444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America agricultural tractors machinery market represents a cornerstone of modern farming operations, encompassing a comprehensive range of mechanized equipment designed to enhance agricultural productivity and efficiency. This dynamic market spans across the United States, Canada, and Mexico, serving as a critical enabler for the region’s vast agricultural sector that feeds millions globally.

Market dynamics indicate robust growth driven by increasing mechanization trends, with the sector experiencing a 6.2% compound annual growth rate over recent years. The integration of advanced technologies such as GPS guidance systems, precision farming tools, and autonomous operation capabilities has transformed traditional farming practices, making agricultural tractors more sophisticated and efficient than ever before.

Regional distribution shows the United States commanding approximately 78% market share, followed by Canada with 15%, and Mexico contributing 7% to the overall North American market. This distribution reflects the varying scales of agricultural operations and mechanization levels across these countries, with larger commercial farms driving demand for high-capacity, technologically advanced machinery.

Technology adoption rates have accelerated significantly, with 42% of new tractor sales now featuring some form of precision agriculture technology. This trend underscores the industry’s commitment to sustainable farming practices and operational efficiency improvements that benefit both farmers and environmental conservation efforts.

The North America agricultural tractors machinery market refers to the comprehensive ecosystem of mechanized farming equipment, including tractors, combines, harvesters, plows, and associated implements used for crop production, soil preparation, planting, cultivation, and harvesting activities across the United States, Canada, and Mexico.

Agricultural tractors serve as the primary power source for various farming operations, ranging from compact utility tractors for small-scale operations to high-horsepower machines capable of handling extensive commercial farming requirements. These versatile machines integrate multiple functionalities through power take-off systems, hydraulic connections, and three-point hitch systems that accommodate diverse agricultural implements.

Modern agricultural machinery encompasses not only traditional mechanical components but also sophisticated electronic systems, including GPS navigation, variable rate technology, automated steering systems, and data collection capabilities that enable precision agriculture practices. This evolution represents a fundamental shift from manual labor-intensive farming to technology-driven agricultural production.

Market scope extends beyond individual tractor sales to include comprehensive machinery packages, service agreements, financing solutions, and aftermarket parts and maintenance services that support the entire lifecycle of agricultural equipment ownership and operation.

Strategic market positioning reveals the North America agricultural tractors machinery market as a mature yet continuously evolving sector characterized by technological innovation, consolidation among manufacturers, and increasing focus on sustainability and efficiency improvements. The market demonstrates resilience despite economic fluctuations, supported by essential food production requirements and government agricultural support programs.

Key growth drivers include the ongoing trend toward farm consolidation, which creates demand for larger, more efficient machinery capable of handling expanded acreage. Additionally, precision agriculture adoption has increased by 35% over the past five years, driving replacement cycles as farmers upgrade to technology-enabled equipment that offers improved productivity and reduced operational costs.

Market segmentation reveals diverse customer bases ranging from small family farms requiring compact tractors to large commercial operations demanding high-horsepower machines with advanced automation capabilities. This segmentation creates opportunities for manufacturers to develop specialized products targeting specific agricultural applications and farm sizes.

Competitive landscape features established global manufacturers alongside regional players, with increasing emphasis on dealer networks, customer service, and comprehensive solutions that extend beyond equipment sales to include financing, maintenance, and technology support services.

Technology integration has become a defining characteristic of modern agricultural machinery, with manufacturers investing heavily in research and development to incorporate artificial intelligence, machine learning, and Internet of Things capabilities into their equipment offerings.

Market maturity indicators suggest that while traditional growth patterns may moderate, innovation-driven replacement cycles and technology upgrades continue to generate substantial business opportunities for manufacturers and dealers throughout the region.

Farm consolidation trends represent a primary driver of agricultural machinery demand, as larger operations require more powerful and efficient equipment to manage expanded acreage effectively. This consolidation creates opportunities for high-capacity tractors and implements that can handle substantial workloads while maintaining operational efficiency.

Labor shortage challenges across North American agriculture have intensified the need for mechanization and automation solutions. With agricultural workforce declining by 23% over the past decade, farmers increasingly rely on advanced machinery to maintain productivity levels while managing reduced labor availability.

Precision agriculture benefits drive adoption of technology-enabled equipment that offers measurable returns on investment through reduced input costs, improved yields, and enhanced operational efficiency. These benefits include optimized fertilizer and pesticide application, precise seeding rates, and detailed field mapping capabilities.

Economic factors including commodity price stability and favorable financing conditions support equipment investment decisions, while technological advancement cycles create natural replacement demand as farmers seek to maintain competitive advantages through modern equipment capabilities.

High capital investment requirements present significant barriers for many agricultural operations, particularly smaller farms that may struggle to justify the substantial upfront costs associated with modern agricultural machinery. These financial constraints can delay equipment replacement cycles and limit adoption of advanced technologies.

Economic volatility in agricultural markets creates uncertainty that affects equipment purchasing decisions, as farmers may postpone major investments during periods of commodity price instability or reduced profitability. This cyclical nature of agricultural economics directly impacts machinery demand patterns.

Technical complexity challenges associated with modern agricultural equipment require specialized knowledge and training that may not be readily available in all regions. The increasing sophistication of machinery systems can create operational difficulties and maintenance challenges for some users.

Regulatory compliance costs associated with emissions standards and safety requirements add to equipment expenses, while trade policy uncertainties can affect pricing and availability of imported components used in machinery manufacturing.

Emerging technology integration presents substantial opportunities for manufacturers to differentiate their products and capture premium market segments through innovative features and capabilities. The convergence of agricultural machinery with digital technologies creates new revenue streams and customer value propositions.

Sustainable agriculture trends drive demand for equipment that supports environmentally responsible farming practices, including precision application systems, reduced tillage implements, and energy-efficient power systems that align with evolving agricultural sustainability goals.

Service sector expansion offers significant growth potential as manufacturers and dealers develop comprehensive support ecosystems that extend beyond equipment sales to include maintenance, training, financing, and technology services that enhance customer relationships and generate recurring revenue.

International expansion opportunities exist as North American manufacturers leverage their technological expertise to serve growing global agricultural markets, while domestic market penetration in underserved segments continues to offer growth potential.

Supply chain evolution has become increasingly complex as manufacturers integrate advanced technologies and global component sourcing strategies while managing cost pressures and delivery requirements. This evolution requires sophisticated logistics management and supplier relationship coordination to maintain competitive positioning.

Customer relationship transformation reflects the shift from transactional equipment sales to comprehensive partnership models that encompass financing, service, training, and ongoing support throughout the equipment lifecycle. This transformation creates deeper customer engagement and enhanced loyalty.

Technology adoption cycles demonstrate accelerating pace of innovation implementation, with digital feature adoption increasing by 28% annually as farmers recognize the competitive advantages offered by advanced machinery capabilities and precision agriculture tools.

Competitive intensity continues to drive innovation and efficiency improvements as manufacturers compete not only on product features and pricing but also on service quality, dealer network strength, and comprehensive customer support capabilities.

Regulatory environment influences product development priorities and market access requirements, while environmental considerations increasingly shape customer preferences and purchasing decisions across all market segments.

Comprehensive market analysis employs multiple research methodologies to ensure accurate and reliable insights into the North America agricultural tractors machinery market. Primary research involves direct engagement with industry stakeholders including manufacturers, dealers, farmers, and agricultural service providers to gather firsthand market intelligence.

Data collection processes incorporate structured interviews with key industry participants, comprehensive surveys of end-users across different farm sizes and geographic regions, and detailed analysis of equipment sales data, registration records, and market share information from authoritative industry sources.

Secondary research components include analysis of government agricultural statistics, industry association reports, trade publication data, and regulatory filings that provide context and validation for primary research findings. This multi-source approach ensures comprehensive market coverage and insight accuracy.

Analytical frameworks utilize advanced statistical methods and market modeling techniques to project future trends, assess competitive dynamics, and identify growth opportunities within the agricultural machinery sector.

United States market dominance reflects the country’s extensive agricultural production capacity and high mechanization levels, with the Midwest region serving as the primary demand center for large-scale agricultural machinery. States including Iowa, Illinois, Nebraska, and Kansas drive substantial equipment demand through their intensive corn and soybean production systems.

Canadian market characteristics emphasize durability and cold-weather performance capabilities, with Prairie provinces of Alberta, Saskatchewan, and Manitoba representing key demand centers for grain production equipment. The Canadian market shows strong preference for high-capacity machinery suitable for extensive farming operations.

Mexican market development demonstrates rapid modernization trends as agricultural operations increasingly adopt mechanized farming practices. Government support programs and foreign investment in Mexican agriculture drive demand for both new and used agricultural machinery across diverse crop production systems.

Cross-border trade dynamics facilitate equipment movement and service support across the North American region, while regulatory harmonization efforts support market integration and standardization of equipment specifications and safety requirements.

Market leadership is characterized by several global manufacturers who have established strong positions through comprehensive product portfolios, extensive dealer networks, and significant investment in research and development capabilities that drive continuous innovation and market expansion.

Competitive strategies emphasize technology differentiation, comprehensive customer support, and strategic partnerships that enhance market positioning and customer loyalty. Manufacturers increasingly compete on total cost of ownership rather than initial purchase price alone.

Innovation leadership drives competitive advantage as companies invest heavily in autonomous systems, precision agriculture technologies, and connectivity solutions that provide measurable value to agricultural customers seeking operational efficiency improvements.

By Horsepower Range: Market segmentation based on tractor power output reflects diverse agricultural applications and farm sizes, from compact utility tractors under 40 horsepower to high-capacity machines exceeding 300 horsepower for large-scale commercial operations.

By Application: Agricultural machinery serves diverse farming activities requiring specialized equipment configurations and performance characteristics tailored to specific operational requirements and crop production systems.

By Technology Level: Equipment sophistication ranges from basic mechanical systems to advanced digital platforms incorporating artificial intelligence and autonomous operation capabilities that represent the future of agricultural mechanization.

Compact Tractor Segment demonstrates strong growth driven by hobby farming trends, landscaping applications, and small-scale agricultural operations. This segment benefits from relatively lower entry costs and versatile application capabilities that appeal to diverse customer bases beyond traditional agriculture.

Utility Tractor Category represents the largest market segment by volume, serving mid-size farming operations that require versatile equipment capable of handling multiple agricultural tasks. These tractors often serve as the primary power source for family farms and regional agricultural operations.

Row Crop Tractor Segment focuses on intensive agricultural production with emphasis on precision agriculture capabilities, GPS guidance systems, and variable rate technology that optimize crop production efficiency and input utilization for maximum profitability.

High-Power Tractor Category serves large commercial farming operations requiring maximum productivity and efficiency across extensive acreage. These machines incorporate the most advanced technology features and automation capabilities available in the agricultural machinery market.

Specialty Equipment Categories including orchard tractors, vineyard equipment, and organic farming implements represent niche markets with specific performance requirements and growth potential driven by specialized agricultural production systems.

Manufacturers benefit from continuous innovation opportunities and market expansion potential as agricultural mechanization trends create demand for advanced equipment solutions. Technology integration capabilities provide competitive differentiation and premium pricing opportunities in sophisticated market segments.

Dealers gain from comprehensive service revenue streams that extend beyond equipment sales to include maintenance, parts, training, and technology support services. These recurring revenue opportunities enhance profitability and strengthen customer relationships throughout the equipment lifecycle.

Farmers realize substantial operational benefits including increased productivity, reduced labor requirements, improved precision in agricultural operations, and enhanced profitability through optimized input utilization and crop management capabilities enabled by modern agricultural machinery.

Agricultural communities benefit from enhanced food production capabilities, improved sustainability practices, and economic development opportunities associated with modern agricultural mechanization and technology adoption.

Strengths:

Weaknesses:

Opportunities:

Threats:

Autonomous operation development represents the most significant technological trend reshaping agricultural machinery markets, with manufacturers investing heavily in self-driving tractors and robotic systems that promise to revolutionize farming operations through reduced labor requirements and enhanced operational precision.

Data-driven agriculture continues expanding as farmers increasingly recognize the value of information-based decision making enabled by connected equipment, sensors, and analytics platforms that optimize crop production and resource utilization across diverse agricultural applications.

Sustainability integration drives development of environmentally responsible equipment solutions including electric power systems, reduced emissions engines, and precision application technologies that minimize environmental impact while maintaining agricultural productivity requirements.

Service transformation shifts industry focus from equipment sales to comprehensive customer support ecosystems that include financing, maintenance, training, and technology services that enhance customer value and manufacturer differentiation.

Technology partnerships between agricultural machinery manufacturers and technology companies accelerate innovation development and market introduction of advanced features including artificial intelligence, machine learning, and autonomous operation capabilities that define next-generation agricultural equipment.

Merger and acquisition activity continues reshaping the competitive landscape as companies seek to expand their technological capabilities, geographic reach, and product portfolios through strategic combinations that enhance market positioning and customer service capabilities.

Regulatory developments including updated emissions standards and safety requirements influence product development priorities and market introduction timelines, while government support programs encourage adoption of environmentally responsible agricultural technologies.

According to MarkWide Research analysis, industry consolidation trends and technology integration initiatives are creating new market dynamics that favor companies with comprehensive innovation capabilities and strong customer support infrastructure.

Customer engagement transformation emphasizes digital platforms, remote support capabilities, and comprehensive training programs that enhance equipment utilization and customer satisfaction across diverse agricultural market segments.

Strategic positioning recommendations emphasize the importance of technology leadership and comprehensive customer support capabilities as key differentiators in an increasingly competitive agricultural machinery market. Companies should prioritize innovation investment and service infrastructure development to maintain market relevance.

Market entry strategies for new participants should focus on niche segments or specialized applications where established competitors may have limited presence, while leveraging technology partnerships to accelerate product development and market introduction timelines.

Customer relationship management requires evolution from transactional sales approaches to comprehensive partnership models that encompass financing, service, training, and ongoing support throughout the equipment lifecycle to maximize customer value and loyalty.

Risk management strategies should address economic volatility, technology disruption, and competitive pressure through diversified product portfolios, flexible manufacturing capabilities, and strong financial management practices that ensure long-term sustainability.

Long-term growth prospects remain positive for the North America agricultural tractors machinery market, driven by continuous technological advancement, increasing mechanization trends, and growing emphasis on sustainable agricultural practices that require sophisticated equipment solutions.

Technology evolution will accelerate autonomous operation capabilities, with semi-autonomous features expected to reach 45% market penetration within the next five years as farmers recognize productivity benefits and technology costs decline through widespread adoption and manufacturing scale economies.

Market transformation toward service-oriented business models will continue as manufacturers develop comprehensive customer support ecosystems that generate recurring revenue streams while enhancing customer relationships and equipment utilization optimization.

MWR projections indicate that precision agriculture technology adoption will reach 75% penetration among commercial farming operations as data-driven decision making becomes standard practice across North American agricultural production systems.

Industry consolidation will likely continue as companies seek scale advantages and technology capabilities, while new entrants may emerge from adjacent industries bringing innovative approaches to agricultural mechanization challenges.

The North America agricultural tractors machinery market stands at a transformative juncture where traditional mechanical engineering excellence converges with cutting-edge digital technologies to create unprecedented opportunities for innovation and growth. This dynamic market environment rewards companies that successfully balance technological advancement with practical agricultural application requirements.

Market fundamentals remain strong, supported by essential food production requirements, ongoing mechanization trends, and increasing adoption of precision agriculture practices that demonstrate measurable returns on investment. The region’s diverse agricultural landscape provides multiple growth avenues for manufacturers willing to develop specialized solutions for specific crops, farm sizes, and operational requirements.

Technology integration will continue driving market evolution as autonomous systems, artificial intelligence, and data analytics become standard features rather than premium options. This technological transformation creates opportunities for companies that can successfully navigate the complexity of modern agricultural equipment development while maintaining reliability and cost-effectiveness.

Success factors in this evolving market include comprehensive customer support capabilities, continuous innovation investment, strategic technology partnerships, and flexible business models that adapt to changing customer needs and market conditions. Companies that embrace these principles while maintaining focus on agricultural productivity enhancement will be best positioned for long-term success in the North America agricultural tractors machinery market.

What is Agricultural Tractors Machinery?

Agricultural Tractors Machinery refers to the equipment used in farming operations, primarily for tasks such as plowing, tilling, and planting. These machines play a crucial role in enhancing productivity and efficiency in agricultural practices.

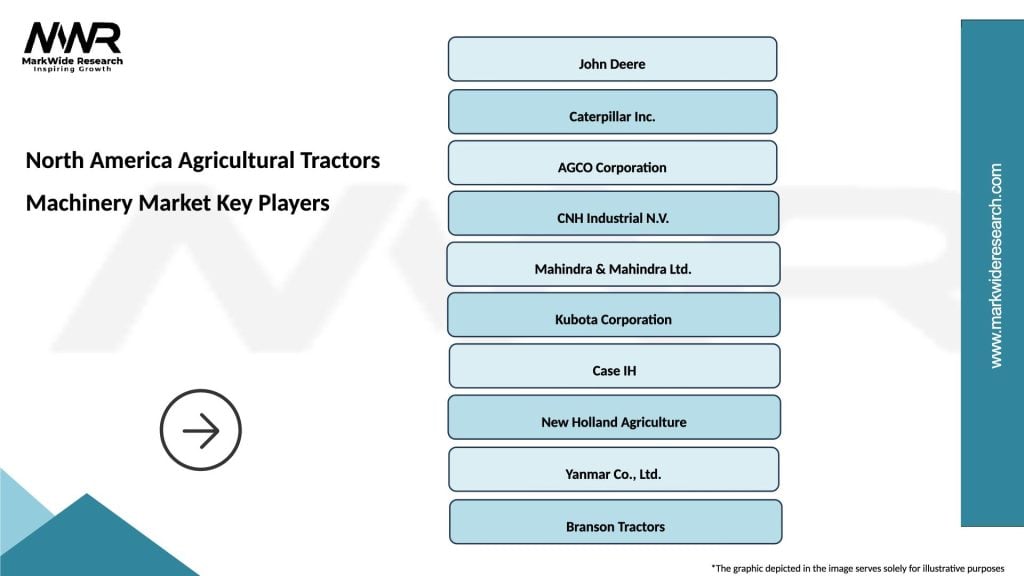

What are the key players in the North America Agricultural Tractors Machinery Market?

Key players in the North America Agricultural Tractors Machinery Market include John Deere, AGCO Corporation, and CNH Industrial. These companies are known for their innovative products and extensive distribution networks, among others.

What are the growth factors driving the North America Agricultural Tractors Machinery Market?

The North America Agricultural Tractors Machinery Market is driven by factors such as the increasing demand for food production, advancements in agricultural technology, and the need for efficient farming practices. Additionally, government initiatives supporting modern farming techniques contribute to market growth.

What challenges does the North America Agricultural Tractors Machinery Market face?

Challenges in the North America Agricultural Tractors Machinery Market include high initial investment costs, fluctuating raw material prices, and the need for skilled operators. These factors can hinder the adoption of advanced machinery in some farming operations.

What opportunities exist in the North America Agricultural Tractors Machinery Market?

Opportunities in the North America Agricultural Tractors Machinery Market include the growing trend of precision agriculture, the integration of smart technologies, and the increasing focus on sustainable farming practices. These trends are likely to drive innovation and investment in the sector.

What trends are shaping the North America Agricultural Tractors Machinery Market?

Trends shaping the North America Agricultural Tractors Machinery Market include the rise of electric and hybrid tractors, the adoption of automation and robotics, and the increasing use of data analytics for farm management. These innovations are transforming traditional farming methods.

North America Agricultural Tractors Machinery Market

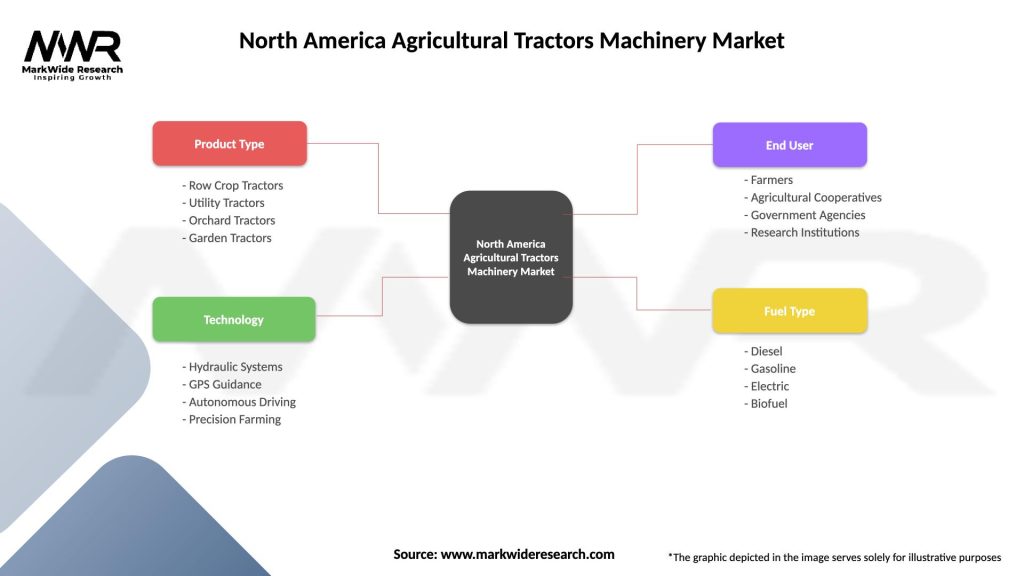

| Segmentation Details | Description |

|---|---|

| Product Type | Row Crop Tractors, Utility Tractors, Orchard Tractors, Garden Tractors |

| Technology | Hydraulic Systems, GPS Guidance, Autonomous Driving, Precision Farming |

| End User | Farmers, Agricultural Cooperatives, Government Agencies, Research Institutions |

| Fuel Type | Diesel, Gasoline, Electric, Biofuel |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Agricultural Tractors Machinery Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at