444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The non-destructive testing in oil and gas market represents a critical segment within the energy sector’s quality assurance and safety infrastructure. This specialized market encompasses advanced testing methodologies that evaluate the integrity of oil and gas infrastructure without causing damage to the components being examined. Non-destructive testing (NDT) technologies have become indispensable for ensuring operational safety, regulatory compliance, and asset longevity across upstream, midstream, and downstream operations.

Market dynamics indicate robust growth driven by stringent safety regulations, aging infrastructure requirements, and technological advancements in testing equipment. The sector is experiencing significant expansion with a projected CAGR of 8.2% over the forecast period, reflecting the industry’s commitment to maintaining operational excellence and preventing catastrophic failures. Digital transformation initiatives are reshaping traditional testing approaches, introducing automated systems and real-time monitoring capabilities that enhance accuracy and efficiency.

Regional distribution shows North America commanding approximately 35% market share, followed by Asia-Pacific and Europe. The market’s growth trajectory is supported by increasing investments in pipeline infrastructure, offshore exploration activities, and the need for comprehensive asset integrity management programs across global oil and gas operations.

The non-destructive testing in oil and gas market refers to the comprehensive ecosystem of testing technologies, services, and equipment designed to evaluate the structural integrity, material properties, and operational safety of oil and gas infrastructure without causing permanent damage to the tested components. This market encompasses various testing methodologies including ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, and eddy current testing specifically tailored for petroleum industry applications.

NDT applications in the oil and gas sector extend across multiple operational phases, from initial construction and commissioning to routine maintenance and end-of-life assessments. These testing procedures are essential for detecting flaws, corrosion, fatigue cracks, and other structural anomalies that could compromise operational safety or environmental protection. Regulatory compliance requirements mandate regular NDT inspections for critical infrastructure components, making this market an integral part of the oil and gas industry’s operational framework.

Market expansion in the non-destructive testing sector for oil and gas applications is driven by multiple converging factors including regulatory mandates, technological innovations, and increasing focus on operational safety. The market demonstrates strong growth potential with digital NDT solutions gaining significant traction among industry participants seeking enhanced accuracy and operational efficiency.

Key growth drivers include the aging global oil and gas infrastructure requiring comprehensive integrity assessments, stringent environmental regulations demanding regular safety inspections, and technological advancements enabling more sophisticated testing capabilities. The market benefits from approximately 42% adoption rate of advanced digital NDT technologies among major oil and gas operators, indicating strong industry acceptance of innovative testing solutions.

Competitive dynamics reveal a fragmented market structure with numerous specialized service providers competing alongside established industrial testing companies. Market participants are increasingly focusing on developing integrated testing solutions that combine multiple NDT methodologies with advanced data analytics capabilities to provide comprehensive asset integrity assessments.

Strategic insights reveal several critical factors shaping the non-destructive testing market in oil and gas applications:

Primary market drivers propelling growth in the non-destructive testing sector include comprehensive regulatory frameworks mandating regular safety inspections across oil and gas operations. Safety regulations established by organizations such as the Pipeline and Hazardous Materials Safety Administration (PHMSA) and similar international bodies require systematic NDT evaluations of critical infrastructure components, creating sustained demand for testing services.

Infrastructure aging represents another significant driver, as much of the global oil and gas infrastructure was constructed decades ago and now requires intensive monitoring to ensure continued safe operation. The need for asset integrity management programs has intensified as operators seek to extend the operational life of existing facilities while maintaining safety standards and regulatory compliance.

Technological advancement in NDT equipment and methodologies is driving market expansion by enabling more accurate, efficient, and cost-effective testing procedures. Digital transformation initiatives are introducing automated inspection systems, real-time monitoring capabilities, and advanced data analytics that enhance the value proposition of NDT services for oil and gas operators.

Environmental consciousness and corporate responsibility initiatives are compelling organizations to implement comprehensive testing programs that prevent environmental incidents and demonstrate commitment to sustainable operations. The growing emphasis on ESG compliance is creating additional demand for thorough asset integrity assessments.

Market constraints affecting the non-destructive testing sector include significant capital investment requirements for advanced testing equipment and technology upgrades. High implementation costs associated with sophisticated NDT systems can present barriers for smaller operators or organizations with limited capital budgets, potentially slowing market adoption rates.

Skilled workforce shortages represent a persistent challenge, as the industry requires highly trained and certified technicians capable of operating complex testing equipment and interpreting results accurately. The technical complexity of modern NDT systems demands extensive training and ongoing professional development, creating potential bottlenecks in service delivery capacity.

Operational disruptions associated with comprehensive testing procedures can impact production schedules and operational efficiency, leading some operators to minimize testing frequency or scope. Access limitations in offshore or remote locations can complicate testing procedures and increase service delivery costs.

Technology standardization challenges across different testing methodologies and equipment manufacturers can create compatibility issues and complicate data integration efforts. The lack of universal standards for digital NDT systems may hinder seamless integration with existing asset management platforms.

Emerging opportunities in the non-destructive testing market include the development of autonomous inspection systems capable of conducting comprehensive evaluations without human intervention. These systems represent significant potential for reducing operational costs while improving inspection frequency and accuracy, particularly in hazardous or difficult-to-access environments.

Digital integration opportunities exist for companies developing comprehensive asset management platforms that incorporate NDT data with other operational information to provide holistic asset health assessments. The integration of Internet of Things (IoT) technologies with NDT systems enables continuous monitoring capabilities that can revolutionize maintenance strategies.

International expansion presents substantial opportunities as developing markets increase oil and gas infrastructure investments while implementing more stringent safety regulations. Emerging economies are establishing regulatory frameworks that mandate regular NDT inspections, creating new market opportunities for service providers and equipment manufacturers.

Sustainability initiatives are creating demand for specialized testing services that support carbon capture and renewable energy integration projects within the oil and gas sector. The transition toward cleaner energy sources requires comprehensive testing of new infrastructure components and materials.

Market dynamics in the non-destructive testing sector are characterized by the interplay between regulatory requirements, technological innovation, and operational efficiency demands. Regulatory evolution continues to shape market requirements, with authorities implementing more comprehensive inspection mandates and shorter inspection intervals for critical infrastructure components.

Technological convergence is creating new market dynamics as traditional NDT methodologies integrate with digital technologies, artificial intelligence, and advanced data analytics. This convergence is enabling predictive maintenance strategies that optimize inspection schedules based on actual asset condition rather than predetermined time intervals, improving efficiency by approximately 28%.

Competitive pressure is driving service providers to develop differentiated offerings that combine multiple testing methodologies with value-added services such as data analysis, reporting, and maintenance recommendations. Market consolidation trends are evident as larger organizations acquire specialized testing companies to expand service capabilities and geographic reach.

Customer expectations are evolving toward comprehensive solutions that provide actionable insights rather than basic testing results. Organizations increasingly demand integrated platforms that combine NDT data with operational information to support strategic decision-making and risk management initiatives.

Research approach for analyzing the non-destructive testing in oil and gas market employs a comprehensive methodology combining primary research, secondary data analysis, and industry expert consultations. Primary research includes structured interviews with key market participants including NDT service providers, equipment manufacturers, oil and gas operators, and regulatory officials to gather firsthand insights into market trends and challenges.

Secondary research encompasses analysis of industry reports, regulatory documents, company financial statements, and technical publications to establish market baselines and identify growth trends. Data triangulation methods ensure accuracy and reliability of market assessments by cross-referencing information from multiple sources and validating findings through expert review.

Market modeling techniques incorporate quantitative analysis of historical market data, regulatory impact assessments, and technology adoption curves to develop growth projections and market forecasts. Scenario analysis considers various market conditions and regulatory changes to provide comprehensive market outlook assessments.

Quality assurance protocols ensure research accuracy through peer review processes, data validation procedures, and continuous monitoring of market developments that may impact research findings and conclusions.

North America maintains market leadership with approximately 35% market share, driven by extensive pipeline infrastructure, stringent regulatory requirements, and advanced technology adoption rates. The region benefits from mature oil and gas operations requiring comprehensive asset integrity management programs and regular safety inspections mandated by federal and state regulations.

Asia-Pacific represents the fastest-growing regional market with projected growth rates exceeding 9.5% CAGR, supported by expanding oil and gas infrastructure investments, increasing regulatory oversight, and growing emphasis on operational safety. Countries including China, India, and Southeast Asian nations are implementing more comprehensive NDT requirements for energy infrastructure projects.

Europe demonstrates steady market growth driven by aging infrastructure requiring intensive monitoring, environmental regulations demanding comprehensive safety assessments, and technological innovation in NDT methodologies. The region’s focus on sustainability initiatives is creating additional demand for specialized testing services supporting renewable energy integration projects.

Middle East and Africa show significant growth potential as major oil-producing nations implement enhanced safety regulations and invest in infrastructure modernization programs. The region’s strategic importance in global energy markets is driving increased focus on asset integrity management and comprehensive testing programs.

Latin America presents emerging opportunities as countries develop regulatory frameworks requiring regular NDT inspections while expanding oil and gas exploration activities. Infrastructure development projects across the region are creating new demand for comprehensive testing services and advanced NDT technologies.

Market competition in the non-destructive testing sector is characterized by a diverse ecosystem of specialized service providers, equipment manufacturers, and integrated solution developers. Leading companies are focusing on technological innovation, service expansion, and strategic partnerships to strengthen market positions and capture growth opportunities.

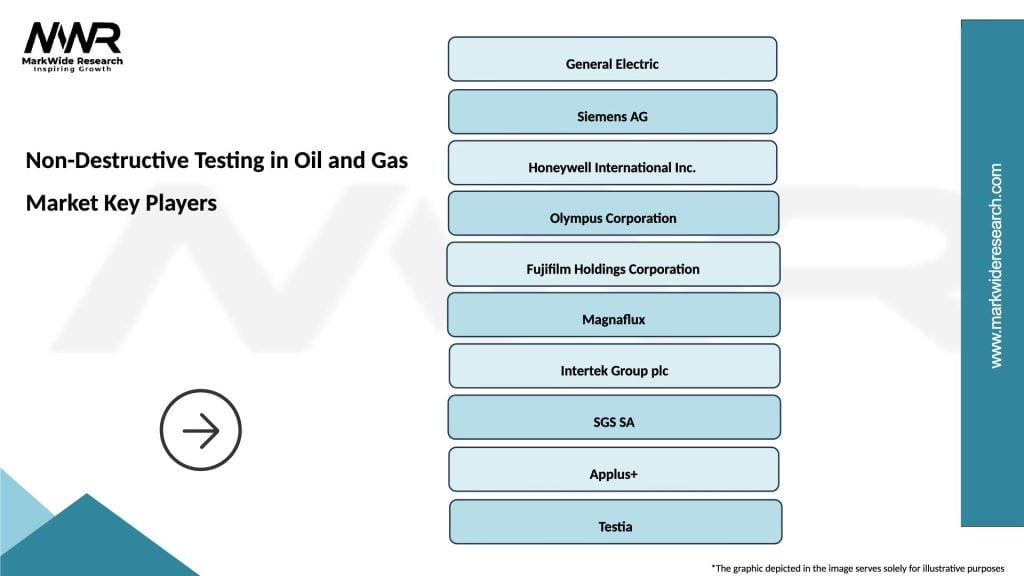

Key market participants include:

Competitive strategies focus on technology differentiation, geographic expansion, and development of integrated service offerings that combine multiple testing methodologies with advanced data analytics capabilities. Strategic partnerships between equipment manufacturers and service providers are becoming increasingly common to deliver comprehensive solutions to oil and gas operators.

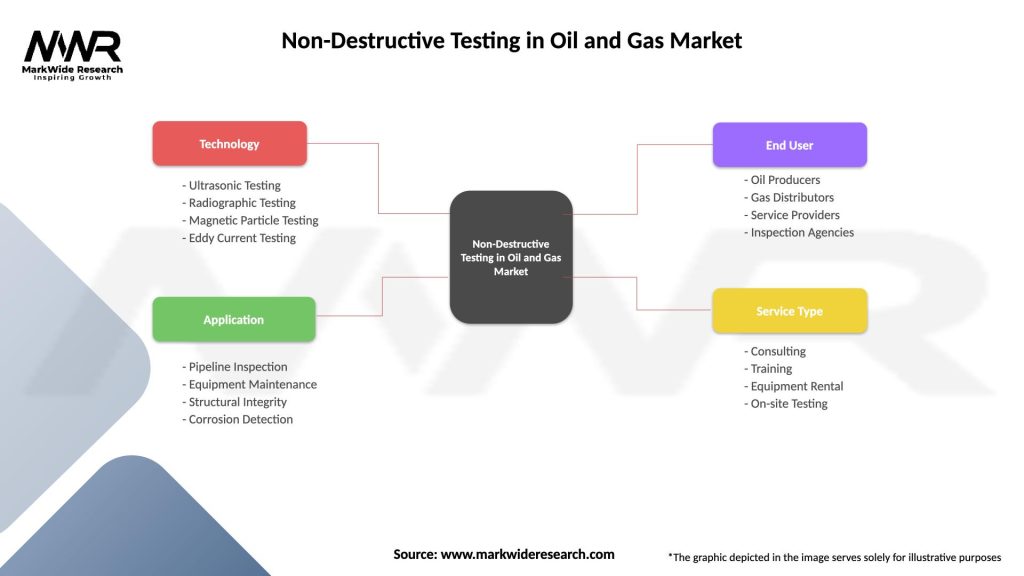

Market segmentation analysis reveals distinct categories based on testing methodology, application area, and service delivery model. By Technology, the market encompasses ultrasonic testing, radiographic testing, magnetic particle testing, liquid penetrant testing, eddy current testing, and visual inspection methodologies, each serving specific applications and material types.

By Application, market segments include:

By Service Model, the market includes in-house testing capabilities, third-party service providers, and hybrid approaches combining internal resources with specialized external expertise. Service delivery models are evolving toward comprehensive asset management partnerships that provide ongoing monitoring and maintenance support.

Ultrasonic Testing represents the largest market segment, accounting for approximately 32% market share due to its versatility, accuracy, and ability to detect internal flaws in various materials. This technology is particularly valuable for thickness measurement and corrosion monitoring in pipeline and storage tank applications.

Radiographic Testing maintains significant market presence despite safety concerns, offering unparalleled capability for detecting internal defects and providing permanent documentation of inspection results. Digital radiography innovations are addressing traditional limitations while maintaining the technology’s core advantages.

Magnetic Particle Testing serves specialized applications in ferromagnetic materials, providing cost-effective detection of surface and near-surface defects. This methodology is particularly valuable for weld inspection and component manufacturing quality assurance.

Eddy Current Testing demonstrates growing adoption for specialized applications including heat exchanger tubing inspection and surface crack detection in non-ferromagnetic materials. Advanced eddy current systems offer enhanced sensitivity and automated data analysis capabilities.

Visual Inspection remains fundamental to comprehensive testing programs, with digital enhancement technologies improving accuracy and documentation capabilities. Remote visual inspection systems are expanding application possibilities in hazardous or difficult-to-access environments.

Operational benefits for oil and gas operators include enhanced safety performance through early detection of potential failures, reduced risk of environmental incidents, and improved regulatory compliance. Predictive maintenance strategies enabled by comprehensive NDT programs can reduce unplanned downtime by approximately 25% while extending asset operational life.

Financial advantages encompass reduced insurance premiums through demonstrated risk management practices, optimized maintenance costs through condition-based scheduling, and avoided costs associated with catastrophic failures or environmental incidents. Asset optimization strategies supported by NDT data can improve operational efficiency and resource allocation.

Regulatory compliance benefits include streamlined inspection documentation, reduced regulatory scrutiny through proactive safety management, and enhanced stakeholder confidence in operational safety practices. Compliance automation systems integrated with NDT platforms can significantly reduce administrative burden.

Stakeholder value creation includes improved investor confidence through demonstrated risk management capabilities, enhanced community relations through environmental protection measures, and strengthened regulatory relationships through proactive compliance initiatives. ESG performance improvements supported by comprehensive testing programs can enhance corporate reputation and market positioning.

Strengths:

Weaknesses:

Opportunities:

Threats:

Digital transformation represents the most significant trend reshaping the non-destructive testing market, with artificial intelligence and machine learning technologies revolutionizing defect detection accuracy and inspection efficiency. Advanced algorithms can now identify potential issues with 95% accuracy, significantly improving upon traditional manual interpretation methods.

Automation integration is driving development of robotic inspection systems capable of conducting comprehensive evaluations in hazardous environments without human intervention. These systems are particularly valuable for offshore applications and confined space inspections where human access is limited or dangerous.

Real-time monitoring capabilities are emerging as organizations seek continuous asset health assessment rather than periodic inspections. IoT-enabled sensors integrated with NDT systems provide ongoing monitoring of critical infrastructure components, enabling immediate response to developing issues.

Data analytics integration is transforming raw inspection data into actionable insights through advanced analytics platforms that combine NDT results with operational data, maintenance history, and environmental factors. Predictive analytics capabilities enable proactive maintenance strategies that optimize resource allocation and minimize operational disruptions.

Sustainability focus is driving demand for testing services that support environmental protection initiatives and corporate responsibility programs. Organizations are implementing more comprehensive testing protocols to prevent environmental incidents and demonstrate commitment to sustainable operations.

Recent developments in the non-destructive testing sector include significant investments in digital inspection technologies by major service providers seeking to enhance service capabilities and operational efficiency. MarkWide Research analysis indicates that leading companies are allocating substantial resources to developing integrated platforms that combine multiple testing methodologies with advanced data analytics.

Regulatory evolution continues to shape industry development, with authorities implementing more comprehensive inspection requirements and shorter inspection intervals for critical infrastructure. International harmonization efforts are creating more consistent standards across different markets, facilitating global service delivery and technology deployment.

Strategic partnerships between equipment manufacturers and service providers are becoming increasingly common as organizations seek to deliver comprehensive solutions that address the full spectrum of customer requirements. These partnerships are enabling development of integrated service offerings that combine equipment supply, training, and ongoing support services.

Technology advancement initiatives include development of portable inspection systems that provide laboratory-quality results in field environments, enabling more frequent and cost-effective testing procedures. Advanced imaging technologies are improving defect visualization and documentation capabilities.

Workforce development programs are addressing skilled labor shortages through enhanced training initiatives, certification programs, and technology solutions that reduce the expertise required for effective NDT implementation. Digital training platforms are improving accessibility and effectiveness of professional development programs.

Strategic recommendations for market participants include prioritizing investment in digital transformation initiatives that integrate artificial intelligence and advanced data analytics with traditional testing methodologies. Organizations should focus on developing comprehensive platforms that provide actionable insights rather than basic inspection results.

Technology adoption strategies should emphasize solutions that enable remote monitoring and automated inspection capabilities, particularly for applications in hazardous or difficult-to-access environments. Investment in IoT-enabled systems can provide competitive advantages through enhanced service capabilities and operational efficiency.

Market expansion opportunities exist in emerging markets where regulatory frameworks are evolving to require more comprehensive NDT inspections. Organizations should consider strategic partnerships with local service providers to establish market presence and navigate regulatory requirements effectively.

Service differentiation strategies should focus on developing integrated offerings that combine multiple testing methodologies with value-added services such as data analysis, maintenance recommendations, and regulatory compliance support. Customer relationship development through comprehensive asset management partnerships can create sustainable competitive advantages.

Workforce development initiatives should address skilled labor shortages through enhanced training programs, technology solutions that reduce expertise requirements, and strategic partnerships with educational institutions. Succession planning programs are essential for maintaining service quality as experienced technicians approach retirement.

Market prospects for non-destructive testing in oil and gas applications remain highly positive, with sustained growth expected across all major market segments and geographic regions. Regulatory trends toward more comprehensive safety requirements and shorter inspection intervals will continue driving demand for advanced testing services and technologies.

Technology evolution will accelerate integration of artificial intelligence, machine learning, and IoT technologies with traditional NDT methodologies, creating new service possibilities and improving inspection accuracy. Autonomous inspection systems are expected to achieve widespread adoption within the next decade, particularly for routine monitoring applications.

Market consolidation trends are likely to continue as larger organizations acquire specialized capabilities and expand geographic reach through strategic acquisitions. This consolidation will create more comprehensive service providers capable of addressing the full spectrum of customer requirements across multiple markets and applications.

Sustainability initiatives will drive increased demand for testing services that support environmental protection and corporate responsibility programs. The transition toward cleaner energy sources will create new testing requirements for carbon capture and renewable energy integration projects within the oil and gas sector.

International expansion opportunities will continue developing as emerging markets implement more stringent regulatory requirements and invest in oil and gas infrastructure development. MWR projections indicate that Asia-Pacific and Latin American markets will experience the strongest growth rates over the forecast period, driven by infrastructure investment and regulatory evolution.

The non-destructive testing in oil and gas market represents a critical and rapidly evolving sector within the global energy industry, characterized by strong growth prospects, technological innovation, and increasing regulatory requirements. Market dynamics are being shaped by the convergence of digital technologies with traditional testing methodologies, creating new opportunities for enhanced accuracy, efficiency, and comprehensive asset management.

Key success factors for market participants include embracing digital transformation initiatives, developing integrated service offerings, and maintaining focus on workforce development to address skilled labor challenges. The market’s future growth will be driven by aging infrastructure requirements, stringent safety regulations, and increasing emphasis on environmental protection and corporate responsibility.

Strategic positioning in this market requires balancing technological innovation with operational excellence, while maintaining the flexibility to adapt to evolving regulatory requirements and customer expectations. Organizations that successfully integrate advanced technologies with comprehensive service capabilities will be best positioned to capture growth opportunities and maintain competitive advantages in this essential market segment.

What is Non-Destructive Testing in Oil and Gas?

Non-Destructive Testing in Oil and Gas refers to a range of techniques used to evaluate the properties of materials, components, or systems without causing damage. This includes methods such as ultrasonic testing, radiographic testing, and magnetic particle testing, which are essential for ensuring safety and integrity in oil and gas operations.

What are the key companies in the Non-Destructive Testing in Oil and Gas Market?

Key companies in the Non-Destructive Testing in Oil and Gas Market include SGS SA, Bureau Veritas, and Intertek Group. These companies provide a variety of testing services and solutions to ensure compliance and safety in the oil and gas sector, among others.

What are the growth factors driving the Non-Destructive Testing in Oil and Gas Market?

The growth of the Non-Destructive Testing in Oil and Gas Market is driven by increasing safety regulations, the need for asset integrity management, and the rising demand for efficient inspection methods. Additionally, advancements in technology are enhancing the effectiveness of testing techniques.

What challenges does the Non-Destructive Testing in Oil and Gas Market face?

Challenges in the Non-Destructive Testing in Oil and Gas Market include the high costs associated with advanced testing equipment and the need for skilled personnel. Furthermore, the complexity of certain materials and structures can complicate testing processes.

What opportunities exist in the Non-Destructive Testing in Oil and Gas Market?

Opportunities in the Non-Destructive Testing in Oil and Gas Market include the growing adoption of automation and digital technologies, which can improve testing efficiency. Additionally, the expansion of renewable energy projects presents new avenues for non-destructive testing applications.

What trends are shaping the Non-Destructive Testing in Oil and Gas Market?

Trends in the Non-Destructive Testing in Oil and Gas Market include the increasing use of drones for remote inspections and the integration of artificial intelligence in data analysis. These innovations are enhancing the accuracy and speed of testing processes.

Non-Destructive Testing in Oil and Gas Market

| Segmentation Details | Description |

|---|---|

| Technology | Ultrasonic Testing, Radiographic Testing, Magnetic Particle Testing, Eddy Current Testing |

| Application | Pipeline Inspection, Equipment Maintenance, Structural Integrity, Corrosion Detection |

| End User | Oil Producers, Gas Distributors, Service Providers, Inspection Agencies |

| Service Type | Consulting, Training, Equipment Rental, On-site Testing |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Non-Destructive Testing in Oil and Gas Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at