444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$3450

Market Overview

The nitrogen market plays a vital role in various industries worldwide. Nitrogen is a chemical element that exists abundantly in the Earth’s atmosphere, comprising approximately 78% of the air we breathe. It is a key component in many industrial processes, including fertilizers, chemicals, pharmaceuticals, and electronics. The global nitrogen market is characterized by steady growth, driven by increasing demand across diverse sectors.

Meaning

Nitrogen is a non-reactive and odorless gas that is crucial for various applications. In its purest form, nitrogen is used extensively in the production of ammonia, which serves as a primary component for manufacturing fertilizers. Additionally, nitrogen gas is widely utilized for inerting purposes in industries such as food packaging, oil and gas, and pharmaceuticals. The ability of nitrogen to displace oxygen helps prevent spoilage, oxidation, and combustion.

Executive Summary

The nitrogen market has witnessed significant growth over the years, primarily driven by the rising global population and the subsequent need for increased agricultural productivity. The demand for nitrogen-based fertilizers has surged due to the need to meet food requirements, driving the market forward. Furthermore, the chemical industry’s expanding applications and the growth of electronics manufacturing contribute to the overall market growth.

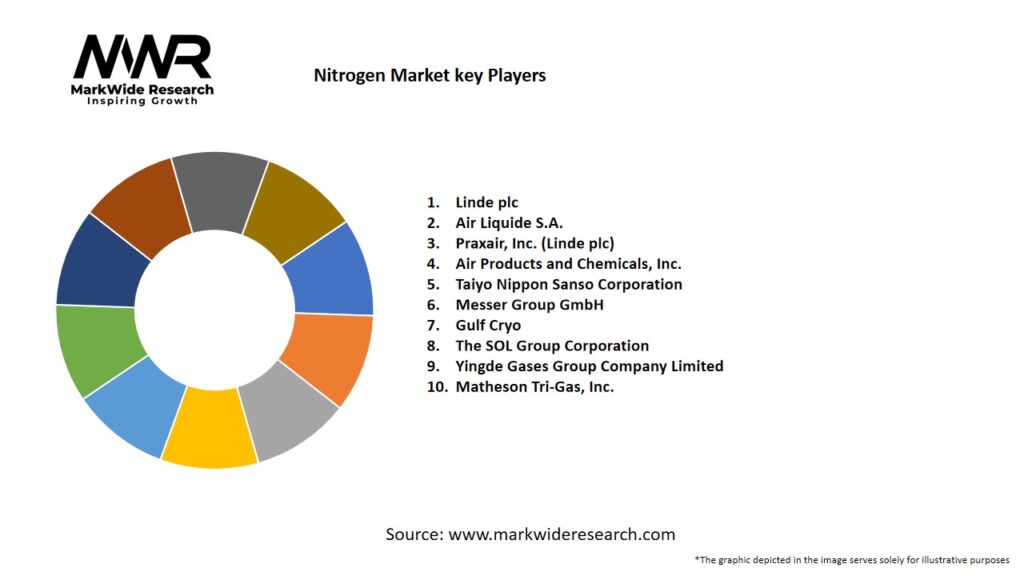

Important Note: The companies listed in the image above are for reference only. The final study will cover 18–20 key players in this market, and the list can be adjusted based on our client’s requirements.

Key Market Insights

Global nitrogen production capacity exceeds 180 million tonnes per year of ammonia equivalent, with fertilizer applications accounting for nearly 80% of consumption.

The Asia-Pacific region dominates nitrogen demand, driven by large-scale agriculture and rapid industrial growth; China alone consumes over 50 million tonnes of ammonia annually.

Manufacturers are adopting renewable-powered electrolysis routes to produce “green ammonia,” reducing reliance on fossil-derived hydrogen and lowering greenhouse gas emissions.

On-site nitrogen generators (membrane and PSA systems) are gaining traction in industrial sectors to ensure consistent supply and cut logistic costs.

Stringent environmental regulations on NOₓ emissions and ammonia slip are prompting end-users to invest in scrubbers, catalyzers, and zero-liquid discharge systems.

Market Drivers

Agricultural Demand: Rising global food consumption necessitates increased fertilizer use; nitrogen-based fertilizers (urea, ammonium nitrate) remain critical for crop yields.

Industrial Applications: Growth in chemical manufacturing, oil & gas processing, electronics (semiconductor manufacturing), and metal fabrication boosts demand for high-purity nitrogen gas.

Energy Transition: The pursuit of green hydrogen and ammonia for energy storage and shipping fuel drives investments in zero-carbon nitrogen production pathways.

On-site Generation: Industries prefer PSAs and membrane systems for reliable nitrogen supply, cost savings, and reduced logistical complexity.

Regulatory Compliance: Emission controls and safety standards compel petrochemical and manufacturing plants to incorporate nitrogen blanketing and inerting to prevent fires, oxidation, and explosions.

Market Restraints

High Energy Costs: Conventional ammonia synthesis via Haber-Bosch is energy-intensive, making nitrogen derivatives sensitive to fluctuations in natural gas prices.

Capital Expenditure: Large-scale air separation and ammonia plants require substantial upfront investment and long lead times, deterring new entrants.

Infrastructure Limitations: In emerging markets, inadequate pipeline and storage facilities constrain distribution of liquid and gaseous nitrogen products.

Environmental Concerns: Fertilizer runoff leading to water eutrophication, and NOₓ emissions from plants pose environmental challenges and can result in stricter regulations.

Feedstock Volatility: Dependence on natural gas or coal as feedstocks for ammonia production creates vulnerability to geopolitical and market volatility.

Market Opportunities

Green Ammonia Projects: Expansion of electrolysis and renewable energy integration to produce zero-carbon ammonia, opening markets for carbon-neutral fertilizers and fuels.

Advanced Fertilizer Formulations: Development of controlled-release and nitrogen-stabilized fertilizers to improve nutrient use efficiency and reduce environmental impact.

Modular On-site Generators: Compact PSA/membrane units enable SMEs and remote facilities to generate nitrogen without reliance on third-party suppliers.

Carbon Capture Integration: Retrofitting existing ammonia plants with carbon capture, utilization, and storage (CCUS) technologies can decarbonize legacy assets.

Value-added Chemicals: Diversification into nitrile rubbers, explosives, and specialty chemicals that utilize ammonia or nitric acid as feedstocks.

Market Dynamics

Technological Innovation: Continuous R&D drives improvements in catalyst efficiency, reactor design, and membrane selectivity, lowering energy consumption per tonne of output.

Strategic Alliances: Partnerships between energy companies, technology providers, and research institutes accelerate commercialization of green ammonia and advanced nitrogen products.

Supply Chain Resilience: Geopolitical tensions and pandemic-induced disruptions highlight the importance of local production and multiple supply routes.

Regulatory Evolution: Carbon pricing, fertilizer application restrictions, and emissions standards are reshaping investment priorities and operational practices.

Market Consolidation: Mergers and acquisitions among major chemical companies streamline portfolios and achieve economies of scale in nitrogen production and distribution.

Regional Analysis

Asia-Pacific: The largest and fastest-growing market, driven by China and India’s fertilizer consumption and emerging green ammonia projects in Australia.

North America: Mature market with established ammonia and nitrogen gas infrastructure; growth centered on specialty gas applications and on-site generation.

Europe: Focus on decarbonization, circular economy, and strict environmental regulations; increasing pilot and commercial green ammonia projects in Scandinavia.

Middle East & Africa: Abundant natural gas reserves underpin large ammonia export terminals; investment in downstream urea and nitrates plants expanding fertilizer trade.

Latin America: Agricultural expansion in Brazil and Argentina fuels nitrogen fertilizer demand; infrastructure upgrades are needed to optimize distribution.

Competitive Landscape

Leading Companies in the Nitrogen Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

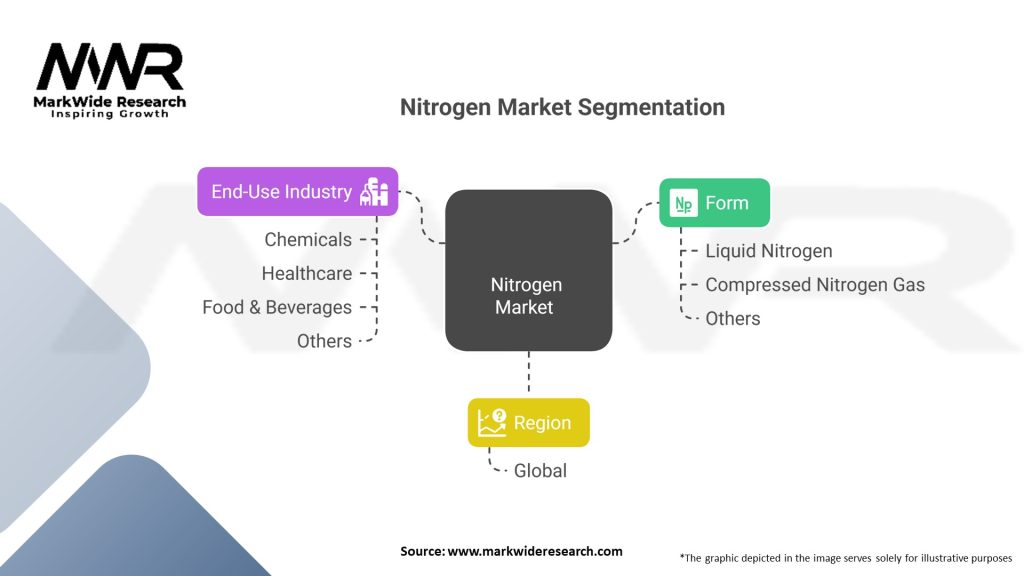

Segmentation

Product Type: Ammonia, Urea, Urea Ammonium Nitrate (UAN), Ammonium Nitrate, Nitrogen Gas (bulk, cylinder, on-site).

Technology: Haber-Bosch Synthesis, PSA/Membrane Separation, Cryogenic Distillation, Electrochemical Ammonia Synthesis.

Application: Fertilizers, Industrial Gases, Chemicals & Petrochemicals, Electronics & Semiconductors, Food & Beverage Packaging, Pharmaceuticals.

End-User: Agriculture, Chemical Manufacturing, Oil & Gas, Electronics Manufacturing, Healthcare, Metal Fabrication.

Category-wise Insights

Fertilizer-grade Ammonia & Derivatives: Core market segment, focusing on large-scale plant expansions, nutrient efficiency technologies, and environmental stewardship.

Industrial-grade Nitrogen Gas: Supplied via ASUs, canisters, and on-site systems for inerting, purging, and blanketing in chemical and oil & gas sectors.

Specialty Gases & Ultra-High Purity: N₆.₀–N₈.₀ purity grades for semiconductor fabrication, laser cutting, and analytical instrumentation.

Green Ammonia: Emerging sub-segment using renewable electricity and electrolytic hydrogen, targeting fertilizer, shipping fuel, and long-term energy storage applications.

Key Benefits for Industry Participants and Stakeholders

Cost Efficiency: On-site generation reduces transportation costs and ensures uninterrupted supply.

Sustainability: Transition to green ammonia and carbon capture aligns with corporate ESG goals and regulatory mandates.

Yield Optimization: Advanced fertilizers and digital agronomy services help farmers maximize crop productivity while minimizing environmental impact.

Process Safety: Nitrogen inerting and blanketing protect facilities from fire and explosion risks, enhancing operational reliability.

Value Chain Integration: Vertically integrated producers capture margin across feedstock procurement, synthesis, downstream processing, and marketing.

SWOT Analysis

Strengths:

Established global infrastructure and supply networks.

Technological leadership in ammonia synthesis and gas separation.

Critical role in food security and industrial operations.

Weaknesses:

High energy intensity and carbon footprint of conventional processes.

Vulnerability to feedstock price fluctuations.

Capital-heavy nature of large-scale plants.

Opportunities:

Scale-up of renewable-powered green ammonia.

Development of precision agriculture and controlled-release fertilizers.

Digitalization of production and distribution processes.

Threats:

Stricter emission regulations and carbon pricing.

Competition from alternative fertilizers (e.g., bio-fertilizers).

Geopolitical instability affecting feedstock and trading routes.

Market Key Trends

Green Ammonia Commercialization: Pilot projects evolving into multi-megaton plants powered by wind and solar, aimed at low-carbon fertilizer and shipping fuel markets.

Digital Farming Integration: IoT-enabled fertilization tools and data analytics optimize nitrogen application rates, reducing waste and environmental runoff.

Modular Nitrogen Generation: Plug-and-play PSA/membrane units for mid-scale industrial users improving supply chain flexibility.

Circular Economy Models: Ammonia as an energy carrier in hydrogen value chains and as a feedstock for synthetic fuels and chemicals.

Enhanced Environmental Controls: Deployment of SCR (Selective Catalytic Reduction) systems and NOₓ abatement technologies at ammonia and nitric acid plants.

Covid-19 Impact

The Covid-19 pandemic caused temporary disruptions in supply chains, logistics, and workforce availability at nitrogen production facilities. While fertilizer demand remained resilient—supported by government stimulus and classification of agriculture as an essential sector—industrial gas consumption dipped in manufacturing and energy sectors during lockdowns. Post-pandemic recovery has been strong, with renewed emphasis on supply chain resilience, on-site generation, and diversification of feedstocks.

Key Industry Developments

Green Ammonia Partnerships: Major energy firms collaborating with renewable developers to build integrated projects combining electrolysis, renewable power, and ammonia synthesis.

Digital Twins & AI: Adoption of advanced process control software and digital twins in ammonia plants to optimize yield, reduce downtime, and predict maintenance needs.

Circular Nitrogen Initiatives: Research consortia exploring ammonia cracking and hydrogen extraction for on-demand fuel, closing the loop on nitrogen as an energy vector.

Analyst Suggestions

Accelerate Green Investments: Prioritize capital allocation toward renewable hydrogen and ammonia projects to pre-empt carbon pricing impacts.

Enhance Agri-Digital Services: Bundle fertilizers with precision agronomy apps and advisory services to improve farmer outcomes and foster loyalty.

Strengthen Local Supply Chains: Develop regional on-site nitrogen generation and storage hubs to mitigate geopolitical and logistic risks.

Engage in Policy Dialogues: Collaborate with regulators on feasible emissions targets, incentive structures for clean ammonia, and sustainable fertilizer use guidelines.

Future Outlook

The Nitrogen Market is set to evolve rapidly over the next decade, balancing traditional ammonia and gas applications with emerging clean-tech innovations. As decarbonization imperatives intensify, green ammonia will transition from niche pilots to mainstream production, reshaping fertilizer markets and creating novel energy storage pathways. On-site nitrogen generation will proliferate among industrial users seeking autonomy and cost control. Overall, the sector will witness deeper digital integration, tighter environmental controls, and a shift toward circular nitrogen economies.

Conclusion

In conclusion, the Nitrogen Market occupies a central role in global food security, industrial processes, and the emerging low-carbon energy landscape. While conventional production remains entrenched, the twin pressures of climate change and energy transition are catalyzing profound technological shifts toward green ammonia, precision fertilizers, and modular gas generation. Stakeholders who embrace innovation, sustainability, and digitalization will secure competitive advantage and help steer the market toward a more resilient and environmentally responsible future.

What is Nitrogen?

Nitrogen is a colorless, odorless gas that makes up a significant portion of the Earth’s atmosphere. It is essential for various applications, including fertilizers in agriculture, industrial processes, and the production of ammonia.

What are the key companies in the Nitrogen Market?

Key companies in the Nitrogen Market include CF Industries, Yara International, Nutrien, and Air Products and Chemicals, among others.

What are the main drivers of the Nitrogen Market?

The main drivers of the Nitrogen Market include the increasing demand for fertilizers in agriculture, the growth of the food production industry, and the rising need for nitrogen in various industrial applications.

What challenges does the Nitrogen Market face?

The Nitrogen Market faces challenges such as environmental regulations regarding emissions, the volatility of raw material prices, and competition from alternative fertilizers.

What opportunities exist in the Nitrogen Market?

Opportunities in the Nitrogen Market include advancements in nitrogen fixation technologies, the development of sustainable fertilizers, and the expansion of nitrogen applications in the energy sector.

What trends are shaping the Nitrogen Market?

Trends shaping the Nitrogen Market include the increasing focus on sustainable agricultural practices, innovations in nitrogen production methods, and the integration of digital technologies in fertilizer management.

Nitrogen Market

| Segmentation Details | Details |

|---|---|

| Form | Liquid Nitrogen, Compressed Nitrogen Gas, Others |

| End-Use Industry | Chemicals, Healthcare, Food & Beverages, Others |

| Region | Global |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading Companies in the Nitrogen Market:

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

North America

o US

o Canada

o Mexico

Europe

o Germany

o Italy

o France

o UK

o Spain

o Denmark

o Sweden

o Austria

o Belgium

o Finland

o Turkey

o Poland

o Russia

o Greece

o Switzerland

o Netherlands

o Norway

o Portugal

o Rest of Europe

Asia Pacific

o China

o Japan

o India

o South Korea

o Indonesia

o Malaysia

o Kazakhstan

o Taiwan

o Vietnam

o Thailand

o Philippines

o Singapore

o Australia

o New Zealand

o Rest of Asia Pacific

South America

o Brazil

o Argentina

o Colombia

o Chile

o Peru

o Rest of South America

The Middle East & Africa

o Saudi Arabia

o UAE

o Qatar

o South Africa

o Israel

o Kuwait

o Oman

o North Africa

o West Africa

o Rest of MEA

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at