444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America alcoholic beverage market represents one of the most dynamic and established consumer goods sectors in the region, encompassing a diverse portfolio of products including beer, wine, spirits, and ready-to-drink cocktails. Market dynamics indicate sustained growth driven by evolving consumer preferences, premiumization trends, and innovative product development across traditional and emerging categories. The region’s mature market infrastructure, combined with sophisticated distribution networks and strong brand loyalty, creates a competitive landscape where both established players and craft producers thrive.

Consumer behavior patterns reveal significant shifts toward premium and super-premium segments, with growth rates of 8.2% annually in craft beer and artisanal spirits categories. The market demonstrates remarkable resilience and adaptability, particularly evident during recent economic fluctuations where premium product categories maintained strong performance despite broader market challenges. Regional preferences vary significantly, with the United States dominating overall consumption volumes while Canada shows distinctive preferences for imported wines and premium spirits.

Innovation trends continue to reshape the market landscape, with health-conscious alternatives, low-alcohol options, and sustainable packaging solutions gaining substantial traction. The emergence of hard seltzers and functional alcoholic beverages represents a paradigm shift, capturing 15.3% market share growth among younger demographics. Distribution channels have evolved dramatically, with e-commerce platforms and direct-to-consumer models complementing traditional retail and on-premise establishments.

The North America alcoholic beverage market refers to the comprehensive ecosystem of production, distribution, and consumption of fermented and distilled alcoholic products across the United States and Canada. This market encompasses traditional categories including beer, wine, and spirits, alongside emerging segments such as hard seltzers, ready-to-drink cocktails, and functional alcoholic beverages designed for health-conscious consumers.

Market scope extends beyond simple product sales to include the entire value chain from raw material sourcing and production facilities to sophisticated distribution networks, retail partnerships, and on-premise consumption venues. The definition encompasses both large-scale commercial operations and the rapidly expanding craft segment, which has fundamentally altered competitive dynamics and consumer expectations across all product categories.

Regulatory frameworks play a crucial role in market definition, with complex three-tier distribution systems in the United States and provincial regulations in Canada creating unique operational requirements. The market includes licensed producers, distributors, importers, and retailers operating within these regulatory structures while adapting to evolving compliance requirements and taxation policies that significantly impact pricing strategies and market accessibility.

Strategic analysis reveals the North America alcoholic beverage market as a mature yet continuously evolving sector characterized by premiumization trends, demographic shifts, and technological innovation. The market demonstrates robust fundamentals with consistent growth patterns, despite periodic volatility related to economic conditions and regulatory changes. Key performance indicators show sustained expansion in premium segments, with craft beer maintaining 12.7% annual growth and premium spirits achieving similar momentum.

Competitive landscape features a balanced mix of multinational corporations, regional producers, and innovative craft manufacturers, creating diverse opportunities for market participation. The rise of direct-to-consumer channels has democratized market access, enabling smaller producers to compete effectively against established brands through targeted marketing and unique product positioning. Consumer preferences increasingly favor authentic, locally-produced, and environmentally sustainable options, driving innovation across all market segments.

Market transformation continues through digital integration, with e-commerce platforms, mobile applications, and social media marketing becoming essential components of successful brand strategies. The integration of technology in production, distribution, and consumer engagement has created new competitive advantages while reducing traditional barriers to market entry. Future projections indicate sustained growth momentum, particularly in premium and super-premium categories, supported by favorable demographic trends and increasing consumer sophistication.

Consumer behavior analysis reveals fundamental shifts in purchasing patterns, with millennials and Generation Z driving demand for premium, craft, and innovative alcoholic beverages. These demographic groups prioritize quality over quantity, sustainability over convenience, and unique experiences over traditional brand loyalty. Purchasing decisions are increasingly influenced by social media recommendations, online reviews, and brand authenticity rather than traditional advertising approaches.

Product innovation trends demonstrate accelerating development cycles, with new product launches increasing by 23.4% annually across all categories. The following key insights shape market dynamics:

Economic prosperity across North America continues to support discretionary spending on premium alcoholic beverages, with higher disposable incomes enabling consumers to explore expensive and artisanal options. The correlation between economic growth and premium alcohol consumption remains strong, particularly in urban markets where sophisticated consumers actively seek unique and high-quality products. Demographic trends favor market expansion, with millennials entering peak earning years and demonstrating strong preferences for craft and premium alcoholic beverages.

Cultural shifts toward experiential consumption drive demand for unique and authentic alcoholic beverage experiences. Consumers increasingly view alcohol purchases as lifestyle statements, seeking products that reflect personal values, social consciousness, and individual taste preferences. Social media influence amplifies these trends, with visually appealing products and authentic brand stories gaining significant traction among younger demographics who share consumption experiences online.

Innovation acceleration creates continuous market expansion opportunities through new product categories, improved production techniques, and enhanced consumer experiences. The craft movement has fundamentally altered consumer expectations, demanding higher quality, unique flavors, and transparent production processes across all alcoholic beverage categories. Distribution evolution through e-commerce platforms and direct-to-consumer models removes traditional barriers, enabling smaller producers to reach broader markets while providing consumers with unprecedented product access and convenience.

Regulatory complexity presents significant challenges for market participants, with intricate licensing requirements, distribution restrictions, and varying state and provincial regulations creating operational difficulties and increased compliance costs. The three-tier distribution system in the United States limits direct-to-consumer opportunities for many producers, while Canadian provincial monopolies create additional market access barriers. Taxation policies continue to impact pricing strategies and consumer accessibility, with frequent tax increases affecting demand patterns across different product categories.

Health consciousness trends create headwinds for traditional alcoholic beverage categories, as consumers increasingly prioritize wellness and moderate consumption patterns. Public health campaigns and medical research highlighting alcohol-related health risks influence consumer behavior, particularly among younger demographics who demonstrate greater health awareness. Social responsibility concerns require companies to invest heavily in responsible marketing practices and community programs, increasing operational costs while potentially limiting marketing effectiveness.

Supply chain vulnerabilities expose the market to disruptions from natural disasters, trade disputes, and global economic instability. Raw material price volatility, particularly for agricultural inputs like grapes, hops, and grains, creates margin pressure and pricing uncertainty. Labor shortages in production, distribution, and hospitality sectors impact operational efficiency and cost structures, while skilled workforce requirements for craft production limit expansion capabilities for smaller producers seeking to scale operations.

Premium segment expansion offers substantial growth potential as consumers continue trading up to higher-quality products with superior ingredients and artisanal production methods. The willingness to pay premium prices for authentic, craft, and locally-produced alcoholic beverages creates opportunities for both established brands and emerging producers to capture increased market share through strategic positioning. Super-premium categories demonstrate particularly strong growth momentum, with luxury spirits and rare wines attracting affluent consumers seeking exclusive experiences.

Health-conscious innovation represents a transformative opportunity, with low-alcohol, organic, and functional alcoholic beverages addressing evolving consumer preferences without sacrificing taste or experience quality. The development of products incorporating wellness ingredients, reduced calories, and natural components appeals to health-conscious consumers who refuse to compromise on lifestyle enjoyment. Functional beverages combining alcohol with vitamins, antioxidants, and other beneficial ingredients create entirely new market categories with significant growth potential.

Digital transformation enables innovative marketing approaches, direct-to-consumer sales channels, and personalized consumer experiences that were previously impossible through traditional distribution models. E-commerce platforms, subscription services, and mobile applications create new revenue streams while providing valuable consumer data for targeted marketing and product development. Technology integration in production processes, supply chain management, and consumer engagement offers competitive advantages and operational efficiencies that support sustainable growth and market differentiation.

Competitive intensity continues to escalate as traditional barriers to entry diminish and consumer preferences fragment across numerous niche segments. Large multinational corporations compete directly with innovative craft producers, creating a dynamic environment where brand authenticity, product quality, and consumer engagement determine market success. Market consolidation occurs simultaneously with fragmentation, as major players acquire successful craft brands while new entrants continuously emerge with innovative products and marketing approaches.

Consumer empowerment through digital platforms and social media fundamentally alters traditional marketing dynamics, requiring brands to engage authentically and transparently with increasingly sophisticated consumers. The democratization of information enables consumers to research products extensively, compare alternatives, and share experiences instantly, creating both opportunities and risks for brand management. Influence patterns shift from traditional advertising to peer recommendations, social media endorsements, and authentic brand storytelling that resonates with target demographics.

Supply chain evolution adapts to changing consumer expectations for sustainability, transparency, and local sourcing while maintaining efficiency and cost-effectiveness. The integration of technology throughout the supply chain enables better inventory management, quality control, and traceability, while sustainable practices become competitive necessities rather than optional initiatives. Distribution innovation through hybrid models combining traditional retail, e-commerce, and direct-to-consumer channels creates new opportunities for market reach and consumer engagement while requiring sophisticated logistics capabilities.

Comprehensive analysis employs multiple research methodologies to ensure accurate and actionable market insights, combining quantitative data collection with qualitative consumer behavior analysis. Primary research includes extensive consumer surveys, industry expert interviews, and focus group discussions across diverse demographic segments to understand purchasing motivations, brand preferences, and consumption patterns. Data collection utilizes both traditional market research techniques and advanced digital analytics to capture real-time consumer sentiment and behavior patterns.

Market intelligence gathering incorporates industry reports, regulatory filings, company financial statements, and trade association data to provide comprehensive market sizing and competitive landscape analysis. Secondary research sources include government statistics, academic studies, and industry publications to validate primary research findings and identify emerging trends. Analytical frameworks employ statistical modeling, trend analysis, and predictive analytics to forecast market developments and identify growth opportunities.

Validation processes ensure research accuracy through triangulation of multiple data sources, expert review panels, and continuous monitoring of market developments. The methodology incorporates feedback loops to refine analysis and update projections based on new information and changing market conditions. Quality assurance protocols maintain research integrity while ensuring findings remain relevant and actionable for industry stakeholders seeking strategic guidance and market insights.

United States market dominates North American alcoholic beverage consumption, representing approximately 89.2% of regional volume with diverse state-level regulations creating complex but lucrative market opportunities. California leads wine consumption and production, while craft beer thrives in states like Colorado, Oregon, and Vermont where supportive regulations and consumer preferences create favorable conditions. Southern states demonstrate strong spirits consumption, particularly bourbon and whiskey, while coastal regions show preferences for imported wines and premium beer categories.

Canadian market exhibits distinct characteristics with provincial liquor control systems creating unique distribution challenges and opportunities. Ontario and Quebec represent the largest consumption centers, with 62.4% of national volume, while western provinces show growing preferences for craft beer and local spirits. Import preferences remain strong, particularly for European wines and premium spirits, while domestic craft producers gain market share through quality improvements and local marketing initiatives.

Regional preferences vary significantly based on cultural heritage, climate conditions, and local production capabilities. The Pacific Northwest excels in craft beer and wine production, benefiting from favorable agricultural conditions and consumer sophistication. Urban markets across both countries drive premium segment growth, with cities like New York, Los Angeles, Toronto, and Vancouver leading consumption of high-end alcoholic beverages. Rural markets maintain preferences for traditional categories while gradually embracing craft and premium options as availability and awareness increase through improved distribution networks.

Market leadership remains divided among several major multinational corporations, regional powerhouses, and innovative craft producers, creating a dynamic competitive environment where different strategies succeed across various market segments. The competitive landscape reflects ongoing consolidation trends alongside continuous new entrant activity, particularly in craft and premium categories where barriers to entry remain relatively low for innovative producers.

Major market participants include:

Competitive strategies emphasize brand differentiation, innovation leadership, and strategic acquisitions to maintain market position while adapting to evolving consumer preferences. Companies invest heavily in marketing, product development, and distribution capabilities to compete effectively across multiple channels and demographic segments.

Product category segmentation reveals distinct market dynamics across beer, wine, spirits, and emerging categories, each with unique consumer profiles, distribution requirements, and competitive landscapes. Beer maintains the largest volume share while spirits generate higher revenue per unit, creating different strategic priorities for market participants. Premium segments across all categories demonstrate superior growth rates and profit margins, driving strategic focus toward quality and brand positioning.

By Product Type:

By Distribution Channel:

By Consumer Demographics:

Beer category analysis reveals ongoing premiumization trends with craft beer maintaining strong growth momentum despite market maturity. Traditional light beer categories face volume declines while craft, imported, and premium domestic brands capture increasing market share. Innovation focus centers on unique flavor profiles, seasonal offerings, and limited-edition releases that create consumer excitement and brand differentiation. The craft beer segment demonstrates resilience and adaptability, with successful breweries expanding distribution while maintaining quality and authenticity.

Wine market dynamics show continued growth in premium segments, with consumers increasingly willing to pay higher prices for quality and authenticity. Domestic wine production benefits from improved quality and recognition, while imported wines maintain strong positions in premium categories. Sustainable viticulture and organic wine production gain consumer acceptance, creating opportunities for environmentally conscious producers. Direct-to-consumer sales through winery visits and online platforms provide higher margins and enhanced customer relationships.

Spirits category performance demonstrates exceptional growth in premium and super-premium segments, with whiskey, gin, and craft spirits leading market expansion. The craft distillery movement mirrors craft beer success, with small-batch, artisanal products commanding premium prices and loyal followings. Cocktail culture revival drives demand for high-quality spirits and unique ingredients, while ready-to-drink cocktails provide convenience without sacrificing quality. Brand storytelling becomes increasingly important as consumers seek authentic connections with spirit brands and their heritage.

Producers and manufacturers benefit from diverse market opportunities across multiple product categories, price segments, and distribution channels, enabling strategic portfolio diversification and risk mitigation. The market’s maturity provides stable demand patterns while innovation opportunities create competitive advantages and premium pricing potential. Craft producers particularly benefit from consumer preferences for authenticity and local production, enabling smaller operations to compete effectively against larger corporations through differentiation and community engagement.

Distributors and retailers capitalize on expanding product variety and consumer sophistication, which drive higher-margin sales and increased customer engagement. The growth of premium categories provides improved profit margins while e-commerce integration creates new revenue streams and customer touchpoints. Retail innovation through enhanced customer experiences, product education, and curated selections creates competitive advantages and customer loyalty in an increasingly competitive marketplace.

Investors and financial stakeholders find attractive opportunities in a market characterized by consistent demand, premium segment growth, and innovation-driven expansion. The combination of established market fundamentals and emerging growth categories provides balanced investment profiles with both stability and growth potential. Strategic acquisitions of successful craft brands offer established companies access to growing market segments while providing craft producers with resources for expansion and distribution enhancement.

Strengths:

Weaknesses:

Opportunities:

Threats:

Premiumization acceleration continues reshaping market dynamics as consumers consistently trade up to higher-quality products with superior ingredients, artisanal production methods, and authentic brand stories. This trend spans all product categories, with craft beer, premium wines, and small-batch spirits leading growth in their respective segments. Quality over quantity becomes the dominant consumer philosophy, driving demand for products that offer unique experiences and superior taste profiles rather than simply alcoholic content.

Health-conscious consumption influences product development and marketing strategies, with low-alcohol, organic, and functional alcoholic beverages gaining significant market traction. Consumers seek products that align with wellness goals while maintaining social and experiential benefits of traditional alcoholic beverages. Moderation trends drive innovation in lower-alcohol options and portion-controlled packaging that enables responsible consumption without sacrificing enjoyment or social participation.

Sustainability integration becomes a competitive necessity rather than optional initiative, with consumers increasingly evaluating brands based on environmental practices, packaging choices, and social responsibility commitments. Circular economy principles influence production processes, with companies investing in renewable energy, water conservation, and waste reduction initiatives. Packaging innovation focuses on recyclable materials, reduced environmental impact, and sustainable sourcing practices that resonate with environmentally conscious consumers.

Digital engagement evolution transforms how brands connect with consumers, utilizing social media platforms, mobile applications, and virtual experiences to build relationships and drive sales. Personalization technology enables targeted marketing and customized product recommendations based on individual preferences and consumption patterns. E-commerce integration provides convenience and accessibility while generating valuable consumer data for continuous product and service improvement.

Strategic acquisitions continue reshaping the competitive landscape as major corporations acquire successful craft brands to access growing market segments and innovative capabilities. These transactions provide craft producers with resources for expansion while offering established companies authentic brands and consumer connections. Integration challenges require careful balance between maintaining brand authenticity and leveraging corporate resources for growth and distribution enhancement.

Regulatory evolution adapts to changing market conditions and consumer preferences, with some jurisdictions relaxing restrictions on direct-to-consumer sales and expanding licensing opportunities for craft producers. Policy modernization reflects recognition of economic benefits from thriving alcoholic beverage industries while maintaining appropriate consumer protection measures. Interstate shipping regulations and e-commerce frameworks continue evolving to accommodate digital transformation trends.

Technology adoption accelerates across production, distribution, and marketing functions, with artificial intelligence, blockchain, and Internet of Things applications improving efficiency and consumer experiences. Production innovation utilizes advanced fermentation techniques, quality control systems, and sustainable manufacturing processes to enhance product quality while reducing environmental impact. Supply chain technology improves inventory management, logistics optimization, and traceability throughout distribution networks.

International expansion opportunities emerge as North American brands gain global recognition and export potential, particularly in premium spirits and craft beer categories. Brand globalization requires adaptation to local preferences and regulatory requirements while maintaining core brand identity and quality standards. Export growth provides revenue diversification and brand prestige that enhances domestic market positioning and consumer perception.

Strategic positioning recommendations emphasize the importance of authentic brand development and consistent quality delivery to build lasting consumer relationships in an increasingly competitive marketplace. Companies should invest in brand storytelling that resonates with target demographics while maintaining product quality and innovation leadership. MarkWide Research analysis indicates that brands with authentic narratives and consistent quality experience 34.7% higher customer retention rates compared to those focusing solely on price competition.

Innovation investment should prioritize health-conscious product development, sustainable packaging solutions, and digital engagement capabilities that align with evolving consumer preferences and market trends. Companies must balance innovation with core competency maintenance, ensuring new product development enhances rather than dilutes brand equity. Portfolio diversification across price segments and product categories provides risk mitigation while capturing growth opportunities in emerging market segments.

Distribution strategy optimization requires integration of traditional retail channels with e-commerce platforms and direct-to-consumer capabilities to maximize market reach and consumer accessibility. Companies should develop omnichannel approaches that provide consistent brand experiences across all touchpoints while leveraging unique advantages of each distribution method. Partnership development with retailers, distributors, and technology providers creates competitive advantages and operational efficiencies that support sustainable growth and market expansion.

Regulatory compliance and government relations require proactive engagement to navigate complex regulatory environments while advocating for industry-friendly policy development. Companies should invest in compliance capabilities and legal expertise to manage regulatory risks while positioning for opportunities created by policy modernization. Industry collaboration through trade associations and advocacy groups strengthens collective influence on regulatory development and public policy formation.

Market evolution projections indicate continued growth momentum driven by premiumization trends, demographic shifts, and innovation acceleration across all product categories. The next decade promises significant transformation as digital integration, sustainability requirements, and health consciousness reshape consumer expectations and industry practices. Growth projections suggest premium segments will maintain annual growth rates of 6.8% while traditional categories stabilize around mature market levels.

Consumer behavior trends will increasingly favor brands that demonstrate authentic commitment to quality, sustainability, and social responsibility while providing superior product experiences and customer engagement. The integration of technology in consumer experiences, from augmented reality marketing to personalized product recommendations, will become essential for competitive success. MWR projections indicate that digitally-integrated brands will capture 42.3% higher market share growth compared to traditional marketing approaches.

Industry consolidation will continue alongside market fragmentation, creating opportunities for both large-scale efficiency and niche specialization strategies. Successful companies will balance scale advantages with agility and innovation capabilities, potentially through strategic partnerships and acquisition programs. Market structure evolution will favor companies that can operate effectively across multiple channels, price segments, and geographic markets while maintaining brand authenticity and consumer connections.

Regulatory landscape modernization will likely create new opportunities for direct-to-consumer sales, interstate commerce, and innovative product categories while maintaining appropriate consumer protection measures. Policy evolution will reflect economic benefits of thriving alcoholic beverage industries balanced with public health considerations and social responsibility requirements. International trade opportunities will expand as North American brands gain global recognition and export potential, particularly in premium and craft categories that showcase regional expertise and innovation leadership.

The North America alcoholic beverage market represents a dynamic and resilient industry characterized by continuous evolution, innovation leadership, and strong consumer engagement across diverse product categories and market segments. Market fundamentals remain robust, supported by established consumer demand patterns, sophisticated distribution infrastructure, and ongoing premiumization trends that drive revenue growth and profit margin expansion. Strategic opportunities abound for companies that successfully balance tradition with innovation while adapting to evolving consumer preferences and market dynamics.

Future success will depend on companies’ ability to navigate regulatory complexity, embrace digital transformation, and maintain authentic brand connections with increasingly sophisticated consumers who prioritize quality, sustainability, and unique experiences. The market’s maturity provides stability while emerging trends create growth opportunities for innovative companies willing to invest in product development, brand building, and customer engagement capabilities. Competitive advantages will increasingly derive from authentic brand storytelling, consistent quality delivery, and sustainable business practices that resonate with environmentally and socially conscious consumers.

The North America alcoholic beverage market outlook remains positive, with sustained growth expected across premium segments, continued innovation in product development and marketing approaches, and expanding opportunities through digital channels and intces while maintaining operational excellence and brand authenticity will capture disproportionate market share and financial performance in this evolving and opportunity-rich marketplace.

What is Alcoholic Beverage?

Alcoholic beverages are drinks that contain ethanol, commonly known as alcohol. They include a variety of products such as beer, wine, and spirits, which are consumed for recreational and social purposes.

What are the key players in the North America Alcoholic Beverage Market?

Key players in the North America Alcoholic Beverage Market include Anheuser-Busch InBev, Diageo, Constellation Brands, and Molson Coors Beverage Company, among others.

What are the main drivers of the North America Alcoholic Beverage Market?

The main drivers of the North America Alcoholic Beverage Market include changing consumer preferences towards premium products, the rise of craft beverages, and increasing social acceptance of alcohol consumption.

What challenges does the North America Alcoholic Beverage Market face?

Challenges in the North America Alcoholic Beverage Market include stringent regulations on alcohol sales, health concerns related to alcohol consumption, and competition from non-alcoholic alternatives.

What opportunities exist in the North America Alcoholic Beverage Market?

Opportunities in the North America Alcoholic Beverage Market include the growing trend of health-conscious drinking, the expansion of e-commerce for alcohol sales, and the increasing popularity of low-alcohol and alcohol-free beverages.

What trends are shaping the North America Alcoholic Beverage Market?

Trends shaping the North America Alcoholic Beverage Market include the rise of flavored spirits, the popularity of ready-to-drink cocktails, and a focus on sustainability in production and packaging.

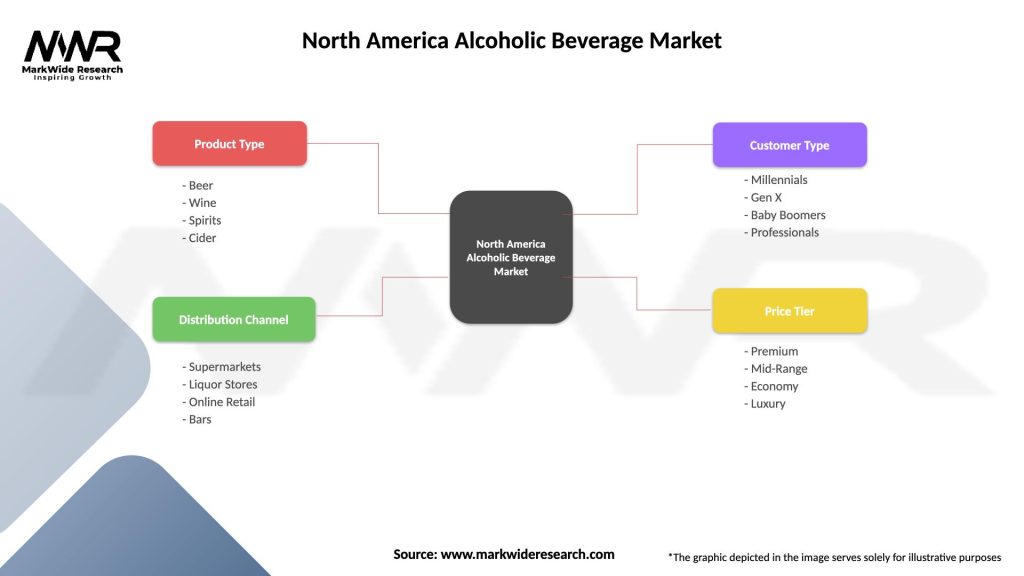

North America Alcoholic Beverage Market

| Segmentation Details | Description |

|---|---|

| Product Type | Beer, Wine, Spirits, Cider |

| Distribution Channel | Supermarkets, Liquor Stores, Online Retail, Bars |

| Customer Type | Millennials, Gen X, Baby Boomers, Professionals |

| Price Tier | Premium, Mid-Range, Economy, Luxury |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Alcoholic Beverage Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at