444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The non-prescription mouthwashes market is experiencing steady growth driven by increasing awareness of oral hygiene and the rising demand for convenient oral care solutions. Non-prescription mouthwashes, also known as over-the-counter mouthwashes, are widely available in supermarkets, pharmacies, and online channels without the need for a prescription. These products offer consumers a convenient and effective way to maintain oral health, freshen breath, and prevent dental issues such as plaque, gingivitis, and cavities.

Meaning

Non-prescription mouthwashes are oral care products used for rinsing the mouth to freshen breath, kill bacteria, and promote oral hygiene. These mouthwashes typically contain ingredients such as antimicrobial agents (e.g., chlorhexidine, cetylpyridinium chloride), fluoride, essential oils, and herbal extracts that help reduce plaque buildup, fight bacteria, and protect against gum disease and tooth decay. Non-prescription mouthwashes are available in various formulations, including alcohol-based and alcohol-free options, catering to different preferences and needs.

Executive Summary

The non-prescription mouthwashes market is witnessing steady growth driven by factors such as increasing oral health awareness, changing consumer lifestyles, and product innovations. With a growing emphasis on preventive healthcare and self-care practices, non-prescription mouthwashes are becoming an integral part of daily oral hygiene routines for consumers of all ages. Key market players are investing in product development, marketing initiatives, and distribution expansion to capitalize on this growing demand and gain a competitive edge in the market.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The non-prescription mouthwashes market is characterized by dynamic trends and factors driving growth, including consumer preferences, oral health awareness, product innovations, regulatory developments, and competitive pressures. Manufacturers need to adapt to these market dynamics by offering differentiated products, investing in marketing initiatives, and expanding distribution channels to capitalize on opportunities and stay competitive in the market.

Regional Analysis

The non-prescription mouthwashes market is distributed globally, with key regional markets including North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Each region has its unique market characteristics, consumer preferences, regulatory frameworks, and competitive landscape dynamics influencing product adoption, market trends, and growth opportunities.

Competitive Landscape

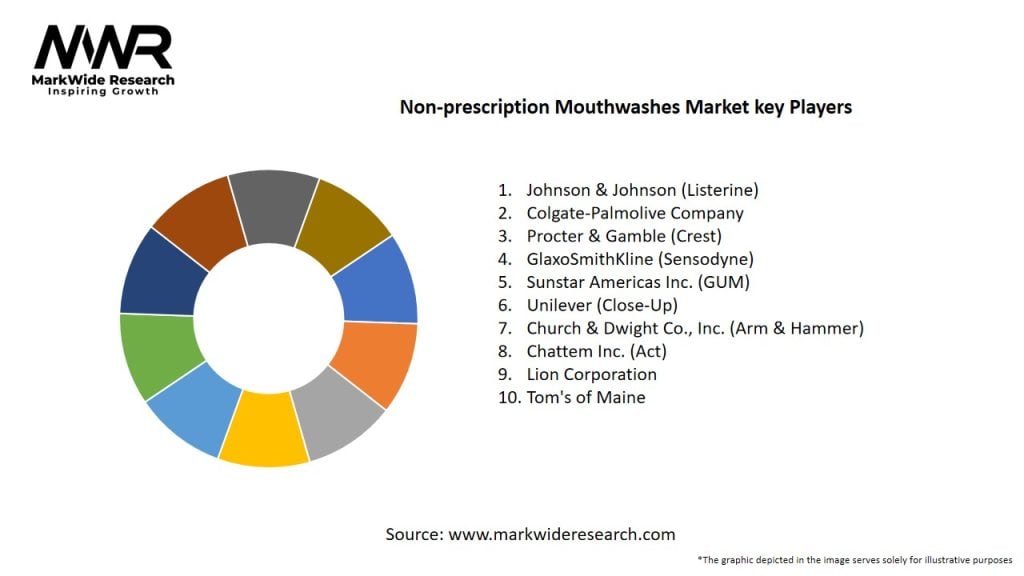

The non-prescription mouthwashes market is highly competitive, with numerous manufacturers, brands, and suppliers offering a wide range of products and formulations to meet diverse consumer needs and preferences. Key players in the market include Colgate-Palmolive Company, Johnson & Johnson Consumer Inc., Procter & Gamble Co., GlaxoSmithKline plc, and Unilever plc, among others. These companies compete based on factors such as product efficacy, safety, affordability, brand reputation, marketing initiatives, and distribution reach, driving innovation and differentiation in the market.

Segmentation

The non-prescription mouthwashes market can be segmented based on product type, formulation, flavor, distribution channel, and end-user segment. Product types include alcohol-based and alcohol-free mouthwashes, fluoride and fluoride-free options, whitening mouthwashes, and specialty formulations for sensitive teeth or gum care. Formulations encompass ingredients such as antimicrobial agents, fluoride, essential oils, and herbal extracts. Flavors range from mint and citrus to herbal and fruity options. Distribution channels include supermarkets, pharmacies, convenience stores, online retailers, and specialty oral care stores. End-user segments span across adults, children, seniors, and individuals with specific oral health concerns.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has heightened awareness of personal hygiene and infection prevention, driving demand for oral care products such as non-prescription mouthwashes as consumers seek additional measures to maintain oral health and reduce the risk of oral infections. Mouthwashes containing antimicrobial agents or hydrogen peroxide are particularly sought after for their potential to kill bacteria and viruses in the mouth, including the SARS-CoV-2 virus responsible for Covid-19, although further research is needed to confirm their efficacy in preventing viral transmission.

Key Industry Developments

Analyst Suggestions

Future Outlook

The non-prescription mouthwashes market is poised for continued growth and innovation as consumers prioritize preventive healthcare, oral hygiene, and personal wellness, driving demand for convenient and effective oral care solutions. With advancements in product formulations, marketing strategies, and distribution channels, non-prescription mouthwashes have the potential to expand market reach, gain consumer acceptance, and achieve sustainable growth and success in the global oral care market.

Conclusion

In conclusion, the non-prescription mouthwashes market offers significant growth opportunities for manufacturers, suppliers, and stakeholders seeking to capitalize on increasing consumer demand for convenient oral care solutions and preventive healthcare trends. By focusing on product innovation, marketing initiatives, regulatory compliance, and consumer education, companies can differentiate their products, gain competitive advantages, and succeed in an evolving market landscape driven by changing consumer preferences, emerging market trends, and technological advancements in oral care products and services.

Non-prescription Mouthwashes Market

| Segmentation Details | Description |

|---|---|

| Product Type | Antiseptic, Whitening, Fluoride, Herbal |

| End User | Adults, Children, Seniors, Athletes |

| Flavor | Mint, Citrus, Herbal, Cinnamon |

| Packaging Type | Bottle, Sachet, Spray, Refill |

Leading Companies in Non-prescription Mouthwashes Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at