444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America chromatography resins market is a thriving industry that plays a crucial role in the field of separation sciences. Chromatography resins are essential components used in various chromatographic techniques to separate, purify, and analyze complex mixtures of chemicals and biomolecules. This comprehensive analysis explores the meaning of chromatography resins, key market insights, market drivers, market restraints, market opportunities, market dynamics, regional analysis, competitive landscape, segmentation, category-wise insights, key benefits for industry participants and stakeholders, SWOT analysis, market key trends, COVID-19 impact, key industry developments, analyst suggestions, future outlook, and conclusion.

Meaning

Chromatography resins are porous materials with specific chemical and physical properties that enable the separation of components in a sample based on their interactions with the resin matrix. They are widely used in chromatographic techniques such as liquid chromatography (LC), gas chromatography (GC), and affinity chromatography to achieve high-resolution separation and purification of target compounds.

Executive Summary

The North America chromatography resins market is experiencing steady growth, driven by advancements in biopharmaceutical research, increased demand for high-quality separation products, and the expansion of the pharmaceutical and biotechnology industries. The market offers a wide range of resins tailored for different applications, providing scientists and researchers with powerful tools for analysis and purification.

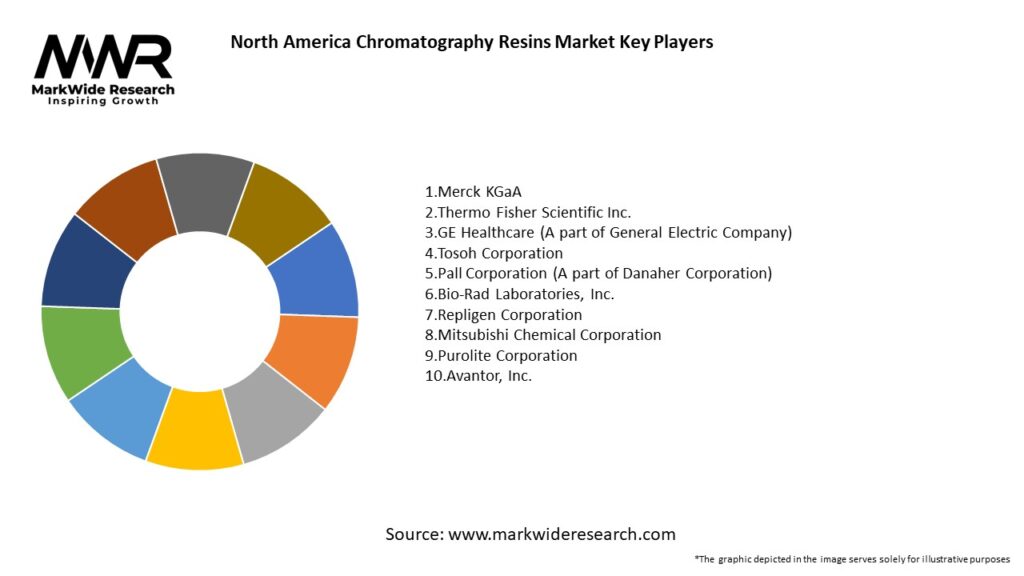

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

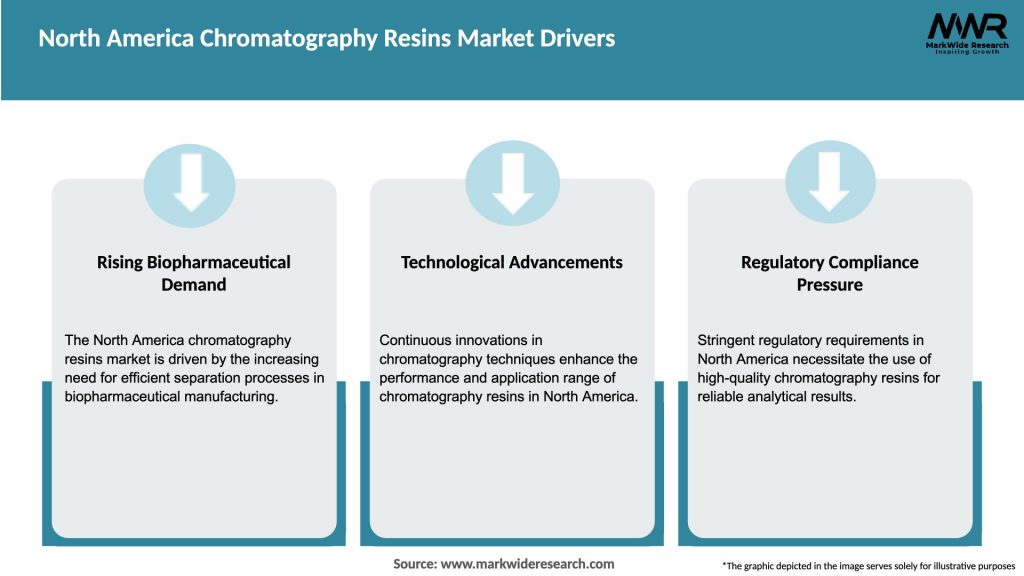

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America chromatography resins market is dynamic and driven by technological advancements, research and development activities, and the evolving needs of various industries. Market players continuously invest in product innovation, collaborations, and strategic partnerships to gain a competitive edge.

Regional Analysis

The United States is the largest market for chromatography resins in North America, driven by the presence of leading biopharmaceutical and biotechnology companies, academic research institutions, and a strong emphasis on scientific advancements. Canada also contributes to the market growth, with a focus on biotechnology and research initiatives.

Competitive Landscape

Leading Companies in the North America Chromatography Resins Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

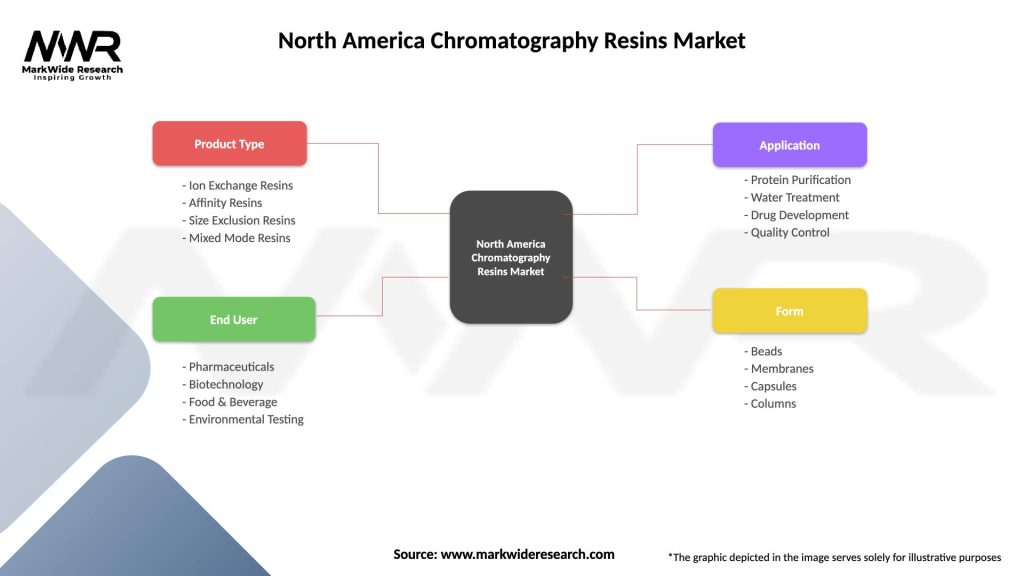

Segmentation

The North America chromatography resins market can be segmented based on resin type, technique, application, and end-user:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has had a significant impact on the pharmaceutical and biotechnology sectors, driving research and development activities related to diagnostics, vaccines, and therapeutic drugs. The demand for chromatography resins used in the development and production of these products has increased, contributing to market growth.

Key Industry Developments

1. Strategic Acquisitions and Partnerships

In recent years, major players in the chromatography resins market have been acquiring smaller companies to expand their product portfolios and market presence. For example, a leading chromatography resin manufacturer recently acquired a company specializing in protein purification to enhance its offerings for the biopharmaceutical industry.

2. Advancements in Resin Technology

Companies are investing heavily in research and development to create next-generation chromatography resins that offer higher capacity, better selectivity, and faster purification processes. The development of innovative resin technologies is expected to drive the market forward as industries seek more efficient and cost-effective solutions.

Analyst Suggestions

Future Outlook

The North America chromatography resins market is poised for growth, driven by the increasing demand for biopharmaceuticals, advancements in separation technologies, and research initiatives. The market will witness continued innovation, expansion into new application areas, and strategic collaborations to meet the evolving needs of customers.

Conclusion

The North America chromatography resins market is a vital component of the separation sciences industry, supporting advancements in biopharmaceutical research, quality control, and analysis. The market offers a diverse range of resins tailored for specific applications, techniques, and industries. With the rising demand for high-quality separation products and the expansion of the pharmaceutical and biotechnology sectors, the market presents lucrative opportunities for industry participants and stakeholders. However, challenges such as the high cost of specialized resins and technological complexity need to be addressed. By focusing on research and development, collaboration, and technological innovation, market players can position themselves for success in this dynamic and promising market.

What is Chromatography Resins?

Chromatography resins are materials used in the separation and purification processes in various applications, including pharmaceuticals, biotechnology, and food processing. They play a crucial role in isolating specific compounds from mixtures based on their chemical properties.

What are the key players in the North America Chromatography Resins Market?

Key players in the North America Chromatography Resins Market include companies like Merck KGaA, Thermo Fisher Scientific, and Bio-Rad Laboratories. These companies are known for their innovative products and extensive portfolios in chromatography technologies, among others.

What are the growth factors driving the North America Chromatography Resins Market?

The North America Chromatography Resins Market is driven by the increasing demand for biopharmaceuticals, advancements in chromatography techniques, and the growing focus on research and development in life sciences. Additionally, the rise in analytical testing in various industries contributes to market growth.

What challenges does the North America Chromatography Resins Market face?

Challenges in the North America Chromatography Resins Market include the high cost of advanced chromatography systems and the complexity of resin selection for specific applications. Additionally, regulatory hurdles in the pharmaceutical industry can impact market dynamics.

What opportunities exist in the North America Chromatography Resins Market?

Opportunities in the North America Chromatography Resins Market include the development of novel resins tailored for specific applications and the expansion of chromatography techniques in emerging fields such as proteomics and metabolomics. The increasing focus on personalized medicine also presents significant growth potential.

What trends are shaping the North America Chromatography Resins Market?

Trends in the North America Chromatography Resins Market include the shift towards automation in chromatography processes, the integration of artificial intelligence for data analysis, and the development of environmentally friendly resins. These innovations are enhancing efficiency and sustainability in separation technologies.

North America Chromatography Resins Market

| Segmentation Details | Description |

|---|---|

| Product Type | Ion Exchange Resins, Affinity Resins, Size Exclusion Resins, Mixed Mode Resins |

| End User | Pharmaceuticals, Biotechnology, Food & Beverage, Environmental Testing |

| Application | Protein Purification, Water Treatment, Drug Development, Quality Control |

| Form | Beads, Membranes, Capsules, Columns |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America Chromatography Resins Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at