444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America biocides market represents a critical segment of the chemical industry, encompassing antimicrobial agents designed to destroy, deter, or control harmful microorganisms. This dynamic market serves diverse industries including water treatment, paints and coatings, personal care, agriculture, and industrial applications across the United States, Canada, and Mexico. Market growth is driven by increasing awareness of hygiene and sanitation, stringent regulatory requirements, and expanding industrial applications requiring microbial control.

Regional dynamics indicate that North America maintains a significant position in the global biocides landscape, with the United States leading consumption patterns at approximately 68% market share within the region. The market demonstrates robust expansion across multiple application segments, with water treatment applications representing the largest consumption category. Technological advancements in biocide formulations and delivery systems continue to drive innovation, while environmental sustainability concerns shape product development strategies.

Industrial demand patterns reflect growing emphasis on infection control, particularly following recent global health challenges. The region’s mature industrial infrastructure and stringent regulatory framework create favorable conditions for high-quality biocide products. Growth projections suggest sustained expansion at a compound annual growth rate of 5.2% through the forecast period, supported by increasing applications in emerging sectors and continuous product innovation initiatives.

The North America biocides market refers to the comprehensive ecosystem of antimicrobial chemical substances and formulations designed to control harmful microorganisms including bacteria, viruses, fungi, and algae across diverse industrial and consumer applications throughout the North American region.

Biocides encompass a broad spectrum of active ingredients and formulated products that provide microbial control through various mechanisms of action. These products serve essential functions in maintaining hygiene standards, preventing material degradation, ensuring product quality, and protecting human health across multiple industries. Market participants include manufacturers of active ingredients, formulators of end-use products, distributors, and end-users across industrial, institutional, and consumer segments.

Regulatory frameworks play a crucial role in market definition, with products subject to registration and approval processes by agencies such as the Environmental Protection Agency (EPA) in the United States and Health Canada. The market encompasses both traditional biocide chemistries and innovative formulations designed to address evolving microbial challenges while meeting increasingly stringent environmental and safety requirements.

Strategic market analysis reveals that the North America biocides market operates within a complex regulatory environment while serving critical functions across multiple industrial sectors. The market demonstrates resilience and growth potential driven by fundamental demand for microbial control solutions in water treatment, industrial processes, and consumer applications. Key market drivers include increasing awareness of hygiene standards, regulatory compliance requirements, and expanding applications in emerging sectors.

Competitive dynamics feature a mix of multinational chemical companies and specialized biocide manufacturers, with innovation focusing on sustainable formulations and enhanced efficacy profiles. The market benefits from North America’s advanced industrial infrastructure and sophisticated end-user requirements that drive demand for high-performance products. Water treatment applications represent approximately 42% of total consumption, followed by paints and coatings, personal care, and industrial preservation applications.

Future growth prospects remain positive, supported by increasing industrial activity, infrastructure development, and heightened focus on infection control measures. The market faces challenges related to regulatory compliance costs and environmental sustainability concerns, while opportunities emerge from technological innovations and expanding application areas in healthcare, food processing, and advanced materials sectors.

Market intelligence reveals several critical insights shaping the North America biocides landscape:

Primary growth drivers propelling the North America biocides market include increasing regulatory requirements for water quality and industrial hygiene standards. Stringent environmental regulations mandate effective microbial control in water treatment facilities, industrial processes, and consumer products, creating sustained demand for reliable biocide solutions. Infrastructure development across the region drives consumption in construction-related applications including paints, coatings, and building materials preservation.

Healthcare sector expansion significantly influences market growth, with hospitals, healthcare facilities, and pharmaceutical manufacturing requiring advanced disinfection and preservation solutions. The COVID-19 pandemic heightened awareness of infection control, leading to increased adoption of biocide products across institutional and consumer segments. Industrial growth in sectors such as oil and gas, pulp and paper, and food processing creates consistent demand for specialized microbial control solutions.

Technological advancement in biocide formulations enables improved performance characteristics including enhanced efficacy, longer-lasting protection, and reduced environmental impact. Innovation in delivery systems and application methods expands market opportunities while addressing evolving customer requirements. Consumer awareness of hygiene and health protection drives demand for biocide-containing products in personal care, household cleaning, and food contact applications.

Regulatory compliance challenges represent significant market restraints, with complex registration processes and evolving safety requirements creating barriers to market entry and product development. The cost and time associated with regulatory approval can limit innovation and market expansion, particularly for smaller manufacturers. Environmental concerns regarding biocide persistence and potential ecological impact drive regulatory restrictions and influence customer preferences toward alternative solutions.

Raw material price volatility affects manufacturing costs and profit margins, particularly for petroleum-derived active ingredients and specialty chemicals used in biocide formulations. Supply chain disruptions and availability constraints for key raw materials can impact production schedules and market supply. Competition from alternative technologies including UV treatment, ozone systems, and physical filtration methods provides customers with non-chemical options for microbial control.

Health and safety concerns associated with biocide handling and application create challenges for end-users and may limit adoption in certain applications. Worker safety requirements and potential liability issues influence purchasing decisions and application methods. Market saturation in mature application segments limits growth opportunities and intensifies price competition among suppliers.

Emerging application sectors present significant growth opportunities, including advanced water treatment technologies, sustainable agriculture practices, and next-generation building materials. The development of smart buildings and infrastructure creates demand for intelligent biocide systems with monitoring and control capabilities. Green chemistry initiatives drive opportunities for bio-based and environmentally sustainable biocide formulations that meet performance requirements while addressing sustainability concerns.

Healthcare sector expansion offers substantial growth potential, with increasing demand for specialized disinfectants, medical device preservation, and pharmaceutical manufacturing applications. The aging population and expanding healthcare infrastructure create sustained demand for infection control solutions. Food safety regulations and consumer awareness drive opportunities in food processing, packaging, and agricultural applications requiring effective microbial control.

Technological innovation enables development of next-generation biocide products with enhanced performance characteristics, reduced environmental impact, and improved cost-effectiveness. Nanotechnology applications, controlled-release systems, and combination products offer differentiation opportunities. Export potential to emerging markets provides growth avenues for North American manufacturers with advanced technology and regulatory expertise.

Supply and demand dynamics in the North America biocides market reflect complex interactions between regulatory requirements, industrial activity levels, and technological innovation. Demand patterns vary significantly across application segments, with water treatment showing steady growth while industrial applications experience cyclical variations tied to economic conditions. Seasonal fluctuations affect certain market segments, particularly those related to construction, agriculture, and recreational water treatment.

Pricing mechanisms reflect raw material costs, regulatory compliance expenses, and competitive positioning strategies. Premium pricing for innovative formulations and specialized applications contrasts with commodity pricing in mature market segments. Market concentration varies by application area, with some segments dominated by major chemical companies while others feature numerous specialized suppliers.

Innovation cycles drive market evolution, with continuous development of new active ingredients, improved formulations, and advanced delivery systems. Regulatory changes create both challenges and opportunities, requiring market participants to adapt product portfolios and business strategies. Customer relationships play crucial roles in market dynamics, with technical support and customized solutions becoming increasingly important competitive differentiators.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable market intelligence. Primary research includes structured interviews with industry executives, technical experts, and key stakeholders across the biocides value chain. Survey methodologies capture quantitative data on market trends, consumption patterns, and future growth projections from representative samples of market participants.

Secondary research encompasses analysis of industry publications, regulatory filings, company annual reports, and technical literature to validate primary findings and provide historical context. Government databases and statistical sources provide authoritative data on production, trade, and consumption patterns. Market modeling techniques integrate multiple data sources to develop comprehensive market size estimates and growth projections.

Expert validation processes ensure research accuracy through review by industry specialists and technical experts familiar with biocides market dynamics. Cross-referencing of data sources and triangulation methodologies enhance reliability of market intelligence. Continuous monitoring of market developments, regulatory changes, and technological innovations ensures research findings remain current and relevant for strategic decision-making.

United States market dominates the North American biocides landscape, accounting for approximately 68% of regional consumption driven by extensive industrial infrastructure, stringent regulatory requirements, and sophisticated end-user applications. The country’s advanced water treatment systems, large-scale industrial operations, and comprehensive healthcare infrastructure create substantial demand across multiple biocide categories. California and Texas represent the largest state markets, supported by significant industrial activity and population centers.

Canadian market dynamics reflect the country’s focus on environmental sustainability and resource-based industries including mining, forestry, and oil sands operations. Canada’s stringent environmental regulations drive demand for eco-friendly biocide formulations while industrial applications in natural resource sectors create specialized requirements. Market share within North America reaches approximately 22%, with growth driven by infrastructure development and increasing industrial activity.

Mexican market expansion represents significant growth potential, supported by industrial development, urbanization, and improving regulatory frameworks. The country’s growing manufacturing sector, expanding water treatment infrastructure, and increasing consumer awareness drive biocide demand. Regional market share of approximately 10% reflects emerging market characteristics with substantial growth opportunities in industrial and institutional applications.

Market leadership in the North America biocides sector features a combination of multinational chemical companies and specialized biocide manufacturers. The competitive environment emphasizes innovation, regulatory expertise, and technical support capabilities as key differentiating factors.

By Product Type:

By Application:

By End-User Industry:

Water treatment applications represent the largest market segment, driven by regulatory requirements for drinking water quality and industrial water system maintenance. This category benefits from consistent demand patterns and long-term growth prospects supported by infrastructure development and environmental regulations. Innovation focus includes development of more effective and environmentally sustainable treatment chemicals.

Paints and coatings preservation constitutes a significant market segment with growth tied to construction activity and industrial maintenance requirements. The category faces challenges from volatile organic compound (VOC) regulations but benefits from innovation in low-emission formulations. Market trends include increasing demand for antimicrobial coatings in healthcare and food processing facilities.

Personal care preservation represents a specialized segment with stringent safety and efficacy requirements. Growth drivers include expanding cosmetics markets and increasing consumer awareness of product quality and safety. Regulatory complexity in this segment requires specialized expertise and comprehensive safety documentation.

Industrial applications encompass diverse sectors including oil and gas, pulp and paper, and manufacturing operations. This segment experiences cyclical demand patterns tied to industrial activity levels but offers opportunities for specialized, high-value formulations. Technical service and customized solutions become increasingly important competitive factors.

Manufacturers benefit from diverse application opportunities and growing demand across multiple industrial sectors. The market offers potential for premium pricing through innovation and technical differentiation, while regulatory barriers create competitive advantages for established players. Product portfolio diversification enables risk mitigation and market expansion opportunities across different application segments.

Distributors and suppliers benefit from consistent demand patterns and opportunities for value-added services including technical support and customized formulations. The market’s technical complexity creates opportunities for specialized distribution channels with industry expertise. Long-term customer relationships provide stability and growth potential through expanding account penetration.

End-users gain access to advanced microbial control solutions that improve operational efficiency, ensure regulatory compliance, and protect product quality. Biocide applications enable cost savings through equipment protection, reduced maintenance requirements, and improved process reliability. Technical support services help optimize application methods and achieve desired performance outcomes.

Regulatory agencies benefit from industry innovation that addresses environmental and safety concerns while maintaining effective microbial control. Collaborative relationships with industry participants facilitate development of appropriate regulatory frameworks. Market transparency and technical data support informed regulatory decision-making processes.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability transformation represents the most significant trend shaping the North America biocides market, with increasing focus on biodegradable formulations and reduced environmental impact. Manufacturers invest heavily in green chemistry initiatives to develop products that maintain efficacy while addressing environmental concerns. Bio-based biocides derived from natural sources gain market acceptance as sustainable alternatives to traditional synthetic chemicals.

Digital integration emerges as a key trend, with smart monitoring systems and IoT-enabled application equipment providing real-time performance data and optimization capabilities. These technologies enable precise dosing, reduce waste, and improve treatment effectiveness. Predictive maintenance applications help customers optimize biocide usage and reduce operational costs.

Regulatory evolution continues to shape market dynamics, with agencies implementing more stringent safety and environmental requirements. This trend drives innovation toward safer formulations while creating competitive advantages for companies with strong regulatory expertise. Harmonization efforts between different regulatory jurisdictions facilitate market access and product development strategies.

Customization demand increases as end-users seek specialized solutions tailored to specific applications and operating conditions. This trend creates opportunities for premium pricing and long-term customer relationships. Technical service integration becomes increasingly important as customers require comprehensive support for optimal product performance.

Recent industry developments highlight the dynamic nature of the North America biocides market and ongoing innovation efforts. Major chemical companies continue investing in research and development to address evolving customer requirements and regulatory challenges. Strategic acquisitions and partnerships reshape competitive dynamics while expanding technological capabilities and market access.

Product launches focus on sustainable formulations and enhanced performance characteristics, with several companies introducing bio-based biocides and low-impact preservation systems. These developments address growing environmental concerns while maintaining effective microbial control. Regulatory approvals for new active ingredients and formulations expand application opportunities and market potential.

Manufacturing investments in North America reflect companies’ commitment to serving regional markets and ensuring supply chain resilience. New production facilities and capacity expansions support growing demand while reducing dependence on international suppliers. Technology partnerships between biocide manufacturers and equipment suppliers create integrated solutions for end-users.

Market consolidation continues through strategic transactions that combine complementary technologies and market positions. These developments create larger, more diversified companies with enhanced innovation capabilities and global reach. Vertical integration strategies help companies control supply chains and improve cost competitiveness.

Strategic recommendations for market participants emphasize the importance of sustainability initiatives and regulatory compliance capabilities. Companies should invest in green chemistry research and development to address environmental concerns while maintaining product performance. MarkWide Research analysis indicates that early movers in sustainable biocide development will capture significant competitive advantages as regulatory requirements evolve.

Innovation focus should prioritize development of multifunctional products that provide enhanced value propositions for end-users. Combination products that offer multiple benefits such as biocidal activity, corrosion inhibition, and scale prevention create differentiation opportunities. Digital integration capabilities should be developed to support smart application systems and performance monitoring.

Market expansion strategies should consider emerging application areas including advanced water treatment, healthcare facilities, and food safety applications. Geographic expansion within North America, particularly in Mexico, offers growth opportunities for established market participants. Partnership strategies with equipment manufacturers and system integrators can expand market reach and create comprehensive solution offerings.

Operational excellence initiatives should focus on supply chain optimization, manufacturing efficiency, and customer service capabilities. Companies should develop robust regulatory affairs capabilities to navigate complex approval processes and maintain market access. Technical service investments become increasingly important for customer retention and premium pricing strategies.

Long-term market prospects for the North America biocides market remain positive, supported by fundamental demand drivers including population growth, industrial development, and increasing awareness of hygiene and safety requirements. The market is expected to maintain steady growth at approximately 5.2% CAGR through the next decade, with sustainability and innovation driving market evolution. Emerging applications in healthcare, food safety, and advanced materials will contribute to market expansion.

Technology advancement will continue shaping market dynamics, with bio-based formulations, nanotechnology applications, and smart delivery systems gaining market acceptance. Regulatory frameworks will evolve to address environmental and safety concerns while supporting innovation in sustainable biocide technologies. Market consolidation is expected to continue, creating larger, more diversified companies with enhanced global capabilities.

Regional growth patterns will vary, with the United States maintaining market leadership while Mexico offers the highest growth potential. Canadian market development will focus on sustainable solutions aligned with the country’s environmental priorities. MWR projections indicate that water treatment applications will maintain the largest market share, while healthcare and food safety segments will experience the fastest growth rates.

Competitive dynamics will increasingly favor companies with strong sustainability credentials, regulatory expertise, and comprehensive technical support capabilities. Innovation in green chemistry and digital integration will become key differentiating factors. Customer relationships and technical service capabilities will become increasingly important for market success in the evolving competitive landscape.

The North America biocides market represents a mature yet dynamic industry segment with substantial growth potential driven by regulatory requirements, industrial development, and increasing awareness of microbial control importance. The market benefits from advanced technological capabilities, comprehensive regulatory frameworks, and sophisticated end-user requirements that support innovation and premium product positioning. Sustainability initiatives and environmental considerations will increasingly influence market development and competitive positioning strategies.

Market participants face both opportunities and challenges as the industry evolves toward more sustainable and technologically advanced solutions. Success factors include innovation capabilities, regulatory expertise, technical service excellence, and strategic positioning in high-growth application segments. Digital transformation and smart application technologies will create new value propositions and competitive advantages for forward-thinking companies.

Future market evolution will be shaped by regulatory developments, technological innovation, and changing customer requirements emphasizing sustainability and performance optimization. Companies that successfully balance environmental responsibility with effective microbial control will capture the greatest market opportunities. The North America biocides market is positioned for continued growth and evolution, offering substantial opportunities for stakeholders across the value chain who adapt to changing market dynamics and customer requirements.

What is Biocides?

Biocides are chemical substances that can deter, kill, or control harmful organisms, including bacteria, fungi, and viruses. They are widely used in various applications such as water treatment, agriculture, and household products.

What are the key players in the North America Biocides Market?

Key players in the North America Biocides Market include BASF SE, Dow Chemical Company, and Lonza Group, among others. These companies are involved in the production and distribution of biocides for various applications.

What are the main drivers of the North America Biocides Market?

The main drivers of the North America Biocides Market include the increasing demand for water treatment solutions, the growth of the agricultural sector, and rising health and hygiene awareness among consumers.

What challenges does the North America Biocides Market face?

The North America Biocides Market faces challenges such as stringent regulatory requirements, potential environmental impacts, and the development of resistance among target organisms, which can limit the effectiveness of biocides.

What opportunities exist in the North America Biocides Market?

Opportunities in the North America Biocides Market include the development of eco-friendly biocides, innovations in formulation technologies, and the expansion of applications in industries such as healthcare and food processing.

What trends are shaping the North America Biocides Market?

Trends shaping the North America Biocides Market include the increasing use of biocides in personal care products, advancements in antimicrobial technologies, and a growing focus on sustainability and regulatory compliance.

North America Biocides Market

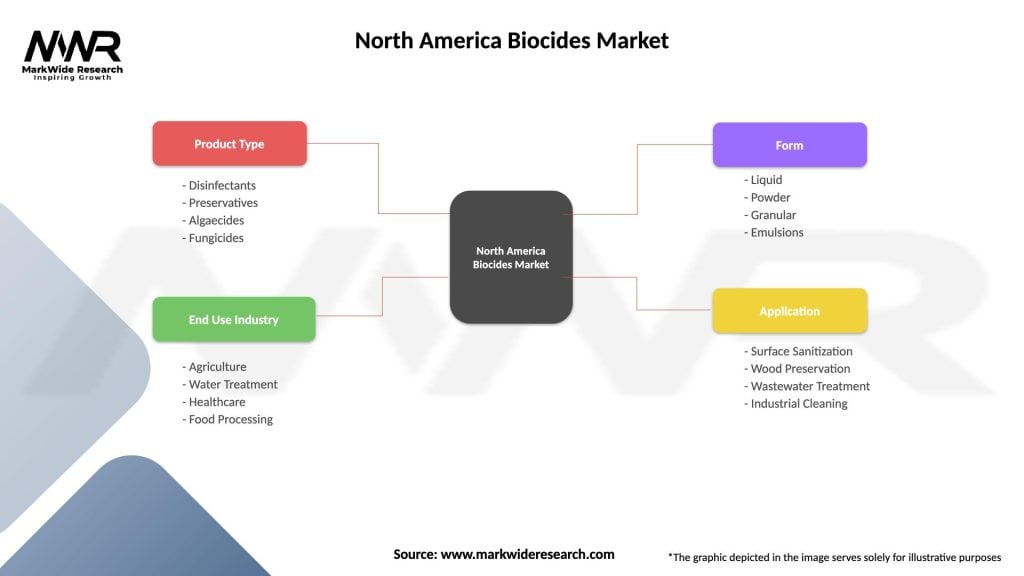

| Segmentation Details | Description |

|---|---|

| Product Type | Disinfectants, Preservatives, Algaecides, Fungicides |

| End Use Industry | Agriculture, Water Treatment, Healthcare, Food Processing |

| Form | Liquid, Powder, Granular, Emulsions |

| Application | Surface Sanitization, Wood Preservation, Wastewater Treatment, Industrial Cleaning |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Biocides Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at