444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America automated material handling systems market represents a dynamic and rapidly evolving sector that encompasses sophisticated technologies designed to streamline warehouse operations, manufacturing processes, and distribution centers across the United States, Canada, and Mexico. This comprehensive market includes automated storage and retrieval systems, conveyor systems, robotic solutions, and intelligent sorting technologies that collectively transform traditional material handling approaches into highly efficient, technology-driven operations.

Market growth in this region is driven by increasing demand for operational efficiency, rising labor costs, and the exponential growth of e-commerce activities. The market demonstrates robust expansion with a projected compound annual growth rate (CAGR) of 8.2% through the forecast period, reflecting strong adoption across diverse industry verticals including automotive, food and beverage, pharmaceuticals, and retail sectors.

Technological advancement serves as a primary catalyst, with artificial intelligence, machine learning, and Internet of Things (IoT) integration becoming standard features in modern automated material handling solutions. The region’s mature industrial infrastructure, combined with significant investments in warehouse automation and smart manufacturing initiatives, positions North America as a leading market for advanced material handling technologies.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 16%, and Mexico contributing 6% to the overall North American market landscape. This distribution reflects varying levels of industrial automation adoption and infrastructure development across the three countries.

The North America automated material handling systems market refers to the comprehensive ecosystem of technologies, equipment, and solutions designed to automate the movement, storage, control, and protection of materials and products throughout manufacturing, warehousing, and distribution processes across the United States, Canada, and Mexico. These systems encompass a wide range of automated technologies including conveyor systems, robotic picking solutions, automated storage and retrieval systems, sortation equipment, and intelligent warehouse management software.

Automated material handling systems integrate mechanical, electrical, and software components to create seamless workflows that minimize human intervention while maximizing operational efficiency, accuracy, and throughput. These solutions typically incorporate advanced sensors, control systems, and data analytics capabilities to optimize material flow, reduce operational costs, and enhance workplace safety across various industrial applications.

The market encompasses both hardware components such as automated guided vehicles, robotic arms, conveyor belts, and storage systems, as well as sophisticated software solutions including warehouse management systems, inventory optimization platforms, and predictive maintenance applications that collectively enable intelligent automation of material handling processes.

Market dynamics in the North America automated material handling systems sector reveal a landscape characterized by rapid technological evolution, increasing adoption across diverse industries, and significant investment in automation infrastructure. The market demonstrates strong momentum driven by e-commerce growth, labor shortage challenges, and the imperative for operational efficiency improvements across supply chain operations.

Key market drivers include the surge in online retail activities, which has increased demand for automated fulfillment solutions by approximately 42% over the past three years. Manufacturing sector adoption continues to expand, with automotive and electronics industries leading implementation efforts to enhance production efficiency and maintain competitive advantages in global markets.

Technology integration trends show increasing convergence of artificial intelligence, machine learning, and IoT capabilities within material handling systems, enabling predictive maintenance, real-time optimization, and autonomous decision-making capabilities. These advanced features contribute to operational efficiency improvements of up to 35% compared to traditional manual handling methods.

Regional leadership remains concentrated in the United States, where established industrial infrastructure, substantial capital investment capabilities, and early technology adoption create favorable conditions for market expansion. Canada and Mexico demonstrate growing adoption rates, particularly in automotive manufacturing and cross-border logistics operations.

Market segmentation reveals distinct patterns across technology types, applications, and end-user industries that shape the North American automated material handling landscape. Understanding these insights provides crucial perspective on market dynamics and growth opportunities.

E-commerce expansion serves as the primary catalyst driving automated material handling system adoption across North America. The exponential growth of online retail operations necessitates sophisticated fulfillment capabilities that can handle high-volume, diverse product mixes with rapid turnaround times. This demand has accelerated automation investments across distribution centers and fulfillment facilities throughout the region.

Labor market challenges significantly influence automation adoption decisions, as businesses face persistent workforce shortages, rising labor costs, and the need for consistent operational performance. Automated systems provide reliable alternatives that maintain productivity levels while reducing dependency on manual labor availability and associated cost fluctuations.

Operational efficiency requirements drive continuous improvement initiatives across manufacturing and distribution operations. Companies seek automation solutions that can enhance throughput, reduce error rates, optimize space utilization, and provide real-time visibility into material flow processes. These efficiency gains translate directly into competitive advantages and improved profitability.

Technology advancement creates new possibilities for automation implementation, with artificial intelligence, machine learning, and advanced sensor technologies enabling more sophisticated and autonomous material handling solutions. These technological capabilities expand the scope of automation applications and improve system performance across diverse operational environments.

Supply chain optimization initiatives emphasize the importance of integrated material handling systems that can seamlessly connect with enterprise resource planning systems, inventory management platforms, and logistics networks. This integration capability enables end-to-end supply chain visibility and optimization opportunities.

High capital investment requirements represent the most significant barrier to automated material handling system adoption, particularly for small and medium-sized enterprises. The substantial upfront costs associated with system design, equipment procurement, installation, and integration can strain financial resources and extend payback periods beyond acceptable thresholds for some organizations.

Technical complexity challenges create implementation difficulties that can delay project timelines and increase total cost of ownership. Integration with existing systems, customization requirements, and the need for specialized technical expertise can complicate deployment processes and create operational disruptions during transition periods.

Maintenance requirements and ongoing operational support needs add complexity to total cost calculations and require dedicated technical resources. Sophisticated automated systems demand regular maintenance, software updates, and skilled technician support to maintain optimal performance levels and prevent costly downtime incidents.

Change management challenges within organizations can slow adoption rates as employees adapt to new technologies and modified workflows. Training requirements, resistance to change, and the need for new skill development can create internal barriers that delay implementation timelines and reduce system effectiveness.

Regulatory compliance considerations in certain industries add complexity to system design and implementation processes. Safety regulations, industry standards, and certification requirements can increase project costs and extend development timelines, particularly in highly regulated sectors such as pharmaceuticals and food processing.

Small and medium enterprise market segments present significant growth opportunities as technology costs decrease and modular solutions become more accessible. The development of scalable, cost-effective automation options specifically designed for smaller operations can expand market reach and drive adoption across previously underserved business segments.

Retrofit and modernization projects offer substantial market potential as existing facilities seek to upgrade aging material handling infrastructure. The opportunity to enhance existing operations with modern automation technologies provides a pathway for market expansion without requiring complete facility reconstruction.

Cross-border trade growth between the United States, Canada, and Mexico creates demand for sophisticated logistics and material handling solutions that can efficiently manage international shipments, customs processing, and multi-modal transportation requirements. This trend particularly benefits border regions and major trade corridors.

Sustainability initiatives drive demand for energy-efficient automation solutions that can reduce environmental impact while maintaining operational performance. Green technology integration, renewable energy compatibility, and waste reduction capabilities create differentiation opportunities for system providers.

Industry 4.0 integration presents opportunities for advanced analytics, predictive maintenance, and autonomous decision-making capabilities within material handling systems. The convergence of automation, data analytics, and artificial intelligence enables new service models and value propositions that extend beyond traditional equipment sales.

Competitive landscape dynamics reflect intense innovation competition among established automation providers and emerging technology companies. Market leaders focus on comprehensive solution portfolios, while specialized providers target niche applications and specific industry verticals. This competitive environment drives continuous technological advancement and solution differentiation.

Technology evolution accelerates market transformation as artificial intelligence, machine learning, and advanced robotics capabilities become standard features rather than premium options. These technological improvements enable more sophisticated automation applications and expand the scope of processes suitable for automated handling solutions.

Customer expectations continue to evolve toward integrated, intelligent systems that provide comprehensive operational visibility and autonomous optimization capabilities. Buyers increasingly demand solutions that can adapt to changing requirements, integrate seamlessly with existing infrastructure, and provide measurable return on investment within defined timeframes.

Supply chain considerations influence market dynamics as global component availability, shipping costs, and delivery timelines affect system pricing and project schedules. MarkWide Research analysis indicates that supply chain optimization has become a critical factor in vendor selection and project planning processes.

Investment patterns show increasing focus on flexible, scalable solutions that can accommodate future growth and changing operational requirements. Companies prioritize automation investments that provide long-term value and adaptability rather than single-purpose solutions with limited expansion capabilities.

Primary research methodology encompasses comprehensive interviews with industry executives, technology providers, end-users, and subject matter experts across the North American automated material handling systems market. This approach ensures direct access to current market insights, emerging trends, and strategic perspectives from key stakeholders throughout the value chain.

Secondary research incorporates extensive analysis of industry publications, company financial reports, government statistics, trade association data, and regulatory filings to establish comprehensive market context and validate primary research findings. This multi-source approach provides robust data foundation for market analysis and projections.

Market sizing methodology utilizes bottom-up analysis combining installation data, technology adoption rates, and regional market characteristics to develop accurate market assessments. Cross-validation through multiple data sources ensures reliability and consistency in market quantification approaches.

Trend analysis employs longitudinal data examination to identify emerging patterns, technology adoption cycles, and market evolution trajectories. This analytical approach enables forward-looking insights and helps identify potential market disruptions or acceleration factors.

Competitive intelligence gathering includes systematic monitoring of technology developments, strategic partnerships, merger and acquisition activities, and new product launches across the automated material handling ecosystem. This ongoing surveillance provides current market dynamics understanding and competitive positioning insights.

United States market dominance reflects the country’s advanced industrial infrastructure, substantial capital investment capabilities, and early adoption of automation technologies across diverse industry sectors. The market benefits from strong e-commerce growth, established manufacturing base, and supportive regulatory environment that encourages automation investments.

Geographic concentration within the United States shows particular strength in the Midwest manufacturing corridor, California’s technology and logistics hubs, Texas distribution centers, and Northeast population centers. These regions demonstrate high adoption rates driven by industrial density, labor market conditions, and proximity to major consumer markets.

Canadian market characteristics include strong adoption in automotive manufacturing, natural resources processing, and cross-border logistics operations. The country’s focus on operational efficiency and productivity improvement drives steady automation investment, particularly in Ontario and Quebec industrial regions.

Mexico’s emerging market shows rapid growth in manufacturing automation, particularly in automotive assembly, electronics production, and maquiladora operations. The country’s role in North American supply chains and competitive manufacturing costs create favorable conditions for automation investment and technology transfer.

Regional integration trends demonstrate increasing coordination of material handling systems across North American supply chains, with companies implementing standardized automation platforms that facilitate seamless operations across multiple countries and facilities.

Market leadership is distributed among several major automation providers that offer comprehensive material handling solutions across diverse industry applications. These companies compete on technology innovation, system integration capabilities, and service support quality.

Competitive strategies emphasize technology differentiation, comprehensive service offerings, and industry-specific expertise. Leading companies invest heavily in research and development, strategic partnerships, and acquisition activities to maintain competitive advantages and expand market presence.

Technology segmentation reveals distinct market categories based on automation approaches and equipment types. Each segment addresses specific operational requirements and offers unique value propositions for different applications and industries.

By Technology:

By Application:

By End-User Industry:

Automated Storage and Retrieval Systems represent the fastest-growing segment, with adoption rates increasing by 12.5% annually across North American facilities. These systems provide maximum space utilization and inventory accuracy, making them particularly attractive for high-density storage applications and facilities with limited expansion opportunities.

Robotic systems demonstrate strong growth momentum driven by advancing artificial intelligence capabilities and decreasing technology costs. Modern robotic solutions offer improved flexibility, easier programming, and enhanced safety features that expand their applicability across diverse material handling tasks and operational environments.

Conveyor systems maintain steady market presence as foundational automation technology that integrates effectively with other automated systems. Innovation focuses on modular designs, energy efficiency improvements, and intelligent control systems that optimize material flow and reduce operational costs.

Sortation systems experience robust demand growth driven by e-commerce expansion and the need for high-speed order processing capabilities. Advanced sortation technologies incorporate machine learning algorithms and predictive analytics to optimize routing decisions and minimize processing times.

Automated Guided Vehicles benefit from technological advancement in navigation systems, battery technology, and fleet management software. These mobile automation solutions provide flexibility advantages that appeal to operations with changing layout requirements and diverse material handling needs.

Operational efficiency improvements represent the primary benefit for end-users implementing automated material handling systems. These solutions typically deliver productivity increases of 30-40% while reducing error rates and improving order accuracy across warehouse and manufacturing operations.

Cost reduction benefits extend beyond labor savings to include reduced facility space requirements, lower inventory carrying costs, and decreased product damage rates. Comprehensive automation implementations often achieve total operational cost reductions of 20-25% within the first two years of operation.

Scalability advantages enable businesses to accommodate growth and seasonal fluctuations without proportional increases in labor requirements or facility space. Modular automation systems provide flexibility to expand capacity and capabilities as business needs evolve.

Data visibility and analytics capabilities provide stakeholders with real-time operational insights, performance metrics, and optimization opportunities. These information advantages enable data-driven decision making and continuous improvement initiatives that enhance competitive positioning.

Safety improvements reduce workplace injuries and create safer working environments by automating hazardous tasks and minimizing human exposure to dangerous conditions. Enhanced safety performance contributes to lower insurance costs and improved employee satisfaction.

Competitive advantages accrue to early automation adopters through improved service levels, faster order processing, and enhanced operational reliability. These capabilities enable superior customer service and market differentiation that support premium pricing and customer retention.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence integration transforms traditional automation systems into intelligent platforms capable of autonomous decision-making, predictive maintenance, and continuous optimization. MWR research indicates that AI-enabled systems demonstrate 15-20% superior performance compared to conventional automation solutions.

Collaborative robotics emergence enables human-robot cooperation in material handling tasks, combining human flexibility with robotic precision and consistency. These collaborative solutions expand automation applicability to operations requiring human judgment and adaptability while maintaining safety and efficiency benefits.

Cloud-based management platforms provide centralized control and monitoring capabilities across distributed operations, enabling real-time visibility and remote system management. Cloud integration facilitates data analytics, predictive maintenance, and system optimization across multiple facilities and geographic locations.

Sustainability focus drives demand for energy-efficient automation solutions that reduce environmental impact while maintaining operational performance. Green automation technologies incorporate renewable energy compatibility, waste reduction capabilities, and environmentally responsible materials and processes.

Modular system design enables flexible automation implementations that can adapt to changing operational requirements and business growth. Modular approaches reduce initial investment requirements while providing scalability options that support long-term business evolution and expansion plans.

Mobile automation solutions gain prominence as businesses seek flexible alternatives to fixed infrastructure investments. Autonomous mobile robots and automated guided vehicles provide material handling capabilities that can adapt to changing facility layouts and operational requirements.

Technology partnerships between automation providers and software companies create integrated solutions that combine hardware capabilities with advanced analytics and artificial intelligence. These collaborations enable comprehensive automation platforms that address both operational and strategic business requirements.

Acquisition activity continues as major automation companies expand their technology portfolios and market reach through strategic purchases of specialized providers and innovative startups. This consolidation trend creates more comprehensive solution offerings while accelerating technology development and market penetration.

Research and development investments focus on next-generation technologies including advanced robotics, machine learning algorithms, and autonomous systems. Industry leaders allocate significant resources to innovation initiatives that will define future automation capabilities and competitive advantages.

Standardization efforts promote interoperability and integration capabilities across different automation systems and vendors. Industry organizations work to establish common protocols and standards that simplify system integration and reduce implementation complexity for end-users.

Workforce development programs address the growing need for skilled technicians and system operators capable of supporting advanced automation systems. Educational institutions and industry organizations collaborate to create training programs that prepare workers for automation-enabled operational environments.

Investment prioritization should focus on scalable, flexible automation solutions that can adapt to changing business requirements and accommodate future growth. Companies should evaluate automation investments based on long-term strategic value rather than short-term cost considerations alone.

Technology selection requires careful consideration of integration capabilities, vendor support quality, and total cost of ownership factors. Organizations should prioritize solutions that offer comprehensive support, proven reliability, and clear upgrade pathways for future enhancement opportunities.

Implementation planning must address change management, workforce training, and operational transition requirements to ensure successful automation deployment. Phased implementation approaches can reduce risk and enable gradual adaptation to new technologies and processes.

Vendor evaluation should emphasize technical expertise, industry experience, and long-term partnership potential rather than initial cost considerations alone. Successful automation projects require ongoing support and collaboration between users and technology providers.

Performance measurement systems should track both operational metrics and strategic business outcomes to ensure automation investments deliver expected returns. Regular performance reviews and optimization initiatives can maximize system value and identify improvement opportunities.

Market expansion projections indicate continued robust growth driven by e-commerce evolution, manufacturing modernization, and operational efficiency requirements. The North American automated material handling systems market is expected to maintain strong momentum with projected growth rates of 8-10% annually through the next five years.

Technology evolution will accelerate integration of artificial intelligence, machine learning, and autonomous systems within material handling applications. These advanced capabilities will enable more sophisticated automation solutions that can adapt to changing conditions and optimize performance without human intervention.

Industry adoption patterns suggest expanding automation implementation across previously underserved sectors including healthcare, pharmaceuticals, and specialty manufacturing. These emerging applications will drive market diversification and create new growth opportunities for automation providers.

Geographic expansion within North America will see increased adoption in secondary markets and smaller metropolitan areas as technology costs decrease and solution accessibility improves. Rural and regional facilities will increasingly implement automation solutions to address labor challenges and competitive pressures.

Integration complexity will continue to increase as businesses seek comprehensive automation platforms that connect material handling systems with enterprise resource planning, customer relationship management, and supply chain optimization applications. This integration trend will drive demand for sophisticated system integration capabilities and comprehensive vendor support services.

The North America automated material handling systems market represents a dynamic and rapidly evolving sector positioned for sustained growth driven by technological advancement, operational efficiency requirements, and changing business models across diverse industries. Market fundamentals remain strong, supported by robust e-commerce growth, manufacturing modernization initiatives, and the ongoing need for competitive operational advantages.

Technology integration continues to transform traditional material handling approaches into intelligent, autonomous systems capable of optimizing performance and adapting to changing operational requirements. The convergence of artificial intelligence, robotics, and data analytics creates unprecedented opportunities for operational efficiency improvements and strategic business advantages.

Market opportunities extend across multiple dimensions including geographic expansion, industry diversification, and technology advancement. Small and medium enterprises represent significant untapped potential, while retrofit and modernization projects offer substantial growth prospects for automation providers and system integrators.

Strategic success in this market requires careful attention to technology selection, implementation planning, and long-term partnership development. Organizations that approach automation investments with comprehensive strategic perspectives and focus on scalable, flexible solutions will be best positioned to realize maximum value from their material handling system implementations.

The future outlook for the North America automated material handling systems market remains highly positive, with continued innovation, expanding applications, and growing recognition of automation’s strategic value driving sustained market growth and evolution throughout the forecast period.

What is Automated Material Handling Systems?

Automated Material Handling Systems refer to the technology and equipment used to automate the movement, storage, and control of materials within a facility. These systems enhance efficiency and accuracy in various applications, including warehousing, manufacturing, and distribution.

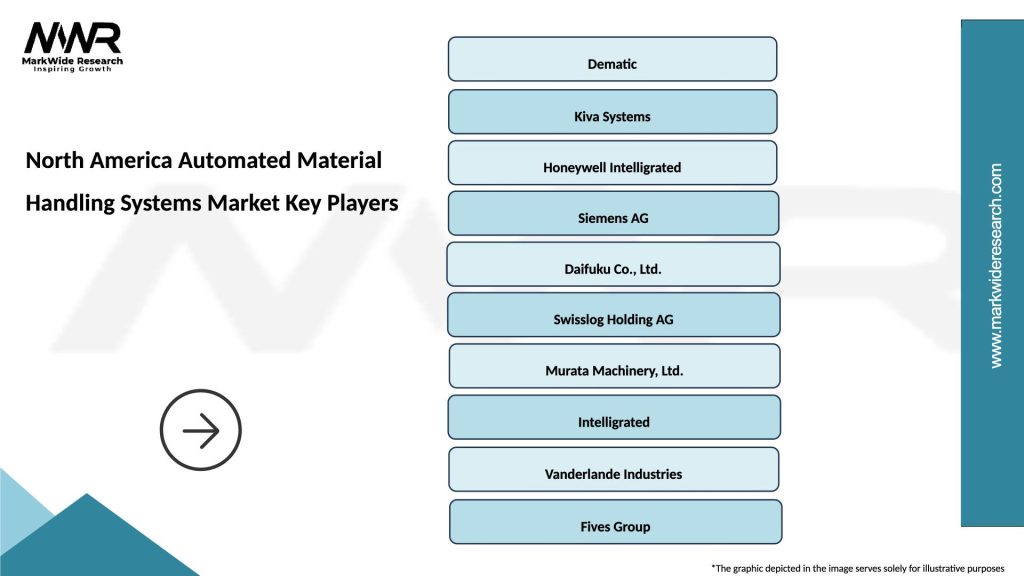

What are the key players in the North America Automated Material Handling Systems Market?

Key players in the North America Automated Material Handling Systems Market include companies like Dematic, Honeywell Intelligrated, and Siemens, which provide innovative solutions for material handling. These companies focus on enhancing operational efficiency and reducing labor costs, among others.

What are the main drivers of growth in the North America Automated Material Handling Systems Market?

The main drivers of growth in the North America Automated Material Handling Systems Market include the increasing demand for efficiency in supply chain operations, the rise of e-commerce, and the need for improved safety in material handling processes. Additionally, advancements in robotics and automation technologies are contributing to market expansion.

What challenges does the North America Automated Material Handling Systems Market face?

Challenges in the North America Automated Material Handling Systems Market include high initial investment costs and the complexity of integrating new systems with existing infrastructure. Additionally, there is a shortage of skilled labor to operate and maintain these advanced systems.

What opportunities exist in the North America Automated Material Handling Systems Market?

Opportunities in the North America Automated Material Handling Systems Market include the growing adoption of Industry Four Point Zero technologies and the increasing focus on sustainability in operations. Companies are also exploring the integration of artificial intelligence and machine learning to enhance system capabilities.

What trends are shaping the North America Automated Material Handling Systems Market?

Trends shaping the North America Automated Material Handling Systems Market include the rise of autonomous mobile robots, the implementation of IoT for real-time tracking, and the shift towards more flexible and scalable systems. These trends are driven by the need for greater efficiency and responsiveness in logistics and supply chain management.

North America Automated Material Handling Systems Market

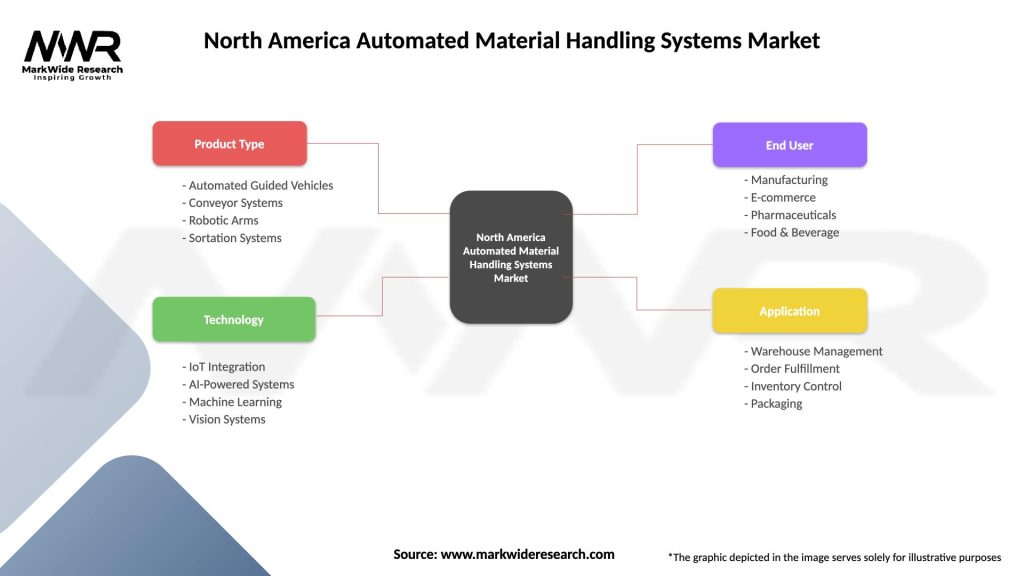

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Conveyor Systems, Robotic Arms, Sortation Systems |

| Technology | IoT Integration, AI-Powered Systems, Machine Learning, Vision Systems |

| End User | Manufacturing, E-commerce, Pharmaceuticals, Food & Beverage |

| Application | Warehouse Management, Order Fulfillment, Inventory Control, Packaging |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Automated Material Handling Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at