain performance standards and regulatory compliance.

Environmental sustainability initiatives encourage commercial property owners to adopt eco-friendly HVAC solutions that reduce carbon footprint and support corporate sustainability goals. Government incentives and rebate programs further stimulate market demand by reducing the initial investment burden for energy-efficient HVAC equipment installations.

Market constraints affecting the North America commercial HVAC equipment sector present challenges that influence adoption rates and growth potential. High initial investment costs represent a primary restraint, as advanced commercial HVAC systems require significant capital expenditure that may deter smaller commercial property owners from upgrading their existing systems.

Installation complexity creates barriers for market expansion, particularly in retrofit applications where existing building infrastructure may not accommodate modern HVAC equipment without extensive modifications. Skilled labor shortage in the HVAC industry limits installation capacity and increases project timelines, potentially delaying market growth initiatives.

Economic uncertainty can impact commercial construction projects and HVAC equipment procurement decisions, as businesses may defer capital investments during periods of financial instability. Regulatory compliance complexity presents challenges for equipment manufacturers and installers who must navigate varying local, state, and federal requirements across different North American jurisdictions.

Technology integration challenges may limit adoption of advanced HVAC systems, particularly in facilities with legacy building management systems that require extensive upgrades to support modern equipment. Maintenance requirements for sophisticated HVAC systems demand specialized technical expertise that may not be readily available in all geographic markets, creating operational challenges for building owners.

Strategic opportunities within the North America commercial HVAC equipment market present significant potential for growth and innovation. Smart building integration offers substantial opportunities as commercial properties increasingly adopt IoT technologies and building automation systems that require compatible HVAC equipment with advanced connectivity features.

Retrofit market expansion represents a major opportunity, as millions of commercial buildings across North America require HVAC system upgrades to meet current efficiency standards and regulatory requirements. Green building certification programs create opportunities for manufacturers to develop specialized equipment that helps commercial properties achieve LEED, ENERGY STAR, and other sustainability certifications.

Heat pump technology advancement presents opportunities for market expansion, particularly in regions with moderate climates where heat pumps can provide efficient heating and cooling solutions. Indoor air quality solutions offer growth potential as commercial facilities prioritize advanced filtration and ventilation systems to ensure healthy indoor environments.

Service and maintenance markets provide recurring revenue opportunities through comprehensive maintenance contracts and predictive maintenance services that leverage IoT sensors and data analytics. Regional market development in underserved areas of Canada and Mexico offers expansion opportunities for established HVAC equipment manufacturers seeking to broaden their geographic presence.

Market dynamics in the North America commercial HVAC equipment sector reflect complex interactions between technological innovation, regulatory requirements, and economic factors. Supply chain optimization has become increasingly important as manufacturers seek to reduce costs and improve delivery times while maintaining quality standards for commercial HVAC equipment.

Competitive pressures drive continuous innovation in energy efficiency, system reliability, and smart technology integration. Customer preferences are evolving toward comprehensive HVAC solutions that combine equipment, controls, and service offerings in integrated packages that simplify procurement and maintenance processes.

Technology convergence between HVAC systems and building automation platforms creates new market dynamics as traditional equipment manufacturers collaborate with software companies to deliver integrated solutions. Seasonal demand patterns influence market dynamics, with peak installation periods typically occurring during spring and fall months when weather conditions are optimal for construction activities.

Economic cycles significantly impact commercial HVAC equipment demand, as construction activities and capital investment decisions correlate with broader economic conditions. Environmental regulations continue to shape market dynamics by establishing performance standards that drive innovation and influence equipment selection criteria across different commercial applications.

Comprehensive research methodology employed for analyzing the North America commercial HVAC equipment market incorporates multiple data collection and analysis techniques to ensure accurate and reliable market insights. Primary research activities include structured interviews with industry executives, equipment manufacturers, distributors, contractors, and end-users across various commercial sectors to gather firsthand market intelligence.

Secondary research components encompass analysis of industry reports, government publications, trade association data, and company financial statements to establish market baselines and validate primary research findings. Market sizing methodologies utilize bottom-up and top-down approaches to ensure comprehensive coverage of all market segments and geographic regions within North America.

Data validation processes include cross-referencing multiple sources, expert panel reviews, and statistical analysis to ensure research accuracy and reliability. Quantitative analysis techniques incorporate statistical modeling and trend analysis to identify growth patterns and market dynamics that influence the commercial HVAC equipment sector.

Qualitative research methods include focus groups and in-depth interviews with industry stakeholders to understand market drivers, challenges, and opportunities from multiple perspectives. Market forecasting models integrate historical data, current market conditions, and forward-looking indicators to project future market trends and growth potential across different commercial HVAC equipment categories.

Regional market analysis reveals distinct characteristics and growth patterns across North America’s commercial HVAC equipment landscape. United States market dominance is evident with approximately 78% regional market share, driven by extensive commercial construction activities, stringent energy efficiency regulations, and high adoption rates of advanced HVAC technologies across diverse commercial sectors.

Canadian market dynamics show strong growth in energy-efficient HVAC systems, particularly in provinces with extreme climate conditions that require robust heating and cooling solutions. Government incentive programs in Canada support commercial HVAC upgrades, contributing to steady market expansion with focus on environmental sustainability and operational efficiency.

Mexican market development demonstrates increasing adoption of commercial HVAC equipment driven by industrial growth, tourism infrastructure development, and rising commercial construction activities. Regional climate variations across North America create diverse equipment preferences, with northern regions emphasizing heating capabilities while southern areas prioritize cooling efficiency.

Urban market concentration is evident in major metropolitan areas including New York, Los Angeles, Toronto, and Mexico City, where commercial development activities drive significant HVAC equipment demand. Rural market opportunities exist in agricultural and industrial applications that require specialized commercial HVAC solutions adapted to unique operational requirements and environmental conditions.

Competitive landscape in the North America commercial HVAC equipment market features established multinational corporations alongside specialized regional manufacturers and emerging technology companies. Market leadership is characterized by companies that combine comprehensive product portfolios with strong distribution networks and service capabilities.

Strategic partnerships and acquisitions are common competitive strategies as companies seek to expand technological capabilities and market reach. Innovation focus centers on energy efficiency, smart technology integration, and comprehensive service offerings that differentiate competitors in the commercial HVAC equipment market.

Market segmentation of the North America commercial HVAC equipment sector encompasses multiple classification criteria that reflect diverse customer needs and application requirements. Product-based segmentation includes heating equipment, cooling systems, ventilation components, and integrated HVAC solutions that serve different commercial applications.

By Equipment Type:

By End-User Application:

By Technology:

Category analysis reveals distinct performance characteristics and market dynamics across different commercial HVAC equipment segments. Heating equipment category demonstrates steady growth driven by replacement demand and energy efficiency upgrades, with heat pump technologies gaining significant market traction due to their dual heating and cooling capabilities.

Cooling systems segment represents the largest category within the commercial HVAC equipment market, with chillers and rooftop units accounting for substantial installation volumes across diverse commercial applications. Variable refrigerant flow systems show particularly strong growth in office buildings and hospitality applications where zone-based climate control provides operational advantages.

Ventilation equipment category has experienced increased demand following heightened awareness of indoor air quality requirements. Energy recovery ventilation systems demonstrate growing adoption rates as commercial facilities seek to balance fresh air requirements with energy efficiency objectives. Air handling units with advanced filtration capabilities show strong market performance in healthcare and educational applications.

Control systems category exhibits rapid growth as building automation integration becomes standard practice in commercial HVAC installations. Smart thermostats and building management systems provide enhanced operational control and energy optimization capabilities that appeal to facility managers seeking improved system performance and reduced operational costs.

Industry participants in the North America commercial HVAC equipment market realize substantial benefits through strategic positioning and market engagement. Equipment manufacturers benefit from steady demand growth, technological innovation opportunities, and expanding market segments that provide diverse revenue streams and growth potential.

Distributors and contractors gain advantages through comprehensive product portfolios, training programs, and technical support that enhance their competitive positioning and customer service capabilities. Service providers benefit from recurring revenue opportunities through maintenance contracts and system optimization services that provide long-term customer relationships.

End-user stakeholders including building owners and facility managers realize significant benefits through improved energy efficiency, reduced operational costs, and enhanced indoor environmental quality. Energy savings from modern commercial HVAC equipment can reduce utility expenses by 20-40% compared to older systems, providing substantial return on investment over equipment lifecycles.

Environmental benefits include reduced carbon emissions and improved sustainability performance that supports corporate environmental goals and regulatory compliance. Operational advantages encompass enhanced system reliability, predictive maintenance capabilities, and improved occupant comfort that contribute to overall building performance and tenant satisfaction.

Technology stakeholders benefit from integration opportunities with building automation systems, IoT platforms, and energy management solutions that create additional value propositions and market differentiation opportunities within the commercial HVAC equipment ecosystem.

Strengths:

Weaknesses:

Opportunities:

Threats:

Key market trends shaping the North America commercial HVAC equipment landscape reflect evolving customer preferences, technological advancement, and regulatory requirements. Energy efficiency optimization continues as a dominant trend, with commercial facilities seeking HVAC systems that minimize operational costs while maintaining optimal indoor environmental conditions.

Smart technology integration represents a transformative trend as IoT sensors, cloud connectivity, and artificial intelligence capabilities become standard features in commercial HVAC equipment. Predictive maintenance technologies are gaining traction, enabling proactive system management that reduces downtime and extends equipment lifespan through data-driven maintenance scheduling.

Indoor air quality focus has intensified following increased health awareness, driving demand for advanced filtration systems, UV sterilization technologies, and enhanced ventilation capabilities. Heat pump adoption is accelerating as these systems provide efficient heating and cooling solutions while supporting electrification initiatives and renewable energy integration.

Modular system design trends enable flexible installation and expansion capabilities that accommodate changing commercial space requirements. Sustainability certifications influence equipment selection as building owners pursue LEED, ENERGY STAR, and other green building credentials that require high-performance HVAC systems.

Service-oriented business models are emerging as equipment manufacturers expand beyond product sales to offer comprehensive maintenance, monitoring, and optimization services that provide recurring revenue streams and enhanced customer relationships.

Industry developments within the North America commercial HVAC equipment market demonstrate continuous innovation and strategic evolution among market participants. Product launches featuring enhanced energy efficiency, smart connectivity, and improved reliability address evolving customer requirements and regulatory standards.

Strategic partnerships between HVAC manufacturers and technology companies facilitate integration of advanced control systems, IoT platforms, and building automation solutions. Acquisition activities enable market consolidation and capability expansion as companies seek to strengthen their competitive positioning and market reach.

Manufacturing facility investments across North America support local production capabilities and reduce supply chain dependencies while improving delivery times and customer service. Research and development initiatives focus on next-generation technologies including variable refrigerant flow systems, magnetic bearing chillers, and advanced heat pump technologies.

Sustainability initiatives include development of low-global warming potential refrigerants and energy-efficient equipment designs that support environmental compliance and corporate sustainability goals. Digital transformation efforts encompass development of mobile applications, cloud-based monitoring platforms, and data analytics capabilities that enhance system performance and user experience.

Training and certification programs address skilled labor shortages by providing comprehensive education for installation technicians and service professionals, ensuring proper system implementation and maintenance across the commercial HVAC equipment market.

Strategic recommendations for stakeholders in the North America commercial HVAC equipment market emphasize the importance of technology adoption, market positioning, and customer relationship management. MarkWide Research analysis suggests that companies should prioritize smart technology integration to meet evolving customer expectations for connected and controllable HVAC systems.

Investment priorities should focus on energy-efficient equipment development and service capability expansion to capture growing demand for comprehensive HVAC solutions. Market entry strategies for new participants should emphasize regional partnerships and specialized application expertise to establish competitive differentiation in specific market segments.

Customer engagement strategies should incorporate digital platforms and data analytics to provide enhanced value propositions beyond traditional equipment sales. Supply chain optimization remains critical for maintaining competitive pricing and delivery performance in an increasingly complex market environment.

Regulatory compliance preparation is essential as environmental standards continue to evolve, requiring proactive product development and market positioning strategies. Service market development presents significant opportunities for recurring revenue generation through maintenance contracts and system optimization services that provide long-term customer relationships.

Geographic expansion strategies should consider regional climate variations and local market preferences when developing product offerings and distribution approaches across different North American markets.

Future market outlook for the North America commercial HVAC equipment sector indicates continued growth driven by technological innovation, regulatory requirements, and evolving customer expectations. Market expansion is projected to maintain steady momentum with growth rates of approximately 5.8% annually over the next five years, supported by commercial construction activities and equipment replacement demand.

Technology evolution will continue to shape market dynamics as artificial intelligence, machine learning, and advanced sensors become integrated into commercial HVAC systems. Energy efficiency standards are expected to become increasingly stringent, driving demand for high-performance equipment that meets or exceeds regulatory requirements.

Market consolidation trends may accelerate as companies seek to achieve economies of scale and expand technological capabilities through strategic acquisitions and partnerships. Service market growth is anticipated to outpace equipment sales as customers increasingly value comprehensive maintenance and optimization services.

Regional market development in Canada and Mexico presents expansion opportunities as economic growth and infrastructure development drive commercial HVAC equipment demand. Sustainability focus will intensify as corporate environmental commitments and regulatory requirements drive adoption of eco-friendly HVAC solutions.

Innovation acceleration in heat pump technologies, variable refrigerant flow systems, and building automation integration will create new market opportunities and competitive advantages for forward-thinking companies. MWR projections indicate that smart HVAC systems will account for approximately 45% of new installations by 2028, reflecting the growing importance of connected building technologies.

Market analysis of the North America commercial HVAC equipment sector reveals a dynamic and evolving industry characterized by steady growth, technological innovation, and increasing focus on energy efficiency and sustainability. Strong market fundamentals including commercial construction activities, equipment replacement demand, and regulatory support provide a solid foundation for continued market expansion across the United States, Canada, and Mexico.

Technology transformation through smart system integration, IoT connectivity, and advanced control capabilities represents a defining characteristic of the modern commercial HVAC equipment market. Customer preferences increasingly favor comprehensive solutions that combine high-performance equipment with intelligent monitoring and optimization capabilities that deliver measurable operational benefits.

Competitive landscape evolution continues as established manufacturers and emerging technology companies collaborate to deliver innovative solutions that address evolving market requirements. Service market opportunities provide additional growth potential through recurring revenue streams and enhanced customer relationships that extend beyond traditional equipment sales.

Future success in the North America commercial HVAC equipment market will depend on companies’ ability to adapt to changing customer needs, regulatory requirements, and technological advancement while maintaining competitive pricing and service excellence. Strategic positioning that emphasizes energy efficiency, smart technology integration, and comprehensive service capabilities will be essential for capturing growth opportunities in this dynamic and important market sector.

What is Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment?

Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment refers to systems and devices used to regulate indoor climate in commercial buildings. This includes heating systems, air conditioning units, ventilation fans, and control systems designed to maintain comfort and air quality in spaces such as offices, retail stores, and warehouses.

What are the key players in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market?

Key players in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market include Carrier Corporation, Trane Technologies, Lennox International, and Rheem Manufacturing Company, among others.

What are the growth factors driving the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market?

The growth of the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market is driven by increasing demand for energy-efficient systems, rising construction activities, and growing awareness of indoor air quality. Additionally, advancements in smart HVAC technologies are contributing to market expansion.

What challenges does the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market face?

Challenges in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market include high installation and maintenance costs, regulatory compliance issues, and the need for skilled labor. These factors can hinder market growth and affect the adoption of new technologies.

What opportunities exist in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market?

Opportunities in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market include the increasing trend towards smart building technologies, the integration of renewable energy sources, and the growing focus on sustainability. These factors are expected to create new avenues for innovation and investment.

What trends are shaping the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market?

Trends shaping the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market include the rise of IoT-enabled HVAC systems, the shift towards eco-friendly refrigerants, and the increasing use of automation in HVAC controls. These trends are enhancing efficiency and user experience in commercial environments.

North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market

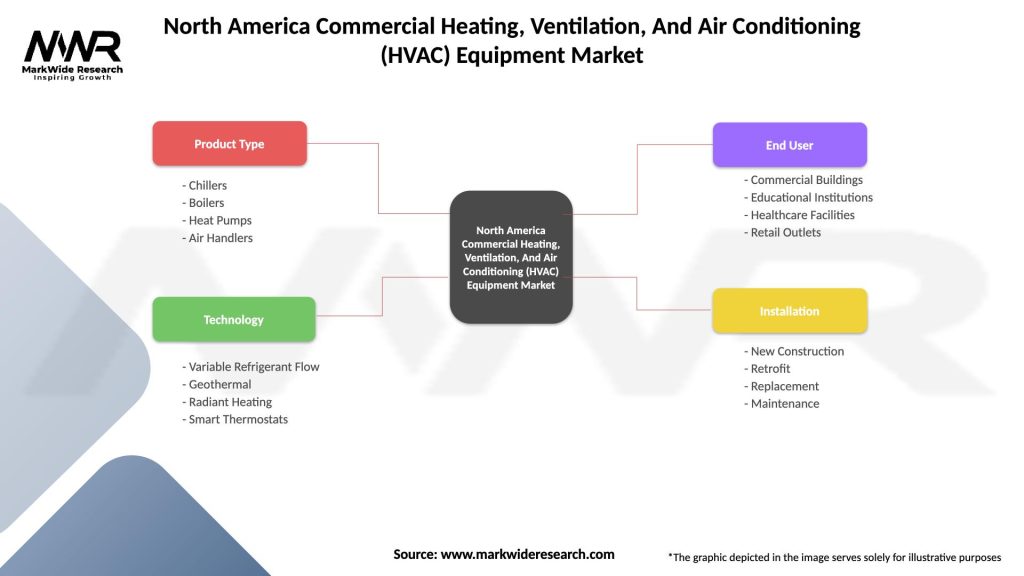

| Segmentation Details | Description |

|---|---|

| Product Type | Chillers, Boilers, Heat Pumps, Air Handlers |

| Technology | Variable Refrigerant Flow, Geothermal, Radiant Heating, Smart Thermostats |

| End User | Commercial Buildings, Educational Institutions, Healthcare Facilities, Retail Outlets |

| Installation | New Construction, Retrofit, Replacement, Maintenance |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Commercial Heating, Ventilation, And Air Conditioning (HVAC) Equipment Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at