444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America accommodation market represents a dynamic and rapidly evolving sector that encompasses a diverse range of lodging options across the United States and Canada. This comprehensive market includes traditional hotels, motels, bed and breakfast establishments, vacation rentals, extended stay facilities, and emerging alternative accommodation platforms. Market dynamics indicate robust growth driven by increasing domestic and international tourism, business travel recovery, and evolving consumer preferences for unique lodging experiences.

Regional distribution shows significant concentration in major metropolitan areas, tourist destinations, and business hubs, with approximately 45% of accommodation capacity located in urban centers. The market has demonstrated remarkable resilience and adaptability, particularly following recent global challenges that reshaped travel patterns and accommodation preferences. Technology integration has become increasingly important, with digital booking platforms, contactless services, and smart room technologies driving operational efficiency and guest satisfaction.

Consumer behavior trends indicate a growing preference for personalized experiences, sustainable accommodation options, and flexible booking arrangements. The market is experiencing significant transformation through the rise of sharing economy platforms, boutique hotels, and eco-friendly lodging alternatives that cater to diverse traveler demographics and preferences.

The North America accommodation market refers to the comprehensive ecosystem of lodging facilities and services that provide temporary housing solutions for travelers, tourists, and business professionals across the United States and Canada. This market encompasses traditional hospitality establishments, alternative lodging options, and emerging accommodation platforms that facilitate short-term and extended stay arrangements for diverse customer segments.

Market scope includes various accommodation types ranging from luxury resorts and business hotels to budget motels, vacation rentals, hostels, and specialized lodging facilities. The sector operates through multiple distribution channels including direct bookings, online travel agencies, global distribution systems, and peer-to-peer platforms that connect property owners with travelers seeking accommodation solutions.

Industry definition extends beyond traditional hospitality services to include ancillary offerings such as food and beverage services, conference facilities, recreational amenities, and concierge services that enhance the overall guest experience and drive revenue diversification for accommodation providers.

Market performance in the North America accommodation sector demonstrates strong recovery momentum with sustained growth across multiple segments. The industry has successfully adapted to changing consumer preferences while implementing innovative technologies and service delivery models that enhance operational efficiency and guest satisfaction. Growth trajectory indicates continued expansion driven by domestic tourism resurgence, business travel normalization, and increasing demand for experiential accommodation options.

Key market drivers include rising disposable income levels, growing preference for leisure travel, business activity recovery, and demographic shifts favoring experience-based consumption. The sector benefits from approximately 38% increase in domestic travel demand and expanding international visitor arrivals that support sustained occupancy rates and revenue growth across diverse accommodation categories.

Competitive landscape features established hotel chains, independent operators, vacation rental platforms, and emerging hospitality brands that compete through differentiated service offerings, strategic location advantages, and innovative guest experience programs. Market consolidation trends and strategic partnerships continue to reshape industry dynamics while creating opportunities for operational synergies and market expansion.

Strategic insights reveal several critical trends shaping the North America accommodation market landscape:

Economic recovery serves as a fundamental driver supporting accommodation market growth across North America. Rising employment levels, increased consumer confidence, and normalized business operations contribute to sustained travel demand that benefits various accommodation segments. Disposable income growth enables consumers to allocate larger portions of their budgets toward travel and hospitality experiences, driving both domestic and international tourism activities.

Demographic trends significantly influence market dynamics, with millennials and Generation Z travelers demonstrating strong preferences for unique accommodation experiences and technology-enabled services. These demographic groups prioritize authentic local experiences, sustainable travel options, and social media-worthy destinations that drive demand for boutique hotels, vacation rentals, and alternative lodging concepts.

Business travel recovery represents a crucial growth driver as corporate activities normalize and companies resume regular travel programs. The market benefits from approximately 42% recovery in business travel volumes compared to pre-pandemic levels, supporting demand for business hotels, conference facilities, and extended stay accommodations in major metropolitan areas.

Tourism infrastructure development across key destinations enhances market accessibility and attracts increased visitor volumes. Government initiatives promoting tourism, improved transportation connectivity, and destination marketing campaigns contribute to sustained accommodation demand growth across diverse geographic markets.

Labor shortage challenges continue to impact accommodation providers across North America, creating operational constraints and increased labor costs that affect service quality and profitability. The hospitality industry faces approximately 23% higher turnover rates compared to other sectors, requiring significant investments in recruitment, training, and retention programs that strain operational budgets.

Rising operational costs including energy expenses, property maintenance, insurance premiums, and regulatory compliance requirements create margin pressure for accommodation providers. Inflationary pressures on utilities, supplies, and services necessitate careful cost management while maintaining service quality standards that meet evolving guest expectations.

Regulatory complexity varies significantly across different jurisdictions, creating compliance challenges for accommodation providers operating in multiple markets. Local zoning regulations, tax requirements, safety standards, and licensing procedures require substantial administrative resources and legal expertise that increase operational complexity and costs.

Market saturation in certain high-demand destinations creates intense competition that pressures occupancy rates and average daily rates. Oversupply conditions in specific markets limit pricing power and require differentiated value propositions to maintain competitive positioning and financial performance.

Technology adoption presents significant opportunities for accommodation providers to enhance operational efficiency and guest experiences through innovative solutions. Implementation of artificial intelligence, Internet of Things devices, and data analytics platforms enables personalized service delivery, predictive maintenance, and dynamic pricing optimization that improve both guest satisfaction and financial performance.

Sustainable tourism growth creates opportunities for eco-friendly accommodation concepts that appeal to environmentally conscious travelers. Green building certifications, renewable energy systems, and sustainable operational practices attract guests willing to pay premium rates for environmentally responsible lodging options, supporting both market differentiation and revenue growth.

Remote work trends generate demand for extended stay accommodations and work-friendly environments that cater to digital nomads and remote workers seeking temporary housing solutions. This market segment represents approximately 31% growth potential as flexible work arrangements become permanently integrated into corporate cultures and individual lifestyle preferences.

Experience-based offerings enable accommodation providers to develop unique value propositions through partnerships with local attractions, cultural institutions, and activity providers. Curated experience packages, local immersion programs, and authentic destination connections create additional revenue streams while enhancing guest satisfaction and loyalty.

Supply and demand equilibrium in the North America accommodation market reflects complex interactions between capacity expansion, consumer preferences, and economic conditions. Market dynamics demonstrate cyclical patterns influenced by seasonal travel trends, economic cycles, and external factors that affect travel behavior and accommodation demand across different segments and geographic regions.

Pricing mechanisms have evolved significantly with the adoption of dynamic pricing strategies, revenue management systems, and data-driven optimization tools. Accommodation providers leverage real-time market data, competitor analysis, and demand forecasting to optimize room rates and maximize revenue per available room while maintaining competitive positioning in their respective markets.

Distribution channel evolution continues to reshape how accommodation providers reach and engage with potential guests. The market experiences approximately 56% of bookings through online channels, including direct booking websites, online travel agencies, and mobile applications that provide convenient booking experiences and comprehensive property information for travelers.

Competitive intensity varies across different market segments and geographic regions, with established hotel chains competing against independent operators, vacation rental platforms, and emerging hospitality brands. Market dynamics favor providers that successfully differentiate their offerings through unique value propositions, superior service quality, and strategic location advantages.

Comprehensive analysis of the North America accommodation market employs multiple research methodologies to ensure accurate and reliable market insights. Primary research includes structured interviews with industry executives, accommodation operators, and key stakeholders across various market segments to gather firsthand perspectives on market trends, challenges, and opportunities.

Secondary research incorporates extensive analysis of industry reports, government statistics, trade association data, and academic publications that provide historical context and market baseline information. Data validation processes ensure consistency and accuracy across multiple information sources while identifying potential discrepancies or data gaps that require additional investigation.

Market modeling utilizes statistical analysis, trend extrapolation, and scenario planning techniques to develop comprehensive market projections and growth forecasts. Quantitative analysis incorporates key performance indicators including occupancy rates, average daily rates, revenue per available room, and market share distributions across different accommodation categories and geographic regions.

Industry validation involves consultation with subject matter experts, industry associations, and market participants to verify research findings and ensure alignment with actual market conditions. Expert interviews provide qualitative insights that complement quantitative analysis while offering strategic perspectives on future market developments and emerging trends.

United States market dominates the North America accommodation sector, representing approximately 87% of regional capacity and demonstrating diverse market characteristics across different geographic regions. Major metropolitan areas including New York, Los Angeles, Chicago, and Miami serve as primary accommodation hubs with high-density lodging options ranging from luxury hotels to budget-friendly alternatives that cater to diverse traveler segments.

Western United States benefits from strong tourism demand driven by natural attractions, entertainment destinations, and technology industry business travel. California leads regional accommodation capacity with robust performance in both leisure and business segments, while emerging markets in Nevada, Arizona, and Colorado demonstrate significant growth potential supported by tourism infrastructure development and economic diversification initiatives.

Eastern United States maintains strong market position through established business centers, historical destinations, and cultural attractions that generate consistent accommodation demand. The Northeast corridor benefits from high-density business travel, while Southeast markets experience growth driven by tourism expansion, retirement migration, and economic development that supports diverse accommodation needs.

Canadian market represents approximately 13% of regional accommodation capacity with concentration in major urban centers including Toronto, Vancouver, Montreal, and Calgary. The market benefits from domestic tourism growth, international visitor arrivals, and business travel recovery that support sustained demand across various accommodation categories and price segments.

Market leadership in the North America accommodation sector features established hotel chains that maintain competitive advantages through brand recognition, loyalty programs, and extensive distribution networks. Leading companies demonstrate strong market positioning through strategic acquisitions, portfolio expansion, and operational excellence initiatives that enhance guest experiences and financial performance.

Major market participants include:

Competitive strategies focus on brand differentiation, technology innovation, and customer experience enhancement that create sustainable competitive advantages. Market leaders invest significantly in digital transformation, sustainability initiatives, and operational efficiency programs that support long-term growth and profitability objectives.

By Accommodation Type:

By Guest Type:

Luxury Accommodation Segment demonstrates resilient performance with approximately 29% premium pricing advantage over midscale properties, driven by affluent traveler demand for exclusive experiences and personalized services. This category benefits from strong brand loyalty, limited supply in prime locations, and ability to command premium rates through differentiated amenities and service quality.

Midscale Hotels represent the largest accommodation category by room count, offering balanced value propositions that appeal to diverse traveler segments. These properties focus on operational efficiency, brand consistency, and strategic location selection that supports stable occupancy rates and financial performance across various market conditions.

Economy Segment serves price-sensitive travelers with streamlined service offerings and competitive pricing strategies. This category emphasizes operational efficiency, technology adoption, and franchise business models that enable rapid market expansion while maintaining cost-effective operations and acceptable profit margins.

Extended Stay Category experiences robust growth driven by remote work trends, corporate relocations, and long-term travel patterns. These properties offer apartment-style accommodations with kitchen facilities and flexible lease arrangements that generate higher revenue per occupied room compared to traditional hotel segments.

Vacation Rental Segment continues expanding through platform-enabled growth and consumer preference for unique, authentic accommodation experiences. This category benefits from diverse property types, local market knowledge, and flexible booking arrangements that appeal to experience-seeking travelers and group bookings.

Property Owners benefit from multiple revenue generation opportunities through accommodation operations, ancillary services, and strategic partnerships that maximize asset utilization and investment returns. Real estate appreciation, tax advantages, and portfolio diversification provide additional financial benefits for property investors and developers in the accommodation sector.

Franchise Operators gain access to established brand recognition, proven operational systems, and comprehensive support services that reduce business risks and accelerate market entry. Franchise relationships provide marketing advantages, purchasing power benefits, and operational expertise that enhance competitive positioning and profitability potential.

Technology Providers experience significant demand for innovative solutions including property management systems, booking platforms, and guest experience technologies. The accommodation industry’s digital transformation creates substantial opportunities for software developers, hardware manufacturers, and service providers specializing in hospitality technology solutions.

Local Communities benefit from accommodation industry growth through job creation, tax revenue generation, and economic multiplier effects that support local businesses and service providers. Tourism development driven by accommodation capacity expansion contributes to infrastructure improvements and community development initiatives.

Guests and Travelers enjoy expanded accommodation options, competitive pricing, and enhanced service quality resulting from market competition and innovation. Technology adoption improves booking convenience, service personalization, and overall travel experiences that meet evolving consumer expectations and preferences.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital Transformation Acceleration continues reshaping accommodation operations through comprehensive technology adoption. Properties implement contactless services, mobile check-in systems, and smart room technologies that enhance guest convenience while reducing operational costs. Artificial intelligence and machine learning applications optimize pricing strategies, inventory management, and personalized guest services that improve both efficiency and satisfaction levels.

Sustainability Integration becomes increasingly important as accommodation providers implement eco-friendly practices and obtain green certifications. Energy-efficient systems, waste reduction programs, and sustainable sourcing initiatives appeal to environmentally conscious travelers while reducing operational costs. Carbon neutrality goals drive investment in renewable energy systems and sustainable building practices across the accommodation sector.

Experience-Centric Offerings reflect changing consumer preferences for authentic, memorable accommodation experiences rather than standardized lodging services. Properties develop unique amenities, local partnership programs, and cultural immersion opportunities that differentiate their offerings and justify premium pricing. Personalization technology enables customized guest experiences based on individual preferences and travel patterns.

Flexible Accommodation Solutions respond to evolving travel patterns including remote work, extended stays, and multi-purpose trips that combine business and leisure activities. Properties adapt their service offerings, pricing structures, and amenity packages to accommodate diverse guest needs and longer-term stays that generate higher revenue per guest.

Strategic Acquisitions continue reshaping the competitive landscape as major hospitality companies expand their portfolios through targeted acquisitions of complementary brands and properties. Recent transactions focus on lifestyle brands, extended stay concepts, and technology platforms that enhance market positioning and operational capabilities.

Technology Partnerships accelerate innovation adoption through collaborations between accommodation providers and technology companies. These partnerships develop integrated solutions for property management, guest services, and operational optimization that improve efficiency and competitive positioning in the digital marketplace.

Sustainability Initiatives gain momentum through industry-wide commitments to environmental responsibility and carbon reduction goals. Major accommodation providers implement comprehensive sustainability programs including renewable energy adoption, waste reduction targets, and sustainable sourcing practices that appeal to environmentally conscious consumers.

Regulatory Adaptations respond to evolving government policies affecting accommodation operations, taxation, and market access. Industry participants actively engage with regulatory authorities to shape policy development while ensuring compliance with changing requirements across different jurisdictions and market segments.

Market Expansion Projects focus on underserved destinations and emerging market segments that offer growth potential. Development initiatives target secondary markets, resort destinations, and specialized accommodation concepts that diversify portfolio exposure and capture new revenue opportunities.

MarkWide Research analysis indicates that accommodation providers should prioritize technology investment and operational efficiency improvements to maintain competitive positioning in the evolving market landscape. Digital transformation initiatives including mobile platforms, data analytics, and automation systems provide sustainable competitive advantages while improving guest experiences and operational performance.

Strategic recommendations emphasize the importance of market segmentation and targeted value propositions that address specific customer needs and preferences. Accommodation providers should develop specialized offerings for business travelers, leisure tourists, and extended stay guests while maintaining operational flexibility to adapt to changing market conditions and consumer behaviors.

Sustainability integration represents a critical success factor as environmental consciousness influences consumer booking decisions and corporate travel policies. Properties should implement comprehensive sustainability programs that reduce environmental impact while creating marketing advantages and operational cost savings that support long-term profitability.

Partnership strategies enable accommodation providers to enhance their value propositions through collaborations with local attractions, transportation providers, and experience companies. Strategic alliances create additional revenue streams while improving guest satisfaction and loyalty through comprehensive destination experiences.

Revenue optimization requires sophisticated pricing strategies and revenue management systems that maximize financial performance across different market segments and booking channels. Dynamic pricing capabilities and data-driven decision making enable properties to optimize rates and inventory allocation while maintaining competitive positioning.

Market trajectory indicates continued growth and evolution in the North America accommodation sector, driven by sustained travel demand recovery and changing consumer preferences. The industry demonstrates resilience and adaptability while embracing technological innovation and sustainable practices that position accommodation providers for long-term success in the dynamic hospitality marketplace.

Growth projections suggest approximately 6.2% annual expansion in accommodation demand over the next five years, supported by domestic tourism growth, business travel normalization, and demographic trends favoring experience-based consumption. Regional markets demonstrate varying growth rates based on economic conditions, tourism infrastructure, and destination attractiveness factors.

Technology evolution will continue transforming accommodation operations through artificial intelligence, Internet of Things integration, and advanced data analytics that enhance both operational efficiency and guest experiences. MWR forecasts indicate that properties investing in comprehensive technology platforms will achieve approximately 18% higher revenue per available room compared to traditional operators.

Market consolidation trends are expected to continue as larger hospitality companies acquire independent operators and specialized brands to expand their market presence and operational capabilities. Strategic partnerships and franchise relationships will provide growth opportunities for smaller operators while enabling rapid market expansion and brand development.

Sustainability requirements will become increasingly important as environmental regulations, consumer preferences, and corporate policies drive demand for eco-friendly accommodation options. Properties implementing comprehensive sustainability programs are projected to achieve premium pricing advantages and higher occupancy rates compared to conventional operations.

The North America accommodation market demonstrates remarkable resilience and growth potential as the industry successfully adapts to evolving consumer preferences and market dynamics. Strong fundamentals including sustained travel demand, technology adoption, and operational innovation position the sector for continued expansion and profitability across diverse market segments and geographic regions.

Strategic opportunities abound for accommodation providers that embrace digital transformation, sustainability initiatives, and experience-centric service delivery models. Market leaders will distinguish themselves through innovative guest experiences, operational efficiency, and strategic positioning that captures emerging demand trends while maintaining competitive advantages in the dynamic hospitality landscape.

Future success requires accommodation providers to balance traditional hospitality excellence with modern technology capabilities and evolving consumer expectations. The industry’s continued evolution toward personalized, sustainable, and technology-enabled accommodation experiences creates significant opportunities for growth and market leadership in the North American hospitality sector.

What is Accommodation?

Accommodation refers to the provision of lodging or housing for travelers and tourists, including hotels, motels, hostels, and vacation rentals. It plays a crucial role in the hospitality industry by offering various options to meet the needs of different types of guests.

What are the key players in the North America Accommodation Market?

Key players in the North America Accommodation Market include Marriott International, Hilton Worldwide, Hyatt Hotels Corporation, and Airbnb, among others. These companies offer a range of lodging options and services to cater to diverse customer preferences.

What are the main drivers of growth in the North America Accommodation Market?

The main drivers of growth in the North America Accommodation Market include increasing travel and tourism activities, rising disposable incomes, and the growing popularity of experiential travel. Additionally, the expansion of online booking platforms has made accommodations more accessible to consumers.

What challenges does the North America Accommodation Market face?

The North America Accommodation Market faces challenges such as fluctuating demand due to economic conditions, competition from alternative lodging options like vacation rentals, and regulatory issues affecting short-term rentals. These factors can impact occupancy rates and profitability.

What opportunities exist in the North America Accommodation Market?

Opportunities in the North America Accommodation Market include the potential for growth in eco-friendly accommodations, the rise of remote work leading to longer stays, and the increasing demand for personalized travel experiences. These trends can drive innovation and investment in the sector.

What trends are shaping the North America Accommodation Market?

Trends shaping the North America Accommodation Market include the integration of technology in guest services, the rise of sustainable practices among accommodations, and the growing preference for unique and local experiences. These trends are influencing how accommodations operate and attract guests.

North America Accommodation Market

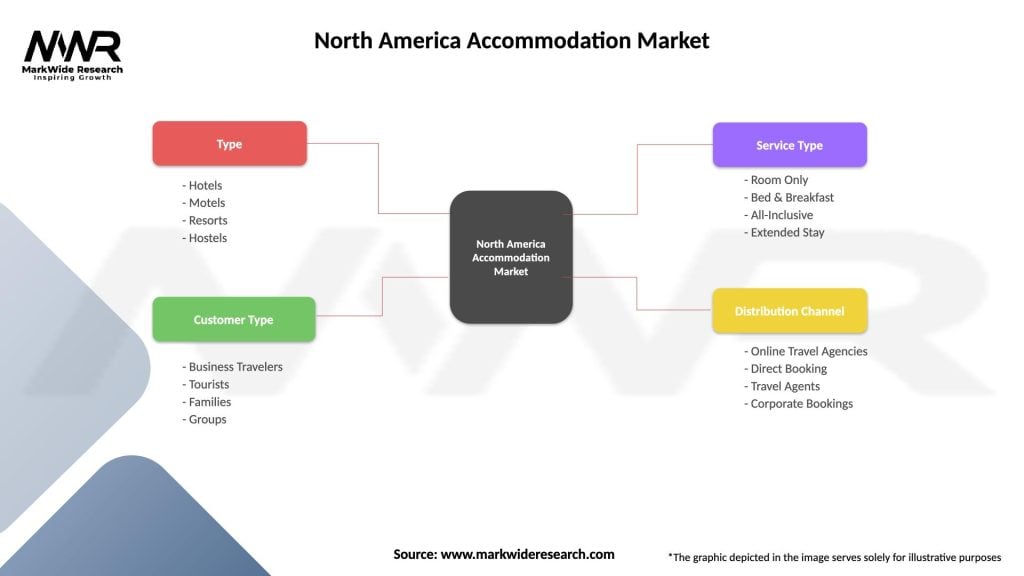

| Segmentation Details | Description |

|---|---|

| Type | Hotels, Motels, Resorts, Hostels |

| Customer Type | Business Travelers, Tourists, Families, Groups |

| Service Type | Room Only, Bed & Breakfast, All-Inclusive, Extended Stay |

| Distribution Channel | Online Travel Agencies, Direct Booking, Travel Agents, Corporate Bookings |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Accommodation Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at