444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The non-leather equestrian apparel market encompasses a diverse range of products tailored for riders and horse enthusiasts, offering alternatives to traditional leather-based gear. From riding apparel to accessories, this market caters to the needs of equestrians while embracing sustainable and cruelty-free materials.

Meaning

Non-leather equestrian apparel refers to riding gear and accessories crafted from materials other than traditional leather. These products serve the same functional purposes as their leather counterparts, providing comfort, durability, and style to riders while prioritizing ethical and sustainable sourcing practices.

Executive Summary

In recent years, the non-leather equestrian apparel market has experienced notable growth driven by increasing awareness of animal welfare and environmental concerns. Equestrians are increasingly seeking alternatives to leather-based products, prompting manufacturers to innovate and offer a wide array of non-leather options. Understanding key market insights, consumer preferences, and industry trends is vital for stakeholders to capitalize on emerging opportunities and navigate competitive dynamics.

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The non-leather equestrian apparel market operates within a dynamic ecosystem shaped by evolving consumer preferences, technological advancements, and regulatory developments. Understanding these dynamics is essential for stakeholders to identify growth opportunities, mitigate risks, and adapt their strategies to changing market conditions.

Regional Analysis

The non-leather equestrian apparel market exhibits regional variations influenced by factors such as consumer demographics, cultural preferences, and regulatory frameworks. While certain regions may have a higher propensity for adopting non-leather alternatives, others may lag behind due to traditional preferences for leather-based products.

Competitive Landscape

Leading Companies in the Non Leather Equestrian Apparel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

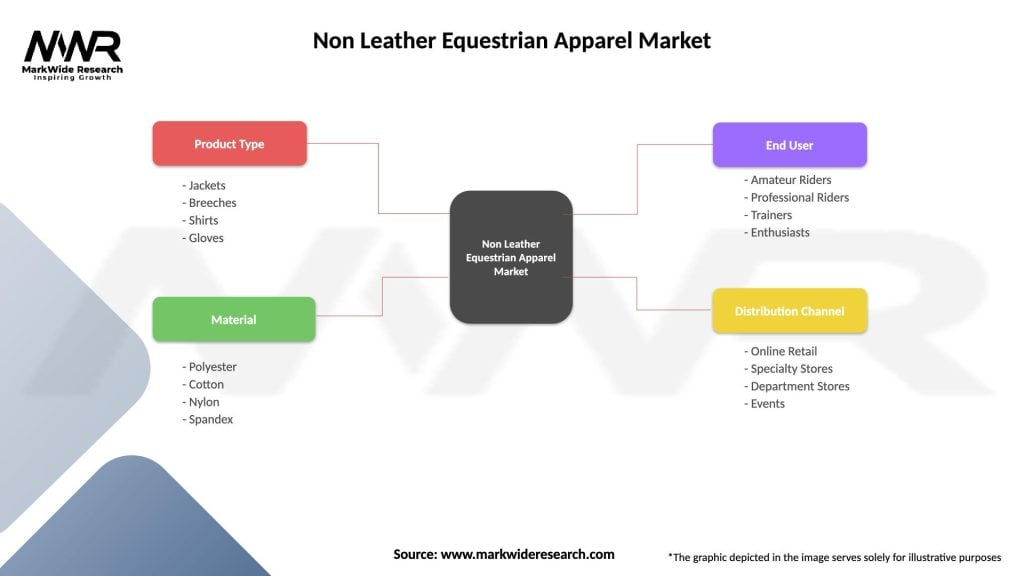

Segmentation

The non-leather equestrian apparel market can be segmented based on various factors, including product type, material type, distribution channel, and geography. Segmenting the market allows manufacturers to tailor their products and marketing strategies to specific customer segments and target markets.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

SWOT Analysis

Market Key Trends

Covid-19 Impact

The COVID-19 pandemic has had mixed effects on the non-leather equestrian apparel market. While disruptions to supply chains and retail operations initially posed challenges, increased emphasis on online shopping and e-commerce has created opportunities for brands to reach new customers and expand their market presence.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the non-leather equestrian apparel market is optimistic, with continued growth expected driven by increasing consumer awareness of ethical and sustainability issues, technological advancements in material science, and shifting consumer preferences towards cruelty-free and eco-friendly products. Brands that embrace innovation, prioritize sustainability, and engage with consumers effectively are well-positioned to succeed in this dynamic and evolving market.

Conclusion

The non-leather equestrian apparel market presents significant opportunities for brands to meet the growing demand for ethical, sustainable, and fashion-forward riding gear. By leveraging material innovation, embracing sustainability practices, and engaging with consumers effectively, brands can differentiate themselves, build loyalty, and drive growth in this dynamic and evolving market. Despite challenges posed by traditional perceptions and market dynamics, the future outlook for non-leather equestrian apparel remains promising, with consumers increasingly prioritizing products that align with their values and beliefs.

What is Non Leather Equestrian Apparel?

Non Leather Equestrian Apparel refers to riding clothing and accessories made from synthetic or alternative materials instead of traditional leather. This includes items such as breeches, jackets, and boots designed for equestrian activities while promoting animal welfare and sustainability.

What are the key companies in the Non Leather Equestrian Apparel Market?

Key companies in the Non Leather Equestrian Apparel Market include Ariat International, Tredstep Ireland, and Horze Equestrian, among others. These companies focus on producing high-quality, durable apparel that meets the needs of riders and equestrian enthusiasts.

What are the growth factors driving the Non Leather Equestrian Apparel Market?

The growth of the Non Leather Equestrian Apparel Market is driven by increasing awareness of animal welfare, the rise in demand for sustainable fashion, and the growing popularity of equestrian sports. Additionally, advancements in fabric technology are enhancing the performance and comfort of non-leather materials.

What challenges does the Non Leather Equestrian Apparel Market face?

The Non Leather Equestrian Apparel Market faces challenges such as competition from traditional leather products, consumer skepticism regarding the durability of synthetic materials, and fluctuating raw material prices. These factors can impact market growth and consumer acceptance.

What opportunities exist in the Non Leather Equestrian Apparel Market?

Opportunities in the Non Leather Equestrian Apparel Market include the potential for innovation in sustainable materials, the expansion of online retail channels, and the growing interest in equestrian activities among younger demographics. These trends can lead to increased market penetration and brand loyalty.

What trends are shaping the Non Leather Equestrian Apparel Market?

Trends shaping the Non Leather Equestrian Apparel Market include the rise of eco-friendly materials, the integration of technology in apparel for enhanced performance, and the popularity of athleisure styles among equestrians. These trends reflect a shift towards more versatile and sustainable equestrian wear.

Non Leather Equestrian Apparel Market

| Segmentation Details | Description |

|---|---|

| Product Type | Jackets, Breeches, Shirts, Gloves |

| Material | Polyester, Cotton, Nylon, Spandex |

| End User | Amateur Riders, Professional Riders, Trainers, Enthusiasts |

| Distribution Channel | Online Retail, Specialty Stores, Department Stores, Events |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Non Leather Equestrian Apparel Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at