444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America advanced X-ray visualization systems market represents a dynamic and rapidly evolving sector within the broader medical imaging industry. This sophisticated market encompasses cutting-edge technologies that enhance diagnostic capabilities through superior image quality, real-time visualization, and advanced processing algorithms. Healthcare providers across the United States and Canada are increasingly adopting these systems to improve patient outcomes and streamline diagnostic workflows.

Market dynamics indicate robust growth driven by technological innovations, aging demographics, and increasing healthcare expenditure. The region’s advanced healthcare infrastructure, coupled with strong regulatory frameworks and substantial research investments, positions North America as a global leader in advanced X-ray visualization systems adoption. Current trends show approximately 68% of major hospitals have implemented or are planning to implement advanced visualization technologies within the next three years.

Regional distribution reveals the United States commanding the largest market share at approximately 78%, while Canada represents a significant growth opportunity with increasing healthcare digitization initiatives. The market encompasses various applications including cardiology, orthopedics, oncology, and emergency medicine, with each segment demonstrating unique growth patterns and technological requirements.

The North America advanced X-ray visualization systems market refers to the comprehensive ecosystem of sophisticated medical imaging technologies that utilize enhanced X-ray capabilities to provide superior diagnostic visualization, real-time imaging guidance, and advanced post-processing features for healthcare applications across the United States and Canada.

Advanced X-ray visualization systems encompass a broad range of technologies including digital radiography systems, fluoroscopy equipment, computed tomography scanners, and specialized imaging workstations. These systems integrate artificial intelligence, machine learning algorithms, and advanced image processing capabilities to deliver unprecedented diagnostic accuracy and clinical efficiency.

Key components of these systems include high-resolution detectors, advanced image reconstruction software, cloud-based storage solutions, and integrated workflow management platforms. The technology enables healthcare professionals to visualize anatomical structures with exceptional clarity, perform minimally invasive procedures with precision, and collaborate effectively across healthcare networks.

Market leadership in North America’s advanced X-ray visualization systems sector is characterized by intense innovation, strategic partnerships, and substantial investment in research and development. The market demonstrates strong fundamentals with consistent growth driven by technological advancement, regulatory support, and increasing clinical adoption rates.

Key growth drivers include the rising prevalence of chronic diseases, increasing geriatric population, and growing demand for minimally invasive procedures. Healthcare digitization initiatives and government support for medical technology advancement further accelerate market expansion. Recent analysis indicates that 72% of healthcare facilities report improved diagnostic efficiency following advanced X-ray system implementation.

Competitive landscape features established medical device manufacturers alongside emerging technology companies specializing in artificial intelligence and imaging software. Market participants are focusing on product differentiation through enhanced image quality, reduced radiation exposure, and improved user interfaces. Strategic acquisitions and partnerships are reshaping the competitive dynamics, with companies seeking to expand their technological capabilities and market reach.

Future prospects remain highly favorable, with emerging technologies such as photon-counting detectors, AI-powered diagnostics, and cloud-based imaging solutions expected to drive next-generation market growth. The integration of advanced visualization systems with electronic health records and telemedicine platforms presents significant opportunities for market expansion and improved patient care delivery.

Strategic insights reveal several critical factors shaping the North America advanced X-ray visualization systems market landscape:

Primary market drivers propelling the North America advanced X-ray visualization systems market include demographic shifts, technological innovations, and evolving healthcare delivery models. The aging population represents a fundamental driver, with individuals over 65 requiring significantly more diagnostic imaging procedures throughout their healthcare journey.

Technological advancement serves as a crucial catalyst, with innovations in detector technology, image processing algorithms, and artificial intelligence capabilities enhancing diagnostic accuracy and clinical efficiency. Healthcare providers recognize that advanced visualization systems enable earlier disease detection, more precise treatment planning, and improved patient outcomes, justifying substantial capital investments.

Healthcare digitization initiatives across North America accelerate market growth as medical facilities modernize their imaging infrastructure. Government incentives, quality improvement programs, and value-based care models encourage healthcare providers to adopt advanced technologies that demonstrate measurable improvements in patient care and operational efficiency.

Clinical specialization drives demand for specialized imaging solutions tailored to specific medical disciplines. Cardiology, orthopedics, and oncology departments require advanced visualization capabilities to support complex procedures and treatment protocols. The growing emphasis on minimally invasive procedures further increases demand for real-time imaging guidance systems.

Significant market restraints challenge the growth trajectory of advanced X-ray visualization systems in North America. High capital costs represent the primary barrier, particularly for smaller healthcare facilities and rural hospitals with limited budgets. The substantial investment required for system acquisition, installation, and infrastructure upgrades can strain financial resources and delay adoption decisions.

Technical complexity poses operational challenges as advanced systems require specialized training, ongoing maintenance, and technical support. Healthcare facilities must invest in staff education and may experience temporary productivity disruptions during system implementation and user adaptation periods. Integration challenges with existing IT infrastructure can further complicate deployment processes.

Regulatory compliance requirements create additional barriers through lengthy approval processes, extensive documentation requirements, and ongoing quality assurance obligations. While regulatory oversight ensures patient safety and system reliability, it can delay product launches and increase development costs for manufacturers.

Reimbursement limitations in certain healthcare segments may restrict adoption rates, particularly for newer technologies that lack established reimbursement codes. Healthcare providers must carefully evaluate the financial viability of advanced systems within current reimbursement frameworks while considering long-term value propositions.

Emerging opportunities in the North America advanced X-ray visualization systems market present substantial growth potential for innovative companies and healthcare providers. The integration of artificial intelligence and machine learning technologies offers unprecedented possibilities for automated image analysis, predictive diagnostics, and personalized treatment recommendations.

Telemedicine expansion creates new market segments as remote diagnostic capabilities become increasingly important. Advanced visualization systems with cloud-based sharing capabilities enable specialist consultations, second opinions, and collaborative care models that extend beyond traditional geographic boundaries. This trend accelerated significantly following recent healthcare delivery transformations.

Point-of-care imaging represents a rapidly growing opportunity as portable and mobile X-ray systems with advanced visualization capabilities gain traction in emergency departments, intensive care units, and outpatient settings. These solutions address the need for immediate diagnostic information while maintaining high image quality standards.

Preventive healthcare initiatives drive demand for screening programs and early detection technologies. Advanced visualization systems that can identify subtle abnormalities and track disease progression over time support population health management strategies and value-based care models increasingly adopted across North America.

Market dynamics in the North America advanced X-ray visualization systems sector reflect complex interactions between technological innovation, regulatory requirements, competitive pressures, and evolving healthcare needs. The dynamic nature of this market requires continuous adaptation and strategic planning from all stakeholders.

Supply chain considerations significantly impact market dynamics, particularly regarding component availability, manufacturing capacity, and distribution networks. Recent global events have highlighted the importance of resilient supply chains and domestic manufacturing capabilities for critical medical technologies.

Competitive intensity drives rapid innovation cycles as manufacturers strive to differentiate their offerings through superior image quality, enhanced user experiences, and advanced clinical applications. This competition benefits healthcare providers through improved technology options and competitive pricing structures.

Healthcare consolidation trends influence purchasing decisions as larger health systems leverage economies of scale and standardization opportunities. Group purchasing organizations and integrated delivery networks play increasingly important roles in technology selection and procurement processes, affecting market dynamics and vendor relationships.

Comprehensive research methodology employed in analyzing the North America advanced X-ray visualization systems market incorporates multiple data sources, analytical frameworks, and validation processes to ensure accuracy and reliability. The research approach combines quantitative analysis with qualitative insights to provide a holistic market perspective.

Primary research activities include extensive interviews with healthcare professionals, technology vendors, industry experts, and key opinion leaders across the medical imaging ecosystem. These interactions provide valuable insights into market trends, technology preferences, adoption barriers, and future requirements that shape strategic decision-making.

Secondary research encompasses analysis of industry publications, regulatory filings, company reports, and academic literature to establish market context and validate primary findings. MarkWide Research utilizes proprietary databases and analytical tools to process large datasets and identify meaningful patterns and trends.

Market modeling techniques employ statistical analysis, trend extrapolation, and scenario planning to develop accurate market projections and identify potential growth trajectories. Cross-validation processes ensure consistency and reliability across different analytical approaches and data sources.

Regional market distribution across North America reveals distinct patterns influenced by healthcare infrastructure, regulatory environments, and economic factors. The United States dominates the market with approximately 78% market share, driven by advanced healthcare systems, substantial research investments, and favorable reimbursement policies.

United States market demonstrates strong growth across all segments, with particular strength in academic medical centers, large hospital systems, and specialized imaging centers. Regional variations exist, with coastal areas and major metropolitan regions showing higher adoption rates of advanced technologies compared to rural and underserved areas.

Canadian market represents significant growth potential with increasing healthcare digitization initiatives and government support for medical technology advancement. Provincial healthcare systems are modernizing their imaging infrastructure, creating opportunities for advanced X-ray visualization systems that improve diagnostic capabilities and operational efficiency.

Cross-border collaboration between United States and Canadian healthcare institutions facilitates knowledge sharing, technology transfer, and joint research initiatives. This collaboration strengthens the overall North American market and accelerates the adoption of innovative imaging technologies across both countries.

Competitive landscape in the North America advanced X-ray visualization systems market features established medical device manufacturers, innovative technology companies, and specialized software developers competing across multiple dimensions including technology performance, clinical outcomes, and customer support.

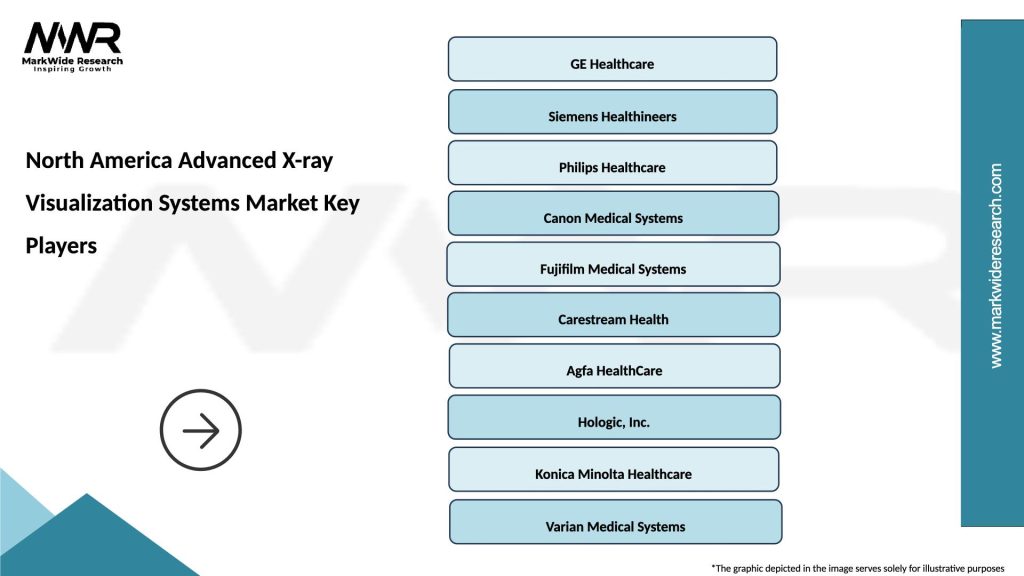

Market leaders include:

Strategic initiatives among competitors include research and development investments, strategic partnerships, acquisitions, and geographic expansion efforts. Companies are increasingly focusing on software capabilities, artificial intelligence integration, and cloud-based solutions to differentiate their offerings.

Market segmentation analysis reveals diverse categories based on technology type, application area, end-user segment, and deployment model. This segmentation provides insights into specific market dynamics and growth opportunities across different categories.

By Technology Type:

By Application Area:

By End-User:

Digital radiography systems represent the largest market segment, driven by widespread adoption and continuous technological improvements. These systems offer superior image quality, reduced radiation exposure, and enhanced workflow efficiency compared to traditional film-based systems. Recent innovations include wireless detectors, advanced image processing algorithms, and AI-powered diagnostic assistance.

Fluoroscopy systems demonstrate strong growth in interventional applications, particularly in cardiology and gastroenterology procedures. Advanced features such as 3D reconstruction, dose monitoring, and real-time image enhancement support complex minimally invasive procedures while maintaining patient safety standards.

Mobile X-ray systems experience rapid growth driven by point-of-care imaging needs and emergency applications. These systems now incorporate advanced visualization capabilities previously available only in fixed installations, enabling high-quality diagnostic imaging in diverse clinical settings.

Computed tomography continues evolving with advanced reconstruction techniques, artificial intelligence integration, and dose optimization technologies. Spectral imaging and photon-counting detectors represent emerging technologies that promise to further enhance diagnostic capabilities and clinical outcomes.

Healthcare providers benefit significantly from advanced X-ray visualization systems through improved diagnostic accuracy, enhanced clinical workflows, and better patient outcomes. These systems enable earlier disease detection, more precise treatment planning, and reduced examination times, ultimately supporting better patient care and operational efficiency.

Patients experience numerous advantages including reduced radiation exposure, shorter examination times, and more accurate diagnoses leading to appropriate treatment decisions. Advanced visualization capabilities often eliminate the need for repeat examinations and enable less invasive diagnostic procedures.

Healthcare systems realize operational benefits through improved resource utilization, enhanced productivity, and better integration with electronic health records and clinical information systems. These efficiencies contribute to cost reduction and improved healthcare delivery across the organization.

Technology vendors benefit from growing market demand, opportunities for innovation, and potential for recurring revenue through service contracts and software updates. The market provides platforms for developing cutting-edge technologies and establishing long-term customer relationships.

Research institutions gain access to advanced imaging capabilities that support clinical research, medical education, and technology development initiatives. These systems enable breakthrough research and contribute to advancing medical knowledge and treatment methodologies.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial intelligence integration represents the most significant trend transforming the advanced X-ray visualization systems market. AI-powered features including automated image analysis, diagnostic assistance, and workflow optimization are becoming standard capabilities rather than optional enhancements. Healthcare providers report that AI integration improves diagnostic accuracy by approximately 23% while reducing interpretation time.

Cloud-based solutions gain momentum as healthcare organizations seek scalable, cost-effective alternatives to traditional on-premise infrastructure. Cloud platforms enable advanced image processing, remote access capabilities, and seamless collaboration between healthcare providers across different locations.

Dose optimization technologies continue advancing as patient safety remains paramount. New detector technologies, advanced image reconstruction algorithms, and intelligent exposure control systems significantly reduce radiation exposure while maintaining or improving image quality standards.

Mobile and portable imaging solutions experience rapid growth driven by point-of-care needs, emergency applications, and home healthcare services. These systems now offer advanced visualization capabilities previously available only in fixed installations, expanding diagnostic imaging accessibility.

Workflow integration becomes increasingly important as healthcare providers seek seamless connectivity between imaging systems, electronic health records, and clinical decision support tools. Integrated workflows reduce manual processes and improve overall operational efficiency.

Recent industry developments highlight the dynamic nature of the North America advanced X-ray visualization systems market. Major manufacturers continue investing heavily in research and development, resulting in breakthrough technologies and enhanced product offerings that address evolving healthcare needs.

Strategic partnerships between imaging equipment manufacturers and software companies accelerate innovation in artificial intelligence applications, cloud-based solutions, and advanced visualization tools. These collaborations combine hardware expertise with software innovation to deliver comprehensive solutions.

Regulatory approvals for next-generation imaging technologies, including photon-counting detectors and AI-powered diagnostic tools, expand market opportunities and enable healthcare providers to access cutting-edge capabilities. MWR analysis indicates that regulatory approval timelines have improved by approximately 15% over the past two years.

Acquisition activities reshape the competitive landscape as companies seek to expand their technology portfolios, market reach, and customer base. These transactions often result in enhanced product offerings and improved market positioning for the combined entities.

Clinical validation studies demonstrate the effectiveness of advanced visualization systems in improving diagnostic accuracy, reducing examination times, and enhancing patient outcomes. These studies provide evidence supporting adoption decisions and reimbursement considerations.

Strategic recommendations for market participants focus on leveraging emerging technologies, addressing market challenges, and capitalizing on growth opportunities. Healthcare providers should prioritize systems that offer comprehensive integration capabilities, advanced AI features, and scalable architectures supporting future expansion.

Technology vendors should focus on developing user-friendly interfaces, comprehensive training programs, and robust customer support services to facilitate successful system implementations. Emphasis on interoperability and standards compliance will be crucial for long-term market success.

Investment priorities should include artificial intelligence development, cloud-based solutions, and mobile imaging capabilities. Companies that successfully integrate these technologies while maintaining high image quality and patient safety standards will achieve competitive advantages.

Partnership strategies can accelerate innovation and market penetration through collaborations with healthcare providers, technology companies, and research institutions. These partnerships enable access to clinical expertise, technology resources, and market insights essential for successful product development.

Market entry considerations for new participants should include regulatory compliance requirements, clinical validation needs, and customer support capabilities. Success in this market requires substantial investment in technology development, regulatory approval processes, and market education initiatives.

Future market prospects for North America advanced X-ray visualization systems remain highly favorable, driven by continued technological innovation, demographic trends, and evolving healthcare delivery models. The market is expected to experience sustained growth with a projected CAGR of 8.2% over the next five years.

Emerging technologies including photon-counting detectors, advanced AI algorithms, and quantum imaging techniques promise to revolutionize diagnostic imaging capabilities. These innovations will enable earlier disease detection, more precise treatment planning, and improved patient outcomes across diverse clinical applications.

Market expansion will be supported by increasing healthcare digitization, growing emphasis on preventive care, and expanding applications in point-of-care settings. The integration of advanced visualization systems with telemedicine platforms and remote monitoring technologies will create new market segments and growth opportunities.

MarkWide Research projects that artificial intelligence integration will become standard across all advanced X-ray visualization systems within the next three years, with AI-powered features expected to be present in over 90% of new system installations by 2027.

Competitive dynamics will continue evolving as traditional imaging companies compete with technology firms and software developers entering the medical imaging space. This competition will drive innovation, improve product offerings, and ultimately benefit healthcare providers and patients through enhanced diagnostic capabilities and improved clinical outcomes.

The North America advanced X-ray visualization systems market represents a dynamic and rapidly evolving sector with substantial growth potential driven by technological innovation, demographic trends, and changing healthcare delivery models. The market demonstrates strong fundamentals supported by advanced healthcare infrastructure, regulatory frameworks, and continuous investment in medical technology advancement.

Key success factors for market participants include embracing artificial intelligence integration, developing comprehensive cloud-based solutions, and maintaining focus on patient safety and clinical outcomes. The ability to provide seamless workflow integration, user-friendly interfaces, and robust customer support will differentiate successful companies in this competitive landscape.

Future growth prospects remain highly favorable as emerging technologies, expanding applications, and evolving healthcare needs create new opportunities for innovation and market expansion. Healthcare providers increasingly recognize the value of advanced visualization systems in improving diagnostic accuracy, operational efficiency, and patient care quality, supporting continued market growth and technology adoption across North America.

What is Advanced X-ray Visualization Systems?

Advanced X-ray Visualization Systems refer to sophisticated imaging technologies that enhance the clarity and detail of X-ray images, enabling better diagnosis and treatment planning in medical and industrial applications.

What are the key players in the North America Advanced X-ray Visualization Systems Market?

Key players in the North America Advanced X-ray Visualization Systems Market include Siemens Healthineers, GE Healthcare, Philips Healthcare, and Canon Medical Systems, among others.

What are the main drivers of the North America Advanced X-ray Visualization Systems Market?

The main drivers of the North America Advanced X-ray Visualization Systems Market include the increasing demand for early disease detection, advancements in imaging technology, and the growing prevalence of chronic diseases.

What challenges does the North America Advanced X-ray Visualization Systems Market face?

Challenges in the North America Advanced X-ray Visualization Systems Market include high costs of advanced systems, regulatory hurdles, and the need for skilled professionals to operate complex imaging equipment.

What opportunities exist in the North America Advanced X-ray Visualization Systems Market?

Opportunities in the North America Advanced X-ray Visualization Systems Market include the integration of artificial intelligence in imaging systems, the expansion of telemedicine, and the increasing focus on personalized medicine.

What trends are shaping the North America Advanced X-ray Visualization Systems Market?

Trends shaping the North America Advanced X-ray Visualization Systems Market include the shift towards portable imaging solutions, the development of hybrid imaging technologies, and the growing emphasis on patient-centered care.

North America Advanced X-ray Visualization Systems Market

| Segmentation Details | Description |

|---|---|

| Product Type | Computed Tomography, Digital Radiography, Fluoroscopy, Mammography |

| Technology | 2D Imaging, 3D Imaging, Dual-Energy, Portable Systems |

| End User | Hospitals, Diagnostic Centers, Research Institutions, Outpatient Clinics |

| Application | Oncology, Orthopedics, Cardiology, Neurology |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Advanced X-ray Visualization Systems Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at