444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

Market Overview

The North America AMH (Automated Material Handling) and storage systems market is a dynamic and rapidly evolving sector. It encompasses various technologies and solutions that enhance the efficiency and productivity of material handling and storage operations. With the advent of advanced automation and robotics, this market has witnessed significant growth in recent years.

Meaning

Automated Material Handling (AMH) refers to the use of automated systems, machinery, and software to streamline and optimize material handling processes in industries such as manufacturing, logistics, and distribution. Storage systems, on the other hand, involve the use of various equipment and solutions to efficiently store and retrieve goods and materials within a facility.

Executive Summary

The North America AMH and storage systems market is poised for substantial growth in the coming years. The increasing demand for efficient material handling and storage solutions, coupled with technological advancements, is driving market growth. This executive summary provides an overview of the key market insights, drivers, restraints, opportunities, and dynamics that are shaping the industry.

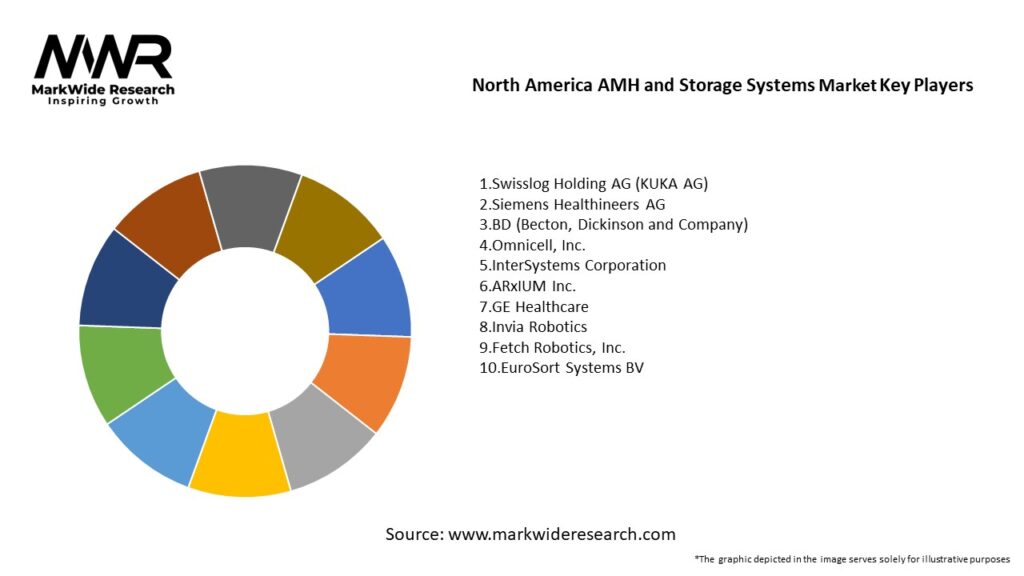

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The North America AMH and storage systems market is highly dynamic, driven by technological advancements, changing customer demands, and evolving industry requirements. The market dynamics include factors such as shifting customer preferences, competitive landscape, regulatory landscape, and emerging trends that influence market growth and development.

Regional Analysis

The North America AMH and storage systems market can be segmented into key regions, including the United States, Canada, and Mexico. The United States dominates the market due to its robust industrial base, technological advancements, and high adoption rate of automation. Canada and Mexico also present significant growth opportunities due to the expansion of industries and increasing investments in automation technologies.

Competitive Landscape

Leading Companies in the North America AMH and Storage Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Segmentation

The North America AMH and storage systems market can be segmented based on various factors such as product type, end-use industry, and technology. The segmentation allows for a more focused analysis of market trends and opportunities. Some key segments include robotics-based systems, conveyor systems, AS/RS (Automated Storage and Retrieval Systems), and end-use industries such as automotive, retail, and e-commerce.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Strengths

Weaknesses

Opportunities

Threats

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic had a significant impact on the North America AMH and storage systems market. The crisis highlighted the need for resilient supply chains and efficient logistics operations. The pandemic accelerated the adoption of automation and robotics in industries, as companies sought to minimize reliance on manual labor and ensure business continuity in times of disruption.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future of the North America AMH and storage systems market looks promising, driven by advancements in automation, robotics, and AI technologies. The increasing focus on efficiency, cost reduction, and workplace safety will continue to fuel the demand for AMH solutions. As industries across various sectors embrace digital transformation, the adoption of advanced material handling and storage systems will be vital for maintaining a competitive edge and ensuring operational excellence.

Conclusion

The North America AMH and storage systems market is undergoing significant transformation due to the increasing need for efficiency, cost reduction, and automation. The integration of advanced technologies, such as robotics, AI, and IoT, is reshaping material handling and storage operations, offering enhanced productivity, safety, and customer satisfaction. Industry participants should leverage the opportunities presented by this evolving market and stay abreast of the latest trends and innovations to remain competitive in the dynamic business landscape.

What is AMH and Storage Systems?

AMH and Storage Systems refer to automated material handling systems and storage solutions that enhance efficiency in warehouses and distribution centers. These systems include technologies such as conveyor belts, automated guided vehicles, and robotic storage solutions.

What are the key players in the North America AMH and Storage Systems Market?

Key players in the North America AMH and Storage Systems Market include companies like Dematic, Swisslog, and Honeywell Intelligrated. These companies are known for their innovative solutions in automation and storage technologies, among others.

What are the growth factors driving the North America AMH and Storage Systems Market?

The growth of the North America AMH and Storage Systems Market is driven by the increasing demand for automation in logistics, the rise of e-commerce, and the need for efficient inventory management. Additionally, advancements in technology are enabling more sophisticated storage solutions.

What challenges does the North America AMH and Storage Systems Market face?

Challenges in the North America AMH and Storage Systems Market include high initial investment costs, the complexity of system integration, and the need for skilled labor to operate advanced technologies. These factors can hinder adoption rates among smaller businesses.

What opportunities exist in the North America AMH and Storage Systems Market?

Opportunities in the North America AMH and Storage Systems Market include the expansion of smart warehouses, the integration of AI and IoT technologies, and the growing focus on sustainability in logistics operations. These trends are likely to shape the future of the market.

What trends are shaping the North America AMH and Storage Systems Market?

Trends in the North America AMH and Storage Systems Market include the increasing adoption of robotics for material handling, the shift towards omnichannel fulfillment strategies, and the development of modular storage solutions. These trends are enhancing operational efficiency and flexibility.

North America AMH and Storage Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Automated Guided Vehicles, Mobile Shelving, Vertical Lift Modules, Carousel Systems |

| End User | Healthcare Facilities, Warehousing, Retail Stores, Manufacturing Plants |

| Technology | RFID, IoT Integration, AI-Powered Systems, Cloud-Based Solutions |

| Application | Inventory Management, Order Fulfillment, Document Storage, Material Handling |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the North America AMH and Storage Systems Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at