444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria data center power market represents a critical infrastructure segment experiencing unprecedented growth as the country’s digital transformation accelerates. Nigeria’s position as Africa’s largest economy and most populous nation has created substantial demand for reliable data center power solutions. The market encompasses uninterruptible power supply systems, generators, power distribution units, and energy management solutions specifically designed for data center environments.

Market dynamics indicate robust expansion driven by increasing internet penetration, cloud adoption, and digital banking services across Nigeria. The country’s data center power infrastructure is evolving rapidly, with annual growth rates exceeding regional averages. Power reliability challenges in Nigeria have paradoxically created opportunities for advanced data center power solutions, as organizations seek to ensure continuous operations despite grid instabilities.

Investment patterns show significant capital flowing into power infrastructure projects, with international and domestic players recognizing Nigeria’s potential. The market benefits from government initiatives promoting digital economy development and foreign direct investment in technology infrastructure. Regional distribution shows Lagos and Abuja accounting for approximately 75% of market activity, though secondary cities are emerging as growth centers.

The Nigeria data center power market refers to the comprehensive ecosystem of power generation, distribution, and management solutions specifically designed to support data center operations across Nigeria. This market encompasses all electrical infrastructure components required to maintain continuous, reliable power supply to data centers, including primary power systems, backup power solutions, power conditioning equipment, and intelligent power management platforms.

Core components include diesel generators, uninterruptible power supply systems, power distribution units, automatic transfer switches, and energy monitoring systems. The market also covers specialized services such as power system design, installation, maintenance, and optimization. Critical importance stems from Nigeria’s power grid challenges, making robust data center power infrastructure essential for digital service continuity and economic development.

Nigeria’s data center power market demonstrates exceptional growth potential driven by accelerating digitalization and increasing demand for reliable computing infrastructure. The market landscape reflects a complex interplay between power grid challenges and technological advancement opportunities. Key growth drivers include expanding telecommunications networks, growing e-commerce adoption, and increasing cloud service deployment across various sectors.

Market segmentation reveals diverse applications spanning telecommunications, financial services, government, and emerging technology sectors. Power capacity requirements range from small-scale edge computing facilities to large hyperscale data centers. Technology adoption shows increasing preference for energy-efficient solutions and hybrid power systems combining grid, generator, and renewable energy sources.

Competitive dynamics feature both international technology providers and local system integrators, creating a balanced ecosystem. Investment trends indicate growing confidence in Nigeria’s long-term digital infrastructure potential, with capacity expansion projects showing annual growth rates above regional benchmarks. Regulatory support through favorable policies and infrastructure development initiatives continues strengthening market foundations.

Strategic insights reveal several critical factors shaping Nigeria’s data center power market development:

Primary market drivers propelling Nigeria’s data center power market growth encompass technological, economic, and regulatory factors. Digital transformation initiatives across public and private sectors create substantial demand for reliable data center infrastructure. The country’s young, tech-savvy population drives increasing internet usage and digital service adoption, requiring robust supporting infrastructure.

Telecommunications expansion represents a major growth catalyst, with mobile network operators investing heavily in 4G and 5G infrastructure requiring sophisticated data center support. Financial sector digitalization accelerates demand as banks and fintech companies expand digital services. Government e-governance initiatives and smart city projects contribute additional demand for secure, reliable data center power solutions.

Economic factors include Nigeria’s position as Africa’s largest economy and growing middle class with increasing digital service consumption. Foreign investment in technology infrastructure brings international expertise and capital, accelerating market development. Cloud service adoption by enterprises seeking operational efficiency and scalability drives data center expansion and corresponding power infrastructure requirements.

Regulatory support through favorable policies for technology investment and infrastructure development creates enabling environment. Power sector reforms and grid modernization efforts, while addressing broader challenges, create opportunities for specialized data center power solutions. International connectivity improvements through submarine cable projects increase Nigeria’s attractiveness for regional data center investments.

Significant challenges constrain Nigeria’s data center power market development despite strong growth potential. Power grid instability creates operational complexities and increases infrastructure costs, as data centers require sophisticated backup power systems and redundancy measures. Frequent power outages and voltage fluctuations necessitate substantial investment in power conditioning and protection equipment.

High capital requirements for data center power infrastructure present barriers, particularly for smaller operators and local companies. Import dependencies for advanced power equipment create cost pressures and supply chain vulnerabilities. Currency fluctuations and foreign exchange challenges affect equipment procurement and project financing, impacting market growth rates.

Technical skills shortages in specialized data center power systems limit market expansion capabilities. Maintenance challenges arise from limited local service capabilities for advanced power equipment, increasing operational costs and downtime risks. Regulatory complexities and bureaucratic processes can delay project implementations and increase development costs.

Security concerns regarding critical infrastructure protection create additional compliance and operational requirements. Environmental factors including extreme weather conditions and dust require specialized equipment specifications, increasing costs. Limited access to long-term financing for infrastructure projects constrains expansion capabilities for many market participants.

Substantial opportunities exist within Nigeria’s data center power market as digital infrastructure demand accelerates. Edge computing expansion creates demand for distributed data center power solutions across secondary cities and rural areas. Growing adoption of Internet of Things applications and smart city initiatives generates requirements for localized data processing capabilities.

Renewable energy integration presents significant opportunities as organizations seek sustainable power solutions. Solar power adoption for data centers gains traction due to Nigeria’s abundant solar resources and declining technology costs. Hybrid power systems combining grid, generator, and renewable sources offer compelling value propositions for cost-conscious operators.

Government digitalization initiatives create substantial market opportunities across education, healthcare, and public service sectors. Financial inclusion programs drive demand for secure data center infrastructure supporting digital banking and payment systems. Growing e-commerce sector requires robust logistics and payment processing infrastructure.

Regional hub potential positions Nigeria as a strategic location for serving West African markets, attracting international data center investments. Submarine cable investments improve international connectivity, enhancing Nigeria’s attractiveness for regional data center operations. Technology partnerships between international providers and local companies create opportunities for knowledge transfer and market development.

Complex market dynamics shape Nigeria’s data center power landscape through interconnected technological, economic, and regulatory forces. Supply-demand imbalances create pricing pressures and capacity constraints, particularly during peak demand periods. Market maturation brings increasing sophistication in power management requirements and service expectations.

Competitive pressures drive innovation and service differentiation among power solution providers. Technology evolution toward more efficient and intelligent power systems creates both opportunities and challenges for market participants. According to MarkWide Research analysis, market dynamics indicate accelerating adoption of advanced power management technologies.

Customer behavior patterns show increasing emphasis on total cost of ownership rather than initial capital costs. Service level expectations continue rising as organizations become more dependent on digital infrastructure. Market consolidation trends emerge as larger players acquire specialized capabilities and smaller operators seek strategic partnerships.

Regulatory evolution influences market dynamics through changing compliance requirements and infrastructure standards. International standards adoption drives market professionalization and quality improvements. Economic fluctuations impact investment patterns and project timing, creating cyclical demand variations.

Comprehensive research methodology employed for Nigeria data center power market analysis combines primary and secondary research approaches. Primary research includes structured interviews with industry executives, technology providers, data center operators, and government officials. Survey data collection from market participants provides quantitative insights into market trends, challenges, and opportunities.

Secondary research encompasses analysis of industry reports, government publications, regulatory documents, and company financial statements. Market data validation through multiple sources ensures accuracy and reliability of findings. Technical analysis of power system specifications and performance metrics provides detailed market understanding.

Stakeholder engagement includes consultations with equipment manufacturers, system integrators, consulting firms, and end-user organizations. Regional analysis covers major metropolitan areas and emerging secondary markets across Nigeria. Market sizing and forecasting utilize statistical modeling and trend analysis methodologies.

Quality assurance processes include data verification, expert review, and cross-validation of findings. Continuous monitoring of market developments ensures research currency and relevance. Analytical frameworks incorporate both quantitative metrics and qualitative insights for comprehensive market understanding.

Regional distribution of Nigeria’s data center power market shows significant concentration in major urban centers with emerging opportunities in secondary cities. Lagos State dominates market activity, accounting for approximately 45% of total market share, driven by its status as Nigeria’s commercial capital and technology hub. The region benefits from superior telecommunications infrastructure, skilled workforce availability, and proximity to international connectivity points.

Federal Capital Territory (Abuja) represents the second-largest market segment with approximately 30% market share, supported by government digitalization initiatives and corporate headquarters locations. Power infrastructure in Abuja shows relatively better reliability compared to other regions, though data centers still require comprehensive backup power solutions.

Rivers State and the broader South-South region demonstrate growing market potential, particularly in Port Harcourt, driven by oil and gas industry digitalization requirements. Kano State leads northern Nigeria market development, benefiting from its position as a regional commercial center and growing telecommunications infrastructure.

Emerging markets in secondary cities show increasing activity as edge computing requirements expand. Regional connectivity improvements through fiber optic networks and power grid enhancements support market expansion beyond traditional centers. Cross-border opportunities with neighboring West African countries create additional growth potential for Nigerian-based data center power infrastructure.

Competitive landscape in Nigeria’s data center power market features diverse participants ranging from global technology leaders to specialized local providers. Market structure combines international equipment manufacturers, system integrators, and service providers creating comprehensive solution ecosystems.

Leading international players include:

Local market participants provide specialized services and system integration capabilities:

Competitive strategies focus on local partnership development, technical capability building, and comprehensive service offerings. Market differentiation occurs through solution customization, service quality, and total cost of ownership optimization.

Market segmentation analysis reveals diverse applications and technology categories within Nigeria’s data center power market. By power capacity, the market spans from small-scale edge computing facilities requiring less than 100kW to large hyperscale data centers exceeding 10MW capacity requirements.

By technology type:

By application sector:

UPS systems category dominates Nigeria’s data center power market, accounting for approximately 40% of total market activity. Online double-conversion UPS systems gain preference for critical applications requiring highest power quality. Modular UPS solutions show increasing adoption due to scalability advantages and maintenance flexibility.

Generator systems represent essential infrastructure components, with diesel generators maintaining market leadership despite growing interest in alternative fuel options. Fuel efficiency improvements and emission reduction technologies drive product evolution. Containerized generator solutions gain traction for rapid deployment and space optimization requirements.

Power distribution category shows growing sophistication with intelligent PDUs and remote monitoring capabilities becoming standard requirements. Rack-level power management gains importance as data center operators seek granular control and optimization capabilities. Energy metering and monitoring solutions support sustainability initiatives and operational cost management.

Energy management systems emerge as high-growth category driven by efficiency optimization requirements and sustainability goals. Cloud-based monitoring platforms enable remote management capabilities and predictive maintenance programs. Integration with building management systems creates comprehensive facility optimization opportunities.

Data center operators benefit from improved operational reliability and reduced downtime risks through advanced power infrastructure solutions. Cost optimization opportunities emerge through energy-efficient technologies and intelligent power management systems. Enhanced monitoring capabilities enable proactive maintenance and performance optimization.

Technology providers gain access to rapidly expanding market opportunities driven by Nigeria’s digital transformation. Local partnership opportunities create channels for market entry and capability development. Growing market sophistication supports premium solution positioning and value-based pricing strategies.

End-user organizations achieve improved service reliability and business continuity through robust data center power infrastructure. Digital transformation enablement supports competitive advantage and operational efficiency improvements. Scalable power solutions accommodate growth requirements and changing technology needs.

Government stakeholders benefit from enhanced digital infrastructure supporting economic development and public service delivery. Foreign investment attraction through improved infrastructure capabilities strengthens Nigeria’s position as regional technology hub. Job creation and skills development opportunities support broader economic objectives.

Local communities gain from improved digital service access and economic development opportunities. Skills development programs create employment opportunities in growing technology sector. Infrastructure investments support broader economic development and modernization initiatives.

Strengths:

Weaknesses:

Opportunities:

Threats:

Sustainability trends drive increasing adoption of energy-efficient power solutions and renewable energy integration in Nigeria’s data center power market. Solar power adoption accelerates as technology costs decline and organizations seek to reduce operational expenses and environmental impact. Hybrid power systems combining multiple energy sources gain traction for optimal cost and reliability balance.

Edge computing expansion creates demand for distributed power infrastructure solutions across secondary cities and rural areas. Micro data centers and containerized solutions enable rapid deployment and scalability for edge applications. 5G network rollout drives requirements for edge computing infrastructure with specialized power requirements.

Intelligent power management becomes standard requirement as operators seek optimization and predictive maintenance capabilities. IoT integration enables remote monitoring and automated response systems for power infrastructure. Cloud-based management platforms provide centralized control and analytics capabilities across distributed facilities.

Modular solutions gain preference for their scalability and maintenance advantages. Prefabricated power modules reduce deployment time and ensure consistent quality standards. Standardization trends support cost reduction and operational efficiency improvements across the market.

Recent industry developments demonstrate accelerating investment and capability expansion in Nigeria’s data center power market. International partnerships between global technology providers and local companies create comprehensive solution ecosystems. Major telecommunications operators announce significant data center expansion plans requiring substantial power infrastructure investments.

Government initiatives include infrastructure development programs and regulatory framework improvements supporting data center investments. Submarine cable projects enhance international connectivity, increasing Nigeria’s attractiveness for regional data center operations. Smart city initiatives in major urban centers create additional demand for data center infrastructure.

Technology advancements include deployment of advanced UPS systems with improved efficiency and monitoring capabilities. Renewable energy projects specifically designed for data center applications gain momentum with several pilot implementations. Training and certification programs expand local technical capabilities in data center power systems.

Investment announcements from international data center operators signal growing confidence in Nigerian market potential. MWR data indicates increasing project pipeline activity across multiple market segments. Financing solutions specifically designed for data center infrastructure projects become more readily available.

Strategic recommendations for Nigeria data center power market participants focus on addressing key challenges while capitalizing on growth opportunities. Local partnership development emerges as critical success factor for international companies seeking sustainable market presence. Building technical service capabilities and training programs supports long-term market development.

Technology providers should focus on solution customization addressing Nigeria’s specific power challenges and operational requirements. Financing partnerships with local and international financial institutions can address capital constraints limiting market expansion. Developing comprehensive service offerings including maintenance and support capabilities creates competitive advantages.

Market entry strategies should emphasize gradual expansion starting with major urban centers before expanding to secondary markets. Risk mitigation through local partnerships and comprehensive insurance coverage addresses operational and political risks. Currency hedging strategies help manage foreign exchange volatility impacts.

Investment priorities should focus on building local technical capabilities and service infrastructure. Sustainability positioning through renewable energy integration and efficiency optimization aligns with global trends and local cost pressures. Developing standardized solutions reduces costs while maintaining quality and reliability standards.

Future prospects for Nigeria’s data center power market remain highly positive despite near-term challenges. Digital transformation acceleration across public and private sectors creates sustained demand growth for reliable data center infrastructure. Market maturation brings increasing sophistication in power requirements and service expectations.

Technology evolution toward more efficient and intelligent power systems supports market expansion while addressing sustainability concerns. Renewable energy integration becomes increasingly viable as technology costs decline and grid reliability challenges persist. Edge computing expansion creates new market segments with distributed power requirements.

Regional development beyond traditional centers creates additional growth opportunities as telecommunications infrastructure expands. Cross-border opportunities position Nigeria as potential regional hub for West African data center operations. Government digitalization initiatives provide sustained demand foundation across multiple sectors.

Market projections indicate continued robust growth with annual expansion rates exceeding regional benchmarks. MarkWide Research analysis suggests market diversification across applications and geographic regions will strengthen overall stability. Investment climate improvements and regulatory framework development support long-term market confidence and sustainable growth trajectories.

Nigeria’s data center power market represents a compelling growth opportunity driven by the country’s digital transformation and strategic position in West Africa. Despite challenges including power grid instability and high capital requirements, the market demonstrates strong fundamentals supported by government initiatives, growing digital economy, and increasing international investment interest.

Market evolution toward more sophisticated and sustainable power solutions creates opportunities for technology providers and service companies. The combination of large domestic demand, regional hub potential, and improving business environment positions Nigeria as an attractive destination for data center power infrastructure investments.

Success factors include local partnership development, comprehensive service capabilities, and solution customization addressing Nigeria’s unique operational requirements. Organizations that can navigate the market’s complexities while delivering reliable, cost-effective solutions will benefit from substantial growth opportunities in this dynamic and expanding market.

What is Data Center Power?

Data Center Power refers to the electrical power supply and management systems that support the operation of data centers, which house computer systems and associated components. This includes power distribution, backup systems, and energy efficiency measures.

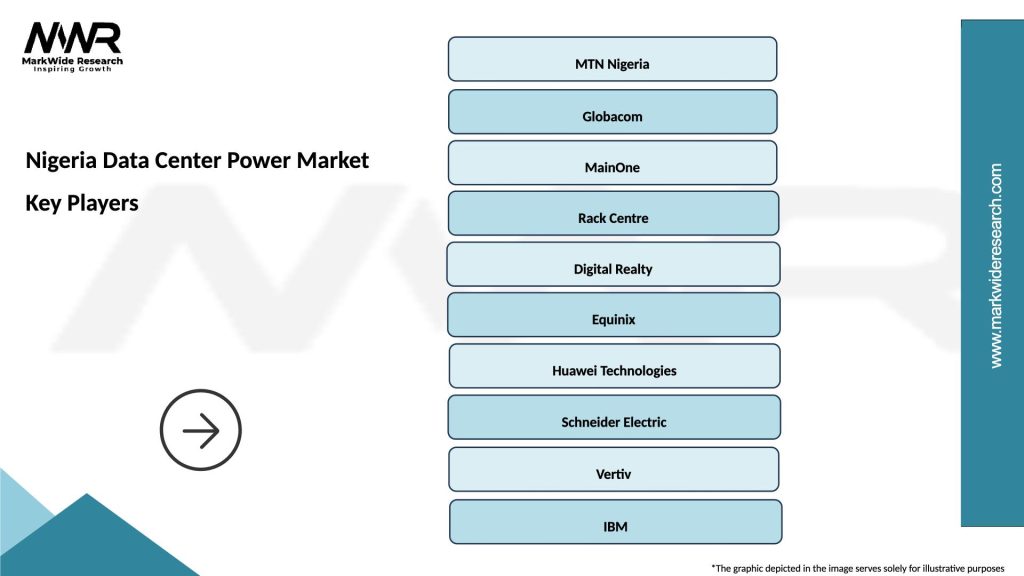

What are the key players in the Nigeria Data Center Power Market?

Key players in the Nigeria Data Center Power Market include companies like MainOne, Rack Centre, and MDXi, which provide critical infrastructure and services for data centers. These companies focus on enhancing power reliability and efficiency, among others.

What are the growth factors driving the Nigeria Data Center Power Market?

The Nigeria Data Center Power Market is driven by the increasing demand for cloud services, the growth of digital transformation initiatives, and the rising need for data storage solutions. Additionally, the expansion of internet connectivity contributes to this growth.

What challenges does the Nigeria Data Center Power Market face?

Challenges in the Nigeria Data Center Power Market include unreliable power supply, high operational costs, and regulatory hurdles. These factors can hinder the development and efficiency of data center operations.

What opportunities exist in the Nigeria Data Center Power Market?

Opportunities in the Nigeria Data Center Power Market include the potential for investment in renewable energy sources, the development of energy-efficient technologies, and the expansion of data center services to meet growing demand. These factors can enhance sustainability and operational efficiency.

What trends are shaping the Nigeria Data Center Power Market?

Trends in the Nigeria Data Center Power Market include the adoption of advanced cooling technologies, the integration of artificial intelligence for power management, and a focus on sustainability practices. These trends aim to improve energy efficiency and reduce environmental impact.

Nigeria Data Center Power Market

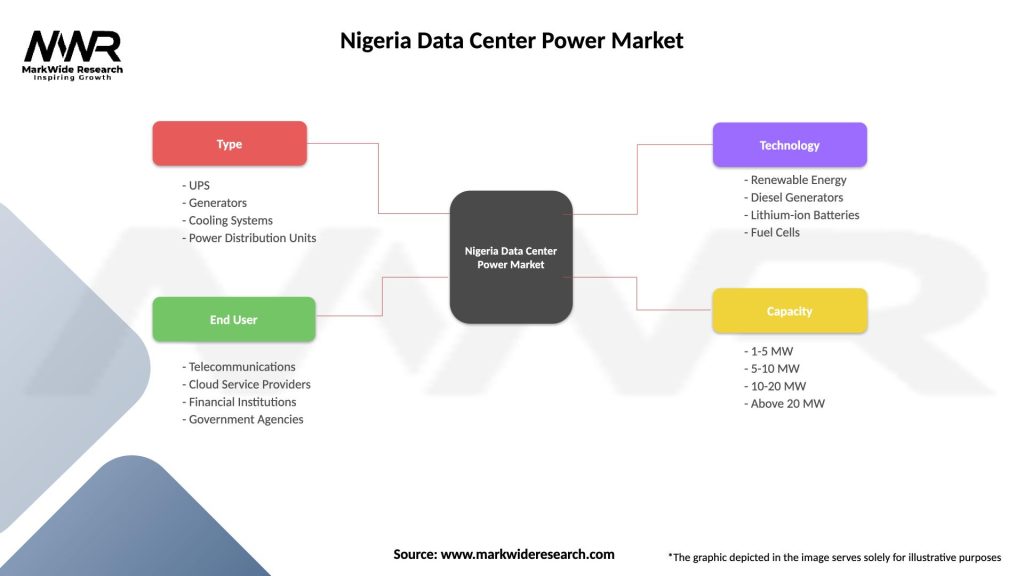

| Segmentation Details | Description |

|---|---|

| Type | UPS, Generators, Cooling Systems, Power Distribution Units |

| End User | Telecommunications, Cloud Service Providers, Financial Institutions, Government Agencies |

| Technology | Renewable Energy, Diesel Generators, Lithium-ion Batteries, Fuel Cells |

| Capacity | 1-5 MW, 5-10 MW, 10-20 MW, Above 20 MW |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Data Center Power Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at