444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America Building Information Modelling Software Market represents a transformative force in the construction and architecture industry, revolutionizing how buildings are designed, constructed, and managed throughout their lifecycle. This sophisticated technology ecosystem encompasses comprehensive digital representation tools that enable architects, engineers, contractors, and facility managers to collaborate more effectively while reducing costs and improving project outcomes.

Market dynamics indicate robust expansion driven by increasing adoption of digital construction technologies, government mandates for BIM implementation, and growing emphasis on sustainable building practices. The region’s construction industry is experiencing a significant shift toward digitalization, with BIM software solutions becoming integral to project delivery across residential, commercial, and infrastructure sectors.

North America leads global BIM adoption, with the United States and Canada implementing progressive policies that mandate BIM usage for public construction projects. The market demonstrates strong growth momentum, expanding at approximately 12.5% CAGR as organizations recognize the substantial benefits of integrated design and construction workflows.

Technology advancement continues to drive market evolution, with cloud-based solutions, artificial intelligence integration, and mobile accessibility transforming traditional construction processes. Major software providers are investing heavily in platform development, creating comprehensive ecosystems that support entire project lifecycles from conceptual design through facility management.

The North America Building Information Modelling Software Market refers to the comprehensive ecosystem of digital tools and platforms that enable the creation, management, and sharing of three-dimensional building models integrated with project data, scheduling information, and cost analysis capabilities throughout the construction project lifecycle.

BIM software encompasses sophisticated applications that facilitate collaborative design processes, enabling multiple stakeholders to work simultaneously on shared digital models while maintaining data integrity and version control. These platforms integrate architectural design, structural engineering, mechanical systems, electrical planning, and plumbing coordination within unified digital environments.

Core functionality includes parametric modeling capabilities, clash detection systems, quantity takeoff automation, 4D scheduling integration, 5D cost modeling, and facility management tools. The software enables real-time collaboration, automated documentation generation, and comprehensive project visualization that enhances decision-making throughout construction processes.

Market scope extends beyond traditional design software to include specialized applications for construction management, facility operations, infrastructure development, and regulatory compliance. Modern BIM platforms integrate with Internet of Things sensors, augmented reality systems, and artificial intelligence algorithms to create intelligent building ecosystems.

Strategic analysis reveals the North America Building Information Modelling Software Market is experiencing unprecedented growth driven by digital transformation initiatives across the construction industry. Government mandates, particularly in the United States federal sector, require BIM implementation for major public projects, creating substantial market demand.

Key market drivers include increasing construction complexity, growing emphasis on sustainable building practices, and the need for improved project coordination among multiple stakeholders. The market benefits from strong adoption rates, with approximately 73% of construction firms now utilizing some form of BIM technology in their project delivery processes.

Technology trends indicate significant advancement in cloud-based solutions, mobile accessibility, and artificial intelligence integration. Leading software providers are developing comprehensive platforms that support entire project lifecycles, from initial design concepts through long-term facility management and maintenance operations.

Regional leadership positions North America as the global benchmark for BIM adoption, with mature market infrastructure supporting widespread implementation across diverse construction sectors. The market demonstrates strong competitive dynamics with established players continuously innovating while new entrants introduce specialized solutions for niche applications.

Market intelligence reveals several critical insights shaping the North America Building Information Modelling Software landscape:

Market maturation indicates shifting focus from basic modeling capabilities toward comprehensive project lifecycle management, with organizations seeking integrated solutions that support collaboration, compliance, and operational efficiency throughout building lifecycles.

Primary growth drivers propelling the North America Building Information Modelling Software Market include comprehensive digitalization initiatives transforming traditional construction practices. Government mandates at federal, state, and municipal levels require BIM implementation for public infrastructure projects, creating substantial market demand and establishing industry standards.

Construction industry evolution drives adoption as projects become increasingly complex, requiring sophisticated coordination tools to manage multiple stakeholders, systems, and timelines. The growing emphasis on sustainable building practices necessitates advanced modeling capabilities for energy analysis, material optimization, and environmental impact assessment.

Cost reduction imperatives motivate organizations to adopt BIM solutions that demonstrate measurable returns on investment through reduced rework, improved coordination, and enhanced project delivery efficiency. The technology’s ability to identify design conflicts before construction begins significantly reduces costly field modifications and project delays.

Collaboration requirements in modern construction projects demand integrated platforms that enable real-time information sharing among architects, engineers, contractors, and owners. Remote work trends accelerated by recent global events have further emphasized the importance of cloud-based collaboration tools that support distributed project teams.

Regulatory compliance needs drive adoption as building codes become more complex and sustainability requirements more stringent. BIM software provides automated compliance checking, documentation generation, and audit trail capabilities that streamline regulatory approval processes and reduce compliance risks.

Implementation challenges present significant barriers to widespread BIM adoption, particularly among smaller construction firms lacking technical expertise and financial resources for comprehensive software deployment. The complexity of modern BIM platforms requires substantial training investments and organizational change management initiatives.

High initial costs associated with software licensing, hardware upgrades, and staff training create financial barriers for many organizations. The total cost of ownership extends beyond software acquisition to include ongoing maintenance, updates, and technical support requirements that strain operational budgets.

Interoperability issues between different BIM platforms and legacy systems create workflow disruptions and data integration challenges. The lack of standardized file formats and communication protocols complicates multi-vendor environments and limits seamless information exchange among project stakeholders.

Workforce skill gaps constrain market growth as organizations struggle to find qualified professionals capable of effectively utilizing advanced BIM capabilities. The rapid pace of technology evolution requires continuous training and skill development that many companies find difficult to maintain.

Data security concerns regarding cloud-based solutions and intellectual property protection create hesitation among organizations handling sensitive project information. Cybersecurity risks and data privacy regulations add complexity to BIM implementation decisions and ongoing operations.

Emerging opportunities in the North America Building Information Modelling Software Market center on artificial intelligence integration that promises to revolutionize design optimization, predictive maintenance, and automated compliance checking. Machine learning algorithms can analyze vast datasets to identify design patterns, predict construction issues, and optimize building performance.

Infrastructure modernization initiatives across North America create substantial opportunities for BIM software providers as governments invest in smart city development, transportation networks, and utility systems. These large-scale projects require sophisticated modeling and coordination capabilities that drive demand for advanced BIM solutions.

Sustainability mandates and green building certification requirements open new market segments for specialized BIM tools focused on energy modeling, carbon footprint analysis, and lifecycle assessment. The growing emphasis on net-zero buildings and circular economy principles creates demand for advanced environmental analysis capabilities.

Mobile and augmented reality technologies present opportunities to extend BIM capabilities into field operations, enabling real-time model access, progress tracking, and quality control processes. These technologies bridge the gap between design intent and construction execution while improving communication and decision-making.

Small and medium enterprise market segments remain underserved, creating opportunities for simplified, cost-effective BIM solutions tailored to smaller organizations’ needs and budgets. Cloud-based subscription models and user-friendly interfaces can democratize BIM access across the construction industry.

Market dynamics in the North America Building Information Modelling Software sector reflect the complex interplay between technological advancement, regulatory requirements, and industry transformation. The market demonstrates strong momentum driven by increasing recognition of BIM’s value proposition in improving project outcomes and reducing construction costs.

Competitive pressures intensify as established software providers expand their platforms while new entrants introduce innovative solutions targeting specific market niches. This competition drives continuous innovation, feature development, and pricing optimization that benefits end users through improved functionality and value.

Technology convergence creates dynamic market conditions as BIM platforms integrate with complementary technologies including Internet of Things sensors, artificial intelligence algorithms, and blockchain systems. These integrations expand BIM capabilities beyond traditional modeling to encompass smart building operations and data-driven decision making.

Industry consolidation trends influence market structure as larger software companies acquire specialized providers to expand their solution portfolios and market reach. According to MarkWide Research analysis, this consolidation creates more comprehensive platforms while potentially reducing competition in specific market segments.

User expectations continue evolving toward more intuitive interfaces, seamless integration capabilities, and mobile accessibility. The market responds with increased investment in user experience design and platform interoperability that enhances adoption rates and user satisfaction.

Comprehensive research methodology employed in analyzing the North America Building Information Modelling Software Market incorporates multiple data collection approaches to ensure accuracy and reliability. Primary research includes extensive interviews with industry executives, software developers, construction professionals, and end users across diverse market segments.

Secondary research encompasses analysis of industry reports, government publications, academic studies, and company financial statements to establish market context and validate primary findings. This approach provides comprehensive understanding of market trends, competitive dynamics, and technological developments shaping the industry.

Quantitative analysis utilizes statistical modeling techniques to identify growth patterns, market correlations, and predictive indicators. Data validation processes ensure accuracy through cross-referencing multiple sources and applying rigorous quality control measures throughout the research process.

Market segmentation analysis examines various dimensions including software type, deployment model, end-user industry, and geographic distribution. This granular approach provides detailed insights into specific market segments and their unique characteristics, growth drivers, and competitive landscapes.

Expert consultation with industry thought leaders, technology specialists, and market analysts provides qualitative insights that complement quantitative findings. This collaborative approach ensures comprehensive understanding of market nuances and emerging trends that may not be apparent through data analysis alone.

United States dominance characterizes the North America Building Information Modelling Software Market, accounting for approximately 78% of regional market share due to advanced construction industry infrastructure, government mandates, and high technology adoption rates. Federal agencies including the General Services Administration require BIM for major construction projects, driving widespread implementation across public sector initiatives.

California and New York lead state-level adoption with progressive building codes and sustainability requirements that necessitate advanced modeling capabilities. These markets demonstrate high concentration of architectural firms, engineering consultancies, and construction companies utilizing sophisticated BIM platforms for complex urban development projects.

Canada represents the second-largest regional market with approximately 18% market share, driven by government infrastructure investments and growing adoption of digital construction technologies. Provincial governments increasingly mandate BIM usage for public projects while private sector adoption accelerates through industry association initiatives and professional certification programs.

Texas and Florida show rapid growth in BIM adoption driven by substantial construction activity, population growth, and infrastructure development needs. These markets benefit from favorable business environments that attract construction companies and technology providers seeking to expand their regional presence.

Regional variations in adoption patterns reflect differences in construction market maturity, regulatory environments, and technology infrastructure. Urban markets typically demonstrate higher adoption rates compared to rural areas, creating opportunities for targeted market development strategies.

Market leadership in the North America Building Information Modelling Software sector is characterized by intense competition among established technology providers and emerging specialized solution developers. The competitive landscape reflects diverse approaches to BIM platform development and market positioning.

Competitive strategies focus on platform integration, user experience enhancement, and specialized industry solutions. Companies invest heavily in research and development to maintain technological leadership while expanding their addressable market through strategic partnerships and acquisitions.

Market segmentation analysis reveals diverse categorization approaches that reflect the complexity and breadth of the North America Building Information Modelling Software Market. Understanding these segments provides insight into specific market dynamics and growth opportunities.

By Software Type:

By Deployment Model:

By End-User Industry:

Design and modeling software represents the largest market category, driven by fundamental BIM requirements for 3D modeling, parametric design, and multi-disciplinary coordination. This segment benefits from continuous innovation in modeling algorithms, rendering capabilities, and user interface design that enhance productivity and design quality.

Cloud-based deployment models demonstrate the highest growth rates, with approximately 34% annual expansion as organizations prioritize collaboration, scalability, and reduced IT infrastructure requirements. Cloud solutions enable real-time project sharing, automatic updates, and mobile accessibility that traditional desktop applications cannot match.

Commercial construction applications dominate end-user adoption due to project complexity, stakeholder diversity, and regulatory requirements that necessitate sophisticated coordination tools. This segment drives demand for advanced features including clash detection, quantity takeoff, and integrated project delivery workflows.

Facility management integration emerges as a high-growth category as building owners recognize the value of maintaining BIM models throughout building lifecycles. This approach enables predictive maintenance, space optimization, and operational efficiency improvements that justify ongoing software investments.

Mobile and field applications show significant potential as construction teams seek to bridge the gap between design intent and field execution. These solutions enable real-time model access, progress tracking, and quality control processes that improve project outcomes and reduce rework.

Architects and designers benefit from enhanced creative capabilities, automated documentation generation, and improved design visualization that enables more effective client communication and design development. BIM software streamlines the design process while maintaining accuracy and consistency across project documentation.

Engineering consultants gain significant advantages through integrated multi-disciplinary modeling, automated clash detection, and coordinated system design that reduces conflicts and improves project quality. The technology enables more efficient collaboration with other design professionals and construction teams.

Construction contractors realize substantial benefits including improved project visualization, accurate quantity takeoffs, enhanced scheduling integration, and reduced rework through early conflict identification. BIM implementation typically results in 10-15% reduction in construction costs through improved coordination and planning.

Building owners and developers benefit from improved project delivery, enhanced facility management capabilities, and better long-term asset performance. BIM models provide valuable data for operational decision-making, maintenance planning, and future renovation projects throughout building lifecycles.

Government agencies achieve improved project oversight, enhanced regulatory compliance, and better public infrastructure management through standardized BIM processes. The technology enables more effective project monitoring and supports evidence-based decision-making for public construction investments.

Software providers benefit from growing market demand, recurring revenue opportunities through subscription models, and expanding addressable markets as BIM adoption spreads across construction industry segments. The market provides substantial growth potential for companies developing innovative solutions.

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first strategies dominate market evolution as organizations prioritize collaboration, scalability, and reduced infrastructure requirements. Software providers increasingly focus on cloud-native development while legacy desktop applications transition to hybrid deployment models that combine local processing with cloud-based collaboration.

Artificial intelligence integration represents a transformative trend with machine learning algorithms enhancing design optimization, predictive analytics, and automated compliance checking. AI-powered features demonstrate 25-30% improvement in design efficiency while reducing human error and accelerating project delivery timelines.

Mobile accessibility expansion reflects changing workforce expectations and field operation requirements. Construction professionals increasingly demand real-time model access, progress tracking, and quality control capabilities through mobile devices that bridge the gap between design intent and field execution.

Sustainability integration becomes increasingly important as environmental regulations tighten and green building certification requirements expand. BIM platforms incorporate advanced energy modeling, carbon footprint analysis, and lifecycle assessment tools that support sustainable design practices and regulatory compliance.

Reality capture integration through laser scanning, photogrammetry, and drone technology creates comprehensive digital twins that enhance project accuracy and enable better decision-making. This trend supports renovation projects, progress monitoring, and as-built documentation that improves project outcomes.

Blockchain implementation emerges as a solution for project data integrity, contract management, and supply chain transparency. While still in early stages, blockchain technology shows potential for addressing trust and verification challenges in complex construction projects.

Strategic acquisitions reshape the competitive landscape as major software providers expand their capabilities through targeted purchases of specialized solution developers. These transactions create more comprehensive platforms while potentially reducing market competition in specific niches.

Government mandate expansion continues across federal, state, and municipal levels with new requirements for BIM implementation on public projects. Recent developments include infrastructure bill provisions that encourage BIM adoption for transportation and utility projects receiving federal funding.

Industry partnership initiatives between software providers, construction companies, and technology integrators create comprehensive solution ecosystems. These collaborations address interoperability challenges while developing industry-specific solutions that meet unique market requirements.

Open standards development through organizations like buildingSMART International promotes greater interoperability between BIM platforms. Industry Format (IFC) enhancements and Common Data Environment standards facilitate better information exchange among project stakeholders.

Educational program expansion in universities and professional organizations addresses workforce development needs through comprehensive BIM training curricula. These initiatives help bridge the skills gap while preparing future professionals for technology-enabled construction practices.

Sustainability certification integration with LEED, BREEAM, and other green building standards creates automated compliance checking and documentation generation capabilities. This development streamlines the certification process while supporting sustainable design practices.

Strategic recommendations for market participants emphasize the importance of comprehensive platform development that addresses entire project lifecycles rather than isolated design or construction phases. MWR analysis suggests that integrated solutions providing seamless workflows from conceptual design through facility management will capture the greatest market share.

Investment priorities should focus on artificial intelligence capabilities, cloud infrastructure development, and mobile accessibility enhancement. Organizations that successfully integrate these technologies while maintaining user-friendly interfaces will achieve competitive advantages in rapidly evolving market conditions.

Partnership strategies become increasingly important as no single provider can address all market requirements independently. Successful companies will develop strategic alliances with complementary technology providers, construction firms, and industry associations to create comprehensive solution ecosystems.

Market expansion opportunities exist in underserved segments including small and medium enterprises, specialized construction sectors, and emerging geographic markets. Simplified solutions with attractive pricing models can democratize BIM access while expanding the total addressable market.

Workforce development initiatives require immediate attention as skill shortages constrain market growth. Companies should invest in training programs, certification development, and educational partnerships to ensure adequate human resources for market expansion.

Regulatory compliance capabilities will become increasingly important as building codes evolve and sustainability requirements expand. Software providers should prioritize automated compliance checking and documentation generation features that streamline regulatory approval processes.

Market trajectory indicates continued robust growth driven by digital transformation initiatives, government mandates, and increasing recognition of BIM’s value proposition. The North America Building Information Modelling Software Market is projected to maintain strong momentum with growth rates exceeding 11% annually through the next five years.

Technology evolution will fundamentally transform BIM capabilities through artificial intelligence integration, augmented reality implementation, and Internet of Things connectivity. These advances will create intelligent building ecosystems that support data-driven decision-making throughout project lifecycles and operational phases.

Market consolidation trends are expected to continue as larger software providers acquire specialized companies to expand their solution portfolios. This consolidation will create more comprehensive platforms while potentially reducing competition in specific market segments.

Regulatory environment will likely become more supportive of BIM adoption through expanded mandate requirements and standardization initiatives. Government infrastructure investments and sustainability goals will drive additional demand for sophisticated modeling and analysis capabilities.

Industry transformation toward prefabrication, modular construction, and industrialized building processes will create new opportunities for BIM software providers. These construction methods require sophisticated coordination and manufacturing integration that BIM platforms are uniquely positioned to support.

Global expansion opportunities will emerge as North American BIM expertise and technology leadership create export potential for software providers and consulting services. This expansion will further strengthen the region’s position in the global construction technology market.

The North America Building Information Modelling Software Market represents a dynamic and rapidly evolving sector that is fundamentally transforming the construction industry through digital innovation and collaborative technology platforms. Market analysis reveals strong growth momentum driven by government mandates, industry digitalization initiatives, and increasing recognition of BIM’s substantial value proposition in improving project outcomes while reducing costs.

Key success factors for market participants include comprehensive platform development, artificial intelligence integration, and user experience optimization that addresses diverse stakeholder needs throughout project lifecycles. The competitive landscape favors companies that can provide integrated solutions combining design capabilities, construction management tools, and facility operations support within unified ecosystems.

Future market development will be shaped by continued technology advancement, regulatory support, and industry transformation toward more efficient and sustainable construction practices. Organizations that successfully navigate implementation challenges while capitalizing on emerging opportunities will achieve significant competitive advantages in this expanding market. The North America Building Information Modelling Software Market is positioned for sustained growth as digital construction technologies become increasingly essential for project success and industry competitiveness.

What is Building Information Modelling Software?

Building Information Modelling Software refers to digital tools that facilitate the creation, management, and sharing of building data throughout the lifecycle of a construction project. It enhances collaboration among architects, engineers, and contractors by providing a centralized platform for design and documentation.

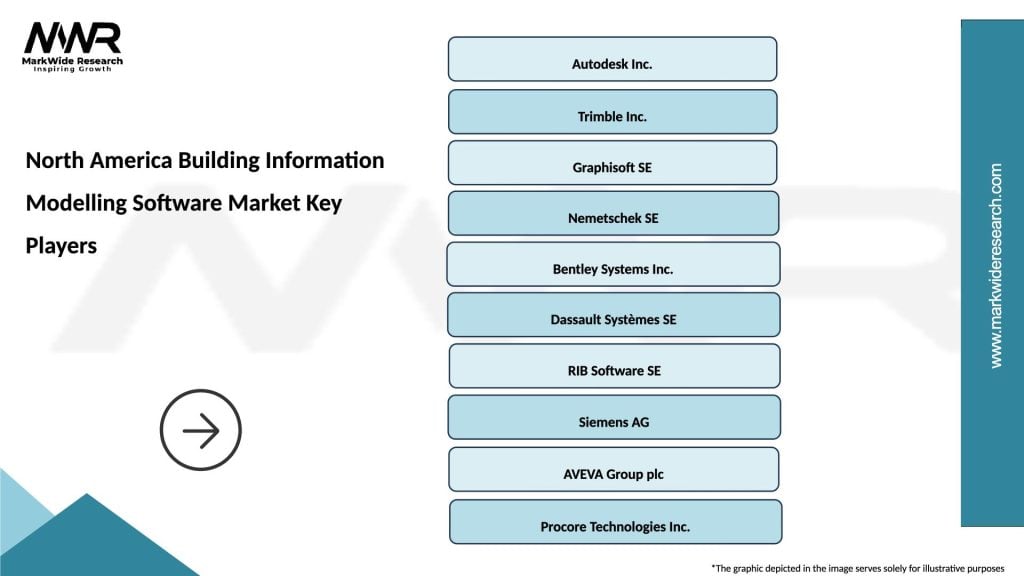

What are the key players in the North America Building Information Modelling Software Market?

Key players in the North America Building Information Modelling Software Market include Autodesk, Bentley Systems, and Trimble, among others. These companies offer a range of solutions that cater to various aspects of building design, construction management, and facility maintenance.

What are the main drivers of growth in the North America Building Information Modelling Software Market?

The main drivers of growth in the North America Building Information Modelling Software Market include the increasing demand for efficient project management, the need for enhanced collaboration among stakeholders, and the rising adoption of sustainable building practices. These factors contribute to the growing integration of BIM in construction projects.

What challenges does the North America Building Information Modelling Software Market face?

Challenges in the North America Building Information Modelling Software Market include the high initial costs of software implementation, the need for skilled personnel to operate these tools, and resistance to change from traditional construction practices. These factors can hinder the widespread adoption of BIM technologies.

What opportunities exist in the North America Building Information Modelling Software Market?

Opportunities in the North America Building Information Modelling Software Market include the growing trend of smart buildings, advancements in cloud-based BIM solutions, and the increasing focus on infrastructure development. These trends present avenues for innovation and expansion within the industry.

What trends are shaping the North America Building Information Modelling Software Market?

Trends shaping the North America Building Information Modelling Software Market include the integration of artificial intelligence and machine learning for predictive analytics, the rise of virtual and augmented reality in design visualization, and the emphasis on interoperability among different software platforms. These innovations are enhancing the capabilities of BIM software.

North America Building Information Modelling Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premise, Cloud-Based, Hybrid, SaaS |

| End User | Architects, Engineers, Contractors, Project Managers |

| Solution | 3D Modeling, Project Management, Cost Estimation, Facility Management |

| Industry Vertical | Construction, Real Estate, Infrastructure, Urban Planning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Building Information Modelling Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at