444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America coaxial cable market represents a critical infrastructure component driving telecommunications, broadcasting, and data transmission across the region. Coaxial cables continue to serve as the backbone for cable television networks, internet service providers, and various industrial applications throughout the United States, Canada, and Mexico. The market demonstrates steady growth momentum with increasing demand for high-speed internet connectivity and advanced broadcasting solutions.

Market dynamics indicate robust expansion driven by the ongoing digital transformation and infrastructure modernization initiatives. The region’s mature telecommunications infrastructure creates substantial demand for both replacement and upgrade projects. Cable operators are investing heavily in network improvements to support higher bandwidth requirements and emerging technologies like 5G networks.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 15% market presence, and Mexico contributing 7% to the overall market. The market experiences consistent demand from residential, commercial, and industrial sectors, with broadband internet applications representing the largest segment by volume.

Technology evolution continues to shape market requirements, with manufacturers developing enhanced coaxial cable solutions featuring improved signal integrity, reduced interference, and higher frequency capabilities. The integration of coaxial cables with fiber optic networks through hybrid fiber-coaxial (HFC) systems maintains their relevance in modern telecommunications infrastructure.

The North America coaxial cable market refers to the comprehensive ecosystem encompassing the manufacturing, distribution, installation, and maintenance of coaxial cables across the United States, Canada, and Mexico. Coaxial cables are specialized transmission lines consisting of a central conductor surrounded by dielectric insulation, metallic shielding, and protective outer jacket, designed to carry electrical signals with minimal interference.

Market scope includes various coaxial cable types such as RG-6, RG-11, RG-59, and specialized variants designed for specific applications including cable television, internet services, security systems, and industrial communications. The market encompasses both residential and commercial applications, serving telecommunications companies, cable operators, system integrators, and end-users.

Industry stakeholders include cable manufacturers, distributors, installers, telecommunications service providers, and equipment manufacturers. The market operates through multiple channels including direct sales, wholesale distribution, retail outlets, and online platforms, creating a comprehensive supply chain network across North America.

Technological applications span traditional cable television broadcasting, high-speed internet delivery, security and surveillance systems, industrial automation, medical equipment connectivity, and emerging applications in smart building infrastructure and Internet of Things (IoT) implementations.

Market performance in North America demonstrates resilient growth patterns supported by continuous infrastructure investments and technological advancement requirements. The coaxial cable market benefits from established telecommunications networks while adapting to evolving connectivity demands and emerging technology integration needs.

Key growth drivers include expanding broadband penetration, cable television service upgrades, security system installations, and industrial automation projects. The market experiences approximately 4.2% annual growth in cable television applications and 6.8% growth in broadband internet segments, reflecting diverse demand patterns across application categories.

Competitive landscape features established manufacturers with strong regional presence, supported by extensive distribution networks and technical expertise. Market leaders focus on product innovation, quality improvements, and customer service excellence to maintain competitive positioning in this mature market segment.

Regional trends show increasing demand for higher-grade coaxial cables supporting advanced applications, with particular growth in smart home installations, commercial building automation, and industrial connectivity solutions. The market adapts to changing consumer preferences and technological requirements while maintaining cost-effectiveness.

Future prospects remain positive with continued infrastructure modernization, emerging technology adoption, and expanding applications in various industry sectors. The market evolution reflects broader telecommunications trends while preserving the fundamental advantages of coaxial cable technology in specific use cases.

Market segmentation reveals distinct patterns across application categories, with residential installations representing the largest volume segment while commercial and industrial applications demonstrate higher value per installation. The market structure reflects diverse customer requirements and application-specific performance criteria.

Market intelligence indicates strong correlation between economic development and coaxial cable demand, with infrastructure investments driving market expansion. The relationship between cable television subscriber trends and market volume demonstrates the importance of entertainment industry dynamics on overall market performance.

Infrastructure modernization serves as the primary market driver, with telecommunications companies and cable operators continuously upgrading networks to support higher bandwidth requirements and improved service quality. These investments create substantial demand for high-performance coaxial cables across residential and commercial installations.

Broadband expansion initiatives throughout North America drive significant cable demand, particularly in underserved rural areas where coaxial cable solutions provide cost-effective connectivity options. Government programs supporting broadband access create additional market opportunities for cable manufacturers and installers.

Smart building integration represents an emerging driver as commercial and residential properties incorporate advanced automation systems requiring reliable cable infrastructure. The integration of security systems, building management platforms, and IoT devices creates new applications for specialized coaxial cable products.

5G network deployment indirectly supports coaxial cable demand through backhaul applications and distributed antenna systems. The complementary relationship between wireless and wired infrastructure maintains coaxial cable relevance in modern telecommunications networks.

Industrial automation expansion across manufacturing, energy, and transportation sectors generates demand for industrial-grade coaxial cables supporting control systems, monitoring equipment, and communication networks. These applications require specialized cable specifications and performance characteristics.

Security system growth in both residential and commercial markets drives demand for coaxial cables supporting surveillance cameras, access control systems, and integrated security platforms. The increasing emphasis on safety and security creates consistent market demand across various sectors.

Fiber optic competition presents the most significant market restraint as telecommunications companies increasingly deploy fiber-to-the-home (FTTH) solutions offering superior bandwidth and future-proofing capabilities. This technology shift reduces long-term demand for coaxial cables in certain applications.

Wireless technology advancement creates alternative solutions for various applications traditionally served by coaxial cables. The proliferation of wireless communication systems, particularly in security and monitoring applications, reduces cable requirements in specific market segments.

Installation complexity and associated labor costs can limit market growth, particularly in retrofit applications where existing infrastructure modifications require significant time and expense. The skilled labor shortage in the telecommunications industry compounds these challenges.

Regulatory changes affecting cable television and telecommunications industries can impact market demand patterns. Evolving broadcast standards and communication protocols may require infrastructure modifications affecting coaxial cable specifications and applications.

Economic sensitivity influences market performance as construction activity, infrastructure investments, and consumer spending directly affect coaxial cable demand. Economic downturns can delay projects and reduce discretionary installations impacting overall market volume.

Environmental concerns regarding cable materials and disposal create additional compliance requirements and potential restrictions on certain cable types. Sustainability considerations may influence product development and market acceptance of various coaxial cable solutions.

Hybrid network solutions present significant opportunities as telecommunications providers implement fiber-coaxial combinations optimizing performance and cost-effectiveness. These hybrid approaches maintain coaxial cable relevance while addressing bandwidth requirements and infrastructure economics.

Industrial IoT expansion creates new market opportunities for specialized coaxial cables supporting sensor networks, monitoring systems, and automated control applications. The growing emphasis on industrial digitization generates demand for reliable, high-performance cable solutions.

Data center connectivity represents an emerging opportunity as facilities require diverse cable solutions for equipment interconnection, monitoring systems, and backup communication networks. The expansion of edge computing and distributed data centers creates additional market potential.

Healthcare applications offer growth opportunities through medical equipment connectivity, patient monitoring systems, and hospital communication networks. The increasing sophistication of healthcare technology creates demand for specialized coaxial cable products meeting stringent performance requirements.

Transportation infrastructure modernization creates opportunities in railway communication systems, traffic management networks, and airport facilities. These applications require ruggedized coaxial cables meeting specific environmental and performance standards.

Retrofit markets provide ongoing opportunities as existing buildings and facilities upgrade communication infrastructure, security systems, and automation platforms. The large installed base of older infrastructure creates consistent replacement and improvement demand.

Supply chain dynamics in the North American coaxial cable market reflect established manufacturing capabilities, efficient distribution networks, and strong supplier relationships. The market benefits from domestic production capacity and strategic inventory management across regional distribution centers.

Pricing mechanisms demonstrate stability with gradual adjustments reflecting raw material costs, manufacturing efficiency improvements, and competitive pressures. The market experiences 2-4% annual price variations depending on cable specifications and volume requirements.

Technology evolution continues influencing market dynamics as manufacturers develop enhanced cable designs supporting higher frequencies, improved shielding effectiveness, and specialized applications. Innovation cycles typically span 3-5 years for major product improvements.

Customer relationships play crucial roles in market dynamics, with long-term partnerships between manufacturers, distributors, and major customers creating stability and predictable demand patterns. Service quality and technical support significantly influence customer loyalty and market positioning.

Regulatory environment affects market dynamics through safety standards, environmental regulations, and industry-specific requirements. Compliance with evolving standards creates both challenges and opportunities for market participants.

Seasonal patterns influence market dynamics with construction activity peaks during favorable weather periods and budget cycles affecting large-scale installations. The market demonstrates 15-20% seasonal variation in installation activity across different regions.

Primary research methodology encompasses comprehensive interviews with industry stakeholders including manufacturers, distributors, installers, and end-users across North America. The research approach includes structured questionnaires, in-depth discussions, and market validation through multiple source verification.

Secondary research incorporates analysis of industry publications, company reports, government statistics, trade association data, and regulatory filings. The methodology ensures comprehensive market coverage through diverse information sources and cross-validation of key findings.

Data collection processes utilize both quantitative and qualitative approaches, gathering market size information, pricing data, competitive intelligence, and trend analysis. The research methodology includes real-time market monitoring and periodic validation of key assumptions and projections.

Market segmentation analysis employs detailed categorization by product type, application, end-user industry, and geographic region. The methodology ensures accurate representation of market dynamics across different segments and customer categories.

Competitive analysis methodology includes company profiling, market share assessment, product portfolio evaluation, and strategic positioning analysis. The research approach provides comprehensive understanding of competitive landscape and market structure.

Validation processes ensure data accuracy through triangulation methods, expert consultation, and market reality checks. The methodology includes sensitivity analysis and scenario modeling to assess various market development possibilities and risk factors.

United States market dominates the North American coaxial cable landscape with mature telecommunications infrastructure and extensive cable television networks. The market demonstrates steady demand across residential, commercial, and industrial segments with particular strength in urban areas and established suburban communities.

Regional distribution within the United States shows concentrated demand in major metropolitan areas including New York, Los Angeles, Chicago, and Houston, while rural broadband initiatives create opportunities in previously underserved regions. The market benefits from established distribution networks and skilled installation workforce.

Canadian market represents approximately 15% of regional demand with strong emphasis on telecommunications infrastructure and broadcasting applications. The market characteristics include harsh weather requirements, bilingual service needs, and government initiatives supporting rural connectivity improvements.

Mexican market demonstrates rapid growth potential with expanding telecommunications infrastructure and increasing broadband penetration. The market shows 8-12% annual growth rates in certain segments, driven by urbanization trends and infrastructure modernization programs.

Cross-border dynamics influence regional market patterns through trade relationships, manufacturing locations, and supply chain optimization. The integrated North American market benefits from USMCA trade agreements and established business relationships across national boundaries.

Geographic variations affect product requirements with different environmental conditions, building codes, and installation practices across regions. These variations create opportunities for specialized products and services tailored to specific regional needs and preferences.

Market leadership in the North American coaxial cable market features established manufacturers with strong brand recognition, extensive distribution networks, and comprehensive product portfolios. The competitive environment emphasizes quality, reliability, and customer service excellence.

Competitive strategies focus on product innovation, manufacturing efficiency, customer service excellence, and strategic partnerships. Market leaders invest in research and development to maintain technological advantages and meet evolving customer requirements.

Market positioning varies among competitors with some emphasizing cost leadership while others focus on premium quality and specialized applications. The competitive landscape accommodates different customer segments and application requirements through diverse positioning strategies.

Product segmentation in the North American coaxial cable market encompasses various cable types designed for specific applications and performance requirements. The segmentation reflects diverse customer needs and technical specifications across different industry sectors.

By Cable Type:

By Application:

By End-User:

Residential segment represents the largest volume category with consistent demand driven by new construction, renovation projects, and technology upgrades. This segment emphasizes cost-effectiveness while maintaining adequate performance for standard applications including cable television and internet connectivity.

Commercial applications demonstrate higher value per installation with emphasis on reliability, performance, and compliance with building codes. The segment includes office buildings, retail facilities, healthcare institutions, and educational facilities requiring professional-grade cable solutions.

Industrial category demands specialized coaxial cables meeting stringent environmental and performance requirements. Applications include manufacturing automation, energy infrastructure, transportation systems, and process control networks requiring ruggedized cable designs.

Telecommunications segment focuses on high-performance cables supporting service provider networks, central office installations, and infrastructure applications. This category emphasizes technical specifications, reliability, and compliance with industry standards.

Security applications show strong growth with increasing emphasis on surveillance systems, access control, and integrated security platforms. The category requires cables optimized for video transmission and compatible with various security equipment types.

Broadcast industry maintains specialized requirements for studio applications, transmission facilities, and content distribution networks. This category demands high-quality cables meeting strict performance specifications for professional broadcast applications.

Manufacturers benefit from stable market demand, established customer relationships, and opportunities for product innovation. The market provides predictable revenue streams through replacement cycles and infrastructure modernization projects while offering growth potential in emerging applications.

Distributors gain from comprehensive product portfolios, established supply chains, and diverse customer bases. The market structure supports efficient inventory management and customer service excellence through regional distribution networks and technical expertise.

Installers benefit from consistent project opportunities, technical training programs, and professional certification pathways. The market provides stable employment opportunities and career advancement potential in growing technology sectors.

End-users receive reliable connectivity solutions, cost-effective infrastructure options, and access to technical support services. The market offers proven technology with established performance characteristics and widespread compatibility with existing systems.

Service providers benefit from mature technology, established supply chains, and flexible deployment options. The market supports various network architectures and provides cost-effective solutions for different service delivery requirements.

Investors find stable market fundamentals, predictable cash flows, and opportunities for strategic positioning in essential infrastructure markets. The industry offers defensive characteristics with growth potential in emerging applications and geographic expansion.

Strengths:

Weaknesses:

Opportunities:

Threats:

Technology integration represents a dominant trend as coaxial cables increasingly function within hybrid network architectures combining multiple transmission technologies. This integration maintains coaxial cable relevance while addressing evolving performance requirements and cost considerations.

Quality enhancement trends focus on improved shielding effectiveness, reduced signal loss, and enhanced durability characteristics. Manufacturers invest in advanced materials and manufacturing processes to deliver superior performance meeting demanding application requirements.

Environmental sustainability becomes increasingly important with emphasis on recyclable materials, reduced environmental impact, and compliance with green building standards. The trend influences product development and manufacturing processes across the industry.

Smart building integration drives demand for coaxial cables supporting building automation systems, IoT devices, and integrated communication platforms. This trend creates new application opportunities and technical requirements for cable manufacturers.

Service integration trends show increasing demand for comprehensive solutions including cable supply, installation services, and ongoing maintenance support. Customers prefer single-source providers offering complete project management and technical expertise.

Customization requirements grow as applications become more specialized, requiring tailored cable solutions meeting specific performance, environmental, and installation criteria. This trend supports premium pricing and differentiated market positioning.

Product innovations continue advancing coaxial cable technology through improved materials, enhanced shielding designs, and specialized configurations for emerging applications. Recent developments include low-loss cables for 5G backhaul and environmentally resistant cables for outdoor installations.

Manufacturing investments focus on automation, quality improvements, and capacity expansion to meet growing demand and maintain competitive positioning. Companies invest in advanced production equipment and process optimization to enhance efficiency and product consistency.

Strategic partnerships between manufacturers, distributors, and service providers create integrated value chains and enhanced customer service capabilities. These collaborations improve market reach and technical support while reducing operational complexity.

Acquisition activity consolidates market participants and creates larger, more capable organizations with enhanced product portfolios and geographic coverage. Industry consolidation improves operational efficiency and competitive positioning.

Technology certifications and standards development ensure product compatibility and performance consistency across different applications and manufacturers. Industry organizations work to establish and maintain technical standards supporting market growth.

Sustainability initiatives address environmental concerns through improved recycling programs, reduced material usage, and environmentally friendly manufacturing processes. These developments respond to customer requirements and regulatory expectations.

Market positioning strategies should emphasize coaxial cable advantages in specific applications while acknowledging competitive pressures from alternative technologies. Companies should focus on market segments where coaxial cables provide optimal performance and cost-effectiveness.

Product development priorities should address emerging applications including industrial IoT, security systems, and hybrid network solutions. MarkWide Research analysis suggests focusing on specialized cables meeting specific performance requirements rather than competing directly with commodity products.

Geographic expansion opportunities exist in underserved markets and emerging applications across North America. Companies should evaluate regional demand patterns and infrastructure development trends to identify growth opportunities.

Service integration represents a key differentiation strategy as customers increasingly prefer comprehensive solutions including technical support, installation services, and ongoing maintenance. This approach creates additional revenue streams and customer loyalty.

Partnership development with complementary technology providers can create integrated solutions addressing customer requirements more effectively than standalone products. Strategic alliances should focus on mutual benefits and market expansion opportunities.

Investment priorities should balance manufacturing efficiency improvements with product innovation and market development initiatives. Companies should maintain competitive cost structures while investing in growth opportunities and customer service capabilities.

Market evolution indicates continued relevance for coaxial cables in specific applications while acknowledging competitive pressures from alternative technologies. The future market will likely focus on specialized applications and hybrid solutions rather than broad-based growth across all segments.

Technology development will emphasize performance improvements, cost reduction, and specialized applications supporting emerging market requirements. Innovation cycles will focus on materials advancement, manufacturing efficiency, and application-specific optimizations.

Demand projections suggest stable to modest growth with 2-4% annual expansion in certain segments offset by declines in traditional applications. The market outlook reflects mature industry characteristics with selective growth opportunities in emerging applications.

Competitive dynamics will likely intensify as market participants compete for market share in a mature industry. Success factors will include operational efficiency, customer service excellence, and strategic positioning in growing market segments.

Regional trends indicate continued infrastructure investment supporting market stability while emerging applications create new growth opportunities. The North American market benefits from established infrastructure and ongoing modernization requirements.

Long-term sustainability depends on successful adaptation to changing technology requirements and customer preferences. The industry must balance traditional strengths with innovation and market development to maintain relevance and growth potential.

The North America coaxial cable market demonstrates resilient characteristics within a mature industry environment, maintaining relevance through specialized applications and hybrid technology solutions. Market fundamentals reflect stable demand patterns supported by infrastructure replacement cycles and emerging application opportunities.

Strategic positioning requires careful balance between traditional market strengths and adaptation to evolving technology requirements. Successful market participants will focus on operational excellence, customer service, and strategic positioning in growing market segments while managing competitive pressures from alternative technologies.

Future success depends on industry ability to innovate within established technology frameworks while identifying and developing new application opportunities. The market outlook suggests continued relevance for coaxial cables in specific applications with selective growth potential in emerging sectors and geographic regions.

What is Coaxial Cable?

Coaxial cable is a type of electrical cable that consists of a central conductor, an insulating layer, a metallic shield, and an outer insulating layer. It is commonly used for transmitting cable television signals, internet data, and other forms of communication.

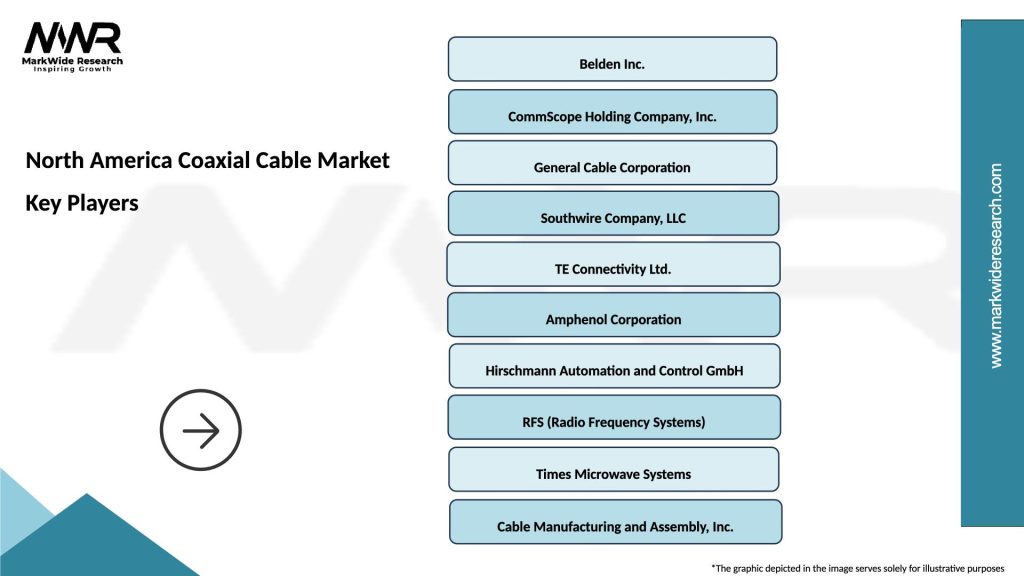

What are the key players in the North America Coaxial Cable Market?

Key players in the North America Coaxial Cable Market include companies like Belden Inc., CommScope, and Amphenol Corporation, which are known for their innovative cable solutions and extensive product lines, among others.

What are the main drivers of the North America Coaxial Cable Market?

The main drivers of the North America Coaxial Cable Market include the increasing demand for high-speed internet, the growth of the telecommunications sector, and the rising adoption of cable television services across various demographics.

What challenges does the North America Coaxial Cable Market face?

Challenges in the North America Coaxial Cable Market include the competition from fiber optic cables, which offer higher bandwidth and faster speeds, and the need for continuous technological advancements to meet consumer expectations.

What opportunities exist in the North America Coaxial Cable Market?

Opportunities in the North America Coaxial Cable Market include the expansion of smart home technologies, the integration of coaxial cables in emerging applications like IoT devices, and the potential for growth in the automotive sector for in-vehicle communication systems.

What trends are shaping the North America Coaxial Cable Market?

Trends shaping the North America Coaxial Cable Market include the increasing use of coaxial cables in broadband networks, advancements in cable manufacturing technologies, and a growing focus on sustainability and eco-friendly materials in cable production.

North America Coaxial Cable Market

| Segmentation Details | Description |

|---|---|

| Product Type | RG-6, RG-11, RG-59, Quad Shield |

| Application | Television, Internet, CCTV, Data Transmission |

| End User | Residential, Commercial, Industrial, Telecommunications |

| Installation Type | Indoor, Outdoor, Aerial, Underground |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Coaxial Cable Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at