444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America almond milk market represents one of the most dynamic segments within the plant-based beverage industry, experiencing remarkable growth driven by evolving consumer preferences and health consciousness. Market dynamics indicate that the region has become a global leader in almond milk consumption and production, with the United States and Canada serving as primary growth engines. The market encompasses various product categories including sweetened, unsweetened, flavored, and organic almond milk variants, catering to diverse consumer needs and dietary requirements.

Consumer adoption has accelerated significantly over the past decade, with almond milk establishing itself as the dominant plant-based milk alternative in North American households. The market demonstrates robust expansion across multiple distribution channels, from traditional grocery retailers to specialty health food stores and e-commerce platforms. Growth rates continue to outpace traditional dairy milk, with the segment achieving a compound annual growth rate of 8.2% in recent years, reflecting strong consumer demand and market penetration.

Regional distribution shows the United States commanding approximately 85% of the North American market share, while Canada represents the remaining 15%, with both countries experiencing consistent growth in almond milk consumption. The market benefits from favorable agricultural conditions in California, which produces over 80% of the world’s almonds, providing a stable supply chain foundation for North American manufacturers.

The North America almond milk market refers to the comprehensive ecosystem encompassing the production, distribution, and consumption of almond-based beverages across the United States and Canada. This market includes all commercial activities related to almond milk products, from raw almond sourcing and processing to final consumer sales through various retail and foodservice channels.

Market scope extends beyond basic almond milk beverages to include fortified variants, organic options, flavored products, and specialty formulations designed for specific dietary needs such as protein-enhanced or low-sugar alternatives. The market encompasses both refrigerated and shelf-stable products, serving diverse consumer segments including health-conscious individuals, lactose-intolerant consumers, vegans, and environmentally aware shoppers seeking sustainable beverage options.

Industry definition includes manufacturers ranging from large-scale commercial producers to artisanal brands, distributors, retailers, and supporting service providers throughout the supply chain. The market also encompasses related products such as almond milk-based yogurts, ice creams, and coffee creamers, representing the broader plant-based dairy alternative category within North America’s evolving food and beverage landscape.

Market performance in the North America almond milk sector demonstrates exceptional resilience and growth potential, driven by fundamental shifts in consumer behavior and dietary preferences. The market has successfully transitioned from a niche health product to a mainstream beverage category, achieving widespread acceptance across diverse demographic groups and geographic regions throughout the United States and Canada.

Key growth drivers include increasing lactose intolerance awareness, rising vegan and vegetarian populations, environmental sustainability concerns, and growing health consciousness among consumers. The market benefits from continuous product innovation, with manufacturers introducing new flavors, formulations, and packaging solutions to meet evolving consumer demands. Distribution expansion has been particularly notable, with almond milk products now available in over 95% of major grocery chains across North America.

Competitive landscape features both established food and beverage companies and specialized plant-based brands, creating a dynamic market environment that fosters innovation and competitive pricing. The market demonstrates strong fundamentals with consistent demand growth, expanding consumer base, and increasing mainstream acceptance, positioning it for continued expansion in the coming years.

Consumer behavior analysis reveals significant insights into North American almond milk consumption patterns and preferences. The following key insights shape market development and strategic planning:

Health consciousness serves as the primary driver propelling North America almond milk market growth, with consumers increasingly seeking alternatives to traditional dairy products. Rising awareness of lactose intolerance, which affects approximately 36% of Americans, has created substantial demand for plant-based milk alternatives. Nutritional benefits associated with almond milk, including lower calorie content, vitamin E enrichment, and absence of cholesterol, appeal to health-focused consumers across all age groups.

Environmental sustainability concerns significantly influence consumer purchasing decisions, with almond milk perceived as more environmentally friendly compared to dairy milk production. The growing vegan and vegetarian population in North America, estimated to represent over 6% of the total population, provides a dedicated consumer base driving consistent demand growth. Dietary restrictions and food allergies, particularly dairy allergies affecting millions of North Americans, create additional market demand for safe, nutritious alternatives.

Product innovation continues to drive market expansion through introduction of new flavors, formulations, and functional ingredients. Manufacturers invest heavily in research and development to create products that closely mimic dairy milk taste and texture while offering enhanced nutritional profiles. Marketing initiatives and celebrity endorsements have increased mainstream awareness and acceptance, contributing to broader market adoption across diverse consumer segments.

Price sensitivity represents a significant constraint for North America almond milk market expansion, as almond milk typically costs 50-100% more than conventional dairy milk. This price differential limits adoption among price-conscious consumers and large families seeking economical beverage options. Supply chain challenges related to almond production, particularly water scarcity issues in California, create potential supply disruptions and cost volatility that impact market stability.

Taste preferences continue to present barriers for some consumers who find almond milk taste and texture different from traditional dairy milk. Despite improvements in product formulations, certain consumer segments remain resistant to switching from familiar dairy products. Nutritional concerns regarding protein content, as almond milk contains significantly less protein than dairy milk, may deter health-conscious consumers seeking high-protein beverages.

Regulatory challenges and labeling requirements create compliance costs and potential market confusion. The ongoing debate over plant-based products using dairy terminology such as “milk” has created regulatory uncertainty in some jurisdictions. Competition from other plant-based alternatives including oat milk, soy milk, and pea protein milk intensifies market competition and may limit almond milk’s market share growth in certain segments.

Product diversification presents substantial opportunities for North America almond milk market expansion through development of specialized formulations targeting specific consumer needs. Opportunities exist in creating protein-enhanced almond milk products, probiotic-enriched variants, and functional beverages incorporating additional nutrients and supplements. Foodservice expansion represents a significant growth avenue, with restaurants, cafes, and institutional food providers increasingly offering plant-based milk alternatives.

Geographic expansion within North America offers opportunities to penetrate underserved markets, particularly in rural areas and regions with lower current adoption rates. E-commerce growth provides platforms for direct-to-consumer sales, subscription services, and bulk purchasing options that can improve market accessibility and customer loyalty. The growing popularity of home baking and cooking during recent years has created opportunities for larger packaging sizes and specialty baking formulations.

Partnership opportunities with coffee chains, smoothie bars, and health food retailers can expand distribution reach and brand visibility. Innovation in packaging technology, including sustainable packaging solutions and improved shelf-stable options, can address environmental concerns while expanding market reach. The increasing focus on personalized nutrition creates opportunities for customized almond milk products tailored to individual dietary needs and preferences.

Supply and demand dynamics in the North America almond milk market reflect complex interactions between agricultural production, consumer preferences, and competitive pressures. Demand patterns show consistent growth across all major market segments, with particularly strong performance in organic and unsweetened categories. The market demonstrates seasonal variations, with increased consumption during health-focused periods and summer months when lighter beverages gain popularity.

Competitive dynamics feature intense rivalry among established brands and emerging players, driving continuous innovation and competitive pricing strategies. MarkWide Research analysis indicates that market leaders maintain positions through brand recognition, distribution networks, and product quality, while newer entrants compete through innovation and niche market targeting. The market shows increasing consolidation as larger food companies acquire successful plant-based brands to expand their portfolios.

Technology adoption influences market dynamics through improved production processes, enhanced product quality, and innovative packaging solutions. Consumer education efforts by manufacturers and health organizations continue to drive market awareness and adoption, particularly among demographics traditionally resistant to plant-based alternatives. The market benefits from positive feedback loops where increased consumption drives economies of scale, leading to improved pricing and broader accessibility.

Data collection for North America almond milk market analysis employs comprehensive primary and secondary research methodologies to ensure accuracy and reliability. Primary research includes consumer surveys, industry interviews, and focus groups conducted across major metropolitan areas in the United States and Canada. Survey methodology encompasses both online and telephone interviews with representative samples of almond milk consumers, non-consumers, and industry stakeholders.

Secondary research incorporates analysis of industry reports, government statistics, trade association data, and company financial statements to provide comprehensive market coverage. Market sizing utilizes multiple data sources including retail sales data, production statistics, and import/export figures to ensure accuracy and completeness. The research methodology includes validation through triangulation of data sources and expert interviews with industry professionals.

Analytical frameworks employed include Porter’s Five Forces analysis, SWOT assessment, and competitive benchmarking to provide strategic insights. Forecasting models incorporate historical trends, demographic changes, and economic indicators to project future market development. The methodology ensures geographic coverage across all major North American markets while maintaining focus on key growth segments and emerging trends.

United States market dominates North America almond milk consumption, representing the largest and most mature market in the region. California leads in both production and consumption, benefiting from local almond production and health-conscious consumer base. The state accounts for approximately 25% of national consumption while also serving as the primary production hub. West Coast markets including Washington and Oregon demonstrate high per-capita consumption rates and strong growth in premium product segments.

East Coast regions show rapid adoption rates, with New York, Florida, and the Northeast corridor experiencing significant market expansion. Urban centers across the United States demonstrate higher consumption rates compared to rural areas, reflecting demographic factors including income levels, education, and health consciousness. The Midwest region represents an emerging growth opportunity with increasing acceptance among traditional dairy-consuming populations.

Canadian market demonstrates strong growth potential with increasing consumer awareness and expanding distribution networks. Ontario and British Columbia lead Canadian consumption, with major metropolitan areas showing adoption patterns similar to comparable U.S. cities. The Canadian market benefits from growing health consciousness and environmental awareness, with organic products showing particularly strong performance. Cross-border trade and shared marketing campaigns contribute to market development across the broader North American region.

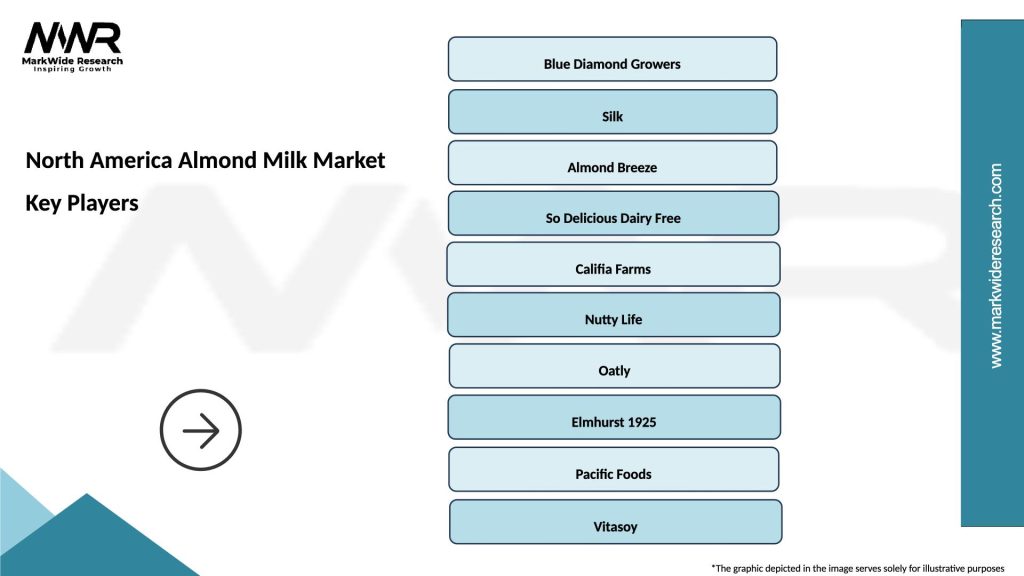

Market leadership in the North America almond milk sector features several key players who have established strong positions through brand recognition, distribution networks, and product innovation. The competitive environment includes both large multinational food companies and specialized plant-based beverage manufacturers.

Competitive strategies focus on product differentiation, brand building, and distribution expansion. Companies invest heavily in marketing campaigns, celebrity endorsements, and social media presence to build brand awareness and consumer loyalty.

Product type segmentation reveals distinct market categories with varying growth rates and consumer preferences. The North America almond milk market segments include multiple product variations catering to diverse consumer needs and taste preferences.

By Flavor Profile:

By Packaging Type:

By Distribution Channel:

Organic almond milk represents the fastest-growing category within the North America market, driven by consumer preferences for natural, pesticide-free products. This premium segment commands higher prices and demonstrates strong brand loyalty among health-conscious consumers. Growth rates in the organic category exceed overall market growth by approximately 3-4 percentage points, reflecting increasing consumer willingness to pay premium prices for perceived quality and health benefits.

Unsweetened varieties have gained significant market share as consumers become more aware of added sugar content in beverages. This category appeals to health-conscious consumers, diabetics, and those following low-carb diets. Protein-enhanced formulations represent an emerging category addressing consumer concerns about protein content compared to dairy milk, with manufacturers adding plant-based proteins to improve nutritional profiles.

Barista blends constitute a specialized category designed for coffee applications, featuring formulations that steam and froth similar to dairy milk. This category targets the growing coffee culture and home brewing trends across North America. Functional varieties incorporating probiotics, additional vitamins, or omega-3 fatty acids represent innovation-driven segments targeting specific health benefits and consumer needs.

Manufacturers benefit from the North America almond milk market through access to a rapidly growing consumer segment with strong purchasing power and brand loyalty. The market offers opportunities for premium pricing, particularly in organic and specialty segments, enabling higher profit margins compared to commodity food products. Innovation opportunities allow manufacturers to differentiate products and capture market share through unique formulations, packaging, and positioning strategies.

Retailers gain advantages through offering high-margin plant-based products that attract health-conscious consumers and drive store traffic. Almond milk products typically generate higher per-unit profits compared to traditional dairy milk while appealing to growing demographic segments. Category expansion opportunities include related plant-based products, creating comprehensive dairy alternative sections that serve evolving consumer needs.

Suppliers and distributors benefit from participating in a growth market with expanding distribution requirements and increasing volume demands. Almond growers particularly benefit from sustained demand growth and premium pricing for high-quality raw materials. Packaging companies gain opportunities through demand for innovative, sustainable packaging solutions that appeal to environmentally conscious consumers while maintaining product quality and shelf life.

Strengths:

Weaknesses:

Opportunities:

Threats:

Clean label movement significantly influences North America almond milk market development, with consumers increasingly demanding products with minimal, recognizable ingredients. Manufacturers respond by simplifying formulations and highlighting natural ingredients on packaging and marketing materials. Sustainability focus drives demand for environmentally friendly packaging, ethical sourcing practices, and carbon-neutral production processes.

Functional beverage trends create opportunities for almond milk products enhanced with probiotics, adaptogens, and additional nutrients targeting specific health benefits. MWR data indicates growing consumer interest in beverages that provide functional benefits beyond basic nutrition. Personalization trends influence product development, with manufacturers exploring customizable nutrition profiles and flavor combinations to meet individual consumer preferences.

Premium positioning continues to gain traction as consumers demonstrate willingness to pay higher prices for perceived quality, organic certification, and artisanal production methods. Convenience trends drive demand for portable packaging, single-serve options, and ready-to-drink formulations suitable for on-the-go consumption. Technology integration includes smart packaging, QR codes for product information, and digital marketing campaigns targeting specific consumer segments through social media and mobile platforms.

Product launches in the North America almond milk market demonstrate continuous innovation and market expansion efforts by leading manufacturers. Recent developments include introduction of protein-enhanced formulations, seasonal flavor varieties, and sustainable packaging solutions. Acquisition activity has intensified as large food companies seek to expand plant-based portfolios through strategic purchases of successful almond milk brands.

Manufacturing investments include facility expansions, production capacity increases, and technology upgrades to meet growing demand and improve operational efficiency. Several companies have announced significant capital investments in North American production facilities to reduce supply chain dependencies and improve market responsiveness. Partnership agreements between almond milk manufacturers and major retailers have expanded distribution reach and improved shelf positioning.

Regulatory developments include ongoing discussions regarding labeling requirements for plant-based milk products and potential impacts on marketing and consumer communication strategies. Sustainability initiatives by major manufacturers include commitments to carbon-neutral production, sustainable packaging, and responsible sourcing practices that appeal to environmentally conscious consumers. Research and development investments focus on improving taste, texture, and nutritional profiles to better compete with dairy milk and other plant-based alternatives.

Market entry strategies for new participants should focus on differentiation through unique product positioning, innovative formulations, or underserved market segments. MarkWide Research recommends that companies consider regional preferences, demographic targeting, and distribution channel optimization when developing market entry plans. Brand building requires significant investment in marketing and consumer education to compete effectively with established market leaders.

Existing players should prioritize product innovation, particularly in functional and premium segments where consumer willingness to pay higher prices supports better profit margins. Distribution expansion into underserved geographic markets and emerging channels such as e-commerce and foodservice represents significant growth opportunities. Sustainability initiatives should be integrated into core business strategies to appeal to environmentally conscious consumers and differentiate from competitors.

Investment priorities should include production capacity expansion, supply chain optimization, and technology upgrades to improve operational efficiency and product quality. Strategic partnerships with retailers, foodservice providers, and complementary brands can accelerate market penetration and reduce marketing costs. Consumer research investments will help companies better understand evolving preferences and identify emerging market opportunities before competitors.

Long-term growth prospects for the North America almond milk market remain highly positive, supported by fundamental demographic and lifestyle trends that favor plant-based alternatives. Market expansion is expected to continue across all major segments, with particularly strong growth anticipated in organic, functional, and premium product categories. The market is projected to maintain robust growth rates of approximately 7-9% annually over the next five years.

Innovation trajectory will likely focus on addressing current product limitations including protein content, taste optimization, and functional benefits. Technology advancement in production processes, packaging solutions, and supply chain management will improve product quality while reducing costs. Market maturation in core segments will drive companies to explore new applications, flavors, and consumer segments to maintain growth momentum.

Competitive landscape evolution will likely feature continued consolidation as larger food companies acquire successful plant-based brands to expand their portfolios. Global expansion opportunities may emerge as North American companies leverage their expertise to enter international markets with growing plant-based beverage demand. Regulatory environment is expected to stabilize, providing clearer guidelines for labeling and marketing plant-based milk products while supporting continued market growth and consumer acceptance.

The North America almond milk market represents a dynamic and rapidly evolving sector within the broader plant-based beverage industry, characterized by strong consumer demand, continuous innovation, and expanding market opportunities. Market fundamentals remain robust, supported by demographic trends, health consciousness, and environmental awareness that favor plant-based alternatives over traditional dairy products.

Growth trajectory indicates sustained expansion across all major market segments, with particular strength in premium, organic, and functional product categories. The market benefits from well-established distribution networks, strong brand recognition among leading players, and increasing mainstream consumer acceptance. Innovation opportunities continue to drive product development and market differentiation, while expanding applications in foodservice and e-commerce channels provide additional growth avenues.

Strategic positioning for market participants requires focus on product quality, brand building, and distribution optimization to compete effectively in an increasingly competitive environment. The market’s future success will depend on continued innovation, sustainable practices, and ability to address evolving consumer preferences while maintaining accessibility and affordability. Overall, the North America almond milk market is well-positioned for continued growth and market expansion, offering significant opportunities for existing players and new entrants who can effectively navigate the competitive landscape and meet evolving consumer demands.

What is Almond Milk?

Almond milk is a plant-based milk alternative made from ground almonds and water. It is often used as a dairy substitute in various applications, including beverages, baking, and cooking.

What are the key players in the North America Almond Milk Market?

Key players in the North America Almond Milk Market include Blue Diamond Growers, Silk, Califia Farms, and Alpro, among others.

What are the main drivers of growth in the North America Almond Milk Market?

The growth of the North America Almond Milk Market is driven by increasing consumer demand for plant-based diets, rising lactose intolerance rates, and the health benefits associated with almond milk, such as lower calories and higher vitamin E content.

What challenges does the North America Almond Milk Market face?

Challenges in the North America Almond Milk Market include competition from other plant-based milk alternatives, fluctuating almond prices, and consumer skepticism regarding the nutritional value compared to dairy milk.

What opportunities exist in the North America Almond Milk Market?

Opportunities in the North America Almond Milk Market include expanding product lines with flavored and fortified almond milk, increasing distribution channels, and targeting health-conscious consumers looking for dairy alternatives.

What trends are shaping the North America Almond Milk Market?

Trends in the North America Almond Milk Market include the rise of organic and non-GMO products, innovative packaging solutions, and the growing popularity of almond milk in coffee shops and cafes as a dairy substitute.

North America Almond Milk Market

| Segmentation Details | Description |

|---|---|

| Product Type | Unsweetened, Sweetened, Flavored, Organic |

| Packaging Type | Carton, Bottle, Tetra Pak, Pouch |

| Distribution Channel | Supermarkets, Online Retail, Health Stores, Convenience Stores |

| End User | Households, Cafés, Restaurants, Food Manufacturers |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Almond Milk Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at