444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America cargo and vehicle screening market represents a critical component of the region’s comprehensive security infrastructure, encompassing advanced technologies and systems designed to detect threats, contraband, and dangerous materials in transportation networks. This dynamic market serves multiple sectors including aviation, maritime, border security, and commercial transportation, with sophisticated screening solutions becoming increasingly essential for maintaining national security and facilitating legitimate trade flows.

Market growth is driven by escalating security concerns, regulatory mandates, and technological advancements in detection capabilities. The region’s extensive transportation infrastructure, including major ports, airports, and border crossings, creates substantial demand for comprehensive screening solutions. Current market dynamics indicate robust expansion at a CAGR of 6.8%, reflecting the critical importance of security screening in modern transportation systems.

Technological innovation continues to reshape the market landscape, with artificial intelligence, machine learning, and advanced imaging technologies enhancing detection accuracy and operational efficiency. The integration of automated screening systems with existing security protocols has improved throughput while maintaining rigorous security standards. Regional adoption rates demonstrate 75% penetration of advanced screening technologies across major transportation hubs.

Government initiatives and regulatory frameworks significantly influence market development, with agencies like the Transportation Security Administration (TSA) and Customs and Border Protection (CBP) establishing stringent screening requirements. These mandates drive continuous investment in next-generation screening technologies and system upgrades across the region.

The North America cargo and vehicle screening market refers to the comprehensive ecosystem of technologies, systems, and services designed to inspect, analyze, and clear cargo shipments and vehicles for security threats, contraband, and regulatory compliance across the United States, Canada, and Mexico. This market encompasses advanced detection equipment, software solutions, and integrated security platforms that enable authorities to maintain border security while facilitating legitimate commerce.

Screening technologies within this market include X-ray imaging systems, gamma-ray scanners, neutron detection equipment, chemical analyzers, and biometric identification systems. These solutions are deployed at various checkpoints including international borders, seaports, airports, and commercial facilities to ensure comprehensive security coverage throughout the transportation network.

Market participants include technology manufacturers, system integrators, service providers, and end-users such as government agencies, port authorities, and private security firms. The market’s scope extends beyond equipment sales to encompass maintenance services, software updates, training programs, and consulting services that support effective screening operations.

Strategic market analysis reveals the North America cargo and vehicle screening market as a rapidly evolving sector driven by heightened security requirements and technological advancement. The market demonstrates strong growth momentum with increasing adoption of AI-powered screening solutions and automated threat detection systems across major transportation corridors.

Key market drivers include escalating global security threats, expanding international trade volumes, and regulatory mandates requiring enhanced screening capabilities. The market benefits from substantial government investment in border security infrastructure and modernization initiatives aimed at improving screening efficiency while maintaining security effectiveness.

Technology trends indicate significant advancement in detection capabilities, with next-generation systems offering improved threat identification accuracy and reduced false alarm rates. The integration of machine learning algorithms has enhanced system performance, enabling more sophisticated threat analysis and pattern recognition capabilities.

Regional dynamics show the United States commanding the largest market share at 68%, followed by Canada and Mexico. This distribution reflects the scale of transportation infrastructure and security investment across the region, with major ports and border crossings driving primary demand for advanced screening solutions.

Market intelligence reveals several critical insights shaping the North America cargo and vehicle screening landscape. The sector demonstrates remarkable resilience and growth potential driven by evolving security challenges and technological innovation.

Security imperatives represent the primary driver for the North America cargo and vehicle screening market, with escalating global threats necessitating enhanced detection capabilities across transportation networks. The increasing sophistication of threat concealment methods requires continuous advancement in screening technologies and detection algorithms.

Trade volume expansion creates substantial demand for efficient screening solutions that can process increasing cargo flows without compromising security standards. The growth in international commerce requires screening systems capable of handling diverse cargo types while maintaining rapid processing speeds to avoid supply chain disruptions.

Regulatory mandates from government agencies establish stringent screening requirements that drive market demand for compliant technologies. These regulations continuously evolve to address emerging threats, requiring ongoing investment in advanced screening capabilities and system upgrades.

Technological advancement enables the development of more sophisticated screening solutions with enhanced detection capabilities and improved operational efficiency. The integration of artificial intelligence and machine learning technologies has revolutionized threat detection accuracy and system performance.

Infrastructure modernization initiatives across the region drive replacement of legacy screening systems with advanced technologies. Government investment in border security infrastructure creates substantial opportunities for screening technology providers and system integrators.

High implementation costs present significant barriers to market expansion, particularly for smaller facilities and organizations with limited security budgets. The substantial capital investment required for advanced screening systems can delay adoption and limit market penetration in certain segments.

Technical complexity of modern screening systems requires specialized expertise for operation and maintenance, creating challenges for organizations lacking adequate technical resources. The need for continuous training and skill development adds to operational costs and implementation complexity.

Privacy concerns related to advanced screening technologies create regulatory and public acceptance challenges. The balance between security effectiveness and privacy protection requires careful consideration in system design and deployment strategies.

Integration challenges with existing security infrastructure can complicate system deployment and increase implementation timelines. Legacy systems may require significant modifications to accommodate new screening technologies, adding complexity and cost to upgrade projects.

False alarm rates in some screening technologies can impact operational efficiency and create additional workload for security personnel. The need to minimize false positives while maintaining high detection sensitivity presents ongoing technical challenges for system developers.

Emerging technologies present substantial opportunities for market expansion, with artificial intelligence, quantum sensors, and advanced materials creating new possibilities for enhanced screening capabilities. These innovations enable more sophisticated threat detection while improving operational efficiency and reducing false alarm rates.

Cross-border trade growth creates expanding demand for efficient screening solutions that can handle increasing cargo volumes while maintaining security standards. The development of smart border initiatives presents opportunities for integrated screening systems that facilitate legitimate trade while enhancing security.

Public-private partnerships offer opportunities for collaborative development and deployment of advanced screening technologies. These partnerships can leverage government resources and private sector innovation to accelerate market development and technology adoption.

Mobile screening solutions represent an emerging opportunity for flexible security deployment in temporary or remote locations. The development of portable screening systems addresses needs for rapid deployment and adaptable security coverage.

Data analytics integration creates opportunities for enhanced threat intelligence and predictive security capabilities. The combination of screening data with broader intelligence systems enables more sophisticated risk assessment and targeted security measures.

Market dynamics in the North America cargo and vehicle screening sector reflect the complex interplay between security requirements, technological advancement, and operational efficiency demands. The market demonstrates strong growth momentum driven by continuous innovation and expanding security applications across transportation networks.

Competitive dynamics are characterized by intense innovation competition among technology providers, with companies investing heavily in research and development to maintain market leadership. The focus on next-generation capabilities drives continuous product enhancement and feature expansion to meet evolving security challenges.

Supply chain considerations play an increasingly important role in market dynamics, with screening technologies becoming integral to supply chain security and risk management strategies. The integration of screening systems with broader logistics networks creates new opportunities for comprehensive security solutions.

Regulatory evolution continues to shape market dynamics, with government agencies regularly updating screening requirements and performance standards. These changes drive technology adaptation and create opportunities for providers offering compliant solutions.

User experience optimization has become a critical factor in market dynamics, with emphasis on systems that maintain security effectiveness while minimizing operational disruption. The balance between thorough screening and efficient processing drives innovation in system design and workflow optimization.

Comprehensive research methodology employed for analyzing the North America cargo and vehicle screening market incorporates multiple data sources and analytical approaches to ensure accurate market assessment and reliable insights. The methodology combines primary research with secondary data analysis to provide comprehensive market understanding.

Primary research activities include extensive interviews with industry stakeholders, including technology providers, system integrators, government officials, and end-users across the screening ecosystem. These interviews provide firsthand insights into market trends, challenges, and opportunities from multiple perspectives.

Secondary research encompasses analysis of government publications, industry reports, regulatory documents, and company financial statements to gather comprehensive market data. This approach ensures thorough coverage of market dynamics and competitive landscape factors.

Data validation processes include cross-referencing multiple sources and conducting follow-up interviews to verify key findings and market assessments. The methodology employs triangulation techniques to ensure accuracy and reliability of market insights and projections.

Analytical frameworks applied include market sizing models, competitive analysis matrices, and trend analysis methodologies. These frameworks enable systematic evaluation of market factors and provide structured insights into market development patterns and future prospects.

United States market dominates the North America cargo and vehicle screening landscape, accounting for approximately 68% market share driven by extensive transportation infrastructure and substantial government investment in security technologies. The country’s major ports, airports, and border crossings create significant demand for advanced screening solutions.

Key growth drivers in the U.S. market include Department of Homeland Security initiatives, TSA modernization programs, and CBP technology upgrades. The presence of major technology providers and system integrators creates a robust ecosystem supporting market development and innovation.

Canada represents the second-largest regional market with 22% market share, characterized by significant investment in border security and port modernization initiatives. The country’s extensive coastline and border with the United States drive demand for comprehensive screening capabilities across multiple transportation modes.

Canadian market dynamics are influenced by the Canada Border Services Agency’s modernization efforts and public safety priorities. The focus on trade facilitation while maintaining security standards creates opportunities for efficient screening technologies.

Mexico accounts for 10% market share with growing investment in border security and port infrastructure development. The country’s role in North American trade drives demand for screening technologies that support legitimate commerce while addressing security concerns.

Regional collaboration through initiatives like the Security and Prosperity Partnership creates opportunities for harmonized screening standards and technology interoperability across North American borders.

Market leadership in the North America cargo and vehicle screening sector is characterized by a mix of established technology providers and innovative emerging companies. The competitive landscape demonstrates strong focus on technological advancement and comprehensive solution offerings.

Competitive strategies focus on innovation, strategic partnerships, and comprehensive service offerings. Companies invest heavily in research and development to maintain technological leadership and address evolving security challenges.

Market consolidation trends include strategic acquisitions and partnerships aimed at expanding technology portfolios and market reach. These activities create integrated solution providers capable of addressing comprehensive screening requirements.

Technology segmentation reveals diverse screening approaches tailored to specific security requirements and operational environments. The market encompasses multiple technology categories, each addressing particular detection capabilities and application needs.

By Technology:

By Application:

By End-User:

X-ray imaging systems represent the largest technology category, offering versatile screening capabilities suitable for diverse cargo types and vehicle configurations. These systems provide detailed imaging that enables security personnel to identify potential threats and contraband with high accuracy.

Advanced imaging features include multi-energy detection, automatic threat recognition, and enhanced image processing capabilities. The integration of artificial intelligence has significantly improved threat detection accuracy while reducing operator workload and training requirements.

Gamma-ray scanning technology addresses specific requirements for inspecting dense cargo containers and large vehicles where X-ray penetration may be limited. These systems offer superior penetration capabilities for comprehensive inspection of heavily loaded containers and complex vehicle configurations.

Neutron detection systems provide specialized capabilities for identifying nuclear materials and radiological threats. These systems are particularly important for border security applications where detection of weapons of mass destruction represents a critical security priority.

Chemical analysis systems offer precise detection of explosive materials, narcotics, and other dangerous substances. The integration of trace detection capabilities enables identification of minute quantities of target substances, enhancing overall security effectiveness.

Mobile screening solutions represent a growing category addressing needs for flexible deployment and rapid response capabilities. These systems enable temporary security installations and support operations in locations where permanent screening infrastructure is not feasible.

Government agencies benefit from enhanced security capabilities that improve threat detection while facilitating legitimate trade and transportation flows. Advanced screening systems enable risk-based approaches to security that optimize resource allocation and operational efficiency.

Transportation operators gain from screening solutions that minimize processing delays while maintaining security compliance. Modern systems offer rapid throughput capabilities that support efficient cargo and vehicle processing without compromising security standards.

Technology providers benefit from substantial market opportunities driven by continuous security requirements and technology advancement needs. The market offers recurring revenue streams through maintenance services, software updates, and system upgrades.

Supply chain stakeholders benefit from enhanced security that reduces risk exposure and supports supply chain resilience. Effective screening systems provide threat mitigation that protects cargo integrity and maintains supply chain continuity.

Economic benefits include job creation in technology development, manufacturing, and security services sectors. The market supports high-skilled employment opportunities in engineering, cybersecurity, and technical support roles.

Public safety enhancement represents a fundamental benefit for society through improved security at transportation hubs and border crossings. Effective screening systems contribute to national security while supporting economic activity through secure trade facilitation.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the cargo and vehicle screening market. AI-powered systems offer enhanced threat detection capabilities with reduced false alarm rates and improved operational efficiency through automated analysis and decision support.

Automation advancement continues to reshape screening operations with systems capable of autonomous threat detection and classification. These developments reduce operator dependency while maintaining high security standards and enabling 24/7 screening capabilities.

Multi-modal screening approaches are gaining prominence as transportation networks become increasingly interconnected. Integrated systems provide seamless security coverage across different transportation modes while maintaining consistent security standards.

Cloud-based solutions are emerging as preferred platforms for screening system management and data analytics. Cloud integration enables centralized monitoring, remote diagnostics, and enhanced data sharing capabilities across multiple screening locations.

Biometric integration is expanding beyond personnel identification to include cargo and vehicle tracking applications. These systems provide comprehensive security coverage that links personnel, cargo, and vehicle identification for enhanced security effectiveness.

Sustainability focus is driving development of energy-efficient screening systems with reduced environmental impact. Green technology initiatives promote sustainable security solutions that minimize power consumption and environmental footprint.

Technology partnerships between screening system manufacturers and AI companies are accelerating the development of intelligent screening solutions. These collaborations combine domain expertise with advanced computing capabilities to create next-generation security systems.

Government modernization programs across North America are driving large-scale screening system upgrades and replacements. These initiatives represent substantial market opportunities for technology providers and system integrators.

Standards harmonization efforts are promoting interoperability between screening systems across different agencies and jurisdictions. These initiatives facilitate technology integration and improve overall security network effectiveness.

Research investments in quantum sensing technologies promise revolutionary advances in detection capabilities. According to MarkWide Research analysis, quantum-based screening systems could offer unprecedented sensitivity for threat detection applications.

Mobile screening deployment is expanding rapidly with development of truck-mounted and portable systems for flexible security coverage. These solutions address emerging security needs in temporary events and remote locations.

Cybersecurity enhancements are becoming integral to screening system design as connected systems require robust protection against cyber threats. Security-by-design approaches ensure comprehensive protection for critical screening infrastructure.

Investment prioritization should focus on AI-enabled screening technologies that offer superior threat detection capabilities with improved operational efficiency. Organizations should evaluate long-term technology roadmaps to ensure sustainable competitive advantage in the evolving security landscape.

Strategic partnerships between technology providers and end-users can accelerate innovation and ensure solutions meet real-world operational requirements. Collaborative development approaches enable customized solutions that address specific security challenges and operational constraints.

Training and development programs are essential for maximizing the effectiveness of advanced screening systems. Organizations should invest in comprehensive training initiatives that ensure personnel can effectively utilize sophisticated screening capabilities.

Integration planning should consider long-term technology evolution and interoperability requirements. System architectures should support future upgrades and integration with emerging technologies to protect investment value.

Performance monitoring systems should be implemented to track screening effectiveness and identify optimization opportunities. Data-driven approaches enable continuous improvement in security operations and system performance.

Regulatory compliance strategies should anticipate evolving security requirements and ensure systems can adapt to changing regulatory landscapes. Proactive compliance approaches minimize disruption risks and maintain operational continuity.

Market projections indicate continued robust growth in the North America cargo and vehicle screening market, driven by persistent security threats and advancing technology capabilities. The market is expected to maintain strong momentum with sustained investment in security infrastructure and technology modernization initiatives.

Technology evolution will focus on enhanced AI capabilities, quantum sensing applications, and integrated security platforms. These advances promise revolutionary improvements in threat detection accuracy and operational efficiency over the next decade.

Regulatory development will likely emphasize performance-based standards that encourage innovation while maintaining security effectiveness. Future regulations may promote risk-based screening approaches that optimize resource allocation and processing efficiency.

Market consolidation trends may continue as companies seek to build comprehensive solution portfolios and expand market reach. Strategic acquisitions and partnerships will create integrated providers capable of addressing complex security requirements.

Emerging applications in supply chain security and critical infrastructure protection will create new market opportunities beyond traditional transportation screening. These applications represent significant growth potential for screening technology providers.

International cooperation in security standards and technology sharing will enhance overall security effectiveness while creating opportunities for technology export and global market expansion. MWR analysis suggests growing international demand for North American screening technologies and expertise.

The North America cargo and vehicle screening market represents a dynamic and essential component of the region’s security infrastructure, characterized by continuous innovation and substantial growth potential. The market’s evolution reflects the critical balance between maintaining rigorous security standards and facilitating efficient transportation operations across diverse applications.

Technology advancement continues to drive market transformation, with artificial intelligence, automation, and advanced detection capabilities creating new possibilities for enhanced security effectiveness. The integration of these technologies promises significant improvements in threat detection accuracy while reducing operational complexity and costs.

Market fundamentals remain strong, supported by persistent security requirements, regulatory mandates, and substantial government investment in security infrastructure. The combination of established demand drivers and emerging technology opportunities creates a favorable environment for sustained market growth and innovation.

Strategic positioning for market participants requires focus on technology leadership, comprehensive solution offerings, and strong customer relationships. Success in this market depends on the ability to deliver advanced security capabilities while addressing practical operational requirements and cost considerations.

Future prospects indicate continued market expansion driven by evolving security challenges and advancing technology capabilities. The North America cargo and vehicle screening market is well-positioned to maintain its leadership role in global security technology development and deployment, creating substantial opportunities for stakeholders across the security ecosystem.

What is Cargo And Vehicle Screening?

Cargo and vehicle screening refers to the processes and technologies used to inspect and assess cargo and vehicles for security threats, contraband, or illegal items. This includes the use of X-ray machines, metal detectors, and other advanced scanning technologies.

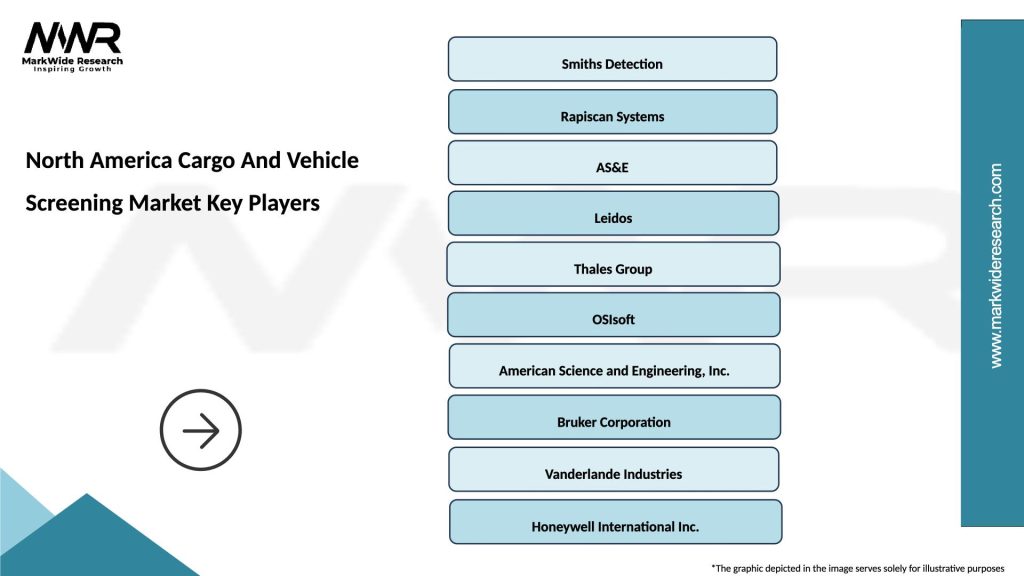

What are the key players in the North America Cargo And Vehicle Screening Market?

Key players in the North America Cargo And Vehicle Screening Market include companies like Smiths Detection, Rapiscan Systems, and L3Harris Technologies, which provide various screening solutions for security applications, among others.

What are the growth factors driving the North America Cargo And Vehicle Screening Market?

The growth of the North America Cargo And Vehicle Screening Market is driven by increasing security concerns, the rise in international trade, and the need for efficient customs inspections. Additionally, advancements in screening technology are enhancing detection capabilities.

What challenges does the North America Cargo And Vehicle Screening Market face?

Challenges in the North America Cargo And Vehicle Screening Market include the high costs associated with advanced screening technologies and the need for continuous updates to comply with evolving security regulations. Additionally, there may be resistance to adopting new technologies in some sectors.

What opportunities exist in the North America Cargo And Vehicle Screening Market?

Opportunities in the North America Cargo And Vehicle Screening Market include the integration of artificial intelligence and machine learning to improve screening efficiency and accuracy. Furthermore, the growing emphasis on supply chain security presents avenues for market expansion.

What trends are shaping the North America Cargo And Vehicle Screening Market?

Trends in the North America Cargo And Vehicle Screening Market include the increasing use of automated screening systems and the development of mobile screening solutions. Additionally, there is a growing focus on enhancing cybersecurity measures within screening technologies.

North America Cargo And Vehicle Screening Market

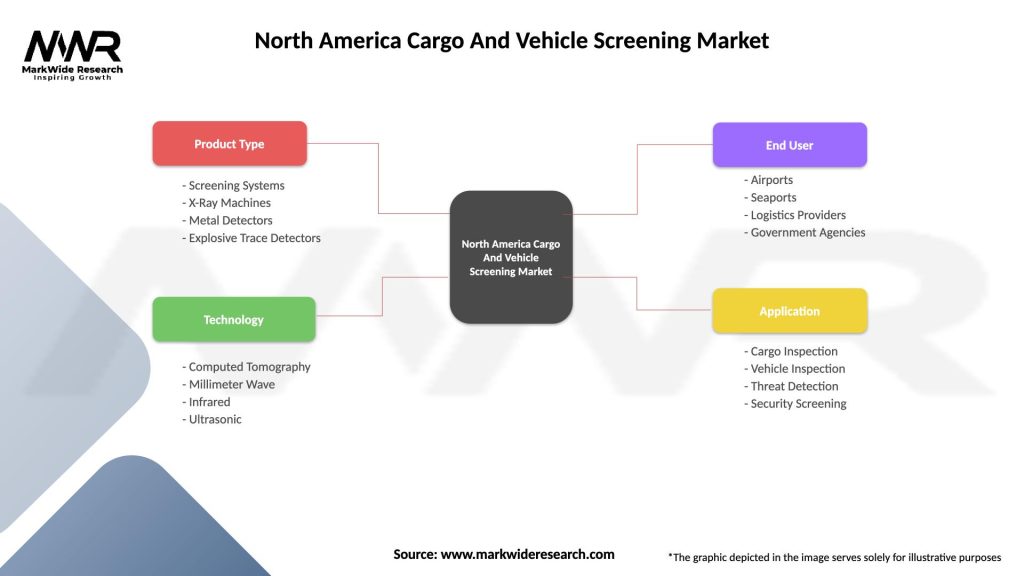

| Segmentation Details | Description |

|---|---|

| Product Type | Screening Systems, X-Ray Machines, Metal Detectors, Explosive Trace Detectors |

| Technology | Computed Tomography, Millimeter Wave, Infrared, Ultrasonic |

| End User | Airports, Seaports, Logistics Providers, Government Agencies |

| Application | Cargo Inspection, Vehicle Inspection, Threat Detection, Security Screening |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Cargo And Vehicle Screening Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at