444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The Non-IC Card Smart Meter market is experiencing significant growth, driven by the increasing adoption of smart metering solutions for electricity, water, and gas utilities worldwide. Non-IC card smart meters, also known as digital or electronic meters, enable automated meter reading, remote monitoring, and real-time data analytics, offering benefits such as improved accuracy, efficiency, and reliability in utility metering operations. With growing emphasis on energy efficiency, grid modernization, and sustainability, the market for non-IC card smart meters is poised for substantial expansion.

Meaning

Non-IC card smart meters are advanced metering devices designed to measure and record utility consumption, such as electricity, water, or gas, using digital or electronic technologies. These smart meters utilize communication protocols such as wireless, cellular, or powerline communication to transmit consumption data to utility companies for billing, monitoring, and analysis purposes. Non-IC card smart meters offer benefits such as real-time metering, remote connectivity, and data integration, enabling utilities to improve operational efficiency, reduce revenue losses, and enhance customer service.

Executive Summary

The Non-IC Card Smart Meter market is witnessing robust growth, driven by increasing demand for energy management solutions, regulatory mandates for smart meter deployments, and technological advancements in metering technologies. Key factors propelling market growth include the need for accurate billing, demand-side management, and grid optimization in the face of rising energy consumption, urbanization, and climate change impacts. Despite challenges such as interoperability issues and cybersecurity concerns, the non-IC card smart meter market is expected to continue expanding, supported by ongoing investments in smart grid infrastructure and digital transformation initiatives.

Key Market Insights

Market Drivers

Market Restraints

Market Opportunities

Market Dynamics

The Non-IC Card Smart Meter market is characterized by dynamic factors such as technological innovation, regulatory environment, market competition, and consumer behavior. Market participants need to adapt to these dynamics by investing in research and development, regulatory compliance, customer engagement, and strategic partnerships to capitalize on emerging opportunities and address evolving challenges in the dynamic non-IC card smart meter market.

Regional Analysis

The Non-IC Card Smart Meter market is geographically segmented into regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America and Europe are mature markets with widespread adoption of smart metering solutions and regulatory mandates for utility modernization and energy efficiency. Asia Pacific is the fastest-growing market, driven by rapid urbanization, industrialization, and government initiatives for smart grid deployment and renewable energy integration.

Competitive Landscape

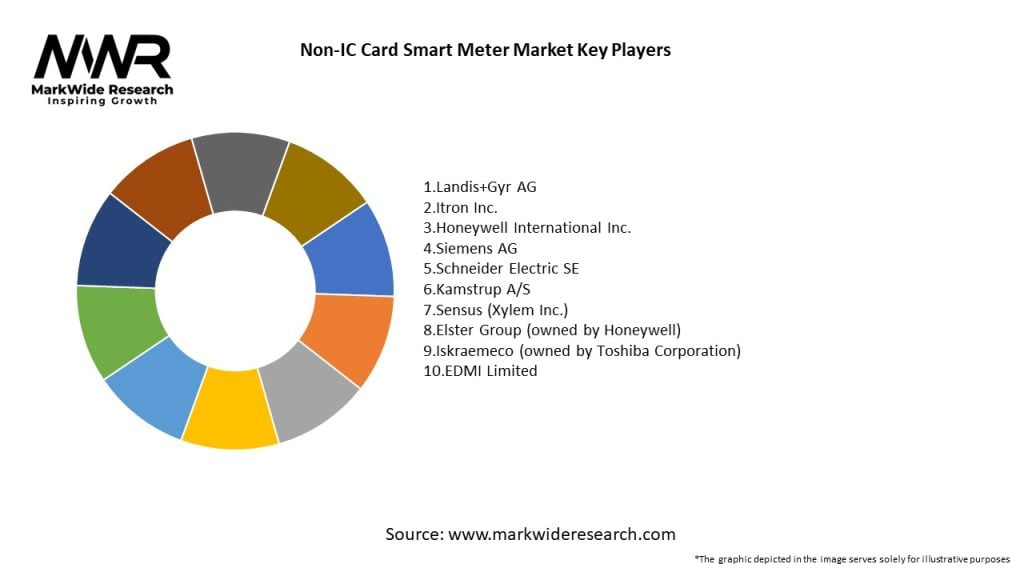

The Non-IC Card Smart Meter market is highly competitive, with several established players and numerous emerging manufacturers competing for market share. Key players in the market include Itron Inc., Landis+Gyr AG, Siemens AG, Schneider Electric SE, and Honeywell International Inc. These companies focus on product innovation, technological leadership, and market expansion to maintain their competitive position and meet evolving customer needs in the dynamic non-IC card smart meter market.

Segmentation

The Non-IC Card Smart Meter market can be segmented based on technology type, application, end-user industry, and geography. Technology types include electricity meters, water meters, and gas meters. Applications encompass residential, commercial, and industrial sectors. End-user industries include utilities, municipalities, and private enterprises.

Category-wise Insights

Key Benefits for Industry Participants and Stakeholders

The adoption of non-IC card smart meters offers several benefits for industry participants and stakeholders. These include:

SWOT Analysis

Strengths:

Weaknesses:

Opportunities:

Threats:

Market Key Trends

Covid-19 Impact

The Covid-19 pandemic has accelerated the adoption of non-IC card smart meters as utilities and consumers seek digital solutions for remote monitoring, contactless operations, and energy management during lockdowns and social distancing measures. While the pandemic has led to delays in meter installations, supply chain disruptions, and financial challenges for utilities and consumers, it has also underscored the importance of smart metering technologies for resilience, efficiency, and sustainability in utility operations and customer services.

Key Industry Developments

Analyst Suggestions

Future Outlook

The future outlook for the Non-IC Card Smart Meter market remains positive, with sustained growth expected in the coming years. Factors such as regulatory mandates, technological innovations, and consumer preferences for energy management solutions are expected to drive market expansion and adoption of non-IC card smart meters in utility operations and customer services. However, businesses need to address challenges such as interoperability issues, cybersecurity risks, and financial constraints to capitalize on emerging opportunities and sustain long-term growth in the dynamic non-IC card smart meter market.

Conclusion

In conclusion, the Non-IC Card Smart Meter market presents significant opportunities for manufacturers, suppliers, and stakeholders to meet growing demand for advanced metering solutions, grid optimization technologies, and energy management services in utility operations and customer services. By investing in technological innovations, regulatory compliance, customer engagement, and strategic partnerships, businesses can capitalize on emerging opportunities and drive growth in the dynamic non-IC card smart meter market. Despite challenges such as interoperability issues, cybersecurity risks, and financial constraints, the outlook for non-IC card smart meters remains positive, supported by increasing awareness, adoption, and integration of smart metering technologies in utility operations and consumer services.

What is Non-IC Card Smart Meter?

Non-IC Card Smart Meter refers to advanced metering devices that do not utilize integrated circuit (IC) cards for data storage or processing. These meters typically employ wireless communication technologies to transmit usage data directly to utility providers, enhancing efficiency and accuracy in energy management.

What are the key players in the Non-IC Card Smart Meter Market?

Key players in the Non-IC Card Smart Meter Market include companies like Landis+Gyr, Itron, and Siemens, which are known for their innovative metering solutions and technologies. These companies focus on enhancing energy efficiency and providing reliable data management systems, among others.

What are the main drivers of the Non-IC Card Smart Meter Market?

The main drivers of the Non-IC Card Smart Meter Market include the increasing demand for energy efficiency, the need for real-time data monitoring, and the growing adoption of smart grid technologies. These factors contribute to improved energy management and consumer engagement.

What challenges does the Non-IC Card Smart Meter Market face?

The Non-IC Card Smart Meter Market faces challenges such as cybersecurity threats, high initial installation costs, and regulatory compliance issues. These challenges can hinder the widespread adoption of smart metering technologies.

What opportunities exist in the Non-IC Card Smart Meter Market?

Opportunities in the Non-IC Card Smart Meter Market include advancements in IoT technology, increasing investments in renewable energy sources, and the potential for enhanced data analytics. These factors can lead to more efficient energy consumption and improved customer service.

What trends are shaping the Non-IC Card Smart Meter Market?

Trends shaping the Non-IC Card Smart Meter Market include the integration of artificial intelligence for predictive analytics, the rise of demand response programs, and the growing focus on sustainability. These trends are driving innovation and improving the functionality of smart meters.

Non-IC Card Smart Meter Market

| Segmentation Details | Description |

|---|---|

| Product Type | Electricity Meters, Water Meters, Gas Meters, Multi-Utility Meters |

| Technology | RFID, Zigbee, Wi-Fi, Cellular |

| End User | Residential, Commercial, Industrial, Utilities |

| Installation Type | Indoor, Outdoor, Wall-Mounted, Pole-Mounted |

Leading Companies in the Non-IC Card Smart Meter Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at