444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America artificial lift systems market is witnessing significant growth as the demand for efficient and cost-effective solutions to enhance oil and gas production increases. Artificial lift systems are used in oil wells to overcome the natural decline in reservoir pressure and maintain or increase the flow of hydrocarbons to the surface. These systems include various technologies, such as rod lifts, electric submersible pumps (ESPs), gas lifts, and progressive cavity pumps. The North America region has a mature oil and gas industry, with a large number of producing wells that require artificial lift systems to optimize production. With the growing need to extract oil and gas from aging and unconventional reservoirs, the North America artificial lift systems market presents lucrative opportunities for manufacturers and service providers.

Meaning

Artificial lift systems refer to the technologies and techniques used to increase the flow of oil or gas from a well to the surface when natural reservoir pressure is insufficient. These systems are employed in oil and gas wells to enhance production and ensure efficient hydrocarbon recovery. Artificial lift systems use various methods, including rod lifts, electric submersible pumps (ESPs), gas lifts, and progressive cavity pumps, to overcome the decline in reservoir pressure and lift the hydrocarbons to the surface. These systems play a crucial role in maintaining or increasing production rates in oil and gas fields.

Executive Summary

The North America artificial lift systems market is experiencing substantial growth due to the increasing demand for efficient and cost-effective solutions to optimize oil and gas production. Artificial lift systems are essential for maintaining production rates in aging wells and extracting hydrocarbons from unconventional reservoirs. The market offers a wide range of technologies, including rod lifts, electric submersible pumps (ESPs), gas lifts, and progressive cavity pumps. Factors such as the growing need for energy, maturing oil and gas fields, and advancements in artificial lift technologies are driving the market. With ongoing investments in the oil and gas sector and the focus on maximizing production, the North America artificial lift systems market is expected to witness significant growth.

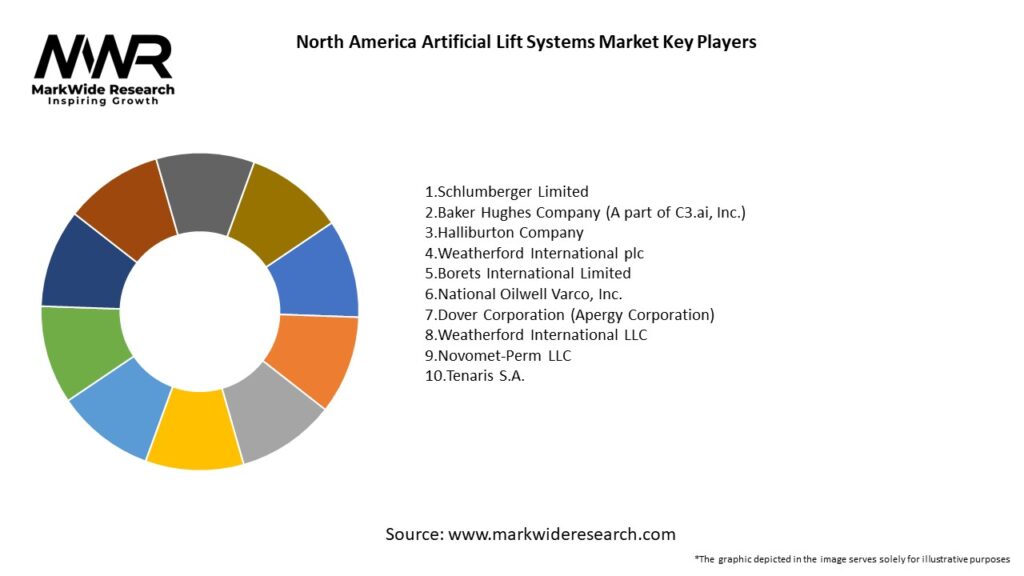

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America artificial lift systems market is driven by the need to optimize oil and gas production, overcome declining reservoir pressures, and maximize hydrocarbon recovery. Aging wells, unconventional reservoirs, and the growing energy demand are key factors driving the adoption of artificial lift systems. Technological advancements in pump designs, control systems, and data analytics contribute to improved efficiency and reliability. However, challenges such as high initial investment, operational complexities, environmental concerns, and oil price volatility can hinder market growth. Opportunities lie in the development of unconventional reservoirs, integration with enhanced oil recovery techniques, digitalization, and service contracts. The market dynamics are influenced by factors such as oil and gas industry trends, regulatory policies, technological advancements, and environmental considerations.

Regional Analysis

The North America artificial lift systems market can be analyzed based on key regions, including the United States and Canada.

Competitive Landscape

Leading Companies in the North America Artificial Lift Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America artificial lift systems market can be segmented based on technology, including:

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic had a significant impact on the North America artificial lift systems market. The global economic slowdown, reduced oil and gas demand, and travel restrictions led to a decline in drilling activities and capital expenditure in the oil and gas sector. Many operators postponed or canceled artificial lift system installations andupgrades, resulting in a temporary slowdown in the market. However, as the global economy recovers and oil and gas demand rebounds, the market is expected to regain momentum. The pandemic highlighted the importance of operational efficiency and cost optimization, driving the need for advanced artificial lift systems to maximize production rates and minimize downtime. The market is also witnessing an increased focus on digitalization and remote monitoring, which enables operators to remotely monitor and control artificial lift systems, reducing the need for onsite personnel and ensuring safe and efficient operations. While the short-term impact of the pandemic has been challenging, the long-term outlook for the North America artificial lift systems market remains positive as the industry adapts to the new normal and explores innovative solutions to optimize production and recovery.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the North America artificial lift systems market is positive, driven by the need to optimize oil and gas production, recover additional hydrocarbons, and maximize field development. Technological advancements, such as digitalization, automation, and data analytics, will play a significant role in improving efficiency, reliability, and performance. The integration of advanced technologies will enable remote monitoring, predictive maintenance, and real-time data analytics for optimized operations. The market will also witness increased collaboration between artificial lift system providers, oil and gas operators, and technology companies to develop customized solutions and drive innovation. Despite challenges such as high initial investment, operational complexities, and environmental concerns, the North America artificial lift systems market is expected to grow as the oil and gas industry continues to evolve and seek efficient and cost-effective solutions for hydrocarbon extraction.

Conclusion

The North America artificial lift systems market is experiencing significant growth as the demand for efficient and cost-effective solutions to optimize oil and gas production increases. Artificial lift systems play a crucial role in maintaining or increasing production rates in aging wells and extracting hydrocarbons from unconventional reservoirs. The market offers various technologies, including rod lifts, electric submersible pumps (ESPs), gas lifts, and progressive cavity pumps. Factors such as declining reservoir pressure, maximizing hydrocarbon recovery, increasing energy demand, and technological advancements are driving market growth. However, challenges such as high initial investment, operational complexities, environmental concerns, and oil price volatility exist. Opportunities lie in unconventional reservoir development, enhanced oil recovery techniques, digitalization, and service contracts. The market dynamics are influenced by oil and gas industry trends, technological advancements, regulatory policies, and environmental considerations. The future outlook for the North America artificial lift systems market is positive, with a focus on digitalization, automation, and sustainability.

North America Artificial Lift Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Rod Lift, Gas Lift, Electric Submersible Pump, Progressive Cavity Pump |

| End User | Oil & Gas Companies, Independent Producers, Service Providers, Offshore Operators |

| Technology | Conventional, Hybrid, Smart Lift, Advanced Control Systems |

| Application | Onshore, Offshore, Heavy Oil, Shale Gas |

Leading Companies in the North America Artificial Lift Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at