444 Alaska Avenue

Suite #BAA205 Torrance, CA 90503 USA

+1 424 999 9627

24/7 Customer Support

sales@markwideresearch.com

Email us at

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at

Corporate User License

Unlimited User Access, Post-Sale Support, Free Updates, Reports in English & Major Languages, and more

$2450

The Nigeria data center physical security market represents a rapidly expanding sector driven by the country’s digital transformation initiatives and increasing cybersecurity awareness. As Nigeria emerges as West Africa’s technology hub, the demand for robust physical security solutions in data centers has experienced unprecedented growth, with industry analysts projecting a compound annual growth rate (CAGR) of 12.8% through the forecast period.

Digital infrastructure expansion across Nigeria has created substantial opportunities for physical security providers, particularly as enterprises recognize the critical importance of protecting their data assets from both physical and environmental threats. The market encompasses comprehensive security solutions including biometric access controls, surveillance systems, fire suppression technologies, and environmental monitoring equipment specifically designed for data center environments.

Government initiatives promoting digital economy growth have significantly influenced market dynamics, with regulatory frameworks emphasizing the importance of data protection and infrastructure security. Nigerian organizations across banking, telecommunications, oil and gas, and government sectors are increasingly investing in sophisticated physical security measures to ensure business continuity and regulatory compliance.

The market landscape features both international technology providers and emerging local solution integrators, creating a competitive environment that drives innovation and cost-effective implementations. Cloud adoption rates in Nigeria have reached approximately 68% among enterprises, further accelerating the need for secure data center facilities and comprehensive physical security infrastructure.

The Nigeria data center physical security market refers to the comprehensive ecosystem of technologies, services, and solutions designed to protect data center facilities from physical threats, unauthorized access, environmental hazards, and operational disruptions. This market encompasses hardware, software, and integrated security systems specifically tailored for Nigeria’s unique operational environment and regulatory requirements.

Physical security solutions in this context include perimeter security systems, access control mechanisms, video surveillance networks, intrusion detection systems, fire suppression equipment, environmental monitoring tools, and emergency response systems. These components work collectively to create multi-layered security architectures that protect critical IT infrastructure and ensure continuous operations.

The market also includes professional services such as security consulting, system integration, maintenance, and managed security services that help organizations implement and maintain effective physical security postures. Compliance requirements from regulatory bodies like the Nigerian Communications Commission and Central Bank of Nigeria drive specific security standards that influence market development and solution specifications.

Nigeria’s data center physical security market demonstrates robust growth potential driven by accelerating digitalization across key economic sectors. The market benefits from increasing awareness of cybersecurity threats, regulatory compliance requirements, and the critical need to protect valuable digital assets housed in data center facilities throughout the country.

Key market drivers include the expansion of cloud computing services, growing adoption of Internet of Things (IoT) technologies, and increasing foreign direct investment in Nigeria’s technology sector. Financial services organizations lead market adoption, accounting for approximately 35% of total market demand, followed by telecommunications companies and government agencies implementing comprehensive security upgrades.

The competitive landscape features established international vendors alongside emerging local solution providers, creating opportunities for technology transfer and skills development within Nigeria’s growing technology ecosystem. Market penetration rates for advanced physical security solutions currently stand at approximately 42% among enterprise data centers, indicating significant growth potential as organizations modernize their security infrastructure.

Investment trends show increasing focus on integrated security platforms that combine physical and logical security capabilities, with organizations seeking comprehensive solutions that provide centralized monitoring and management capabilities across multiple facility locations.

Market dynamics in Nigeria’s data center physical security sector reveal several critical insights that shape industry development and investment strategies:

Emerging trends indicate increasing demand for artificial intelligence-powered security analytics, cloud-based security management platforms, and integrated environmental monitoring systems that provide comprehensive facility protection and operational optimization capabilities.

Digital transformation initiatives across Nigeria’s economy serve as the primary catalyst for data center physical security market expansion. Government policies promoting cashless transactions, digital banking, and e-governance have created substantial demand for secure data processing facilities, driving organizations to invest heavily in comprehensive physical security infrastructure.

Regulatory compliance requirements from multiple Nigerian regulatory bodies mandate specific security standards for data centers handling sensitive information. The Central Bank of Nigeria’s cybersecurity framework, Nigerian Communications Commission guidelines, and emerging data protection regulations create compliance-driven demand for advanced physical security solutions.

Increasing cyber threat sophistication has heightened awareness of the need for layered security approaches that combine physical and logical protection mechanisms. Organizations recognize that comprehensive security strategies must address both digital and physical attack vectors to ensure effective protection of critical infrastructure and sensitive data assets.

Foreign investment growth in Nigeria’s technology sector brings international security standards and best practices, driving demand for world-class physical security implementations. Multinational corporations establishing operations in Nigeria require security solutions that meet global compliance standards and corporate security policies.

Cloud adoption acceleration creates demand for secure data center facilities as organizations migrate critical workloads to cloud platforms. Service providers must implement robust physical security measures to attract enterprise customers and maintain competitive positioning in the growing cloud services market.

High implementation costs present significant barriers for many Nigerian organizations considering comprehensive physical security upgrades. The substantial capital investment required for advanced security systems, combined with ongoing operational expenses, can strain budgets and delay implementation timelines, particularly for small and medium-sized enterprises.

Limited local expertise in specialized security technologies creates implementation challenges and increases project costs. While training initiatives are addressing this gap, the shortage of qualified security professionals and certified system integrators continues to impact market growth and solution deployment effectiveness.

Infrastructure limitations including unreliable power supply and telecommunications connectivity affect the performance and reliability of sophisticated security systems. Organizations must invest in backup power systems and redundant communications links, adding complexity and cost to security implementations.

Import dependency for advanced security equipment creates challenges related to foreign exchange fluctuations, import duties, and supply chain disruptions. These factors can significantly impact project costs and timelines, making it difficult for organizations to accurately budget for security investments.

Regulatory complexity arising from multiple overlapping regulatory frameworks can create confusion and compliance challenges for organizations implementing security solutions. Navigating different requirements from various regulatory bodies requires specialized expertise and can slow implementation processes.

Government digitalization programs create substantial opportunities for physical security providers as public sector organizations modernize their IT infrastructure and implement secure data processing facilities. Smart city initiatives, digital identity programs, and e-governance platforms require robust security implementations that protect citizen data and ensure service continuity.

Financial inclusion initiatives driving mobile banking and digital payment adoption create demand for secure transaction processing infrastructure. Banks and fintech companies expanding their digital services require comprehensive physical security solutions to protect payment processing systems and customer data repositories.

Data localization requirements emerging in various sectors create opportunities for local data center development and associated security implementations. Organizations previously relying on offshore data processing must establish domestic facilities with appropriate physical security measures to comply with evolving regulatory requirements.

Public-private partnerships in technology infrastructure development offer opportunities for security solution providers to participate in large-scale projects with government backing. These partnerships can provide stable revenue streams and opportunities to demonstrate capabilities in high-profile implementations.

Regional expansion potential exists as Nigerian companies extend operations across West Africa, creating demand for standardized security solutions that can be replicated across multiple locations. This regional growth opportunity allows security providers to leverage Nigerian implementations as reference sites for broader market expansion.

Supply chain dynamics in Nigeria’s data center physical security market reflect a complex interplay between international technology providers, local system integrators, and end-user organizations. The market structure favors partnerships between global vendors and local implementation partners who understand Nigerian business practices and regulatory requirements.

Competitive pressures drive continuous innovation and service enhancement as providers seek to differentiate their offerings in an increasingly crowded marketplace. Organizations benefit from improved solution capabilities, competitive pricing, and enhanced service levels as vendors compete for market share in this growing sector.

Technology evolution creates both opportunities and challenges as new security technologies emerge and existing solutions require regular updates and enhancements. Organizations must balance the benefits of cutting-edge security capabilities with the costs and complexity of frequent technology refreshes.

Customer expectations continue to evolve as organizations become more sophisticated in their security requirements and demand integrated solutions that provide comprehensive protection while simplifying management and operations. This trend drives vendors to develop more user-friendly and automated security platforms.

Economic factors including currency fluctuations, inflation, and economic growth patterns significantly influence market dynamics and investment decisions. Organizations must carefully evaluate security investments against broader economic conditions and business priorities to ensure sustainable implementations.

Primary research activities for analyzing Nigeria’s data center physical security market involved comprehensive interviews with key stakeholders including security vendors, system integrators, end-user organizations, and industry experts. These discussions provided valuable insights into market trends, challenges, and growth opportunities from multiple perspectives.

Secondary research components included analysis of regulatory documents, industry reports, vendor publications, and academic studies related to data center security in emerging markets. This research provided context for understanding regulatory requirements, technology trends, and best practices applicable to the Nigerian market environment.

Market sizing methodologies employed bottom-up and top-down approaches to validate market estimates and growth projections. Analysis included evaluation of data center capacity growth, security spending patterns, and technology adoption rates across different industry sectors and geographic regions within Nigeria.

Data validation processes involved cross-referencing information from multiple sources and conducting follow-up interviews to verify key findings and assumptions. This approach ensured accuracy and reliability of market analysis and projections presented in the research findings.

Analytical frameworks applied industry-standard methodologies for market analysis including Porter’s Five Forces, SWOT analysis, and competitive positioning assessments. These frameworks provided structured approaches for evaluating market dynamics and competitive landscapes affecting the Nigerian data center physical security sector.

Lagos State dominates Nigeria’s data center physical security market, accounting for approximately 45% of total market activity due to its position as the country’s commercial capital and technology hub. The concentration of multinational corporations, financial institutions, and telecommunications companies in Lagos creates substantial demand for sophisticated security solutions and drives market innovation.

Federal Capital Territory (Abuja) represents the second-largest market segment, capturing roughly 20% of market share through government agency implementations and corporate headquarters facilities. The presence of regulatory bodies and government data centers creates unique security requirements and drives adoption of compliance-focused security solutions.

Port Harcourt and surrounding regions in the Niger Delta contribute approximately 15% of market demand, primarily driven by oil and gas industry requirements for secure data processing facilities. These organizations require specialized security solutions that address both conventional threats and industry-specific risks associated with critical infrastructure protection.

Northern Nigeria markets including Kano, Kaduna, and Jos collectively account for 12% of market activity, with growth driven by agricultural technology initiatives, mining operations, and regional government digitalization programs. These markets present opportunities for cost-effective security solutions tailored to regional economic conditions.

Emerging regional centers in states like Ogun, Rivers, and Cross River show increasing security investment as organizations establish secondary data processing facilities and disaster recovery sites. According to MarkWide Research analysis, these secondary markets demonstrate growth potential as organizations implement distributed IT architectures for improved resilience and performance.

Market leadership in Nigeria’s data center physical security sector features a diverse ecosystem of international technology vendors, regional solution providers, and specialized local integrators. The competitive landscape reflects the complex requirements of Nigerian organizations and the need for solutions that address both global standards and local operational challenges.

International vendors maintain strong market positions through advanced technology offerings and global support capabilities:

Regional solution providers offer specialized services and local market expertise:

Competitive strategies focus on partnership development, local capacity building, and solution customization to address specific Nigerian market requirements while maintaining international quality standards and compliance capabilities.

By Technology:

By Application:

By Industry Vertical:

Access Control Systems represent the largest technology segment, driven by regulatory requirements for authenticated facility access and detailed audit trails. Biometric solutions show particularly strong adoption rates, with fingerprint recognition systems achieving 72% penetration among enterprise data centers due to their reliability and user acceptance in the Nigerian market.

Video Surveillance Solutions demonstrate rapid growth as organizations implement comprehensive monitoring capabilities with advanced analytics features. IP-based camera systems with artificial intelligence capabilities are increasingly popular, providing automated threat detection and reducing the need for extensive human monitoring resources.

Fire Suppression Systems require specialized expertise due to the critical nature of data center environments and the need to protect equipment while ensuring personnel safety. Clean agent suppression systems are preferred over traditional water-based systems, though cost considerations influence adoption rates among smaller facilities.

Environmental Monitoring solutions gain importance as organizations recognize the impact of environmental conditions on equipment reliability and security system performance. Integrated monitoring platforms that combine security and infrastructure management capabilities show strong market acceptance and growth potential.

Integrated Security Platforms represent the fastest-growing category as organizations seek comprehensive solutions that provide centralized management and coordinated response capabilities across multiple security domains. These platforms reduce operational complexity and improve security effectiveness through automated workflows and intelligent analytics.

Technology Vendors benefit from Nigeria’s expanding data center market through increased demand for sophisticated security solutions and opportunities to establish long-term customer relationships. The market provides platforms for demonstrating advanced capabilities and building reference implementations that support regional expansion strategies.

System Integrators gain opportunities to develop specialized expertise in data center security implementations while building partnerships with international vendors. The growing market creates demand for local integration services and ongoing support capabilities that provide sustainable revenue streams.

End-User Organizations achieve enhanced security postures through access to advanced technologies and professional implementation services. Comprehensive security solutions provide business continuity assurance, regulatory compliance support, and operational efficiency improvements that justify investment costs.

Government Agencies benefit from improved data protection capabilities and enhanced citizen service delivery through secure digital platforms. Physical security investments support broader digitalization initiatives and help build public confidence in government technology services.

Financial Institutions gain competitive advantages through robust security implementations that enable digital service expansion and customer trust building. Advanced security capabilities support regulatory compliance and risk management objectives while facilitating business growth initiatives.

Service Providers can differentiate their offerings through comprehensive security capabilities that attract enterprise customers and support premium pricing strategies. Security investments enhance service reliability and customer satisfaction while reducing operational risks and liability exposure.

Strengths:

Weaknesses:

Opportunities:

Threats:

Artificial Intelligence Integration emerges as a dominant trend with security vendors incorporating AI-powered analytics into surveillance systems, access control platforms, and threat detection solutions. These capabilities provide automated incident response, predictive maintenance, and enhanced security effectiveness while reducing operational overhead for Nigerian organizations.

Cloud-Based Security Management gains traction as organizations seek centralized control over distributed security infrastructure. Cloud platforms enable remote monitoring, automated updates, and scalable management capabilities that address the challenges of managing security systems across multiple locations in Nigeria’s diverse geographic landscape.

Mobile Security Integration reflects the growing importance of smartphone-based access control and security management solutions. Mobile applications provide convenient user interfaces for security system interaction while enabling location-based authentication and emergency response capabilities tailored to Nigerian operational requirements.

Cybersecurity Convergence drives integration between physical and logical security systems, creating comprehensive protection platforms that address both digital and physical threats. This convergence enables coordinated incident response and provides holistic security visibility across organizational assets and operations.

Sustainability Focus influences security solution design and implementation as organizations prioritize energy-efficient systems and environmentally responsible technologies. Green security initiatives align with broader corporate sustainability goals while reducing operational costs and environmental impact.

Regulatory Technology (RegTech) solutions incorporate automated compliance monitoring and reporting capabilities that help organizations maintain adherence to evolving regulatory requirements. These solutions reduce compliance costs and risks while providing audit trail capabilities required by Nigerian regulatory bodies.

Strategic partnerships between international security vendors and Nigerian system integrators have accelerated market development and local capability building. These collaborations combine global technology expertise with local market knowledge to deliver solutions that meet both international standards and Nigerian operational requirements.

Government policy initiatives including the National Digital Economy Policy and Strategy have created frameworks supporting data center development and security investment. These policies provide regulatory clarity and incentives that encourage private sector investment in secure digital infrastructure.

Technology localization efforts by major vendors include establishing local assembly facilities, training programs, and support centers that reduce costs and improve service delivery. These investments demonstrate long-term commitment to the Nigerian market and enhance solution accessibility for local organizations.

Industry certification programs developed by professional associations and educational institutions are addressing the skills gap in data center security. These programs provide standardized training and certification pathways that improve the availability of qualified security professionals and system integrators.

Regulatory framework evolution includes updated guidelines from the Central Bank of Nigeria, Nigerian Communications Commission, and emerging data protection authorities. These developments provide clearer security requirements and compliance standards that guide organizational investment decisions and vendor solution development.

Investment in research and development by both international vendors and local technology companies focuses on solutions adapted to Nigerian environmental conditions, power infrastructure limitations, and operational requirements. This R&D investment drives innovation and improves solution effectiveness in challenging operating environments.

Vendor Strategy Recommendations emphasize the importance of developing comprehensive partnerships with local system integrators and establishing in-country support capabilities. MWR analysis indicates that vendors with strong local presence achieve higher customer satisfaction rates and more successful long-term market penetration compared to those relying solely on remote support models.

Technology Investment Priorities should focus on solutions that address Nigeria’s specific challenges including power reliability, environmental conditions, and skills availability. Organizations should prioritize integrated platforms that combine multiple security functions while providing simplified management interfaces that reduce operational complexity.

Implementation Approach recommendations suggest phased deployment strategies that allow organizations to spread investment costs over time while building internal expertise and demonstrating value. Starting with critical security components and expanding gradually enables better budget management and risk mitigation during implementation processes.

Skills Development Initiatives require coordinated efforts between vendors, integrators, and educational institutions to build local technical expertise. Investment in training programs and certification pathways will improve solution quality and reduce long-term operational costs while supporting market growth and sustainability.

Regulatory Compliance Strategies should incorporate proactive monitoring of evolving requirements and early engagement with regulatory bodies to understand implementation expectations. Organizations benefit from establishing compliance frameworks that can adapt to changing requirements while maintaining operational efficiency and cost effectiveness.

Partnership Development opportunities exist for international vendors to collaborate with Nigerian technology companies, creating mutually beneficial relationships that combine global expertise with local market knowledge. These partnerships can accelerate market entry, reduce operational risks, and improve solution acceptance among Nigerian organizations.

Market growth projections indicate continued expansion of Nigeria’s data center physical security market driven by accelerating digitalization across all economic sectors. The market is expected to maintain robust growth rates exceeding 12% annually as organizations implement comprehensive security upgrades and new facilities come online to support growing digital service demand.

Technology evolution will continue toward more intelligent, automated, and integrated security solutions that provide enhanced protection while reducing operational overhead. Artificial intelligence, machine learning, and IoT technologies will become standard components of data center security implementations, enabling predictive maintenance and automated threat response capabilities.

Regulatory development is expected to drive more stringent security requirements across multiple industries, creating compliance-driven demand for advanced security solutions. Data localization requirements and enhanced privacy regulations will influence data center design and security implementation strategies throughout the forecast period.

Market consolidation may occur as smaller vendors struggle to compete with comprehensive solution providers offering integrated platforms and extensive support capabilities. This consolidation could benefit customers through improved solution quality and service levels while creating opportunities for strategic partnerships and acquisitions.

Regional expansion opportunities will emerge as Nigerian organizations extend operations across West Africa, creating demand for standardized security solutions that can be replicated across multiple countries. This regional growth potential provides significant opportunities for vendors with proven Nigerian implementations and local expertise.

Investment patterns will shift toward solutions that provide measurable business value beyond basic security protection, including operational efficiency improvements, energy savings, and enhanced business continuity capabilities. Organizations will increasingly evaluate security investments based on total cost of ownership and business impact rather than initial acquisition costs alone.

Nigeria’s data center physical security market presents substantial opportunities for growth and innovation as the country continues its digital transformation journey. The convergence of regulatory requirements, technological advancement, and increasing security awareness creates a favorable environment for comprehensive security solution adoption across multiple industry sectors.

Market dynamics favor vendors and integrators who can combine advanced technology capabilities with local expertise and support infrastructure. Success in this market requires understanding of Nigerian operational challenges, regulatory requirements, and customer expectations while delivering solutions that meet international quality and security standards.

Future success will depend on continued investment in local capabilities, technology adaptation, and partnership development that creates sustainable competitive advantages. Organizations that establish strong market positions during this growth phase will benefit from long-term customer relationships and expansion opportunities as Nigeria’s digital economy continues to mature and expand throughout the region.

What is Data Center Physical Security?

Data Center Physical Security refers to the measures and protocols implemented to protect data centers from physical threats such as unauthorized access, natural disasters, and vandalism. This includes surveillance systems, access controls, and environmental monitoring.

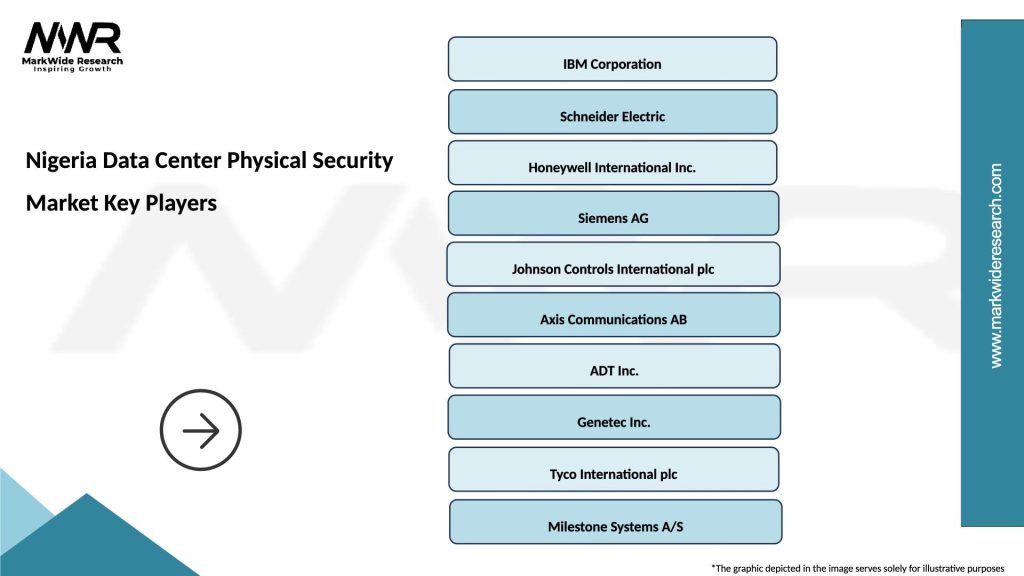

What are the key players in the Nigeria Data Center Physical Security Market?

Key players in the Nigeria Data Center Physical Security Market include companies like Schneider Electric, IBM, and Cisco, which provide various security solutions and technologies for data centers, among others.

What are the main drivers of the Nigeria Data Center Physical Security Market?

The main drivers of the Nigeria Data Center Physical Security Market include the increasing need for data protection due to rising cyber threats, the growth of cloud computing, and the expansion of digital infrastructure in the region.

What challenges does the Nigeria Data Center Physical Security Market face?

Challenges in the Nigeria Data Center Physical Security Market include the high costs of advanced security technologies, a shortage of skilled security professionals, and the evolving nature of security threats that require constant adaptation.

What opportunities exist in the Nigeria Data Center Physical Security Market?

Opportunities in the Nigeria Data Center Physical Security Market include the increasing investment in data center infrastructure, the adoption of innovative security technologies like AI and IoT, and the growing awareness of the importance of physical security among businesses.

What trends are shaping the Nigeria Data Center Physical Security Market?

Trends shaping the Nigeria Data Center Physical Security Market include the integration of advanced surveillance systems, the use of biometric access controls, and the implementation of comprehensive risk management strategies to enhance overall security.

Nigeria Data Center Physical Security Market

| Segmentation Details | Description |

|---|---|

| Type | Physical Barriers, Surveillance Systems, Access Control, Alarm Systems |

| Technology | Biometric Systems, RFID Solutions, Video Analytics, Intrusion Detection |

| End User | Telecommunications, Financial Services, Government, Healthcare |

| Installation | On-Premises, Remote Monitoring, Integrated Systems, Managed Services |

Please note: The segmentation can be entirely customized to align with our client’s needs.

Leading companies in the Nigeria Data Center Physical Security Market

Please note: This is a preliminary list; the final study will feature 18–20 leading companies in this market. The selection of companies in the final report can be customized based on our client’s specific requirements.

Trusted by Global Leaders

Fortune 500 companies, SMEs, and top institutions rely on MWR’s insights to make informed decisions and drive growth.

ISO & IAF Certified

Our certifications reflect a commitment to accuracy, reliability, and high-quality market intelligence trusted worldwide.

Customized Insights

Every report is tailored to your business, offering actionable recommendations to boost growth and competitiveness.

Multi-Language Support

Final reports are delivered in English and major global languages including French, German, Spanish, Italian, Portuguese, Chinese, Japanese, Korean, Arabic, Russian, and more.

Unlimited User Access

Corporate License offers unrestricted access for your entire organization at no extra cost.

Free Company Inclusion

We add 3–4 extra companies of your choice for more relevant competitive analysis — free of charge.

Post-Sale Assistance

Dedicated account managers provide unlimited support, handling queries and customization even after delivery.

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

GET A FREE SAMPLE REPORT

This free sample study provides a complete overview of the report, including executive summary, market segments, competitive analysis, country level analysis and more.

ISO AND IAF CERTIFIED

Suite #BAA205 Torrance, CA 90503 USA

24/7 Customer Support

Email us at