444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

The Non Alcoholic Steatohepatitis (NASH) therapeutics and diagnostics market represents a rapidly evolving healthcare sector addressing one of the most pressing liver diseases of the modern era. NASH has emerged as a significant global health concern, affecting millions of individuals worldwide and creating substantial demand for innovative therapeutic solutions and advanced diagnostic technologies. The market encompasses a comprehensive range of pharmaceutical interventions, diagnostic tools, and monitoring systems designed to address the complex pathophysiology of this progressive liver condition.

Market dynamics indicate robust growth potential, with the sector experiencing a compound annual growth rate (CAGR) of approximately 15.2% driven by increasing disease prevalence and advancing medical technologies. The therapeutic segment includes various drug classes such as anti-fibrotic agents, metabolic modulators, and anti-inflammatory compounds, while the diagnostics segment features advanced imaging technologies, biomarker testing, and non-invasive assessment tools.

Regional distribution shows North America maintaining the largest market share at approximately 42%, followed by Europe and Asia-Pacific regions. The market’s expansion is fueled by rising obesity rates, metabolic syndrome prevalence, and growing awareness among healthcare professionals about NASH diagnosis and treatment protocols.

The Non Alcoholic Steatohepatitis therapeutics and diagnostics market refers to the comprehensive healthcare sector focused on developing, manufacturing, and commercializing medical solutions for the diagnosis, treatment, and management of NASH, a progressive form of non-alcoholic fatty liver disease characterized by liver inflammation and damage in individuals who consume little to no alcohol.

This market encompasses pharmaceutical therapeutics designed to address various aspects of NASH pathogenesis, including hepatic steatosis, inflammation, fibrosis, and metabolic dysfunction. Additionally, it includes diagnostic technologies ranging from traditional liver biopsy procedures to innovative non-invasive assessment methods such as elastography, magnetic resonance imaging, and biomarker-based testing platforms.

The therapeutic component involves drug development across multiple mechanisms of action, including insulin sensitizers, lipid metabolism modulators, anti-fibrotic agents, and anti-inflammatory compounds. The diagnostic segment focuses on early detection, disease staging, treatment monitoring, and prognostic assessment tools that enable healthcare providers to deliver personalized patient care.

The NASH therapeutics and diagnostics market stands at a critical juncture, with numerous breakthrough therapies advancing through clinical development pipelines and innovative diagnostic solutions gaining regulatory approval. The market’s growth trajectory reflects the urgent medical need to address NASH, which affects an estimated 3-5% of the global population and represents the fastest-growing indication for liver transplantation in developed countries.

Key market drivers include the rising prevalence of obesity and metabolic syndrome, increasing awareness of NASH among healthcare professionals, and substantial investments in research and development by pharmaceutical companies. The therapeutic landscape is characterized by a diverse pipeline of investigational drugs targeting different aspects of NASH pathophysiology, with several candidates showing promising results in Phase II and Phase III clinical trials.

Diagnostic innovations are revolutionizing NASH assessment, with non-invasive technologies gaining preference over traditional liver biopsy procedures. Advanced imaging modalities, biomarker panels, and artificial intelligence-powered diagnostic tools are enhancing diagnostic accuracy while improving patient comfort and reducing healthcare costs.

Market challenges include regulatory complexities, high development costs, and the need for standardized diagnostic criteria. However, the significant unmet medical need and potential for substantial clinical and economic impact continue to attract investment and drive innovation across the sector.

Strategic market analysis reveals several critical insights shaping the NASH therapeutics and diagnostics landscape:

The NASH therapeutics and diagnostics market is propelled by several powerful drivers that continue to fuel growth and innovation across the sector. Rising obesity prevalence serves as the primary catalyst, with obesity rates increasing globally and directly correlating with NASH incidence. The metabolic syndrome epidemic, characterized by insulin resistance, dyslipidemia, and hypertension, creates a substantial patient population requiring NASH intervention.

Increasing disease awareness among healthcare professionals has significantly improved diagnosis rates and treatment initiation. Medical education initiatives, clinical guidelines, and professional society recommendations have enhanced understanding of NASH pathophysiology and management strategies. This heightened awareness translates into earlier diagnosis and intervention, expanding the addressable market.

Technological advancement in diagnostic capabilities has revolutionized NASH assessment, making diagnosis more accessible and accurate. Advanced imaging technologies, including magnetic resonance elastography and controlled attenuation parameter measurements, provide non-invasive alternatives to liver biopsy. These innovations reduce patient burden while improving diagnostic precision.

Regulatory support from agencies such as the FDA and EMA has created favorable development pathways for NASH therapeutics. Clear regulatory guidance, breakthrough therapy designations, and fast-track approval processes encourage pharmaceutical investment and accelerate time-to-market for innovative treatments.

Investment influx from venture capital, pharmaceutical companies, and government funding agencies has accelerated research and development activities. This financial support enables biotechnology companies to advance promising therapies through expensive clinical trial programs and regulatory approval processes.

Despite significant growth potential, the NASH therapeutics and diagnostics market faces several restraints that challenge market expansion and development timelines. High development costs represent a primary barrier, with NASH drug development requiring extensive clinical trials involving large patient populations and long study durations to demonstrate efficacy and safety.

Regulatory complexity poses ongoing challenges, as NASH drug approval requires demonstration of histological improvement and clinical benefit. The lack of validated surrogate endpoints complicates clinical trial design and extends development timelines. Regulatory agencies continue to refine approval criteria, creating uncertainty for developers.

Diagnostic standardization remains problematic, with variations in diagnostic criteria and assessment methods across different healthcare systems and geographic regions. This lack of standardization complicates clinical trial enrollment, treatment comparisons, and market access strategies.

Limited treatment options currently available create market uncertainty, as no FDA-approved therapies specifically for NASH exist, leading to off-label use of medications developed for other indications. This situation affects physician confidence and patient treatment decisions.

Healthcare reimbursement challenges impact market access, particularly for expensive diagnostic procedures and emerging therapies. Insurance coverage policies vary significantly, affecting patient access to optimal care and limiting market penetration for innovative solutions.

Competition from alternative approaches including lifestyle interventions, bariatric surgery, and treatments for underlying metabolic conditions may limit the addressable market for specific NASH therapeutics.

The NASH therapeutics and diagnostics market presents numerous compelling opportunities for growth and innovation across multiple dimensions. Emerging market expansion offers substantial potential, particularly in Asia-Pacific regions where rising affluence, dietary changes, and lifestyle modifications are increasing NASH prevalence. These markets represent untapped opportunities for both therapeutic and diagnostic solutions.

Combination therapy development represents a significant opportunity, as NASH’s complex pathophysiology may require multi-target approaches. Companies developing complementary mechanisms of action can create synergistic treatment regimens that address different aspects of disease progression simultaneously.

Personalized medicine applications offer opportunities to optimize treatment selection based on patient-specific characteristics, genetic profiles, and disease stage. Biomarker-guided therapy selection and precision diagnostic approaches can improve treatment outcomes while reducing healthcare costs.

Digital health integration presents opportunities to develop comprehensive NASH management platforms combining diagnostic tools, treatment monitoring, and patient engagement solutions. Mobile health applications, telemedicine platforms, and remote monitoring technologies can enhance patient care delivery.

Early-stage intervention opportunities exist in addressing pre-NASH conditions and preventing disease progression. Therapeutic solutions targeting simple steatosis or early fibrosis stages can capture larger patient populations and potentially prevent advanced disease development.

Diagnostic technology advancement continues to create opportunities for improved, cost-effective, and patient-friendly assessment methods. Artificial intelligence applications, point-of-care testing, and home-based monitoring solutions represent emerging opportunities.

The NASH therapeutics and diagnostics market operates within a complex ecosystem of interconnected factors that influence growth patterns, competitive positioning, and innovation trajectories. Supply-side dynamics are characterized by intense research and development activities, with pharmaceutical companies and biotechnology firms investing heavily in novel therapeutic approaches and diagnostic technologies.

Demand-side factors reflect the growing patient population requiring NASH intervention, driven by increasing obesity rates and metabolic syndrome prevalence. Healthcare providers are increasingly recognizing NASH as a significant clinical concern, leading to improved screening practices and treatment initiation rates of approximately 25% annually.

Competitive dynamics involve both established pharmaceutical companies and emerging biotechnology firms competing across different therapeutic targets and diagnostic approaches. The market exhibits characteristics of both collaboration and competition, with strategic partnerships enabling resource sharing while maintaining competitive differentiation.

Innovation cycles in the NASH market are relatively long due to the chronic nature of the disease and regulatory requirements for demonstrating long-term efficacy and safety. However, breakthrough therapy designations and accelerated approval pathways are shortening development timelines for promising candidates.

Market access dynamics vary significantly across different healthcare systems, with reimbursement policies and clinical guidelines influencing adoption patterns. Payers are increasingly focusing on value-based care models that emphasize clinical outcomes and cost-effectiveness.

Technology integration is reshaping market dynamics, with digital health solutions, artificial intelligence, and precision medicine approaches creating new value propositions and competitive advantages for market participants.

Comprehensive market analysis for the NASH therapeutics and diagnostics sector employs a multi-faceted research approach combining primary and secondary data sources to ensure accuracy and reliability. Primary research methodologies include structured interviews with key opinion leaders, healthcare professionals, pharmaceutical executives, and regulatory experts to gather insights on market trends, challenges, and opportunities.

Secondary research components encompass analysis of clinical trial databases, regulatory filings, patent landscapes, and published scientific literature to understand the competitive landscape and innovation pipeline. Financial analysis of public companies, venture capital investments, and licensing agreements provides insights into market valuations and investment trends.

Data validation processes involve cross-referencing multiple sources, expert verification, and statistical analysis to ensure data accuracy and reliability. Market sizing methodologies utilize epidemiological data, treatment patterns, and pricing analysis to develop comprehensive market assessments.

Forecasting models incorporate multiple variables including disease prevalence trends, regulatory approval timelines, competitive dynamics, and healthcare policy changes to project future market scenarios. Sensitivity analysis and scenario planning account for various market conditions and potential disruptions.

Quality assurance measures include peer review processes, expert validation, and continuous data updates to maintain research accuracy and relevance. The methodology ensures comprehensive coverage of all market segments while maintaining analytical rigor and objectivity.

North America dominates the NASH therapeutics and diagnostics market, accounting for approximately 42% of global market share, driven by high disease prevalence, advanced healthcare infrastructure, and substantial research investments. The United States leads regional growth with robust clinical trial activities, regulatory support, and strong pharmaceutical industry presence. Canada contributes significantly through government-funded research initiatives and collaborative healthcare programs.

Europe represents the second-largest market with approximately 28% market share, characterized by strong regulatory frameworks, comprehensive healthcare systems, and active pharmaceutical research. Germany, France, and the United Kingdom lead European market development through clinical excellence centers and innovative diagnostic technologies. The European Medicines Agency’s supportive regulatory environment encourages NASH drug development.

Asia-Pacific emerges as the fastest-growing region with projected growth rates exceeding 18% annually, driven by increasing obesity prevalence, improving healthcare access, and rising awareness of liver diseases. China and Japan represent significant opportunities due to large patient populations and expanding healthcare investments. India and South Korea show promising growth potential through healthcare modernization initiatives.

Latin America demonstrates moderate growth potential with increasing recognition of NASH as a clinical concern. Brazil and Mexico lead regional development through improved diagnostic capabilities and healthcare infrastructure investments. Market growth is supported by rising metabolic syndrome prevalence and expanding healthcare access.

Middle East and Africa represent emerging opportunities with growing healthcare investments and increasing disease awareness. Market development is supported by improving healthcare infrastructure and rising affluence in key countries.

The NASH therapeutics and diagnostics market features a diverse competitive landscape encompassing established pharmaceutical giants, specialized biotechnology companies, and innovative diagnostic technology firms. Market leaders are pursuing various strategic approaches to establish competitive advantages and capture market share.

Competitive strategies include strategic partnerships, licensing agreements, and acquisition activities to access complementary technologies and expand market presence. Companies are investing heavily in clinical development programs while building commercial capabilities for future product launches.

Innovation focus areas include novel therapeutic targets, combination therapies, personalized medicine approaches, and advanced diagnostic technologies that improve patient outcomes while reducing healthcare costs.

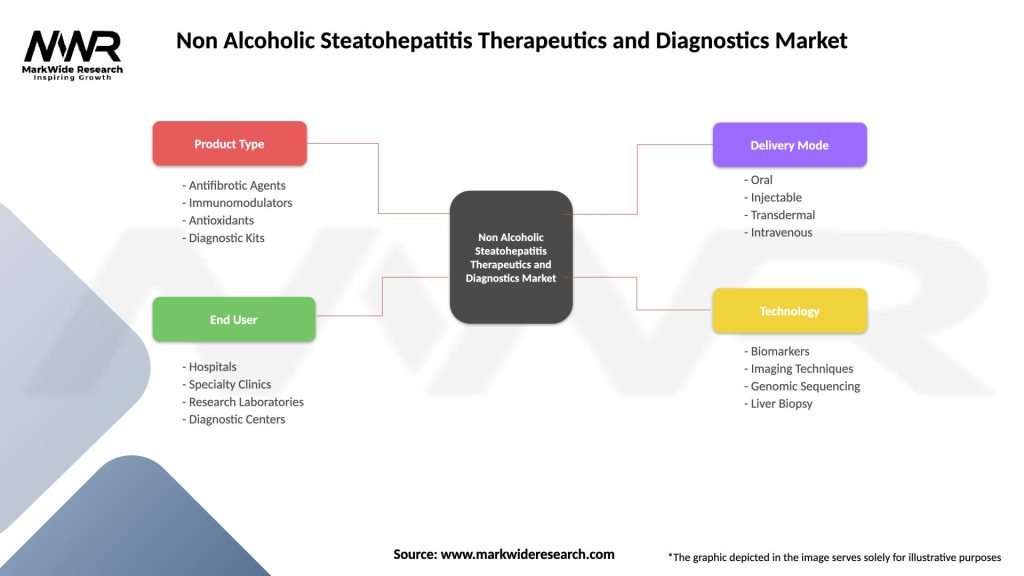

The NASH therapeutics and diagnostics market can be segmented across multiple dimensions to provide comprehensive understanding of market structure and growth opportunities. By product type, the market divides into therapeutics and diagnostics segments, each with distinct characteristics and growth drivers.

Therapeutic Segmentation:

Diagnostic Segmentation:

By End User:

Therapeutic categories within the NASH market demonstrate varying levels of development maturity and commercial potential. Anti-fibrotic agents represent the most advanced therapeutic category, with several candidates in Phase III clinical trials showing promising efficacy in reducing liver fibrosis. This category benefits from established regulatory pathways and clear clinical endpoints.

Metabolic modulators address the underlying causes of NASH by targeting insulin resistance, lipid metabolism, and glucose homeostasis. This category shows strong potential due to the metabolic nature of NASH and the availability of validated therapeutic targets from diabetes and obesity research.

Anti-inflammatory compounds focus on reducing hepatic inflammation and preventing disease progression. While mechanistically attractive, this category faces challenges in demonstrating long-term clinical benefit and differentiation from existing anti-inflammatory therapies.

Diagnostic categories show distinct adoption patterns and growth trajectories. Non-invasive imaging technologies are experiencing rapid adoption due to patient preference and cost-effectiveness compared to liver biopsy. Advanced elastography techniques and MRI-based assessments are gaining market share at approximately 22% annually.

Biomarker-based diagnostics offer convenience and accessibility advantages, with blood-based panels providing comprehensive liver assessment. This category benefits from standardization efforts and integration with electronic health records systems.

Traditional biopsy procedures maintain importance for definitive diagnosis and clinical trial enrollment, despite declining use in routine clinical practice. This category is evolving toward more targeted and efficient sampling techniques.

Pharmaceutical companies participating in the NASH therapeutics market gain access to a large and growing patient population with significant unmet medical need. The market offers substantial revenue potential due to chronic treatment requirements and premium pricing for innovative therapies. First-mover advantages are particularly significant given the current lack of approved NASH-specific treatments.

Biotechnology firms benefit from focused expertise and agility in developing specialized NASH solutions. These companies can leverage partnerships with larger pharmaceutical companies to access resources while maintaining innovation leadership. The market provides opportunities for significant value creation through successful drug development and commercialization.

Diagnostic companies gain from the growing demand for non-invasive assessment methods and the shift toward personalized medicine. Advanced diagnostic technologies command premium pricing while improving patient outcomes and reducing healthcare costs. Technology integration opportunities enable expansion into comprehensive NASH management solutions.

Healthcare providers benefit from improved diagnostic capabilities and treatment options that enhance patient care quality. Non-invasive diagnostic methods reduce patient burden while providing accurate disease assessment. Effective NASH treatments can prevent disease progression and reduce long-term healthcare costs.

Patients gain access to innovative treatments and improved diagnostic methods that offer better outcomes with reduced invasiveness. Early diagnosis and intervention can prevent disease progression and improve quality of life. Personalized treatment approaches optimize therapeutic outcomes while minimizing adverse effects.

Healthcare systems benefit from cost-effective solutions that address a growing disease burden. Effective NASH management can reduce the need for liver transplantation and associated healthcare costs. Prevention-focused approaches offer long-term economic benefits.

Strengths:

Weaknesses:

Opportunities:

Threats:

Non-invasive diagnostic adoption represents the most significant trend reshaping the NASH market landscape. Healthcare providers and patients increasingly prefer advanced imaging technologies and biomarker-based assessments over traditional liver biopsy procedures. This trend is driving innovation in elastography, MRI-based techniques, and blood-based diagnostic panels that provide comprehensive liver assessment without invasive procedures.

Combination therapy development is emerging as a key trend, with pharmaceutical companies recognizing that NASH’s complex pathophysiology may require multi-target therapeutic approaches. Companies are developing complementary mechanisms of action that can be combined to address different aspects of disease progression simultaneously, potentially improving efficacy while managing safety profiles.

Personalized medicine integration is gaining momentum through biomarker-guided therapy selection and precision diagnostic approaches. Companies are developing companion diagnostics and patient stratification strategies to optimize treatment selection based on individual patient characteristics, genetic profiles, and disease stage.

Digital health transformation is revolutionizing NASH management through comprehensive platforms that integrate diagnostic tools, treatment monitoring, and patient engagement solutions. Mobile health applications, telemedicine platforms, and remote monitoring technologies are enhancing care delivery while improving patient outcomes.

Regulatory pathway optimization continues to evolve, with agencies providing clearer guidance for NASH drug development and approval. Breakthrough therapy designations, accelerated approval pathways, and adaptive clinical trial designs are shortening development timelines for promising candidates.

Market consolidation activities are increasing through strategic partnerships, licensing agreements, and acquisition activities as companies seek to access complementary technologies and expand market presence.

Recent regulatory milestones have significantly impacted the NASH therapeutics landscape, with the FDA providing updated guidance on clinical trial design and approval pathways. Breakthrough therapy designations have been granted to several promising candidates, accelerating development timelines and providing regulatory support for innovation.

Clinical trial achievements include positive Phase III results for multiple therapeutic candidates, demonstrating significant improvements in liver histology and fibrosis reduction. These results have validated therapeutic approaches and increased investor confidence in the market potential.

Strategic partnerships between pharmaceutical companies and biotechnology firms have accelerated development programs while sharing risks and resources. Notable collaborations include licensing agreements for novel therapeutic targets and joint development programs for combination therapies.

Diagnostic technology launches have introduced advanced non-invasive assessment methods that improve diagnostic accuracy while reducing patient burden. MarkWide Research analysis indicates that these innovations are driving market adoption and changing clinical practice patterns.

Investment activities have reached record levels, with venture capital funding and pharmaceutical industry investments supporting numerous NASH-focused companies. These investments are enabling clinical trial advancement and commercial preparation activities.

Regulatory approvals for diagnostic technologies have expanded treatment monitoring capabilities and improved patient management. Advanced imaging systems and biomarker panels have received regulatory clearance in major markets.

Market access developments include improved reimbursement coverage for NASH diagnostic procedures and treatment monitoring, enhancing patient access to innovative care solutions.

Strategic recommendations for market participants emphasize the importance of diversified development approaches and strategic partnerships to navigate the complex NASH market landscape. Pharmaceutical companies should consider combination therapy strategies that address multiple aspects of NASH pathophysiology while building comprehensive clinical development programs that demonstrate both histological improvement and clinical benefit.

Investment prioritization should focus on therapeutic approaches with clear regulatory pathways and validated mechanisms of action. Companies should balance innovation with development risk by pursuing both novel targets and established pathways with differentiated approaches. Portfolio diversification across different therapeutic categories can mitigate development risks while maximizing market opportunities.

Diagnostic companies should prioritize non-invasive technologies that provide comprehensive liver assessment while integrating digital health capabilities. MWR analysis suggests that companies combining diagnostic accuracy with patient convenience and cost-effectiveness will achieve the strongest market positions.

Market access strategies should emphasize value-based care models that demonstrate clinical outcomes and cost-effectiveness. Companies should engage with payers early in development to understand reimbursement requirements and develop appropriate health economic evidence.

Geographic expansion strategies should prioritize emerging markets with growing NASH prevalence and improving healthcare infrastructure. Asia-Pacific markets offer significant opportunities for companies with appropriate regulatory and commercial capabilities.

Technology integration recommendations include developing comprehensive NASH management platforms that combine diagnostics, therapeutics, and patient monitoring capabilities. Digital health solutions can create competitive advantages while improving patient outcomes.

The NASH therapeutics and diagnostics market is positioned for substantial growth over the next decade, driven by increasing disease prevalence, advancing therapeutic options, and improving diagnostic capabilities. Market projections indicate continued expansion at a compound annual growth rate exceeding 16% through 2030, supported by multiple drug approvals and diagnostic technology adoption.

Therapeutic landscape evolution will be characterized by the approval of first-generation NASH-specific treatments, followed by improved second-generation therapies and combination approaches. The market will likely see multiple approved treatments addressing different aspects of disease progression, creating a diverse therapeutic armamentarium for healthcare providers.

Diagnostic transformation will continue toward non-invasive assessment methods, with advanced imaging technologies and biomarker panels becoming standard practice. Artificial intelligence integration will enhance diagnostic accuracy and enable personalized treatment selection, improving patient outcomes while reducing healthcare costs.

Regional market development will see continued North American leadership while Asia-Pacific markets experience the highest growth rates. Emerging markets will become increasingly important as healthcare infrastructure improves and disease awareness increases.

Innovation trends will focus on precision medicine approaches, digital health integration, and prevention-focused strategies. Companies will develop comprehensive solutions that address the entire NASH care continuum from early detection through advanced treatment.

Market maturation will bring increased competition, pricing pressures, and consolidation activities. Successful companies will differentiate through clinical outcomes, patient convenience, and cost-effectiveness while building strong commercial capabilities.

The Non Alcoholic Steatohepatitis therapeutics and diagnostics market represents one of the most promising healthcare sectors, addressing a significant unmet medical need with substantial growth potential. The market’s evolution from an underrecognized condition to a major clinical focus reflects the urgent need for innovative solutions to address the growing NASH epidemic.

Market fundamentals remain strong, supported by increasing disease prevalence, advancing therapeutic pipelines, and improving diagnostic technologies. The convergence of regulatory support, investment interest, and clinical innovation creates favorable conditions for continued market expansion and value creation.

Success factors for market participants include strategic focus on validated therapeutic targets, development of comprehensive solutions that address multiple aspects of NASH management, and building strong commercial capabilities for global market access. Companies that effectively combine innovation with execution will capture the greatest market opportunities.

The future landscape will be characterized by approved therapeutic options, advanced diagnostic capabilities, and integrated care solutions that improve patient outcomes while reducing healthcare costs. MarkWide Research projects that the market will continue its robust growth trajectory, driven by ongoing innovation and expanding global recognition of NASH as a critical healthcare priority requiring comprehensive intervention strategies.

What is Non Alcoholic Steatohepatitis?

Non Alcoholic Steatohepatitis (NASH) is a liver condition characterized by inflammation and damage caused by the accumulation of fat in the liver, not due to alcohol consumption. It can lead to serious liver diseases, including cirrhosis and liver cancer, making its diagnosis and treatment critical.

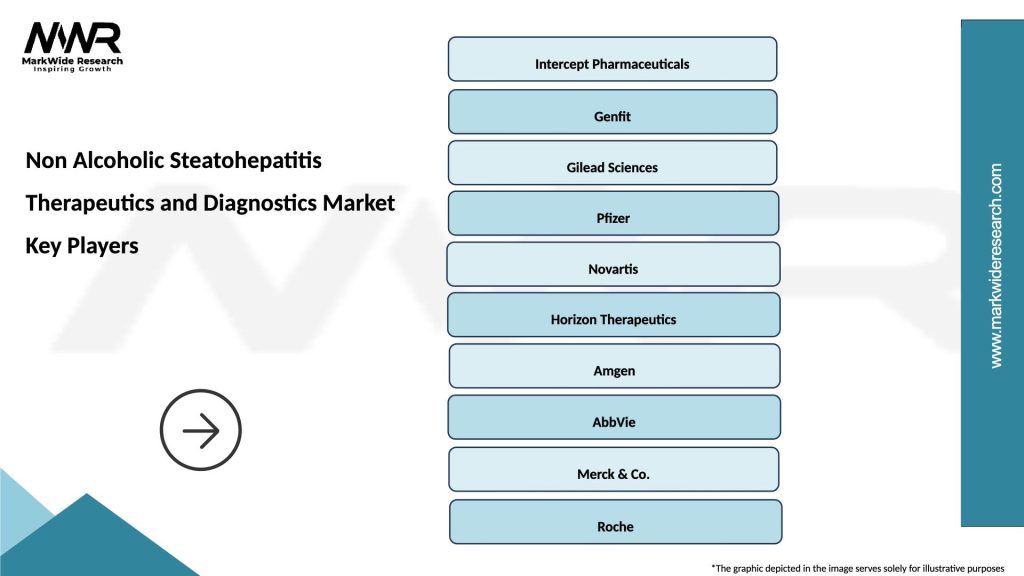

What are the key players in the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market?

Key players in the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market include Intercept Pharmaceuticals, Gilead Sciences, and Novo Nordisk, among others. These companies are involved in developing innovative therapies and diagnostic tools to address NASH.

What are the growth factors driving the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market?

The growth of the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market is driven by the increasing prevalence of obesity and diabetes, rising awareness about liver diseases, and advancements in diagnostic technologies. Additionally, the demand for effective treatment options is propelling market expansion.

What challenges does the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market face?

The Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market faces challenges such as the complexity of NASH diagnosis, the need for more effective treatment options, and regulatory hurdles in drug approval processes. These factors can hinder market growth and innovation.

What opportunities exist in the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market?

Opportunities in the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market include the development of novel therapies targeting NASH, increased investment in research and development, and the potential for partnerships between pharmaceutical companies and research institutions. These factors can enhance treatment options and improve patient outcomes.

What trends are shaping the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market?

Trends shaping the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market include the rise of personalized medicine, the integration of digital health technologies for monitoring, and a focus on non-invasive diagnostic methods. These trends are expected to improve patient management and treatment efficacy.

Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market

| Segmentation Details | Description |

|---|---|

| Product Type | Antifibrotic Agents, Immunomodulators, Antioxidants, Diagnostic Kits |

| End User | Hospitals, Specialty Clinics, Research Laboratories, Diagnostic Centers |

| Delivery Mode | Oral, Injectable, Transdermal, Intravenous |

| Technology | Biomarkers, Imaging Techniques, Genomic Sequencing, Liver Biopsy |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Non Alcoholic Steatohepatitis Therapeutics and Diagnostics Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at