444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview:

The non-woven glass fiber prepreg market is experiencing steady growth due to the increasing demand for lightweight and high-performance materials in various industries. Non-woven glass fiber prepreg refers to a composite material made by impregnating glass fibers with a resin matrix. This material offers excellent mechanical properties, including high strength, stiffness, and thermal resistance, making it suitable for applications in aerospace, automotive, construction, and electrical industries, among others.

Meaning:

Non-woven glass fiber prepreg is a composite material where glass fibers are combined with a resin matrix to create a strong and durable material. The non-woven nature of the glass fibers provides additional reinforcement and enhances the overall performance of the material. Prepregs are commonly used in industries that require lightweight and high-strength materials for their products.

Executive Summary:

The non-woven glass fiber prepreg market is witnessing significant growth globally. The market is driven by the rising demand for lightweight materials with superior mechanical properties in various end-use industries. The use of non-woven glass fiber prepregs enables manufacturers to develop products that are stronger, stiffer, and more resistant to heat and chemicals. Additionally, the market is influenced by advancements in manufacturing technologies and increasing investments in research and development activities.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

The non-woven glass fiber prepreg segment is growing faster than its woven counterpart, thanks to advantages in cost, drapability, and isotropic mechanical performance.

Automotive OEMs are integrating non-woven prepregs for lightweight structural parts—such as door panels, dashboards, and underbody shields—to meet stringent CO₂ and fuel-efficiency targets.

Wind energy manufacturers favor non-woven prepregs for large, segmented blade sections due to simplified lay-up and reduced cure cycle times in OOA processes.

The rising adoption of prepreg compression molding and resin transfer molding (RTM) technologies is boosting demand for high-quality, consistent prepreg materials.

Market Drivers

Several factors are propelling the Non-Woven Glass Fiber Prepreg market:

Lightweighting Initiatives: OEMs across automotive and aerospace sectors are pursuing weight reduction to comply with emissions regulations and improve fuel economy, driving composites adoption.

Process Efficiency: Non-woven prepregs enable faster lay-up, reduced labor costs, and lower waste compared to wet-lay and woven prepreg processes.

Cost Competitiveness: The simpler manufacturing of non-woven mats and lower resin content compared to woven systems contribute to cost savings.

Isotropic Performance: Random fiber orientation in non-wovens provides balanced tensile and flexural properties, reducing the need for multi-directional fabrics.

Sustainability Focus: Emerging bio-based resins and recyclable thermoplastic matrices in non-woven prepregs align with circular economy goals.

Market Restraints

Despite strong growth prospects, the market faces several challenges:

Thermal and Dimensional Stability: Non-woven mats may exhibit lower in-plane stiffness than woven fabrics, necessitating hybrid constructions for high-performance applications.

Limited High-Temperature Resins: While thermoset resins dominate, development of non-woven prepregs with high-temperature thermoplastic matrices remains nascent.

Equipment Investment: Transitioning to prepreg compression molding or OOA curing requires capital expenditure on specialized presses and autoclave-alternative ovens.

Fiber–Resin Compatibility: Achieving uniform wet-out and void-free cure in non-woven mats demands precise control over resin viscosity and fiber sizing.

Market Fragmentation: A variety of resin systems and mat weights can confuse end-users, slowing specification and adoption.

Market Opportunities

The Non-Woven Glass Fiber Prepreg market presents multiple avenues for growth and differentiation:

Thermoplastic Prepregs: Expansion of non-woven mats impregnated with recyclable thermoplastics (e.g., polypropylene, polyetheretherketone) for automotive interior parts.

High-Throughput Production: Inline impregnation and automated cutting systems to scale up prepreg output and reduce lead times.

Hybrid Composites: Combined non-woven and woven layers to tailor stiffness and strength for specialized aerospace and rail applications.

Customized Resin Systems: Development of flame-retardant, UV-resistant, or conductive resin matrices for transit, renewable energy, and electronics markets.

Aftermarket and Repair: Precut prepreg patches and repair kits for field maintenance of wind blades, boats, and industrial equipment.

Market Dynamics

The Non-Woven Glass Fiber Prepreg market is shaped by evolving technologies, regulatory demands, and collaboration across the value chain:

Advancements in Resin Chemistry: Low-viscosity epoxies and fast-cure systems are reducing cycle times and energy consumption.

Out-of-Autoclave Trends: OOA-compatible prepregs support cost-effective curing for large structures, bypassing expensive autoclaves.

Supply Chain Localization: Regional prepreg production hubs reduce logistics costs and lead times for key markets in Europe, North America, and Asia-Pacific.

Regulatory Standards: Certifications such as UL 94 flame retardancy and ISO 9001 quality management drive supplier credibility.

Collaborative R&D: Partnerships between resin manufacturers, fiber suppliers, and OEMs accelerate development of next-generation prepregs.

Regional Analysis

The Non-Woven Glass Fiber Prepreg market shows distinct regional patterns:

Europe: Strong uptake in wind energy and rail sectors, supported by regional sustainability mandates and established composites clusters in Germany, Denmark, and Spain.

North America: Growth in automotive lightweighting and defense applications, with major hubs in the U.S. Midwest and Ontario, Canada.

Asia-Pacific: Rapid expansion driven by automotive production in China and India, plus wind farm installations in China and Japan.

Latin America: Emerging demand for wind energy components and building façade elements in Brazil and Mexico.

Middle East & Africa: Niche opportunities in pipeline rehabilitation and lightweight construction materials for infrastructure projects.

Competitive Landscape

Leading Companies in the Non-Woven Glass Fiber Prepreg Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

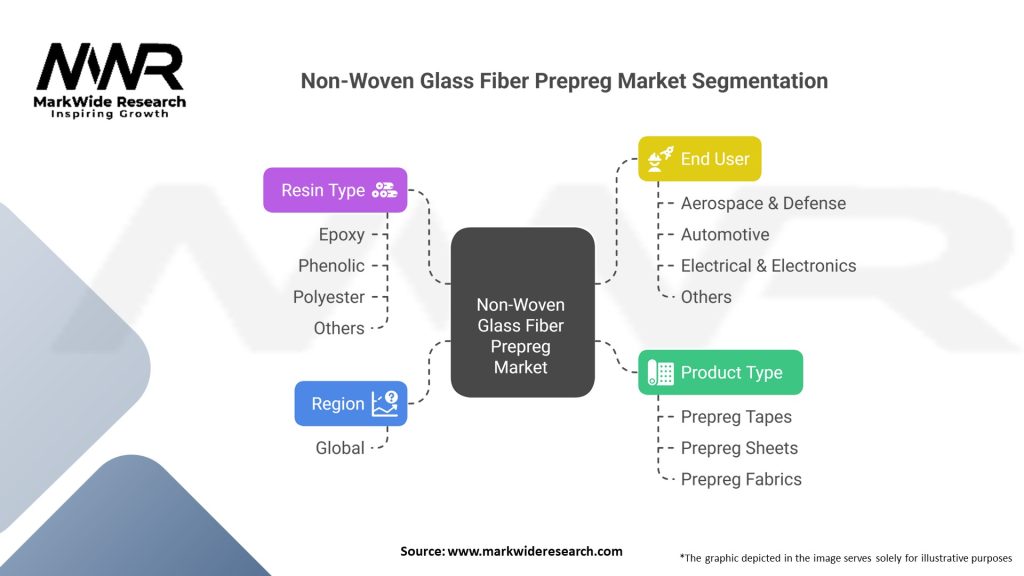

Segmentation

The Non-Woven Glass Fiber Prepreg market can be segmented based on:

Resin Type: Epoxy, Polyester, Vinyl Ester, Thermoplastic.

Prepreg Form: Mats, Tapes, Chopped Strand Prepregs.

End-Use Industry: Automotive, Aerospace & Defense, Wind Energy, Marine, Construction & Infrastructure.

Curing Process: Autoclave, Out-of-Autoclave, Resin Transfer Molding (RTM), Compression Molding.

Category-wise Insights

Each prepreg category targets specific application needs:

Epoxy Mats: Preferred for high-performance parts in aerospace and wind energy due to superior mechanical and environmental resistance.

Polyester & Vinyl Ester Prepregs: Cost-effective solutions for marine, construction, and recreational vehicle markets.

Thermoplastic Non-Wovens: Rapid processing and recyclability make them ideal for automotive interior panels and consumer goods.

Chopped Strand Prepregs: Offer ease of handling and compatibility with compression molding for complex, high-volume automotive parts.

Key Benefits for Industry Participants and Stakeholders

The Non-Woven Glass Fiber Prepreg market delivers multiple advantages:

Consistent Quality: Controlled resin content and fiber distribution ensure predictable mechanical performance and reduced scrap.

Reduced Cycle Times: Faster lay-up and shorter cure cycles lower manufacturing costs and increase throughput.

Lightweight Structures: High strength-to-weight ratios contribute to fuel savings and lower carbon footprints.

Design Flexibility: Mat conformability simplifies molding of complex geometries without wrinkles or fiber distortions.

Sustainability Gains: Advances in recyclable thermoplastics and bio-based resins align with ESG objectives.

SWOT Analysis

Strengths:

Simplified processing and faster production cycles.

Balanced mechanical properties in multiple directions.

Compatibility with OOA and high-volume molding techniques.

Weaknesses:

Generally lower in-plane stiffness compared to woven fabrics.

Dependence on specialized curing equipment for optimal properties.

Fragmented supplier base with varying quality standards.

Opportunities:

Development of high-temperature thermoplastic prepregs for aerospace.

Growth in emerging markets driven by infrastructure and renewable energy projects.

Integration into additive manufacturing hybrid composite structures.

Threats:

Competitive pressure from carbon fiber and hybrid fiber systems.

Volatility in raw material (glass fiber and resin) prices.

Stringent environmental regulations on volatile organic compound (VOC) emissions.

Market Key Trends

Key trends shaping this market include:

Thermoplastic Prepreg Adoption: Rising interest in recyclable, weldable composites for circular economy initiatives.

Automation in Lay-Up: Robotic and CNC-controlled placement of mats and tapes for precision and labor savings.

Low-Emission Resins: Formulation of high-performance, low-VOC systems for indoor/outdoor architectural applications.

Multifunctional Composites: Embedding sensors, heating elements, or conductive fillers within prepreg layers for smart structures.

Digital Twins: Simulation-driven design and process optimization for reduced prototyping and accelerated time-to-market.

Covid-19 Impact

The Covid-19 pandemic initially disrupted supply chains and slowed production across composites industries. However, recovery strategies highlighted the value of lightweight, durable materials in medical devices, ventilator components, and protective equipment. Demand for prepreg-based structural parts rebounded as automotive and wind energy sectors resumed growth, with many manufacturers accelerating investment in localized prepreg production to mitigate future disruptions.

Key Industry Developments

Recent developments include:

Joint Ventures for Capacity Expansion: Major resin and fiber producers partnering to build regional prepreg manufacturing plants in Asia-Pacific and Europe.

OOA Certification Programs: Industry consortia establishing standards and test protocols for validated out-of-autoclave curing processes.

New Resin Systems: Launch of bio-based epoxy prepregs and next-generation phenolic resins for high-temperature and fire-resistant applications.

Analyst Suggestions

Industry analysts recommend:

Invest in Hybrid Architectures: Combine non-woven mats with woven fabrics or unidirectional tapes to tailor stiffness and strength for critical load-bearing parts.

Enhance Supply Chain Resilience: Develop regional prepreg sourcing and inventory strategies to reduce lead times and buffer against raw material volatility.

Prioritize Low-Emission Systems: Adopt low-VOC resin formulations and closed-loop curing ovens to meet tightening environmental regulations and customer preferences.

Leverage Digital Tools: Implement simulation and digital twin platforms to optimize lay-up sequences, cure cycles, and part performance before prototyping.

Future Outlook

The Non-Woven Glass Fiber Prepreg market is poised for sustained growth, driven by global lightweighting mandates, renewable energy expansions, and the shift toward sustainable composites. Innovations in thermoplastic matrices, automated lay-up systems, and multifunctional prepregs will unlock new applications—from smart infrastructure to next-generation transportation. As the industry continues to localize production and refine performance, non-woven prepregs will play a central role in the evolving composite materials landscape.

Conclusion

In conclusion, the Non-Woven Glass Fiber Prepreg market offers a compelling combination of performance, cost-efficiency, and design flexibility that aligns with the demands of modern industries. By embracing advanced resin systems, automation, and sustainable practices, stakeholders across the value chain can capitalize on growing opportunities in automotive, aerospace, wind energy, and beyond. Strategic investments in R&D, process innovation, and regional capacity will be instrumental in maintaining competitive advantage and driving long-term market leadership.

What is Non-Woven Glass Fiber Prepreg?

Non-Woven Glass Fiber Prepreg refers to a composite material made from glass fibers that are pre-impregnated with a resin system. This material is widely used in various applications, including aerospace, automotive, and construction, due to its lightweight and high-strength properties.

What are the key players in the Non-Woven Glass Fiber Prepreg Market?

Key players in the Non-Woven Glass Fiber Prepreg Market include Hexcel Corporation, Toray Industries, and SGL Carbon, among others. These companies are known for their innovative solutions and extensive product offerings in the composite materials sector.

What are the growth factors driving the Non-Woven Glass Fiber Prepreg Market?

The growth of the Non-Woven Glass Fiber Prepreg Market is driven by the increasing demand for lightweight materials in the aerospace and automotive industries. Additionally, the rising focus on fuel efficiency and sustainability in manufacturing processes contributes to market expansion.

What challenges does the Non-Woven Glass Fiber Prepreg Market face?

The Non-Woven Glass Fiber Prepreg Market faces challenges such as high production costs and the complexity of the manufacturing process. Additionally, competition from alternative materials can hinder market growth.

What opportunities exist in the Non-Woven Glass Fiber Prepreg Market?

Opportunities in the Non-Woven Glass Fiber Prepreg Market include advancements in manufacturing technologies and the growing use of composites in renewable energy applications. The increasing adoption of electric vehicles also presents a significant growth avenue.

What trends are shaping the Non-Woven Glass Fiber Prepreg Market?

Trends in the Non-Woven Glass Fiber Prepreg Market include the development of bio-based resins and the integration of smart materials. These innovations aim to enhance performance and sustainability in various applications, including construction and automotive sectors.

Non-Woven Glass Fiber Prepreg Market

| Segmentation Details | Details |

|---|---|

| Product Type | Prepreg Tapes, Prepreg Sheets, Prepreg Fabrics |

| Resin Type | Epoxy, Phenolic, Polyester, Others |

| End User | Aerospace & Defense, Automotive, Electrical & Electronics, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Non-Woven Glass Fiber Prepreg Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at