444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2750

The North America access control software market represents a dynamic and rapidly evolving sector within the broader security technology landscape. This market encompasses sophisticated software solutions designed to manage, monitor, and control access to physical and digital resources across various industries. Access control software serves as the digital backbone for modern security infrastructure, enabling organizations to implement comprehensive security protocols while maintaining operational efficiency.

Market dynamics in North America are characterized by increasing security concerns, regulatory compliance requirements, and the growing adoption of cloud-based solutions. The region’s mature technology infrastructure and high security awareness among enterprises drive substantial demand for advanced access control systems. Organizations across sectors including healthcare, government, education, and commercial real estate are investing heavily in modernizing their security frameworks.

Growth trajectories indicate robust expansion, with the market experiencing a compound annual growth rate of 8.2% driven by digital transformation initiatives and heightened security requirements. The integration of artificial intelligence, machine learning, and Internet of Things (IoT) technologies is revolutionizing traditional access control approaches, creating new opportunities for software providers and system integrators.

Regional leadership in North America stems from the presence of major technology companies, substantial research and development investments, and early adoption of innovative security technologies. The United States dominates market share at approximately 78%, while Canada contributes significantly to market growth through government modernization initiatives and private sector investments in security infrastructure.

The North America access control software market refers to the comprehensive ecosystem of software solutions, platforms, and applications designed to manage and regulate access to physical facilities, digital resources, and sensitive information across organizations in the United States, Canada, and Mexico. This market encompasses both on-premises and cloud-based software solutions that enable organizations to authenticate users, authorize access privileges, and monitor security activities in real-time.

Access control software fundamentally transforms how organizations approach security management by providing centralized control over multiple access points, user credentials, and security policies. These solutions integrate with various hardware components including card readers, biometric scanners, mobile devices, and surveillance systems to create comprehensive security ecosystems that protect valuable assets and ensure regulatory compliance.

Core functionalities include user authentication, authorization management, audit trail generation, real-time monitoring, and integration capabilities with existing enterprise systems. Modern access control software solutions leverage advanced technologies such as artificial intelligence, machine learning, and predictive analytics to enhance security effectiveness while reducing operational complexity and administrative overhead.

Strategic market positioning reveals that North America’s access control software sector is experiencing unprecedented growth driven by evolving security threats, regulatory compliance mandates, and digital transformation initiatives. The market demonstrates strong resilience and adaptability, with organizations increasingly prioritizing comprehensive security solutions that offer scalability, flexibility, and advanced analytical capabilities.

Technology evolution is reshaping market dynamics as cloud-based solutions gain prominence, accounting for approximately 62% of new deployments. This shift reflects organizations’ preferences for scalable, cost-effective solutions that reduce infrastructure requirements while providing enhanced functionality and remote management capabilities. The integration of mobile access technologies and biometric authentication methods further accelerates market expansion.

Competitive landscape features established technology leaders alongside innovative startups, creating a dynamic environment that fosters continuous innovation and competitive pricing. Market consolidation through strategic acquisitions and partnerships is strengthening solution portfolios while expanding geographic reach and customer bases across diverse industry verticals.

Future prospects indicate sustained growth momentum supported by increasing cybersecurity investments, smart building initiatives, and the growing adoption of zero-trust security frameworks. Organizations are recognizing access control software as a critical component of comprehensive security strategies, driving demand for integrated solutions that combine physical and logical access management capabilities.

Market intelligence reveals several critical insights that define the North America access control software landscape and influence strategic decision-making across the industry:

Security threat evolution serves as a primary market driver, with organizations facing increasingly sophisticated security challenges that require advanced access control solutions. The rise in workplace violence, data breaches, and unauthorized access incidents has heightened awareness of comprehensive security needs, prompting investments in robust access control software platforms that provide multi-layered protection and real-time threat detection capabilities.

Regulatory compliance mandates across various industries are compelling organizations to implement comprehensive access control systems that ensure audit trail integrity and regulatory adherence. Healthcare organizations must comply with HIPAA requirements, financial institutions face stringent regulatory oversight, and government agencies require security clearance management capabilities, all driving demand for specialized access control software solutions.

Digital transformation initiatives are fundamentally reshaping organizational security approaches, with companies recognizing access control software as essential infrastructure for modern business operations. The shift toward remote work, hybrid workplace models, and digital-first business processes requires flexible, scalable access control solutions that support diverse access scenarios while maintaining security integrity.

Cost optimization pressures are encouraging organizations to adopt software-based access control solutions that reduce hardware dependencies, minimize maintenance requirements, and provide centralized management capabilities. Cloud-based solutions offer particular appeal by eliminating infrastructure investments while providing enhanced functionality and automatic updates that reduce total cost of ownership.

Technology advancement integration is driving market growth as organizations seek to leverage artificial intelligence, machine learning, and IoT technologies within their security frameworks. These advanced capabilities enable predictive analytics, automated threat response, and intelligent access management that enhances security effectiveness while reducing administrative overhead.

Implementation complexity represents a significant market restraint, as organizations often struggle with the technical challenges associated with deploying comprehensive access control software solutions. Integration with legacy systems, data migration requirements, and the need for specialized technical expertise can create barriers to adoption, particularly for smaller organizations with limited IT resources and budget constraints.

Cybersecurity concerns paradoxically serve as both drivers and restraints, with some organizations hesitating to adopt cloud-based access control solutions due to data security and privacy concerns. The fear of cyber attacks targeting access control systems, potential data breaches, and concerns about third-party data handling can slow adoption rates, especially in highly regulated industries with strict data protection requirements.

Budget limitations constrain market growth as organizations balance security investments with other operational priorities. The initial costs associated with software licensing, implementation services, training, and ongoing maintenance can be substantial, particularly for comprehensive enterprise-wide deployments that require extensive customization and integration work.

Change management challenges often impede successful access control software implementations, as organizations must navigate user resistance, workflow disruptions, and the need for comprehensive training programs. The transition from traditional key-based or card-based systems to sophisticated software-driven solutions requires significant organizational change management efforts that can delay or complicate deployment timelines.

Vendor lock-in concerns create hesitation among organizations considering long-term commitments to specific access control software platforms. The potential for vendor dependency, limited interoperability with alternative solutions, and concerns about future pricing or feature availability can influence decision-making processes and slow market adoption rates.

Smart building integration presents substantial opportunities as organizations increasingly adopt intelligent building management systems that require sophisticated access control capabilities. The convergence of building automation, energy management, and security systems creates demand for integrated software solutions that can manage multiple building functions while providing comprehensive access control and monitoring capabilities.

Artificial intelligence advancement opens new market opportunities through the development of intelligent access control solutions that can learn user behavior patterns, detect anomalies, and provide predictive security analytics. AI-powered features such as facial recognition, behavioral analysis, and automated threat response are creating differentiation opportunities for software providers and driving premium pricing for advanced capabilities.

Mobile technology proliferation creates opportunities for innovative access control solutions that leverage smartphone capabilities, wearable devices, and other mobile technologies. The growing acceptance of mobile credentials and contactless access methods, accelerated by health and safety concerns, is driving demand for software solutions that support diverse mobile authentication methods and provide seamless user experiences.

Vertical market specialization offers opportunities for software providers to develop industry-specific solutions that address unique regulatory requirements, operational workflows, and security challenges. Healthcare, education, government, and manufacturing sectors each present distinct opportunities for specialized access control software solutions that provide tailored functionality and compliance capabilities.

International expansion potential exists for North American access control software providers to leverage their technological expertise and market experience in global markets. The growing security awareness in emerging markets, combined with increasing regulatory requirements and infrastructure development, creates opportunities for expansion beyond the North American market through strategic partnerships and localized solution development.

Competitive intensity within the North America access control software market is driving continuous innovation and feature enhancement as providers seek to differentiate their offerings and capture market share. This dynamic environment encourages rapid technological advancement, competitive pricing strategies, and the development of comprehensive solution portfolios that address diverse customer requirements across multiple industry verticals.

Technology convergence is reshaping market dynamics as traditional boundaries between physical security, cybersecurity, and building management systems continue to blur. This convergence creates opportunities for integrated solutions while challenging providers to develop comprehensive expertise across multiple technology domains and maintain compatibility with diverse system architectures.

Customer expectations evolution is influencing market dynamics as organizations demand more sophisticated functionality, better user experiences, and greater integration capabilities from their access control software solutions. The shift toward consumerization of enterprise technology is driving expectations for intuitive interfaces, mobile accessibility, and seamless integration with existing business applications and workflows.

Regulatory landscape changes continuously impact market dynamics as new compliance requirements emerge and existing regulations evolve. Software providers must maintain agility to adapt their solutions to changing regulatory environments while ensuring backward compatibility and providing migration paths for existing customers facing new compliance requirements.

Economic factors influence market dynamics through their impact on organizational security budgets, technology investment priorities, and risk tolerance levels. Economic uncertainty can slow adoption rates while economic growth periods typically accelerate investments in security infrastructure and technology modernization initiatives that drive market expansion.

Comprehensive market analysis employs a multi-faceted research approach that combines primary and secondary research methodologies to provide accurate, reliable, and actionable market intelligence. The research framework incorporates quantitative data analysis, qualitative insights gathering, and expert opinion synthesis to develop a complete understanding of market dynamics, competitive landscapes, and future growth prospects.

Primary research activities include extensive interviews with industry executives, technology leaders, end-users, and market participants across various industry verticals. These interviews provide firsthand insights into market trends, technology adoption patterns, purchasing decisions, and future requirements that inform market projections and strategic recommendations.

Secondary research sources encompass industry reports, government publications, regulatory filings, company financial statements, and technology research publications. This comprehensive secondary research foundation ensures data accuracy and provides historical context for market trend analysis and future growth projections.

Data validation processes employ multiple verification methods including cross-referencing between sources, expert review panels, and statistical analysis techniques to ensure research accuracy and reliability. The validation framework includes peer review processes and industry expert consultations that enhance the credibility and usefulness of research findings.

Market modeling techniques utilize advanced analytical methods including regression analysis, scenario planning, and predictive modeling to develop accurate market forecasts and identify key growth drivers. These quantitative approaches are complemented by qualitative analysis that considers market dynamics, competitive factors, and technological evolution trends that influence market development.

United States market dominance is evident through its substantial share of the North American access control software market, driven by the presence of major technology companies, extensive enterprise adoption, and significant government investments in security infrastructure. The U.S. market benefits from mature technology ecosystems, high security awareness levels, and substantial research and development investments that foster innovation and market growth.

California and Texas represent the largest state markets within the United States, accounting for approximately 32% of total market activity. These states benefit from large technology sectors, extensive commercial real estate markets, and significant government and defense installations that require sophisticated access control solutions. The concentration of technology companies in these regions also drives innovation and competitive dynamics.

Canadian market growth is characterized by strong government modernization initiatives, increasing private sector security investments, and growing adoption of cloud-based solutions. Canada’s market represents approximately 18% of regional market share, with particular strength in government, healthcare, and education sectors that prioritize comprehensive security and compliance capabilities.

Mexico’s emerging market shows significant growth potential driven by expanding manufacturing sectors, increasing foreign investment, and growing security awareness among enterprises. While currently representing a smaller portion of the regional market, Mexico’s growth rate of 12.5% annually indicates substantial future opportunities for access control software providers seeking expansion in emerging markets.

Regional integration trends are creating opportunities for cross-border business expansion and technology sharing, with many organizations operating facilities across multiple North American countries requiring unified access control solutions. This trend drives demand for software platforms that can support multi-national deployments while accommodating diverse regulatory requirements and operational practices across different countries.

Market leadership in the North America access control software sector is characterized by a diverse ecosystem of established technology companies, specialized security software providers, and innovative startups that collectively drive market innovation and competitive dynamics. The competitive landscape reflects varying approaches to market positioning, technology development, and customer engagement strategies.

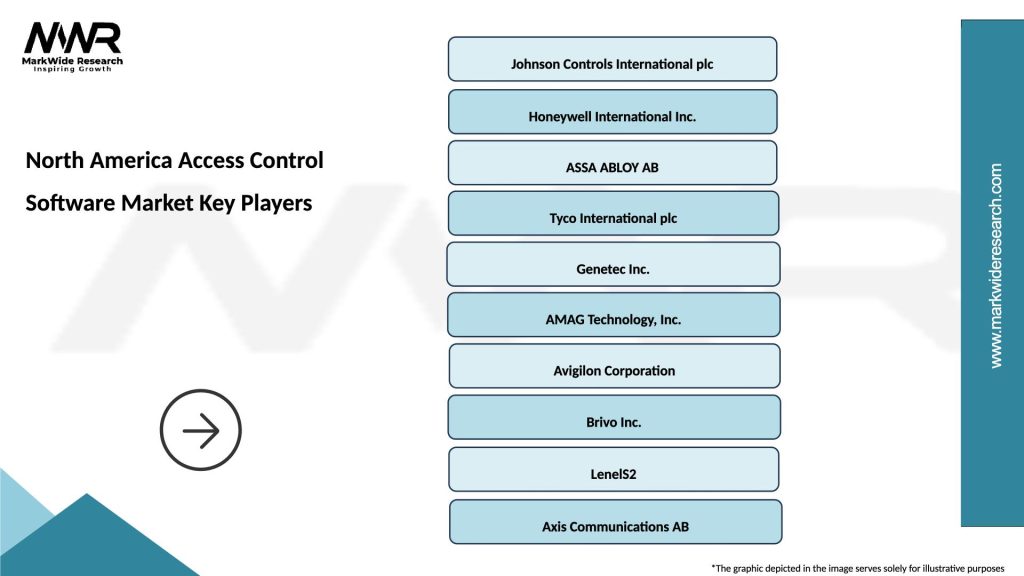

Major market participants include:

Competitive strategies vary significantly across market participants, with some focusing on comprehensive enterprise solutions while others specialize in specific market segments or technology niches. Innovation in artificial intelligence, mobile integration, and cloud platforms serves as key differentiators in competitive positioning and market share capture efforts.

Market consolidation trends are evident through strategic acquisitions, partnerships, and technology licensing agreements that strengthen solution portfolios and expand market reach. These consolidation activities reflect the industry’s maturation and the need for comprehensive solution offerings that address diverse customer requirements across multiple industry verticals.

Technology-based segmentation reveals distinct market categories that address different organizational requirements and technology preferences:

Deployment model segmentation reflects organizational preferences and technical requirements:

Organization size segmentation demonstrates varying requirements and adoption patterns:

By Technology Integration:

Artificial Intelligence Integration represents the most dynamic category, with organizations increasingly adopting AI-powered access control solutions that provide advanced analytics, behavioral pattern recognition, and predictive security capabilities. These solutions offer enhanced threat detection accuracy and automated response capabilities that reduce security incidents while minimizing false alarms and operational disruptions.

Mobile Technology Integration continues expanding rapidly as organizations embrace smartphone-based access credentials and contactless entry methods. The mobile-first approach provides superior user experiences while reducing hardware dependencies and enabling flexible access management across diverse facility types and organizational structures.

By Industry Application:

Healthcare Sector demonstrates strong growth driven by regulatory compliance requirements, patient safety concerns, and the need for comprehensive audit capabilities. Healthcare organizations require specialized access control solutions that support HIPAA compliance, patient privacy protection, and integration with electronic health record systems.

Government and Defense sectors maintain steady demand for high-security access control solutions that support security clearance management, multi-level access authorization, and comprehensive audit trail capabilities. These applications require advanced security features and integration with existing government security infrastructure.

By Deployment Complexity:

Single-site Deployments focus on simplicity and cost-effectiveness, appealing to organizations with concentrated operations and straightforward access control requirements. These solutions emphasize ease of implementation and user-friendly management interfaces that minimize training requirements and administrative overhead.

Multi-site Enterprise Deployments require sophisticated management capabilities, centralized administration, and integration with existing enterprise systems. These complex deployments demand scalable architecture and comprehensive reporting capabilities that support organizational governance and compliance requirements.

For End-user Organizations:

For Software Providers:

For System Integrators:

For Technology Partners:

Strengths:

Weaknesses:

Opportunities:

Threats:

Cloud-first Architecture is fundamentally transforming the access control software landscape as organizations prioritize scalable, flexible solutions that reduce infrastructure requirements and provide enhanced functionality. This trend reflects broader digital transformation initiatives and the growing acceptance of cloud-based security solutions that offer superior accessibility and management capabilities compared to traditional on-premises deployments.

Artificial Intelligence Integration is revolutionizing access control capabilities through advanced analytics, behavioral pattern recognition, and predictive security features. AI-powered solutions provide enhanced threat detection accuracy while reducing false alarms and enabling automated response capabilities that improve security effectiveness and operational efficiency.

Mobile-centric Solutions are gaining prominence as organizations embrace smartphone-based credentials and contactless access methods. The shift toward mobile-first approaches reflects changing user expectations and the desire for convenient, secure access methods that eliminate traditional key cards and physical tokens while providing enhanced user experiences.

Zero Trust Security Framework adoption is driving demand for comprehensive access control solutions that verify every access request regardless of user location or device. This security model requires sophisticated authentication and authorization capabilities that continuously validate user identity and access privileges throughout system interactions.

Integration Platform Development is creating opportunities for unified security management solutions that combine access control with video surveillance, intrusion detection, and building management systems. These integrated platforms provide comprehensive security oversight while reducing system complexity and administrative requirements for organizations managing multiple security technologies.

Biometric Authentication Advancement is expanding beyond traditional fingerprint recognition to include facial recognition, iris scanning, and behavioral biometrics. These advanced authentication methods provide enhanced security levels while improving user convenience and reducing the potential for credential theft or unauthorized access attempts.

Subscription-based Pricing Models are becoming standard as organizations prefer predictable, scalable pricing structures that align with operational budgets and growth patterns. This trend toward software-as-a-service models provides customers with continuous updates and support while enabling providers to develop sustainable, recurring revenue streams.

Strategic acquisitions are reshaping the competitive landscape as major technology companies acquire specialized access control software providers to strengthen their security solution portfolios. Recent acquisition activity demonstrates the industry’s consolidation trend and the strategic importance of comprehensive security platforms that integrate multiple technologies and capabilities.

Partnership ecosystem expansion is creating new collaboration opportunities between software providers, hardware manufacturers, and system integrators. These partnerships enable comprehensive solution development and expanded market reach while providing customers with integrated offerings that address diverse security requirements and operational needs.

Regulatory compliance enhancements are driving continuous product development as software providers adapt their solutions to meet evolving compliance requirements across various industries. Recent developments include enhanced audit capabilities, improved data protection features, and specialized compliance reporting tools that support regulatory adherence and risk management objectives.

Technology innovation investments are accelerating as companies recognize the competitive importance of advanced capabilities including artificial intelligence, machine learning, and predictive analytics. These investments are resulting in next-generation solutions that provide superior security effectiveness while reducing operational complexity and administrative overhead.

Market expansion initiatives are evident through geographic expansion efforts, vertical market specialization, and solution portfolio diversification. Companies are investing in market development activities that extend their reach into new customer segments and geographic regions while adapting their offerings to address specific industry requirements and use cases.

Cybersecurity enhancement programs are addressing growing concerns about access control system vulnerabilities through improved encryption, secure communication protocols, and comprehensive security testing procedures. These initiatives reflect the industry’s commitment to maintaining customer trust and protecting against evolving cyber threats that target security infrastructure.

MarkWide Research analysis indicates that organizations should prioritize access control software solutions that provide comprehensive integration capabilities, scalable architecture, and advanced analytics features. The research emphasizes the importance of selecting platforms that can adapt to evolving security requirements while providing long-term value and operational efficiency improvements.

Investment prioritization should focus on solutions that combine physical and logical access control capabilities, enabling organizations to implement unified security frameworks that address comprehensive protection requirements. Companies should evaluate platforms based on their ability to integrate with existing enterprise systems while providing future-ready capabilities that support organizational growth and technology evolution.

Vendor selection criteria should emphasize proven implementation experience, comprehensive support capabilities, and strong financial stability that ensures long-term partnership viability. Organizations should prioritize vendors that demonstrate continuous innovation and maintain active development programs that address emerging security challenges and technology opportunities.

Implementation strategy recommendations include phased deployment approaches that minimize operational disruption while enabling comprehensive testing and user training programs. Organizations should develop change management plans that address user adoption challenges and ensure successful transition from existing access control systems to new software platforms.

Technology roadmap planning should consider emerging trends including artificial intelligence integration, mobile technology advancement, and cloud platform evolution. Organizations should select solutions that provide upgrade pathways and technology integration capabilities that support future enhancement and expansion requirements.

Risk management considerations should address cybersecurity vulnerabilities, vendor dependency concerns, and regulatory compliance requirements that may impact access control software selection and implementation decisions. Companies should develop comprehensive risk assessment frameworks that evaluate potential security, operational, and financial risks associated with different solution alternatives.

Market growth projections indicate sustained expansion driven by increasing security awareness, regulatory compliance requirements, and technology advancement opportunities. The North America access control software market is expected to maintain robust growth momentum with a projected CAGR of 9.1% over the next five years, reflecting strong demand across diverse industry verticals and organization sizes.

Technology evolution will continue reshaping market dynamics through artificial intelligence integration, mobile technology advancement, and cloud platform sophistication. These technological developments will enable next-generation capabilities including predictive analytics, automated threat response, and seamless integration with emerging security technologies that enhance overall protection effectiveness.

Market consolidation trends are expected to continue as larger technology companies acquire specialized providers to strengthen their security solution portfolios and expand market reach. This consolidation will create opportunities for comprehensive platform development while potentially reducing the number of independent vendors serving specific market niches.

Industry vertical expansion will create new growth opportunities as access control software adoption spreads beyond traditional security-focused sectors into industries such as retail, hospitality, and manufacturing. These emerging markets will drive demand for specialized solutions that address unique operational requirements and regulatory compliance needs.

International market opportunities will provide growth potential for North American access control software providers seeking to leverage their technological expertise and market experience in global markets. The increasing security awareness in emerging economies creates opportunities for geographic expansion through strategic partnerships and localized solution development initiatives.

Innovation acceleration will continue driving competitive differentiation as companies invest in research and development programs that address emerging security challenges and technology opportunities. Future innovations will likely focus on enhanced user experiences, improved integration capabilities, and advanced analytics features that provide superior security effectiveness while reducing operational complexity.

The North America access control software market represents a dynamic and rapidly evolving sector that plays a critical role in modern organizational security infrastructure. Market analysis reveals strong growth momentum driven by increasing security threats, regulatory compliance requirements, and digital transformation initiatives that prioritize comprehensive, scalable security solutions.

Technology advancement continues reshaping market dynamics through cloud platform adoption, artificial intelligence integration, and mobile technology proliferation. These developments are creating opportunities for innovative solutions that provide enhanced security effectiveness while improving user experiences and reducing operational complexity for organizations across diverse industry verticals.

Competitive landscape evolution reflects the industry’s maturation through strategic consolidation, partnership development, and continuous innovation investments that strengthen solution portfolios and expand market reach. This dynamic environment fosters technological advancement while creating opportunities for specialized providers and comprehensive platform developers.

Future prospects indicate sustained growth potential supported by emerging market opportunities, technology innovation acceleration, and expanding application areas that extend beyond traditional security-focused sectors. Organizations that invest in comprehensive, scalable access control software solutions will be well-positioned to address evolving security challenges while achieving operational efficiency improvements and regulatory compliance objectives.

The market’s trajectory toward integrated, intelligent solutions that combine physical and logical access control capabilities represents the future direction of organizational security management, creating substantial opportunities for providers, integrators, and end-users who embrace comprehensive, technology-driven security approaches.

What is Access Control Software?

Access Control Software refers to systems that manage and regulate who can enter or exit a facility or area. These systems are essential for security in various sectors, including commercial buildings, educational institutions, and healthcare facilities.

What are the key players in the North America Access Control Software Market?

Key players in the North America Access Control Software Market include companies like Johnson Controls, Honeywell, and ASSA ABLOY, which provide a range of solutions for security management and access control, among others.

What are the growth factors driving the North America Access Control Software Market?

The North America Access Control Software Market is driven by increasing security concerns, the rise in smart building technologies, and the growing adoption of cloud-based solutions. These factors contribute to enhanced security and operational efficiency across various industries.

What challenges does the North America Access Control Software Market face?

Challenges in the North America Access Control Software Market include the high initial costs of implementation and the complexity of integrating new systems with existing infrastructure. Additionally, concerns regarding data privacy and cybersecurity threats pose significant challenges.

What opportunities exist in the North America Access Control Software Market?

Opportunities in the North America Access Control Software Market include the increasing demand for mobile access control solutions and the integration of artificial intelligence for enhanced security features. These advancements can lead to more efficient and user-friendly systems.

What trends are shaping the North America Access Control Software Market?

Trends in the North America Access Control Software Market include the shift towards biometric authentication methods and the growing use of IoT devices for access management. These innovations are transforming how organizations approach security and access control.

North America Access Control Software Market

| Segmentation Details | Description |

|---|---|

| Deployment | On-Premises, Cloud-Based, Hybrid, SaaS |

| End User | Government, Healthcare, Education, Commercial |

| Solution | Biometric Systems, Keyless Entry, Video Surveillance, Access Control Management |

| Technology | RFID, Biometrics, Mobile Credentials, Smart Cards |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the North America Access Control Software Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at